【Trove】A collectible-focused perpetual exchange built on HIP-3 / Offering not just collectibles, but also related stock and prediction market opportunities / @TroveMarkets

Futures markets serve the functions of price discovery and insurance.

Good morning.

I’m Mitsui, a web3 researcher.

Today I researched “Trove.”

What is Trove?

Available trading strategies and derivative design

Transition and Outlook

Futures markets serve the functions of price discovery and insurance.

TL;DR

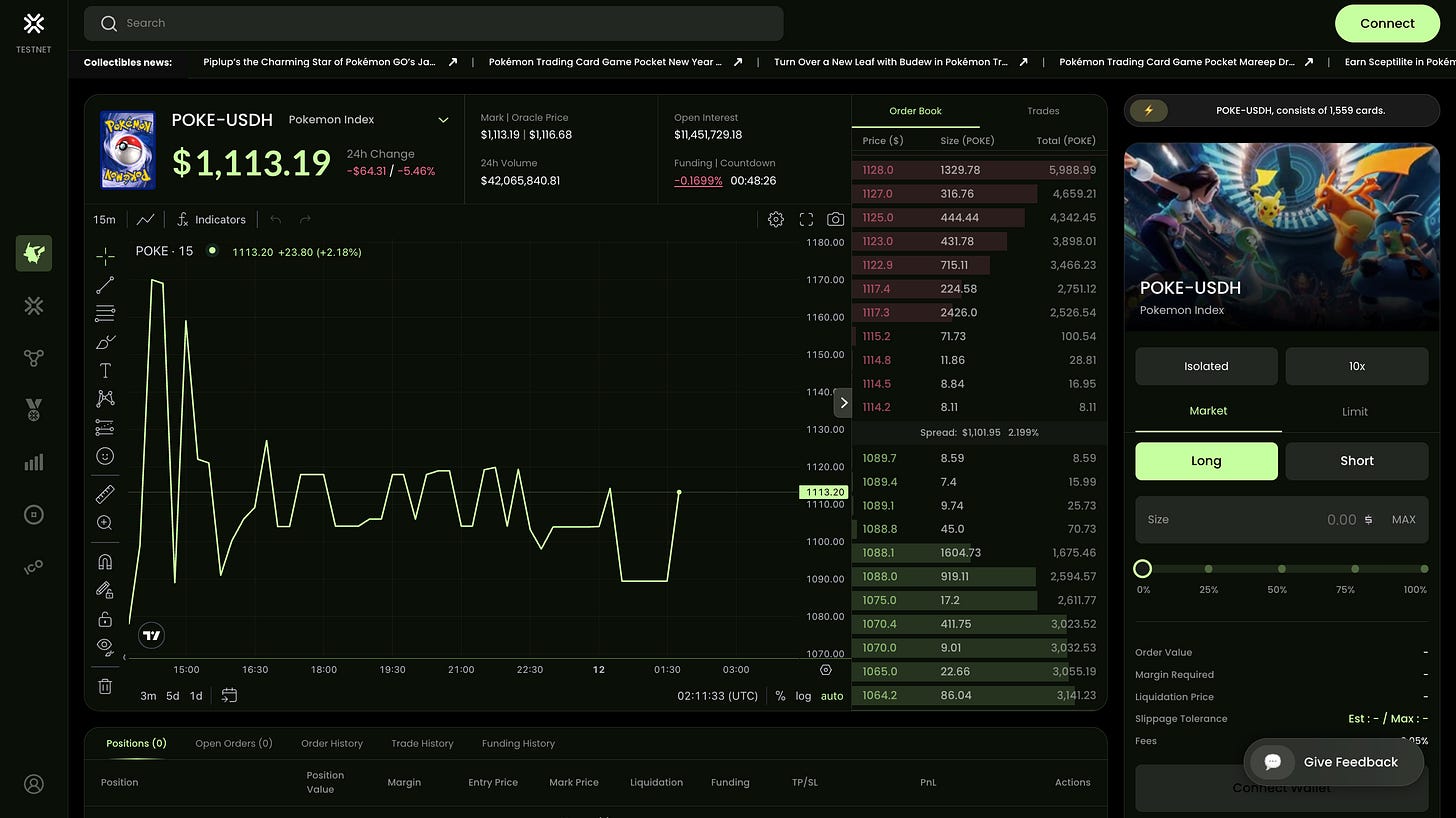

Trove is a decentralized perpetual exchange built on Hyperliquid, enabling trading of collectible assets like Pokémon cards and in-game skins with up to 5x leverage.

Leveraging HIP-3, we have realized a futures market for niche assets by inheriting Hyperliquid’s high-speed matching, margin, and settlement infrastructure while independently designing oracles and implementing risk management.

A pioneer in transforming “previously unfinancialized assets” into on-chain derivatives for both speculative and hedging purposes, covering collectible indices, related stocks, and prediction markets.

