【Foil】futures market protocol for price stabilization of gas and blob space / Eliminates on-chain cost volatility / @foilxyz

Foil is a futures market protocol for reducing price volatility of gas and blob space on Ethereum, providing transaction cost stabilization.*Free public access for one week only.

Good morning.

Mitsui from web3 researcher.

Today we researched Foil.

📈Overview|What is Foil?

⚙️Structure|Building a futures market for gas prices

✨Changes and prospects|With support from prominent VCsTesting in progress

💬Summary and discussion|Providing useful products using finance is one of the true values of web3.

🧵TL;DR

Foil is a futures market protocol for reducing price volatility of gas and blob space on Ethereum, providing transaction cost stabilization.

The system utilizes oracles and AMMs to forecast and trade "average future gas prices," allowing users to lock in costs in advance and helping operators manage their budgets.

Many web3 players are key targets, including oracle nodes, DeFi traders, DApp developers, roll-up operators, and large users.

Although currently in the testing phase, the possibility of DAO and token issuance has been suggested in the future, and it is expected to grow as a web3 infrastructure.

📈Overview|What is Foil?

Foil" is a decentralized protocol that aims to stabilize the price of on-chain resources such as Gas and Blobspace on Ethereum.

On the home page you will see "Gas and Blobspace with Stable Pricing. Lock in your on-chain costs regardless of network congestion.Lock in your onchain costs regardless of network congestion.(Lock in your onchain costs regardless of network congestion.It presents a worldview where on-chain users do not have to worry about fluctuating transaction costs.

Many people involved in web3 have experienced losses due to rising gas prices.Among them, businesses, especially those that handle large amounts of money, can suffer unintended losses due to rising gas prices.Being able to predict losses is especially important for business operations, but the current gas prices in the web3 industry make that difficult.

In short, Foil is trying to stabilize gas prices by building a futures marketfor gas prices.This mechanism allows users and developers to make their own decisions on the price of gas.This mechanism allows users and developers to predict and fix future transaction costs in advance, reducing cost uncertainty due to ethereum congestion.

Specifically, the following entities are assumed to be the target audience.

Oracle nodes and data provision services: Node operators of distributed oracle projects (e.g. Pyth and Chainlink) regularly issue transactions to Ethereum itself and L2to issue transactions and post price data.With Foil, Oracle node operators can hedge future gas costsand stabilize service operating costs,stabilize service operating costs.For example, when Pyth writes a price on Ethereum L1, it can purchase a contract in advance on Foil that corresponds to the average price of gas for the next month, so that it can respond at no additional cost when gas prices rise, and conversely offset the loss on Foil when gas prices are low.This facilitates budget management and reduces the risk of service interruptions due to excessive gas price hikes.

DeFi trading platforms and arbitragers: Traders and arbitrage bots with high frequency on-chain transactions are also major users of FoilFoil's main users are traders and arbitrage bots that engage in high frequency on-chain transactions.For example, bots that arbitrage between multiple DEXs (arbitrage) issue hundreds of swap transactions per day.If the network is congested, there is a risk that gas costs will exceed profits, but by fixing gas costs in advance with Foilrevenue fluctuations are reduced and stable operationsbecomes possible.Similarly, MEV searchers (users looking for lucrative trading opportunities within a block) may also want to hedge their gas prices with Foil, as they will need to bid (pay the block proponent) for gas.

DApp developers and project operators:DApps that want to provide services to users without making them aware of gas costs (e.g., games and SNS DApps) may themselves shoulder the userIn some cases, DApps (e.g., games and SNS DApps) that want to provide services to users without making them aware of the cost of gas (gas sponsorship) may themselves shoulder the cost of the gas token.With Foil, projects can flat-rate gas sponsorship costsand makes budget planning easier.This also works well with the gas user non-payment model with Account Abstraction, and hedging with Foil can absorb risk on the sponsor's side.

