【Resolv】True Delta Neutral (TDN) Stablecoin hedged by cash and short futures perpetuals / 1:1 stablecoin issuance with ETH deposits / @ResolvLabs

The era of Stablecoin 3.0 is upon us.

Good morning.

Mitsui from web3 researcher.

Today we researched "Resolv.

🔵What is Resolv?

🤑Delta Neutral Strategy Yields and Safety

💧Points Program in the works

💬The era of Stablecoin 3.0 is upon us.

🔵What is Resolv?

"Resolv" is a true delta neutral (TDN) stabled coin.

I think this explanation is not clear enough, so I will start with the problems facing the existing stablecoin market.

First, the most famous existing stablecoins are the legal tender-backed USDC and USDT.While these are very convenient, the custody of collateral assets is often held by a centralized institution.

Indeed, when Silicon Valley Bank failed, it was announced that $3.3 billion, or 8% of USDC's reserves, was sitting unprocessed, causing USDC to temporarily depeg and prices to diverge significantly.Prices have since returned to normal by making up the difference, but this risk continues to exist.

What about crypto-asset-backed on the other hand?While this is inevitable due to the volatility of crypto assets, they are essentially over-collateralized (e.g., 150% collateral), which leads to poor capital efficiency.

Resolv is a new stablecoin that solves these problems.

Users can mint the stable coin USR at one-to-one with the amount deposited by depositing ETH.

The deposit of crypto assets can be managed entirely on-chain, and since it is a one-to-one exchange, capital efficiency is not compromised.

However, crypto assets are subject to high price volatility and collateral ratios can change quickly.How is this resolved?

Resolv" takes two main approaches.

(1) Delta Neutral Strategy

Delta-neutral strategy is a term used in the existing financial industry and is an investment strategy that takes a neutral position to the ups and downs of the market.Resolv" hedges risk by holding physical ETH but entering into a short (sell) perpetual futures contract in case its price falls.

Through this mechanism, when the price of ETH rises, it profits from the cash, and when it falls, it benefits from the short perpetual futures contract.As a result, stability is maintained.