What is Trove?

Trove is a decentralized perpetual exchange where users can trade collectible assets such as Pokémon cards and in-game skins with up to 5x leverage.

Built on Hyperliquid, it provides a trading environment that combines real-time performance, low costs, and on-chain transparency.

◼️Using HIP-3

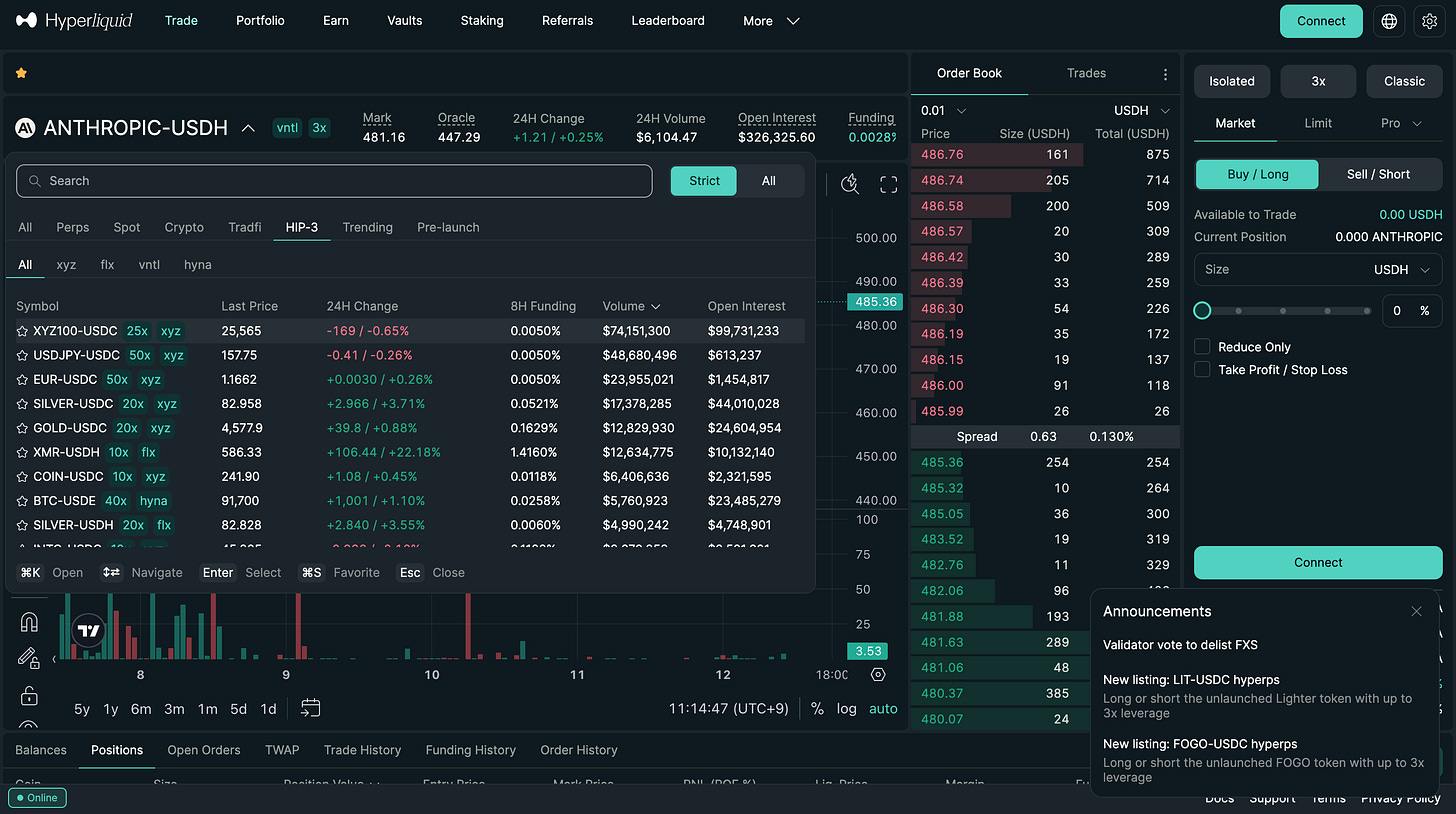

Trove is the first collectibles-focused marketplace leveraging HIP-3 (Hyperliquid Improvement Proposal 3) on the Hyperliquid chain.

HIP-3 is a feature that allows anyone to launch a perpetual market on Hyperliquid by staking 500,000 $HYPE. Through this mechanism, Trove directly utilizes Hyperliquid’s ultra-low latency matching engine and shared risk engine.

This eliminates the need to build Trove’s proprietary trading infrastructure from scratch, allowing it to inherit the unified margin and liquidation model and settlement logic from the existing Hyperliquid protocol.

Trove defines each market’s specific oracle design, leverage limits, and margin rules, while handling operational aspects such as continuous price data updates and suspending trading or processing settlements as necessary.

