【Sui Complete Review (Part 3)]】Talkonomics / Storage Funds / Ecosystem / Talkonomics Allegations and Criticisms / Challenges and Potential Risks / SuiPlay0X1 / Competitive Advantage / @SuiNetwork

Finally, the last one, all about Sui!

Good morning.

Mitsui from web3 researcher.

TodayKuripto Kuriptois a contributed article by Mr. Kuripto.It is titled "Sui Complete Review" and is a commentary that covers all of Sui as of September 2024, but this is finally the last article.

Please see to the end!

11. Talkonomics

12. Storage fund deflationary effects

13. Ecosystem (on-chain data and status of each sector)

14.Allegations and criticisms regarding Sui's talknomics

15.Sui's challenges and potential risks

16.SuiPlay0X1 release

17.Where is Sui's competitive advantage?

18. Summary

11. Tokenomics

This section describes the tokenomics of Sui's native token, SUI, which is designed to encourage participation in the network ecosystem and its tokenomics adopts a unique approach.Below is a detailed description of SUI tokenomics.

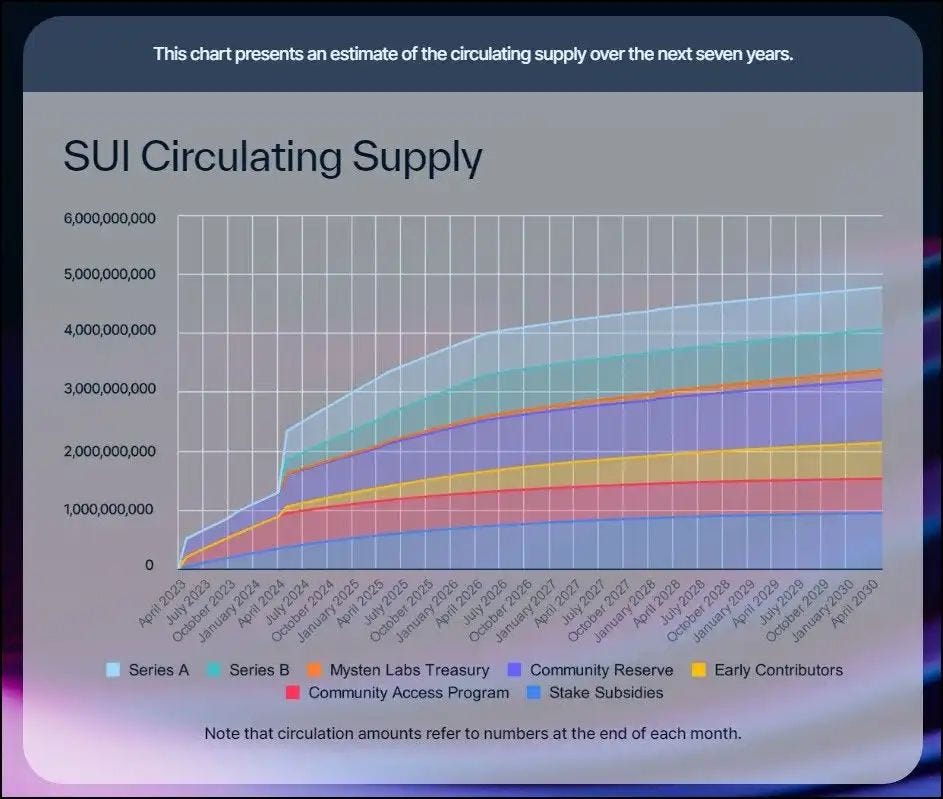

SUI is the core element of the network's operational security; the total amount of SUI tokens issued is fixed at 10 billion SUI.The supply schedule is published by the Sui Foundation immediately after the main network launch, and tokens are unlocked according to that schedule each month.

At this time, only the 2030 schedule is available, and even as of April 2030, only 5 billion SUI will be supplied, indicating that inflation will be gradual over a relatively long period of time compared to other blockchains.

There has been no airdrop of SUI tokens since the launch in 2023 until August 2024.In other major events, there was an increase in the circulating supply in May 2024 when about 1 billion SUI were unlocked at once, but there was no obvious price impact.

It is also important to mention the inflation rate of SUI tokens.Occasionally I see comments on social networking sites about SUI's token inflation concerns, so I looked up the actual SUI inflation rate.