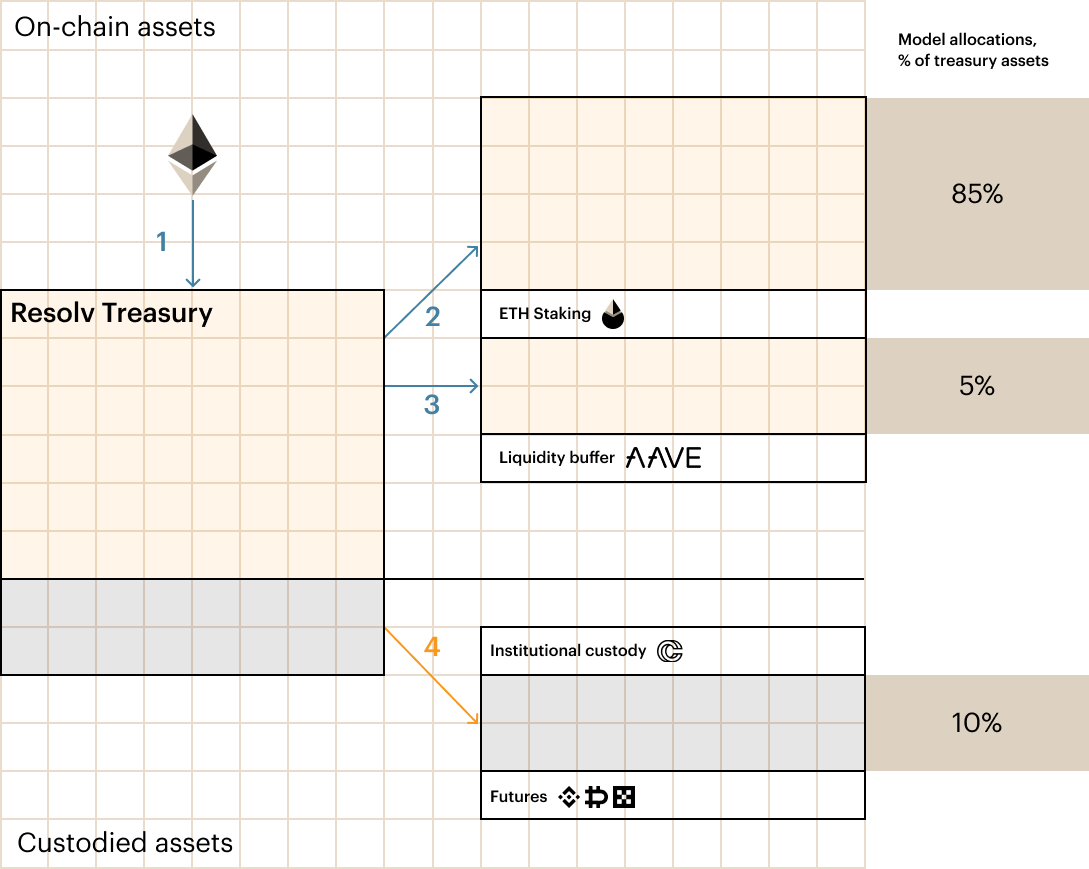

The detailed architecture is as follows

Assets deposited by users are first placed in Treasury.

From there, 85% is placed in ETH Staking

5% as a reserve in the liquidity pool

10% will be used primarily for CEX short permanent futures trading

However, this mechanism alone is flawed.It is a guarantee in the event of excessive losses.In addition, since short perpetual futures transactions are often conducted on CEXs such as Binance, for example, when Binance goes bankrupt, the funds cannot be recovered, similar to what happens to USDC in Silicon Valley Bank.

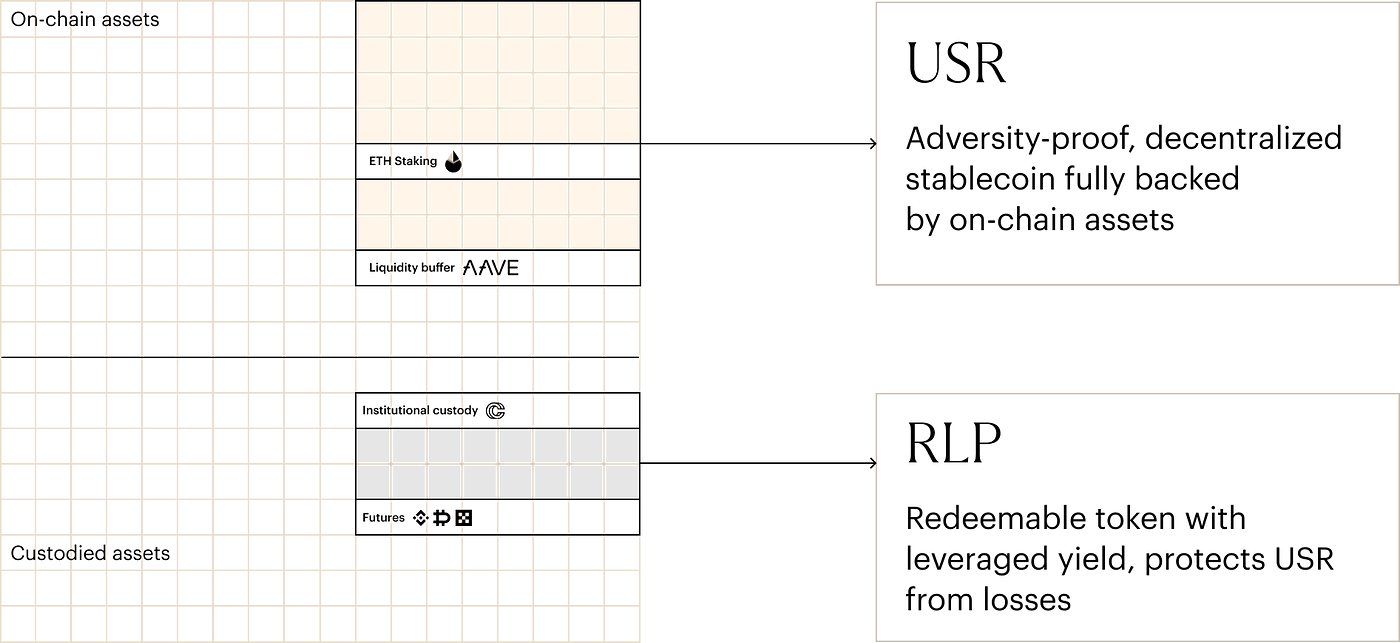

To avoid this, $RLP is issued as an insurance layer for USR's excess collateral.

