【Web3 Situation in Thailand】 Introduction to Basic Information, Ecosystem, and Notable Web3 Startups!

🇹🇭Web3 Situation Survey in Various Countries, Thailand Edition

Good morning.

I am mitsui, a web3 researcher.

Today, I have compiled information on "The web3 scene in Thailand".

Table of Contents

1. What about Thailand?

-Basic information

-Economic situation

2. The web3 scene in Thailand

-Basic information

-Participating companies

-6 noteworthy web3 startups in Thailand for 2024

3. Conclusion

What about Thailand?

As I mentioned in yesterday's newsletter, I am currently in Thailand. To be honest, I didn't come here solely to investigate web3, but since I am here, I will take the opportunity to research the web3 scene in Thailand again.

◼️ Basic Information

First, let's review some basic information about the country called "Thailand".

Thailand, located in Southeast Asia, has a population of 69 million people and Thai is the official language. However, English is also widely spoken, especially in shops and hotels in Bangkok (which is close to tourist areas), where English is primarily used.

◼️ Economic Situation

Looking at the economic situation in general,

Among the ASEAN countries, Thailand is considered an "advanced country"

In terms of GDP, agriculture and fisheries account for 10%, tourism for 20%, and manufacturing for 30%, making them the major industries. Financial services and the advancement of renewable energy are also notable.

The challenges for the Thai economy are aging population and high export dependency.

High export dependency makes the economy vulnerable to external factors, causing GDP to be greatly influenced and leading to instability.

Although Thailand heavily relied on exports to China, any fluctuations in China's economy significantly impact Thailand's GDP. Therefore, efforts are being made to diversify exports.

In 2015, the Thai government introduced an innovative concept called "Thailand 4.0" with a vision for the next 20 years.

While "Thailand 3.0" focused on heavy industries and industrial product exports, "Thailand 4.0" aims to steer towards innovation-driven economic growth.

The goal is to increase per capita GDP to $13,000 by 2036 and become a high-income country.

The following 10 sectors are particularly emphasized:

Next-generation automobiles, smart electronics, medical and health tourism, agriculture and biotechnology, future foods, robotics industry, aviation and logistics, biofuels and bioscience, digital industry, and medical hub.

Looking at the economic situation, it feels similar to Japan. Both countries have a strong manufacturing sector and tourism industry. Previously, Thailand experienced robust economic growth driven by the export of manufactured goods, but as export dependency increased, its economy became susceptible to fluctuations in major exporting countries. Additionally, as the industrial focus gradually shifts from manufacturing to IT, Thailand's influence has decreased. Furthermore, the aging population poses a significant challenge, and it is crucial for the country to quickly foster innovation (startup support) at a national level.

There seems to be some similarities.

Web3 Situation in Thailand

Next, let's summarize the "Web3 Situation in Thailand". This is also based on basic information. I will attach the reference article below.

◼️ Basic Information

The average monthly visitors to CoinMarketCap in 2023 is 648,000, accounting for 0.94% of Thailand's total population.

The total trading volume of major digital asset exchanges in Thailand, such as Bitkub, Bitazza, and Satang, from January to October 2023, is approximately 116,436,471,138.81 USD, totaling about 410 million USD.

Bitkub has the largest market share, accounting for 77.04% of the total trading volume.

Currently, Thai digital asset exchanges hold over 2.94 million user accounts, which accounts for 4.27% of the country's total population and more than half of the 5.5 million accounts in the stock market.

