【Rise】web3 payroll payment solution that enables hybrid payments in 90 local currencies and 100+ crypto assets / supports KYC, AML, tax calculation, and post-receipt DeFi operations / @rise_pay

Companies can pay from their bank accounts or wallets and recipients can receive in their preferred method of local currency or crypto assets.

Good morning.

Mitsui from web3 researcher.

Today I researched "Rise".

🟣What is Rise?

✨Funding History and Pricing

💬In the age of multinational, multicurrency payments

🟣What is Rise?

Rise" is the fastest and most flexible solution to hire, onboard, and pay your globally distributed team in one place, in cash or cryptocurrency.

The three main functions are.

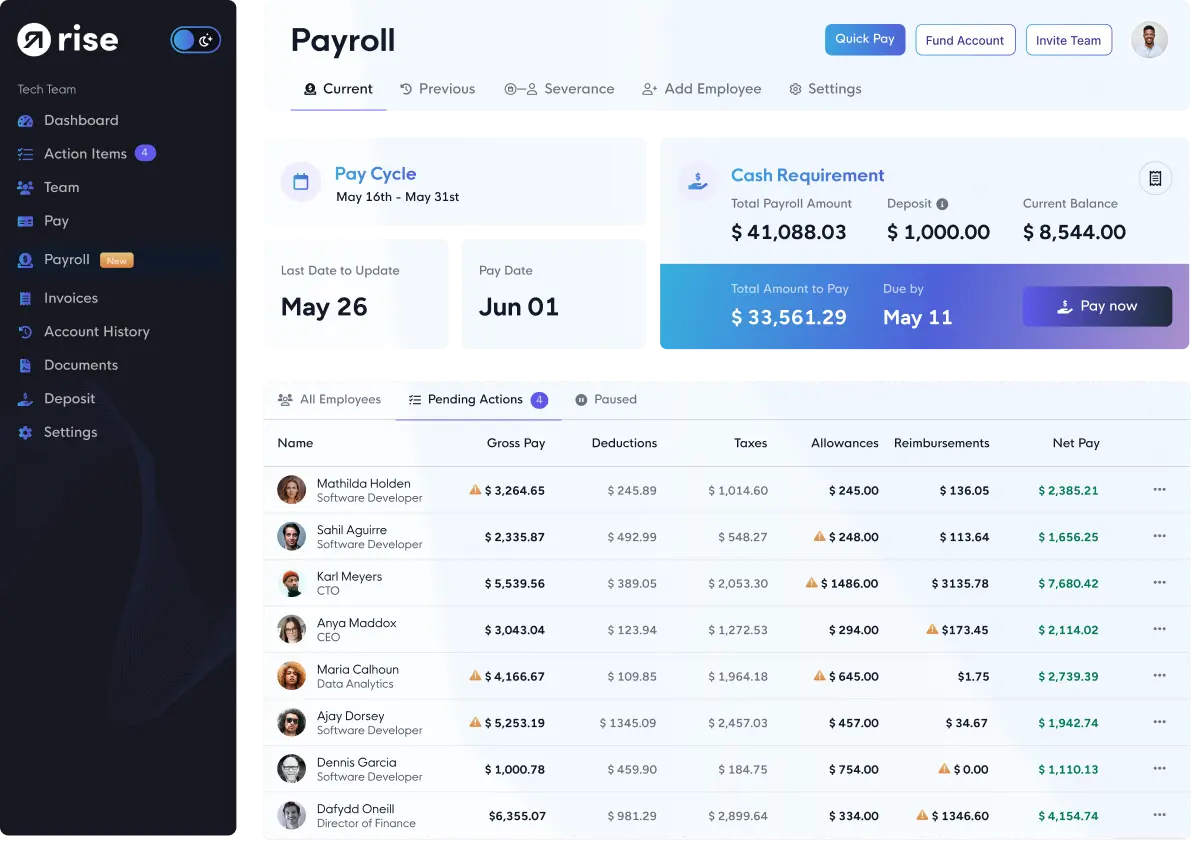

(1) Hybrid payroll payment in legal tender and crypto assets

Rise combines legal tender and crypto assets to provide flexible, compliant, and efficient payments to international contractors.