(2) Insurance layer of excess collateral

$RLP can likewise be earned by users depositing funds into the Resolv treasury.The $RLP is not a stable coin and its price fluctuates.

The $RLP is positioned primarily as an investment product where the risk of the USR is acceptable and risk exists instead of offering a high yield.

We mentioned earlier that the deposited ETH will be used for staking and short permanent futures trading, and the investment profit here will be distributed to users as well.The distribution is to stUSR (USR staking token) or $RLP holders; simply holding USR does not entitle you to a share of the investment profit.

And since RLP holders are willing to accept risk in the event of loss, they earn a higher yield than stUSR holders.

The generated profit is split into three parts, each of which is distributed every 24 hours

Base fee (70%): to staked USR (stUSR) and RLP holders

Risk Premium (30%): to RLPs only

Protocol fee (0% *at present): to protocol finance

In addition, stUSR has a constant value, so the volume will increase, and RLP will be rebased to the price to distribute the fee.

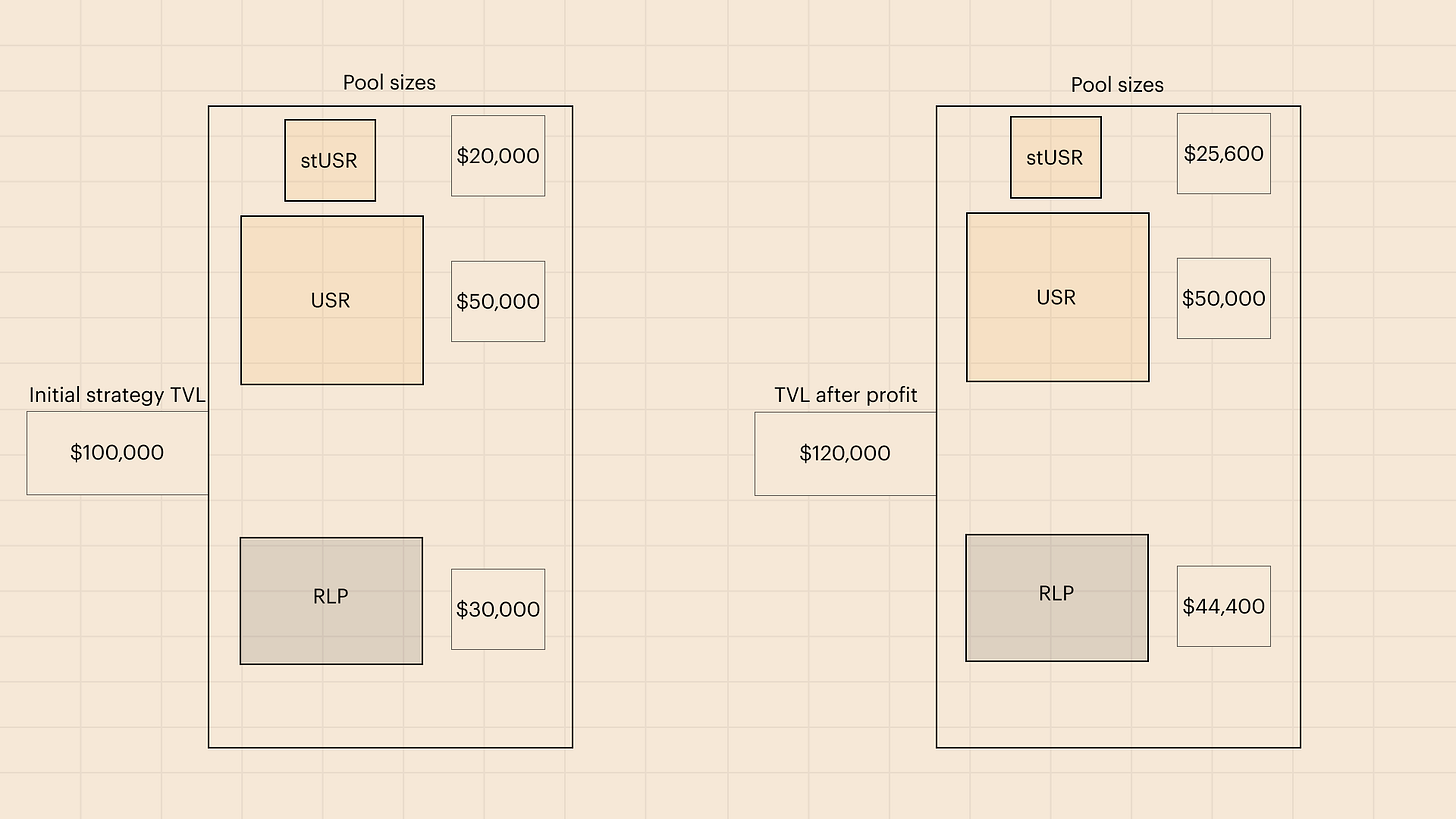

Let's look at a concrete example.Suppose $100,000 is deposited in the protocol, of which $70,000 is deposited in USR and $30,000 in RLP. $20,000 of the $70,000 USR is staked and stUSR is issued.

(1) $20,000 profit achieved

Base compensation (70%)

20,000 x 70% = $14,000 overall

Distribution according to TVL ratio (in this case, stUSR $20,000 and RLP $30,00, so 2:3)

stUSR distribution: 14,000 x 40% = 5,600

RLP distribution: 14,000 x 60% = 8,400

Risk premium (30%)

