【Solana Full Review (Part 2)】Improvements to Dispersion / Ecosystem Trends / Overview of Talkonomics / Expectations and Concerns about ETH in Kind / Evaluation and Discussion / @solana

Understand the big picture, including the future of Solana.

Good morning.

Mitsui from web3 researcher.

Today's article is contributed by CryptCrypt..Entitled "Solana Complete Review," the article provides a thorough explanation of Solana's history, technical features, and ecosystem.

If you have not seen yesterday's Part I, please click here to view it.

8. Improvements to Decentralization

9. Current Solana Ecosystem Trends

10. Partnership with Filecoin

11. Solana SmartphonesSaga2

12. SOL Talk Nomics

13. SOL Physical ETFsExpectations and Concerns

14. Solana Evaluation and Discussion

8. improvements to decentralization

Early Solana received much criticism for its centralization, with the Solana Labs team holding all authority and VC funding for validators.

The blockchain trilemma asserts that a project can achieve decentralization, security, or scalability, but to achieve two of them, the third must be sacrificed, and Solana sacrificed decentralization.

Solana not only understands this concern, but has acted surprisingly quickly and is in the process of introducing three additional validator clients - Sig, JITO, and Firedancer.This makes Solana, along with Ethereum, the leading blockchain with multiple live validator clients.

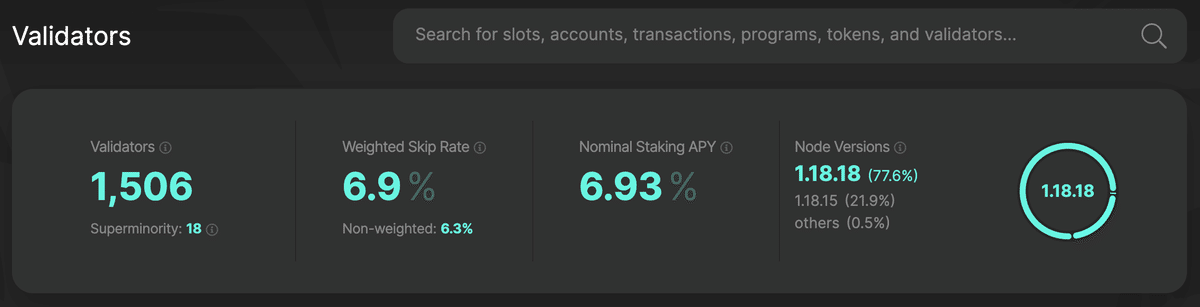

At the time of this writing, Solana has approximately 1500 block generation validators in operation, with the number steadily increasingNakamoto coefficientis also increasing.In fact, Solana boasts one of the highest Nakamoto coefficients of all PoS blockchains, making it resistant to the risk of a node operator controlling more than 33.33% of all stakes on the network.