◼️Primary Trading Partners

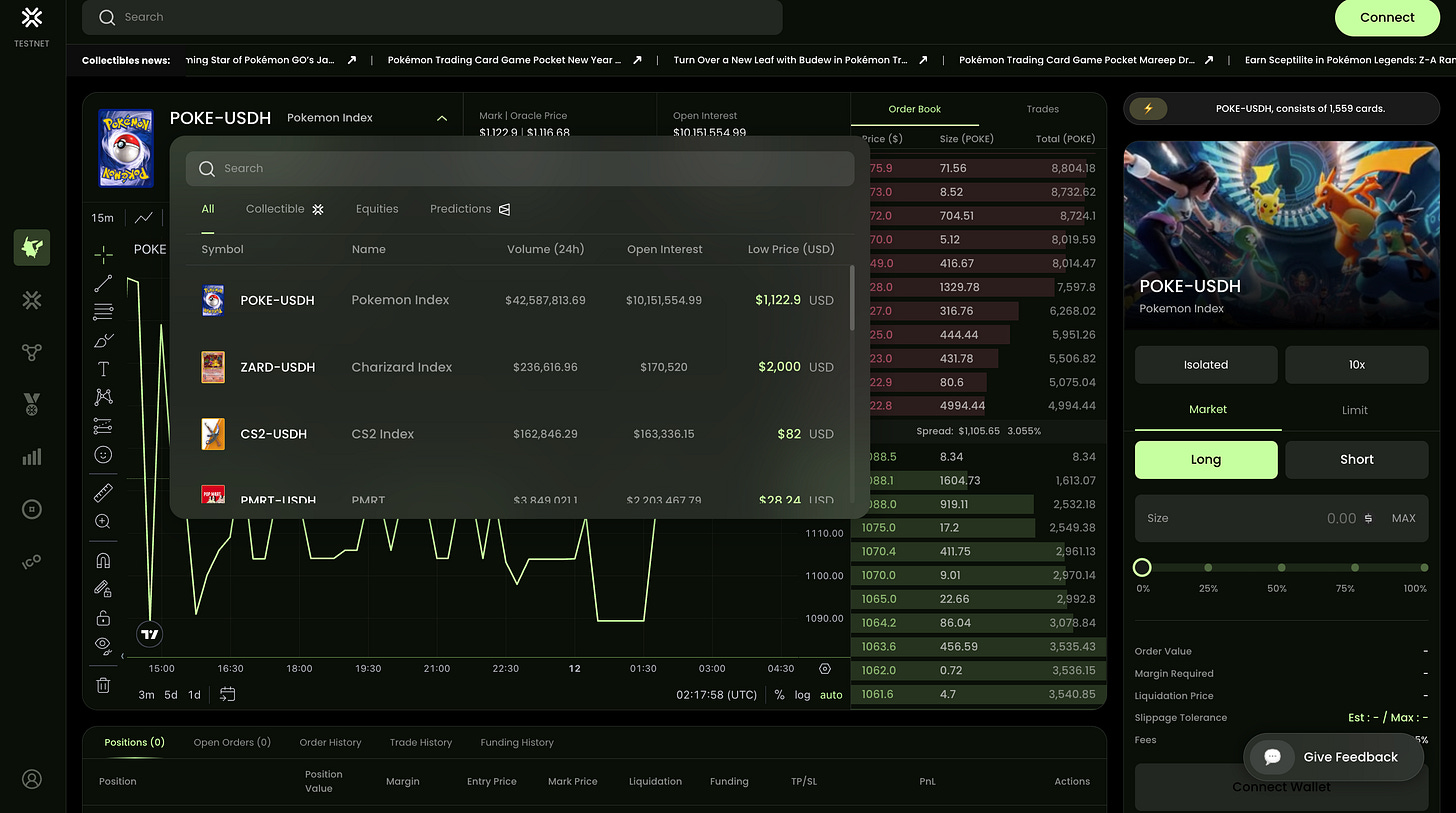

The tradable markets offered by Trove represent a unique asset class that has been largely overlooked in traditional DeFi.

There are three types: collectibles like Pokémon cards, stocks of collectibles-related companies like Nintendo and Pop Mart, and prediction markets for collectibles-related events.

Specifically, the following stocks exist.

①Collectible

Pokémon Card Index (POKE | ZARD Index)

Comprehensive price index for major PSA-graded Pokémon cards. Calculated by aggregating price data from multiple collectible marketplaces such as eBay and TCGplayer. This index incorporates trends for individual cards (e.g., Charizard) and is traded in USDC.Counter-Strike 2 (CS2) Skin Index

An index composed of high-value weapon skins frequently traded on Steam Marketplace and third-party exchanges. It aggregates the prices of multiple representative CS:GO/CS2 in-game skins into a basket, providing a stable price benchmark difficult to achieve with individual items.

