A 5-Minute Recap of Last Week's Web3 Market

We have compiled the latest market information and major news from the past week.

Happy New Year.

I’m Mitsui, a web3 researcher.

We’re resuming our newsletter starting today. The first issue will be a news recap, though there wasn’t much to cover due to the year-end and New Year holidays. We’ll continue updating as usual from today onward, so thank you for your continued support!

📰Pickup News

📗Pickup Article

📊Market & News

📰Pickup News

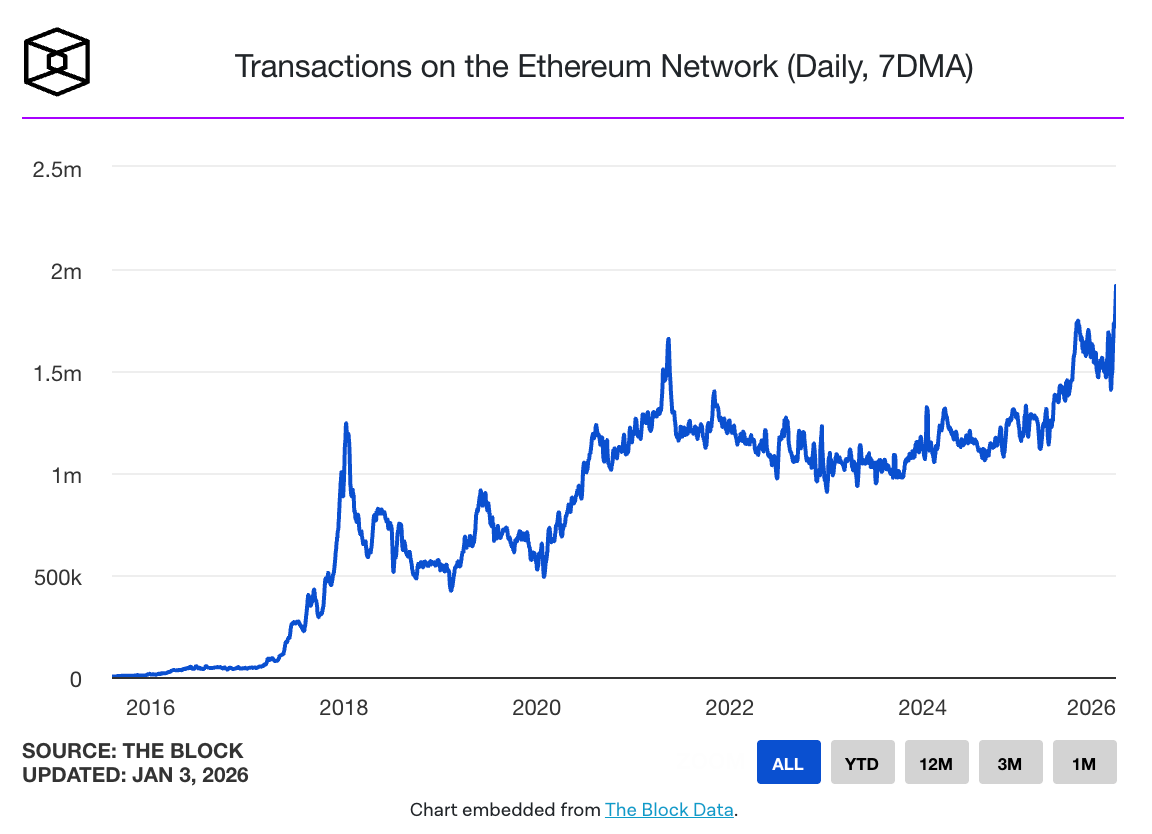

Ethereum’s daily transaction volume hit a record high, surpassing the 2021 NFT boom.

Ethereum’s daily transaction count has reached 1.87 million, surpassing the peak during the 2021 NFT boom.

The number of new and active addresses has also reached its highest level in several years, with network usage expanding driven by actual demand.

Reducing fees and improving scalability, among other things,Effects of the Pectra・Fusaka Upgradebecomes apparent

ETFs, RWA, stablecoins, etc.,Establishment of Financial Use Casesis the background

Creator Coin has once again failed to meet expectations, and ZORA has declined.

A coin issued by a prominent creator on Base’s Zora platform plummeted by approximately 80% in a short period, significantly failing to meet expectations.

Following this disappointment, the ZORA token itself also declined, leading to a loss of confidence in the creator coin model.

Market participants strongly criticize it as “a structure lacking real demand or ongoing utility, destined to be sold after unlocking.”

The experiment combining content and tokens proved unsustainable beyond mere buzz, highlighting a lack of design for sustained usage and revenue.

Lighter Launches Native Token LIT, Allocating Half to Ecosystem Growth

Lighter, a decentralized perpetual DEX,Native Token LITissue

50% of the total supply is allocated to ecosystem growth (airdrops and future incentives).

Protocol revenue is visualized on-chain,Value accrues to LIT holdersDesign

Lighter is solidifying its position as one of the major perpetual DEXs, backed by high trading volume and growth rates.

Dexter AI has released the x402 SDK to add per-request USDC payments to its API.

Dexterx402-compatible SDKEnables easy implementation of USDC micropayments per API

Automate 402 error handling, wallet signing, and retries,Implement payment processing with just a few lines of codepossible

Dynamic pricing based on token count (for AI inference) and Phantom compatibility included as standard features

Based on API × Payment × AI,Practical Implementation of On-Chain Billing InfrastructureExamples demonstrating

Trust Wallet Begins $7 Million Compensation Process for Browser Extension Hacking Victims

The Trust Wallet Chrome extension has been compromised,Approximately $7 million was lost.

The cause was due to an API key leak in the Chrome Web Store,Malicious updates distributedthe point that was made

Trust Wallet has officially launched its compensation process,The full amount of damages will be compensated.Then stated

In wallet extensionsSupply Chain Attack Riskhas been brought into sharp relief once again

📗Pickup Article

Introducing posts and articles I found interesting.

