【Rayls】Blockchain infrastructure designed specifically for the needs of banks and other financial institutions with The Blockchain for Banks / Permissionless L2 and Permissioned Network / @RaylsLabs

It is a platform on which banks and other financial institutions can build their own blockchains.

Good morning.

I am mitsui, a web3 researcher.

Today I researched "Rayls".

🏦What is Rayls?

⚙️ technical-architecture

🚩 Transition and Prospects

💬Finance and blockchain integration is moving forward.

🧵TL;DR

Rayls is a "blockchain for banks" that integrates private and public chains with EVM compatible mechanisms and natively incorporates KYC/AML and governance.

The "Enygma" protocol utilizes zero-knowledge proof and quasi-isomorphic cryptography to maintain confidentiality and allow selective disclosure to regulators, and also supports ERC-20 and NFT confidential transfers and exchanges.

Private Leisure supports over 10,000 TPS and millions of accounts, and also enables secure asset transfers to and from other chains and public environments, such as Atomic Teleport.

Developed by Parfin, founded in 2019, launching in 2024. The company is working with the Central Bank of Brazil's CBDC demonstration, JP Morgan's PoC, Núclea, Mastercard, and others to eventually integrate TradFi and DeFi to on-chain multi-trillion dollar liquidity.

🏦What is Rayls?

The "Rayls" are,Blockchain infrastructure designed specifically for the needs of banks and other financial institutions with "The Blockchain for BanksIt is.

Rayls is an EVM-compatible blockchain ecosystem that integrates private (permission-based) networks with public chains. The network natively incorporates privacy protections, governance controls, and regulatory compliance (KYC/AML) to enable financial institutions and their customers to utilize blockchain technology in a secure and compliant manner.

Below is a brief list of their characteristics.

Native regulatory compliance:The public chain on Rayls requires KY for all accounts, which overcomes the regulatory challenges (dusting attacks, illicit fund inflows, etc.) of traditional blockchains, which are highly anonymous.