20,000 x 30% = $6,000 to RLP holder

Total

stUSR distribution: $5,600

RLP distribution: $8,400 + $6,000 = $14,400

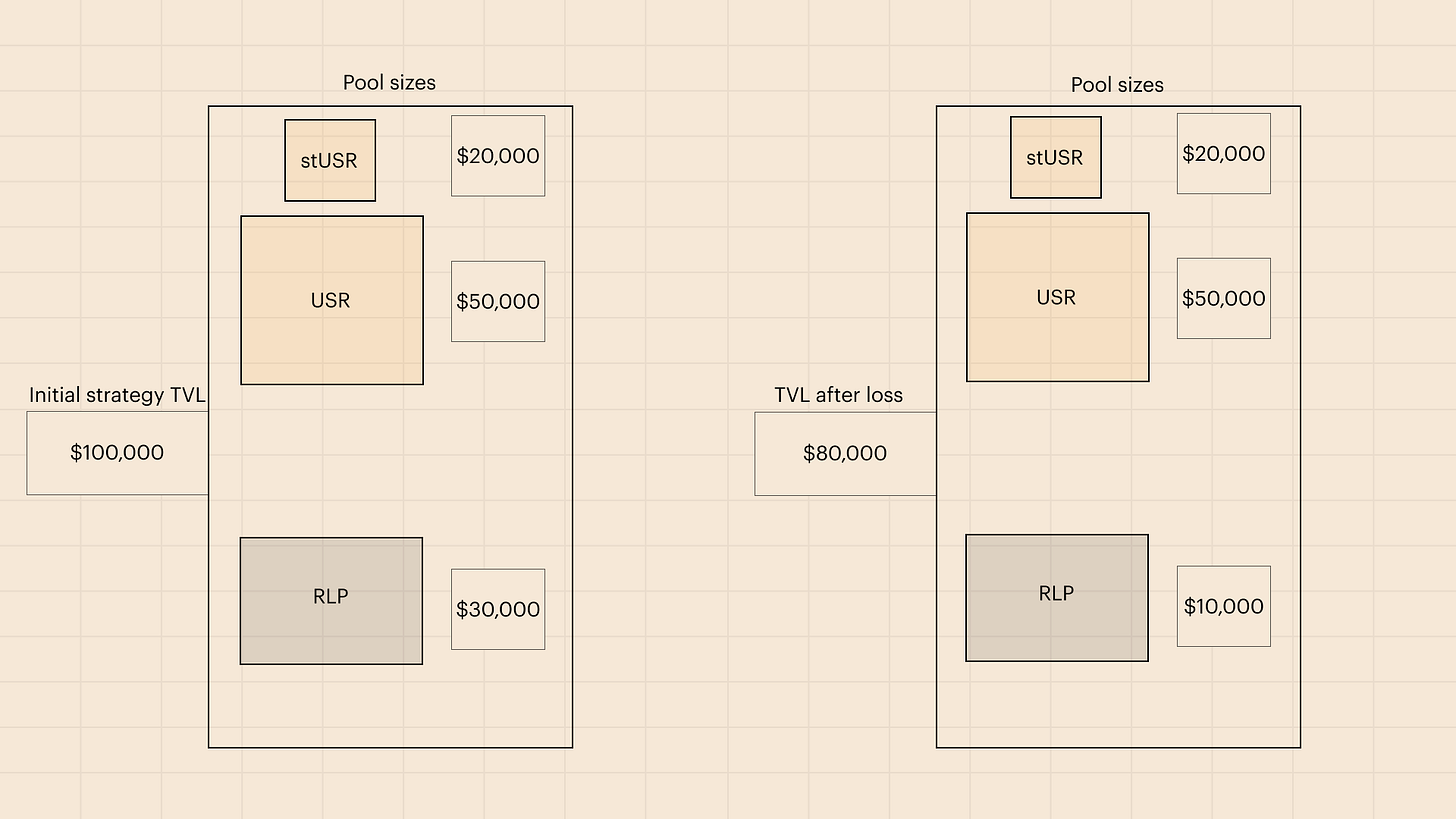

(2) $20,000 loss.

The entire loss is allocated to RLP, reducing its value by $20,000.

No distribution to stUSR will be made.

