【4/9(Wed)Top 10 Major web3 News】Aavegotchi NFT game moves from Polygon to Base / Bitcoin's "safe haven" narrative is being tested, etc.

A 5-minute commentary on today's major news stories!

Hello.

Mitsui from web3 researcher.

This is a summary of the major news stories of the last 24 hours.Please use it to gather information.

Fake Nvidia-Hedera Partnership News Boosts HBAR Market Cap $2 Billion

Argentine Congress Supports Investigation of Officials Over Libra Meme Coin

Ethernet DEX trading volume has halved since December peak as traders move to more cost-effective alternatives

"Chain-independent" M^0 Stable Coin Middleware Platform Expands to Solana

Aavegotchi NFT gaming community votes to move to Base, ending Polygon rollout

Bitcoin ETF Issuer BlackRock Adds Anchorage Digital as Custodian

Progmat Forms Capital and Business Alliance with Norichu Trust Bank, Aozora Bank and Kenedix

The Bitcoin "safe haven" narrative is being tested: Binance Research

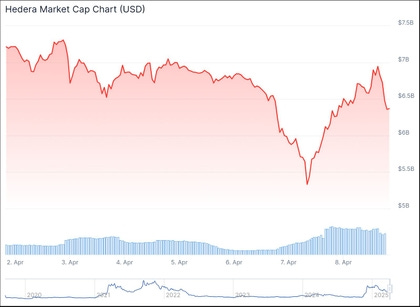

📈Fake Nvidia and Hedera Partnership News Boosts HBAR Market Cap $2 Billion

The price of this asset rose after LinkedIn reported fake news about a partnership between enterprise blockchain protocol Hedera and microchip giant NVIDIA

The asset's price then fell to around $0.15, up about 1% in the past 24 hours

🇦🇷Argentine Congress Supports Investigation into Officials Over Libra Meme Coin

Argentina's Chamber of Deputies passed three resolutions in February to investigate officials involved in the Libra virtual currency scandal.

According to a statement from the Chamber of Deputies, the resolutions include the creation of a specialized commission to investigate meme coins, the summoning of various officials of the executive power, and a request for a report from the government on Libra