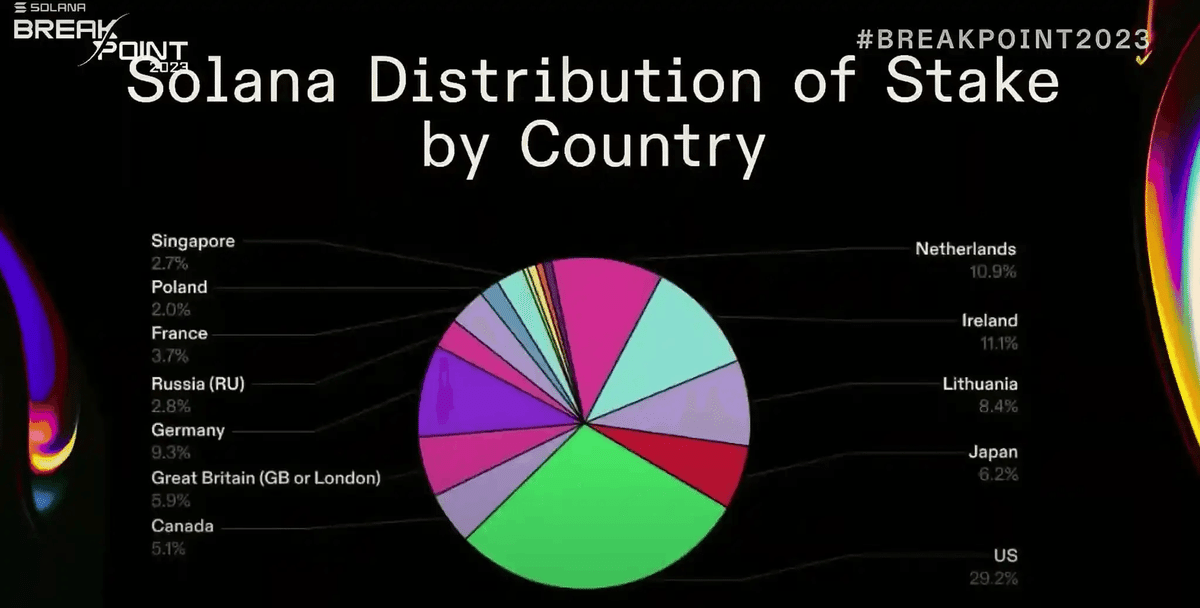

Below is Solana's stake allocation by country; the data is a bit out of date as of September 2023, but please use it as a reference.

The hosting distribution of validator nodes has also been improved.This is important because it means that Solana is not overly dependent on a single data center, such as AWS hosting.

The image above shows that Solana is nearly 33% independent of any single data center, which mitigates the single point of failure problem.In the early days, centralization was a concern for Solana, but now it is steadily becoming more decentralized.These improvements are great, and Solana is well on its way to a sustainable decentralized ecosystem.

9. current Solana ecosystem trends

In 2022, the collapse of FTX and Alameda, which had invested heavily in the Solana ecosystem, created an atmosphere in the market that Solana was going to fade away, but Solana overcame this in 2023 and made a dramatic comeback.

The price of SOL tokens increased 658% in one year in 2023, the developer community became more active, and new project launches increased.This was largely due to the support of the community as a whole for Solana, which attracted new investors, developer grant programs, and real events such as the Solana Hacker House Tour and Breakpoint.

Solana's resurgence has played a key role in restoring market confidence and laying the foundation for sustained growth.

Below is a summary of each sector to give you a picture of current trends in the Solana ecosystem.

DeFi

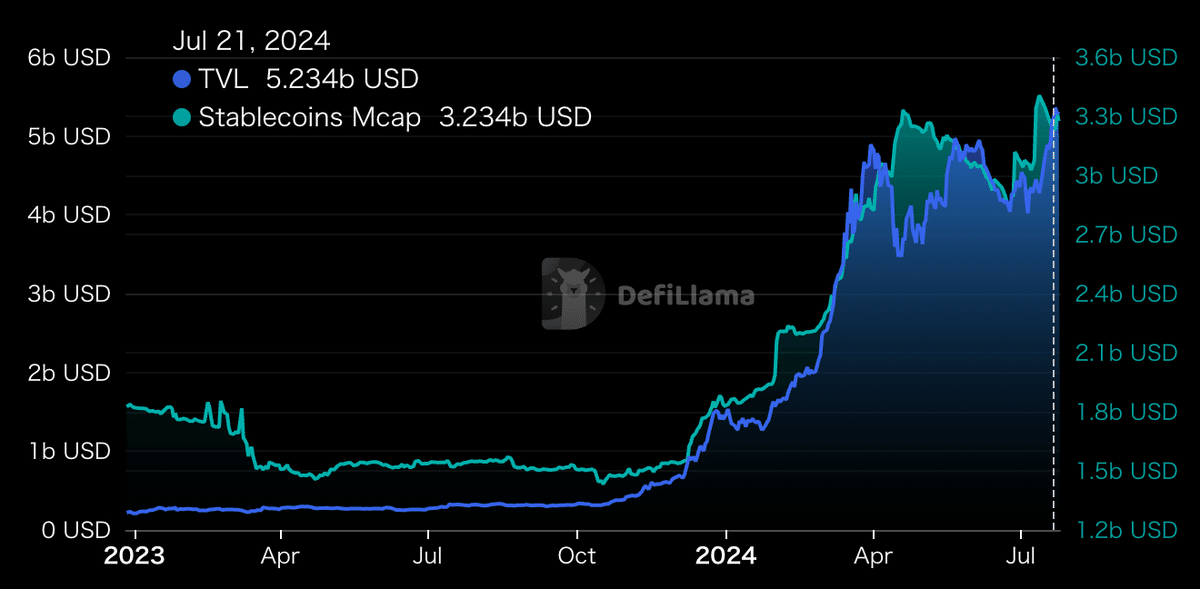

DeFi is currently the largest and most important sector in Solana's ecosystem, with a TVL of $5 billion as of 2024 according to DeFiLlama Major projects such as Marinade Finance and Jito provide liquidity and convenience, contributing to the growth of the DeFimarket expansion.Liquid staking in particular is an important component of Solana, with Jito and Marinade leading the field and Sanctum also receiving attention.These projects make it possible to maintain the liquidity of assets while reaping the rewards of staking.Liquid staking is an important mechanism to increase the availability of assets for users.