Rollup Operators (L2 Sequencers): Layer 2 rollups such as Optimism, Arbitrum and Base need to post transaction data on their own chains to the Ethereum mainnet periodically.Foil will also provide a marketplace for blob space (Ethereum's data availability space).Foil provides a marketplacefor rollup operators and Rollup-as-a-Service providers to hedge their own operating costs on Foil.As a practical example, Foil has launched a Celestia blob space marketin the testing phase, which supports futures trading of the cost of writing data to the Celestia network.We also support futures trading of costs.This allows each project to reduce instability from cost fluctuations as the demand for data increases in the future with the advent of numerous roll-ups and modular chains.

Centralized Exchanges (CEX) and large users:In cases where CEXs such as Binance process large withdrawals on Ethereum, or large users concentrate theirFoil is also useful for on-chain operations.For example, if there is a popular NFT mint event on Ethereum and participants expect to be exposed to a gas war, they can purchase the necessary gas in advance with Foil and avoid paying unexpectedly high gas prices later.Similarly, if CEX is incurring withdrawal transaction fees on behalf of users during busy periods, they can hedge and stabilize those costs with Foil.

As mentioned above, the main target users of Foil are the entities that conduct regular or large volume on-chain transactions.

👀Premise understanding: what are gas prices?What are the reasons for the skyrocketing gas prices?What is blob space?Understand the prerequisite knowledge here.

Foil solves the gas price spike problem.

If you are involved in web3, you have probably seen a gas price spike or have been a victim of one yourself when Txing.

So why do we need gas prices in the first place?In what situations do gas bills skyrocket?

It is said that not only Ethereum gas prices but also blob space prices will be fixed, but what is blob space in the first place?

This is a simplified explanation of the premise knowledge of this area so that you can understand the outline of Foil more deeply.(*This explanation is designed to be understandable through images rather than 100% technical accuracy.)

◼️"What is a gas bill?"

The "calculation fee" for processing a transaction.

In Ethereum, every time you do something, such as send money, NFT, DeFi, etc., there is "work" on the network

For this "amount of work (calculation)", you pay a fee in units of Gas.

What you actually pay is "Amount of Gas x Gas unit price (Gwei)", paid in ETH.

Example: send ETH → 21,000 gas x 50 Gwei = approx. 0.00105 ETH

◼️ "Why is the cost of gas skyrocketing?"

Because "when the network gets congested, people pile on more "chips" to get it processed, and the price per gas goes up.

In the Ethereum mechanism:

There is a limiton how much processing (gas) can be put into one block.

If everyone puts out a transaction at the same time, it becomes a "race for seats".

As a result, those offering the highest commission (per gas unit price) get priority for processing

📈 Common examples of skyrocketing prices:

Popular NFT mints (e.g. Yuga Labs)

Meme coin festivals (e.g. PEPE)

Run-ins before large airdrops

Spam Attacks

◼️ "What is Blobspace?"

"Cheap space dedicated to data" introduced by Ethereum.

Introduced in EIP-4844 (Proto Dunksharding)

An inexpensive data storage areacreated called "blob", separate from regular transactions

When L2 (Layer 2) writes transaction information to Ethereum, it can post cheaper and larger volumes than ever

Many of you may have a similar image to what we had in mind, but the bottom line is simply that if a transaction is popular, the fee is higher because you cannot put in a transaction at once.

It may be similar to the price of airplanes where the number of seats is fixed and supply and demand vary from season to season.Foil solves this problem.

⚙️Structure|Creating a futures market for gas prices

Now we will resolve the mechanism in more detail.

As mentioned above, in a nutshell, this is accomplished by building a futures market for gas prices.

