【Superfluid】Protocol for dynamic remittance and distribution / Wrap ERC-20 to SuperToken / Enable real-time payment of subs and salaries / Token sale now on Kaito LaunchPad / @Superfluid_HQ

It can be a central part of the on-chain economic zone.

Good morning.

I am mitsui, a web3 researcher.

Today I researched "Superfluid".

🥛What is Superfluid?

🚩 Transition and Prospects

💬One of the underlying protocols of the on-chain economy

🧵TL;DR

Superfluid is a protocol for the continuous transfer (Money Streaming) and distribution (Distribution) of assets on the blockchain, and has issued a Governance Token SUP for 2025.

Super Token is a wrapped token that extends ERC-20, allowing for real-time sending and receiving and dynamically changing balances.

Money Streaming can securely perform one-to-one, second-by-second transfers and is used for payroll, subs, donations, and investments.

Distribution provides efficient one-to-many distribution and is used for DAO rewards, DeFi interest, revenue sharing, and vesting management.

🥛What is Superfluid?

Superfluid" is a project that provides asset streaming and distribution capabilities running on the blockchain.

By introducing a new token standard, Super Token, and adding real-time remittance capabilities to the existing ERC-20 tokens, dynamic payroll payments, subscriptions, etc. can easily be sent and received in real time.

Let's take a look at how it works.

◼️Super Token

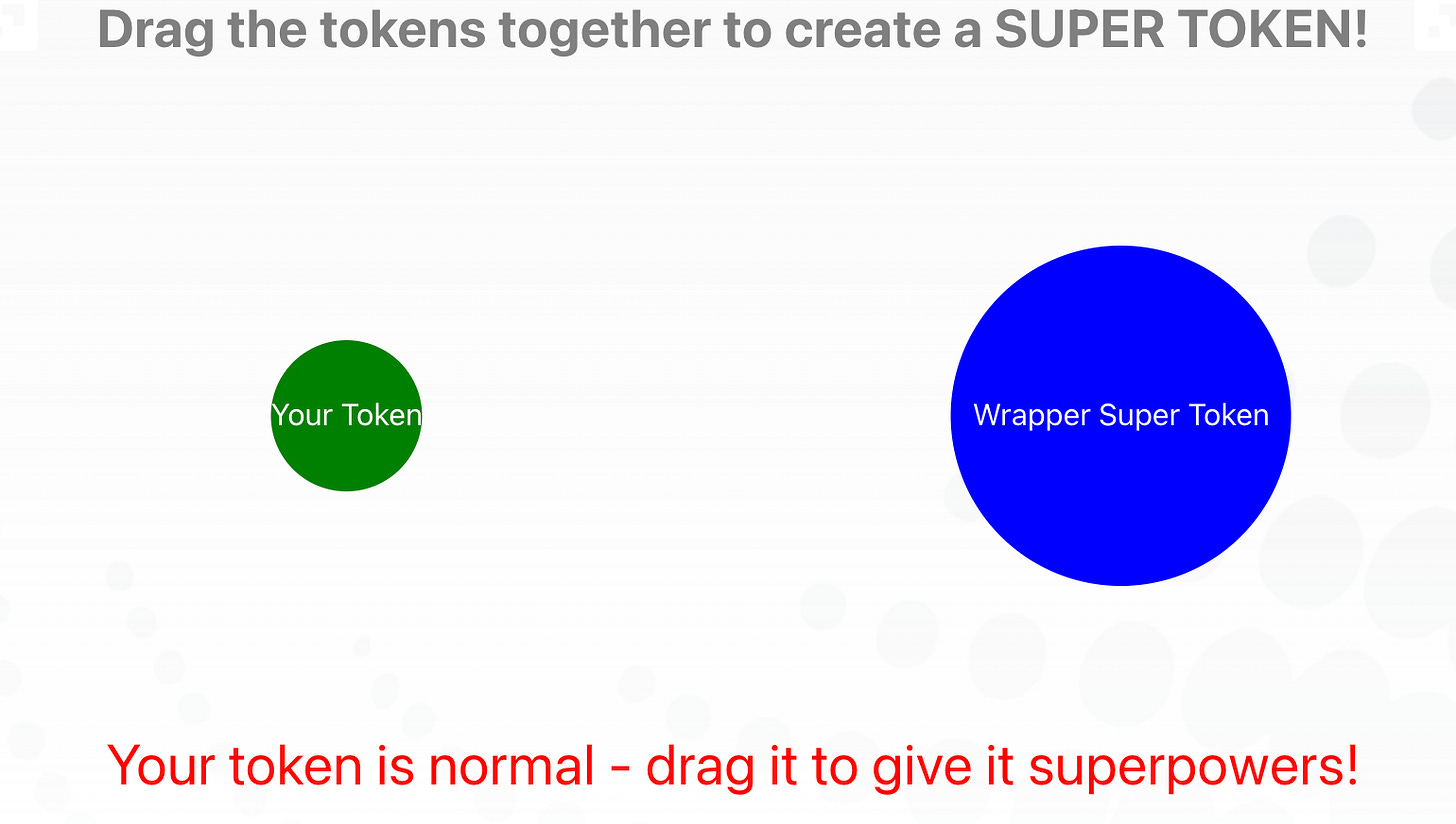

Super Token is a special token implemented as an extension of ERC-20 (and ERC-777), a token with "super" features such as real-time money transfer and one-to-many distribution on the network.

