【Space】Decentralized prediction market platform on Solana supporting 10x leverage / Echo round raises 1,360% of its funding target / @intodotspace

Leveraged prediction markets have emerged

Good morning.

I’m Mitsui, a web3 researcher.

Today I researched “Space.”

What is Space?

Transition and Outlook

Leveraged prediction markets have emerged

TL;DR

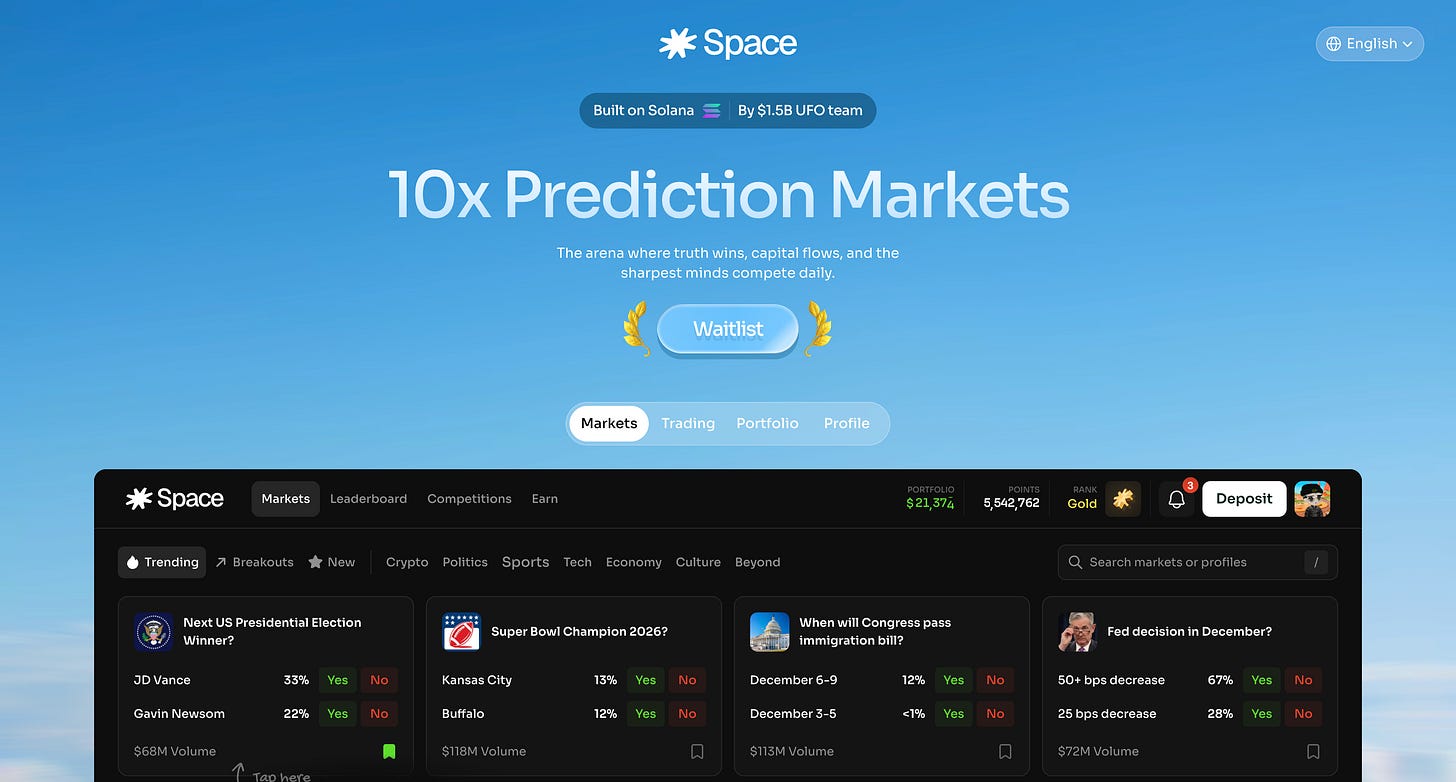

Space is a prediction market on Solana supporting 10x leverage, a platform where you can trade a wide range of real-world events with YES/NO bets.

Addressing existing market challenges—liquidity shortages, poor capital efficiency, weak UX, and lack of incentives—through CLOB trading, dynamic fees, liquidity rewards, multi-outcome markets, and leverage functionality.

Evolving from UFO Gaming, it aims to become next-generation prediction market infrastructure through its Solana migration, community-led fundraising (Echo/Seedify), and token reward design.

What is Space?

“Space” is a decentralized prediction market platform built on Solana that supports 10x leverage.

The basic mechanism is the same as a typical prediction market, where users can buy and sell “YES” or “NO” positions on various real-world events such as cryptocurrency, politics, sports, technology, economics, and culture.

“Space” will feature seven categories as markets: Crypto, Politics, Sports, Technology, Economy, Culture, and Beyond.

Now, let’s explain the issues with existing prediction markets that Space points out and Space’s features that address them.

Space points out that the current prediction market has the following structural problems.

Low liquidity

The most serious challenge is the lack of market liquidity. Outside of high-profile themes like the major U.S. presidential election, market order books are extremely thin, creating vulnerability where even small amounts of capital can cause significant odds fluctuations.

For instance, even an order worth around $10,000 can cause odds to shift by more than 10%, rendering the price indicator unreliable. This makes it difficult for large investors and institutional investors to participate. Consequently, the market often lacks sufficient order book depth and active participants, making it prone to difficulties in executing trades.

Poor capital efficiency and low profitability

Current platforms also suffer from low capital efficiency, often requiring users to lock up funds for extended periods until market outcomes are settled. Funds remain immobilized for months or even years while awaiting results, unable to be effectively deployed. Furthermore, returns on prediction market bets are typically capped at $0 to $1, preventing significant leverage and resulting in low return rates.

Furthermore, there are structural constraints preventing liquidity sharing across multiple outcomes—for instance, funding one market (such as a Yes/No binary choice) prevents allocating funds to other options. These structural limitations make it difficult for users to find strong incentives to pursue significant profits in prediction markets.

User experience shortcomings

Many platforms have UX issues. For example, they often restrict which markets (questions) users can trade on, and transaction fees are entirely taken by the platform operators. This design hardly prioritizes the user.

Furthermore, there is a lack of mechanisms to encourage continued use. Without gamification elements commonly found in apps—such as daily missions, login bonuses, or rewards for consecutive trades—and without provisions for compensating liquidity providers or frequent traders, users are likely to leave after a single transaction.

Lack of Incentive Design and Absence of Experts

As noted above, current prediction markets lack sufficient rewards and incentive measures for users, failing to provide adequate compensation for contributions to the market. Consequently, even skilled traders with valuable insights tend to avoid participation, deeming it not worth the effort due to low returns (limited by profit caps and the inability to leverage) and low market liquidity.

Furthermore, with no means to demonstrate one’s “predictive accuracy” or “knowledge” beyond one-off transactions and no mechanism for evaluation, it has become an environment where experts struggle to exert their influence. As a result, the very people who should possess the most valuable insights are being left out of the market, preventing prediction markets from realizing their inherent value.

Space aims to solve the challenges outlined above and evolve prediction markets into infrastructure that is truly rooted in society.

Transparent Order Book

Space rejects centralized exchanges and adopts a client-layer order book (CLOB) system where users trade directly with each other. There is no room for the platform to act as a counterparty and manipulate odds. It also implements a mechanism that penalizes participants attempting market manipulation by increasing their fees.