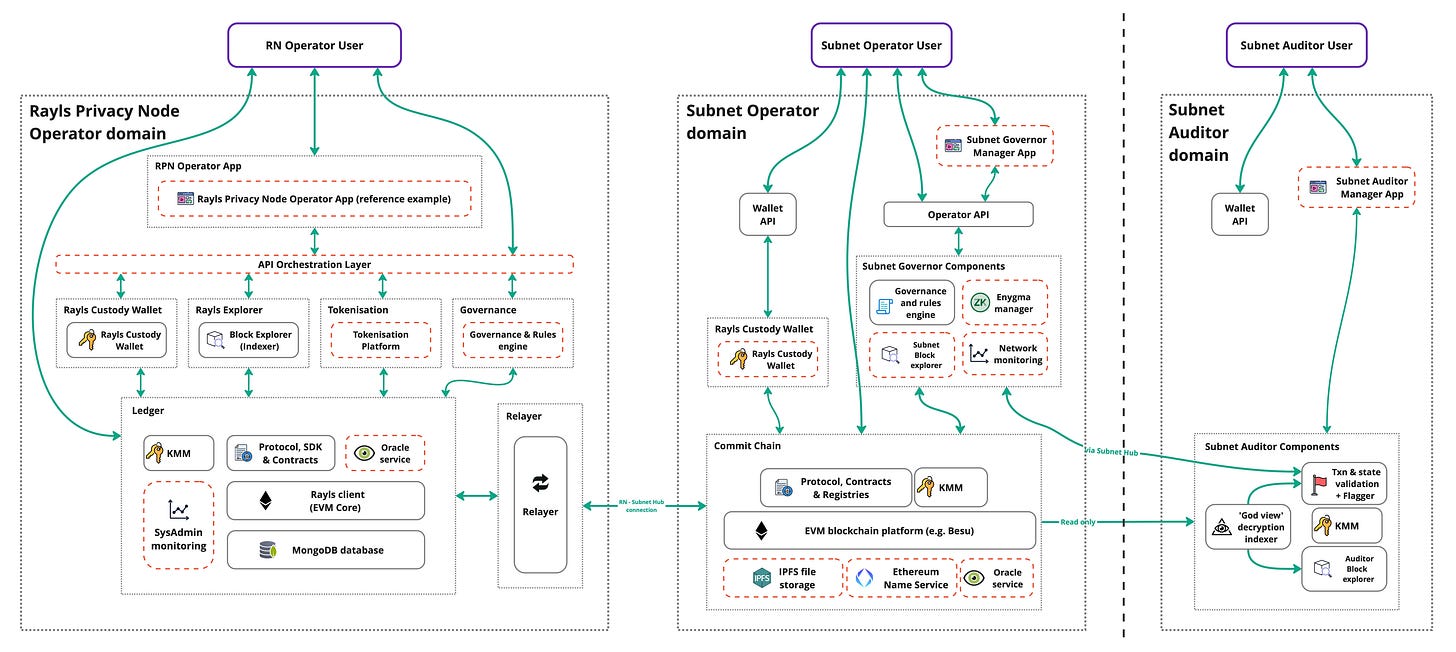

Privacy and data confidentiality:The advanced cryptographic protocol "Enygma", which combines Zero Knowledge Proof (ZK) and Semi-Homomorphic Cryptography (HE), is used to achieve "Selective Disclosure", which keeps the contents of on-chain transactions and party information secret, but allows disclosure and verification to authorized auditors. This enterprise-grade privacy feature enables Quantium to provide a quantum quantum of privacy. This enterprise-grade privacy feature protects sensitive data with quantum-computer resistant cryptography while still providing a mechanism that can be traced by regulators and internal auditors as needed. For example, it also provides features such as confidential transfer of ERC-20 tokens (encryption of address, balance, and amount) and confidential exchange between ERC-20/721/1155 (Atomic Swap), allowing for asset exchange with built-in compliance checks.

High throughput and scalabilityThe private ledger (Privacy Ledger) available to each participating financial institution has the capacity to handle more than 10,000 TPS and manage millions of accounts, and is flexible enough to be deployed in an on-premise environment.

Interoperability and network integrationThe system is designed with a modular architecture that allows for secure asset transfer and coordination between individual private networks or between private and public networks. In particular, a mechanism called the "Atomic Teleport protocol" allows simultaneous and consistent asset transfers between different chains, allowing participation in multiple markets and networks without compromising security or privacy.

Governance and Customizability:Governance controls are also natively provided, allowing network operators to distribute and manage approver nodes through Proof of Authority (PoA)-type consensus. This allows for custom governance rule settings and network policies to be applied to each institution, ensuring the flexibility of a consortium-type blockchain.

As described above, Rayls is unique in that it combines the requirements of financial institutions for "privacy," "compliance," "scalability," "interoperability," and "decentralization" in a single solution.

⚙️ technical-architecture

The following section describes the architecture in more detail.

Rayls' technology architecture is flexible enough to provide the benefits of permission-based blockchain for financial institutions while also connecting to the permissionless blockchain world as needed.