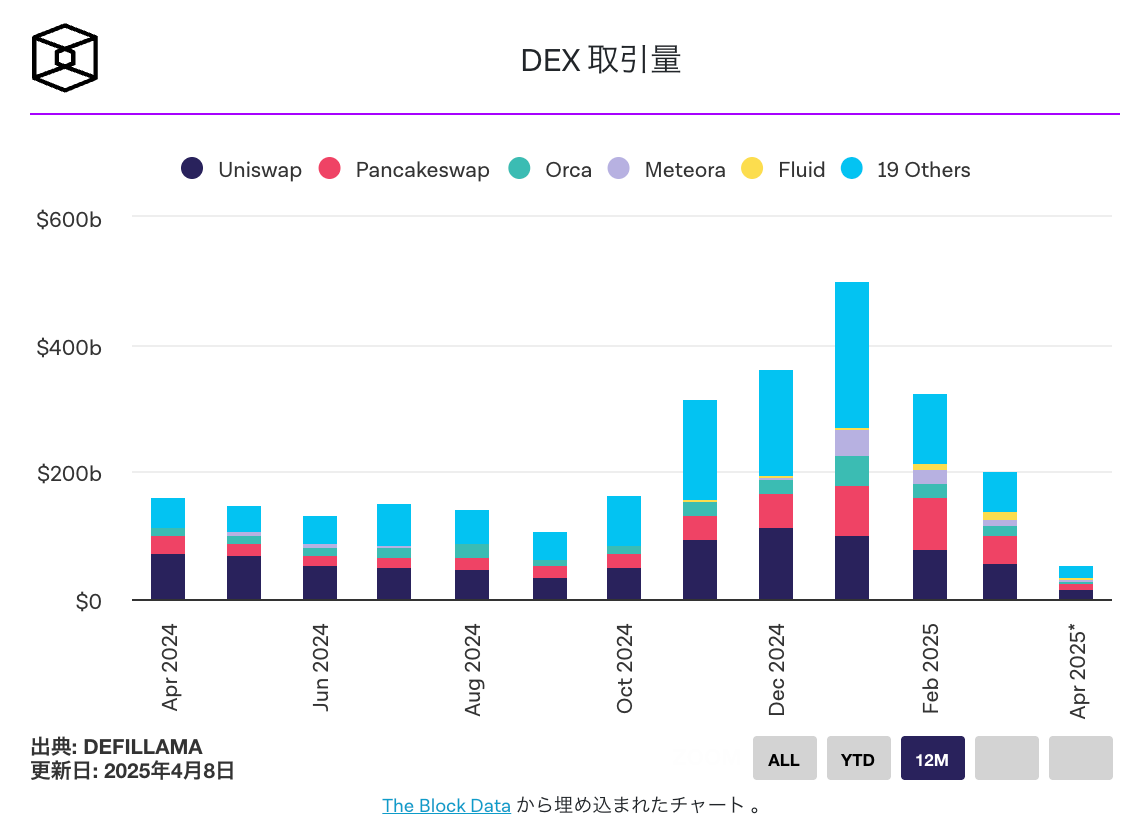

📉Ethernet's DEX trading volume has halved since its December peak as traders have moved to more cost-effective alternatives

Ethereum DEX Trading Volume Slows, Daily Unique Traders Down to Nearly 40,000 Addresses

This is a 12-month low and a significant decrease from the peak of 95,000 addresses observed in late 2024

The sharp decline in DEX participation is consistent with the overall cooling of the market and speculative capital flows in the cryptocurrency industry as a whole

Trading volume has shrunk along with user participation, with Ethereum DEX trading volume falling to $57 billion in March 2025, almost half of the $112 billion recorded at the market peak in December 2024

💴Kathy Wood's Arc Invest held an additional $4.8 million worth of Coinbase shares ahead of President Trump's new tariffs

Arc Invest purchased an additional $4.8 million worth of Coinbase (COIN) shares through three exchange-traded funds on Tuesday in advance of President Trump's reciprocal tariffs, which took full effect at midnight Wednesday

The investment firm's latest purchase came just a day after it purchased $13.3 million worth of Coinbase shares for the ARKW and ARKF funds

⛓️"Chain-independent" M^0 stablecoin middleware platform expands to Solana

Ethereum-Based M^0 Stablecoin Development Platform Expands to Solana as Latest Showcase of "Chain Independent" Approach to Digital Dollar Deployment

KAST, a "neo-bank" that also uses stablecoin, becomes the first bank to launch a brand-specific stablecoin project using M^0's new Solana-based infrastructure

🌉Aavegotchi NFT Gaming Community Votes to Move to Base, End Polygon Rollout

Aavegotchi DAO Votes in Favor of Polygon to Base Transition and End of Geist Layer 3

In theory, it shouldn't matter where the game is played, but in practice, eyes are on where liquidity flows and Polygon PoS TVLs have been flat or declining since 2022," "Therefore, will Aavegotchi leave Polygon and create its own chain?"Therefore, it is the right move for Aavegotchi to leave Polygon and either create its own chain or join a growing chain with strong ecosystem support," commented coderdan, founder of Aavegotchi.

In addition, developer Pixelcraft Studios had "drastically reduced its workforce and extended its development timeframe"

👛Bitcoin ETF Issuer BlackRock Adds Anchorage Digital as Custodian

Anchorage Digital announced Tuesday that BlackRock has selected the company to custodian digital assets and support the asset manager's spot crypto asset ETFs

Robert Mitchnick, head of BlackRock's digital assets division, said in a statement that the company needed to select additional partners due to the growing demand for virtual currency-based investment products

🇺🇸SEC Invites Former Legal Rivals Coinbase, Cumberland DRW, Uniswap Labs to Virtual Currency Roundtable

The Securities and Exchange Commission will host a roundtable on cryptocurrencies on Friday with panelists from Coinbase, Cumberland DRW, and Uniswap Labs

The roundtable will discuss the regulation of cryptocurrency trading

💰Progmat Forms Capital and Business Alliance with Norinchukin Trust Bank, Aozora Bank, and Kenedix

Progmat, provider of the Progmat digital asset issuance and management platform, announced on April 9 a capital and business alliance with The Norinchukin Trust & Banking, Aozora Bank, and Kenedix.

