【Trade.xyz】Perpetual Stock DEX built using HIP-3 / Enables 24/7 trading with internal oracles / @tradexyz

HIP-3 Leads the Way into the Era of RWA Perpetuals

Good morning.

I’m Mitsui, a web3 researcher.

Today I researched “Trade.xyz”.

What is Trade.xyz?

What is Hyperliquid’s HIP-3?

Transition and Outlook

HIP-3 Leads the Way into the Era of RWA Perpetuals

TL;DR

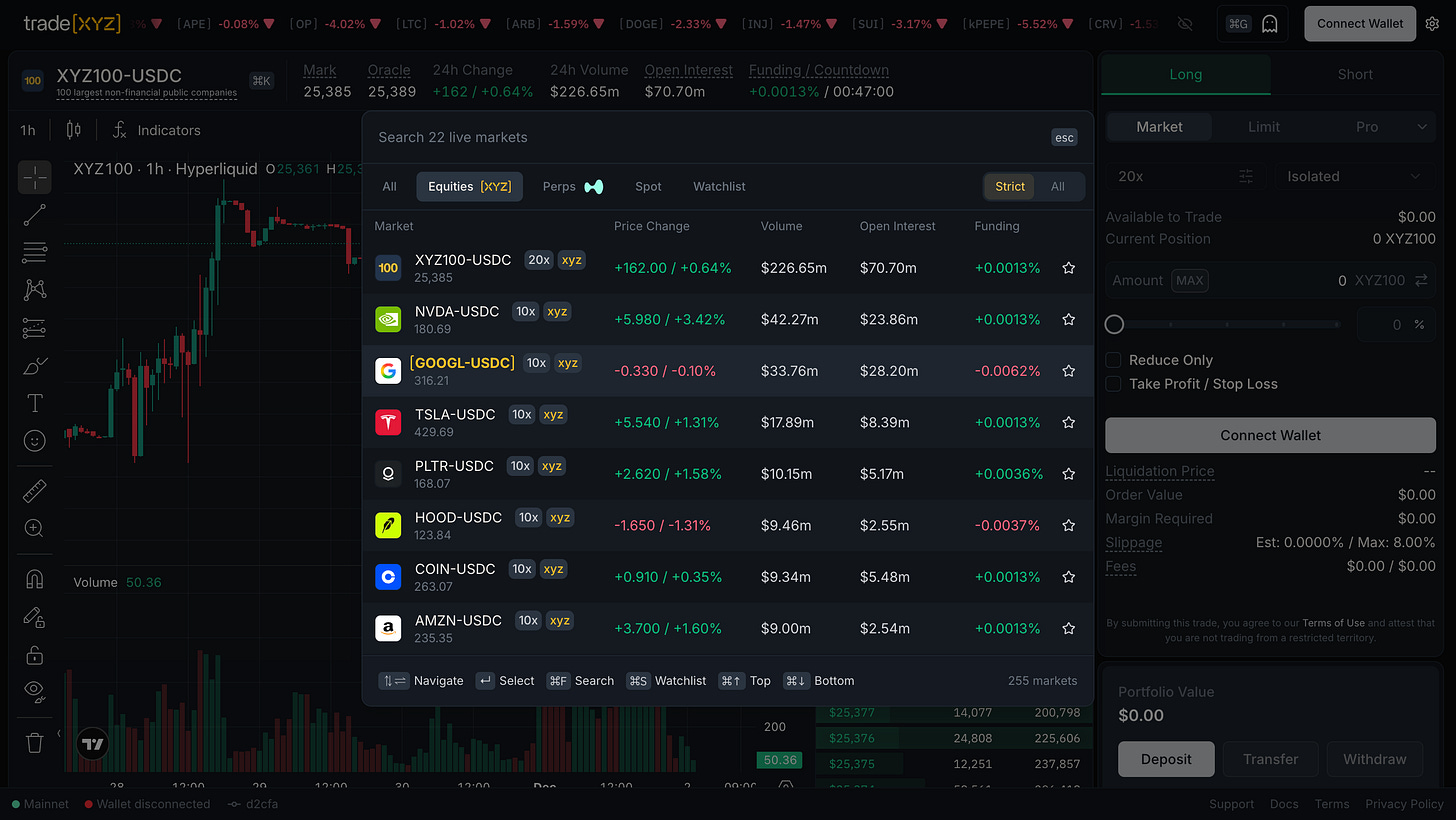

Trade.xyz is a “perpetual equity-only DEX” built using Hyperliquid’s HIP-3. Crypto Perps/Spot leverage Hyperliquid’s liquidity directly, while Equities operates its own independent market.

Stock Perp combines external oracles (such as Pyth) with an internal pricing model (EMA + order book supply-demand fair value), enabling uninterrupted 24/7 trading even on weekends.

Launched as the flagship DEX meeting HIP-3 requirements (500,000 HYPE stake, 50% fee rewards, etc.), its trading volume is rapidly expanding due to the 90% fee discount in Growth Mode.

What is Trade.xyz?

Trade.xyz is a cross-asset perpetual futures platform that enables 24/7, 365-day trading of all assets.

Based on Hyperliquid’s HIP-3 protocol, we are launching the platform on the Hyperliquid chain by staking 500,000 HYPE tokens.

The following are the markets we offer. Among these, “Perps” and “Spot” utilize Hyperliquid’s liquidity directly, with only the frontend built. The standout feature of “Trade.xyz” is “Equities[XYZ]”.

In other words, the platform that has realized perpetual stocks is “Trade.xyz”.

For example, tokenized indices like “XYZ100” (based on the NASDAQ100) and individual stocks such as AMZN (Amazon), AAPL (Apple), and TSLA (Tesla) can be traded 24 hours a day, 365 days a year. This represents a groundbreaking shift from traditional stock markets, which were only open for trading during weekday daytime hours, by enabling trading even on weekends and at night.

For perpetual stock contracts, the price oracle mechanism is crucial.