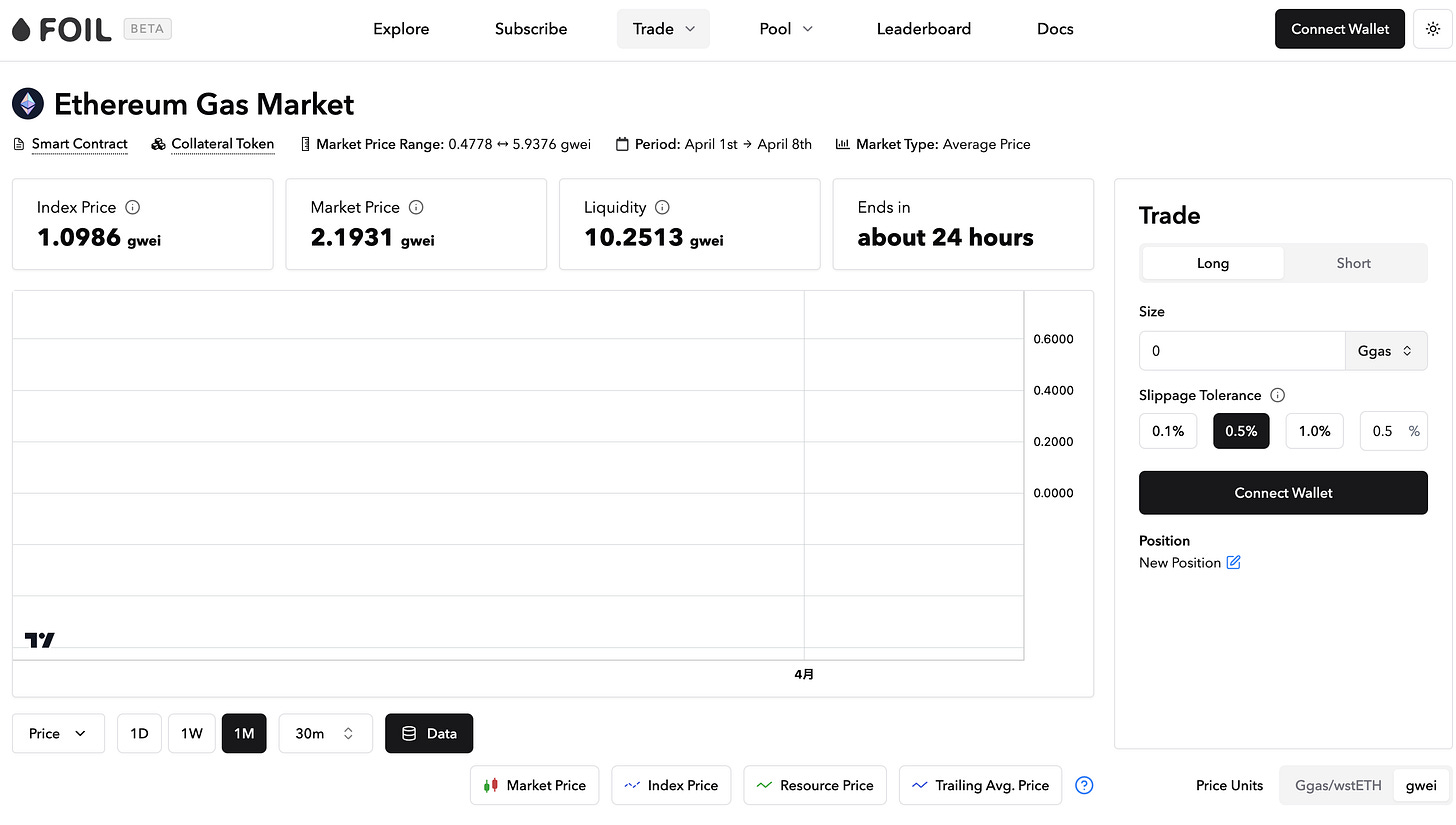

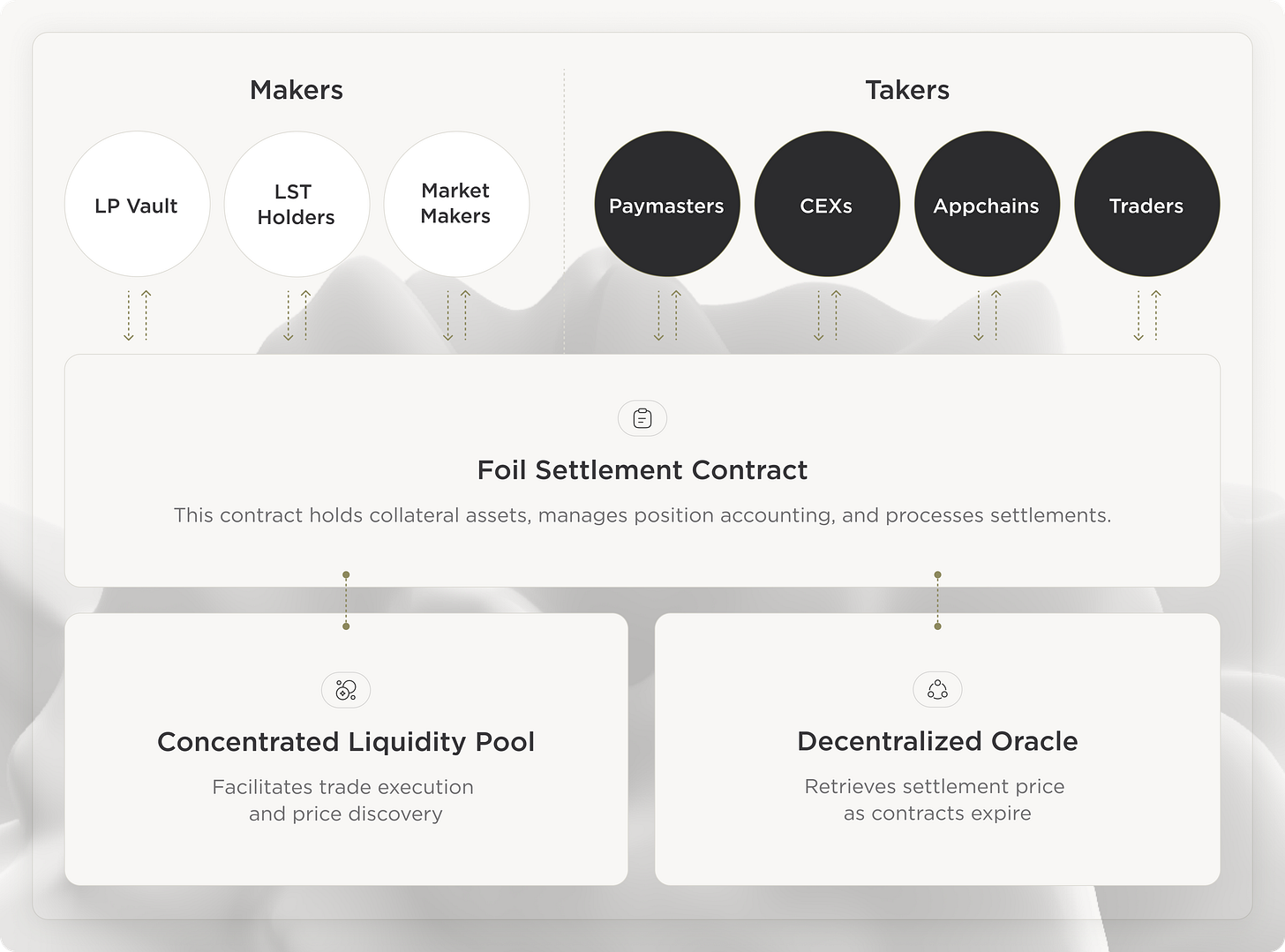

Foil is a bilateral market enabler and uses the Uniswap V3-inspired AMM mechanism for price discovery.

Specifically, users can buy and sell exposure (≈ price forecast) to the future price of gas through a pool provided by a liquidity provider (LP), thereby creating an appropriate market price on-chain for supply and demand.