②Stock

Nintendo Stock Perpetual ($NTDO)

Perpetual futures tracking Nintendo (NTDOY) stock. Offers 5x leverage and is available for 24-hour trading on Hyperliquid under the ticker $NTDO. Nintendo maintains deep ties to the Pokémon card market (holding a 32% stake in The Pokémon Company), and its performance and developments ripple through the card market, leading to its listing as a “collectibles-related stock.”Pop Mart Perpetual ($PMRT)

Perpetual contract tracking the stock price of Pop Mart (9992.HK), a Chinese blind box toy manufacturer. Ticker: $PMRT, 5x leverage, 24/7 trading. Pop Mart leads the designer toy market in Asia (with flagship IPs like Labubu and Molly), and its popularity has extended to trading cards and plush toys. It is included as an Asian collectibles-related stock.

③Prediction Market

In January 2026, we plan to announce an official partnership with Polymarket and implement a two-way integration.

Perpetuals based on Polymarket’s binary prediction markets are now available on Trove.

Specifically, we will list perpetual futures contracts that allow continuous trading of prices representing the probability of outcomes for events operated on Polymarket (events determined by YES/NO results). This enables users to trade with leverage on prediction market odds.Polymarket has launched a prediction market using Trove’s collectible index data.

For example, create a market on Polymarket asking “Will the Pokémon Index exceed $2,000 by year-end?” and settle it using Trove’s price oracle. This enables users to place prediction bets on events tied to collectible prices, something previously unavailable.

As described above, Trove handles a wide range of unique markets, including collectibles in general, collectible-related stocks, and prediction market events.

A common feature across all markets is the ability to trade real-world assets (RWAs) and events as on-chain derivatives—assets that previously lacked direct hedging or speculative instruments. Trove has emerged as a pioneer in this field.

◼️Use Cases and Target Users

Trove’s use cases can be broadly categorized into two types: speculation (trading for profit) and hedging (mitigating the risk of value fluctuations in held assets).

First, as a speculative use case, Trove offers crypto traders new alpha opportunities. This is because they can apply the leverage trading expertise they’ve honed in cryptocurrency and stock markets to non-traditional markets like Pokémon cards, in-game items, and even event predictions.

For example, if you predict that “the price of a card that wins a tournament will surge,” you can preemptively go long on the index containing that card. Conversely, if you feel that “the temporary boom for a popular IP has become too overheated,” you can short the index to target profits during the correction phase.

On the other hand, hedging use cases benefit collectors and holders.

For example, collectors holding high-value Pokémon card collections are constantly exposed to the risk of overall market price declines. By shorting the Pokémon Card Index on Trove, they can partially offset the decline in the value of their physical assets.

Similarly, for the first time, risk hedging measures will be offered, such as users holding large numbers of rare CS:GO skins shorting the skin index to prepare for a market crash.

Introducing the concept of insurance using futures to the collectibles market—where previously the only way to guard against price decline risk was to sell the physical item—can be considered groundbreaking.

Available trading strategies and derivative designs

Next, I’ll explain the trading strategy in a bit more detail.

◼️Leverage

Trove offers leverage of up to 5x across all markets.

While other perpetual DEXs often offer leverage exceeding 100x, a 5x setting is relatively conservative. This is likely a risk management constraint based on the underlying asset’s liquidity and price characteristics.

A 5x leverage position would reach liquidation if prices fluctuate by 20%, making it resilient enough to withstand short-term volatility even in markets like the Pokémon Card Index, which has shown long-term annual growth of 30–40%.