Five Charts Showing How Cryptocurrency Will Change by 2025, Based on Data

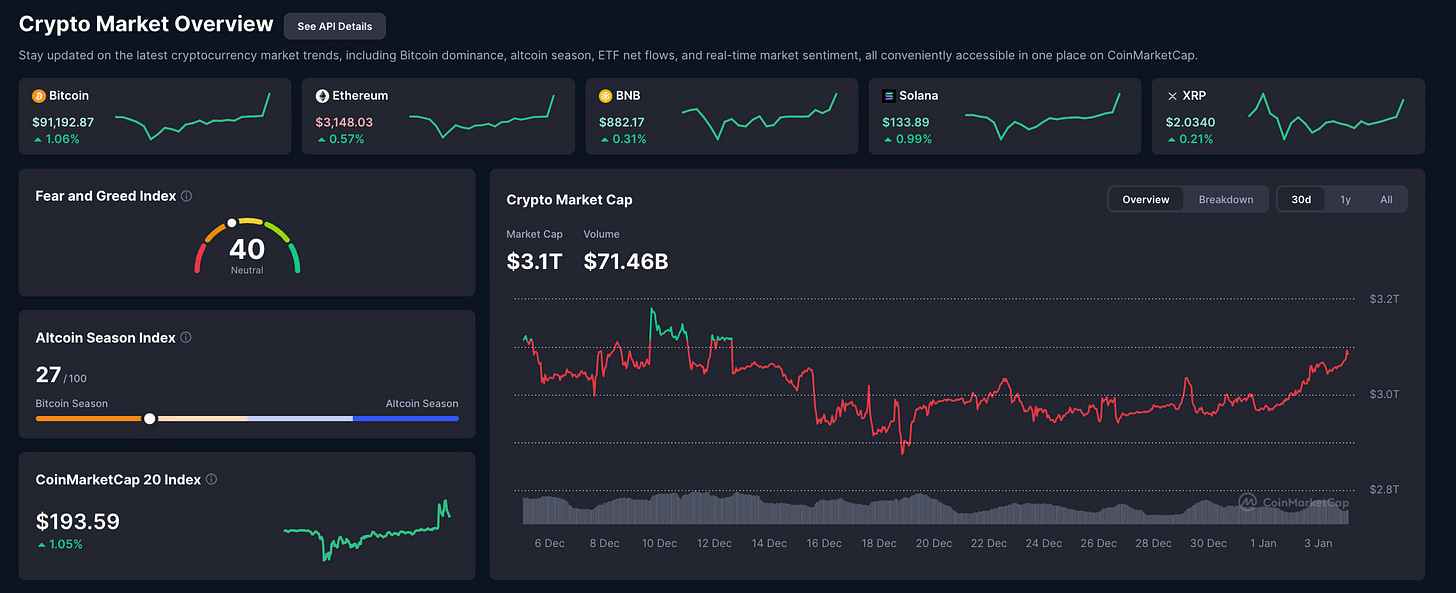

In 2025, while BTC will hit new highs,The alto section as a whole is sluggish.The bull market failed to materialize

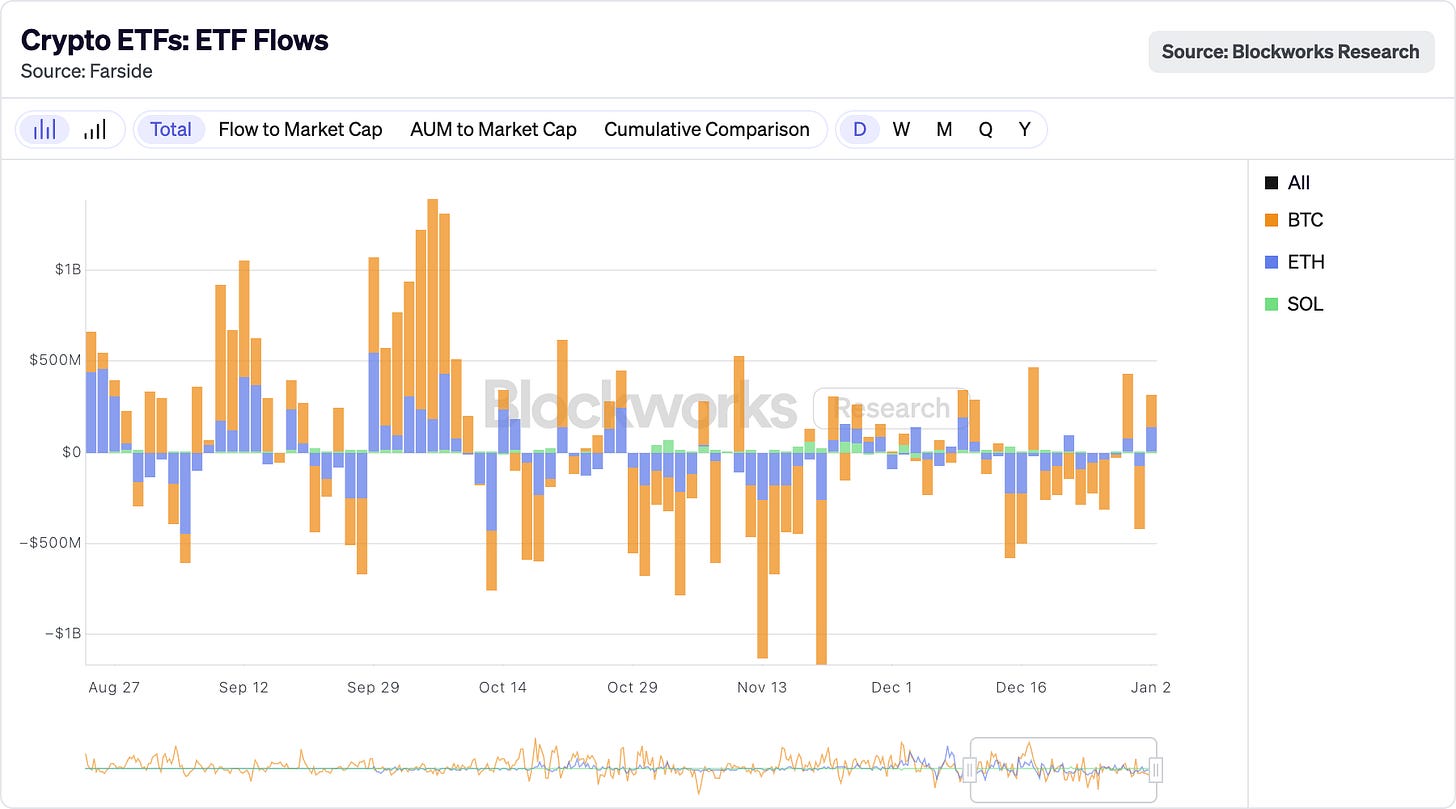

U.S. spot ETFs continue to see inflows,Institutional investor involvement has become established

