【Usual】Project to issue RWA collateralized USD0 and distribute 100% of investment income from collateralized funds / redistribute ownership and governance through $USUAL tokens / @usualmoney

The system is designed to benefit the early users more.

Good morning.

Mitsui from web3 researcher.

Today we researched Usual.

🔴What isUsual?

⚙️ detailed structure

🚩Transition and awesomeness

💬An interesting new currency system

🔴What is Usual?

Usual is a secure, decentralized stablecoin issuance project that redistributes ownership and governance through $USUAL tokens.

Usual was built to solve the following three problems with the existing USDC and USDT.The third issue is not only a problem with stablecoin, but also with DeFi as a whole.

Only stablecoin issuers have a monopoly on profits

There is a risk of bankruptcy

There is a mismatch between yield and growth that gives early contributors ample profit.

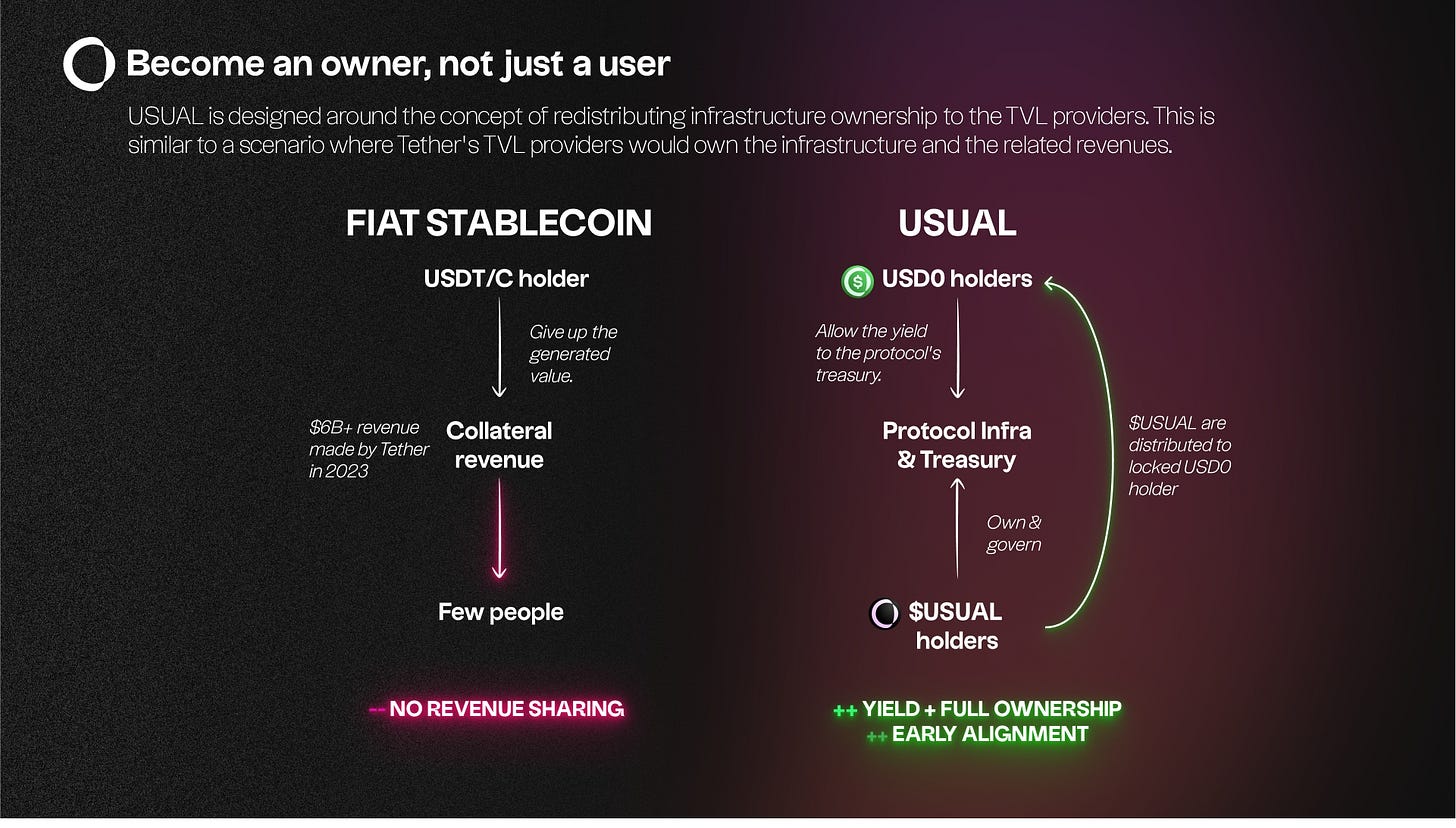

1 is well-known: Tether and Circle generated over $10 billion in revenues in 2023 and are valued at over $200 billion, but none of this created wealth is shared with the users who contributed to their success.

