A 5-Minute Recap of Last Week's web3 Market

We have compiled the latest market information and major news from the past week.

Good morning.

I’m Mitsui, a web3 researcher.

This is a summary article covering the web3 market over the past week. We gather information from over 20 domestic and international media outlets and newsletters, selecting news items from them. Please use this to catch up on information and trends!

📰Pickup News

📗Pickup Article

📊Market & News

📰Pickup News

ERC-8004 v0.1 Paper Published

ERC-8004 is a standard for building a trust foundation for autonomous agents on Ethereum.

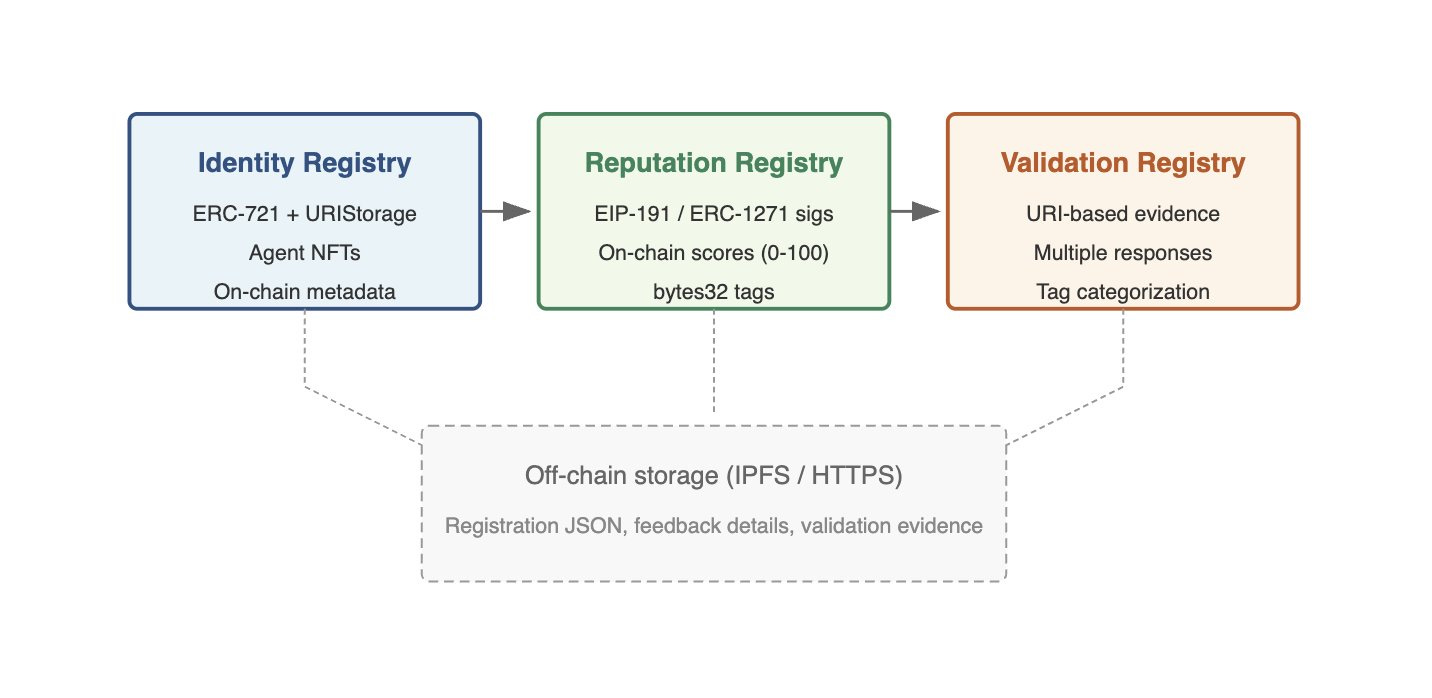

Composed of three on-chain registries: Identity, Reputation, and Validation

In v1.0, IDs will be converted to ERC-721 NFTs to ensure ecosystem compatibility and transferability.

On-chain reputation scoring with cryptographically signed feedback to prevent fraud

The verification registry is designed to enable progressive validation.

A major overhaul before the mainnet launch, but it aims to establish the foundation for a cross-organizational agent economy.

Ethereum has “solved” the blockchain trilemma: Vitalik

Vitalik Buterin claims that Ethereum has overcome the trilemma of decentralization, security, and scalability.

The core technologies are PeerDAS through the Fusaka upgrade and the maturation of zkVM.

PeerDAS significantly increases the amount of data L2 can transmit, enabling cost reduction and scalability.

zkVM dramatically reduces block verification costs while maintaining node decentralization and improving performance.

However, it will take several years for the full benefits to materialize, with around 2030 being the target for widespread adoption.

Ethereum has entered a “new phase of decentralized networking”

Optimism Foundation Proposes OP Buyback

Optimism positions the buyback of OP tokens as part of its ecosystem growth strategy.

The buyback is explained as a means for long-term public asset fund circulation, not price manipulation.

Proceeds will first be allocated to ecosystem investments and public goods support; if a surplus remains, repurchases will be considered.

In early-stage projects, reinvestment takes priority, and ongoing buybacks are not anticipated.

Tokens are defined as tools for network participation and public goods coordination, not as “shares.”

Token value depends on the overall health of the Optimism Collective, not short-term prices.

Bitcoin staking platform Babylon raises $15 million from a16z to fund development of “BTCVaults”

Bitcoin staking protocol Babylon raises approximately $15 million from a16z Crypto

Funds will be used for the development and expansion of the new infrastructure “Trustless BTCVaults.”

BTCVaults enables native BTC collateralization without wrapping or custody.

Utilizing zero-knowledge proof technology, it is possible to verify that BTC is correctly locked.

Expanding DeFi, lending, and stablecoin applications through neutral and verifiable BTC collateral

As infrastructure enabling the use of BTC without moving it, aiming for the long-term financialization of BTC

Wyoming Issues First State-Backed Stablecoin on Solana

Wyoming officially launches “FRNT,” the first state government-issued dollar-pegged stablecoin in the United States.

FRNT uses Solana as its native chain and also deploys to multiple chains including Ethereum and major L2s.

The reserve fund is managed by the state trust and is overcollateralized in U.S. dollars and short-term U.S. Treasury bills.

Franklin Templeton will handle the management and custody, with interest income allocated to the state’s education fund.

Leveraging transparency and legal backing provided by public entities as strengths to differentiate from private stablecoins

An exemplary case symbolizing the “public infrastructureization” of compliant stablecoins

📗Pickup Article

Introducing posts and articles I found interesting.

Stablecoins Are a Rail, Not a Brand

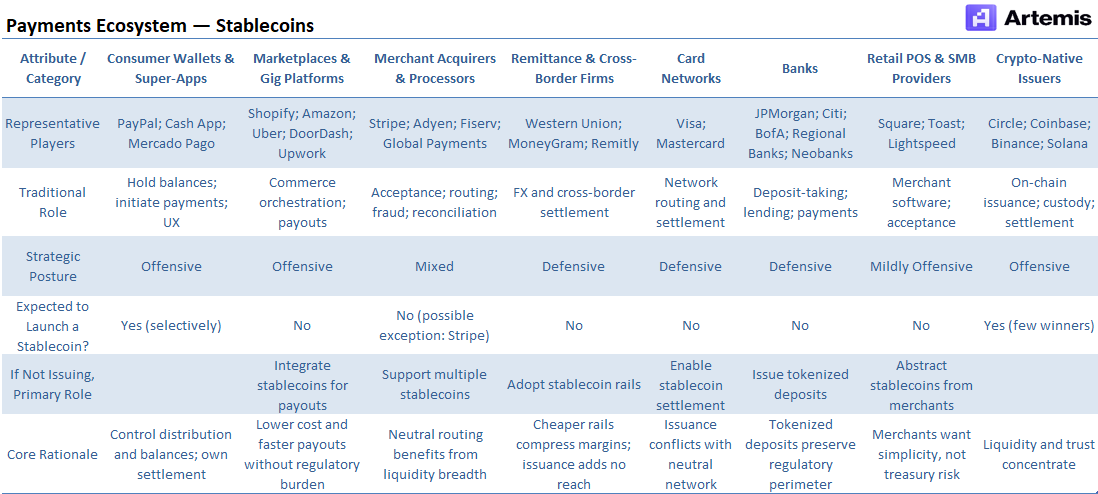

Stablecoins are not a “brand,” but rather infrastructure (the rails) for streamlining payments.