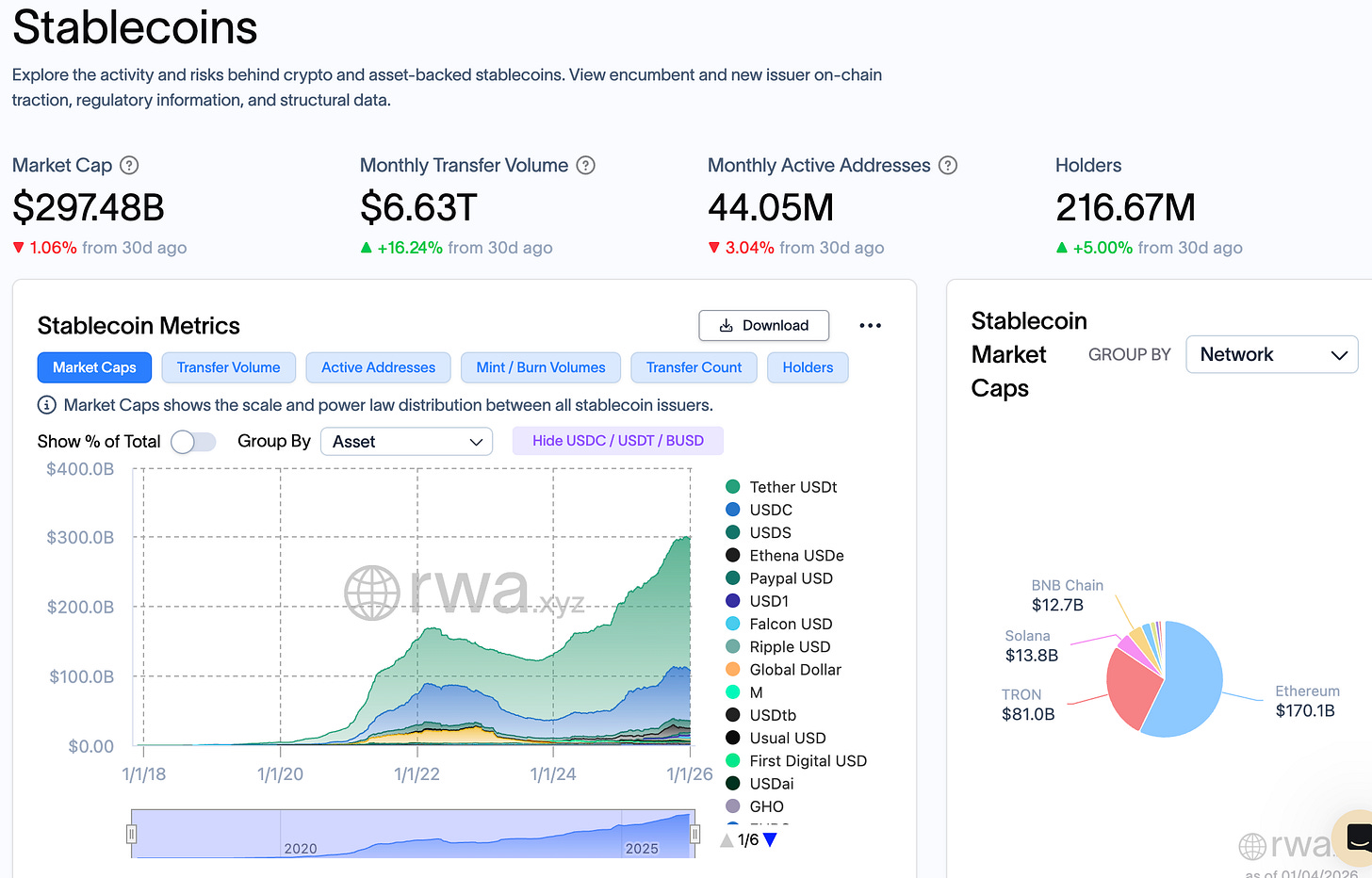

Stablecoin supply has reached record levels, establishing itself as a payment and remittance infrastructure.

Prediction markets (Polymarket / Kalshi) become mainstream and integrate with media and finance

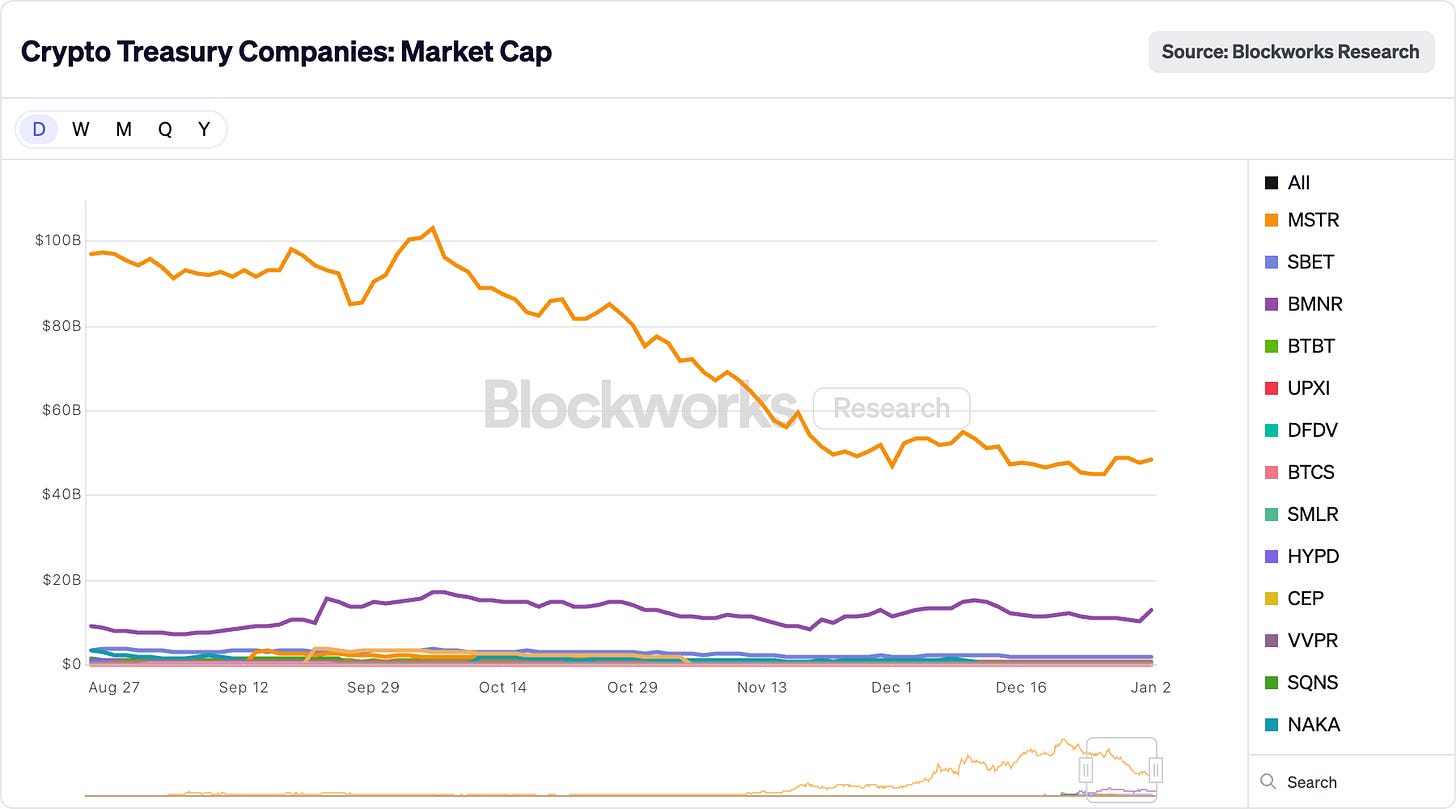

While Perp DEX makes a comeback, the boom in cryptocurrency holding companies (DATs) rapidly shrinks.

Balance of power

Modern society faces the simultaneous expansion of three major powers: big government, big business, and big crowds.

The essence of the problem is,A structure where economies of scale self-reinforce power concentration

As a solution, the diffusion of technology, knowledge, and means of production is crucial, rather than mere redistribution of wealth.

Open standards, interoperability, and adversarial interoperability are key.

