【USAT】Dollar-linked stablecoin by Tether to comply with US GENIUS Act / Issued by Anchorage Digital Bank, custody and US Treasury trading handled by Cantor Fitzgerald / @USAT_io

Designed to meet requirements for 100% asset backing, monthly disclosure, AML/KYC, consumer protection, etc.

Good morning.

I am mitsui, a web3 researcher.

Today I researched "USAT".

🇺🇸What is USAT?

⚙️Operating Entities and Partners

💬 Stablecoin is a currency war

🧵TL;DR

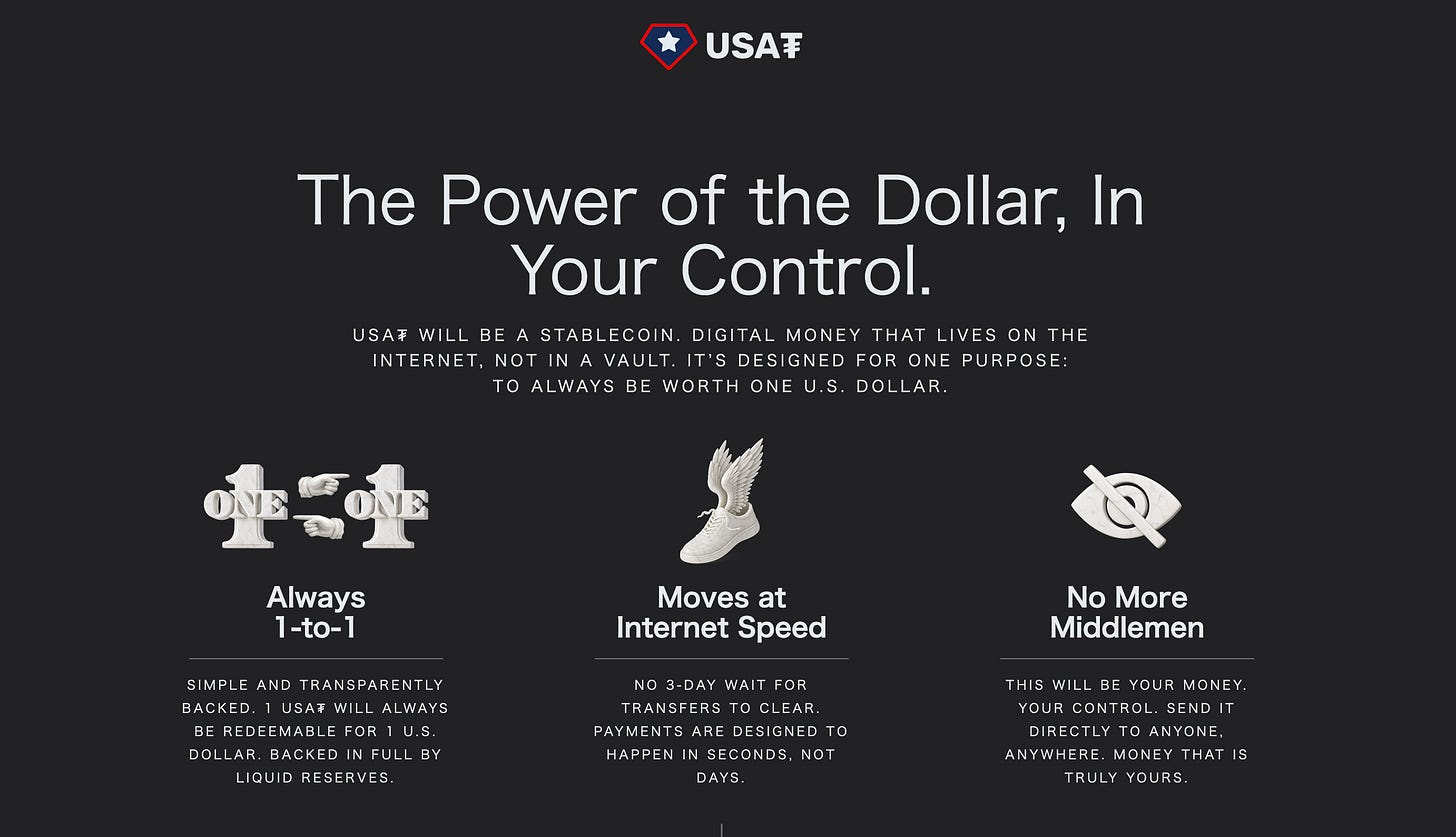

USAT is a U.S. regulatory-compliant dollar-linked stablecoin announced by Tether in September 2025, with 1 USAT = 1 U.S. dollar secured by fully reserved assets.