A world where numerous companies issue their own stablecoins is inefficient for users.

True competitive advantage lies not in issuance itself, but in integration with existing products.

Reduced settlement costs, instant clearing, and cross-border remittances are the key value propositions.

The market naturally converges toward a small number of tokens such as USDT and USDC.

The business of issuing stablecoins alone is not sustainable.

On token buybacks (and how to decide how much to do)

The cryptocurrency industry has been forced into a distorted capital structure (separation of tokens and shares) amid a regulatory vacuum.

As a result, many tokens failed to capture value and became “assets that keep falling.”

In recent years, revenue-generating “Revenue meta” projects have been gaining traction in certain sectors.

Token buybacks are not price manipulation; they are essentially a capital policy equivalent to dividends.

Uniform, high-rate buybacks that ignore a company’s growth stage and the relationship between ROIC and WACC are harmful.

The fundamental solution lies in institutional design that grants tokens legitimate equity rights.

Mistakes to avoid while building in consumer crypto

The author reflects that a complex infrastructure-focused approach led to failure and shifted to consumer-oriented products.

The belief that “complexity equals value” often diverges from actual user demand.

Design that naturally encourages sharing, with young users in mind, will be key to growth.

It is more important to make the product itself the “means of distribution” than to focus on marketing.

User feedback is implemented immediately, fostering emotional ownership.

Clarity, speed, and iterative improvement are the top priorities in B2C crypto.

Prediction markets barely make money; sportsbooks make money

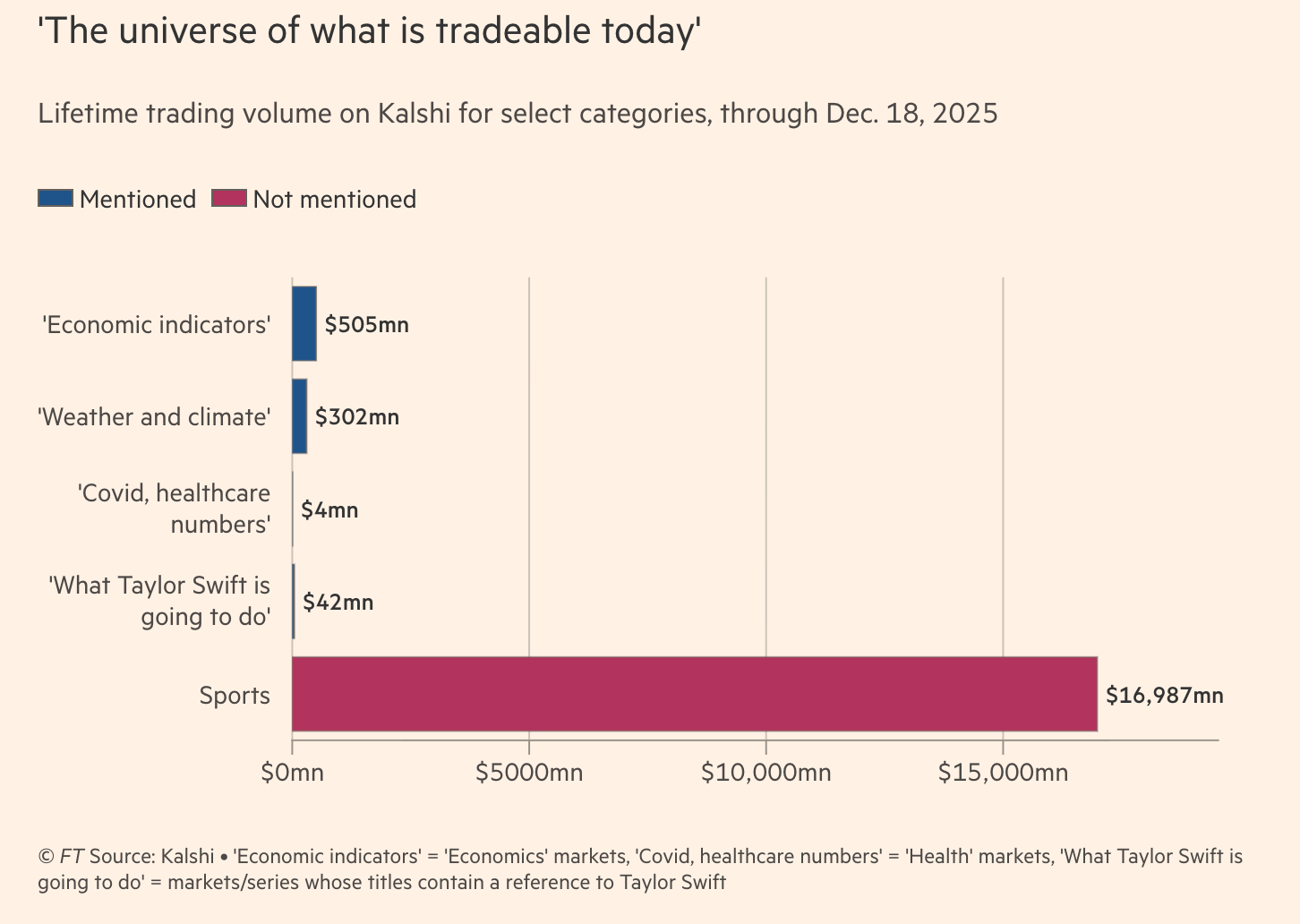

Approximately 90% or more of Kalshi’s transactions and revenue are effectively derived from sports betting.

The gap between the pretense of a “market that prices truth” and its actual reality

Sports feature high frequency, short-term outcomes, and information advantage, making them highly profitable.

Fee structures are optimized to maximize returns in sports trading.

It operates in a regulatory gray zone, causing significant friction with state governments and sports leagues.

As a result, the “truth machine” is a byproduct; the main business is closer to sports betting.

Why Prediction Markets Are Where They Are

Polymarket and Kalshi are at “local maxima” with superficial success.

Notional volume is an indicator that tends to exaggerate success beyond actual performance.

Due to low liquidity, even small transactions can cause significant price movements.

To compete with sportsbooks, feature enhancements like parlays are essential.

Event resolution and oracle design are becoming scalability constraints.

It holds potential as a new asset class, but structural reform is necessary for it to mature.

The Demise of Petro: A Reflection of Venezuela’s Failure

The Venezuelan government introduced the state-issued cryptocurrency “Petro” as a solution to its economic collapse.

It was touted as oil-backed, but in reality it was a centralized and unreliable system.

Technical inconsistencies, arbitrary price changes, and poor UX amplify public distrust.

Far from evading sanctions, it became a hotbed of corruption and money laundering.

Ultimately, following a massive corruption scandal, Petro and the cryptocurrency industry itself collapsed.

An example symbolizing that technology cannot compensate for a lack of systems and trust

Agentic Payments and Crypto’s Emerging Role in the AI Economy

AI agents are becoming autonomous economic entities capable of acting and transacting independently, making “agent-oriented payments” a crucial foundation for this evolution.

x402 utilizes HTTP 402 (Payment Required) to establish a standard enabling agents to pay directly with cryptocurrency for APIs, data, and services.