Existing regular tokens (ERC-20) can be converted to Super Token by wrapping them, and conversely, they can be downgraded back to the original token at any time.

For example, upgrading a USDC will issue a Super Token (Super USDC) called USDCx, and conversely, downgrading will incinerate the USDCx and return the original USDC. This mechanism allows you to use Superfluid's features without compromising your existing assets.

Super Token represents not only a static balance, but also a dynamic balance that takes into account real-time changes due to ongoing streams and distributions. In other words, the user's wallet balance changes from moment to moment, increasing or decreasing with the flow of transfers and receipts.

Specifically, the following two main functions are available after conversion to Super Token.

◼️①Money Streaming

This function continuously transfers tokens at a fixed flow rate.

When the sender (sender of the stream) initiates the stream by specifying a "how much per second" rate (flow rate), the tokens will continuously flow to the receiver in synchronization with the block time.

For example, if Alice initiates a "send one token per second to Bob" stream, it will automatically move one token per second from Alice's balance to Bob's balance and continue indefinitely until stopped. With this mechanism, there is no need to issue a transaction for each transfer; simply set up the stream once and the funds transfer proceeds in real time.

At the start of the stream, the sender locks in a certain amount of deposit in advance. If the sender's balance is about to be depleted, an external monitor called a "sentinel" will force the stream to stop, and the sender will receive a reward from this deposit.

This mechanism ensures that the stream operates securely while preventing defaults due to inadvertent insufficient balances. In addition, both sender and receiver can terminate the stream at any time, and the remaining deposit is returned to the sender after the money has been transferred up to the point of termination.

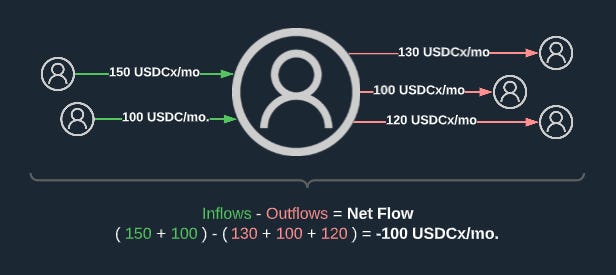

The stream also calculates your net flow (net rate of change per second) for each sender and receiver. The difference between the total rate of all streams coming into you and the total rate of all streams going out of you is the net flow, and your wallet balance increases or decreases in real time based on this value.

The following use cases have been created using this mechanism, for example

Salary and compensation streaming

DAOs and startups pay employees/contributors by the second.

The wallet balance increases instantly as you work, so you don't have to wait for payday to utilize your funds.

Examples: core unit payments for MakerDAO, DAO payroll functionality through integration with Coinshift.

Subscription payments (subscription service billing)

Automatic billing for services like Netflix and Spotify based on time of use rather than on a monthly basis.

Flexibility and transparency, as payments stop immediately upon cancellation.

Example: Diagonal (web3 version of Stripe) leverages Superfluid to offer recurring billing.

Ongoing donations and support

Fans and supporters continue to send donations to creators and open source developers in seconds.

Example: experiments with real-time support for "guesses" on Gitcoin, Lens, etc.

Dollar Cost Averaging (DCA) Investments

Investors pour small amounts of tokens into the DEX every second for automatic, distributed purchases.

Smoothing market price volatility risk.

Example: DAIx stream on Ricochet Exchange (on Polygon) -> regular swap to ETH or MATIC.