Memecoin

Memecoin is a sector that is growing particularly fast from late 2023 to the present; BONK, WIF, and POPCAT are notable examples; BONK, as a community-driven project, has had a significant impact on the NFT ecosystem and DeFi traders; POPCAT hasPOPCAT has attracted a high level of interest from investors (gamblers?) as prices have skyrocketed due to recent large scale trading on the DEX.It is no exaggeration to say that it is this sector that supports Solana's current growth.

It is no exaggeration to say that this is the sector that supports Solana's current growth and how important it is for the platform's growth to heat up speculation fever and increase transaction fees.

NFT and Digital Art

NFT and digital art do not seem to be as exciting as they were in 2022, to be honest.Still, Magic Eden has gained popularity with NFT collectors for its extensive collection and ease of use, and the growth of the NFT market is closely related to the gaming realm, so there is a good chance that it will pick up steam.

Gaming

The gaming sector is also growing rapidly in the Solana ecosystem and looks promising: STEPN has had great success with its "Move to Earn" concept, offering fitness and rewards to users.Although it is not as exciting as it once was, it is still a leader in Solana's gaming sector with a strong fan base.The new STEPN GO was recently announced and has been the talk of the town.

Other than STEPN, Star Atlas is also worth mentioning, as it is an epic space exploration game.These games leverage Solana's unique and powerful blockchain technology to provide new experiences for users.For the gaming sector, a major theme throughout Web3 is how to continuously engage new customers and keep existing users engaged in the game.

DePIN

DePIN is a sector that is gaining attention as we enter 2024, but in terms of overall size, is still in the process of slowly picking up steam: Helium offers a distributed wireless network, while Hivemapper uses dashcams and AI to collect up-to-date map data.Render is focused on sharing GPU computing power, and these projects link real-world infrastructure to the blockchain.

Bridges and Cross-Chain Compatibility

When discussing the Solana ecosystem, we must mention Wormhole as an important infrastructure supporting Solana: Wormhole is Solana's primary cross-chain bridge, facilitating the transfer of assets between different blockchains.As new features and integration with other chains continues, Wormhole plays an important role in the expansion of the Solana ecosystem.Cross-chain compatibility allows seamless integration between different blockchain ecosystems.

Partnerships and Corporate Collaborations

Solana has formed many large corporate partnerships in recent years, including collaborations with Mastercard and Visa, support for Google Cloud and Amazon Web Services, and Solana Pay integration with Shopify, which havegrowth and adoption.Corporate collaboration is further expanding the Solana ecosystem and increasing practical use cases.

These elements are shaping the Solana ecosystem in 2024 and paving the way for the future of blockchain technology.The growth and development of each sector contributes to Solana's continued growth and proliferation.

10. partnership with Filecoin

Solana and Filecoin have announced a strategic partnership aimed at enhancing data scalability and accessibility in the blockchain in February 2024.This will involve integrating Filecoin's decentralized storage capabilities into Solana's high-performance blockchain, which in effect will significantly expand Solana's block size.

What can we expect from a significant expansion of Solana's block size?

First, Solana can ensure redundancy of historical data.This increases data availability by ensuring that data can be accessed without loss in the event of a network failure.It should also lead to less scalability as the number of transactions and data size increases, as Solana will be able to store larger data sets more efficiently.

In addition, application development may be able to do more: the ability to store data in Solana's integrated IPFS will allow for more complex dApps to be built without having to rely on centralized storage.

In summary, the benefits for Solana are improved data redundancy and security, enhanced scalability, and more options for developers.

On the other hand, challenges and concerns include the technical complexity and operational costs associated with deploying distributed storage.In particular, if the cost cannot be reduced to at least the same level of operational cost compared to existing Web2 cloud storage, it will be difficult to increase its adoption.