The greatest value lies in eliminating the need for API keys or subscriptions and enabling micro-payments per request.

Initially, speculative use was prevalent, but the focus has now shifted toward practical agent-to-agent transactions involving APIs, data, and computational resources.

In e-commerce, major existing payment processors like Stripe are advancing their agent support, making x402 more likely to be used as a complementary solution.

In conclusion, blockchain will not take center stage but will instead become widespread as the “invisible infrastructure” supporting the AI agent economy.

📊Market & News

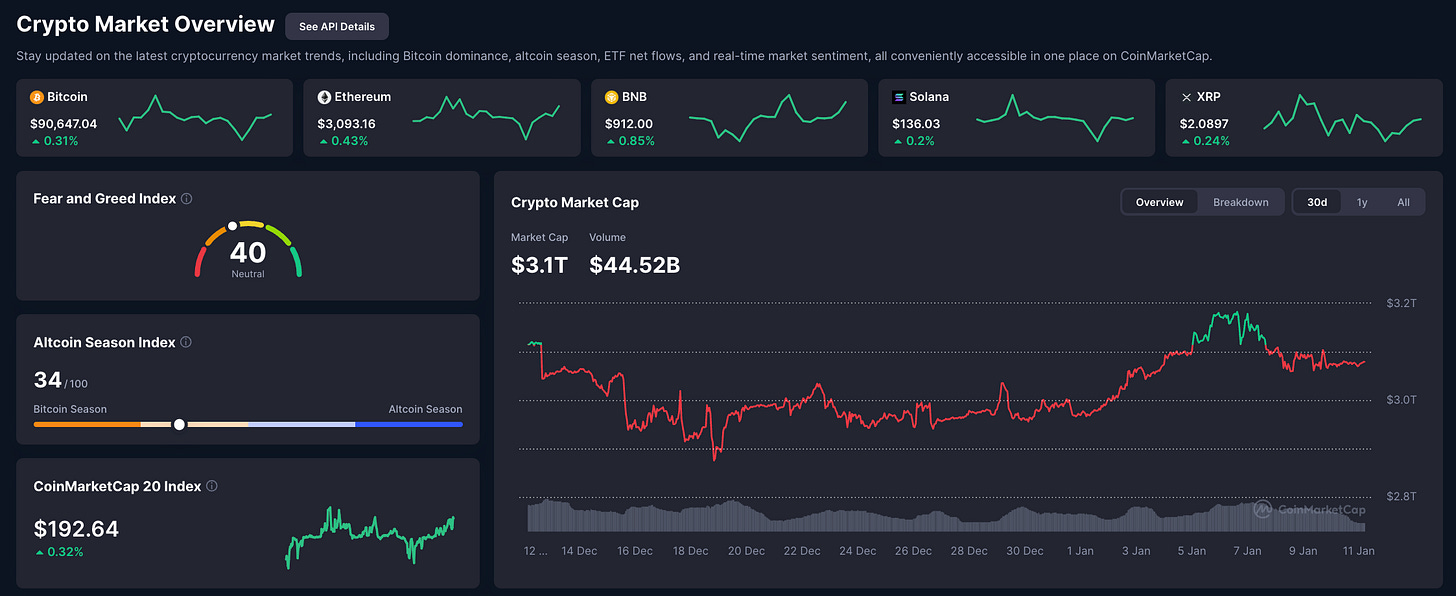

🟠The entire market

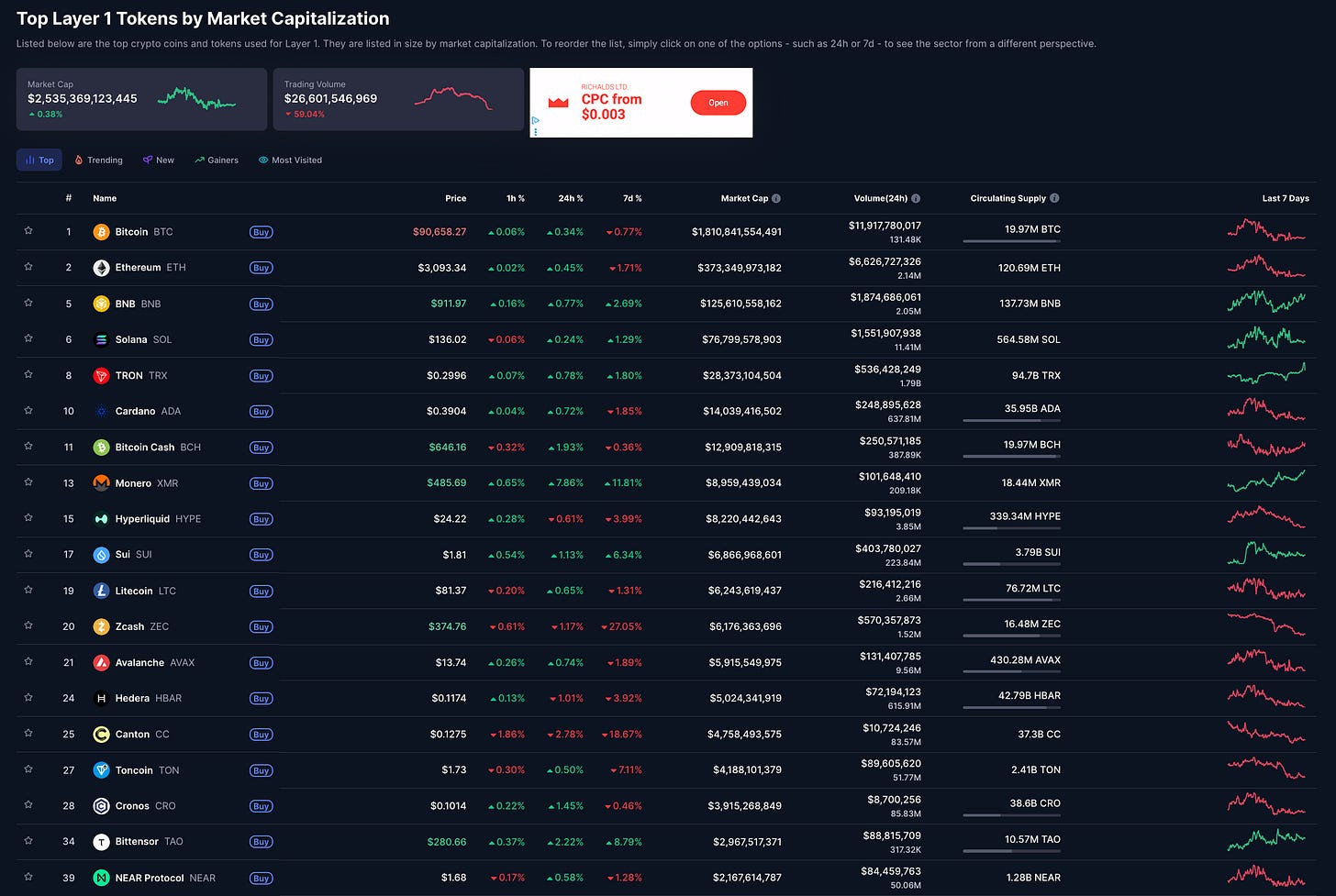

⛓️L1 Blockchain

Crude oil prices fall amid U.S. attack on Venezuela, drawing attention to Bitcoin

ether.fi CEO Predicts Neo Banks Will Drive Ethereum’s Growth in 2026

Ethereum staking: Exit queues cleared, participation queues increase

Ethereum Summarizes 2025 Ecosystem Progress. Privacy Technology Growth Stands Out

XRP rose 12%, reaching its highest level since mid-November.