◼️②Distribution

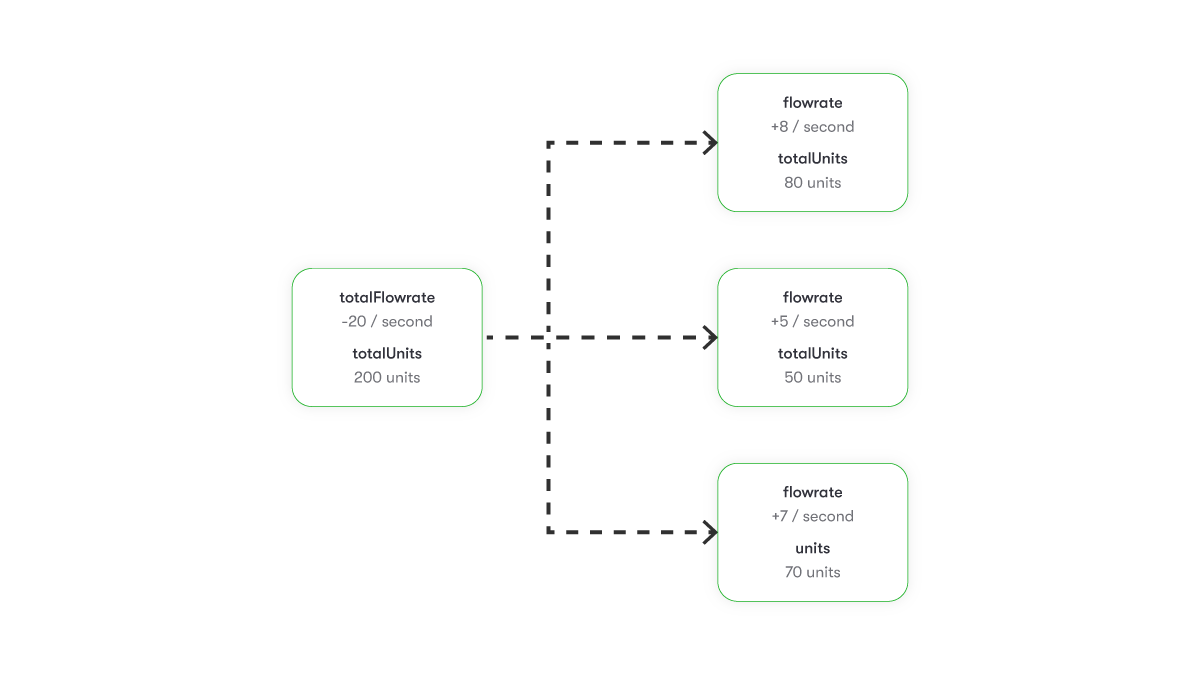

This is a mechanism for efficient one-to-many token distribution.

When a sender (distributor) distributes tokens to multiple recipients, each recipient is assigned a share, called a unit, in advance, and when the total amount of tokens to be distributed is updated at the time of distribution, the balances for all recipients are automatically updated according to their share.

For example, if Alice issues one unit each to Bob, Carol, Dave, and Erin, each will be entitled to 25% of the future distribution. If Alice were to execute a "distribute 100 tokens," each person's balance would automatically be credited with 25 tokens each. Once the units are set, Alice can then distribute them to the same distribution group as many times as she wishes in a single transaction, eliminating the need for multiple individual transfers.

This mechanism allows for extremely scalable distribution, as gas costs remain constant even if there are dozens or hundreds of recipients.

Superfluid also introduced a new mechanism called Distribution Pool in the circa 2023 update. This is a smart contract (pooling) of the distribution group itself, with equity units transferable like ERC-20 tokens.

Simply put, by making the units ERC-20, we made it possible to trade pool interests like shares in a liquidity offering. This increased versatility by allowing a remittance stream to be poured into a pool and all members in that pool to receive tokens in real time in proportion to their unit ratios.

The following use cases have been created using this mechanism, for example

DAO Treasury Reward Distribution

DAO distributes governor tokens and USDCs to community members en masse.

Even distribution of several hundred people can be handled in a single transaction.

Example: Superfluid Distribution used for Optimism's RetroPGF grant distribution.

Automatic distribution of DeFi interest and rewards

Liquidity provision and staking yields are distributed to users in real time.

No more need to press the "claim reimbursement button."

Example: Idle Finance streams interest via Distribution.

Revenue Sharing

Project sales and commission revenues are distributed to investors, NFT holders, and creators.

If units (Units) are tokenized, they are transferable = revenue rights can be bought and sold on the secondary market.

Distribution to teams and investors

Startups distribute tokens to investors and team members on a regular basis when they issue tokens.

Vesting and unlocking can be automatically managed in the Distribution pool.

These are the core functions.

🚩Transition and Outlook

Superfluid is a project created to create a "money flow" experience on the blockchain. Founded in February 2020 in London, UK, the company is co-founded by Francesco George Renzi (CEO), Michele D'Alessi (COO), and ZhiCheng (Miao) Miao (CTO).

Initially, the project was developed around the Constant Flow Agreement (CFA) and Instant Distribution Agreement (IDA) smart contracts on Ethereum to enable second-by-second payroll (streaming) and immediate distribution of compensation to a large group of people ( distribution) to a large number of people.

In 2023, we will also support Base, increasing the cost of use and scalability. In 2023, the company will also support Base, increasing the cost of use and scalability.

Furthermore, starting in late 2023, "Distribution Pools" and "Streaming Distribution" will be implemented, evolving to a comprehensive "distribution" function that includes one-to-many continuous distribution. Along with this evolution, the terminology within the protocol has been updated, with CFA being referred to as "Money Streaming" and IDA being referred to as "Distribution.