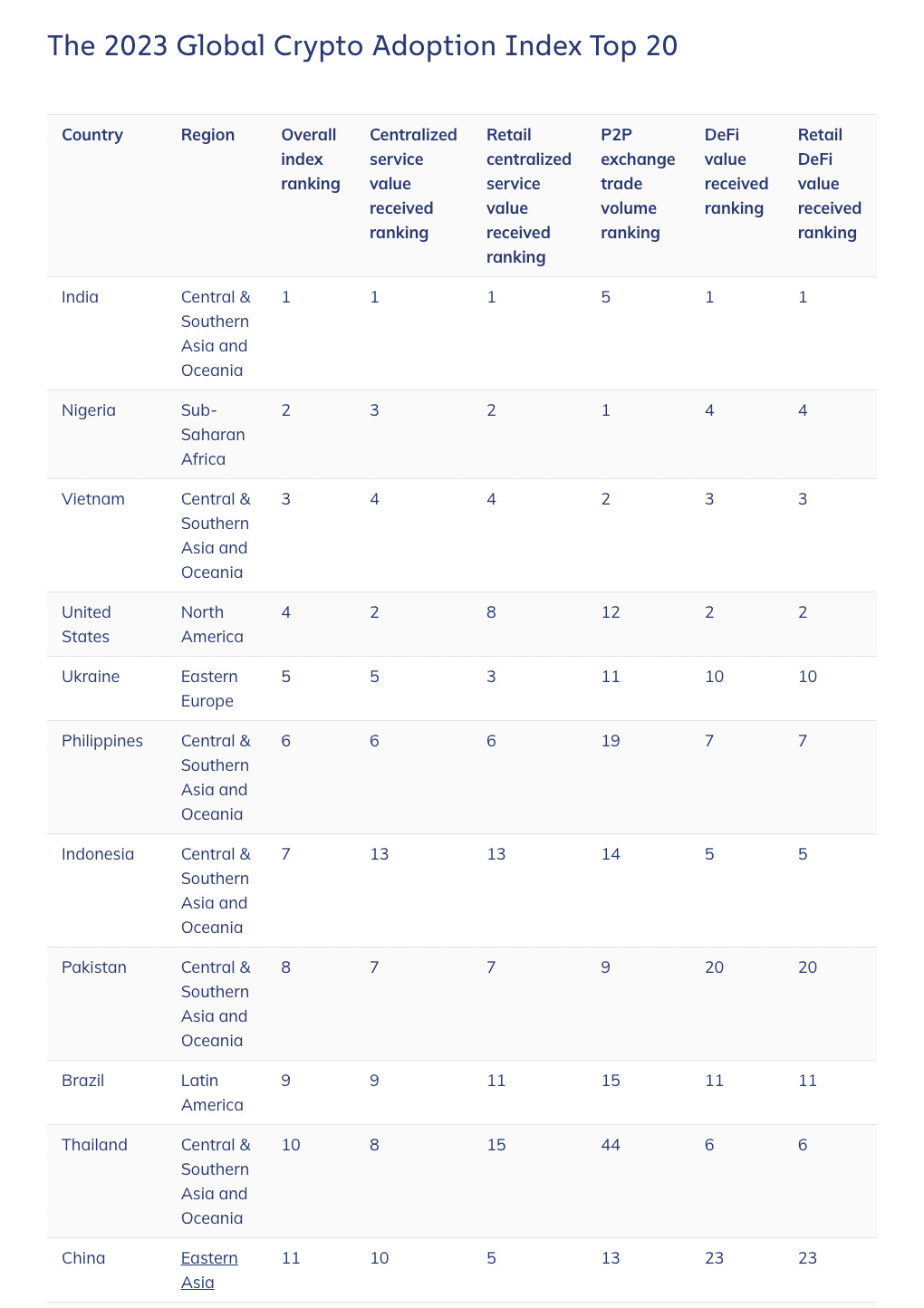

Ranked 10th in the 2023 Cryptocurrency Adoption Index by Chainalysis.

This index analyzes each country based on five indicators, including P2P transaction volume, DeFi lock volume, and per capita trading volume of centralized exchanges, as shown in the table below.

Looking at this, it is evident that not only Thailand but also Asia is strong.

There are also tax incentives, and on March 7, 2023, a cabinet decision was made to exempt corporate tax and value-added tax for web3 companies issuing crypto tokens in Thailand.

With this new rule, it is expected that token issuance worth 128 billion baht (approximately 3.71 billion dollars) will be anticipated within the next 2 years in Thailand, and the estimated impact on tax revenue will be around 35 billion baht.

