【Pye】A protocol that separates staking positions into PT and YT and tokenizes them / Validators provide time-locked staking products with predefined conditions / @pyefinance

Will staking operations become the equivalent of government bonds on-chain?

Good morning.

I’m Mitsui, a web3 researcher.

Today I researched “Pye”.

What is Pye?

Technical Configuration

Transition and Outlook

Will staking operations become the equivalent of government bonds on-chain?

TL;DR

Pye is a protocol that provides time-lock staking products designed with conditions set by validators, built on Solana’s native staking.

The key feature is that by separating and tokenizing staking positions into principal (PT) and yield (YT), they can be treated as tradable financial instruments with a maturity date.

This enables staking to evolve from a mere means of earning rewards into on-chain financial infrastructure with yield curves.

What is Pye?

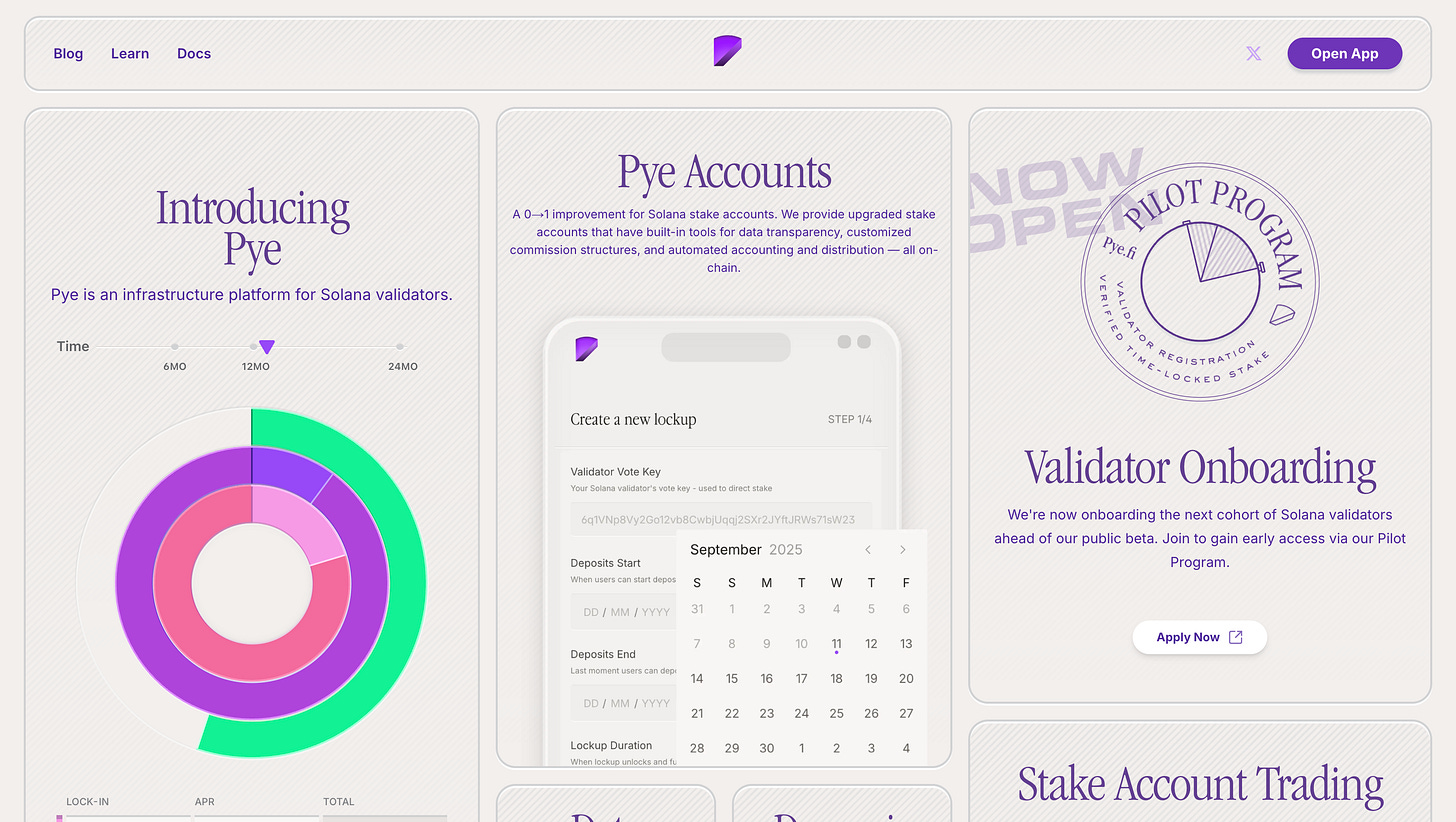

Pye is a startup providing next-generation staking infrastructure on Solana, building an on-chain trading marketplace for time-locked staking positions.

Currently, SOL staked on Solana is locked and illiquid while delegated to validators, and customizing conditions has been difficult. Pye addresses this issue, aiming to make staking more flexible and efficient.

Specifically, it provides a marketplace where validators issue staking products with commercial terms such as duration and reward distribution, and users (stakers) can choose preferred staking contracts based on yield, duration, and reward structure.

For example, staking contracts with conditions like “earn a high reward rate instead of staking for 12 months” are realized on-chain, providing stakers with planned yields and validators with stable assets under custody.

Additionally, stakers will be able to trade the principal and interest portions of their deposits separately as distinct tokens.

This is a yield-separated mechanism like Pendle, represented by Principal Tokens (PT) and Yield Tokens (YT).

In other words, staking—which was previously uniform—can now be customized for each validator by setting parameters, enabling its transformation into a financial product. This allows validators and stakers alike to operate with greater flexibility.

In fact, Pye’s mission is to “upgrade Solana’s PoS staking layer and create a new market that benefits both validators and stakers.”

Solana’s staking assets, valued at tens of billions of dollars, are currently mostly locked and illiquid. Pye transforms them into transferable and tradable assets, making it easier for validators to raise funds and acquire stakes, while giving stakers liquidity and choice.