Foil's smart contract functions as a centralized liquidity AMM, and users participate in the market by supplying ETH (strictly staked ETH tokens, see below) to this pool.

The following is a list of features.

◼️Price forecast and decision per period

For each trading period (e.g., weekly or monthly), Foil buys and sells exposure to "average gas prices during that period" or "average blob space rates".At the end of the period, the value of the position is fixed based on the actual average price.

For this finalization (clearing), Foil has integrated the Oracle of UMA protocols.(This is the oracle that Polymarket also uses).

Using UMA's Optimistic Oracle, the true average value for the period under consideration (e.g. the average gas price for Ethereum L1) is written on-chain, which is used to close the position.The use of UMA allows for reliable data provision and governance verification, and allows for objections to be raised if inaccurate values are proposed.

◼️Transactions and positions

Users participate in the market in ETH denomination; Foil V1 supports an ETH-denominated commission futures market, which takes the form of a contract linked to the average price of Ethereum L1 gas, for example, and settled in ETH.

When a user takes a position in the pool at the beginning of the period, it is valued at the price based on the market forecast at that time, and the profit or loss is compared to the actual value determined via UMA Oracle at the end of the period.

In other words, through Foil, the user can pre-fixfuture gas pricesor speculatively participate in their fluctuations (for trading purposes).or participate speculatively (for trading purposes) in the future price of gas.

To achieve this transaction on the smart contract, we handle two pseudo assets in the poolThe first is the underlying ETH (ETH).One is the underlying ETH (more precisely, the staking derivative, see below) and the other is a kind of derivative token that represents "the right to exchange it for ETH equivalent to the average gas price per unit at the end of the term".

The rate between these two assets corresponds to the market's expected average gas price level, and participants fix their future gas bills by trading this rate.

◼️Liquidity Provision and LST Utilization

Foil's AMM pool is also unique in that the liquidity provider (LP) supplies liquidity staking tokens (LSTs) as one asset.

For example, in the test phase, Lido's staked ETH, wstETH, is used for the pool, and LPs can earn staking rewards in addition to their normal transaction fee income by providing wstETH.

This design allows LPs to benefit from receiving interest on the underlying asset while providing liquidity to the market, while users can expect to trade at stable prices (lower slippage) due to deeper liquidity.

◼️ modularization

Foil's protocol is modular, allowing a market to be built for each on-chain resource x duration combination.

Starting with the Ethereum L1 gas price market, the Ethereum data availability (DA, blob) market, the Celestia blob space market, and the L2 rollup gas market can also be rapidly deployed by deploying a Foil V1 instance!Foil is a very scalable and flexible solution.

This design makes Foil highly scalable and flexible enough to adapt to new resource types and chains.

◼️ gas-subscription

For users who primarily want to hedge their gas costs, users can estimate the amount of gas they will consume and for how long, and purchase a plan that fixes future costs.

Setting, for example, "number of transactions in month X" or "target gas unit price" as input items will display the required ETH payment amount and the amount of transactions to be covered.

Although the Subscribe function is a behind-the-scenes transaction against the same pool as the Trade function, the user experience is simplified to a form similar to "purchasing a fixed price gas plan" without giving the feeling of dealing with a complicated financial instrument.This makes it easy for non-technical users and developers to hedge appropriately for their on-chain activities.

For example, a GameFi developer offering gas sponsorship can utilize the Subscribe feature to hedge gas costs.

These are the main mechanisms and features.