In March 2022, tax rules for cryptocurrency investments were announced, allowing traders to offset taxable profits with losses and exempting 7% value-added tax on transactions conducted on approved domestic exchanges (limited time).

In addition, there have been reports of progress in Thailand on CBDCs and "investment token" licenses behind the scenes.

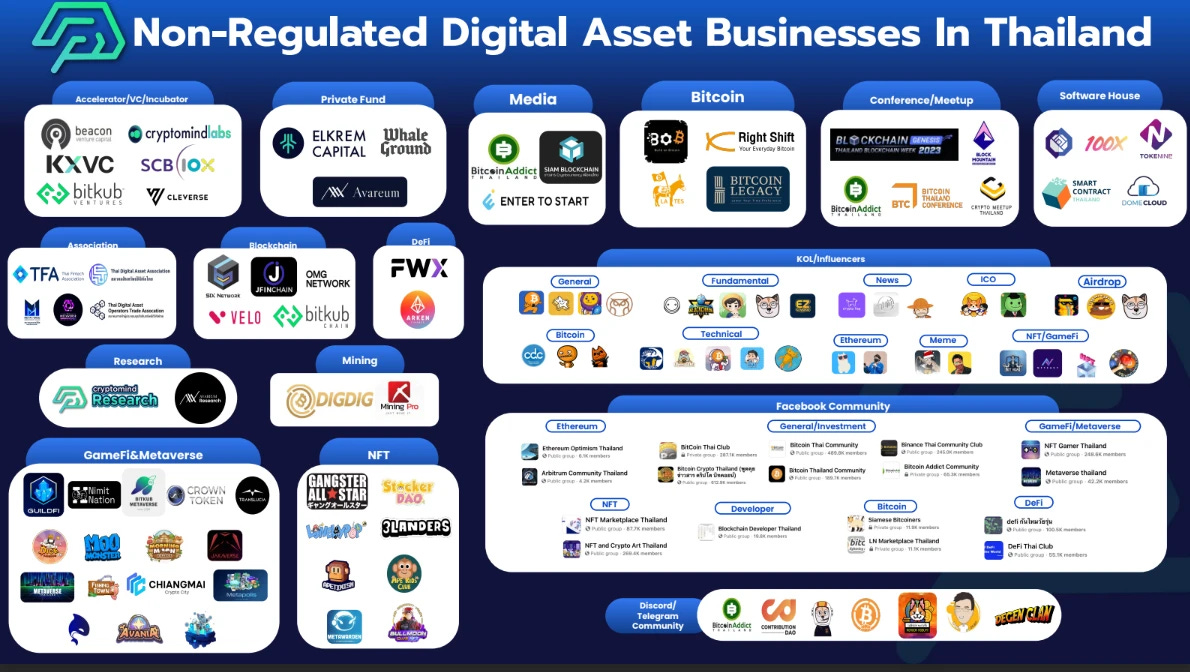

◼️Entering Companies

In recent years, many traditional large companies in Thailand, such as Siam Commercial Bank (SCB) and the aforementioned KBANK, as well as major energy companies like Gulf and PTG Energy, have entered the digital currency market.

Gulf and Binance jointly established the joint venture company Gulf Binance Co., Ltd. and launched the Thai version of Binance (cryptocurrency exchange).

The Tourism Authority of Thailand has also conducted multiple campaigns to issue tourism NFTs.

Visitors can acquire NFTs at tourist destinations and receive rewards based on the number of acquisitions.

◼️Top 6 Web3 Startups to Watch in Thailand in 2024

A web3 game Wiki community that utilizes Open AI. It aims to create a game Wiki community where game creators and hardcore players can freely edit the Wiki, earn unique contribution points, and directly monetize their contributions.

A development company that builds excellent applications on the blockchain. Currently, they are involved in bookmark management and note-taking apps.

A marketplace where professional traders can monetize their knowledge directly from Telegram, and beginners can earn income and learn from blockchain-verified traders.

Provides blockchain services specifically for ESG businesses and agriculture. They support verification, supply chain tracking, and tokenization.