It is designed to comply with the GENIUS Act, the U.S. Stable Coin Act, and to meet the requirements of 100% asset backing, monthly disclosure, AML/KYC, and consumer protection.

Issuance will be handled by Anchorage Digital Bank, custody and U.S. Treasury trading by Cantor Fitzgerald, and Tether will establish a new division, Tether US, with Bo Hines as CEO.

The project aims to strengthen its legitimacy in the U.S. and maintain dollar dominance, and is scheduled for launch at the end of 2025.

🇺🇸What is USAT?

USAT is a U.S. regulatory-compliant dollar-linked stablecoin introduced by Tether in September 2025.1 USAT is designed as a digital dollar that is always valued at US$1 and is backed by a full reserve asset.

Tether issues USDT, the world's number one stablecoin with a 58.96% share, but has been criticized by U.S. authorities for transparency and oversight.

To meet these challenges, USAT is committed to transparent reserve management and disclosure in accordance with U.S. legal standards (GENIUS Act). Tether aims to maintain and enhance the U.S. dollar's dominance in the digital asset space while achieving high standards of transparency and compliance.

The project is also positioned as the "next chapter" in Tether's growth in overseas markets and its legitimacy and presence in the U.S. market, where, according to Tether CEO Paolo Ardoino, USAT will "maintain the U.S. dollar as the foundation of trust in the digital asset space. It will contribute to a variety of use cases, including emerging economies and overseas remittances, by providing businesses and individuals in the U.S. with the freedom to exchange dollars without an intermediary.

◼️What is the GENIUS Act

Before going into the details of USAT, let me explain a little about the GENIUS Act here.

USAT will be the first major stablecoin to comply with the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act), the U.S. stablecoin law passed in 2025.

The GENIUS Act establishes a comprehensive regulatory framework for the issuance and distribution of stabled coins in the United States and imposes the following key requirements

Full asset security and information disclosure: 100% backing of issued stablecoins with liquid assets at all times and monthly disclosure of the breakdown of reserves.

Consumer ProtectionThe following measures should be implemented: prohibit misleading representations in advertisements and solicitations regarding stablecoins, and provide certain safeguards, such as the preservation of user funds and the right to priority return of funds.

Thorough AML/KYC: Implement anti-money laundering (AML) and identity verification (KYC) procedures for all customers to prevent the use of illicit funds and sanctioned persons.

The USAT is designed to meet these requirements, and from the time of its issuance, the USAT has taken a stance of full compliance with U.S. law.

For example, reserve assets will be held by a U.S. trust bank and will be subject to monthly audits and disclosure reports. KYC information will also be verified for users through the bank's account opening process, etc., to deter the transfer of large amounts of money in anonymity.

Furthermore, Tether emphasizes that the USAT model will allow it to address its own opacity (e.g., doubts about reserves) that has been pointed out over the years.

⚙️Operating entities and partners

Now, let me explain the details of how it works. However, since this is a stablecoin project, this is a sit-down explanation, not a technical detail.

◼️IssuingBases

USAT is Tether's proprietary asset tokenization platform, "HadronHadron is a state-of-the-art platform dedicated to RWA tokenization, leveraging blockchain technology for seamless and compliant token issuance, management and transaction tracking.

It has not been officially announced on which specific blockchain it will be issued.

◼️Issuing Entity and Custodian

In order to maintain the value of 1 USAT token = 1 USD, the USAT will be fully backed with reserve assets equal to the amount of issuance. The reserve will be funded by highly liquid assets such as US dollar cash and US Treasury bills, and the issuing entity guarantees that 1 USAT will be redeemable for 1 USD at any time.

The collateral assets will be held and managed by Anchorage Digital Bank, a trust bank, with the involvement of financial services giant Cantor Fitzgerald as custodian and preferred dealer for U.S. Treasury securities.

Anchorage is chartered by the Office of the Comptroller of the Currency (OCC) as a national trust bank and will issue and manage USAT as a GENIUS-compliant issuer of stable coins. Anchorage will also be one of the main shareholders in the new USAT business and will reportedly share reserve interest and other revenues.