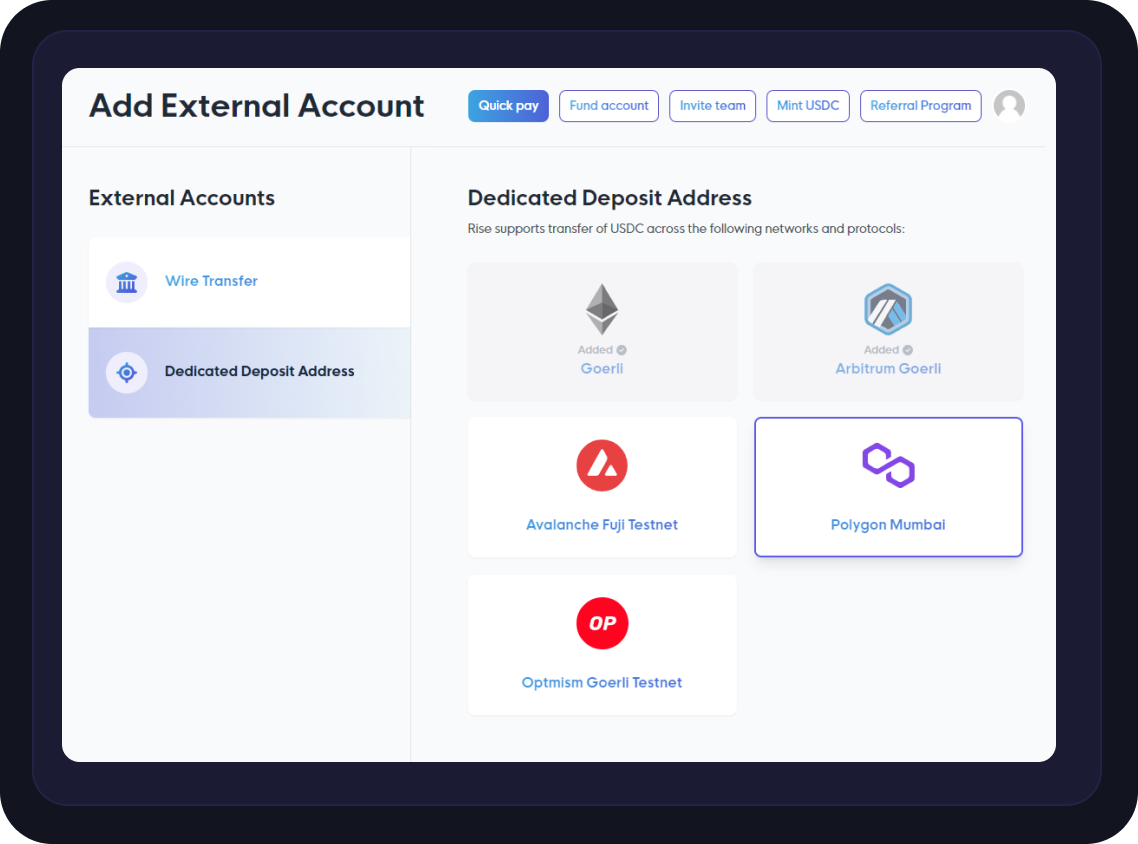

The payer company connects its bank account or crypto asset wallet and pays its employees and contractors in stable coins.This conversion to stablecoin is performed automatically.The recipient can then receive it in the currency of his/her choice, either legal tender or crypto asset.Crypto assets can also be received in currencies other than stablecoin.

The supported local currencies are as follows

In addition, you are free to choose the chain to which payments will be made from your bank account and automatically converted and paid in stable coins as follows

Payments are also efficiently implemented through smart contracts and can be customized, with payments made on a predetermined schedule, or by having the client submit work history and making payments accordingly.

As a platform, Rise also handles compliance checks, KYC, and tax processing, allowing for mutual peace of mind.