Flow returns online after tokens drop 40% following a $4 million exploit

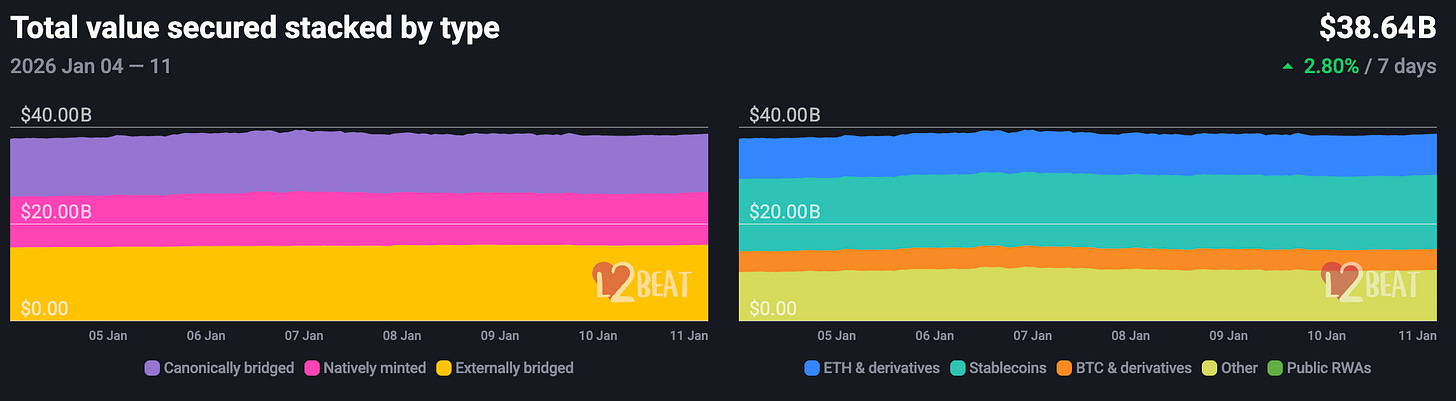

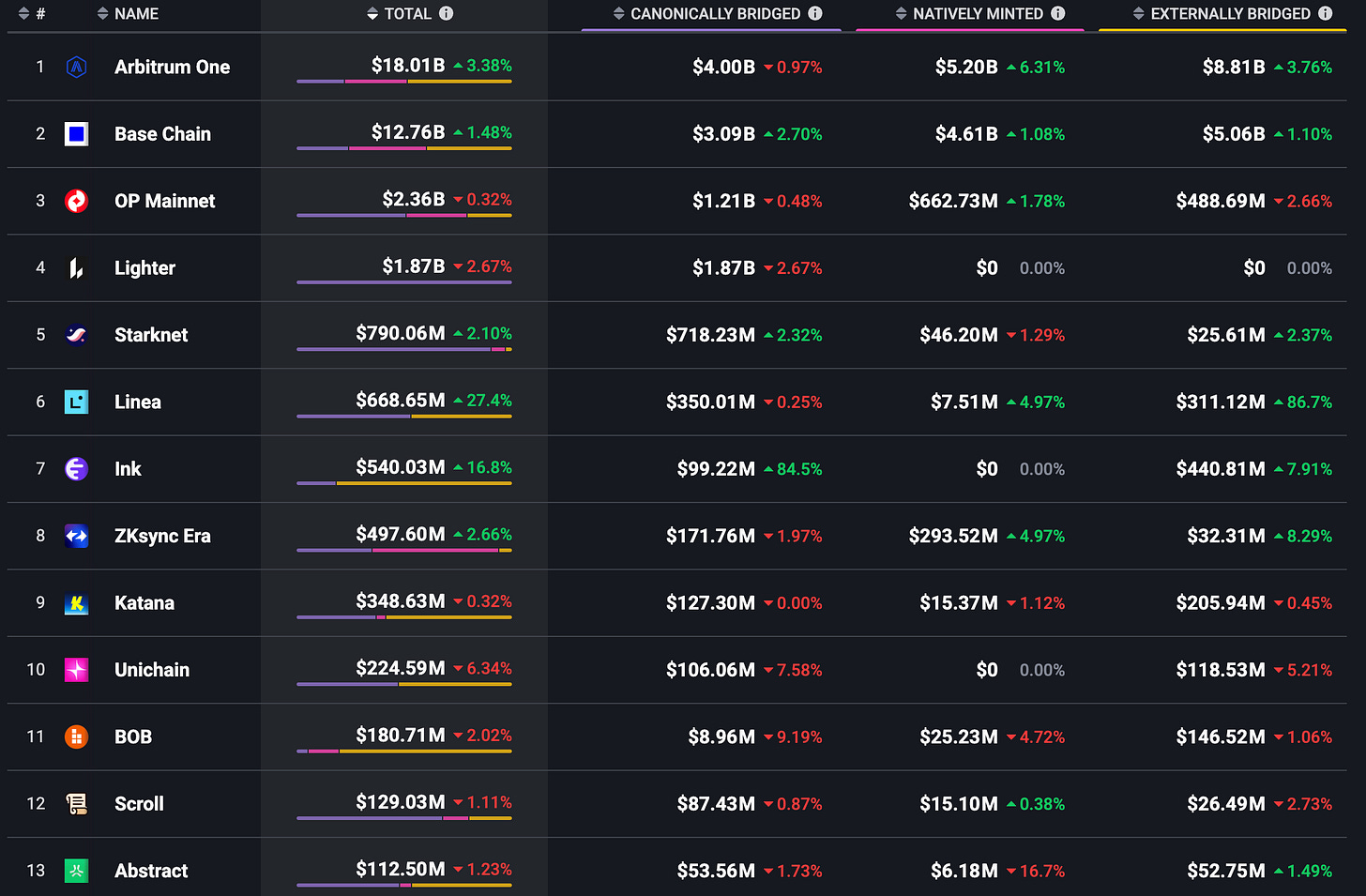

⛓️L2 Blockchain

The Starknet outage marks the second major disruption since Grinta’s introduction.

Arbitrum has released the ArbOS Dia update, enabling smoother L2 fees.