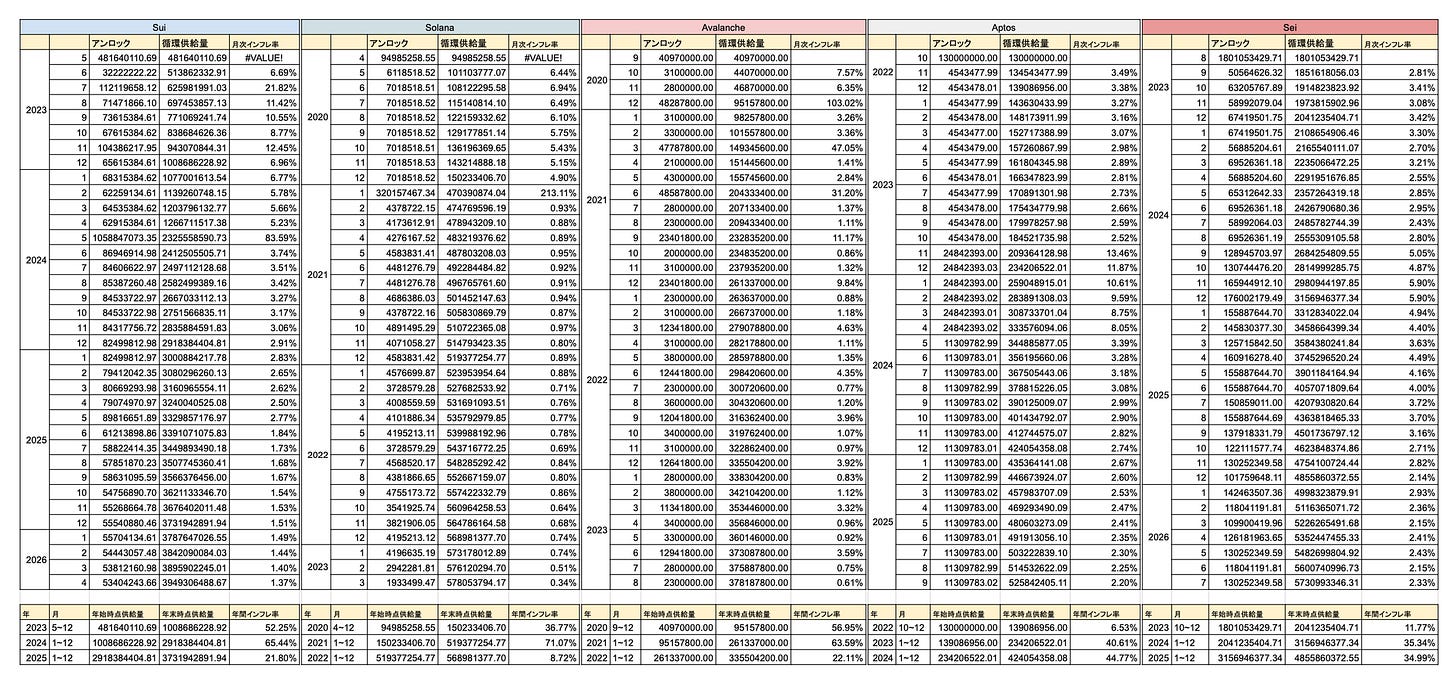

This is a comparison of the token supply schedule for each Layer 1 over the first 36 months after launch, based on Token Unlock, and I think it gives a good idea of whether SUI inflation is really a concern.It is "normal" in relative terms, and the rate of inflation is not as worrisome as other major Layer 1 chains.

And here are the token allocations (final allocations)

Community Reserve: 50% of total supply is allocated to the Community Reserve for various community activities and network growth programs.

Initial contributors: 20% will be allocated to key contributors in the early stages of development.

Investors: Investors who support the development will receive 14%.

Mysten Labs: Mysten Labs, which developed Sui, retains 10% and funds R&D and operations.

Community Access Program and App Testers: 6% will be allocated to facilitate testing of new applications and community expansion.

The use cases for SUI tokens are primarily for key currency usage and staking of the network.Token holders can participate in the security and consensus mechanisms of the network by staking SUI or delegating staking.

In general, many projects have a utility as community governance, but in Sui there is currently no such community governance, and the SUI token has no role as a governance token.

12. Deflationary Effects of Storage Funds

This section provides further details on Sui's "Storage Fund" described earlier.The Storage Fund is an innovative tokenomics that enhances the sustainability of the blockchain network.The fund provides a mechanism for effectively managing growing storage requirements to ensure that the network functions reliably over the long term.

The Storage Fund is designed to spread the cost burden of storing data on Sui's on-chain storage, which incurs a fee based on the size of that data.

Specifically, when every transaction is made, a portion of the fee is allocated to the Storage Fund as a future storage cost.This money is used as an incentive to validators to store data permanently on the network, so the size of the fund grows as transactions increase.

One of the features of the storage fund is a "delete option".This is a mechanism whereby a portion of the storage fee paid is refunded as a rebate when a user deletes data that is no longer needed.

This feature provides an incentive to efficiently manage the data lifecycle and offload the blockchain.This improves blockchain performance and preserves overall efficiency.

An additional interesting aspect of the Sui storage fund is that as the use of the Sui increases, it may contribute to an increase in token value.

What this means is that as data is stored on the blockchain, it has the effect of locking a certain amount of SUI into the network as a "delete option" reserve.In other words, the SUI token is temporarily excluded from the economy while the data is stored, creating a deflationary effect.

This economic model implies that as the use of SUI increases, more tokens will be locked in the network due to increased funds.This makes tokenomics attractive to investors because it reduces the amount of SUI in the market and makes it easier for the price to rise.

13. Ecosystem

13-1. Tracing Sui after launch with on-chain data

Let's check Sui's growth one year and four months after its mainnet launch in May 2023 with various data.

First is the price of the SUI token.After launch, the SUI price fell and dropped to a low of $0.38 in October 2023.It then rose as the crypto market recovered, reaching $2.04 in March 2024.After that, the price gradually dropped and is at $0.81 as of this writing.

The market capitalization still increased around October.Although the token price has declined, the increase in circulating supply has not led to a major decline, and since the beginning of 2024, the market capitalization has remained roughly flat between $1.5 billion and $2.5 billion, after peaking at $2.68 billion in June.