✨Transition and Prospects|Well-known VCs are also supporting and testing

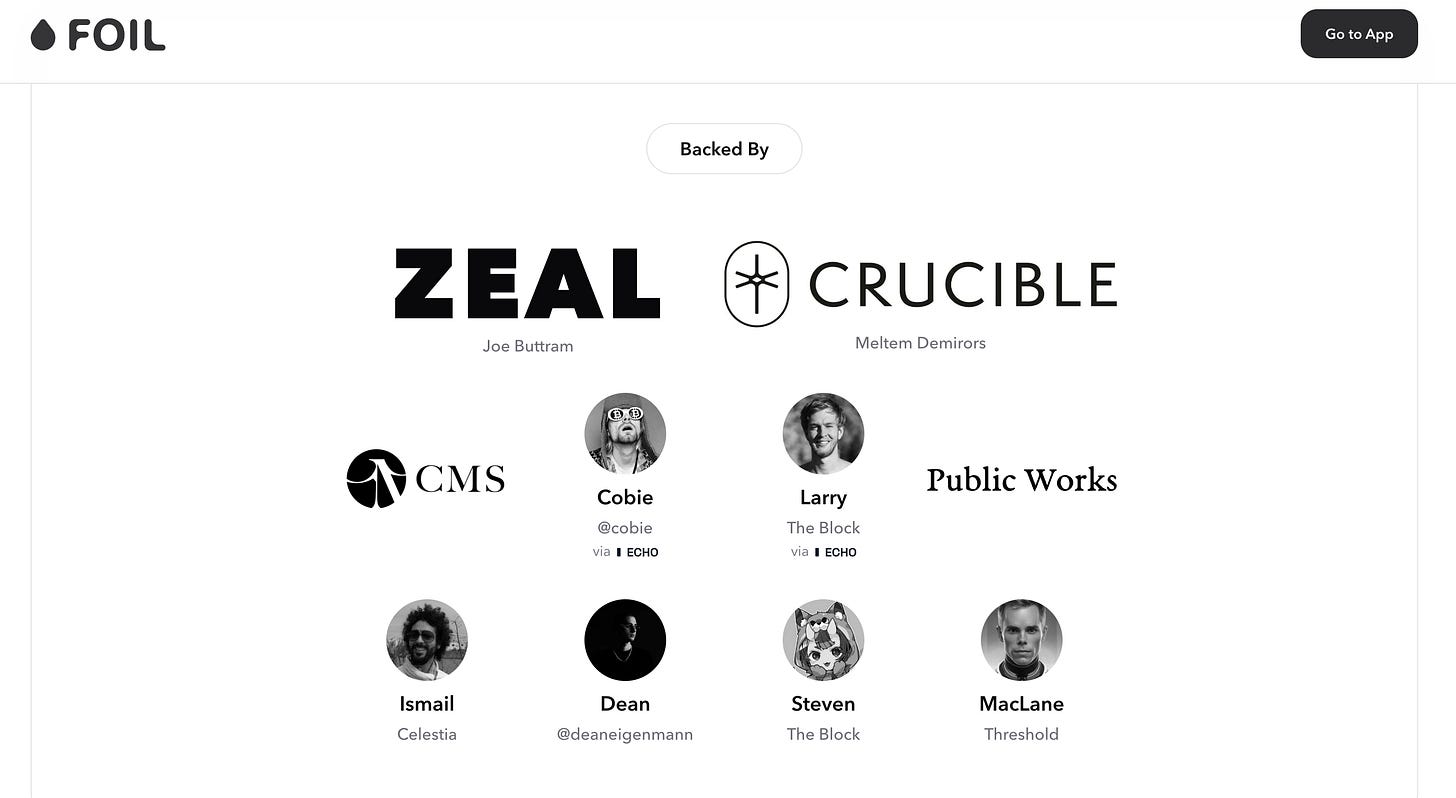

Foil is an emerging project established in 2024, but it is already backed by several leading investors and backers.The following institutional and private investors/advisors are involved with Foil

Co-Founder Noah is an influential developer within Ethereum.He not only founded Foil, but is also the Co-Founder of Cannon, a deployment automation and development tool for the EVM chain, and a contributor to the Ethereum protocol standard ERC-7412.

