【Street】New ERC-S Standard Tokenizes Startup Equity Value / Enables Liquidity Without Treating Shares as Securities / @StreetFDN

To gain exposure to startup stocks

Good morning.

I’m mitusi, a web3 researcher.

Today I researched “Street.”

What is Street?

ERC-S’s 20 modules

Transition and Outlook

To gain exposure to startup stocks

TL;DR

Street is a stock tokenization platform that enables the liquidity of startup equity without treating it as securities, providing ERC-S as its core technology.

ERC-S implements exposure to a company’s economic upside—rather than the equity itself—through FT (ERC-20) + multiple modules, centered on the pillars of “non-securitization, business model independence, compatibility with traditional investments (VC/M&A), and limited investor rights.”

Legally, the scheme avoids securities classification under the Howey Test through a corporate → SPV/foundation → DAO → holder discretionary distribution structure, while standardizing launch/operation/exit across 20 modules.

What is Street?

Street is a platform that provides tokenization services for startups.

Our philosophy is to “liquidate startup shares without treating them as securities,” supporting tokenization by accompanying companies from their founding phase.

This core technology is “ERC-S.” Street published a white paper detailing the ERC-S standard in 2025.

As a design principle, ERC-S has been built from the outset to satisfy the following “four pillars.”

Non-securities:Tokens are designed to not qualify as securities, allowing free trading on-chain or on exchanges without KYC.

Business model independence:Startups can adopt this token without needing to pivot to blockchain companies, utilizing it without making significant changes to their existing business models or cap tables.

Compatibility with conventional investments:It is designed to avoid conflicts with traditional venture capital investments and M&A. Specifically, even if an ERC-S token is issued, companies can still raise funds from VCs. Furthermore, during corporate acquisitions or IPOs, the acquiring party does not need to directly engage with the crypto assets, and it does not affect senior debt or the rights of existing shareholders.

Limitation of Rights for Token Investors:Token holders (general investors) are not granted direct control over company management or voting rights, while economic ownership protection (return of economic value) is ensured. This strikes a balance where the decision-making authority of founders and board members is preserved, while token holders also benefit from increases in corporate value.

The ERC-S token is designed to be implementable on any blockchain, including Ethereum, and is characterized by the fact that it does not represent shares or management rights themselves.

In other words, ERC-S tokens do not digitize a company’s equity stake, voting rights, or stock price itself. Instead, they provide a means for speculating on the economic upside of startup companies.

Technically, it adheres to the ERC-20 standard in FT format, but incorporates special rules within the smart contract, making it a standard that includes multiple modules such as a transfer suspension function and disclosure rules.

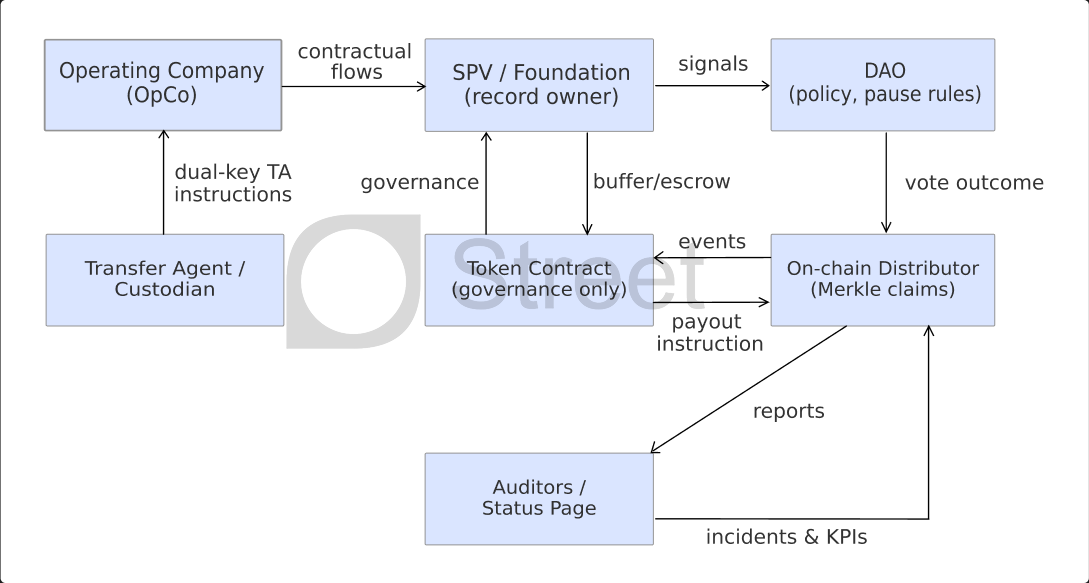

ERC-S not only handles the technical aspects of token issuance and transfer but also integrates with legal frameworks, enabling discretionary economic benefit distribution through the flow: company → SPV/foundation → DAO → token holders.

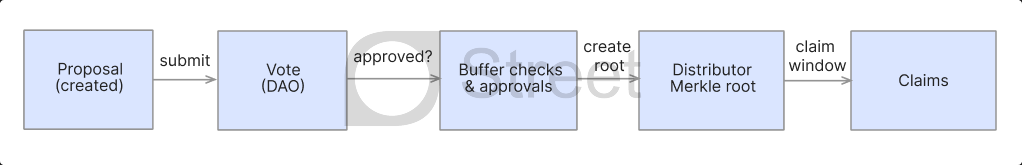

For example, a company establishes a special purpose vehicle (SPV) or foundation backed by a portion of its own shares, creating a mechanism to support the economic value of tokens. The flow envisions management and token holders approving revenue distribution proposals through DAO-style voting, with a distribution contract on the smart contract then distributing arbitrary rewards to token holders.

Under this structure, token holders do not directly possess legal rights as shareholders (such as voting rights or dividend claims). However, they can benefit from the increase in value accompanying the company’s success through the token price and may receive profit distributions (equivalent to dividends) at the company’s discretion when necessary.

Overall, ERC-S can be described as a new type of token standard designed to implement programmable rights on the blockchain while avoiding classification as a security.

◼️Regulatory Compliance in the United States

ERC-S has been developed with the paramount requirement that it not be considered a security under applicable laws and regulations. In the United States, it has been structured to avoid qualifying as an “investment contract,” bearing in mind the Howey Test used to determine securities classification.