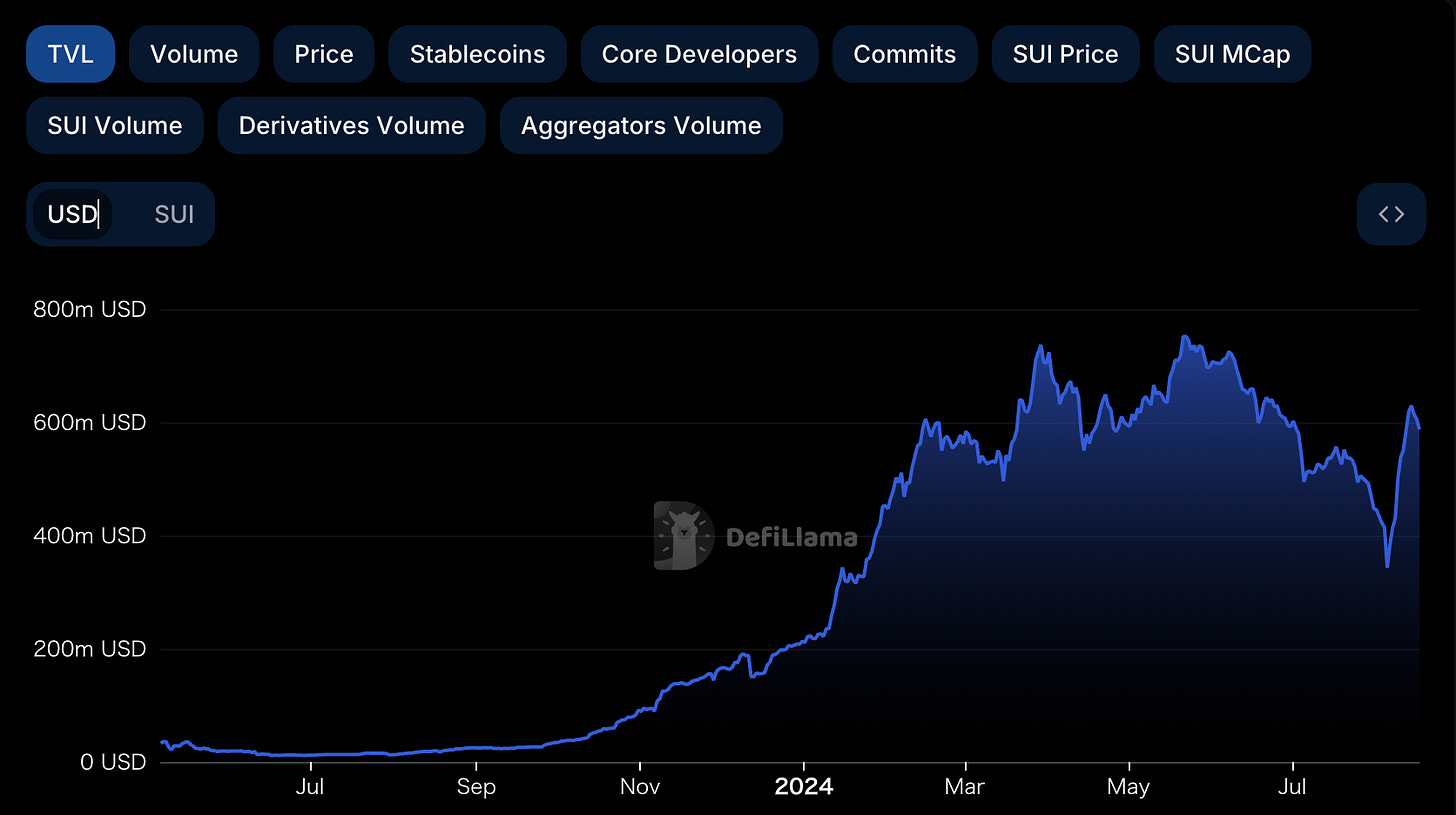

TVL's market capitalization has a similar shape to that of its market capitalization: in May 2024, TVL recorded a TVL of $750 million, which dropped to around $400 million for a time as prices declined.

The 24-hour trading volume has been in the $50-100 million range recently, although there were a few days in early 2024 when prices were rising that exceeded $200 million.What is interesting is that there seems to have been a transaction volume of over $400 million on January 31, but we were unable to find out what this was in this research.The volume of transactions is almost equal to TVL at that time, but what happened?Please let me know if you have any information.

The number of transactions increased as soon as we entered 2024, and on January 27, we processed a whopping 60 million transactions.Since Solana's daily transactions on the same day were about 26 million, this is a tremendous increase.However, the momentum did not last long, and since then the number of transactions has hovered around 10 million, or about 7 million at the time of this writing.

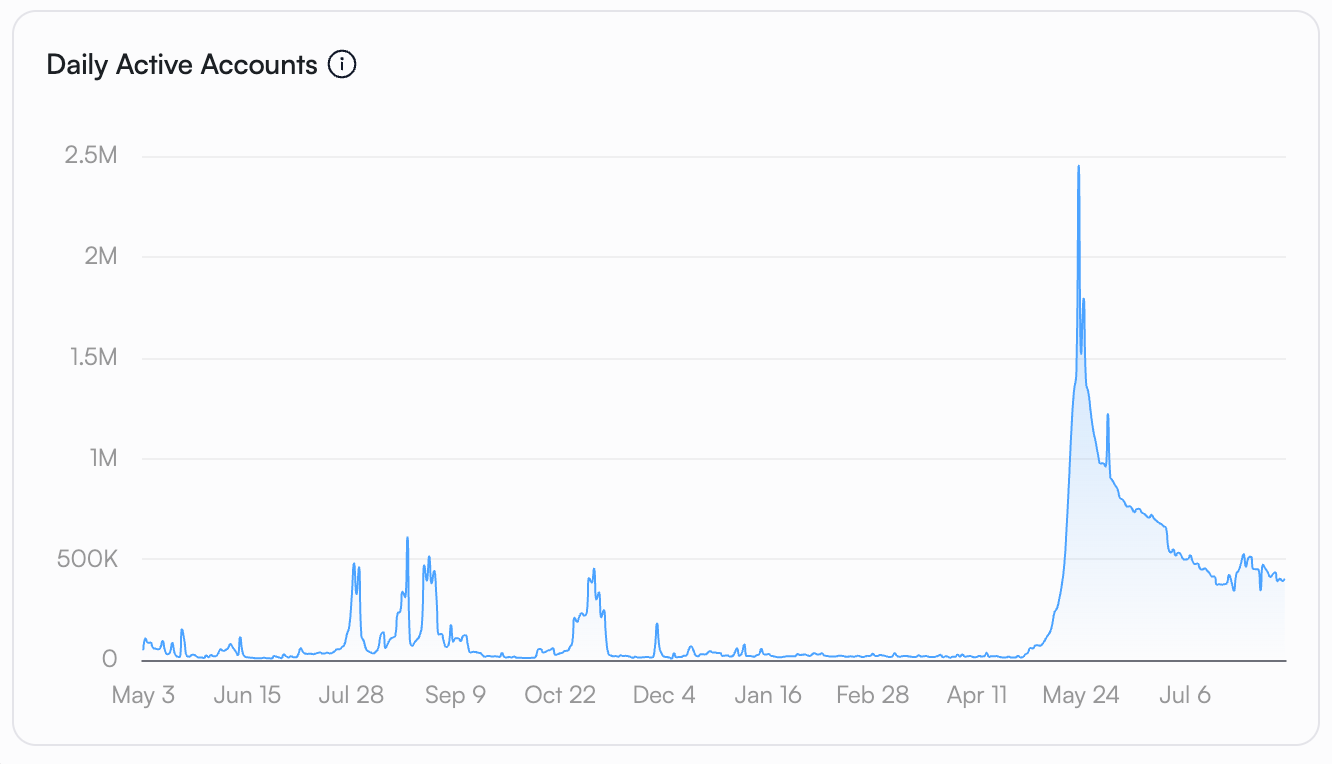

However, an interesting analysis can be made by looking at the Daily Active Accounts.While other data showed a big boost from January to April 2024, the Daily Active Account trend shows that the number of active accounts increased quickly from late April, with as many as 2 million accounts being active at one time.The events that took place around this time provide a background for the temporary popularity of spam trading on Sui in April-May.

Perhaps this is the reason for the increase in daily active accounts, but it is positive to see that even now that the spam trading fad has passed, as many as 500,000 accounts remain active on a daily basis.