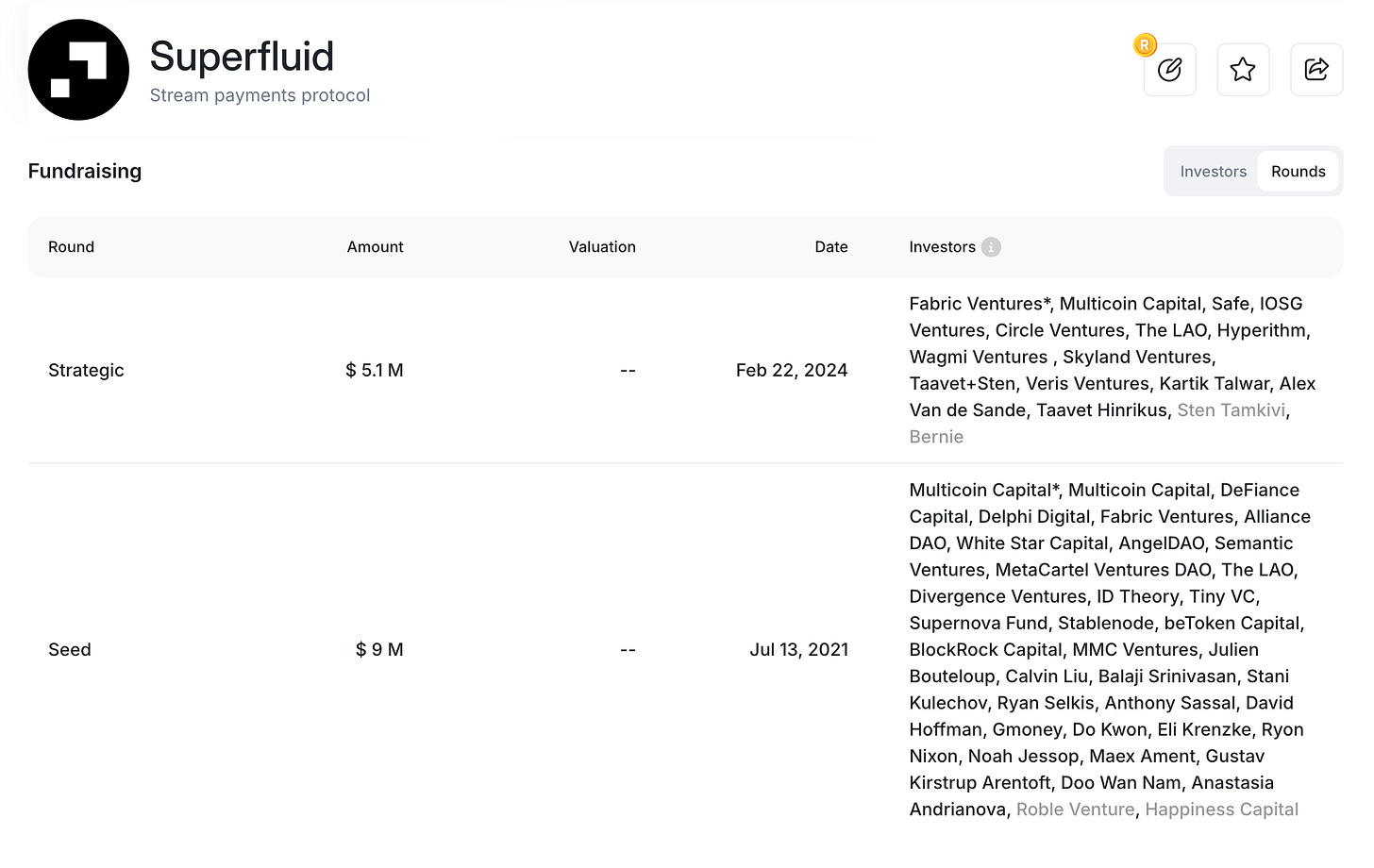

Funding was raised in August 2021 for $9 million, with investments from Fabric Ventures, Delphi Digital, Balaji, and Aave founder Stani. An additional $5.1 million was then raised in February 2024, bringing the total raised to $14.1 million.

Finally, in February 2025, the native governance token "SUP" was issued.

