Good morning.

Mitsui from web3 researcher.

Today I'm going to write about my recent thoughts on the topic of "Sanctum's Concept of Token Abstraction and Programmable Money", which is more of a discussion than a commentary on Sanctum.

🔵What is Sanctum?

🏭LST OEM factory

💰 ProgrammableI want to make money.

🔵What is Sanctum?

Let's begin with a brief description of Sanctum.

Sanctum is the liquidity hub for LSTs in Solana.I will include more details in another research article after the tokens are firmly launched, but here is just an overview.

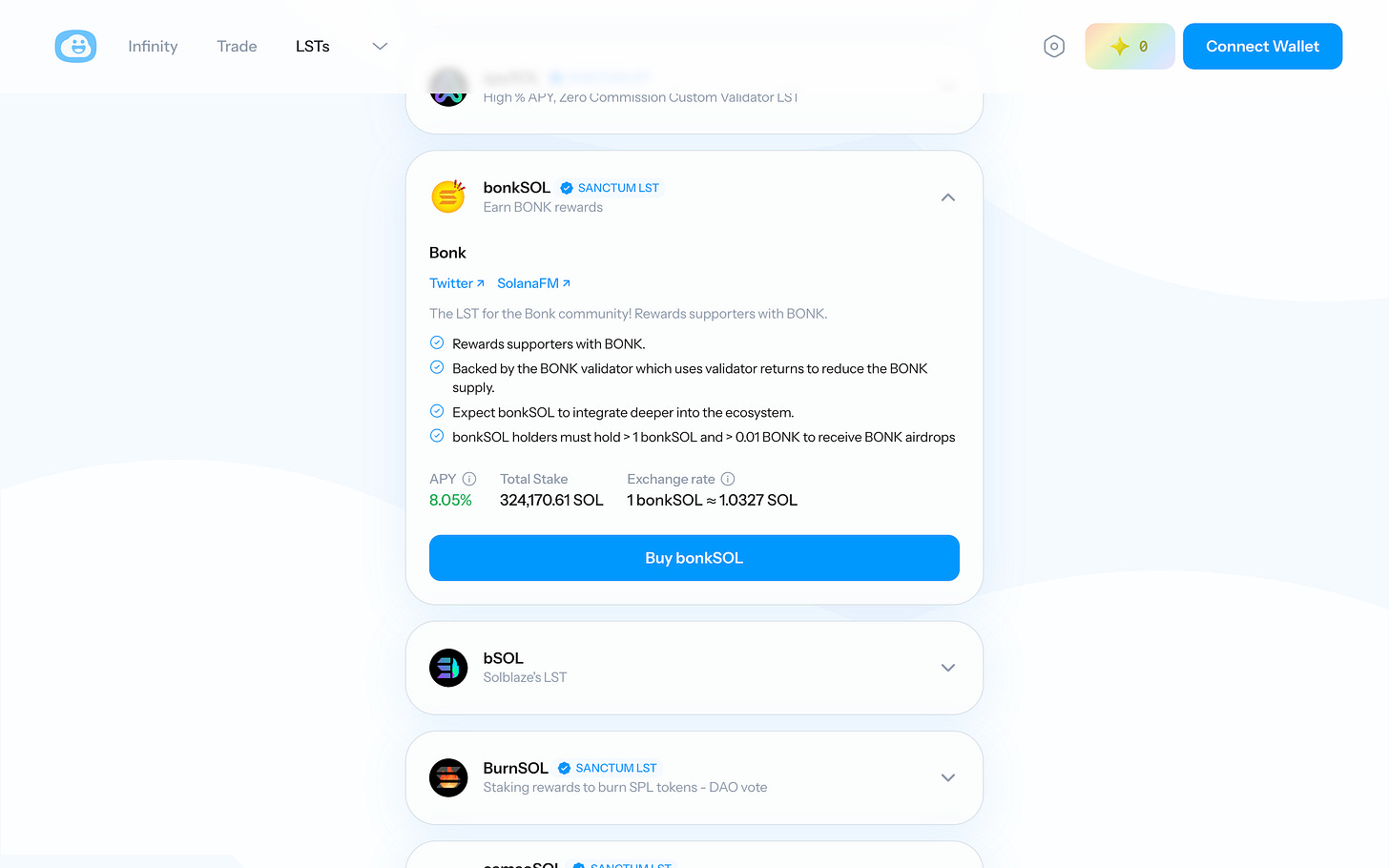

Sanctum allows each protocol to freely issue LSTs (liquid staking tokens).For example, there is an LST called $bonkSOL issued by Solana's meme coin $BONK.