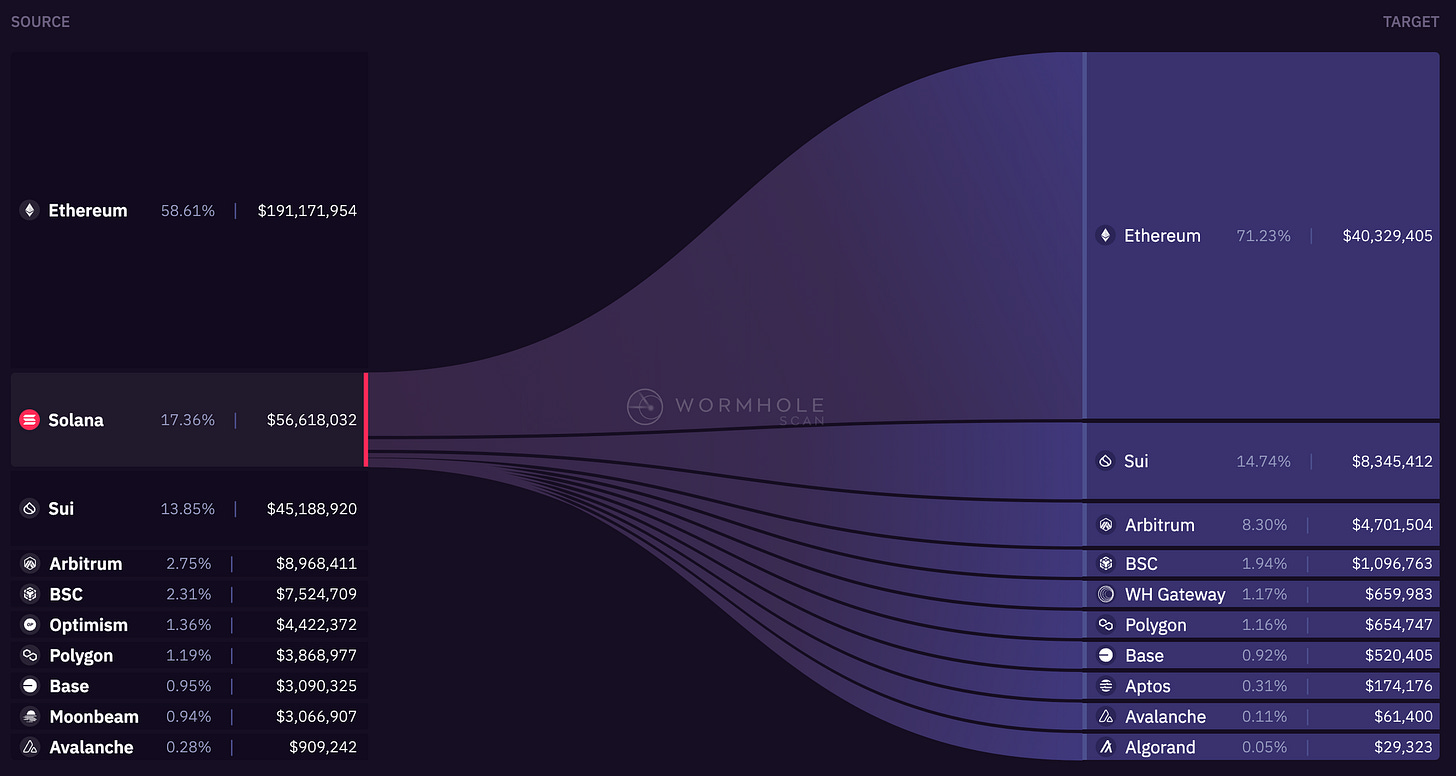

13-2. inflow from other chains

This is on-chain data from Wormhole.It shows that 59.2% of funds were moved from Ethereum to Sui in the last 7 days, which is the highest percentage of funds moved to Sui among all chains.This remained almost the same when the period was changed to 365 days, with 53% of funds moved from Ethereum to Sui.

And a certain percentage of outflows from Solana are also flowing to Sui.In the last 7 days, 14.7% of the outflow from Solana has flowed to Sui.This also shows that a not small percentage, 7.72%, has flowed to Sui over the past 365 days.

13-3. Trends in each sector

DeFi

In 2024, Sui Network's DeFi ecosystem has experienced remarkable growth and has established itself as a significant player in the Web3 sector. according to DiFiLlama, Sui is currently (as of September 7, 2024) the TOP 12 TVL ranked blockchain with $634.9Mof funds have been deposited.TVL, the second largest non-EVM chain after Solana.

TVL exceeded $740M in late March 2024, due in part to expectations of airdrops in each dApps and the rising price of the SUI token itself.After that, TVL dropped significantly along with the overall market decline, but started to pick up around July.

The growth of the Sui ecosystem is driven by NAVI Protocol, Scallop, Cetus, and Suilend, but other protocols are not far behind in TVL, giving the impression of balanced growth overall.

In terms of overall number of protocols, Sui is somewhat small at 38.While other EVM-compatible chains have more than three digits of protocols, Sui is a little short in terms of the number of protocols.This is a downside of Sui's new Move language-based development environment.

NFT

PFP NFT culture is almost breathless when looking at Web3 as a whole, but PFP NFT culture is actually active in Sui PFP NFT has played an important role in the formation of personal identity and community in Web3 since the NFT boom of 2021Now that the boom has collapsed, the PFP NFT culture is still very much alive and kicking.

Now that the boom has collapsed, the popularity of NFT projects deployed on each blockchain is fading, and the category is somewhat shrinking overall, but at Sui, its technical uniqueness and community cohesion provide strong support for this culture.

A representative project of PFP culture at Sui is Studio Mirai's "Prime Machin" is a prime example; Prime Machin utilizes Sui's dNFT technology to develop PFPs that go from black and white to color and evolving characters based on object ownership.

The founders of Mysten Labs have now also adopted the Prime Machin character as their X icon, making it a popular PFP that represents Sui.Other PFPs also from Studio Mirai include "Enforcer Machin" and "Fuddies," an owl character,Kumo," a cat character, are popular.

Meme Coins

Meme coins have not yet gained much traction on Sui compared to other blockchains, but that seems to be changing with the recent emergence of Move Pump, a meme coin generation app modeled after Solana's Pump.fum.Some meme coins, such as FUD and BLUB, are gaining recognition and presence in the community, while many others are emerging and being talked about more and more.

Gaming

Although the gaming sector has no applications that are attracting users at this time, Sui is almost certain to focus its efforts in this area in the future.Sui's SuiPlay1x0 consumer game console, which will be discussed below, is now available for sale, and various game development companies are set to join Sui's platform.

This game area has been anticipated by Web3 for a long time, but has not yet grown into a large market.There is a good chance that Sui will establish a strong presence in Web3 games in the future, and its trend will be watched closely from this year into next year.

DePIN

The DePIN sector is gaining attention as we enter 2024, and two DePIN projects are currently attracting attention in Sui: Karria One and Chirp, both DePIN projects that aim to democratize wireless connectivity and build distributed mobile networks.projects that aim to democratize wireless connectivity and build a decentralized mobile network.

At this point, both projects have just started, have not grown significantly, and are not well known yet, so they have not attracted much attention.

Native Bridges

Sui has relied on Wormhole, a third-party protocol, for cross-chain bridges in the past, but is now developing a native bridge, Sui Bridge.

Sui Bridge is scheduled to launch in October 2024 and will provide a native means to securely transfer assets between Ethereum and Sui Sui Bridge will enhance integration with the Sui ecosystem and provide a critical infrastructure to allow seamless asset movement between blockchains.Sui Bridge is a key infrastructure that enhances integration with the Sui ecosystem and allows for seamless asset movement between blockchains.