◼️Price Oracle

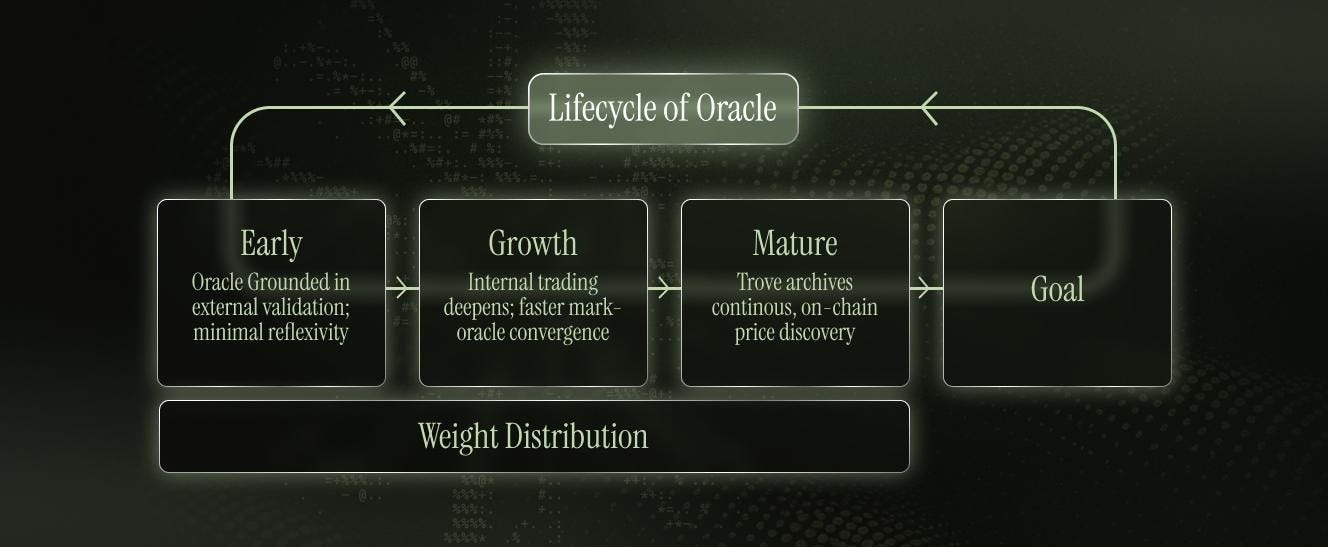

A key feature of Trove’s derivative design is the introduction of a hybrid oracle that combines multiple price elements.

The price for each market is initially calculated using a weighted average of three factors, each weighted at 33%: 1) The trading price within Trove (Mark), 2) The verification price from external markets (Validator), 3) The EMA (Exponential Moving Average) of the price within Trove.

For example, the Pokémon Card Index equally reflects the most recent Trove transaction prices, weighted prices gathered from over 25 external collectibles marketplaces, and Trove’s 8-hour EMA, ensuring it never deviates significantly from actual market conditions. Furthermore, these weighting coefficients dynamically adjust according to market developments.

During the initial launch phase, we will prioritize price manipulation resistance and real-world correlation by heavily weighting external data (Validator 50–60%). As trading volume increases and our internal price discovery capabilities improve, we will gradually raise the Mark and EMA ratios to enhance responsiveness. Ultimately, in the mature phase, we plan to transition to internal price discovery leadership, with Mark/EMA combined at 65–70% versus Validator at approximately 30%.

Through this self-evolving oracle, we aim to maintain reliability from the early stages of low market liquidity while ultimately positioning Trove itself as the standard price benchmark.

Transition and Outlook

The Trove development team is currently anonymous (not publicly disclosed), and specific member names have not been revealed on the official website or in documentation.

The project itself commenced with the HIP-3 update in October 2025.

In November 2025, the public beta launched, enabling users to trade perpetual futures on diverse collectible assets—including Pokémon cards, luxury watch indices, Hermès Birkin bags, in-game assets (CS2 skins), and even real-world stocks like Nintendo and Pop Mart—with up to 5x leverage.

With the platform launch, a reward system granting Trove Points to participants was introduced, energizing community-led testing.

Within less than a month of its launch, it reportedly reached a cumulative trading volume of $1 billion and over 24,000 users, demonstrating strong interest in this niche market. Furthermore, on December 5th, a snapshot of user activity across the entire Hyperliquid ecosystem was taken, distributing initial points based on past trading volume, staking activity, NFT holdings, and other metrics.

On January 7, 2026, as mentioned above, we announced our partnership with Polymarket. The $TROVE token ICO was conducted from January 8 to 11, 2026.

