Good morning.

This is mitsui from web3researcher.

Every Monday will be a recap of the past week's web3 market. Please use it to catch up on information and trends!

1) Market information and major news

2) 13 funded projects

3) Articles and recap updated in the last week

(1) Market Information and Major News

⛓️Blockchain

L1

This week was a week of decline. In terms of growth during, Aptos' UAW and transaction numbers are up.

L2

Overall, the market is almost flat.

💰DeFi

Overall, the number of TVLs in Uniswap is flat, but there has been a sharp increase in TVLs in Uniswap.

Tether Announces "aUSDT," a Gold-Backed U.S. Dollar Stable Coin

EigenLayer Launches Second Phase of Season 1 Airdrop for LRT Users

LayerZero Foundation to Begin Airdrop Claims for ZRO Tokens Today

Aave Community Endorses Lido Alliance, Approves V3 Deployment with Focus on stETH

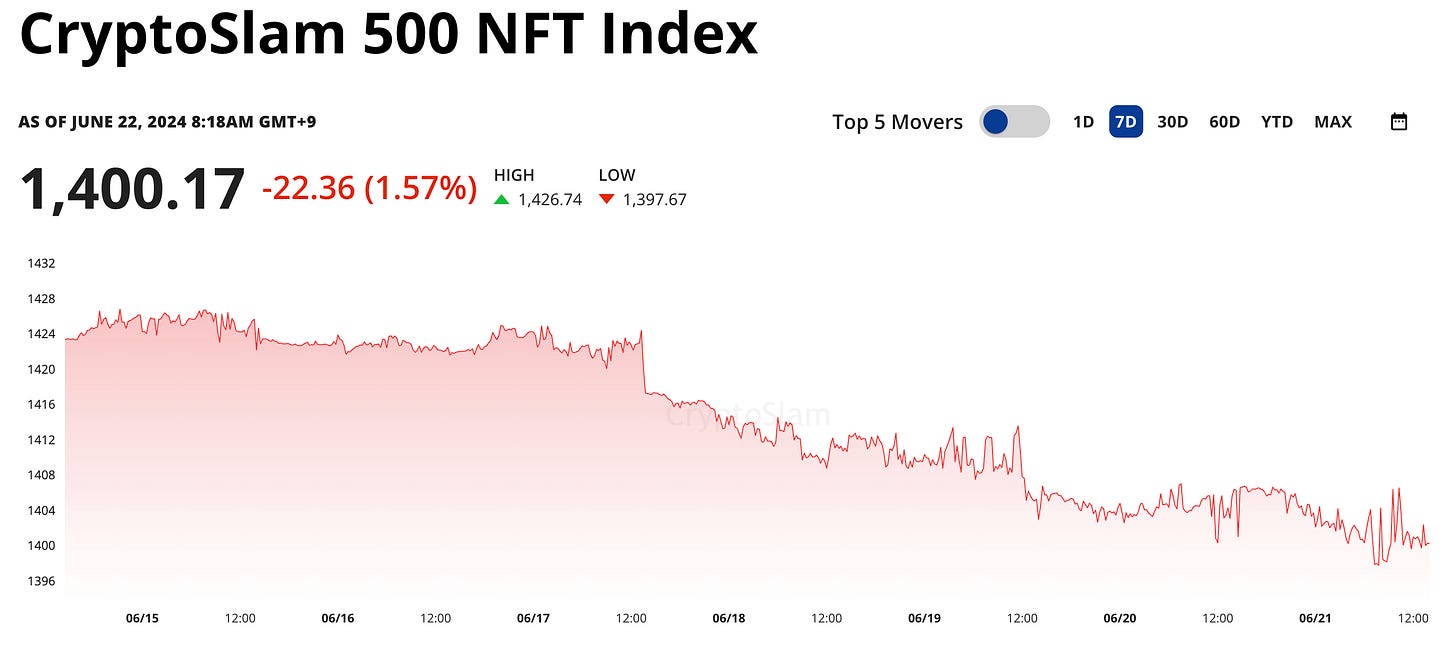

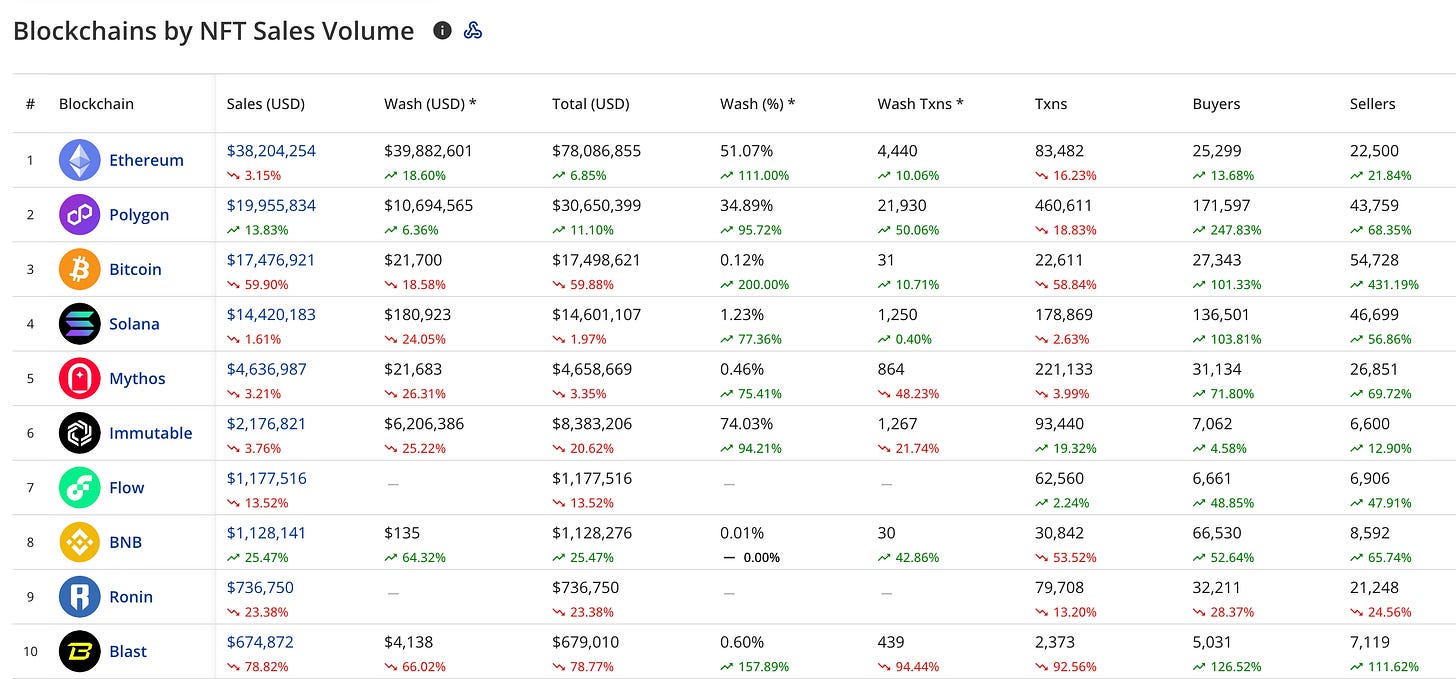

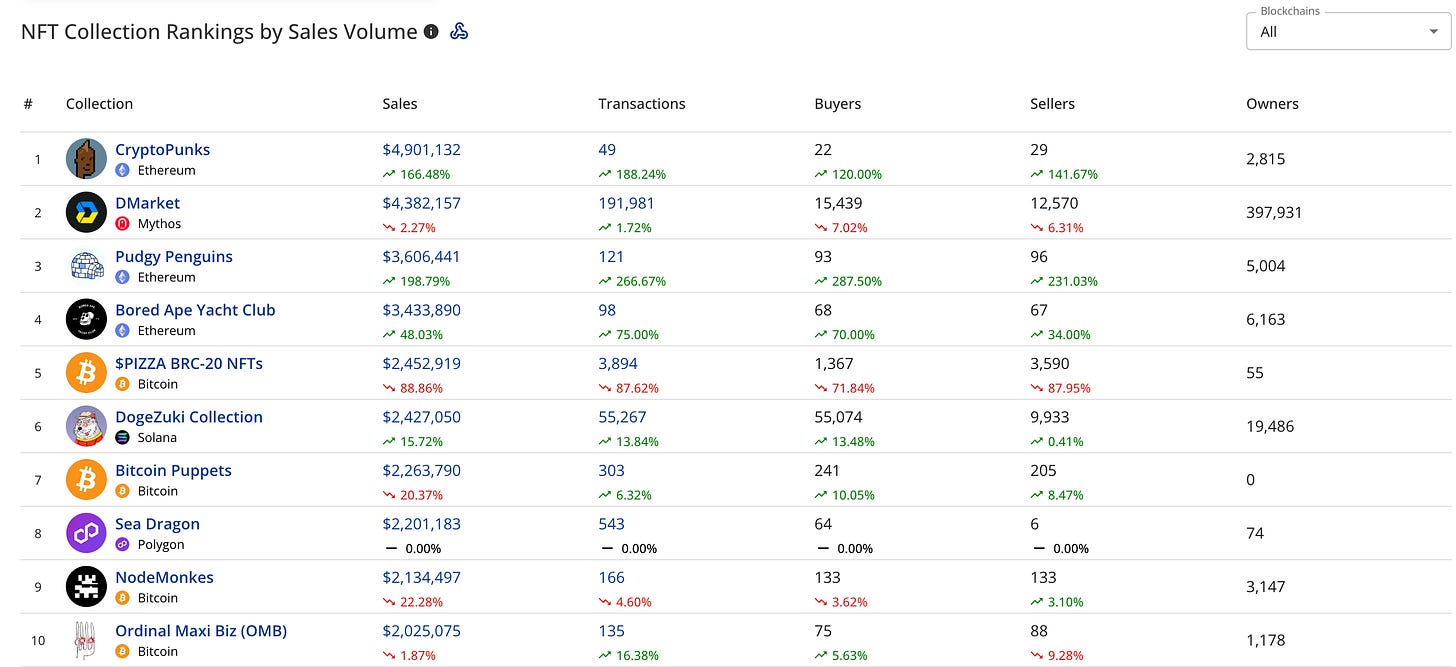

🖼️NFT

The NFT continues to fall.