Decentralization is not “neutralization,”Design that exerts influence without creating dominanceis

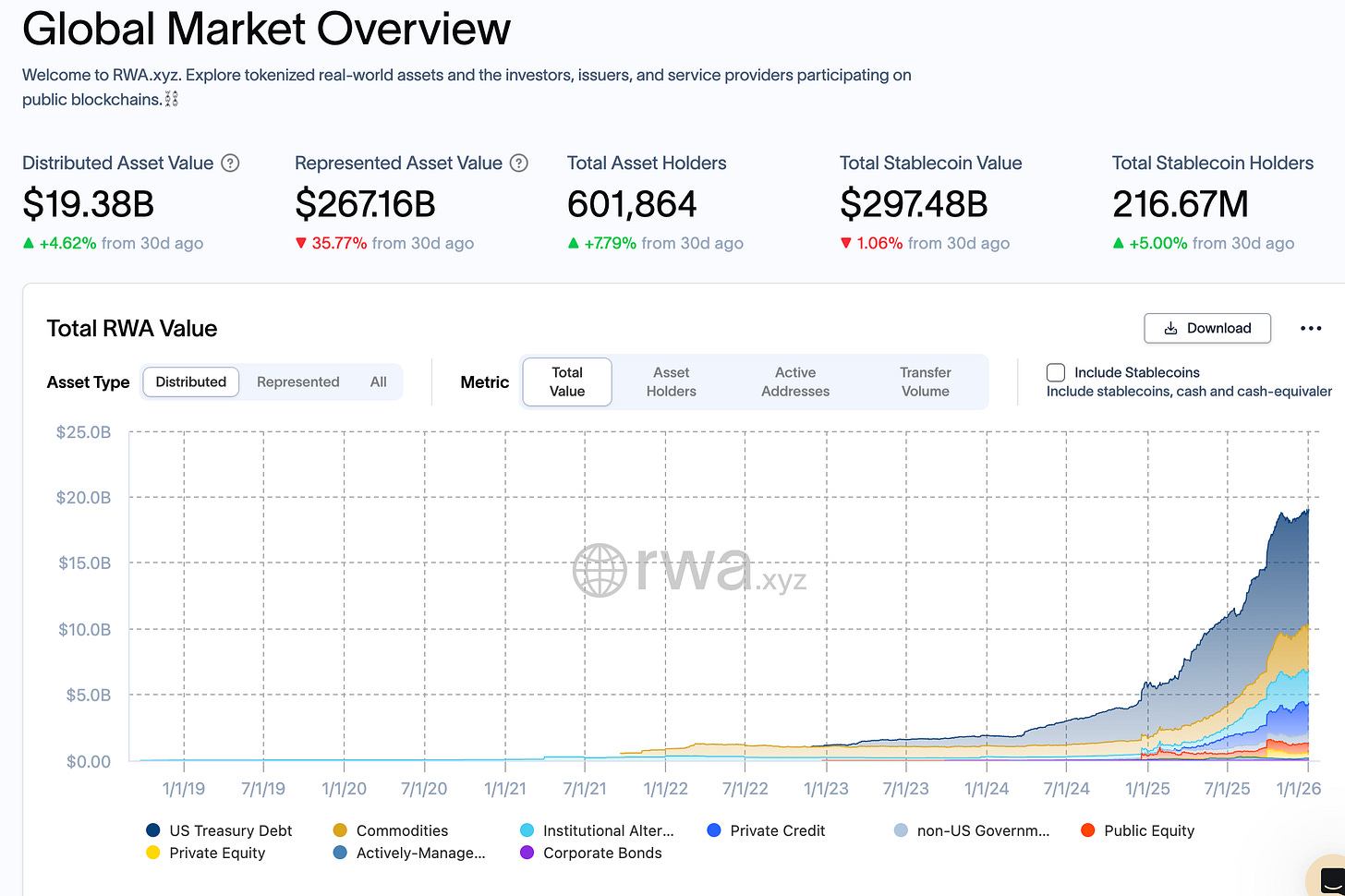

2026: What to Expect from Real-World Asset Tokenization

RWA tokenization has concluded its experimental phase,Standard Infrastructure for Asset Managementis beginning to be positioned as

By 2026, it is predicted that a majority of major asset managers will have strategies based on tokenization.

The axis of growth is not speculation,Actual demand, stability, operational efficiency (settlement, liquidity, distribution)

Index products, government bonds, and private credit are being fully integrated onto the blockchain.

The challenge lies not so much in the issuance itselfCirculation, Integration, and Secondary Marketand this is where the competition lies

To Predict or Not to Predict? My take on Prediction Markets in 2026

Prediction markets will transition from niche to mainstream by 2025, with 2026 marking the stage of “how they will evolve.”

AI agents are not analytical tools,market participants themselvesbecome

Rather than opinion polls,Predictive markets begin to be used as a reference layer for decision-making.

Evolving from YES/NO-type to conditional branching and scenario decomposition markets

The future competitive axis will be more about quality than liquidity.Reliability and Standardization of Resolution