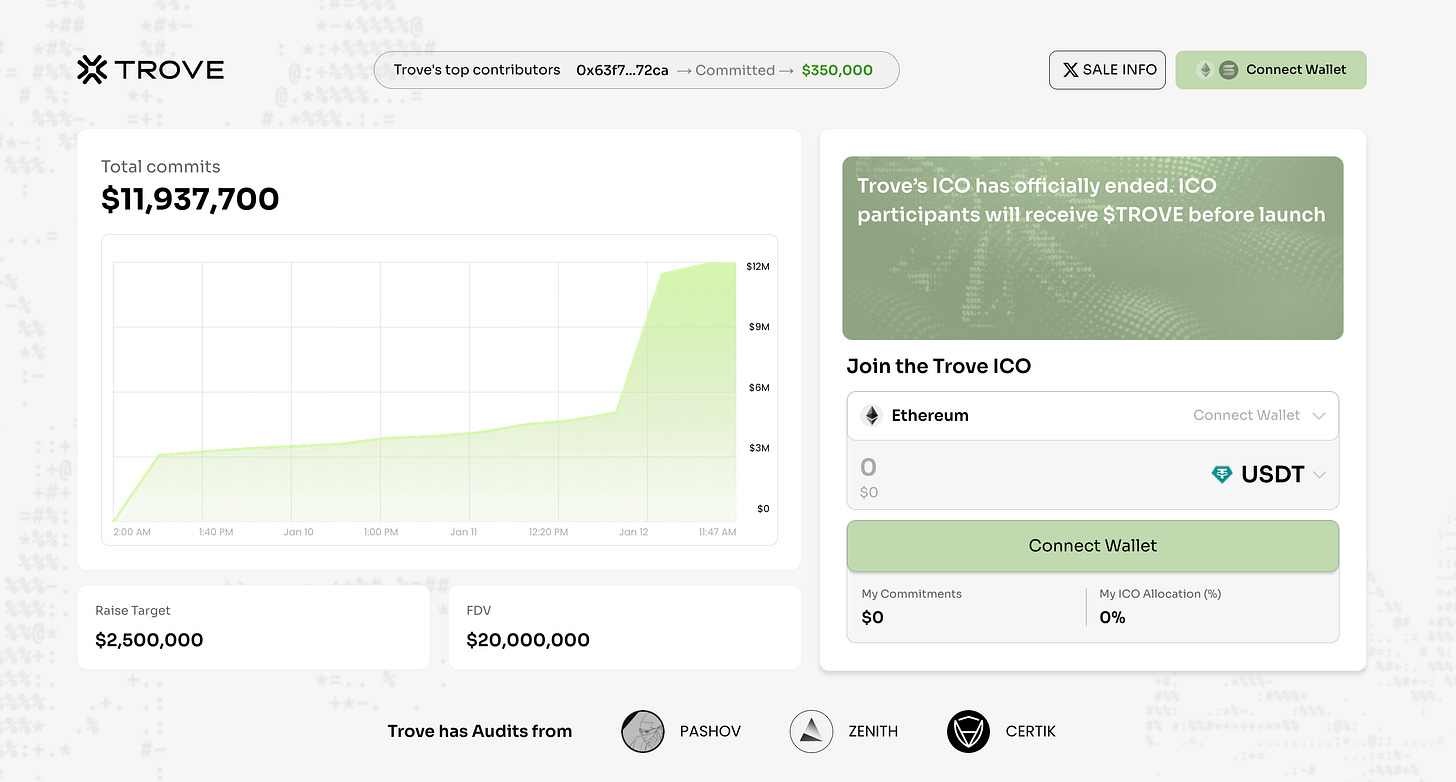

The fundraising target is $2.5 million (FDV approx. $20 million), with 12.5% of the total token supply being sold. An overflow mechanism was adopted for the oversubscribed portion, implementing a pro-rata allocation and refund system.

Participation registration supports USDC/USDT/USDH deposits on Ethereum mainnet, Arbitrum, Base, and Hyperliquid chains. The $TROVE token is designed to be 100% instantly unlocked at the TGE.

To reflect contributions made during the testing phase, users holding a certain threshold of Trove Points were granted preferential treatment, receiving up to a 20% increase in token allocation during the ICO.

Just before the initial offering period ended, suspicious funds were detected flowing in, prompting an announcement to extend the ICO period by five days. However, this decision faced backlash from the community, and the offering concluded as originally scheduled. Ultimately, the amount raised exceeded the $2.5 million target by a factor of four.

Excess funds will be refunded, and tokens are scheduled to be distributed via airdrop to participants before the mainnet goes live.