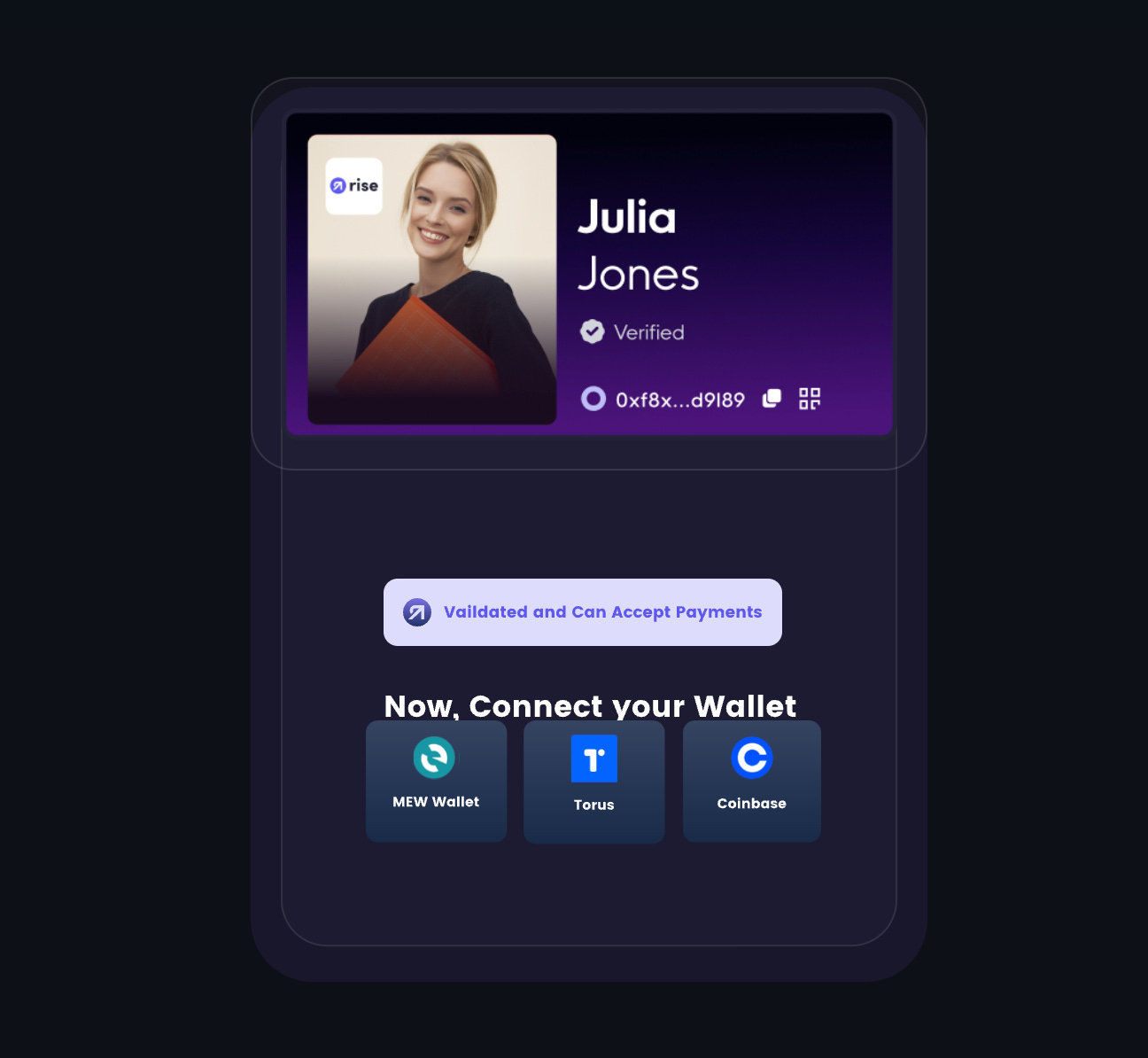

(2) Rise ID on the contractor side

We also offer a DID solution called Rise ID.This is a solution for contractors that allows them to keep their KYC history and work history on-chain.It will be possible to receive payments through this ID, and at the same time, it will be able to be linked to other protocols, so that it can be used as a work history in the web3 market.

More than 100,000 Rise IDs have already been issued.

(iii)Automatic Onboarding and Compliance Checks

Rise is a platform that covers all the bases.

Rise has a thorough compliance process, from employee background checks to KYC/AML.Contracts and work reports are also managed on the platform and are automatically executed via smart contracts.

