A 5-Minute Recap of Last Week's web3 Market

We have compiled the latest market information and major news from the past week.

Good morning.

I’m Mitsui, a web3 researcher.

This is a summary article covering the web3 market over the past week. We gather information from over 20 domestic and international media outlets and newsletters, selecting news items from them. Please use this to catch up on information and trends!

📰Pickup News

📗Pickup Article

📊Market & News

📰Pickup News

Superstate’s new direct issuance program enables listed companies to raise capital using tokenized shares.

Superstate announces a mechanism enabling listed companies to raise funds directly through tokenized shares.

Investors pay with stablecoins and instantly receive on-chain shares.

Achieving faster settlement and cost reduction without going through underwriting securities firms.

Against the backdrop of U.S. regulatory approval, the on-chain transformation of capital markets has advanced further.

Tempo, a blockchain specialized for Stripe and Paradigm settlements, has launched its public testnet.

Tempo, a payment-focused L1 incubated by Stripe and Paradigm, launches its public testnet.

Leveraging instant settlement, low fees, and stablecoin-native design as key strengths.

Klarna, Mastercard, UBS, and others are involved as design partners.

Stablecoin Mainnet Launch Plunges into Chaos Amid Token Price Plunge

Bitfinex-backed L1 “StableChain” launched its mainnet, but encountered issues including withdrawal failures and flawed gas design.

Users received STABLE tokens but were unable to convert them back to USDT, leading to an outpouring of strong dissatisfaction.

Paying for gas requires the proprietary token gUSDT, and the poor user experience is exacerbating the confusion.

The STABLE price has fallen approximately 25% from its recent high, reigniting criticism of the pre-funding design.

Grayscale anticipates TAO price increase following next week’s Bitcoin halving

The decentralized AI network Bittensor will undergo its first halving on December 14.

Grayscale analysis indicates that the halving of new TAO issuance will enhance scarcity, positively impacting price.

The introduction of dTAO has made subnets investment targets, expanding institutional investor interest.

The convergence of actual demand for AI and cryptocurrency with supply constraints indicates that the market has entered a medium-to-long-term maturation phase.

📗Pickup Article

Introducing posts and articles I found interesting.

The Anatomy of a Crypto Neobank

Neobanks disrupted traditional banks with low costs and convenience, but their reliance on custodians makes them inferior to DeFi in terms of transparency and freedom.

The current CEX is a “crypto version of a neobank,” but it still relies on legacy financial rails and has not yet become a true on-chain bank.

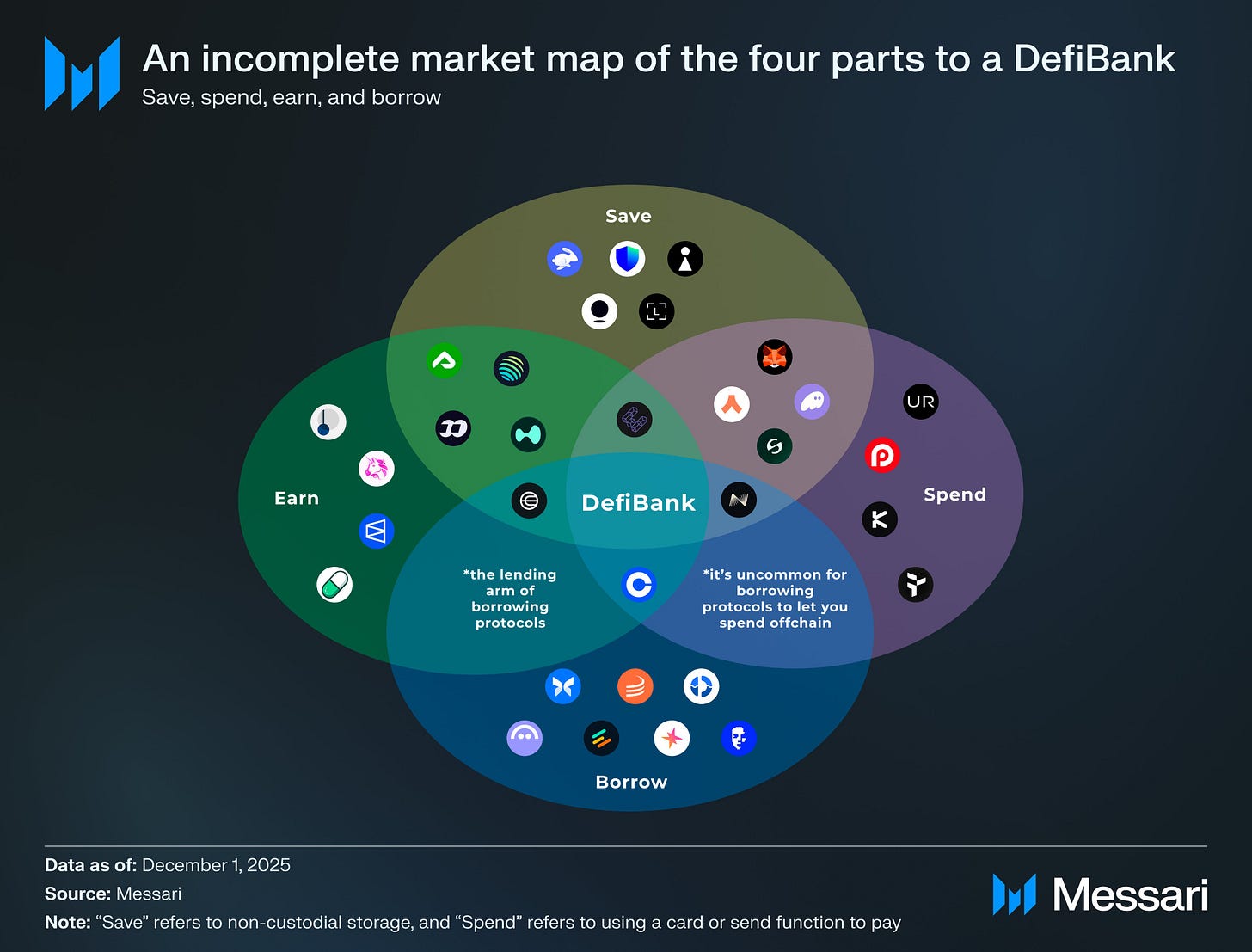

The proposed “DefiBank” model enables users to self-custody their assets and complete all functions—Save/Spend/Earn/Borrow—entirely on-chain.

By eliminating intermediary settlement providers, optimizing MEV, and implementing on-chain credit assessments, it has the potential to become more efficient than traditional banks and neobanks.

Stablecoins, DeFi, and on-chain data integration will form the “next-generation bank,” with particularly high potential for adoption in emerging markets.