Technical Composition

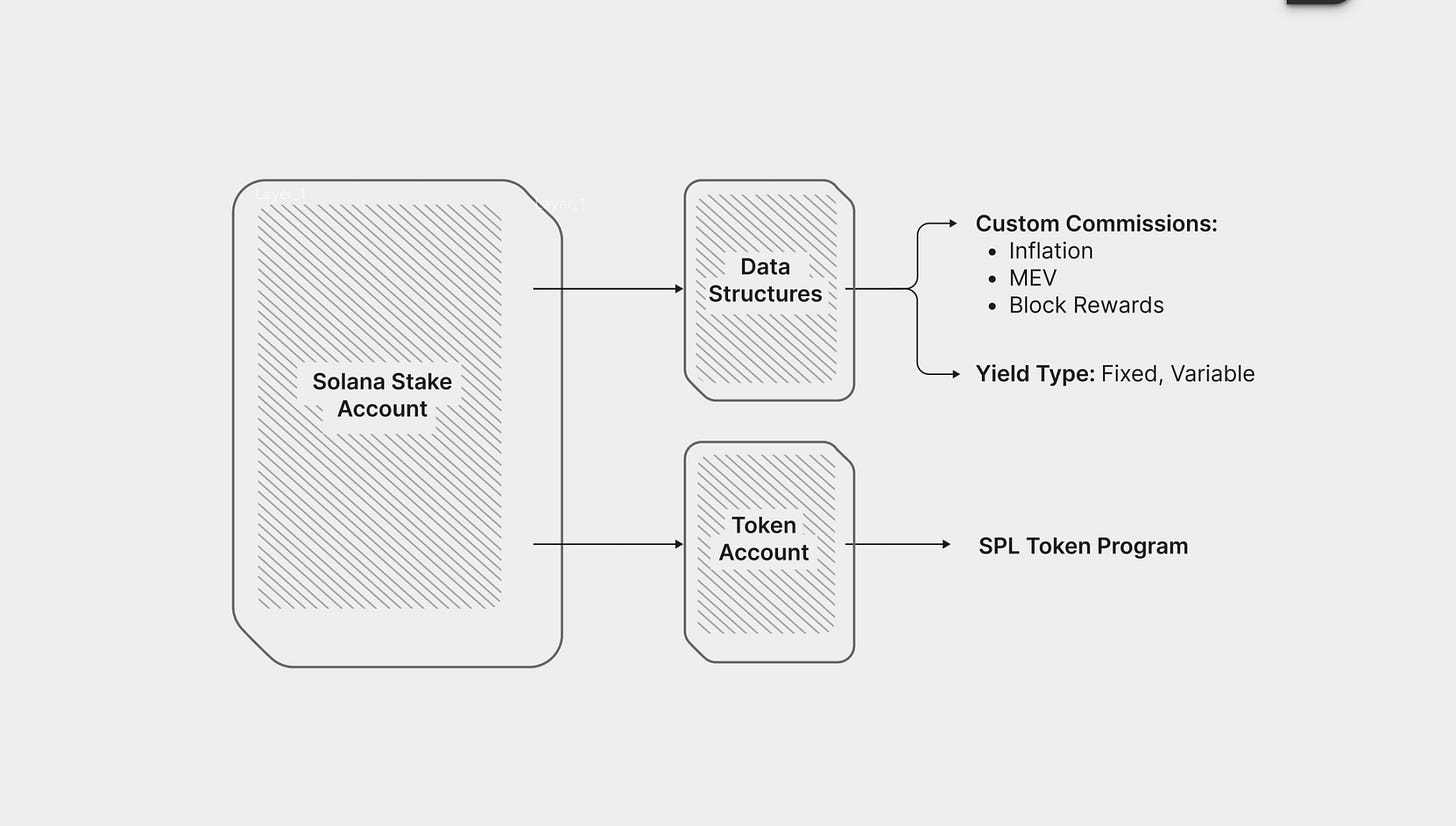

Pye’s staking mechanism is based on a new system called the “Pye account,” which adds additional logic to Solana’s native stake account.

However, Pye accounts are designed to extend Solana’s native staking functionality, and their fundamental security and efficiency are equivalent to Solana’s native staking.

Pye’s unique “Date Structures” and “Token Account” are built in association with the native staking account.

◼️Date Structures

Each Stake Account is uniquely linked to Pye’s proprietary metadata account.

This design enables the definition of the following three points:

①Custom Commissions

Inflation

MEV

Block Rewards

Regarding each:

What percentage to stakers

What percentage to the validator

or fixed amount or capped

We explicitly define such distribution rules. In other words, we can set the contractual terms themselves, specifying “the cash flow generated by this Stake Account will be distributed in this manner.”

②Yield Type

Variable

Similar to regular staking

Linked to actual network rewards

Fixed

The validator declares “guarantees X% per year.”

If actual compensation is insufficient, self-reimbursement

Regarding the so-called compensation structure, Pye offers two types: variable-rate and fixed-rate.

Like many traditional staking models, the basic approach involves variable yields based on the network’s inflation rate and validator fee income. However, Pye also enables validators to issue products with fixed interest rates.

For example, if a validator promises to pay a fixed annual interest rate of 10%, when a staker deposits 100 SOL, the validator will make an additional payment of 0.054 SOL (equivalent to 10% annual interest) per epoch, adjusting to ensure a total annual return of 10%.

In this fixed-yield model, stakers receive a consistent return regardless of fluctuations in the network’s actual yield, while validators bear the obligation to cover any shortfall themselves. Conversely, in the variable-yield model, validators only share a predetermined percentage of the network’s rewards, meaning staker yields fluctuate based on market conditions.

Pye caters to both types of stakers by offering them as options: those prioritizing stability and those seeking network-linked returns.

③Time Lock / Maturity

Lock period (e.g., 6 months / 12 months)

Maturity

These three points enable the definition of additional data for native staking accounts, making it possible to financialize staking.