🤑Yield and safety of delta-neutral strategies

Thus, RLPs can have high yields and losses.However, to date, the Delta Neutral strategy has produced stable yields.

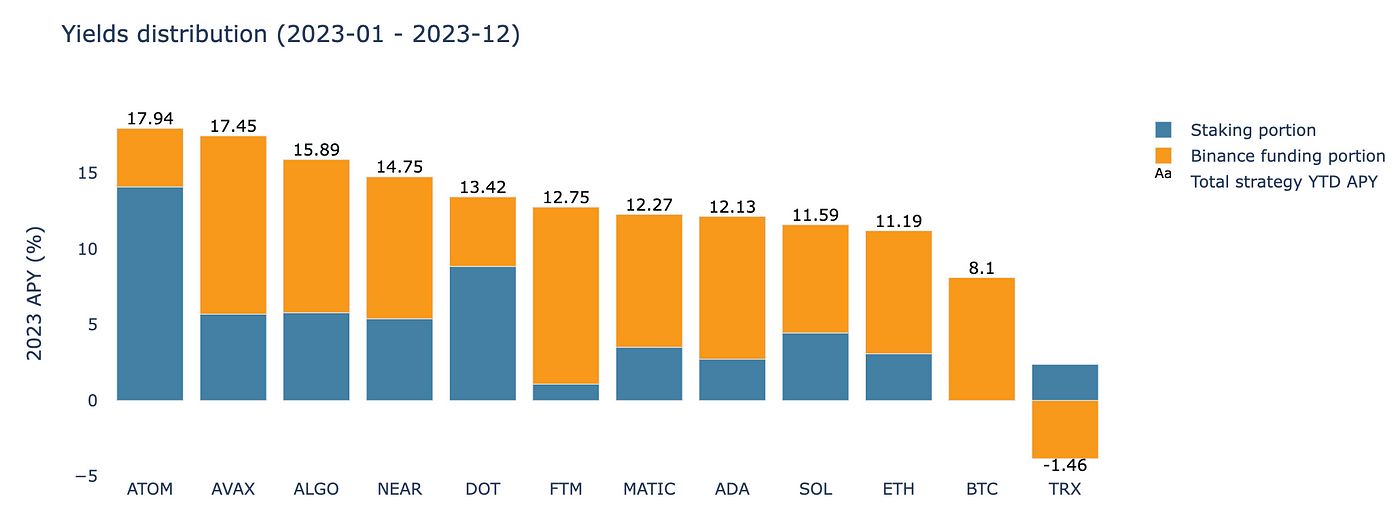

The Resolv team also tested 2023 on the major L1 blockchain tokens and found that the non-TRX tokens yielded nearly 10%.