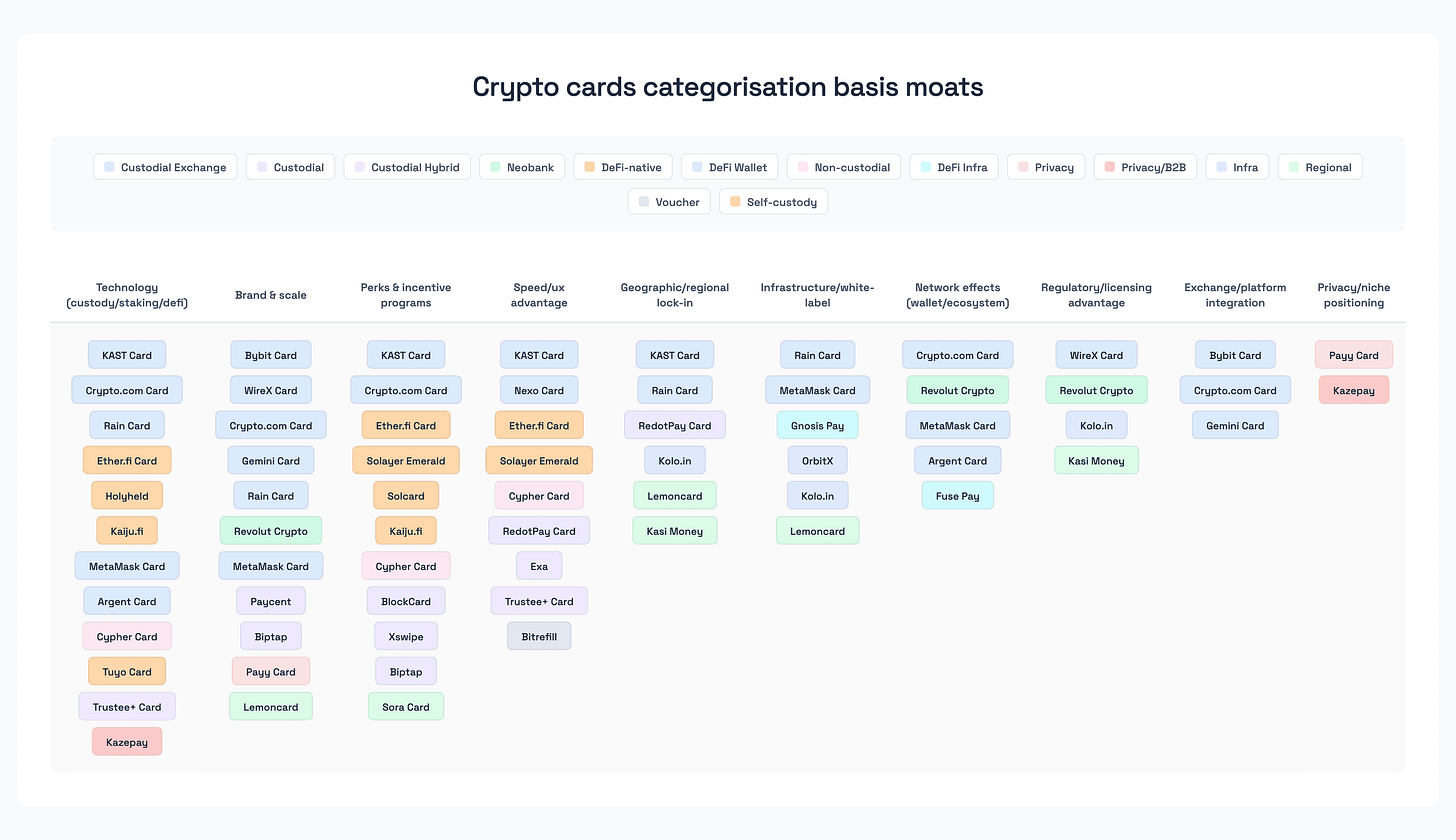

Crypto Card Moats

The crypto card market has entered a mature phase,Rewards and cashback are no longer differentiating factors.

The true moat lies in the “underlying infrastructure” of liquidity, licensing, compliance, and settlement rails.

CeFi platforms achieve scale but have low profit margins, while DeFi platforms offer high leverage tied to yields but are unstable.

B2B infrastructure providers (issuance, FX, KYC, settlement)Once integrated, it becomes extremely difficult to switch.

The future winner will be,Stripe-like full-stack middlewareplayer holding

📊Market & News

🟠The entire market

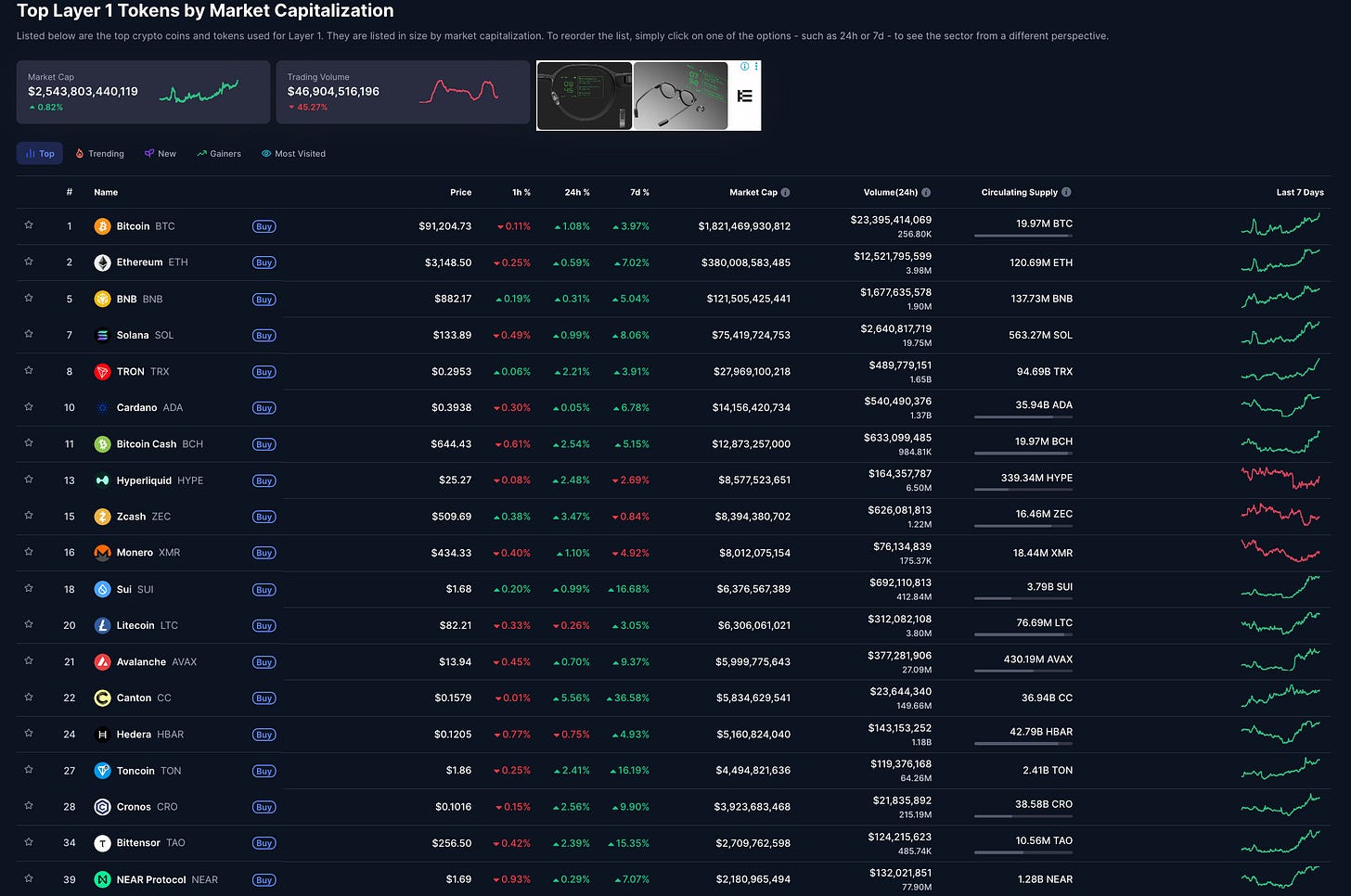

⛓️L1 Blockchain

The Fed leaked bullish liquidity signals suggesting Bitcoin could anticipate a 2026 recovery.

Why Tom Lee Says Ethereum Is Headed for a 2026 ‘Supercycle’ Despite Price Decline

Vitalik Buterin emphasizes true usability and decentralization over the victory of the “next meta.”

Ethereum’s daily transaction volume hit a record high, surpassing the 2021 NFT boom.