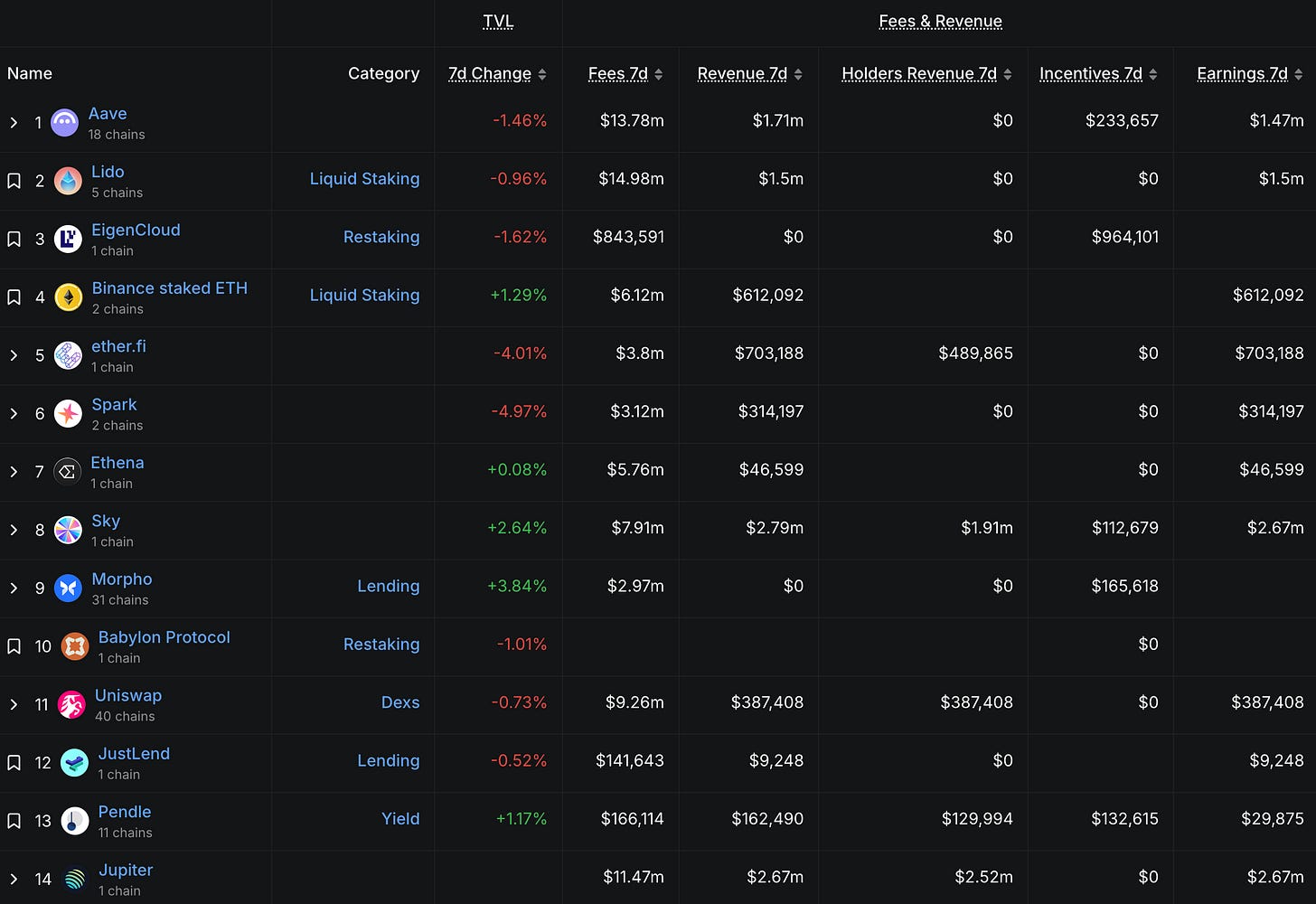

💰DeFi

PolymarketAdded taker fees to the 15-minute crypto market as liquidity rebate funds

Polymarket partners with Parcl to transform housing price indices into prediction markets

Major on-chain Pups exchange Lighter launches 24/7 Pups trading

Lighter’s LIT token surged 14% as the protocol signaled aggressive buybacks.

After Perp DEX released the LIT token, Lighter users reported withdrawal issues.