While $bonkSOL is Solana's LST, it also enjoys $bonkSOL-specific benefits.Specifically, the following benefits exist

8.05% yield

Airdrop in $BONK

So you can earn yields like regular LSTs just by holding $BONKSOL and also receive airdrops in $BONK.

In this way, Sanctum is a protocol that allows various projects to issue LSTs with their own benefits.

However, that is not all.What would happen if each project issued its own unique LST?

It will not be liquid and will not function as a token.

There is no point in issuing only LSTs as "liquid" tokens, as their value will diminish if they are not liquid.In order to issue our own LSTs and make them function properly, we would need to build liquidity and utility by creating our own liquidity pool and finding DeFi to handle the operations.This is not practical.

This is exactly where Sanctum's revolution lies.

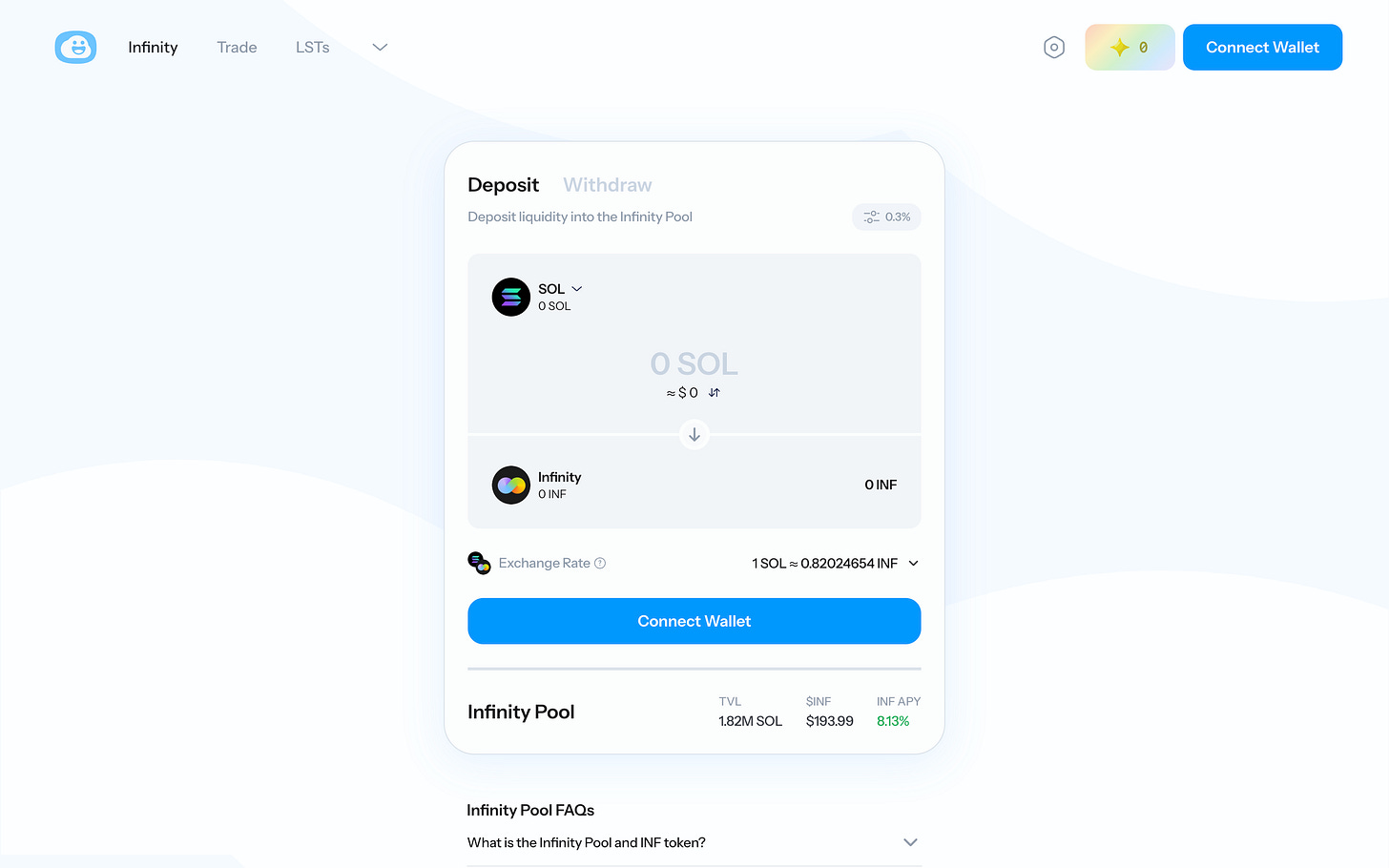

Sanctum is the liquidity hub for LSTs in existence.It provides a unified liquidity pool for infinite LSTs.Specifically, we issue a token called $INF for all LSTs and build an Infinity pool that becomes a common liquidity pool for all LSTs.

