【Yield】Infrastructure for embedding staking and DeFi yields with a single API / Integrates 75+ blockchains and 200+ yield sources / @yield_xyz

Embedded aggregation layer competition.

Good morning.

This is mitsui, a web3 researcher.

Today I researched about "Yield".

🟧What is Yield?

🚩Transition and Outlook

💬 Importance of Embedded Aggregation Layer

🧵TL;DR

Yield is a web3 yield infrastructure that integrates over 75 blockchains and 200+ yield sources.

The main API suite consists of StakeKit (staking), DeFiKit (DeFi operations), and DataKit (yield data).

Already deployed by Zerion, Ledger, and others, embedding companies can monetize through deposit fees, performance fees, and management fees.

🟧What is Yield?

Yield" offers a variety of yield opportunities on multiple blockchains in a single platformweb3 yield infrastructureintegrates over 200 different yield sources on more than 75 blockchain networks and allows developers to access them via a single API.

This allows a single integration API provided by Yield to replace the many DeFi protocols that previously had to be linked separately for each wallet or app, eliminating complex back-end integration tasks.

Let's take a look at some of the key products.

◼️StakeKit

The only multi-validator API that supports multiple chains and multiple validators, helping users to obtain yields from staking various tokens in self-custody.

With StakeKit, delegation to over 25 major validator operators (e.g. Chorus One, Figment, etc.) can be seamlessly accomplished with a single API integration, allowing for revenue optimization and diversification of yield sources.The yields offered include not only native staking of various Layer 1 tokens, but also re-staking of Ethereum (e.g. EigenLayer) and staking via other protocols (e.g. Liquid Staking by Lido).

◼️DeFiKit

This module handles DeFi yields (stable coin deposits and operations) and provides a single interface for deposits and withdrawals to and from various DeFi protocols.

Specifically, lending pools (e.g., interest on deposits at Aave and Compound), yield farming and bolting (e.g., bolting operations at Learn Finance), and liquidity provision,stable asset management destinations across multiple networksto a single source.

DeFiKit has the highest number of integrations in the industry, bringing together numerous stable coin yield products and DeFi pools under the "All DeFi, One API" concept.

◼️DataKit

This is a set of APIs dedicated to data acquisition.It is a comprehensive yield data API that covers staking and DeFi operation position information, earned compensation amounts, and various network and protocol metrics (validator performance, yield rates, etc.).

While StakeKit and DeFiKit are APIs for "managing user assets," DataKit is an API for "querying and monitoring the status of yields being earned by user assets.Its role is to provide centralized insight by eliminating data silos across chains and protocols.

For example, if a user is staking in multiple chains and also operating in different protocols, DataKit can be used to retrieve their balances, rewards, and required actions (e.g., when they can be unstaked) in one place.

◼️Front-end related tools (widgets, SDKs, etc.)

For developers, we also provide a suite of tools for front-end integration.A typical example is an embedded component called the StakeKit widget, a tool that, with just a few lines of code, can be embedded in your own app or site to provide a complete UI for users to get paid for staking crypto assets.

With widgets, ready-made flows (e.g., token selection → validator selection → quantity entry → stake execution) can be added without having to design screens or implement transaction processing UI from scratch.Multilingual support (10+ language translations) and theme/style customization features are also built in, allowing widgets to be displayed in colors and fonts that match the company's branding, and dark mode is also supported.

◼️ Target users and achievements

Having introduced the major products, these APIs and SDKs (Yield) will allow service providers such as Wallet, DApp, and Neobank to easily integrate staking and yield products into their products.

It has already been integrated into several prominent products.

A prime example is Zerion, whose StakeKit API integration allows Zerion users to earn a wide variety of yields, including staking, liquid staking, re-staking, and DeFi operations on over 13 blockchains.

Hardware wallet giant Ledger has also partnered with StakeKit to revamp the Earn section in the Ledger Live app.Other partnerships include Coin98 Wallet and Questflow, a DeFi automation platform that utilizes AI agents.