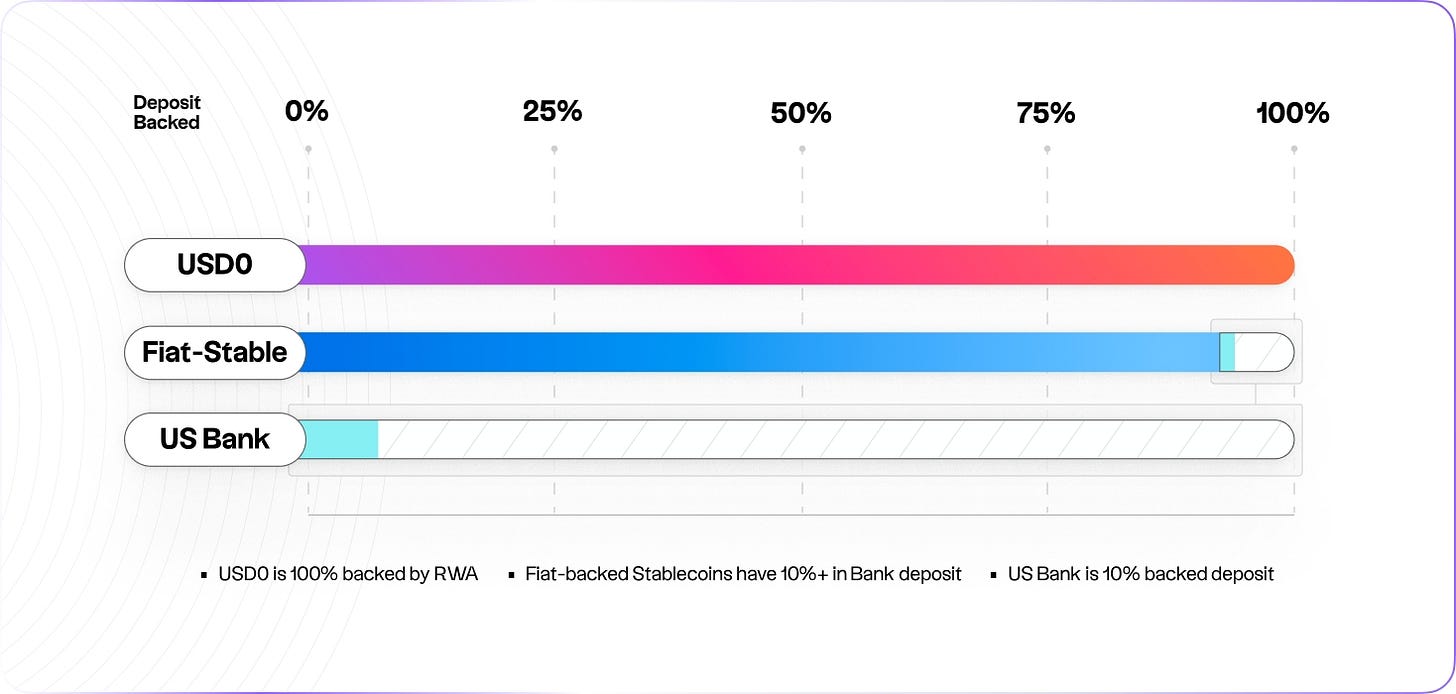

As for #2, USDC's temporary depegging during the collapse of Silicon Valley Bank also caused problems, as USDC kept some of its collateral funds in legal tender with existing financial banks and is therefore at risk of bankruptcy.

3 will be explained in Usual's Token Economics below.

Based on these factors, Usual issues USD0 stable coins that are 100% collateralized by RWAs.In addition, 100% of the yield generated from the collateralized funds will be held in a treasury, with the ownership and governance rights of the treasury held by the $USUAL token holders.The treasury funds are then distributed to the communities in the ecosystem.

The basic idea is as described above.

100% backed by RWAs (U.S. Very Short Term Bonds) Stablecoin

100% of proceeds from collateral funds are held in Treasury

Treasury ownership is held by the $USUAL holder

Return of Yield from Treasury into the Ecosystem

Here is a more detailed look at how it works.