11. Solana Smartphone Saga2

Solana plans to market its newest smartphone, the Saga 2, in 2025.This is a high-performance smartphone offering pure Android and integrated Web3 functionality, developed in collaboration with OSOM.

Of particular note is the "Seed Vault" security feature that protects seed phrases with AES encryption, allowing users to approve transactions securely and quickly; the Solana Mobile Stack is included to support the development of distributed applications (dApps).It also provides an advanced framework to support the development of distributed applications (dApps).

The first "Saga" was launched in December 2023 and sold out immediately due to the surge in the accompanying "BONK" meme coin.This provided enough value to offset the price of the smartphone itself and generated a lot of interest.

The subsequent launch of "Saga 2" has similarly generated interest in the cat-themed "MEW" and "MANEKI" tokens airdropped to pre-order purchasers, a mechanism that reduces the financial burden on the purchaser.The rising value of these tokens has also increased attention to the product.

Thus, Solana's smartphone releases are driven by the proliferation of Web3 technology and the enhancement of the user experience; Solana aims to promote distributed applications that do not rely on traditional Internet services and intends to create an environment in which users can use Web3 functionality on a daily basis.Solana is aiming to make distributed applications independent of traditional Internet services, and intends to create an environment where users can use Web3 functionality on a daily basis.

In particular, Solana is working to attract a new user base and expand its ecosystem by making blockchain technology and cryptocurrency more convenient through the everyday device of a smartphone.As decentralized applications become more prevalent in the future, I would expect to see new business models emerge that leverage Solana's technology and infrastructure.

12. tokenomics of SOL

This section provides an in-depth look at Solana's native token SOL.Understanding token supply and allocation, staking mechanics, transaction fees and Burn mechanisms, and validator challenges is important for a deeper understanding of Solana's tokenomics.

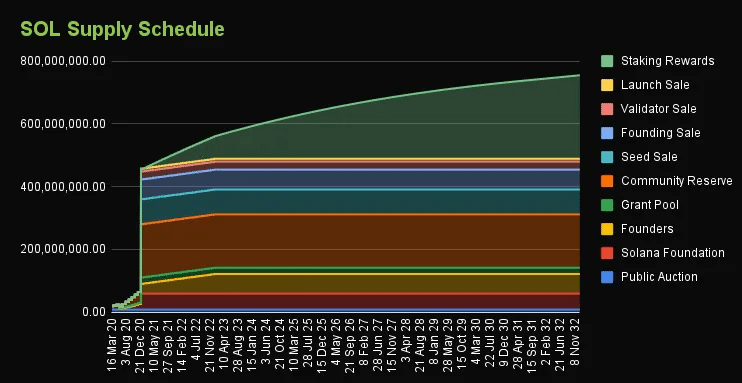

The total supply of Solana's native token, SOL, is limited to 489 million tokens.This limited supply is intended to increase long-term scarcity and value.Initial token allocations were made as follows.

25.6% to seed sale

20.4% for the foundation sale

20.2% for Solana Foundation

Team 20.2%

8.2% for validator sale

2.6% on public sale

Strategic Sale 3%.

These allocations were made through a funding round to support Solana's development and growth.The supply schedule was made available to the public after the initial allocations, with staking rewards available in December 2020.All supply for founders, validators, and other initial allocations will be distributed between December 2022 and early January 2023, after which staking will be the only way to create new SOLs.

Solana employs a Proof of Stake (PoS) consensus mechanism, allowing token holders to stake SOL tokens to protect the network and verify transactions.

Staking fees are paid in the form of newly issued SOL tokens, and current staking fees are around 5%-6%.Validators receive the newly issued SOL tokens as staking fees, while earning a portion of the user's transaction fees as revenue.

Specifically, validators receive half of the transaction fee and half is Burned.In addition, in 2024, the Solana community voted to give validators a preferred commission.This will further incentivize validators to receive a preferred commission in addition to their transaction fee.

A small amount of SOL is required to become a validator and a reserve of 0.02685864 SOL is required to maintain a voting account.Voting requires sending a voting transaction for every block the validator agrees to, which can cost up to 1.1 SOL per day.

Hardware requirements can be found here.

Solana Validator Requirements | Solana Validator

The supply of SOL is designed to decrease over time, balancing inflation and deflation.

Solana's inflation rate will be 8% in the first year, decreasing by 15% annually and eventually stabilizing at 1.5%.This inflation adjustment is intended to control the growth rate of the token supply over time while encouraging staking, which is an important consideration for the sustainability of the network.