Sanctum Infinity Pool allows swapping between all LSTs in the poolMulti LST liquidity pool.This can be considered an LST basket.

$INFTokens aretokens obtained in exchange for providing liquidity to the Infinity Pool.The $INF is an LST basket.The $INF is a basket of LSTs and is interchangeable with all LSTs.

The $INF yield is a combination of the staking yield from the LST basket and the transaction fee.

In short, you can issue your own LSTs with liquidity.

🏭OEM factory for LST

I believe Sanctum is an OEM factory for LST.Each brand can create LSTs with its own design and benefits, but behind the scenes, Sanctum is actually there.

In the real world, for example, it is not uncommon for apparel products to look different from the products users come into contact with, but the factories behind the scenes are actually the same as OEMs.

Sanctum is the LST version of this.The following is a diagrammatic representation.

The key point is the presence of "Additional Rewards" on the far right.Attracted here, users deposit SOLs and issue LSTs.The project or brand side gets a share of the staking yield.

I personally consider this mechanism to be quite revolutionary.I have organized the benefits of each.

Of course, concerns about the LST mechanism itself, the risk of hacking the protocol, and the risk of thrashing and centralization of staking exist, but once these concerns are put aside, a new experience of investment consumption (tentative/coined term) can be created.

Sanctum officials also sent out a message that a world where service can be received by holding can be realized, and I believe that is exactly the kind of use that will emerge.Right now, this is only a project in the crypto world, but if we expand this horizontally, I think it can be done at all in web2companies.

For example, if Pokémon were to issue poSOLs and grant early access rights and limited card purchase tickets to poSOL holders, a fan club-like structure could be created, creating a new passive revenue opportunity for Pokémon.Moreover, unlike existing fan clubs, fans do not lose money.

And I believe that in this era, "token abstraction" will be realized.Token abstraction is a coined term, but it will be a world where you are not aware of tokens.More precisely, it is a world where you are aware of the tokens you hold, but you are not constrained technically or UX-wise by the differences between tokens.It is exactly the kind of worldview that Sanctum is realizing, where any LST can be pooled and swapped.

Of course, token abstraction is not just for LSTs, but also in the direction of a truly token-unaware, paymaster-like gasless, which may be closer in meaning to AA or other abstractions, but, well, I'm not particularly particular about the definition of that, so for once.I'll leave it vague.What I'm trying to convey is that a common liquidity pool like Sanctum will lead to a world where tokens become brand symbols and the backside is all designed with a unified operation, like an OEM.

💰We want to create programmable money

As I mentioned the other day when I wrote an article explaining Flatcoin, I am interested in the web in general, but I am particularly interested in making "money".I am especially interested in making "money". When using blockchain, people tend to focus on the fact that it cannot be tampered with, is decentralized, transparent, etc., but I personally believe that "Money can be programmed.data-dl-uid="88">"The point is very interesting.

By utilizing smart contracts, money can be created that works autonomously and as programmed; I think it is rather revolutionary that LSTs and such are automatically rebased, and money that increases just by holding it is good.

This concept is already being tested in Singapore, and could have an impact on national monetary policy.

I know there are many forms this programmable money can take, but I think a scheme with LST issuance would be interesting.

And based on this premise, I have already decided what I personally want to create and am looking for people who are willing to help.(I posted this yesterday and someone contacted me immediately.Thank you...)

If you are interested, please feel free to DM me.It's still in the conceptual stage, but I'd be grateful for rough discussions.

Actually, it is a concept that I have had in mind for quite some time, and I kept thinking that I would like to make it a little further down the road, but I thought that by utilizing Sanctum, I could do it without having to develop the concept I had in mind in a full-scratch fashion.

Well, I still don't know if I can make it to the actual release, but for now, I will start with the walloping and work my way up to a little more resolution.

This is the "Thinking about token abstraction and programmable money from the Sanctum concept" article!

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.