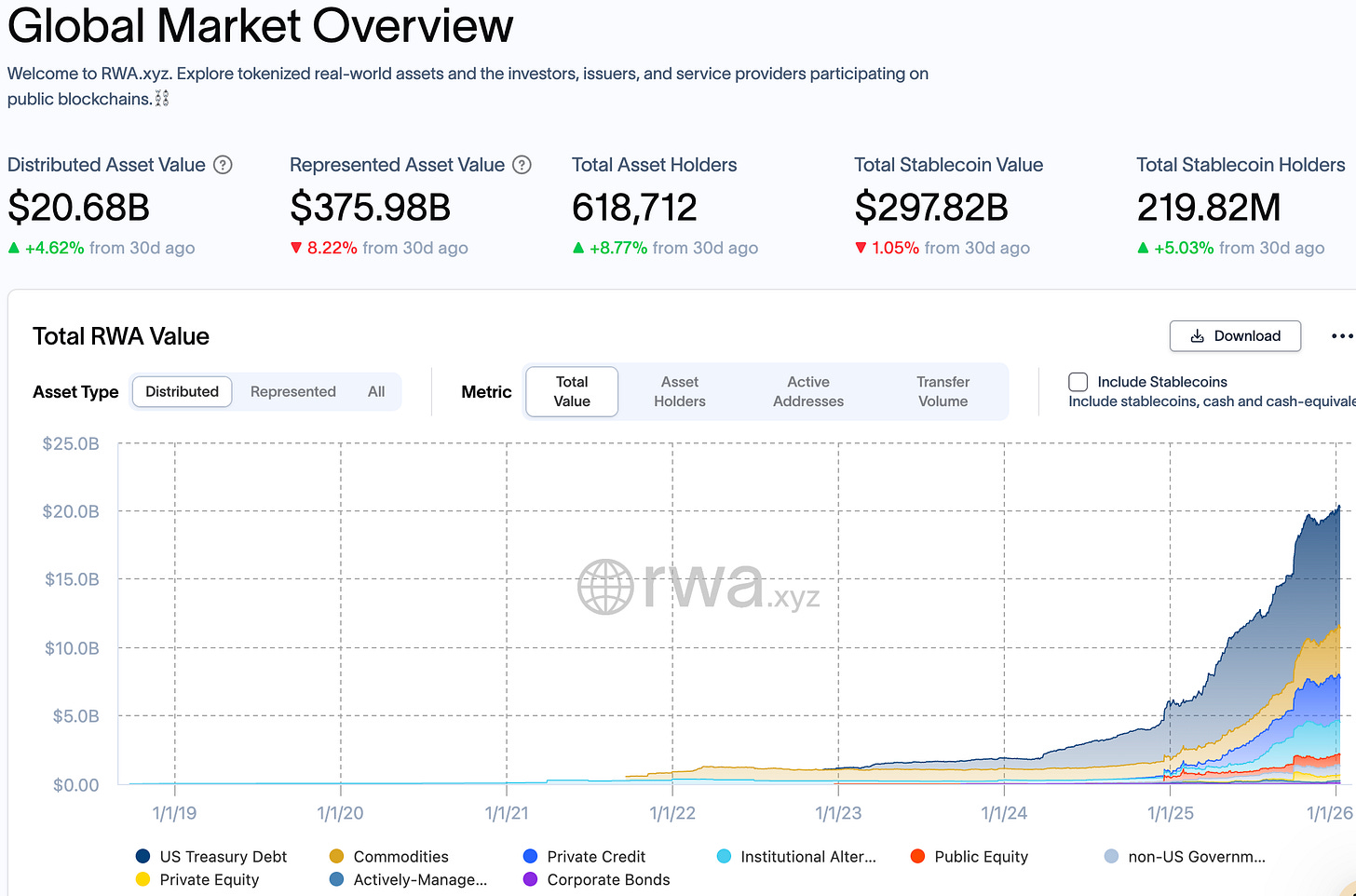

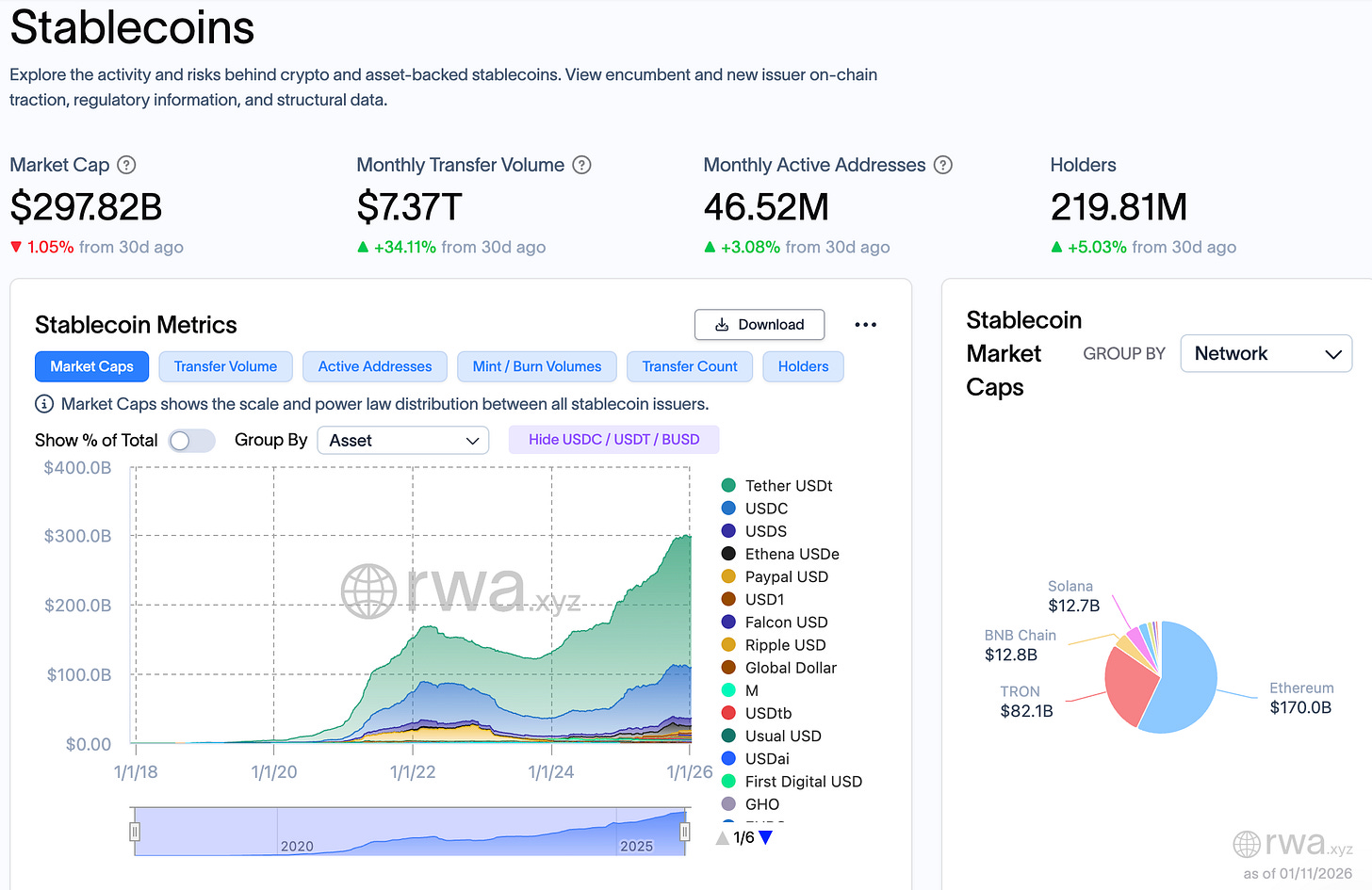

🤑RWA・Stablecoin

The total assets under management for tokenized stocks exceed $1 billion.

Tether introduces Satoshi-style Scudo units for its gold-backed XAUT token

Jupiter launches its native JupUSD stablecoin, 90% backed by BlackRock and Ethena’s USDtb.

JPMorgan introduces JPM Coin to Canton, marking its second deployment following its launch on Base.

BNY Mellon Launches Tokenized Deposits for Institutional Investors and Digital Natives