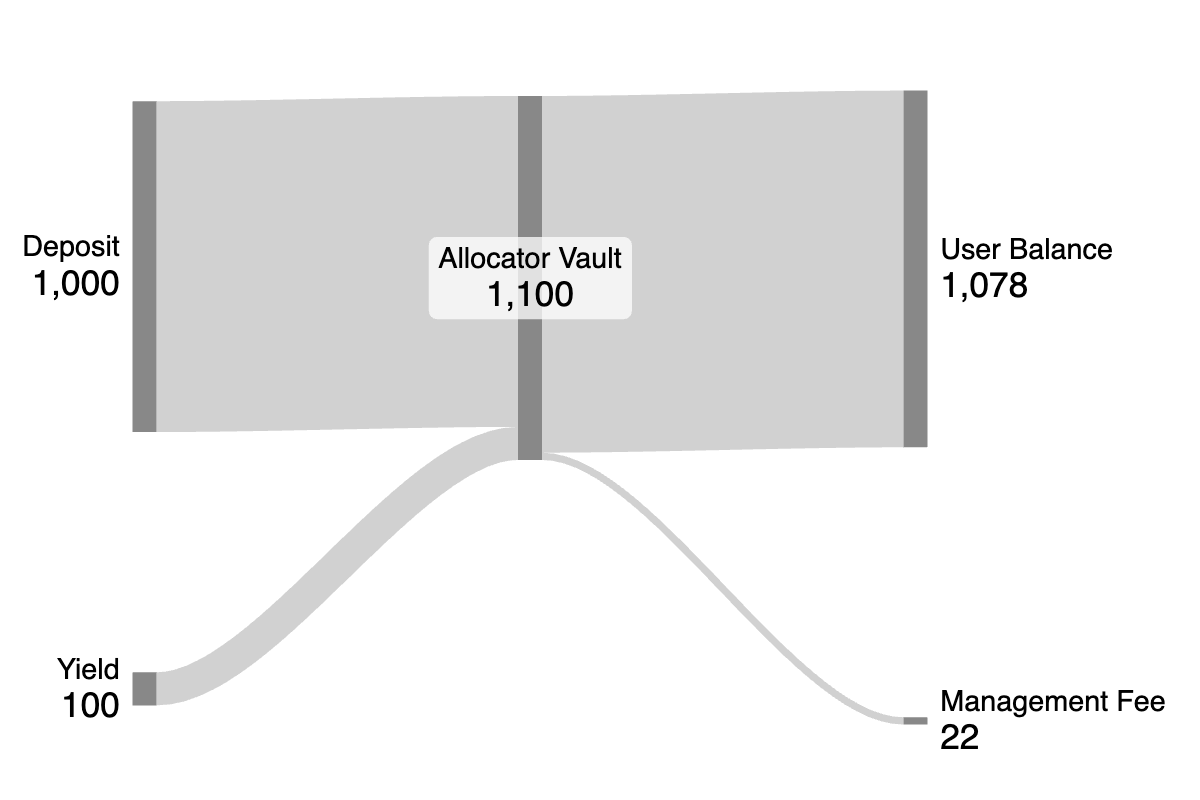

Incidentally, embedding companies and wallets can set up three mechanisms for intermediary fees when offering yields.

The first is a Deposit Fee, where a percentage (usually in the range of 0.2% to 0.8%) or a flat fee is deducted on the spot when a user makes a deposit into a staking or DeFi operation.

The second is the Performance Commission, in which a portion of the fee (usually set between 10% and 30%; the industry standard is 20%) is collected based on the performance of the user's assets as they yield.

The third is the management fee.A portion of the funds deposited by the user (typical rates range from 1% to 5% per year; the industry standard is 2%) is collected annually.

Using these methods, the embedding side can also monetize.

🚩Transition and Outlook

Yield is managed by a team that has been in place since 2021.

Serafin leads the project as Founder & CEO and co-founded the predecessor multi-chain wallet Steakwallet (later Omni) in 2021.

Alex Harley and James Stackhouse were co-founders of Steakwallet, which was renamed Omni as the product grew and continued to develop.

Omni Wallet was noted at the time as an advanced mobile wallet that supported over 27 blockchains from its early days, and was reportedly aiming to be a "web3 super app that could do anything" with news feed and even NFT display capabilities.

After raising $11M in 2022, Omni Wallet continued to grow its user base until it was acquired by Echo Base, the parent company of Paxful (a prominent bitcoin P2P marketplace), in March 2024.

After the acquisition, Omni's wallet business continued under the Echo Base umbrella, while Serafin and his founding team pivoted to a new business, Yield.

The strategy change is to step back from providing wallet apps to consumers and focus on providing behind-the-scenes infrastructure (Yield API).In doing so, the company clearly stated its intention to "deploy the multi-chain yield functionality demonstrated by Omni to all services and raise the level of the entire ecosystem.

In addition, a $5M strategic investment round was led by Multicoin Capital to transform and fund Yield.The history of prior funding rounds is as follows

Although no clear roadmap for the future has been disclosed, the following developments are possible based on interviews and other information.

Automatic rebalancing and optimizationProviding advanced strategies for automatic rebalancing/optimization on the platform side.Specifically, an algorithm is implemented that automatically moves deposited assets between multiple protocols according to the user's risk tolerance profile, always pursuing optimal yields.

Bridging the gap with traditional finance: Yield will not only work with crypto asset native companies, but also with traditional financial institutions and fintech companies.It could be used as a white label infrastructure for banks and other institutions to offer crypto asset yield products to their customers.

Expansion of Supported Networks and ProtocolsThe product covers more than 75 networks and hundreds of protocols at this point, and we plan to expand the scope of the product in the future.

Basically, it is an extension of the current product, "the realization of a world where all yields can be enjoyed with a single click.With the explosive growth in demand for stablecoin, the demand for yield services as a depository for these coins is also expected to increase in the future.

💬The importance of embedded aggregation layers

Finally, a summary and discussion.

The functionality and positioning of Yield is very clear and promising.There is a lot of competition, but the future should require the ability to deposit to DeFi from any customer interface, including wallets, banks, payment services, exchanges, AI agents, etc.

Simple staking is one thing, but DeFi will still be the place to operate stablecoins after the explosion of stablecoins.There is a possibility that the stablecoin operators will simply return the yield, but I think that the spread of stablecoins like USDC and USDT will be faster, in which case it will still be necessary to operate them in DeFi.

You may think that there will be less need to invest in DeFi if it is used more for payments, but many wallets these days have a function to automatically invest just by holding it, so the world will become like a bank interest rate, where just holding a stablecoin will always be invested at 4% until the moment it is used.I believe that the world will become like a bank interest rate.

In this world, it is very difficult for a company to connect its own operational partners on its own, so we feel that a business in a position like "Yield" will become necessary.

The competition for customer interfaces will begin, the competition for DeFi to be connected behind the scenes will begin, and the competition for aggregation APIs in between will begin.All of them are going to be fierce competition, but I personally think that the customer interface competition will continue until the end, and the DeFi and aggregation API competition will converge somewhere to a certain extent.

Because those two have economies of scale at work and reliability is important.

Then, "Yield," which is now starting to be embedded to get there, has a very interesting positioning.Developers will use "Yield" without developing their own products because it is simply convenient.

We will continue to follow this layer of competition, including updates to "Yield" itself, as well as competing projects.

This is my research on "Yield"!

🔗Reference Link:HP / DOC / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.