Progmat raises funds through a third-party allotment of common stock to the three companies.

Progmat has now closed its first round of pre-series A financing and has added three new shareholders.

The companies also cite the direction of cooperation with Progmat

Recommended Articles *Only available for free for a weekFoil] Establishes futures market to stabilize prices of gas, blob space, and other commodities

Foil is a futures market protocol for reducing price volatility of gas and blob space on Ethereum, providing transaction cost stabilization.

The system utilizes oracles and AMMs to forecast and trade "average future gas prices," allowing users to lock in costs in advance and helping operators manage their budgets.

Many web3 players are key targets, including oracle nodes, DeFi traders, DApp developers, roll-up operators, and large users.

Currently in testing phase, but with the possibility of DAO and token issuance suggested in the future, it is expected to grow as a web3 infrastructure.

🧵Pickup:The Bitcoin "safe haven" narrative is being tested: Binance Research.

🌱News Summary

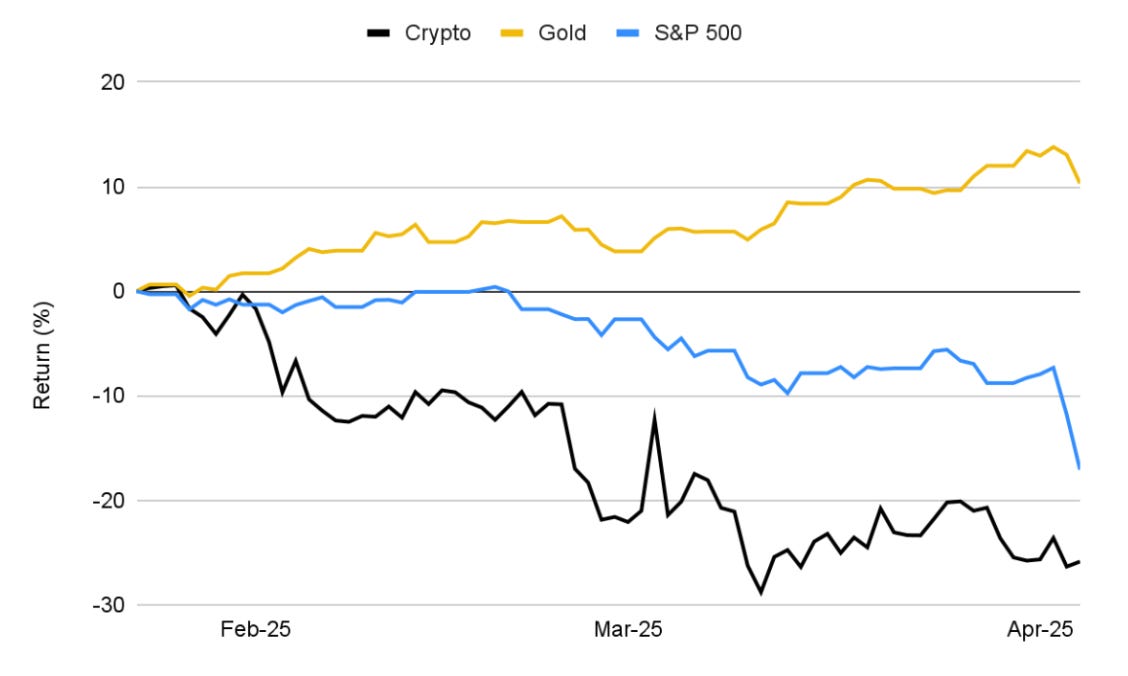

In early 2025, U.S. President Donald Trump introduced new tariffs, which were countered by countries implementing retaliatory tariffs, resulting in intensified global trade friction.

The crypto asset market was hit hard by this impact, with market capitalization falling by about 25.9% and losing about $1 trillion in value.Bitcoin (BTC) fell 19.1%, and other major crypto assets experienced similar declines.