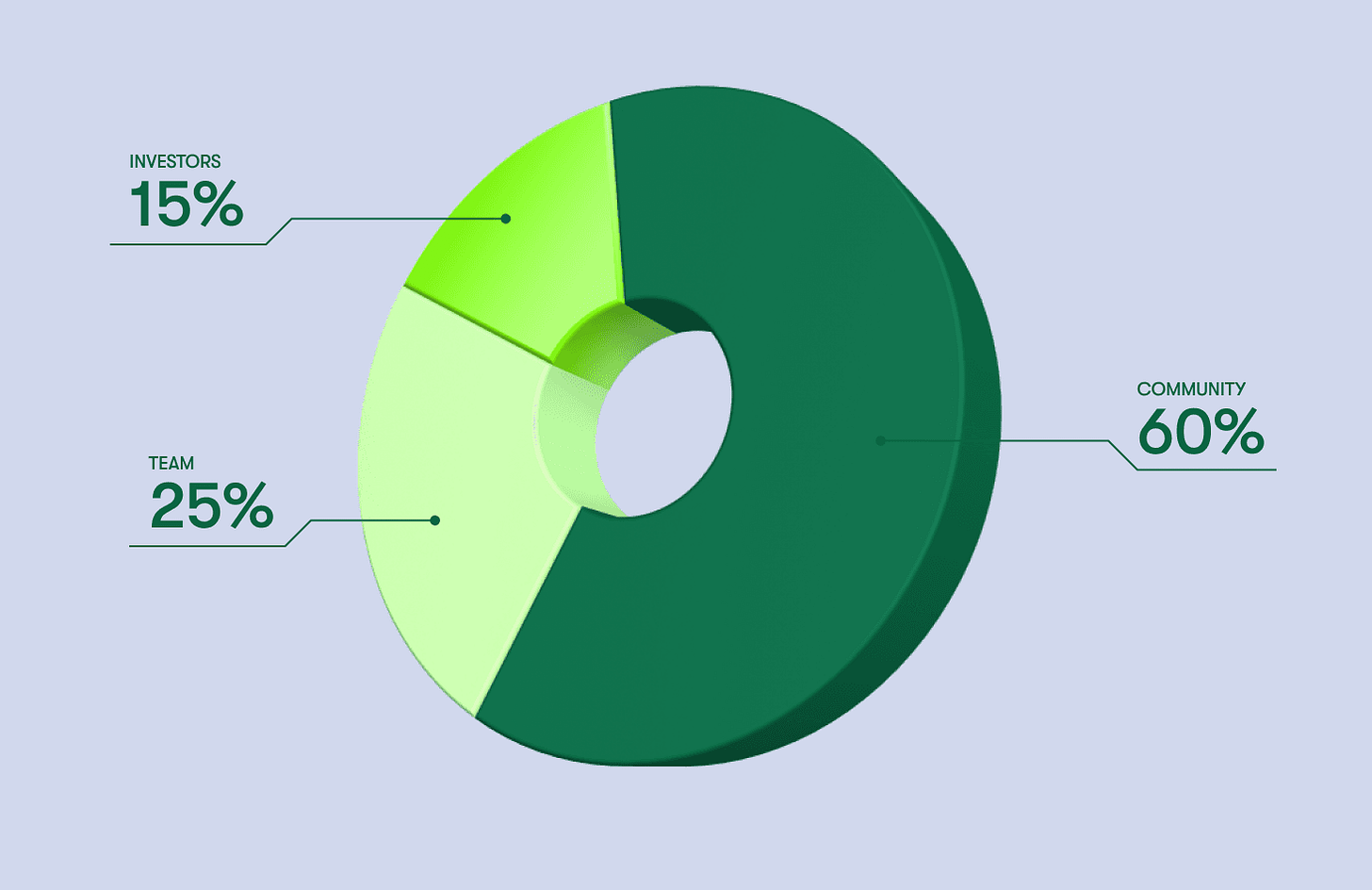

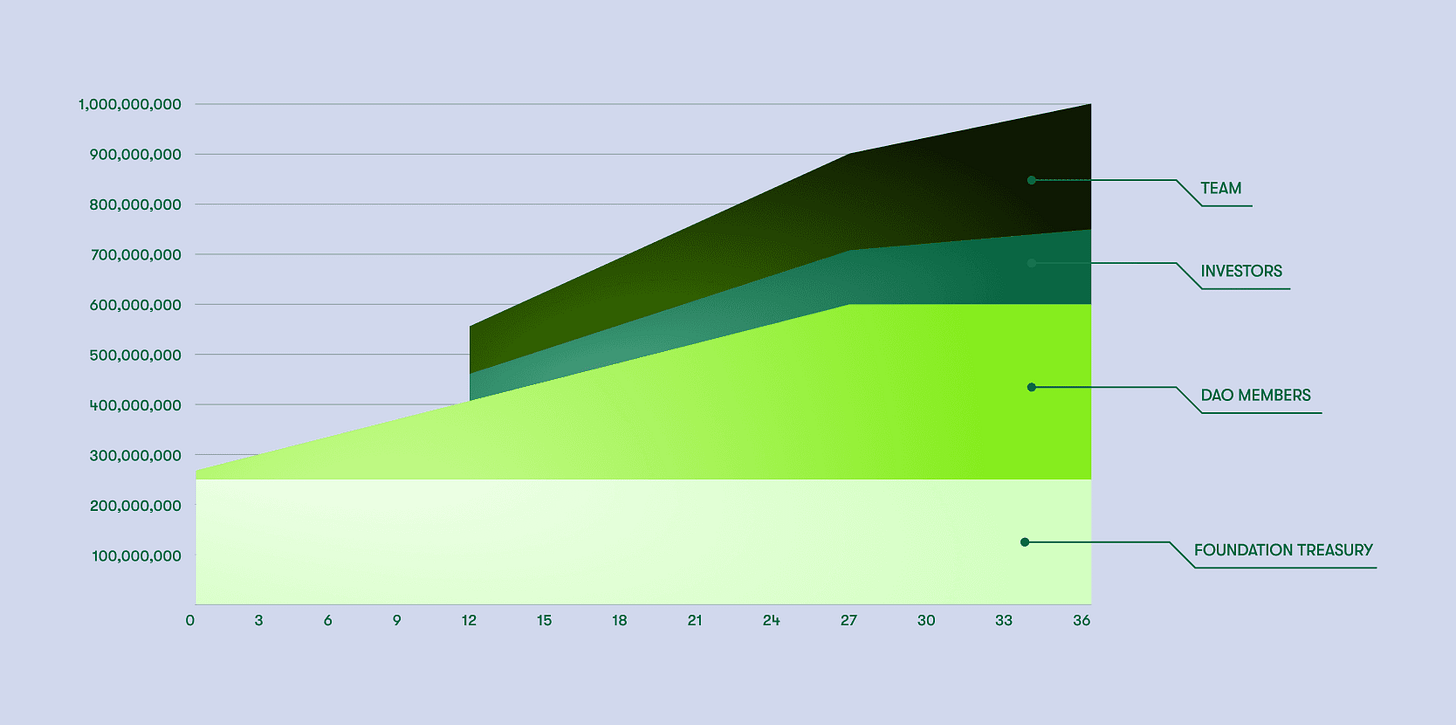

The total supply is designed to be 1 billion SUP, with a distribution of 60% community (35% DAO Treasury, 25% Foundation), 25% team, and 15% initial investors. The team/investor portion is subject to a 1-year cliff + 3-year streaming lockup to ensure long-term involvement.