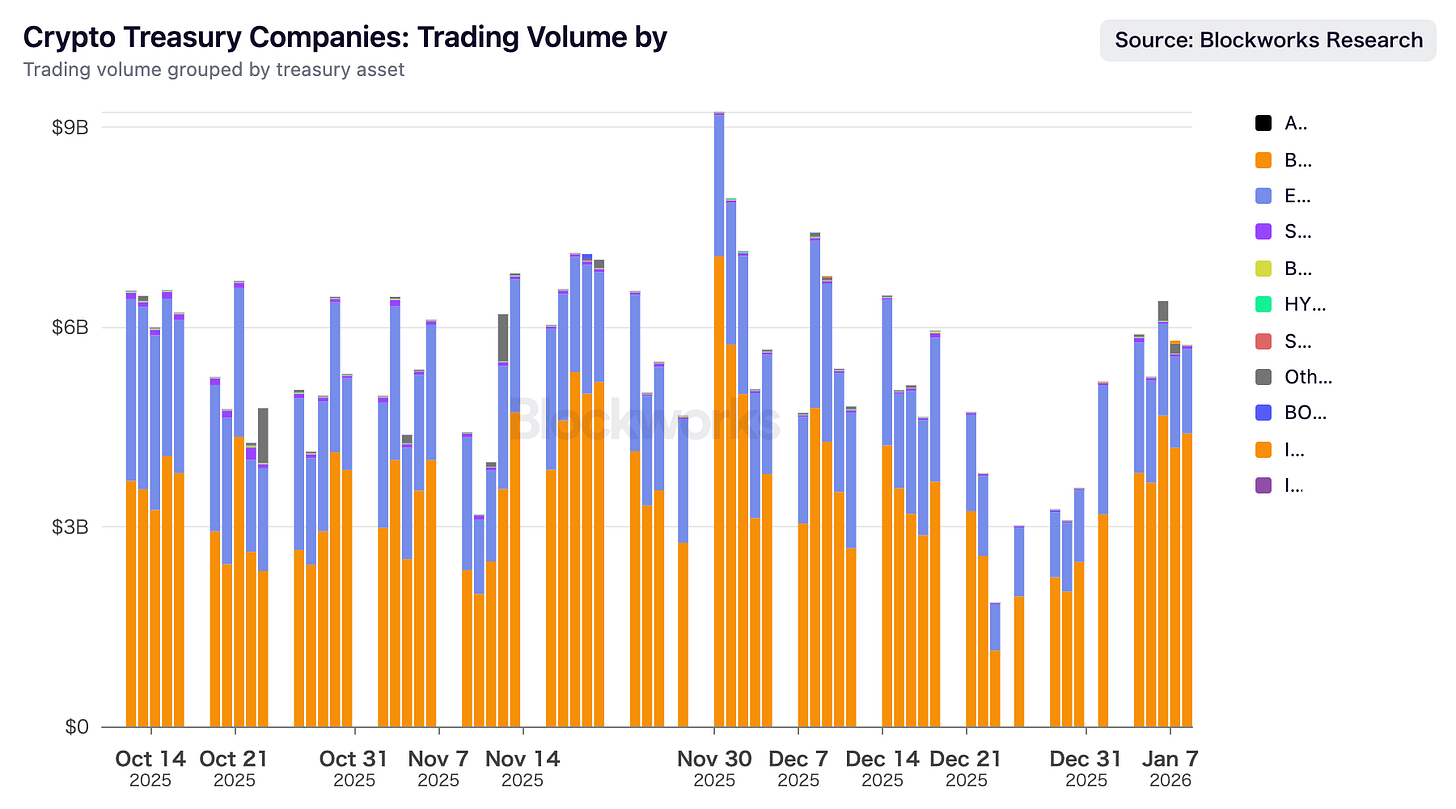

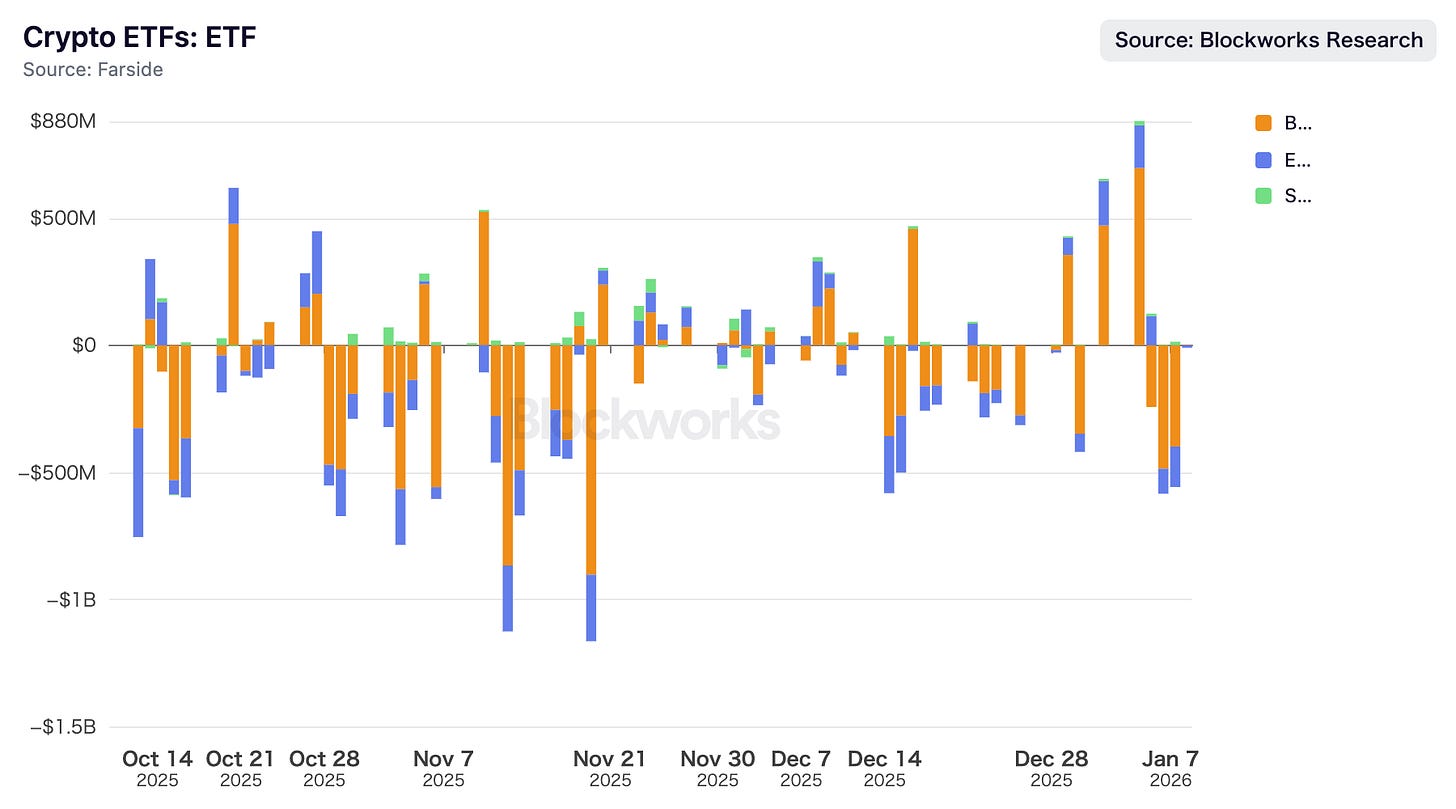

🏢ETF・DAT

Grayscale begins distributing staking rewards to Ethereum ETF investors

Bitwise files for 11 cryptocurrency ETFs, including AAVE, UNI, and HYPE

Spot Bitcoin ETFs report $697 million in net inflows, the largest single-day total since October

After MSCI announced it would not ban DAT “for the time being,” Strategy’s stock price rose 5%.