The ETH that led to its adoption also yielded a 2-year back-tested performance of about 7.50% APY.

From this, stUSR and RLP are assuming the following yields.

stUSR : 5-6% annual interest

RLP : 20-30% annual interest.

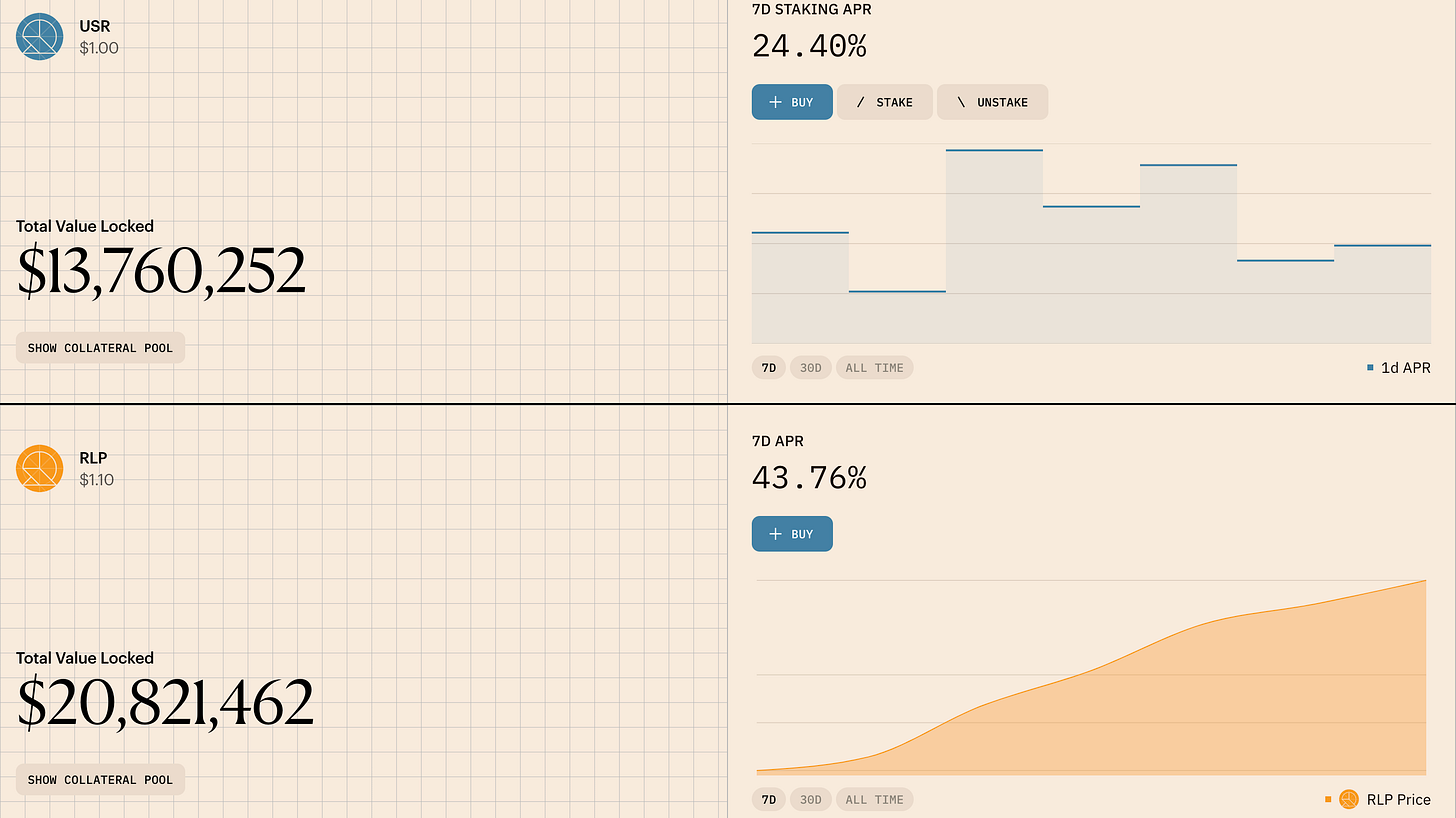

Now let's look at the current yields.

stUSR: 24.40

RLP: 43.76%

which is a very high yield.The stUSR in particular offers a high yield of over 20%, even though it is a stabled coin pegged to the dollar.