It allows users to transfer assets such as ETH, wBTC, USDC, and USDT to and from Sui securely and efficiently.According to the official page, asset transfers from Sui to Ethereum are immediate, and transfers from Ethereum to Sui take about 13 minutes.

Oracle.

The price oracles employed by Sui are Pyth Network and Supra Oracles.

Pyth Network is a distributed oracle network that has been widely adopted in recent high-performance blockchains.It is primarily responsible for providing reliable pricing data at high speed to the DeFi protocol and other blockchain applications.

Supra Oracles is an innovative oracle solution that combines rapid data delivery with security, and is a distributed oracle network with a growing presence.Supra Oracles obtains real-time data directly from over 74 data providers, eliminating the traditionalIt eliminates the middlemen found in oracles, reducing the risk of data tampering and errors.

Stable Coins

Various stablecoins are currently being integrated on Sui; as we enter 2024, FDUSD issued by First Digital Labs and AUSD issued by Agora are being integrated on Sui.

In addition, USDY, a stable coin alternative asset issued by Ondo Finance, has similar functionality as a USD-pegged asset, making a variety of stable coins available on Sui.

This availability of multiple stablecoins on Sui offers many benefits beyond functional redundancy, including improved liquidity, risk diversification, different use cases, regulatory compliance, competition promotion, and enhanced interoperability.

This aspect makes the Sui ecosystem an increasingly attractive platform for institutional investors and projects that value reliability.

Partnerships with companies and other projects

Sui has announced strategic partnerships with several major companies, many of which are developer-focused, providing technology and tools to enhance Sui's ecosystem.

Amazon Web Service (AWS) and Alibaba Cloud simplify Sui's node operations and provide secure, scalable infrastructure.This allows developers to focus on application development by reducing the effort required to build infrastructure.Alibaba Cloud is also translating Move documentation into Chinese and Korean, allowing Asian developers to participate in development on Sui across language barriers.

Google Cloud and BytePlus are working with Sui to provide an AI-powered development environment and code generation tools to help developers create applications more efficiently. the Move programming language using Google Cloud's Vertex AISupport and the ability to bridge Web2 and Web3 using Sui's zkLogin technology have attracted attention.

Sui's gaming platform has announced many partnerships with Japanese companies.Currently, partnerships with GREE, Inc. and Square Enix have been announced, and gumi, Inc. has announced the joint development with Sui of Brave Frontier Versus.

Grayscale's Investment Products

On August 18, Grayscale made headlines when it announced the Grayscale Sui Trust, a single asset fund that invests in SUI, the native token of Grayscale's Sui blockchain.

The Trust offers value based on the price of the SUI token, allowing investors to gain exposure to SUI while eliminating the hassle of directly purchasing, storing, and managing SUI.The product is aimed primarily at institutional investors and reduces the technical challenges and risks associated with holding crypto assets directly.

Grayscale has a number of such crypto-based fund products, and now SUI has joined them; since Grayscale announced this trust, attention has once again turned to Sui, triggering its recent price increase.

14. allegations and criticisms about Sui's talknomics

June 2023 Press Coverage

The alleged sale of staking fees regarding the Sui Foundation in June 2023 was one of the most high-profile events.This sequence of events is described in detail.

On June 27, 2023, crypto asset trader DeFi^2 indicated that the Sui Foundation was splitting the staking rewards from locked SUI tokens multiple times, sending them to the major exchange Binance, and selling them.

According to DeFi^2, he tracked the wallet where the Sui Foundation was staking 30% of its SUI tokens, and found that the Sui Foundation's staking rewards were being sent to Binance via several addresses.This point was quickly spread on social networking sites and criticism of the Sui Foundation spread.The next day, the Sui Foundation issued a statement on X denying the allegations of the sale.The main points of the statement are as follows

Allocated tokens are subject to lock-up and transfer restrictions in accordance with the contract

The remitted amount is subject to contractual lockup and is not the same as a sale

Locked staking rewards and other tokens have not been sold on Binance or other exchanges

The supply of SUI tokens has never exceeded the market value reported by CoinMarketCap

Thus, the Sui Foundation offered an explanation for the allegations and promised to release a release schedule for the tokens in the near future.Despite the Sui Foundation's denial statement, the allegations were not completely dispelled within the community, and some users continued to question the transparency of theSome users continued to question the transparency.In particular, some thought that the remittance to Binance might actually be tantamount to a sale.

October 2023 Press Coverage

In October 2023, the South Korean news media TechM reported that the Korea Financial Supervisory Service (FSS) was investigating allegations of token supply manipulation against the Sui Foundation.The investigation began when South Korean Democratic Party lawmaker Min Byung-Duk pointed out that the Sui Foundation was using SUI tokens that should not be in circulation for staking and funneling the rewards to the market.

In response to this report, the Sui Foundation issued a statement on X, strongly denying the allegations of token supply manipulation.The foundation claims that its SUI token supply schedule is publicly available and transparent through its website and API.The Foundation also stated that it has not sold any SUI tokens since the initial Community Access Program (CAP).

This series of upheavals has further depressed the price of SUI tokens and has many investors concerned about the Sui Foundation.