Flow blockchain, FLOW token plunges over 40%, investigates security incident

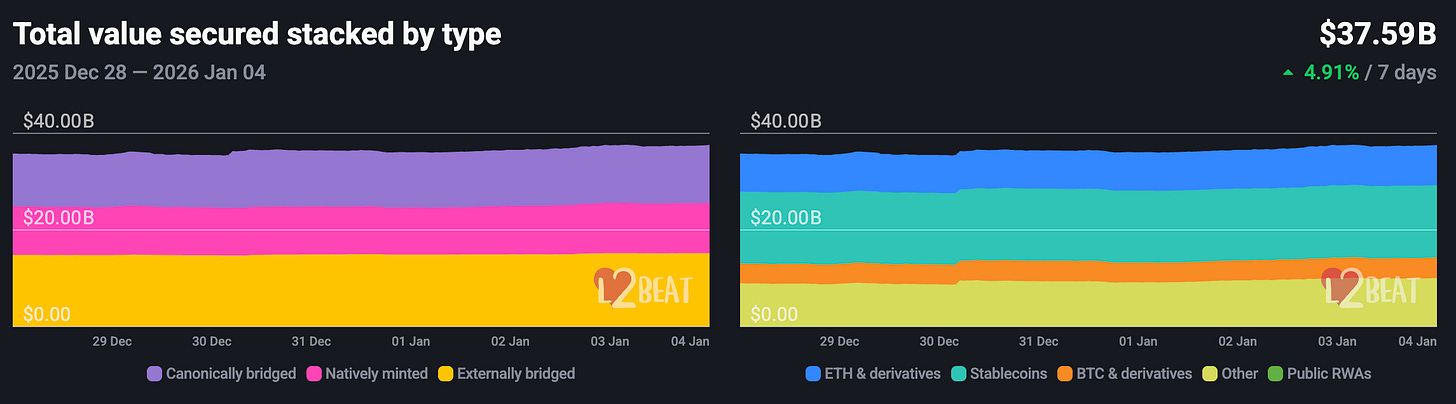

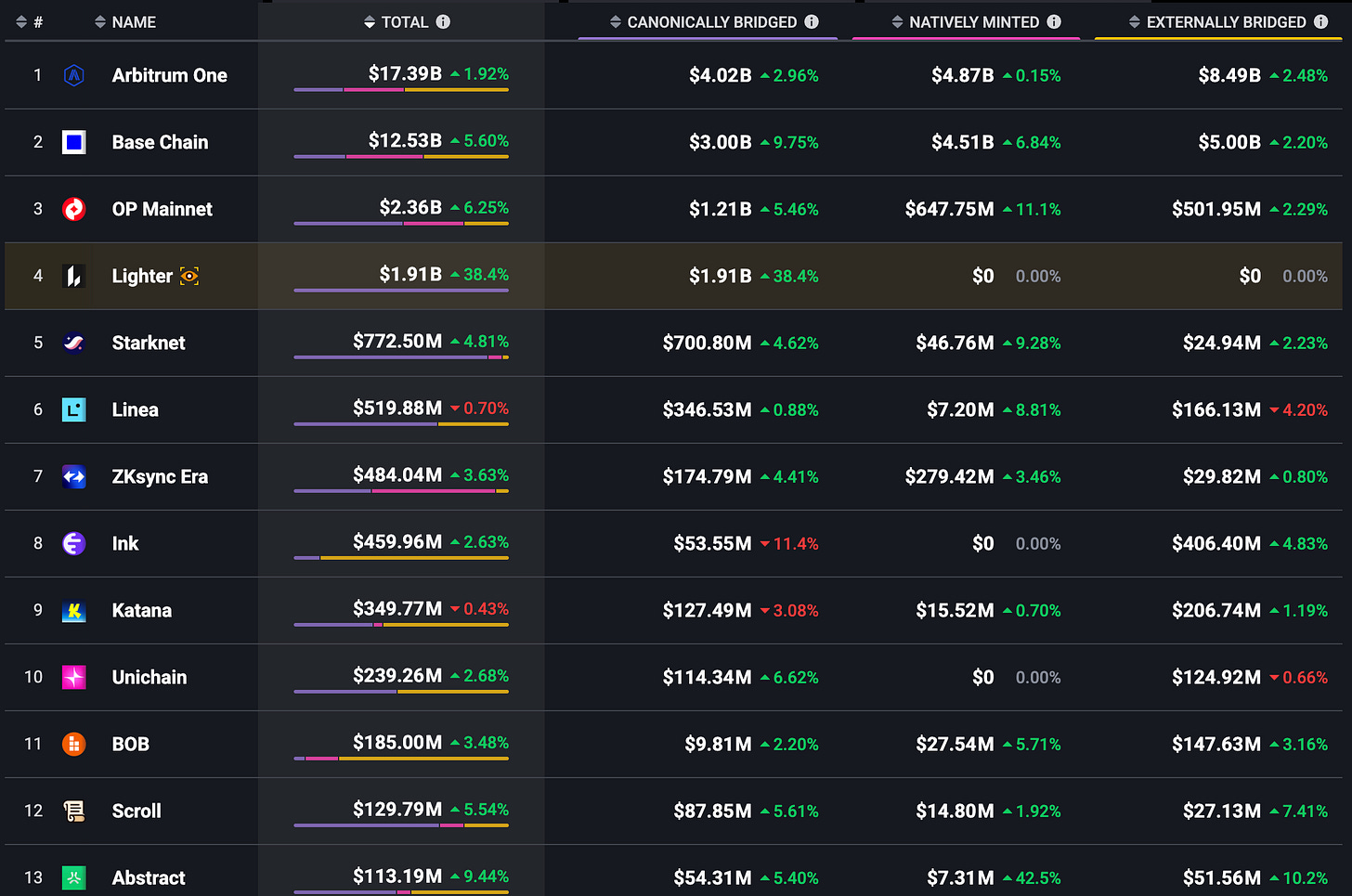

⛓️L2 Blockchain

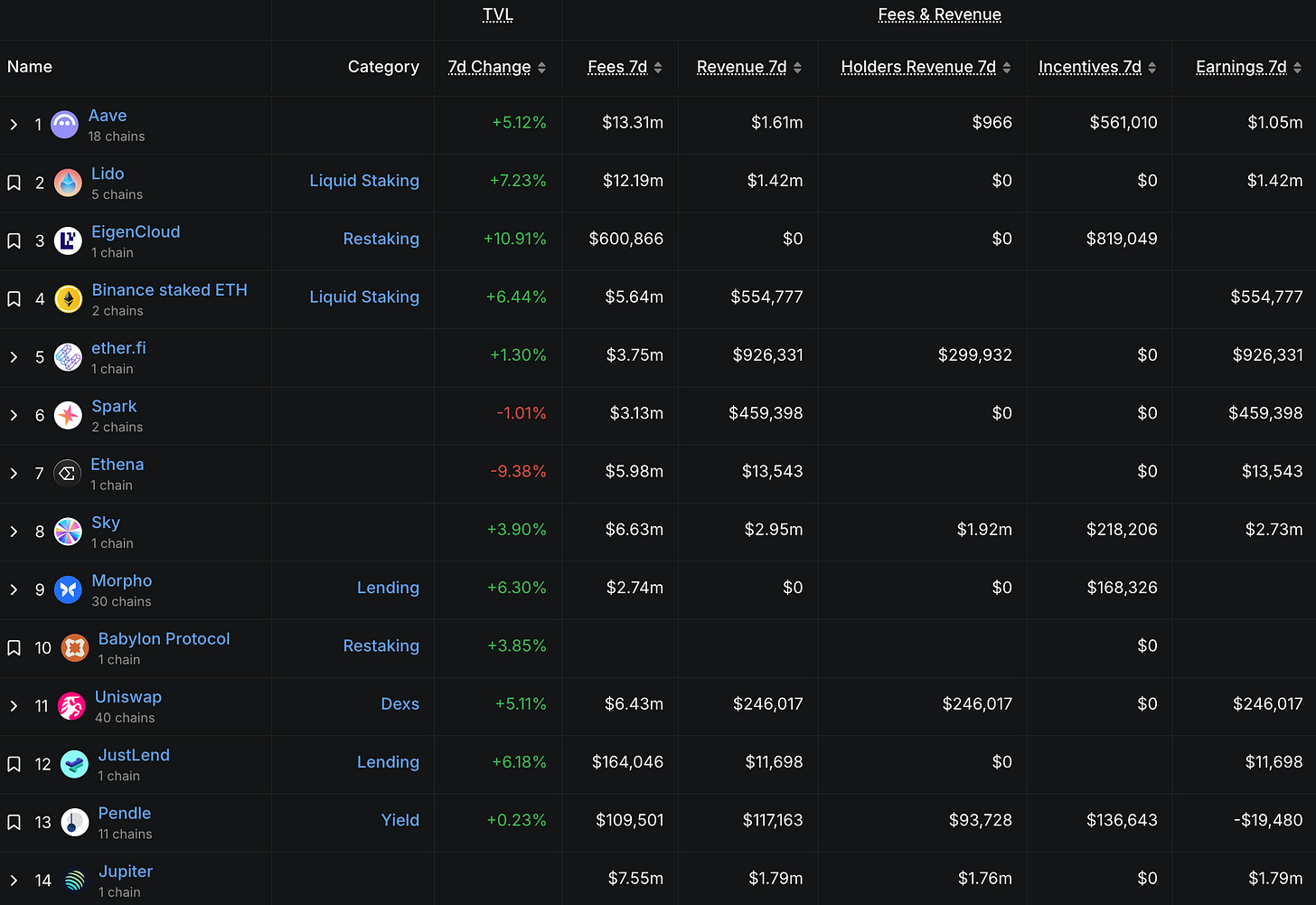

💰DeFi

Creator Coin has once again failed to meet expectations, and ZORA has declined.

Hyperliquid Labs Schedules Next HYPE Token Payment Following Unstaking of 1.2 Million Tokens

Lighter Launches Native Token LIT, Allocating Half to Ecosystem Growth

Kalshi’s weekly trading volume reached $2.3 billion, nearly double that of Polymarket.

🤑RWA・Stablecoin

🏢ETF・DAT

Spot crypto ETF cumulative trading volume has surpassed $2 trillion, doubling in half the time.