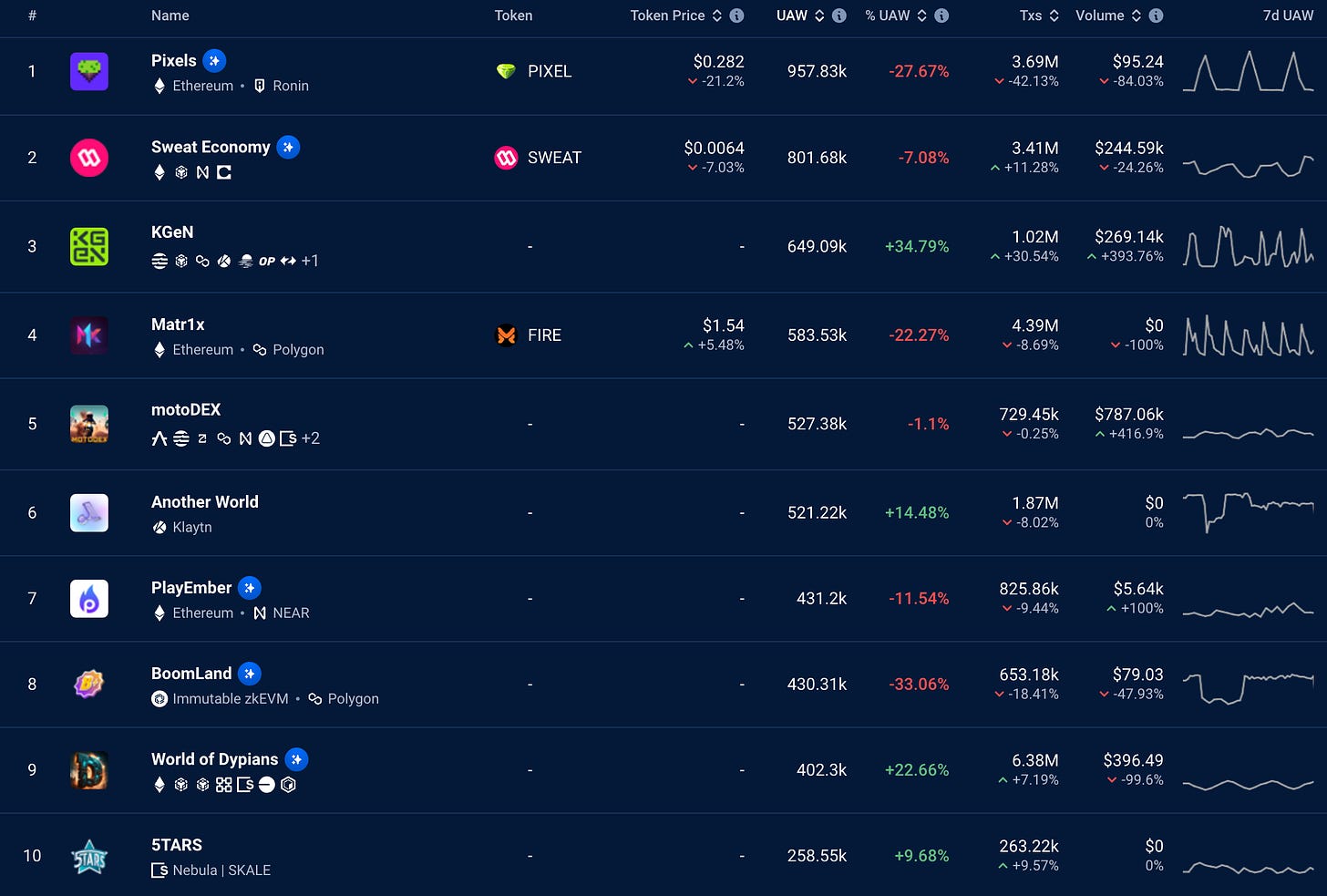

🎮GameFi

The excitement varies with each title.

SNPT, the Japan-based Snap to Earn "SNPIT" token, to be listed on Gate. io and MEXC

Catizen, a cat cafe management game app, has over 20 million users.

Pirate Nation (PIRATE), a web3 game, to be listed on Coinbase

Telegram game "Hamster Combat" experiences explosive growth, surpassing 150 million players.

Notcoin Founder Explains How Telegram Games, Including His Own, Will Evolve

KONAMI adopts "Avalanche subnet" and NFT-provided solution "Reseller".

👀Others

Dapps Related

USDC-issuing U.S. Circle launches "Programmable Wallet" with Solana support.

Farcaster co-founder: "No plans for global expansion of Warpcast"

Transak Adds Legal Tender to Cryptocurrency On-Ramp to PayPal USD

State, legal and regulatory affairs

Former House Speaker Paul Ryan Calls on U.S. to Fight China with Stablecoin

President Buquere Proposes Bitcoin Bank in El Salvador Two Weeks After Starting Second Term

Binance US Successive License Revocations in Several U.S. States

Other

Paradigm Raises $850 Million to Invest in Early-Stage Crypto Projects

Deutsche Telekom, T-Mobile's parent company, plans to mine bitcoin in addition to running nodes

Arkham Offers $150,000 to Find Out Who's Behind Trump-Themed DJT Token

Rumored Trump Token DJT Soars as Traders Bet on Authenticity

Tokens worth $740 million to be unlocked over the next 30 days

Creators of "OpenSeason," a Fortnite-style Ethereum Game, Announce Token Air Drop

HashKey Group's Proprietary Token "HSK" to List in Q3, Airdropping in Late June

ZachXBT Wins $150,000 for Exposing Martin Shkreli as DJT Token Creator

CertiK Finds Kraken Bug, Announces Return of Funds to Exchange

Binance launches HODLer Airdrops, an airdrop service for BNB holders.