As the inflation rate approaches its final value, validator rewards will decrease and validators will have less incentive to participate in the network.Validators will therefore need to consider optimizing operational efficiency and diversifying revenue sources.It will also be important for validators to actively participate in governance, advocating their own interests and contributing to the sustainability of the network.

Next, let's talk about the utility of SOL tokens, which is wide-ranging.It is primarily used for transaction fee payments, staking, and network governance.

Holding an SOL allows users to use dApps on the Solana network and pay transaction fees.Through staking, users contribute to the security of the network and are rewarded.In addition, SOL tokens play an important role in governance, allowing holders to participate in decision-making regarding the future of the network.

There are concerns about token decentralization in Solana's token distribution, as VCs and early investors own the majority of the supply.This concentration presents a challenge to maintaining network security and decentralization, but it is anticipated that this concern will be mitigated in the future as these tokens are gradually distributed to the general investing public.

13. expectations and concerns about SOL physical ETFs

Approximately six months after a BTC physical ETF was approved in the U.S. in January 2024, an ETH physical ETF was approved for trading this month and began trading on July 23, 2024.

With the approval of the ETH ETF, expectations are high for SOL ETFs as well: on June 27, 2024, leading asset manager VanEck filed for the first SOL physical ETF in the US.

However, there are some challenges to consider in this regard.The Securities and Exchange Commission (SEC) has filed a lawsuit against Binance, a crypto asset exchange, claiming that several crypto assets, including SOL, are securities, effective June 2023.

The Solana Foundation is challenging SOL's status as a security, but no concrete conclusion has been reached at this time; VanEck has filed an application claiming that SOL is a commodity and not a security, but SOL is not clearly a security in the lawsuit filed by the SEC.VanEck's application is unlikely to pass smoothly and without incident, as SOL is clearly a commodity, not a security, in the lawsuit filed by the SEC.

Therefore, the approval or disapproval of the SOL physical ETF will depend on the outcome of the lawsuit.

Of course, if a SOL physical ETF were approved, it would certainly have a positive long-term impact on the price of SOL.According to a report by crypto asset market maker GSR Markets, if the approval of a SOL physical ETF coincides with an overall bull market in crypto assets, it could send the price of SOL soaring 8.9 times.Since the SOL price at the time of this report's writing was $149, calculations based on that would push it to over $1320, bringing SOL's market cap to $614 billion.

Needless to say, this is only a possibility.No one knows what the future holds, so please use it only as a reference.

14. evaluation and discussion of solana

Overall, Solana is definitely a promising project with the support and confidence of many investors, developers, and communities.

First, the development of the ecosystem speaks for itself, with a balanced growth of various sectors.Second, the network is actually being used.Currently, more than $5 billion in assets are deposited in Solana, and daily transaction volume exceeds $2 billion.Third, the project did not attract huge investments at launch, but has gradually built up to where it is today.This is an extraordinary feat, and is the best proof that the Solana team has made the right choice to come this far.

In the past, Yakovenko has asked, "What happens when decentralized exchanges become more efficient than centralized ones?"(You can see an automatic translation of the Japanese version here.(You can see an automatic translation of the Japanese version here.)

This is an important question for the development of Web3.The answer is that centralized exchanges will switch their business to blockchain, and I think that is exactly what Solana is aiming for.

That is, it seems that the goal is not how to incorporate Web3 technology into the existing Web2 business, but how Web3 will eventually take the position that Web2 will replace.Solana's current momentum suggests that it has a good chance of taking that position in the near future.Perhaps Solana will become a platform that attracts even more users.

On the other hand, the rapid increase in transactions may also choke Solana, whose repeated network outages have not been resolved to date.Of course, each time a problem occurs, the team addresses the cause and makes incremental improvements, but Jakovenko admits that there are structural limitations in the underlying architecture.

And given that a fundamental update is a very difficult road to travel, it remains to be seen how many users Solana will be able to cover if and when more and more people become Web3 users in the future.I think one of the key points will be Firedancer, which is scheduled for integration into the mainnet in 2025.

Despite these challenges, there is no doubt that this blockchain is establishing itself as one of the top contenders to handle hundreds of millions of users.

This is the "Solana Complete Review (Part 2)".If you have not yet read the first part, we hope you will take a look at that as well and use it to get an overall picture of Solana at this point.

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.