The following major components are present

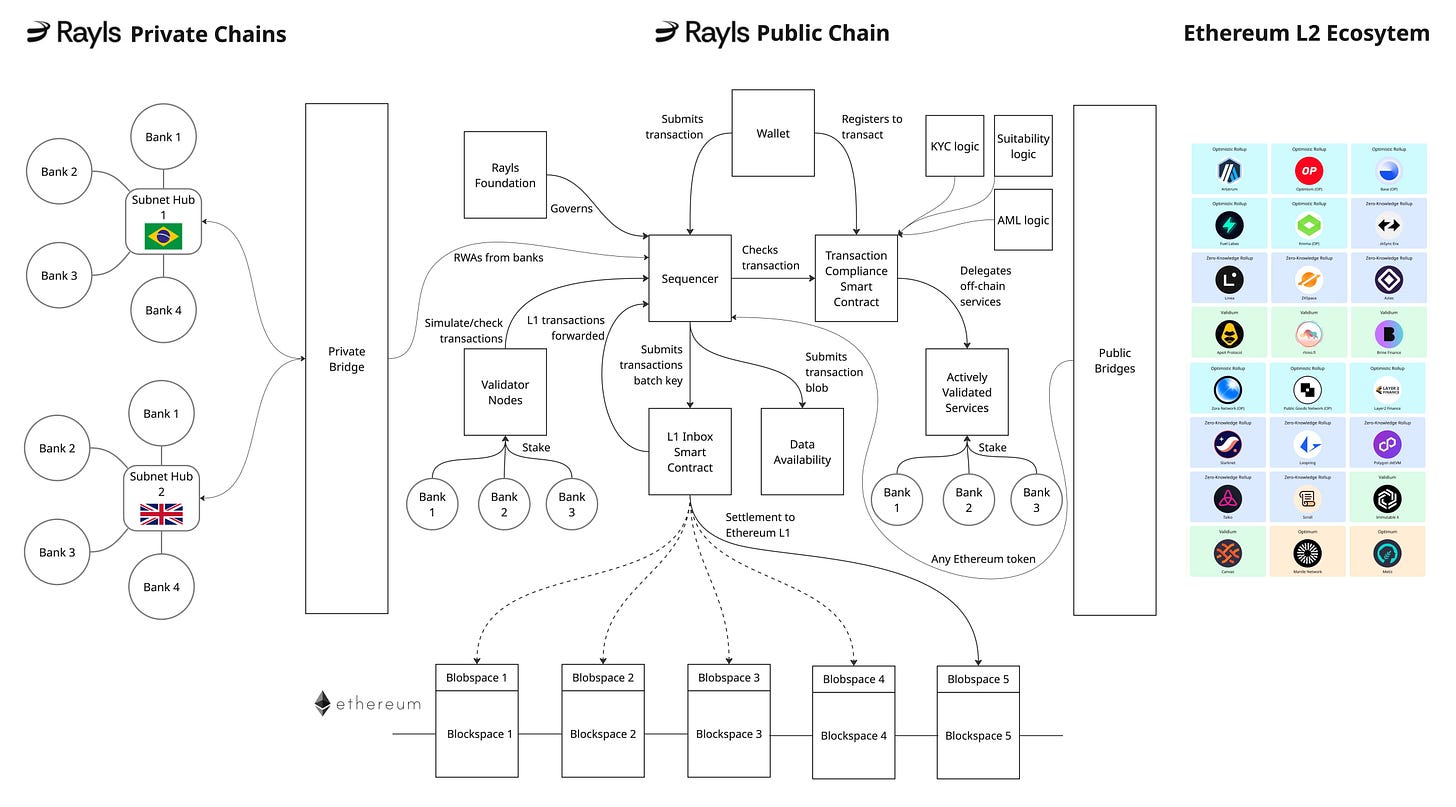

◼️Rayls Public Chain

in the Rayls ecosystempermissionlessblockchain, built on Ethereum's L2.EVM compatible chainIt is built utilizing Arbitrum Orbit.

Although it is a public chain, its "all accounts KYC'd" nature and the fact that all participants' identities are verified in advance make it easy for financial institutions to participate directly.

In the future, the $RAYLS utility token will be used to pay transaction fees and network services.

◼️Rayls Private Networks

A group of networks of permission-based EVM chains that can be built independently for each financial institution.

Each institution has its own privacy leisure (individual ledger), which can be located on-premise for completely private transaction processing.

This ledger supports high TPS and large account counts as mentioned above, and is fully compatible with Ethereum standard smart contracts and tokens. The exchange between multiple private ledgers is realized by a module called "Private Bridge", which allows quantum secure transaction relay with zero-knowledge proofs and quasi-isomorphic cryptography.

These mechanisms allow financial institutions to enjoy the benefits of both public and private chains.

🚩Transition and Outlook

Parfin, the company developing Rayls, was founded in 2019. The founders are individuals who have been deeply involved in both traditional finance and crypto assets.

CEO Marcos Viriato comes from a banking background and has been focusing on Bitcoin since early on, while CPTO Alex Buelau is a "Crypto OG" who has been involved in crypto assets since 2013. He is also active as a miner and investor, and leads the company's technology strategy.

At the time of its establishment, the company will be developing infrastructure for digital asset custody and financial institutions, and by 2024, it will be developing a bank-specific blockchain "RaylsThe company officially launched the "KDDI" website in the same year. That same year, the company raised a Series A round of funding of $10 million (ultimately in the $16 million range), laying the groundwork for global expansion. The financing was led by prominent investors including ParaFi Capital, Framework Ventures, and Núclea, Inc.

Rayls is already working with several financial institutions on demonstrations and collaborations. Typical examples include

Central Bank of Brazil (CBDC "Drex")

Adopted as the CBDC demonstration platform for privacy protection, a large-scale test was conducted with more than 16 commercial banks participating.Kinexys (formerly Onyx/JP Morgan) - Project EPIC

Participated in the demonstration of a privacy and digital identity solution for institutional tokenized transactions, which was highly praised by JP Morgan as "a solution that balances privacy and regulatory compliance."Núclea (Brazilian Financial Market Infrastructure)

Partnering with Núclea, the company behind the multi-trillion dollar per year payment network, Rayls technology was introduced into the Núclea Chain, a tokenization infrastructure. We are contributing to the digitization of commercial receivables and RWAs.B3 Digitas (Brazilian Stock Exchange subsidiary) and Banco BV

Rayls infrastructure is used for digital asset management and tokenization projects.NG.CASH (Fintech)

Jointly developed a crypto asset service platform for young adults.

In addition, it has been selected for Mastercard's Start Path program.

Nevertheless, Rayls' public chain is still in the test-net stage and will be released as the main net in the future. It is also stated that the chain will eventually be operated by DAOs after issuing its own tokens.

The ultimate goal is to connect TradFi and DeFi to bring billions of bank accounts and trillions of dollars of real asset liquidity on-chain, and we are working more closely with existing financial institutions to achieve this.

💬Finance and Blockchain Integration Moving Forward

The last part is a consideration of the summary.

I feel like I write the same thing every time in my discussions, but it seems that blockchain integration is accelerating these days, especially for existing finance.

But make no mistake, people in the crypto village are constantly exposed to blockchain, so they feel integrated with existing finance and in demonstrations, but there is still a time lag for ordinary users to come in contact with blockchain, understand it, and start using it naturally.

Nevertheless, as regulations are developed and banks and other existing financial institutions develop buttons for purchasing stablecoins and cryptos within their own services and depositing them into DeFi, I believe that the market will penetrate at a faster pace than imagined.

The ban on stablecoin is finally going to be lifted in Japan, but honestly, there are still many issues to be solved, and I personally still believe that if the smoothness of the on/off ramp is resolved, stablecoin payments and transfers will be available on a land line, which will speed up the spread. We will just have to wait and see here....

Although the discussion is a bit short, I have introduced this project because it is a very interesting and easy-to-understand use case, and demonstration experiments have already begun.

This is the research for "Rayls"!

🔗Reference Link:HP / DOC / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.