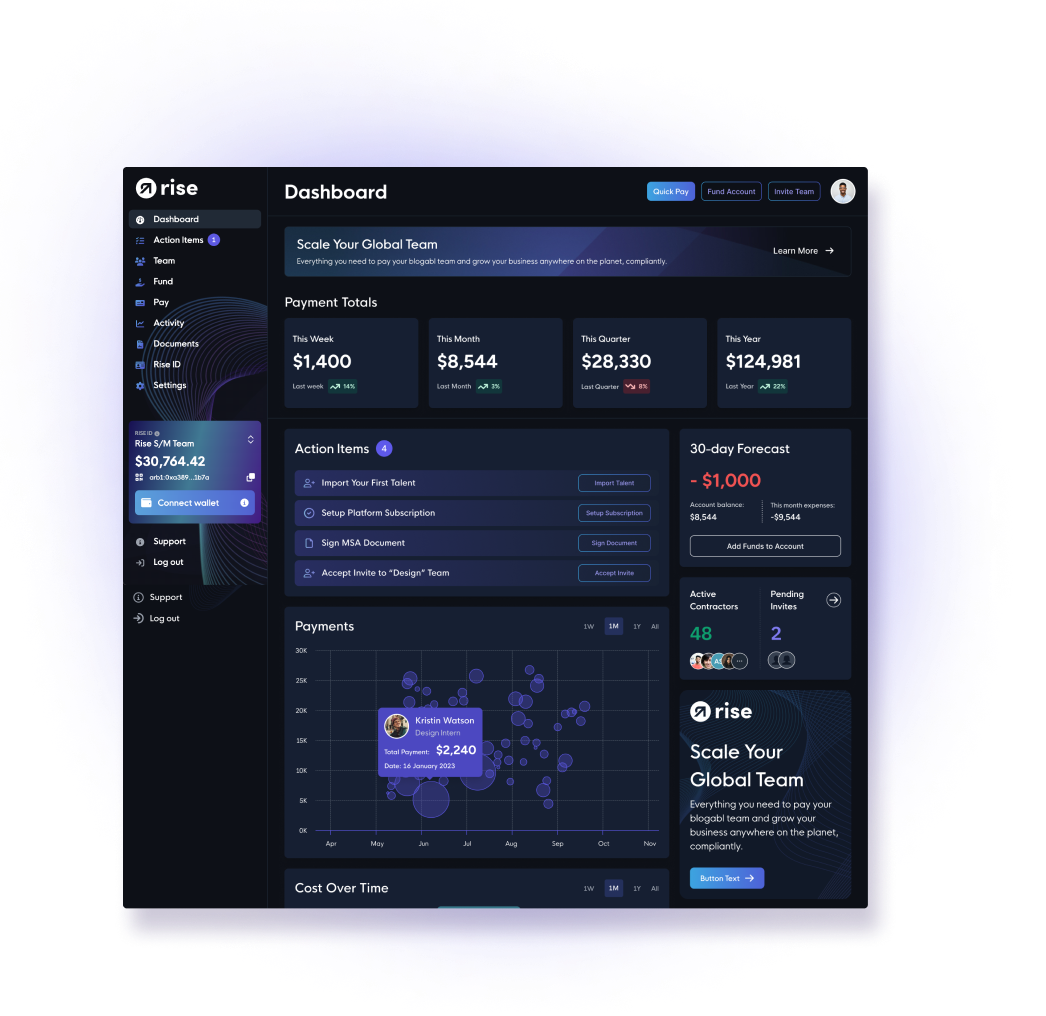

These solutions provide an environment where businesses or employees and contractors can work freely and securely in multiple currencies across multiple countries.Currently, Rise has over 150 customers and 100,000+ contractors.

✨Funding History and Pricing

Rise was founded in 2022 and initially created a crypto-asset version of a Linkedin-like service, but quickly transitioned to developing a hybrid payment solution.