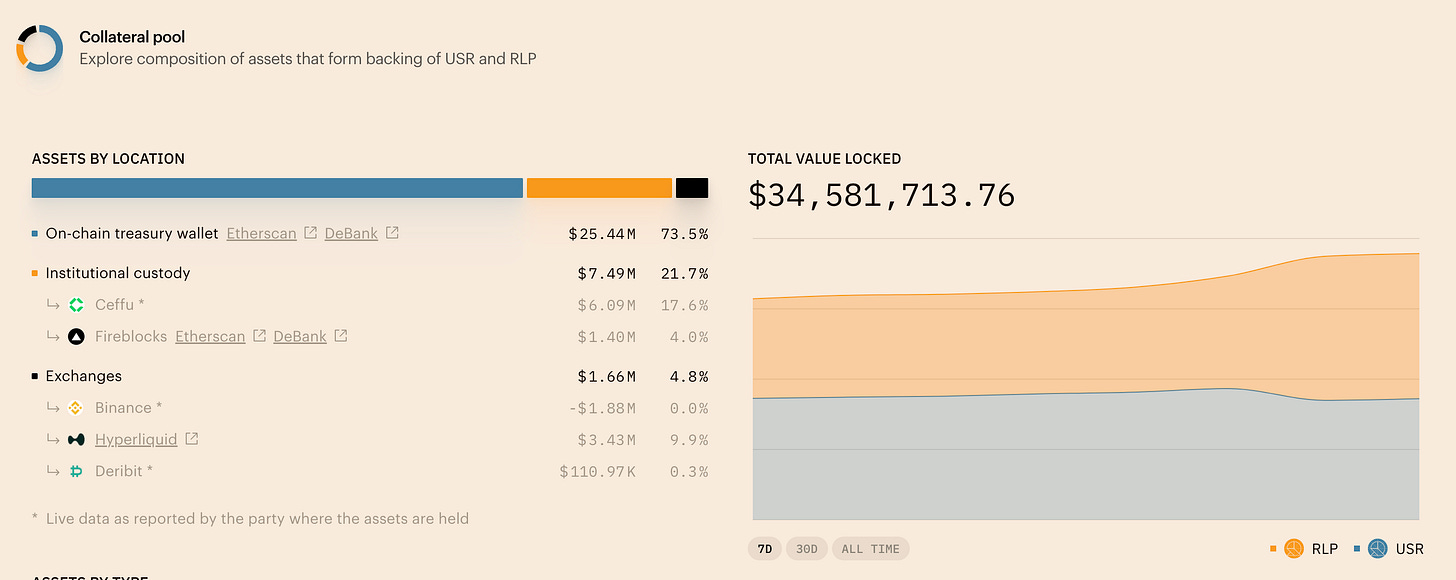

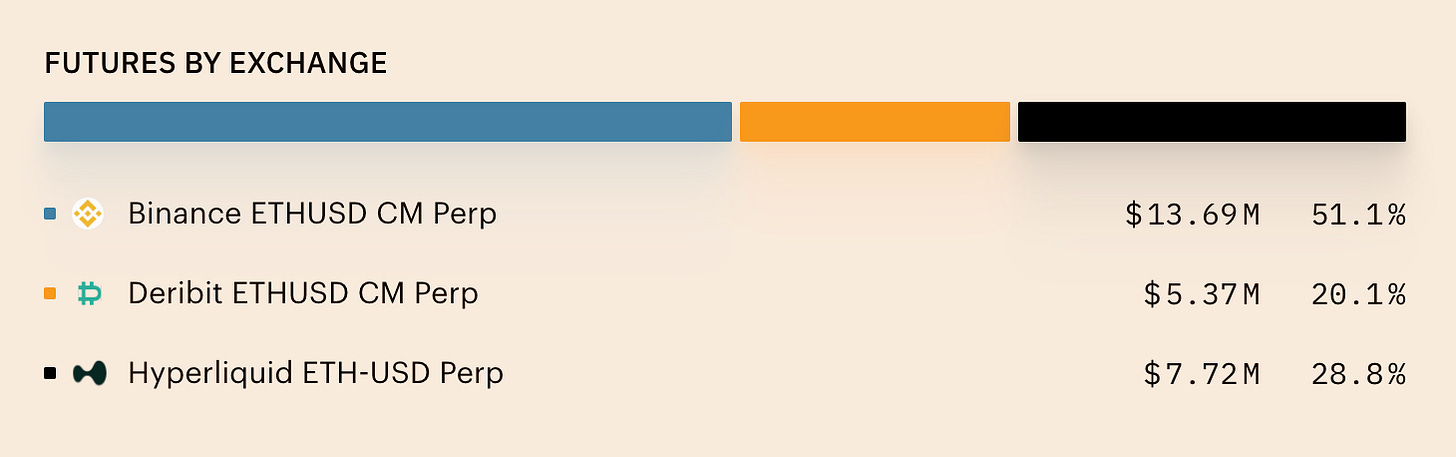

The TVLs of the collateral pools are listed below, and their respective asset distributions are also listed below.

This strategy has succeeded in creating a capital-efficient stablecoin, with USRs issued on a one-for-one basis, while most assets are managed on-chain with RLPs acting as an insurance layer for excess collateral.

The major risk is first of all the bankruptcy of the CEX, but the margin for futures positions is kept by a third-party custodian outside the exchange.The risk is also spread across several exchanges.

Additionally, if RLPs are rapidly withdrawn, the insurance layer of excess collateral will be lost.In case that happens, RLPs will not be able to be withdrawn if the USR collateral ratio falls below 110%.

Also, with such a high yield, fewer RLP holders will increase distributions, so logically, more people will participate for RLPs, and supply and demand will automatically adjust.

💧The Points Program is now in place

Resolv plans to issue its own token, RSLV.Details have not yet been disclosed, but it will be a governance token and will function as a decision-making authority regarding the rate of profit sharing and how the assets will be managed.

And prior to that, a points program is being implemented.

You can earn points through referrals of friends, holding USRs, stUSRs and RLPs, and providing liquidity.

A loyalty structure called Resolv Club was also announced.

This will be done by joining the community and contributing by responding to chats, AMAs, participating in group events, etc., and KOLs will get grants by tweeting on social networking sites.Details on this one are likely to be announced at a later date.

💬The era of Stablecoin 3.0 is upon us

The last one is a consideration.

I personally find projects to design such a currency very interesting.As was the case with the flat coin concept that I researched previously, the general framework seems to be to bifurcate (tranche) risky assets and stable assets, and stabilize them by collecting two tokens and two stakeholders.