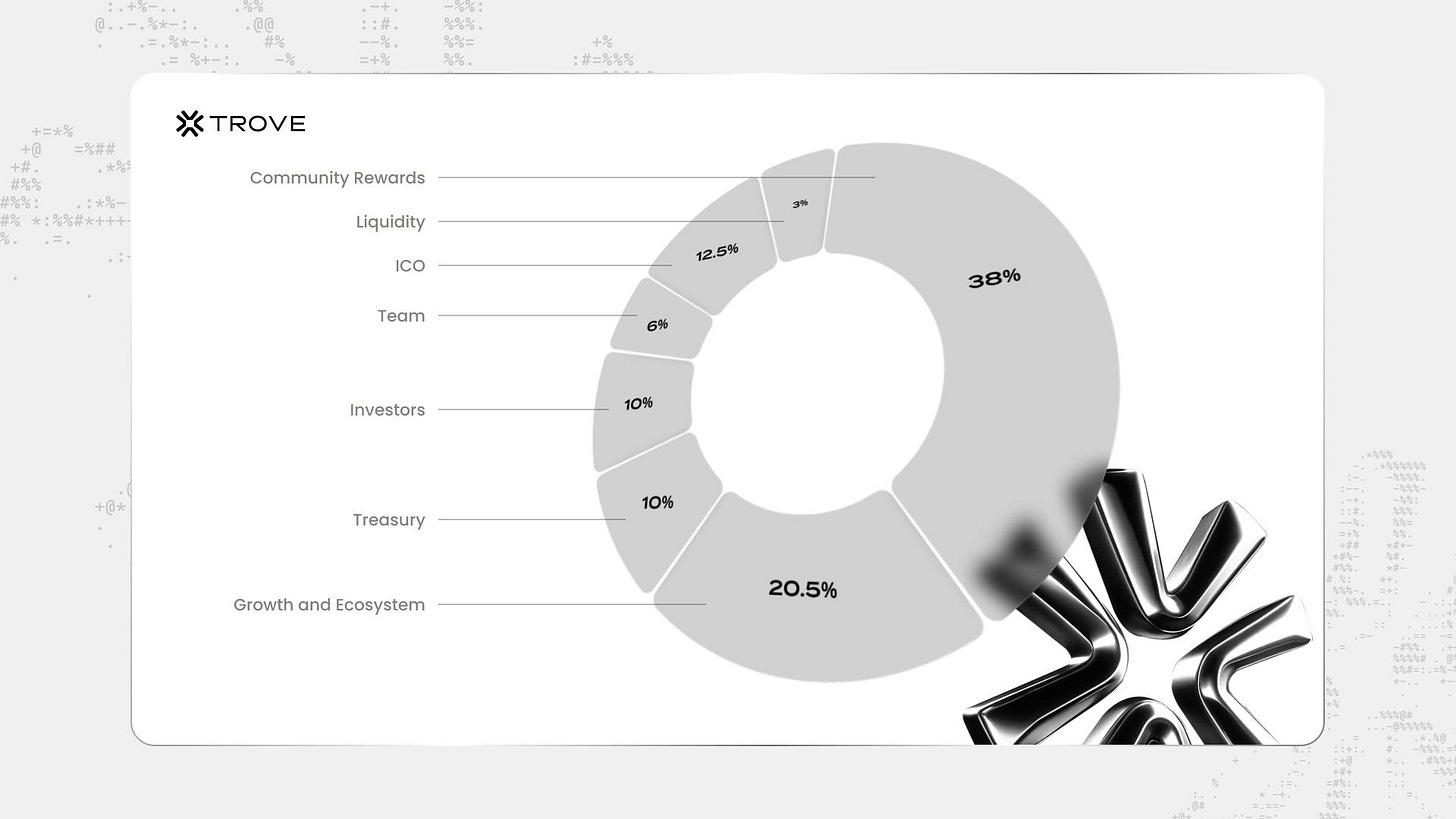

The allocation of $TROVE tokens is as follows:

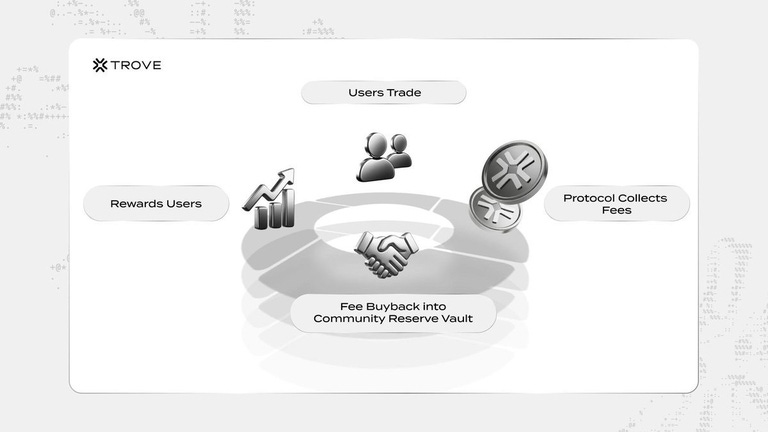

As a utility, it incorporates a value capture model that allows $TROVE holders to benefit from the protocol’s success.

Specifically, all transaction fee revenue generated on Trove is allocated as follows:

60%: Automatic buyback (burn) of $TROVE on the market

10%: Allocated as token staking rewards

20%: HIP-3 Market Operation Support

10%: Growth and Expansion Budget (New Market Integration, Liquidity Support, Partnerships, etc.)

This model aims to create a flywheel effect: increased trading volume → higher fee income → increased buybacks and staking rewards → enhanced token value → attracting more users.