(2) 13 funded projects

💥Top 5 Projects

1,Renzo

Abstract: An Ethereum re-staking protocol based on EigenLayer that simplifies the complexity of re-staking in EigenLayer and provides users with a more accessible and fluid way to process

Category: Restaking, DeFi

Amount raised: $17M

Investment round: TBD

Investors: *Brevan Howard Digital, *Galaxy Digital, Maven 11 Capital, Figment Capital, etc.

Summary: Full stack, data-driven, configurable web3 data and development platform. Modular L1 blockchain that promotes chain abstraction.

Category: L1, Modular

Amount raised: $15M

Investment round: Series A

Investors: ★The Spartan Group, ★gumi Cryptos Capital (gCC), SevenX Ventures, Morningstar Ventures, etc.

3,Sonic

Abstract: The first atomic SVM chain built on the concurrent scaling framework HyperGrid to enable sovereign game economies on Solana; Solana's L2 chain; the first SVM chain to enable sovereign game economies on Solana; the first SVM chain to enable sovereign game economies on Solana; and the first SVM chain to enable sovereign game economies on Solana.

Category: GameFi, L2

Amount raised: $12M

Investment round: Series A

Investors: ★BITKRAFT Ventures, Galaxy Interactive, Big Brain Holdings, Sanctor Capital, etc.

4,Gudchain

Summary: A pioneering blockchain platform designed to remove barriers to entry for players and advance the game.

Category: GameFi

Amount raised: $5M

Investment round: TBD

Investors: *Mechanism Capital, Morningstar Ventures, Manifold, SkyVision Capital

5,ZKX

Abstract: The first permissionless derivatives trading protocol built on StarkNet, StarkWare's L2 network that leverages ZK rollups.

Category: ZKP, DeFi

Amount raised: $3.10M

Investment round: Strategic

Investors: Flowdesk, Global Coin Research (GCR), Dewhales Capital

👀Others, 8 projects

Zeek Network[$3M/seed]: A decentralized collaboration economy that encourages reputation through a social bounty mechanism called "Wishes.

Wasabi[$3M/TBD]: a DeFi protocol designed for efficient price discovery of long-tail assets, allowing leveraged trading of meme coins and NFTs.

Farworld Labs[$1.75M/Pre Seed]: Develops the Farcade platform, a suite of tools for creating cryptocurrency native games integrated with decentralized social media.

BorpaToken[$1.06M/Public Sale]: seeks to redefine the world of cryptocurrencies by blending the absurdity and cuteness of the Borpa meme with Dogecoin's friendly spirit, Sushi's tactical value, and FOMO3D's edgy game play Meme Tokens.

Ordinox[$1M/Pre Seed]: a simple DeFi app chain built using the Tendermint consensus engine, the Cosmos-SDK state machine, and the GG20 threshold signature scheme (TSS).

Artfi[$80.00k/Public Sale]: a financial and art technology company that democratizes investment in high-value artworks through fragmentation and blockchain technology.

Rango Exchange[TBD/Strategic]: a multi-chain super aggregator platform for DEX and bridges, designed to find the fastest, cheapest, and most secure route for users' cryptocurrency transactions.

Router Protocol[TBD/Strategic]: a cross-chain messaging protocol that utilizes a mesh network architecture to enable seamless communication between different blockchains.

(3) Articles updated last week and summary

📝Last week's article

All of the articles are interesting, so if you have not yet seen any of them, please do so!

💬 Summary

Overall market conditions were down this week. Token prices were down, as was the point where DeFi and other TVLs were declining, and the number of projects funded was also down in a big way. Of course funding is not something that fluctuates from week to week, but the recent recession may have had an impact, as the number of projects funded has dropped from around 30 to about half of what it used to be.

Personally, I think it will be in the form of a period of recess for a few more months, followed by a renewed excitement in the fall and at the end of the year. The half-life schedule has been the same in the past, so I am wondering if the transition will be the same this year.

So, we will continue to update our research this week!

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.