The transition so far is as follows

November-December 2024: Testnet version launched and competition held

In late November 2024, Foil launched the Ethereumgas market on the Sepolia testnet and launched a testnet trading competition for the community.The competition lasted one month, with cash prizes (awards in PEPE tokens) awarded according to participants' trading performance (profit margins).A bug bounty was also conducted at the same time, with rewards of up to 100 million PEPE for serious bug reports.Intensive testing and feedback was conducted during this period to improve the UX and make adjustments to the contract.March 2025: MainNet (Base) Beta Launch

Base is Ethereum's L2 networkis where we are developing the Ethereum L1 gas rate market for March and April 2025 and the Ethereum blob market.This was effectively a beta test using mainnet assets (ETH), with a small but real-world trading environment.At this time, Foil also published an on-chain resource market data portal, providing real-time visualization of key market indicators (price trends, trading volume, etc.).April 2025: Main Net Trading Competition Held

As part of beta operations on Base, a productionA trading competition is being conducted.This is a competition to see how much profit can be made in the weekly gas futures market (ETH L1 gas futures for the first four weeks of April) and the Celestia blob futures market for the single month of April.

Currently in an iterative testing phase, co-founder Noah states that in terms of future prospects, "Foil's ultimate goal is to provide a set of products that completely alleviate gas and transaction issues for consumer apps."

Therefore, he envisions a future where on-chain apps can be as seamless as Web2 is today, including layer 2 and other chains in the future.

Also, while there is no specific mention of tokens at this time, the official Mirror dispatch states, "Be one of Foil's earliest power users -- and maybe something more in the future?"which also implies full decentralization in the future, it is expected that tokens will likely be issued in the future.

💬Summary and Discussion|Providing useful products using finance is one of the true values of web3

This was a very interesting product.

The problem of rising gas prices was so serious that we wondered why there had been no service like "Foil" until now.

However, it is thought that until now, the technological infrastructure such as gas sponsorship by AA was not in place or operators did not build their business on the web3 in earnest.

Having said that, I have heard of similar product ideas that confront the same sense of challenge, but I have not heard of a system like "Foil" where a futures market is built and settled by UMA Oracle.

My own guess is that the idea may have been conceived in reference to the success of prediction markets such as Polymarket.

I personally believe that the Polymarket mechanism is one of the true values of web3.

Polymarket is a value to those who objectively see each person acting in their own interest using finance.Blockchain allows these to be performed in a transparent and decentralized manner.While there are still uncertain issues, such as the recent UMA Oracle takeover, and there are regulatory issues with betting, I believe that the decentralized forecasting market will definitely establish itself as a use case for web3.

In this context, I felt the same thing about "Foil".

In a nutshell, it is a decentralized forecasting market product with respect to gas costs.

In addition to allowing operators to lock in gas prices, this can also be used to forecast future gas prices even if no betting is done.Exactly as Polymarket shows future forecasts as the future of news, "Foil" provides price forecasts for gas bills and blob space.

We think this mechanism is very interesting and there is definitely a demand for it.

To be honest, especially if Web2 businesses come directly to "Foil" to fix their gas bill.

To be honest, it may be a hurdle for Web2 service providers in particular to come directly to "Foil" to implement gas subscriptions, so it is likely to be implemented in such a way that another service provider (e.g., a development kit provider such as Thirdweb) is in between, where one click can fix gas bills and "Foil" is actually working behind the scenes.

This is still in the testing phase and will be fully implemented in the future, but if it works properly, it could solve the problem of rising gas prices and make it easier for service providers to build use cases.

Although the market has been unstable in the recent past, I personally find it very interesting and exciting to see them as infrastructures like "Foil" are steadily being put in place.

Naturally, the better the market is, the happier I am, but in this newsletter, I will explore the possibilities of what web3 can really do by analyzing various use cases, rather than providing information and analysis of such short-term market ups and downs.We look forward to your continued support!

This is the research for Foil!

🔗Reference/image credit: HP / DOC / X / BLOG

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.