⚙️ Detailed Mechanism

Before I go any further, let me say that Usual is a bit complicated in its mechanics.I will try to explain it as clearly as possible so that you can understand the whole picture.

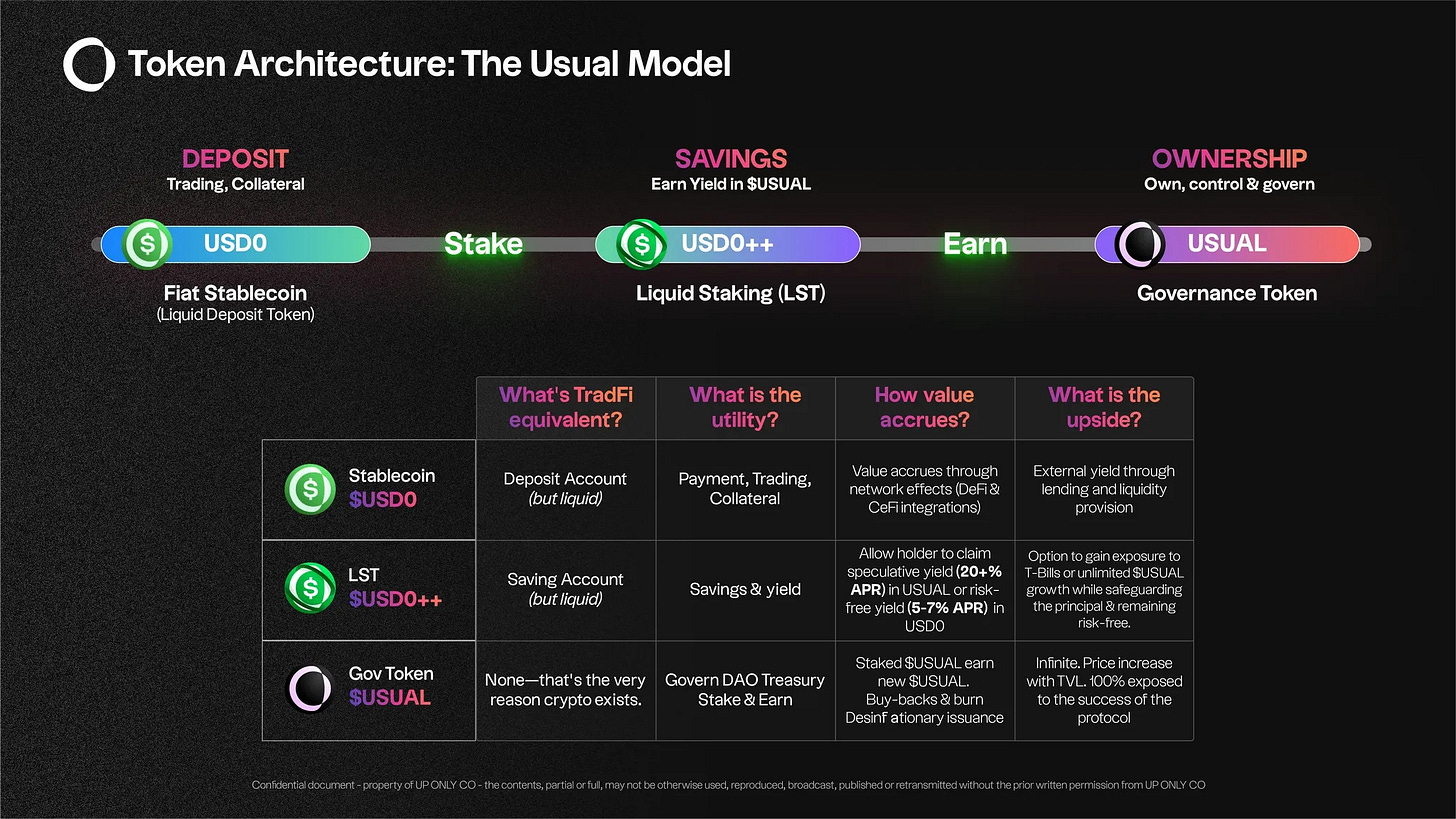

First, there are three core tokens

USD0: Legal tender-backed stablecoin secured by RWA

USD0++: LST of USD0

$USUAL: Governance token for Usual

(There is also USUALx, which is obtained by staking Usual further here, and USUAL* (USUAL Star), which is called a genesis token, but we will discuss this later.)

USD0

Users can mint USD0 by depositing USDC or RWA tokens.