Then, by offering a yield to each, the economics are built in such a way that supply and demand are automatically adjusted by incentives.

Of course, since it is a stablecoin, there is basically no room for one mistake.In the past, stablecoins that were said to be innovative have been de-pegged and collapsed.So I think these mechanisms will need to be followed continuously in the future, but I still feel that this is an interesting initiative.

There has been a recent increase in the number of on-chain but not over-collateralized Stablecoin 3.0-like projects like this USR.I feel that this trend is triggered by the fact that Ethena's USDe is becoming more successful, and I also feel that it has something to do with the fact that the volatility of crypto assets is decreasing as much as in the past.And it must also have something to do with the fact that there are more places to operate on-chain.

The soil is now in place to provide a mechanism for issuing stablecoins on a one-to-one basis with almost full on-chain and transparent asset management.Currently, USDC/USDT still dominates the market, but we do not know what this market share will look like in a few years.

However, I feel that stable coins with capital and brand power like USDC and USDT are more likely to become popular since the general public will also use them when they become popular in the future.I am wondering how much of web3's philosophy will be reflected in mass adoption.

Personally, I believe that this area of programmable money is exactly the realm of blockchain and will revolutionize society, but the mechanism is also complex, so I believe that it will take quite some time before it truly becomes a mainstream currency.I think the order of things is that it will continue to be used by people who like the idea or by some people as a high-yield asset for the next few years, where it will be tested to see if it is stable, and then somewhere along the line, the idea will spread.

I think I will touch on this a little myself!

This is the research for "Resolv".

🔗Reference/Image Citation:HP / DOC / BLOG / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.