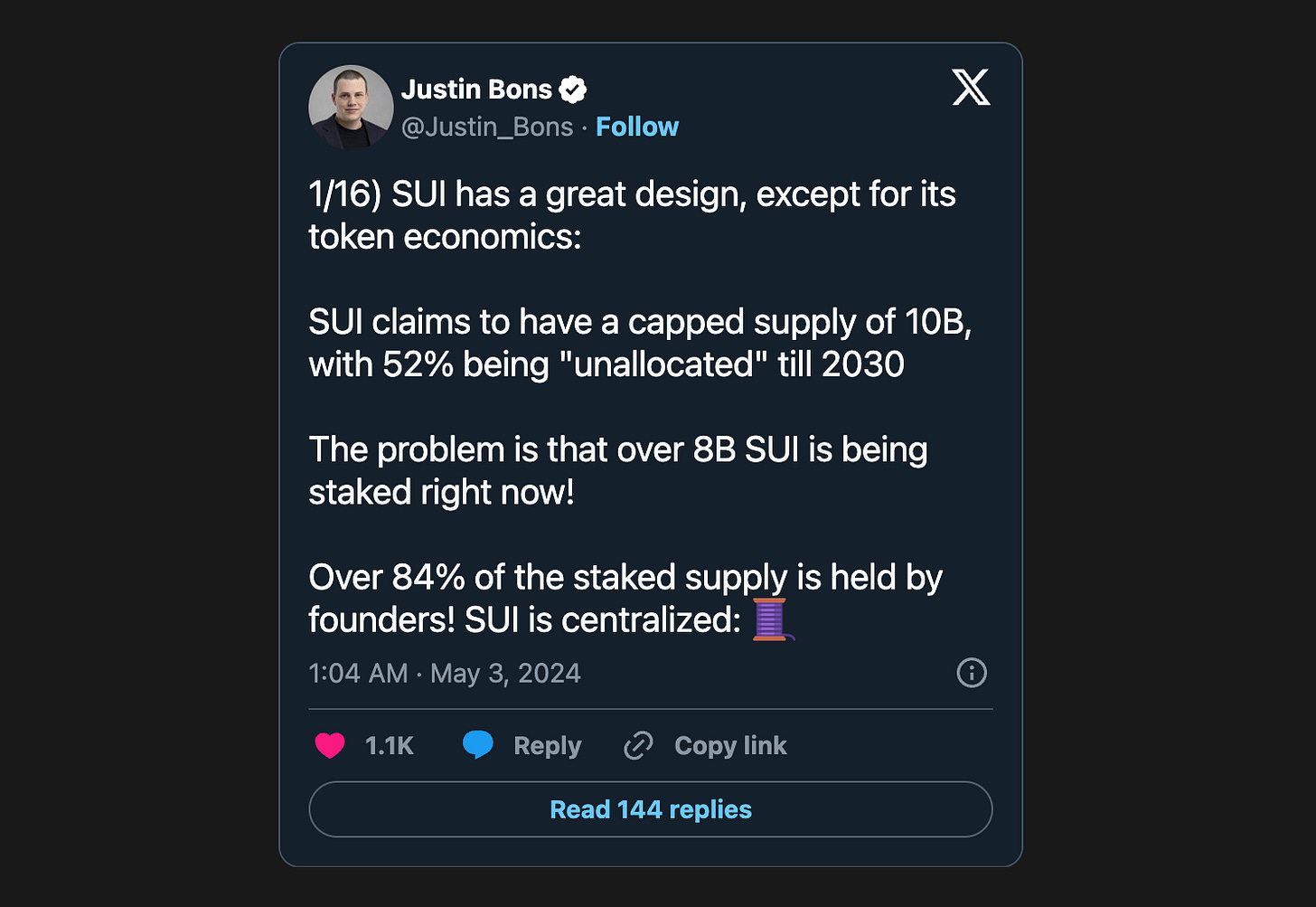

Justin Bons' Criticism of the Sui Foundation in May 2024

On May 3, 2024, crypto analyst Justin Bons offered a critique of Sui's talknomics on his X

Bons noted that of the total 10 billion SUI tokens issued, 8 billion SUI, including those not yet supplied, have already been staked.He added that 84% of the staked SUI tokens are controlled by the founders and project team, effectively creating a centralized control structure for SUI.

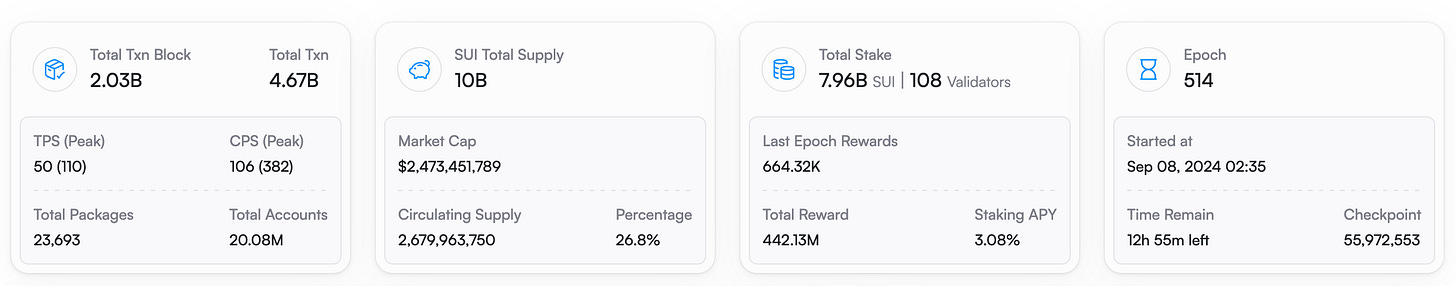

In fact, a check of SuiVision shows that the total supply of SUI is 10 billion SUI, with a circulating supply of 2.67996 billion SUI (as of September 8).On the other hand, the total stake is 7.96 billion SUI, indicating that more SUI tokens have been staked than the current circulating supply.

Thus, Sui is using unsupplied SUI for network staking, which is why the June and October 2023 reports were suspicious of the handling of such staking and its rewards in the market.

Bons said that there is no legal guarantee that the Sui Foundation has a lock on the bulk of the SUI supply, and pointed out that the Sui Foundation essentially controls the tokens, which can be freely marketed, and that neither the Sui Foundation nor its founders have disclosed details of the token supply,Bons expressed strong dissatisfaction with the lack of disclosure by the Sui Foundation and its founders of the details of the token supply.

Bons' criticism quickly spread through social networking sites, but the Sui Foundation responded to Junstin Bons' criticism with the following statement: the Sui Foundation has stated that unallocated and supplied locked tokens are securely stored at the contract level by third-party custodians (BitGo, Anchorage, Coinbase Prime), and that the founder of Mysten Labs is not a member of the Sui Foundation's treasury or community registry,The founder of Mysten Labs clearly stated that he has no authority over the Sui Foundation's treasury, community reserve, staking grants, or tokens allocated to investors.The founder of Mysten Labs clearly stated that he has no authority over the Sui Foundation's treasury, community reserve, staking grants or tokens allocated to investors.

He emphasized that all token supplies, including staking rewards, are managed according to a published schedule and that they are used to subsidize developers, hackathons, enhance network security, etc., to the benefit of the community.

To support this claim by the Sui Foundation, BitGo is deploying a custody service with staking capabilities; the Sui Foundation will partnerwith BitGo in a February 2023partnershipwith BitGo.And it is assumed that the Sui Foundation also uses such services for staking.

However, one of the arguments surrounding this criticism would be the question of whether it is correct to use unallocated tokens for staking.

Because, ultimately, the Sui Foundation definitely retains the final say over the tokens, no matter how securely they are held by a third-party custodian, and there must be some way to get them back in their possession.Ultimately, the logic that the Sui Foundation does not have control over unallocated tokens is difficult to accept, and Junstin Bons' criticisms have some persuasive force.

Unallocated SUI tokens are indeed tightly controlled by a third-party custodian.Therefore, it may not be easy for the founder or project team to move or sell the tokens freely, but in the end, the final criterion to determine if the SUI tokens are properly managed is "can you trust the Sui Foundation".

Incidentally, while researching this, we were able to identify several projects other than Sui that use unallocated tokens for staking.This seems to be a common practice among Web3 projects.