In order to encourage mid- to long-term involvement, the $SUP is designed to be distributed in phases, starting with a non-transferable distribution, followed by DAO approval to lift the ban on transfers. Currently, a transfer of authority to the Superfluid DAO is underway along with a token distribution program, with initial provisional approval by ProtoDAO and transition to full-scale on-chain voting once the distribution progresses and a quorum is met.

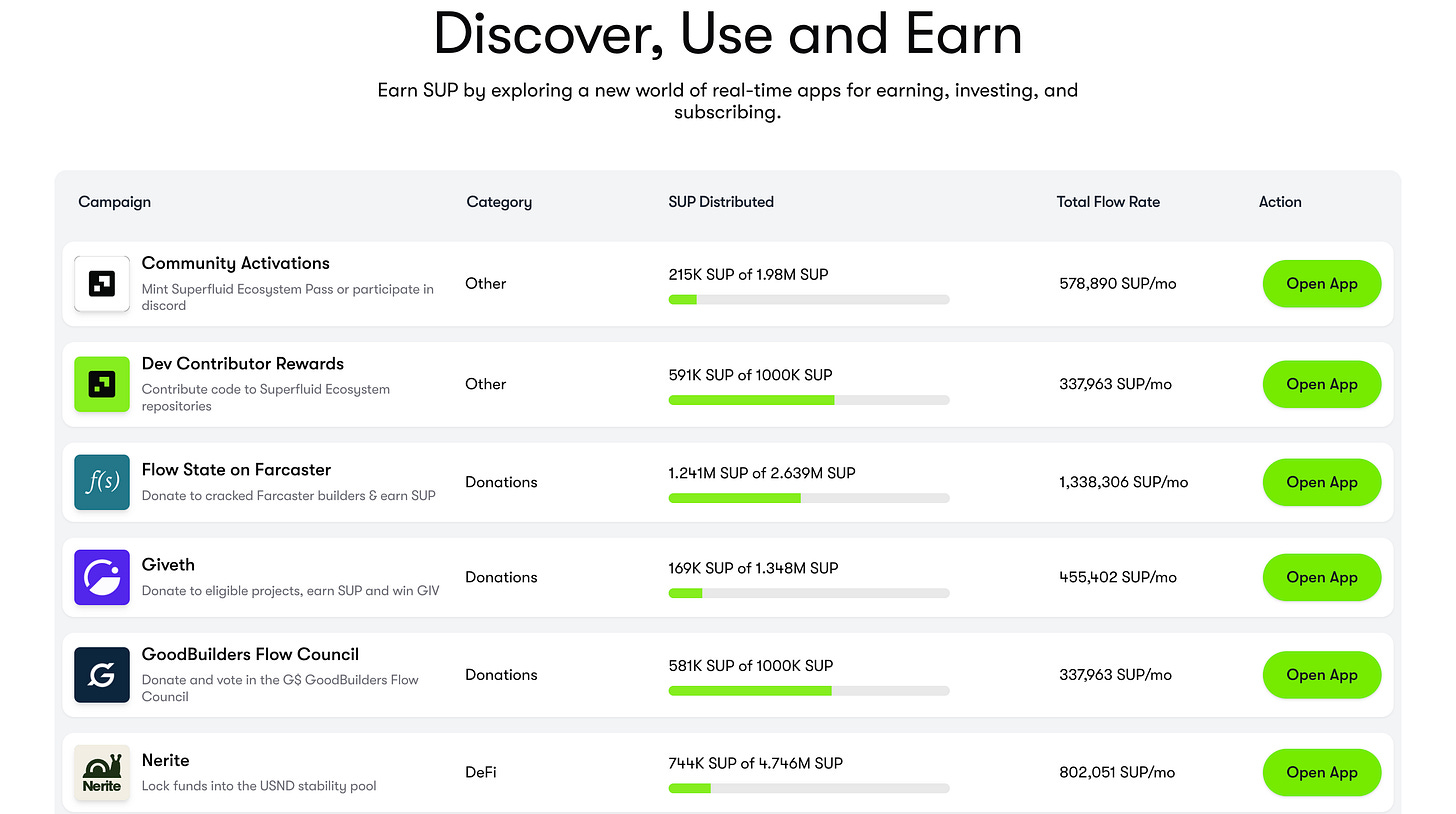

Season 1 allocates 5% of the total supply (50 million SUPs) and distributes them every second according to the usage of the target dApp. Season 1 allocates 5% of the total supply (50 million SUPs) and distributes it every second according to usage of the target dApp. Receipts are streamed to each individual's Reserve contract and are designed with a penalty for early bulk withdrawals and preferential treatment (redistribution) for long-term retention/stake/LP.