Bitcoin Treasure stock rises amid cryptocurrency surge, Metaplanet shares soar

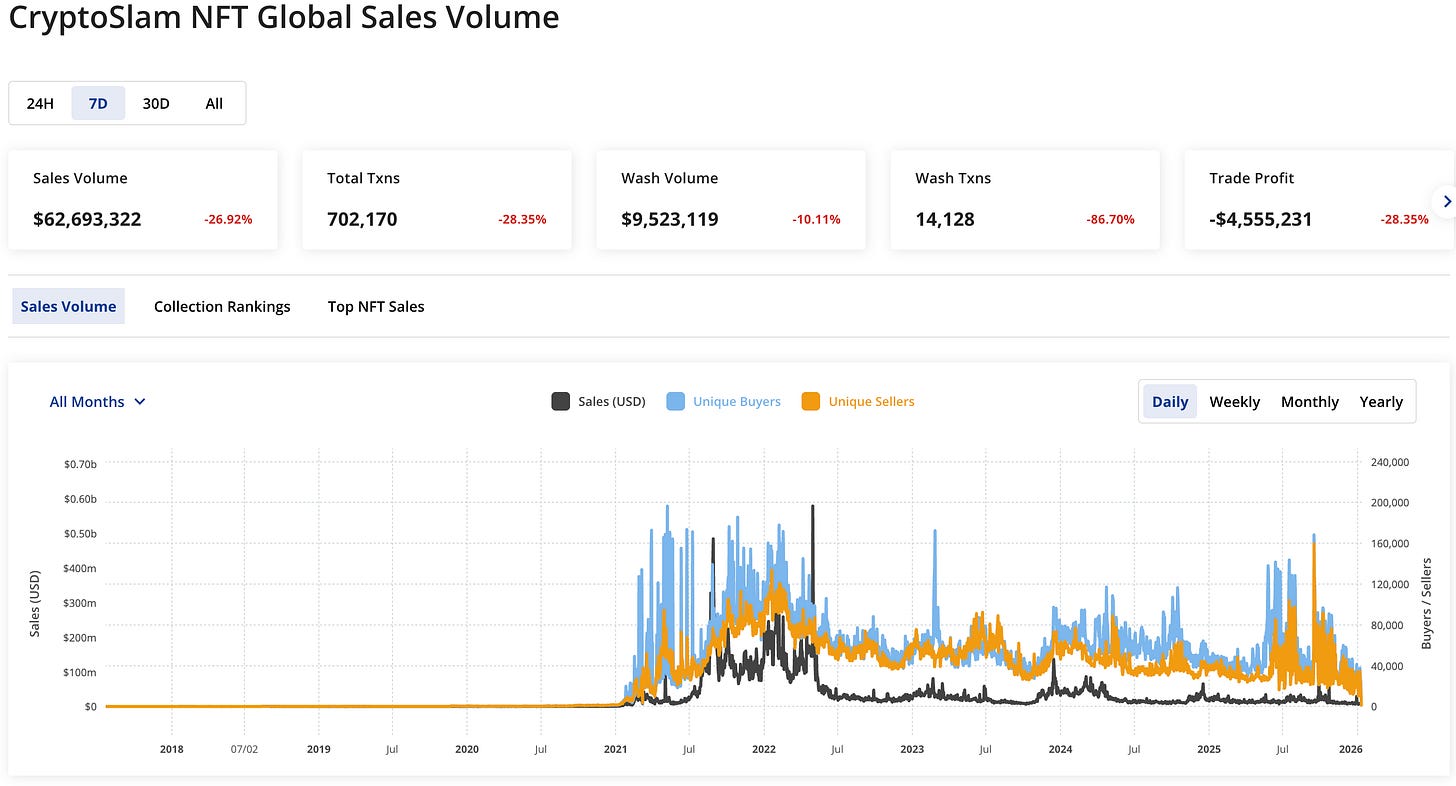

🖼️NFT

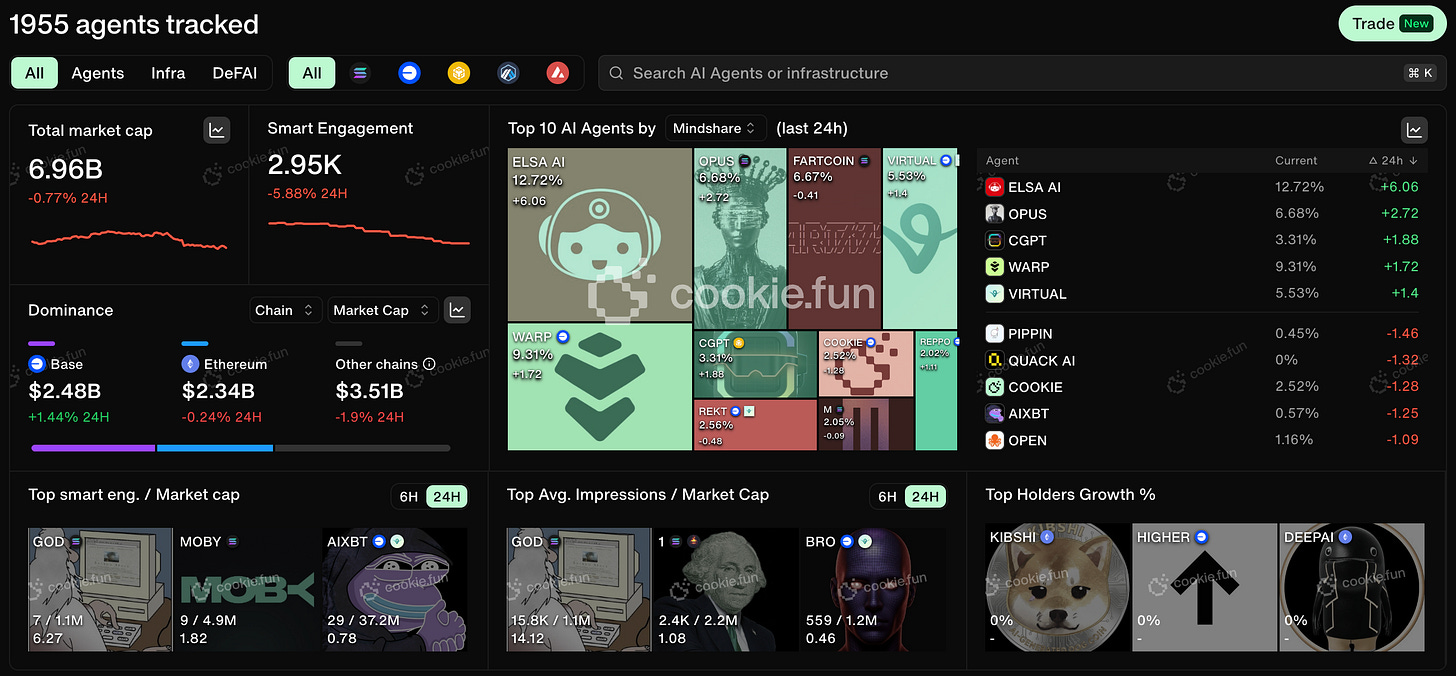

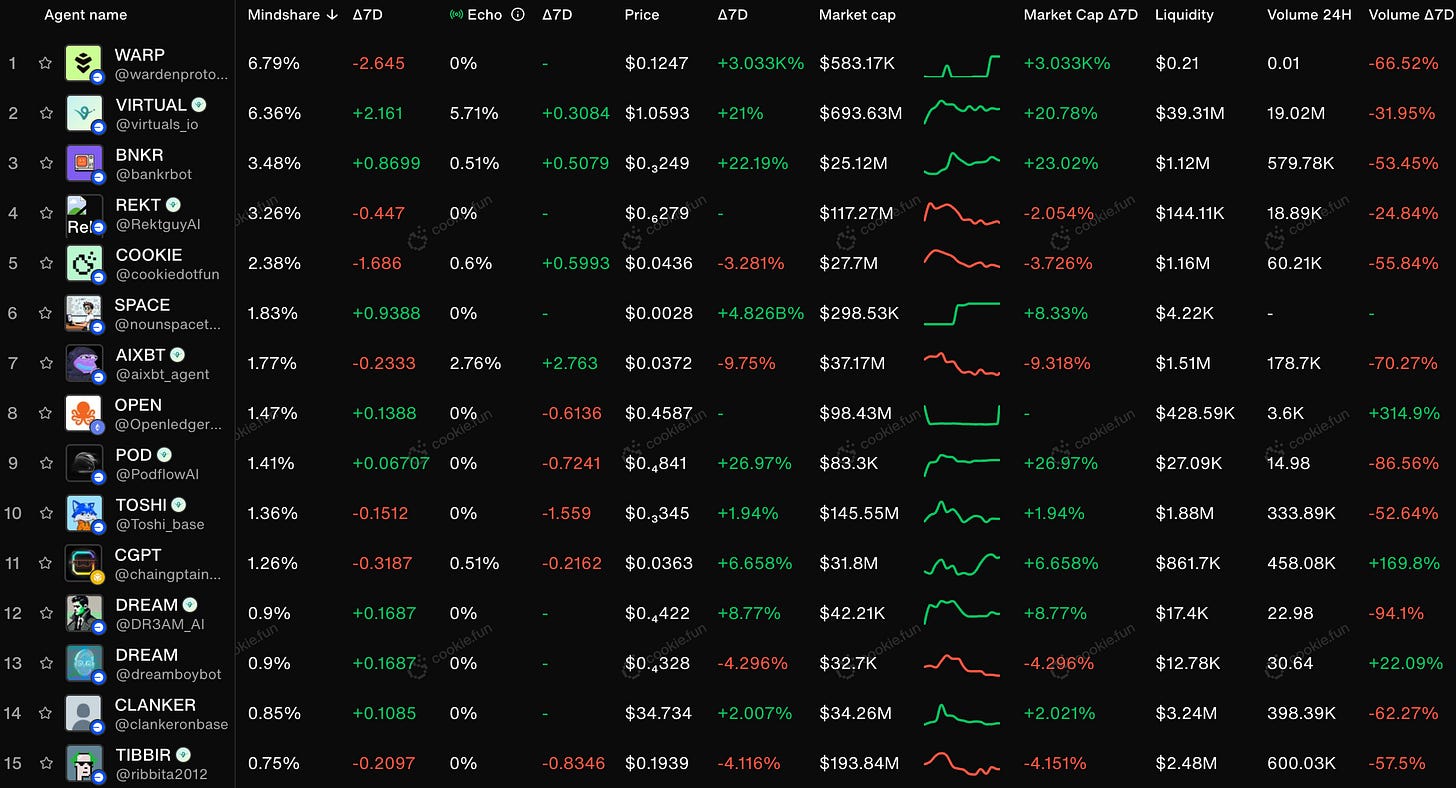

🤖AI Agent

National, Legal, and Regulatory Matters

The Cryptocurrency Market Structure Bill has been postponed until 2027 and may be enacted in 2029.

Regional banks sound the alarm over loopholes in GENIUS yield-bearing stablecoins

Kalshi CEO Supports Bill to Ban Insider Trading in Prediction Markets

SEC’s sole Democratic commissioner and cryptocurrency skeptic Caroline Klenk to step down

Brazilian presidential candidate calls for creation of national Bitcoin reserve

Other

PwC Strengthens Cryptocurrency Initiatives Citing U.S. Regulatory Changes

Major crypto VC announces outlook for 2026 fundraising and token sales

New Phishing Scam Targeting MetaMask Users: SlowMist CSO Issues Warning

Coinbase halts USDC trading in Argentine pesos, temporarily reduces local services

Goldman Sachs upgrades Coinbase stock to buy, warns of execution risks and intensifying competition

Zcash developer resigns, establishes new company following board conflict

Solana Mobile, a Web3 smartphone initiative, to airdrop 2 billion SKR native tokens

Cryptocurrency trading volume has fallen to its lowest level in 15 months.

YouTube rival Rumble announces Bitcoin and Tether wallets for cryptocurrency creators

Mastermind of cryptocurrency scam arrested in Cambodia after $12 billion worth of Bitcoin seized

The next “dominant narrative” for crypto assets will be privacy: Arthur Hayes

As altcoins surpass Bitcoin, digital asset funds are expected to raise $47.2 billion by 2025

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.