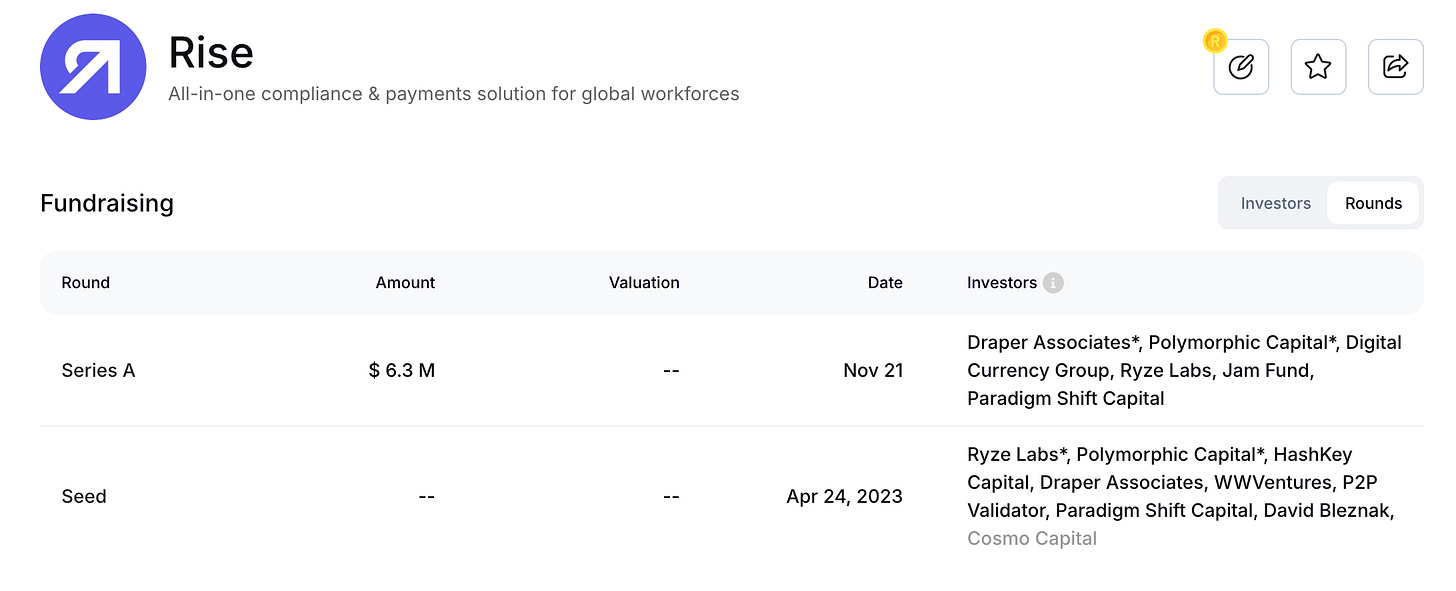

The company has had two funding rounds so far; the 2023 seed round did not disclose the amount raised, but the most recent November funding round was in the amount of $6.3M, and it stated that the total amount raised reached $10M, so we can assume that the seed round was around $4MThe most recent November funding round was $6.3M and the total amount raised was $10M.

The catalyst for this attention was winning the 2023 Consensus pitch competition.According to a 2021 survey by investment advisory firm deVere, more than one-third of Millennials and more than half of Gen Z employers would like to receive 50% of their paychecks in crypto assets, demonstrating the size of this market and unique technology solutions.

