Good morning.

I am mitsui, a web3 researcher.

This is a summary article about the web3 market for the last week. We have gathered information from over 20 national and international media outlets and newsletters and have picked out news from them. Please use it to catch up on information and trends!

📰Pickup News

📗Pickup Article

📊Market & News (L1, L2, DeFi, NFT, GameFi, AI, Other)

📰Pickup News

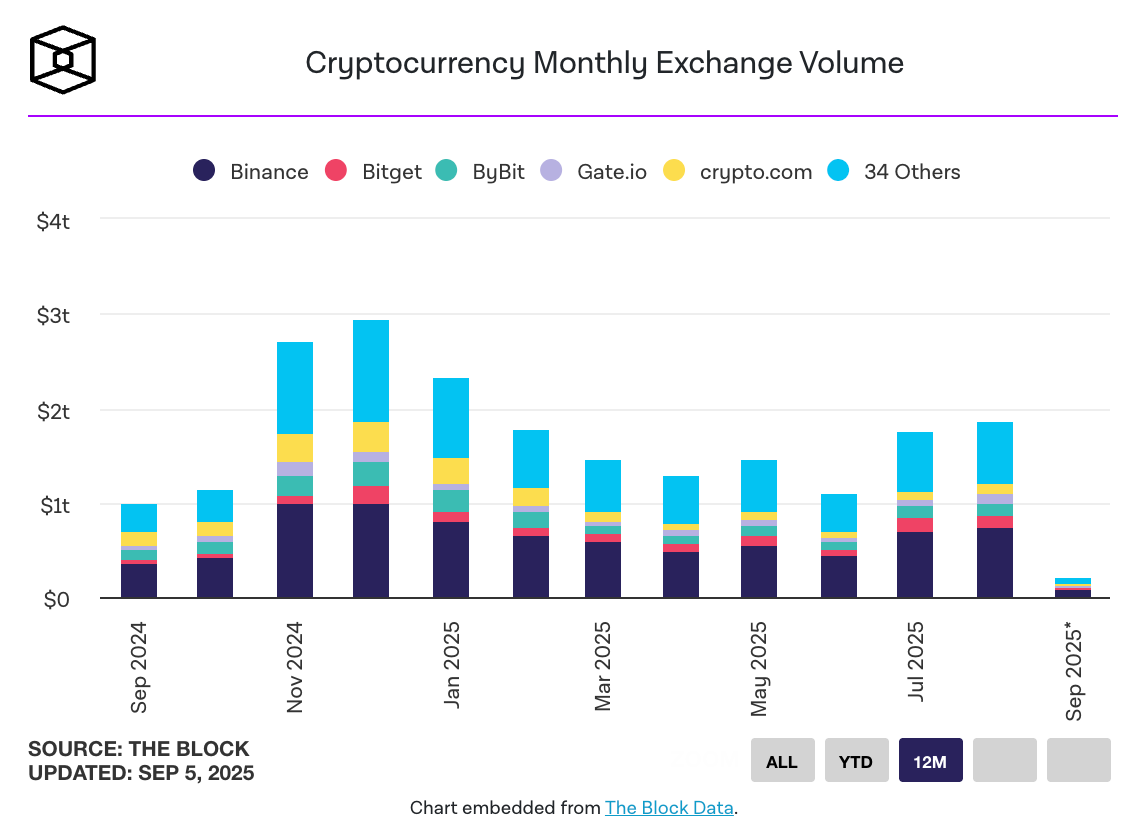

August Virtual Currency Trading Volume Exceeds $1.8 Trillion, Highest Monthly Level Since January

In August 2025, the volume of physical transactions on virtual currency exchanges reached $1.86 trillion, the highest level since January.

Binance maintained the top spot with approximately $73.7 billion, followed by Bybit and Bitget.

DEX trading volume also rose to $368.8 billion, with Uniswap leading with $143 billion.

Investor interest shifted from Bitcoin to Ethereum, with ETH ETFs recording inflows of $3.8 billion and BTC ETFs recording outflows of $750 million.

Solana Validator Approves Alpenglow Upgrade, SOL to Rise to $250

On September 2, the Solana validator approved the "Alpenglow" upgrade (98.27% in favor).

Introduced a new consensus "Votor" that reduces transaction finalization time from 12.8 seconds to 100-150 milliseconds.

The economic model was also changed, with a participation fee of 1.6 SOL per epoch charged to validators.

The analysis indicated that SOL could rise to $215 at the end of September and $250 at the end of the year.

Ethereum Layer 2 Linea to Launch Token Next Week

Consensys-supported L2 "Linea" plans token TGE on September 10.

The premarket valuation at HyperLiquid was originally $6 billion, but dropped to $270 million.

10% of total supply is airdropped to initial users and 75% is allocated to the Ecosystem Fund.

TVL surged with the "Ignition" campaign by Aave and others, reaching $1.17 billion most recently.

Ondo Finance Opens "Ondo Global Markets" in Ethereum, Offering Trading in Over 100 Tokenized U.S. Stocks and ETFs

Ondo Finance launches "Ondo Global Markets" on Ethereum, offering more than 100 US stocks and ETFs in tokenized form.

Backed by shares held by a US registered broker-dealer and available 24 hours a day on DeFi.

Scheduled to expand to over 1,000 issues by the end of the year, the Alpaca API will be integrated to ensure liquidity and convenience.

Future plans include cross-chain deployment, issuing token-backed storable coins, and adding staking and lending capabilities.

Stripe and Paradigm Announce Tempo, a Blockchain Specializing in Payments

Stripe and Paradigm launch Tempo, a payment-specific L1 blockchain, on Testnet.

Optimized for real-world financial services by leveraging Stripe's payment experience and Paradigm's crypto asset knowledge.

Anthropic, Deutsche Bank, DoorDash, OpenAI, and Revolut are already partners.

The objective is to enable payment acceptance, global remittances, micro-payments, tokenized deposits and agent payments on-chain.

📗Pickup Article

Posts and articles that you may find interesting.

Liquid Staking 101: Unlocking Liquidity in Proof-of-Stake Networks

The Ethereum PoS currently has more than 10 million nodes and over 34 million ETH staked, ensuring the safety of the network.

While staking can be expected to yield 3-3.5%, there are also risks such as capital constraints, price fluctuations, thrashing, and custody risk.

Liquid Staking enables staking while ensuring liquidity, allowing LSTs to be used in DeFi and secondary markets.

However, there are multifaceted caveats, including liquidity risk, smart contract risk, governance concentration, fees, and divergence in secondary markets.