15.Sui's Challenges and Potential Risks

Sui has experienced significant growth in just one year and four months since its mainnet launch, but not enough to get on a sustainable growth curve as a blockchain platform.

There are several challenges that need to be addressed in order to take another step forward in growth from here.In this section, we will take another look at Sui's current challenges and consider what we need to work on in the future.

Lack of Developers and Difficulties in Expanding the Ecosystem

While Sui has a very technologically advanced architecture, it faces several challenges.One of these is the lack of developers; while there is a shortage of developers throughout the Web3 industry, Sui further uses its own smart contract language, Sui Move, which makes it more difficult to expand its developer community than other blockchains.

Sui Move is based on the Move language, which is highly secure and efficient, but it is fundamentally different from the traditional blockchain mechanism, so even if you have mastered other languages such as Solidity or Rust, there is much to learn from scratch, which is a major barrier to Sui development.This is a major barrier to Sui development.Therefore, quickly increasing the number of smart contract developers on Sui is not an easy task.

On the other hand, according to the latest Electric Capital developer data, Sui is one of the largest and fastest growing projects in the Move language developerSui is considered one of the largest and fastest growing projects in the Move language community.

This shows that Sui is certainly attracting developers and expanding its community, but more talent is needed for future growth.

Therefore, one of Sui's challenges is how to attract other blockchain developers while highlighting its technical advantages.

Sui has unique technical features such as parallel processing capabilities and object-based asset management, and successfully promoting these features to encourage more developers will be key to its future development.

Low Speculative Expectations

Second, Sui has taken a somewhat reluctant stance toward strategies that raise speculative expectations.I am not sure if this can be called a "challenge," but while the strategy of recent blockchain projects for growth has been to raise speculative expectations among users, Sui seems to have dared to distance itself from such a move.

One of the typical methods of raising speculative expectations is "airdrops," but Sui is not aggressive about this marketing technique.On the other hand, many other blockchains have successfully used airdrop strategies to raise attention at once.

In addition, projects such as Solana can create a virtuous cycle, with meme coins and bot activity gaining momentum, maintaining speculative expectations in the platform at all times, and further increasing speculative expectations as people and money flow in.

While there is a negative aspect to these trends, in that they tend to be short-term boosts, if properly utilized, they can be effective in attracting attention and attracting large-scale users and funding at once.

While it is debatable whether Sui should adopt such a strategy, it is a factor that should not be ignored in order to raise the profile of the project and energize the ecosystem.While short-term speculative fervor is risky, its power to create excitement is great, and how to harness that power will be key to Sui's future growth.

Regulatory Risk Due to Low Dispersion

In the current Web3 environment, a favorable regulatory rating is a huge advantage as it brings the physical ETFs much closer to approval.In particular, if the FIT21 bill passes in the U.S., it will be of great interest to all projects, not just Sui, whether SUI tokens will fall under the jurisdiction of the SEC (Securities and Exchange Commission) or the CFTC (Commodity Futures Trading Commission).

In order for SUI tokens not to be considered securities subject to regulation by the SEC as, it is first necessary to prove sufficient decentralization.

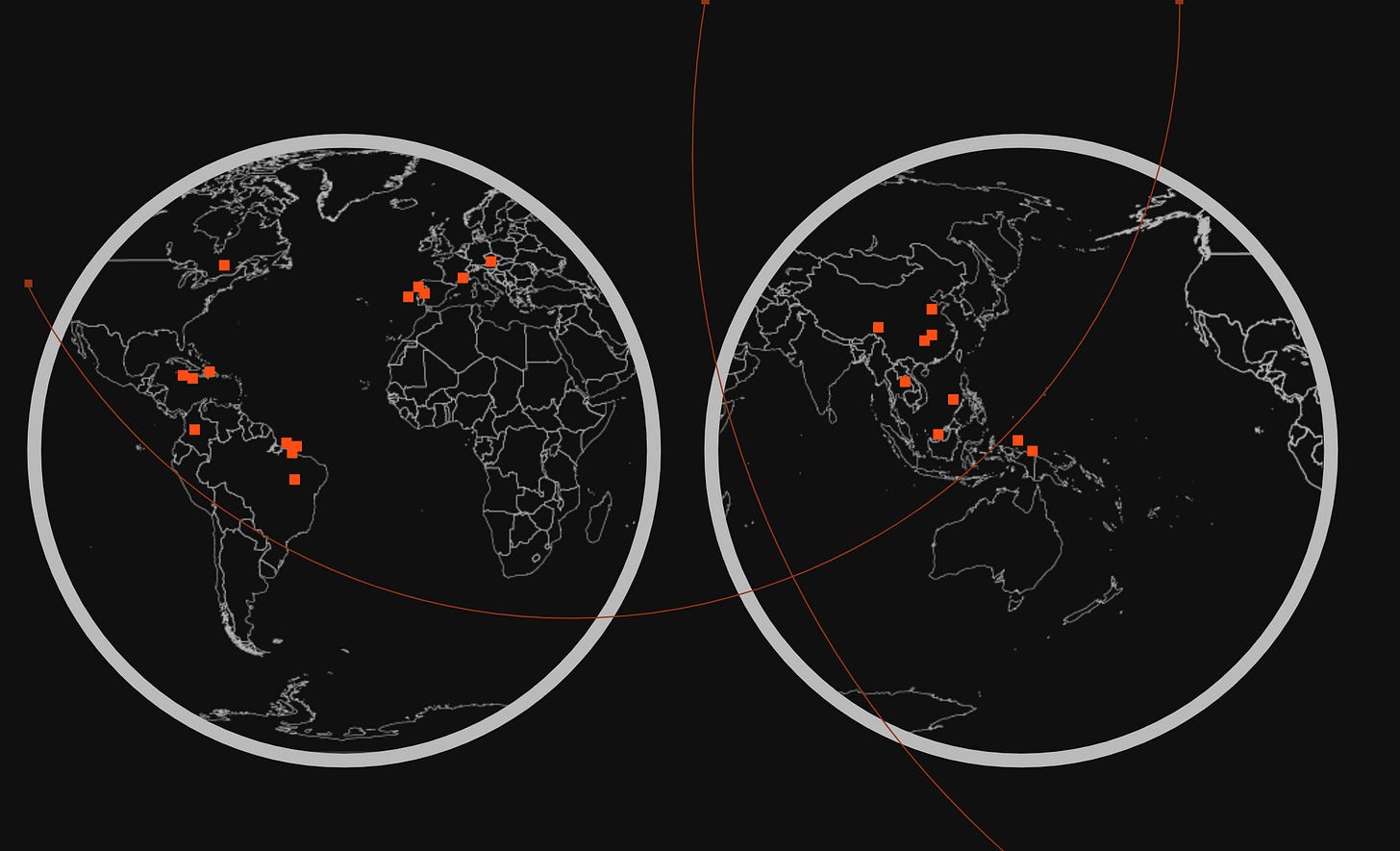

Currently, the Sui network has approximately 100 validator nodes in operation, but given that Solana has over 1,400 validator nodes but has been cited by the SEC for security status, Sui is at similar risk.Ensuring network decentralization will be one of the major issues to be addressed in the future, as the likelihood of being regulated by the SEC will increase if it is deemed less decentralized.