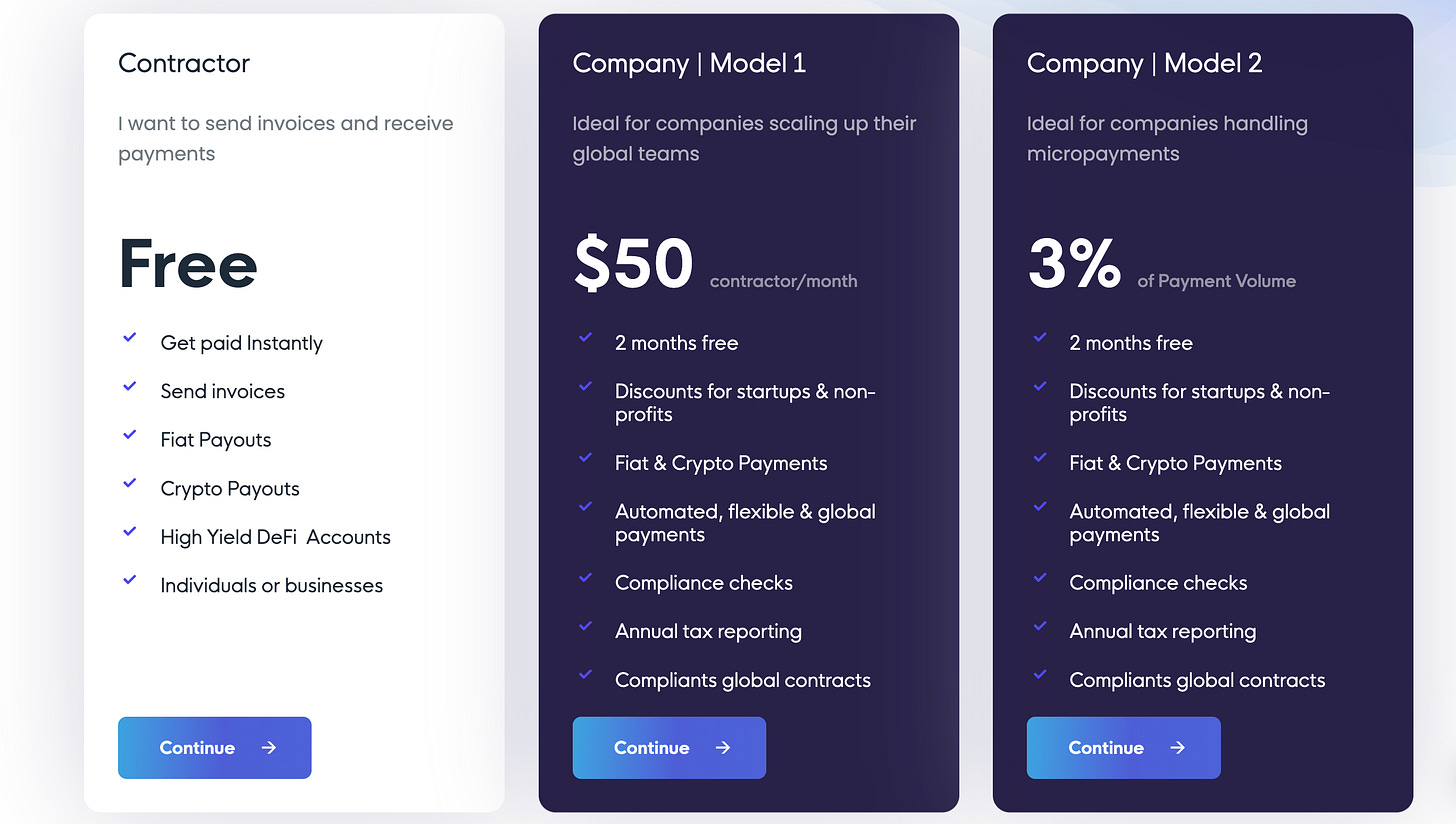

As far as pricing is concerned

The contractor side is free of charge and the company side costs money.You can choose between a fixed monthly payment of $50 or 3% of the amount used.

💬Multi-national, multi-currency payments

The last is a consideration.

Rise was a very interesting service.The price is not too high, and I think it is worth considering using if you have a multinational team.In particular, it would be a very good solution for those who employ people who do not have local bank accounts, or who have bank accounts but want to receive their money in crypto assets due to high inflation.

Rise is already

Rise also has the ability to invest the crypto assets received directly in DeFi, so that contracting, work reporting, receiving compensation, and asset management can all be performed on a single platform.

Personally, I feel that this form of platform will become the default feature of payroll platforms, especially for multinational companies in the next decade.Blockchain-based stable coin payments with low settlement fees and short payment timeframes are excellent as a solution, and the freedom to choose the currency for both the payer and the receiver is very good.

If you want to use this service, a demo will be scheduled, and it seems that use will begin upon inquiry, so I was personally curious to see how it would work if I tried it.I would like to use it once on both the receiving and paying end.

In particular, I think the ability to operate in DeFi as is is is quite revolutionary, and if you can put the crypto assets received in stablecoin directly into DeFi and withdraw them when you use them, you can receive them as effectively a higher amount than you would normally receive.and USDT, so there is some currency risk and hacking risk of the DeFi you deposit, but the experience is very pleasant.

Also, and I will summarize this in another article, but I feel that the "Fat Wallet" theory is becoming popular these days, and I am beginning to think that the businesses that hold the wallet are very strong.The wallet is the gateway to everything, so anything is possible.

In that sense, I feel that a form of offering a cross-section from the cut-off point where there is a need for payroll receipt to access to DeFi could be one wallet strategy.Since wallets are no longer a battleground, it may be possible to attack one area where there is an absolute need and provide a wallet as a cross-functional feature.

This is a bit off topic, but the platform was very imaginative as a way of working in the future.To be honest, in Japan, it may not be realistic to receive crypto assets due to end-of-term taxation issues, but I think it may be possible to make payments, or to receive stable coins and keep them invested in DeFi as is.

I am very much looking forward to the future.

This is my research on "Rise"!

🔗Reference/image credit: HP / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.