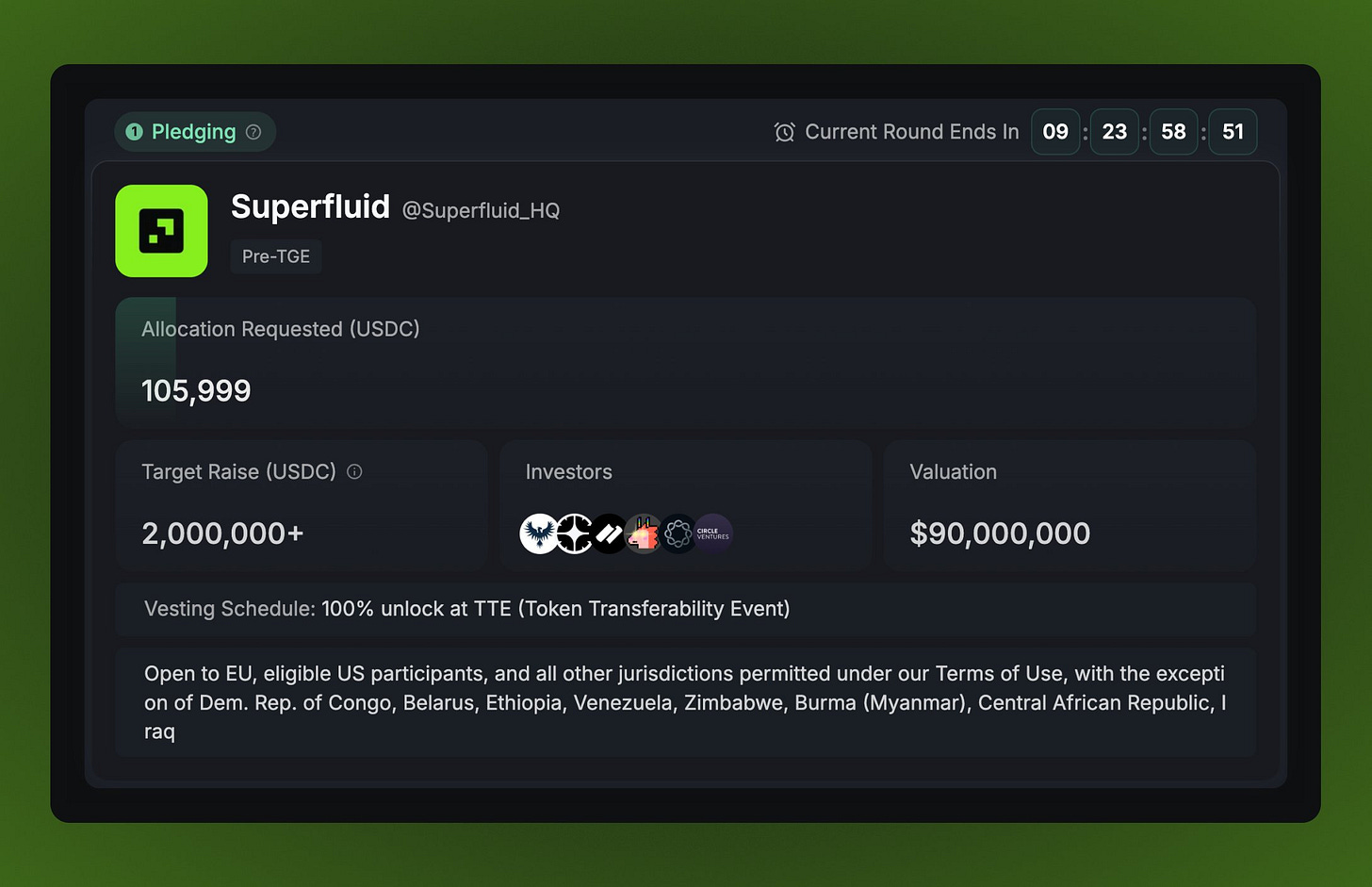

In addition, a community sale will be held on the Kaito Capital Launchpad from August 28-September 7, with an estimated FDV of $90 million and an announced fundraising goal of $2 million.

Note that as of August 2025, the Superfluid protocol itself has no transaction fees or protocol usage fees, but plans have been indicated to introduce protocol fees in the future.

According to the official roadmap, sustainable fee models (monetization), etc. are being considered for the next version (Protocol V2), and the DAO will decide whether to activate the "protocol fee switch" if necessary.

If this fee is introduced, it could become a new utility for SUP tokens, including the treatment of the revenue (return to token holders, burn, funding, etc.).

At this point, the specific design is left to community consultation, but at the very least, the SUP token is designed to be more than just a voting right, but to serve as a core asset that supports the economy within the ecosystem.

💬One of the underlying protocols of the on-chain economy

The last part is a consideration of the summary.

Superfluid is a project that has been around for quite some time, but it was surprising to see a token issue and a token sale at this time.