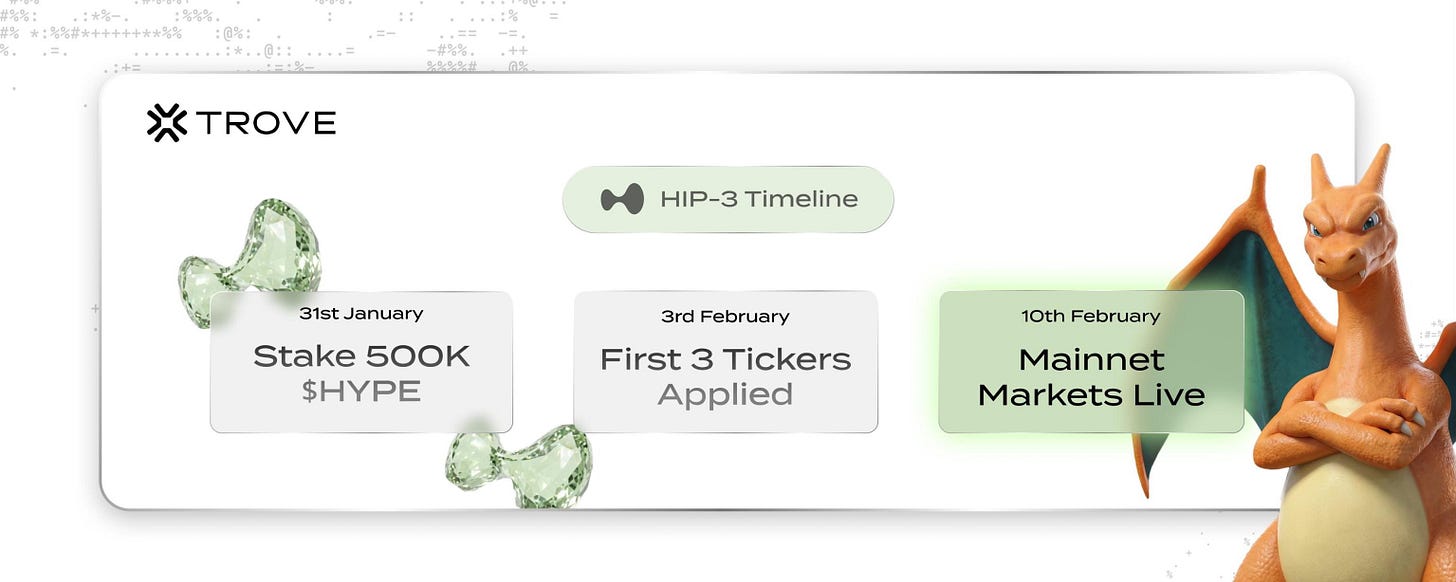

After several months of development and testing, Trove will officially enter its mainnet operational phase. The plan has been announced as follows.

First, we plan to acquire and stake 500,000 $HYPE tokens required to become a service provider on Hyperliquid, completing the staking by January 31, 2026.

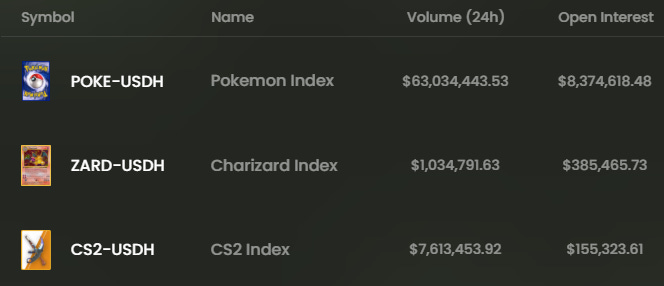

Following that, the first three ticker applications were submitted on February 3rd. After passing the review, the first three mainnet markets are scheduled to launch on February 10th. Specifically, the following three perpetual markets will be simultaneously released on February 10th:

It is expected that the token’s TGE will be implemented during that process.

The futures market has price discovery and insurance functions.

Finally, we conclude with a summary and analysis.

Perpetual trading of RWA Collectibles is highly intriguing. As mentioned in the use cases, this serves as a new investment vehicle for traders, but I also believe it can function as an asset hedging tool for collectors.

Delta-neutral models like Ethena’s USDe can be implemented with trading cards such as Pokémon cards. In recent years, cards worth millions to hundreds of millions of yen have appeared, and some people hold cards as investment assets. Naturally, such investors are concerned about price declines.

Therefore, holding the physical cards while maintaining a leveraged short position on Trove can serve as a hedge against a certain price decline, particularly a crash. While it may not hedge against individual cards, it does hedge against the overall market. Consequently, it might be beneficial for companies in the card industry to maintain short positions for risk hedging purposes.

Writing it this way, some may find it hard to imagine perpetual contracts becoming more than just a place for speculation. Yet the original futures market was a financial instrument with insurance-like functions.

For example, in agricultural futures trading, farmers could eliminate risks such as weather and secure their income, while investors could profit during bumper crops or price surges. Furthermore, stock prices often fluctuate in tandem with futures markets.

In other words, futures markets serve not only speculative purposes but also functions of price discovery and risk hedging.

Just as prediction markets possess truth-discovery functions beyond speculation, I believe perpetual trading will also begin to serve functions beyond speculation. This will lead to its wider adoption in society and the emergence of its value as a medium.

Perpetual contracts, being perpetual futures, are a viable option for many businesses to maintain positions as a hedge against operational risks. For example, Japanese companies might consider holding USD/JPY positions to prepare for yen depreciation.

As it becomes more widespread in society, I believe we will see the emergence of price discovery functions for traders and media, as well as perpetual trading markets serving as insurance for corporations, which will unlock even greater potential.

Trove has carved out a unique position within this landscape, so we will continue to keep an eye on it.

That concludes our research on “Trove”!

Reference Links:HP / DOC / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.