Grayscale files for spot Bittensor ETF after network’s first halving event

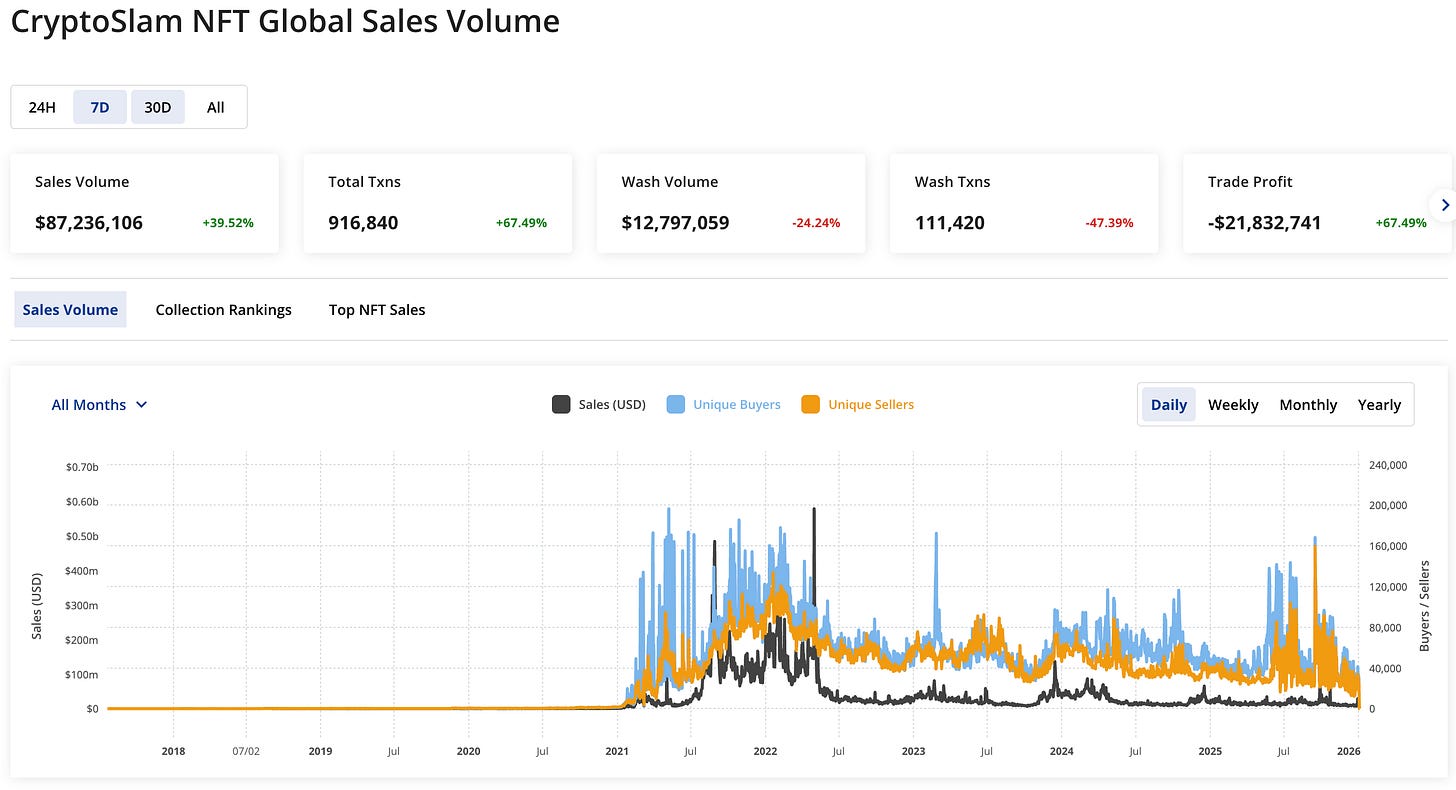

🖼️NFT

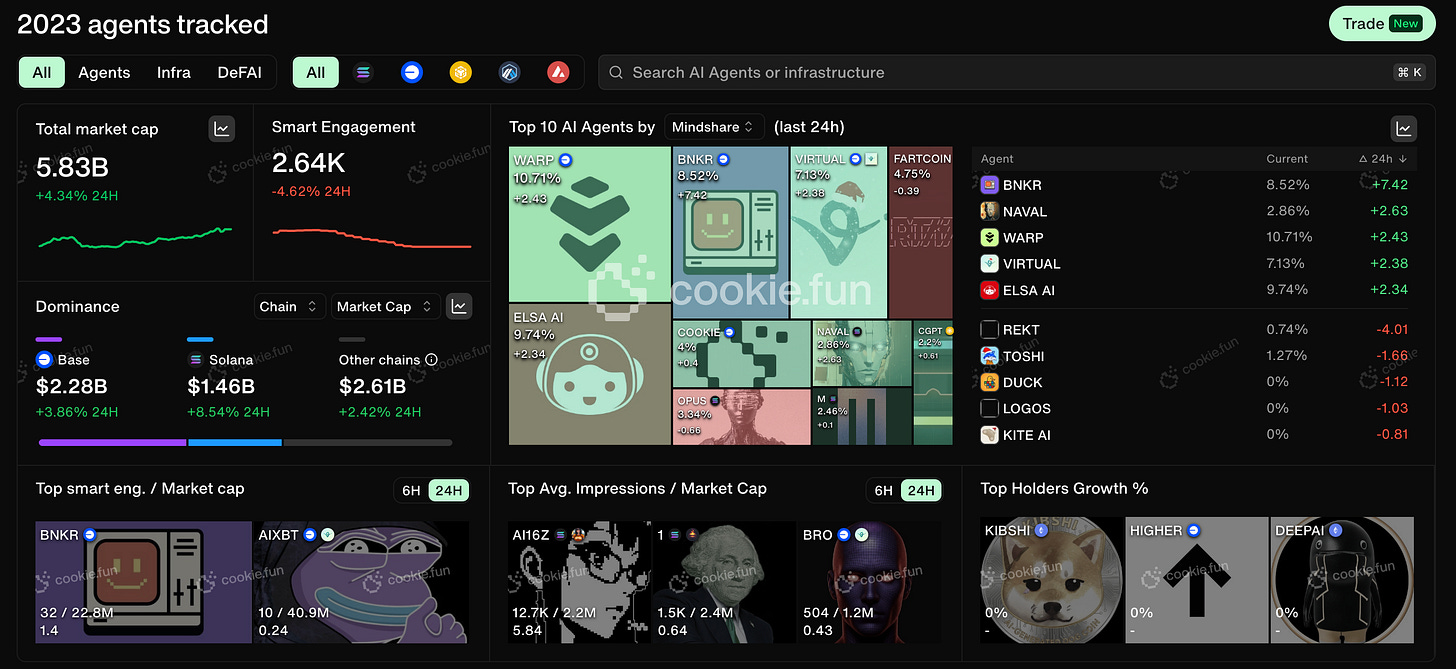

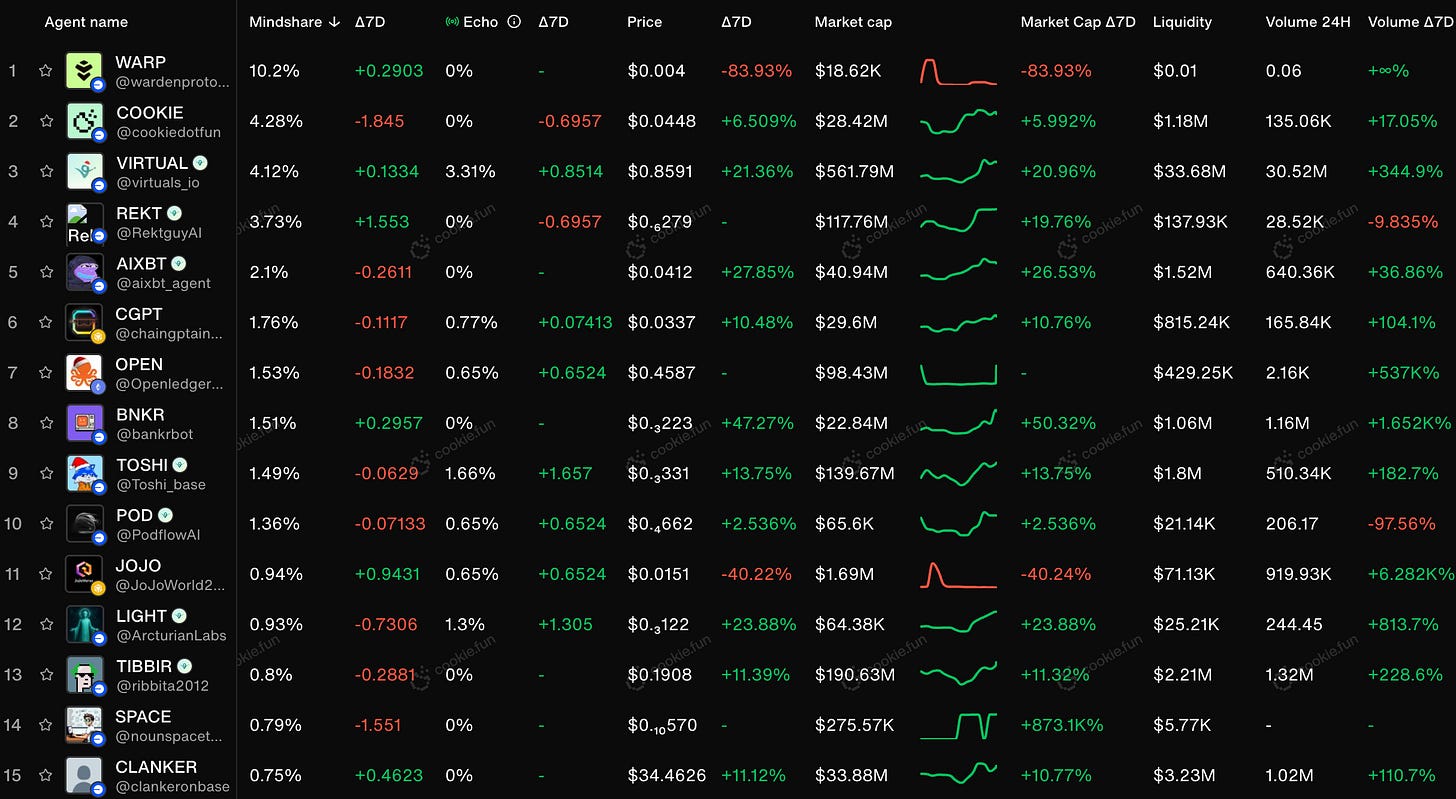

🤖AI Agent

National, Legal, and Regulatory Matters

Coinbase CEO Announces First Arrest in India Over Insider Data Leak: “More Arrests to Follow”

South Korea’s stablecoin bill stalls amid controversy over issuance qualifications

Other

December cryptocurrency trading volume hits lowest level in 15 months

Hundreds of crypto wallets compromised across EVM chains; root cause remains unidentified: ZachXBT

Trust Wallet Begins $7 Million Compensation Process for Browser Extension Hack Victims

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.