A platform that enhances the interoperability of NFTs in the GameFi space. It is a noteworthy presence among Thai web3 companies, with investors such as Animoca also investing in it.

Building a decentralized lending platform to revolutionize real estate collateralized lending. It connects multiple lenders with a single loan request collateralized by real estate, reducing risks for all parties involved, promoting lender diversification, and protecting borrowers from predatory practices.

Summary

I have summarized the basic information about Thailand and its web3 scene.

Based on my impression, although Thailand is not aggressively promoting itself as a nation in the web3 space, it is putting efforts into supporting startups, which naturally leads to the growth of web3. This gives me a sense that Thailand is somewhat similar to Japan. Japan is also promoting web3, but it is mainly focusing on startups due to the decline in domestic industries. It seems that web3 is being promoted as part of this startup support in Thailand as well.

Additionally, Thailand is taking economic policy references from Singapore and has a strong focus on the financial sector. This, coupled with the robust financial regulations, creates a favorable environment for web3 startups to thrive.

However, when I explored the streets and researched web3 events in Thailand, I didn't come across regular crypto payments being made in the city, and there weren't many web3 events either. I also spoke to someone who is involved in supporting startups in Thailand, and they mentioned that while web3 is gaining traction among those with high literacy in the field, it hasn't yet reached the general population. This seems to be similar to the situation in Japan.

Nevertheless, I felt that there is a high potential for growth.

As shown in the cryptocurrency adoption index chart explained above, web3 in Asia is currently hot. Considering this background, I believe there is a thought process that goes like this: "Asia has experienced some economic growth, but it has been mainly driven by manufacturing. With signs of decline in the manufacturing sector, the country needs to prevent the decline of industries. Let's follow the example of Singapore's success and focus on digitalization and finance!".

Web3 is highly compatible with people in developing countries like Africa who don't have bank accounts, but as their economies are not fully developed yet, the market size for web3 naturally becomes smaller. On the other hand, Asia has a large population and has reached a certain level of economic growth. In this context, as the country strives to build the next industries, the blockchain technology, which has a high affinity with finance and digitalization, may be the right technology to adopt.

When I was in Thailand, I noticed a lot of advertisements for banks. Upon investigation, I found that there are many emerging startup banks, and the fact that they can advertise prominently near Bangkok's airport is evidence of the startup's significant progress. The fintech market is booming. In this trend, the adoption of web3 might also spread rapidly.

Surprisingly, I find the following numbers to be impressive: about half of the people who have stock market accounts (probably online brokerage accounts?) also have accounts with cryptocurrency exchanges. With a population of approximately 70 million in Thailand, there are 5.5 million stock market accounts, indicating that there is still significant room for growth. Along with the growth of this market, the digital asset trading market for cryptocurrencies is also likely to expand.

"Thailand's digital asset exchanges currently hold more than 2.94 million user accounts, accounting for 4.27% of the country's total population and more than half of the 5.5 million stock market accounts."

(In Japan, with a population of 120 million, there are about 34 million online brokerage accounts and about 7.6 million cryptocurrency exchange accounts.)

Another significant advantage is that English is widely spoken in most places. This allows web3 startups to have a global presence from the beginning and compete on a worldwide scale.

In conclusion, although this may seem like a random explanation, I have summarized the web3 situation in Thailand. Personally, I feel that there is a certain market size, and with the growth of fintech and the English-speaking market in Thailand, there is a relatively significant opportunity. I'm not sure if I will establish a branch there, but I sense the potential.

That concludes the explanation of "Thailand's web3 situation"!

Reference articles:

Is Thailand becoming a web3 powerhouse? Latest trends in the world's crypto tax havens

HashKey Capital: Thailand Blockchain Ecology Report 2023

Latest situation of Thailand's economy in 2023 - What are the traps hindering Thailand 4.0?

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

A web3 newsletter delivered in five languages around the world. We deliver various articles about web3, including project explanations, news and trend analysis, and industry reports, every day. You can subscribe for $8 per month ($80 per year) and receive research articles that took 100 hours to complete every day.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.