Cantor Fitzgerald is a leading U.S. financial services company that serves as custodian and preferred primary dealer for reserve assets in the USAT project. Cantor Fitzgerald is also a primary dealer authorized by the U.S. Department of the Treasury (a financial institution directly qualified to participate in government bond auctions), Cantor Fitzgerald is also a U.S. Treasury-approved primary dealer (a financial institution directly qualified to participate in government bond auctions), making it a reliable partner for Tether in managing reserves.

Through this collaboration, Tether aims to dispel market concerns about its own reserve asset management (which have been criticized in the past for transparency) and to ensure the soundness and liquidity of its reserves under third-party control.

◼️Tether US新設

In addition, for the USAT rollout, Tether has created the equivalent of a new US division, Tether US, and appointed Bo Hines as a candidate for CEO.

Mr. Hynes' background as a former White House Crypto Asset Advisor (former Executive Director of the President's Digital Asset Advisory Committee) gives him a background in policy and legal expertise. His appointment is a testament to Tether's commitment to working with U.S. regulators and governments.

◼️ transition and upcoming schedule

The USAT project is in full swing with the passage of the GENIUS Act in July 2025.

In August, Bo Hines was appointed as Tether's U.S. Strategic Advisor, and preparations for U.S. entry are underway. Then, on September 12, 2025, Tether CEO Paolo Ardoino officially announced USAT's plans at an event in New York City.

Concurrent with this announcement, it was also announced that Mr. Hines will be the CEO of the newly created Tether USA₮ division.

Once the project is announced, the necessary regulatory filings and finalization of the technical infrastructure are expected to follow. CEO Aldoino has stated that the plan is to launch USAT "by the end of the year" (end of 2025), and preparations are currently underway to achieve that goal.

💬Stablecoin is a currency war

The final section is a summary and discussion.

Finally, Tether's U.S.-compliant USAT has been announced. Personally, my first impression was the naming. I could not find any explanation of what it stands for, but I think it is probably USA Tether. Since regular stable coins are USD+XXX, the name USAT, which seems to have the United States in its name, looks pretty good.

So, we have no idea what will happen to USAT, as no details have been announced yet, but we expect that it will probably be deployed with a significant budget. At that time, Stable and Plasma, the stable coin-specific chains supported by Tether, are also likely to release their mainnets, so we expect a campaign in conjunction with them.

The GENIUS Act prohibits the return of investment income from reserve funds, so if we want to bring a return to USAT holders, we need to have some kind of build-up. So, I think we will do something like, for example, if you have USAT on Stable, you can operate it at 15% APY, in combination with the dissemination of the chain, either by taking out funds on the Tether side or by airdropping.

It will cost quite a bit, but we are cash rich to begin with, and we can kill two birds with one stone by promoting stabled coins and chains.

Then, to change the subject a bit, stablecoin can be easily used by people in any country. They are very easy to use once you get used to them, from making payments in your daily life to connecting to DeFi to invest in assets.

So we believe that this could lead to a currency war between nations, if we take a slightly broader view. If dollar-based stable coins are used on a daily basis in countries around the world and for asset management, the demand for legal tender in those countries will drop and the demand for dollars will increase.

Naturally, payment of taxes in that country must be made in legal tender, which guarantees a minimum demand, but it may no longer be used in daily life. If this happens, it will be difficult for the nation to formulate economic and monetary policies, and the dollar economy may indirectly dominate the country.

I don't think it will be this extreme, but the spread of stable coins has that potential. So, from the U.S. government's point of view, it is a two birds with one stone, since the dollar will spread around the world and in addition, reserve funds will buy a large amount of U.S. Treasury bonds.

That is why I think it is a good idea to do it as soon as possible for defense, not to promote the use of stablecoin because it is convenient or because it is a new technology, but because if we do not create an economic zone in our own legal tender, everything will be replaced by the dollar. Already 99% of DeFi is dollar based, and when you can buy stocks and ETFs with DeFi, I think it will become the norm to buy and manage US stocks and ETFs with dollar stablecoins.

There are many ways to think about this area, but I thought the time frame is the key, because the risk of thinking on a macro scale cannot be dismissed, and it is quite difficult to turn it over once it has taken hold.

This is a bit of a digression from the USAT story, but I wrote this because I have a lot of thoughts about how dollar stabled coins are likely to become even more popular over the next year, considering that Tether is serious about expanding USAT to the U.S. and, once again, the rest of the world.

This is the research for "USAT"!

🔗Reference Link:HP / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.