📗 Prerequisites

Tariffs and Trade Friction: Tariffs are taxes imposed on imported goods to protect domestic industry and correct trade deficits.However, high tariffs can lead to retaliation by trading partners and become a barrier to international trade.The tariffs imposed by the United States in 2025 were the highest since the Smoot-Hawley Tariff Act of the 1930s, and had a significant impact on the global economy.

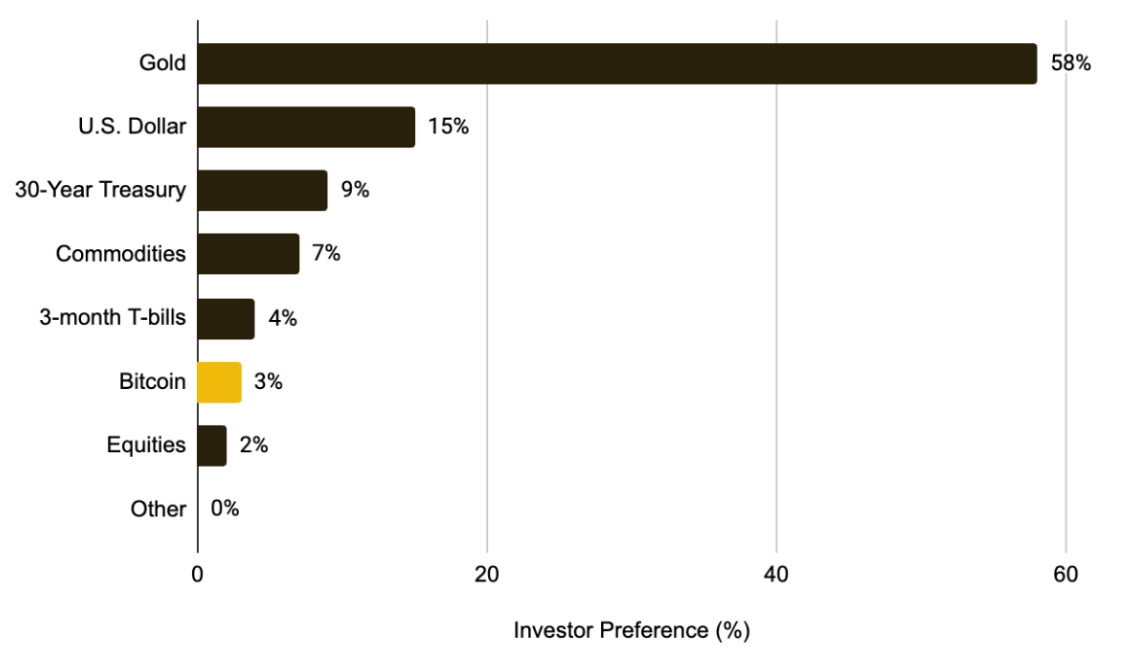

Crypto Asset "Safe Asset" Theory: Bitcoin, also referred to as "digital gold," is expected to serve as a "safe asset" that will retain value during disruptions in traditional financial markets.Bitcoin is also referred to as "digital gold.However, actual market trends show that bitcoin may behave as a risk asset, and the characteristics of bitcoin continue to be debated.

👀 Noteworthy, detailed explanation

Change in Bitcoin correlation: After the tariff measures, the correlation between Bitcoin and the stock market increased, highlighting its aspect as a risk asset.On the other hand, the correlation between bitcoin and gold decreased, highlighting its differences from traditional safe assets.

Change in investor behavior: The tariffs increased market uncertainty and investors became more risk averse.This led to an outflow of funds from crypto assets and a shift of funds into traditional safe assets such as gold.

Increased Volatility: Following the tariff announcement, bitcoin price volatility increased, with the daily decline reaching its highest level since the COVID-19 shock in 2020.

📈 Future projections

Market stabilization will take time: As long as trade friction continues, volatility in the crypto asset market could remain high.Investors are expected to remain cautious and refrain from large capital deployments until the uncertainty is resolved.

Reassessing Bitcoin's Role: This market trend will lead to a reassessment of whether Bitcoin functions as a "safe asset" or has a strong risk asset aspect.This is expected to be the case.

Change in regulatory environment: As governments respond to trade friction, regulations on crypto assets may also tighten.Investors should keep a close eye on regulatory developments and manage risk appropriately.

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.