There are also concerns about the decentralized nature of the SUI token holdings.As explained in the previous section, there is a risk that token holdings and network decentralization may be deemed inadequate in a situation where the SUI Foundation is storing many of its unallocated tokens in custody services such as BitGo and delegating them to individual validators.

We do not know how the unallocated portion of the tokens will be determined, but we cannot rule out the possibility that they will be considered securities by the SEC unless extensive token dispersion takes place.

Furthermore, Sui's developer community may also be deemed insufficiently decentralized.Since Mysten Labs is currently the primary developer of Sui and development is almost entirely dependent on this one company, there is also a risk that Sui could be considered a Mysten Labs product.The fact that community-driven development is not progressing may well influence regulatory decisions.

In light of the above, it is difficult to say that Sui is sufficiently decentralized in its current state and will likely fall under the jurisdiction of the SEC once the FIT 21 bill is enacted.

16. SuiPlay0X1 release

Sui presented the SuiPlay0X1 consumer gaming device at the Sui Basecamp in Paris in April.The SuiPlay0X1 is a gaming device being developed in collaboration with Playtron.

The device features both PC and mobile versions of Web2 and Web3 games, and the lightweight gaming Playton OS, optimized for the new generation of handheld gaming PCs developed by Playtron, supports games from a variety of stores, including Steam and Epic.The Playton OS is compatible with games from a variety of stores, including Steam and Epic.

This news is a big deal in the Web3 community, as there are few examples of physical devices being sold by Web3 companies.This is expected to be a very important product in the development of the Sui ecosystem.

Specifications.

Processor: AMD RYZEN 7 7840U

Memory: 16GB

Storage: 512GB SSD

Display: High-resolution display for comfortable game play.

Price: $599 (pre-order)

Based on the above specs and features, Steam Deck and Asus ROG Ally are expected to be direct competitors, but considering the price to specs ratio, it is cost-effective enough to compete and will be a device that will attract attention not only from Web3 users but also from existing game users.It has the potential to become a device that attracts attention not only from Web3 users but also from existing game users.

The most notable aspect of SuiPlay0X1 is its advanced Web3 functionality.It combines the traditional gaming experience with blockchain technology, allowing players to acquire and own items and tokens with real value.

In-game characters, weapons, and items become actual digital assets that can be traded among players.This blurs the boundary between the game world and the real world, allowing players not only to enjoy the game, but also to participate in new economic activities.

The launch of SuiPlay0X1 also has a very strategic meaning for Sui: the Web3 industry needs to provide products that users actually experience, and through this game console, Sui aims to make ordinary users who do not usually have deep exposure to Web3 feel the benefits of blockchainSui aims to make the benefits of blockchain technology felt by ordinary users who do not usually have in-depth contact with Web3.

In addition, the entire Sui ecosystem will be revitalized around this game console, and more developers and companies will consider expanding on the Sui platform.

The SuiPlay0X1 is more than just a game console, it is the embodiment of our vision of how Web3 technology will shape the future of the game industry.Sui is also very important to the future of Web3.

17. Where does Sui's competitive advantage lie?

Now it is time to summarize Sui's competitive advantage.

After all, what is the competitive advantage that Sui has?It varies, as we have explained throughout this article.Of course, Sui's oft-repeated innovations for fast processing and high scalability are important competitive advantages, but the high performance of blockchain these days has become so obsolete that it can no longer be taken for granted.

No matter how attractive the numbers and technology may seem, its comfort cannot be experienced until it is actually used.Therefore, we invite you to try Sui to experience its amazing comfort.

Beyond that, Sui's biggest competitive advantage in this article is its "overwhelming completeness as a blockchain platform designed to bridge Web2 and Web3 with a technical support structure that seamlessly connects the entire ecosystem.

For example, technologies such as zkLogin and Stashed make it easy to onboard Web2 users to the Web3 ecosystem, while DeepBook and other liquidity solutions and financial infrastructures will be the foundation for many apps and services to be launched on Sui in the future.Sui is one of these technologies.

In Sui, each of these technologies does not exist as an independent function, but as a whole, neatly integrated.This is what makes Sui easy to use and has a significant impact on the user experience.Such an integrated blockchain platform is currently unparalleled.

If Web3 is truly a technology worth transforming society in the future, moving away from its current status as a money game for a select few, then a highly complete platform such as Sui should attract more companies and users in the future.

In terms of specific developments, we will see further progress, especially in the gaming and NFT markets.The release of the SuiPlay0X1 consumer gaming device is an important step in pushing the boundaries of the Web3 industry.The device brings the benefits of Web3 to traditional game users, specifically a new experience that enables true ownership of digital items and participation in economic activity.

We expect that the innovation brought by Sui will trigger the expansion of mass adoption of Web3, as in-game items and currencies will have real value on the blockchain and can be traded among users.

18. summary

Throughout this lengthy discussion, we have learned much about the potential of the Sui blockchain and the challenges it faces, and it is clear how Sui has leveraged its innovative architecture and technological advantages to establish a unique position in the Web3 world.

Sui aims to be more than just a fast and scalable blockchain platform.It is to form a completely new kind of blockchain ecosystem that bridges the gap between Web2 and Web3, achieving a fusion of technology and usability.

As we have explored in this report, Sui's competitive advantage lies in its integrated ecosystem and its transparent, user-friendly interface.This makes it easier for developers and users to use blockchain technology, which in turn enables new forms of digital interaction.

Furthermore, through innovative products like the SuiPlay0X1, Sui seeks to extend the value of Web3 to the gaming world as well.These efforts have the potential to allow new market participants, as well as traditional gaming users, to experience the benefits of blockchain.

Ultimately, Sui's future depends on the development of its community and ecosystem.While it is hoped that its innovative approach will shape the overall industry trend and present new standards for other projects, no one knows yet whether this innovation will be the future of blockchain.But it is a certain fact that Sui is preparing to embark on a voyage that will take Web3 to new horizons.

This is "Sui Complete Review (Part 2)".

The contents of this article are too voluminous to be fully understood in a single session, so we hope that you will repeat the second part of this article, as well as the first and second parts, and read them again and again!

Also, Kuripto Kuripto took the time to create this article, so please like, comment and share the article on social networks!We would be very grateful if you could help us!(And if you have any requests for next time, we'd love to hear from you!)

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.