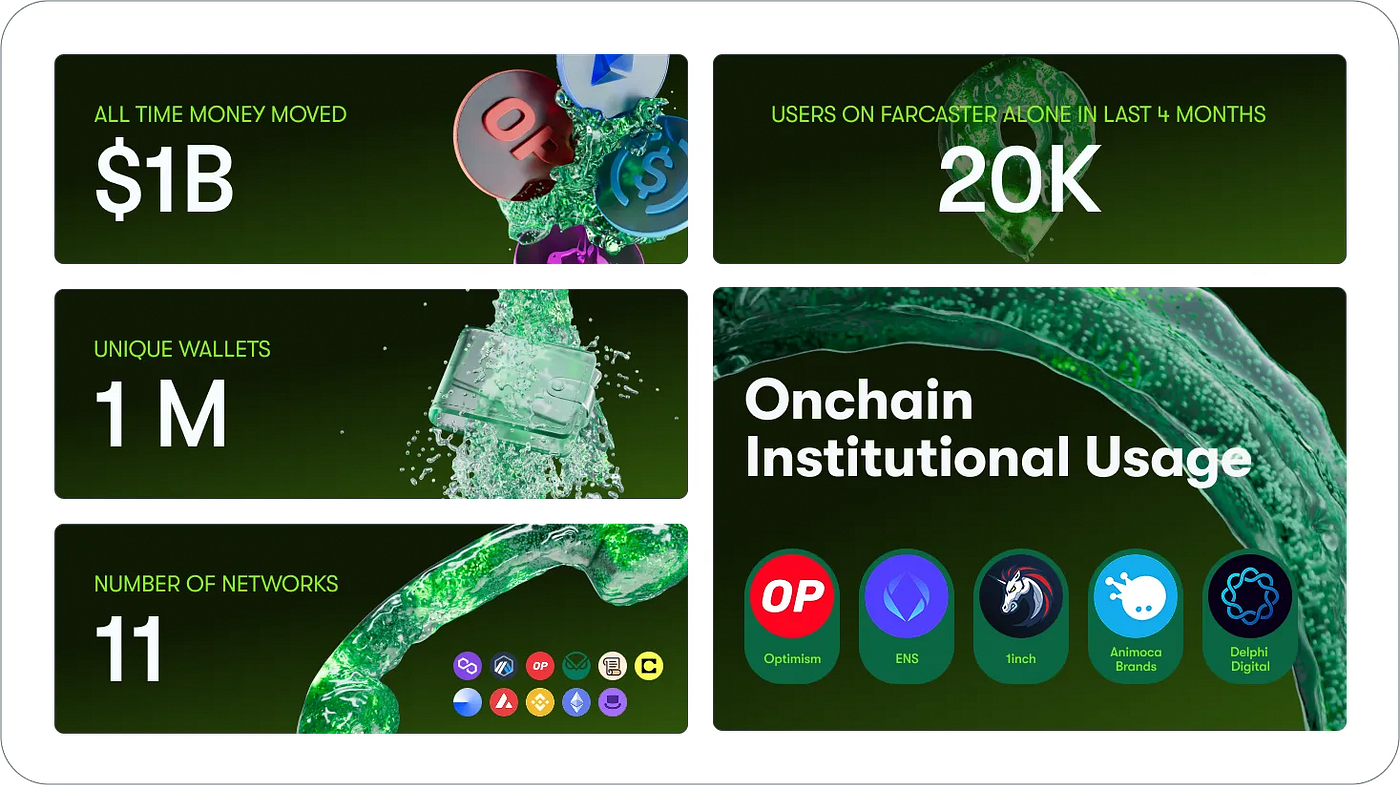

To date, it has handled $1B in funds transfers and has 1M users. It also has a good track record, with major protocols such as Optimism also adopting it.

I think there are many implications to issuing tokens at this time, but looking at the blog, I still think there is a will to decentralize the governance and make it more protocol-oriented.

In a future where the coming on-chain economic sphere will be the norm, functions like Suprefluid are essential. You would think that one of the functions could be to have that place governed by decentralized governance, rather than one entity being able to control it, while still preserving the crypto worldview.

This is a bit derivative, but I personally have been wondering lately where the optimal solution for decentralized governance lies.

My current conclusion is that a good balance would be to delegate decision-making authority for important resolutions to a decentralized system.

Frankly speaking, if all operations are shifted to a decentralized system, product improvement will not progress, and the raison d'être of the product, which was the root of its value, will be questioned. Therefore, we believe that it is always better to have an entity that takes the lead.

Then, rules could be set up such that important matters, such as algorithm changes or fee changes, for example, cannot be changed without the approval of governance. This is the general meeting of shareholders in a stock company, and more broadly, rules that bind those in power, like laws and constitutions.

This is truly governance, and I think it makes a certain amount of sense for this place to be set up for general services as well. However, there is also the opinion that even those changes will be slow if they are not made with a sense of speed, so I think this area is a balance, but I personally believe that more and more startups will grow by raising funds through token issuance rather than through equity issuance in the future, so I believe that this is a balance I personally believe that more and more startups will grow by issuing tokens instead of issuing shares, so I believe that they will seek this area as a balance.

We do not know what will happen to Superfluid, but we can predict that the core functionality has been in place and proven over the past several years, and that it will be able to continue to grow with a certain market share even if it moves to decentralized governance.

So, while I am concerned about the development of the product itself, I am personally interested to see how the project, which has achieved a certain level of growth to this point, will issue tokens and decentralize the process.

We will be following this as the transfer restrictions are gradually removed, the token launches are completed, and the distribution program is implemented.

This is the research for "Superfluid"!

🔗Reference Link:HP / DOC / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.