◼️Token Account

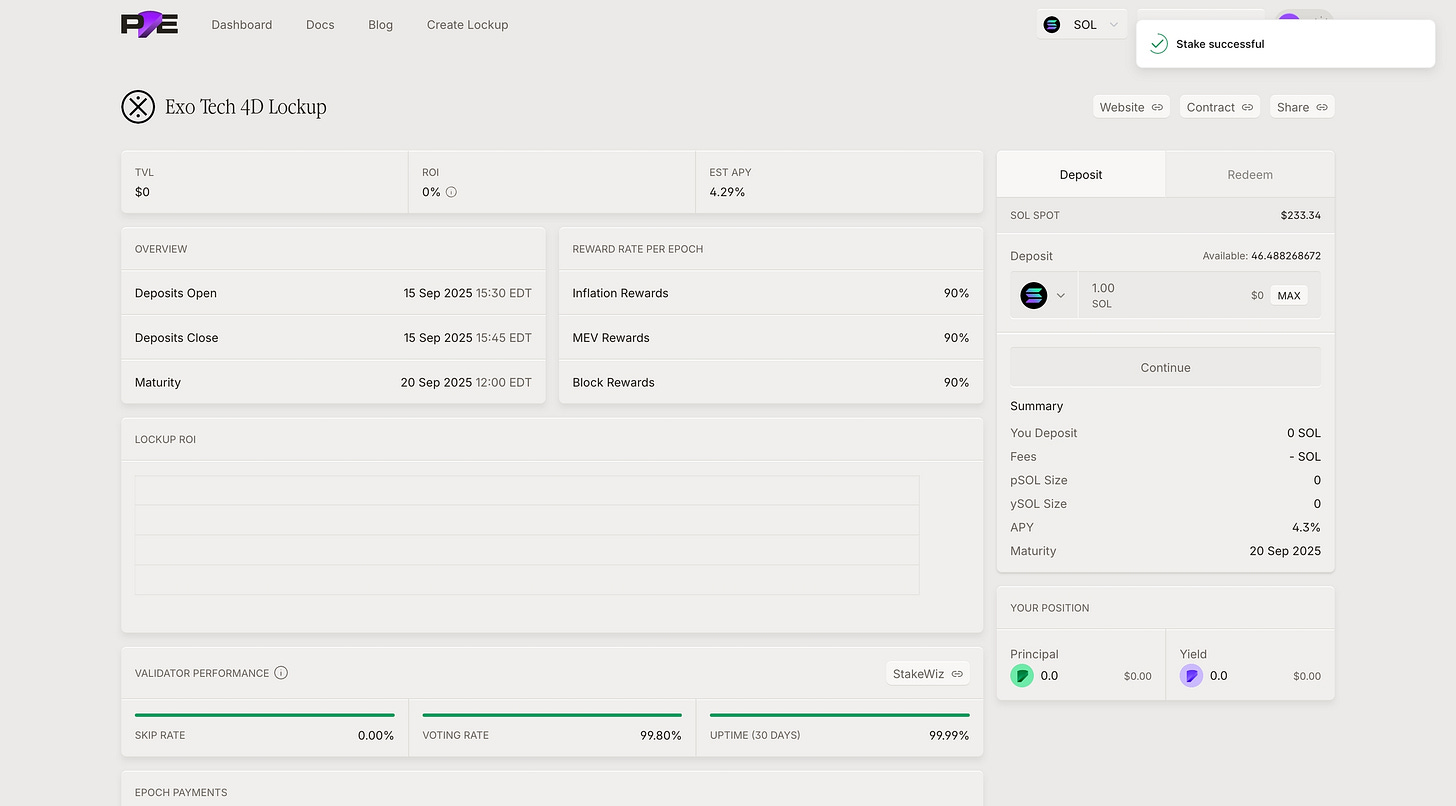

The product defined by the Stake Account and Data Structure (an on-chain contract) is represented as a divisible SPL Token.

As mentioned above, it is fundamentally divided into two parts: PT, which represents the principal, and YT, which represents the yield portion.

PT (Main Token)

Representing a principal amount of 100 SOL

Exchange for 100 SOL at maturity

YT(Yield Token)

The right to receive the yield generated during that period

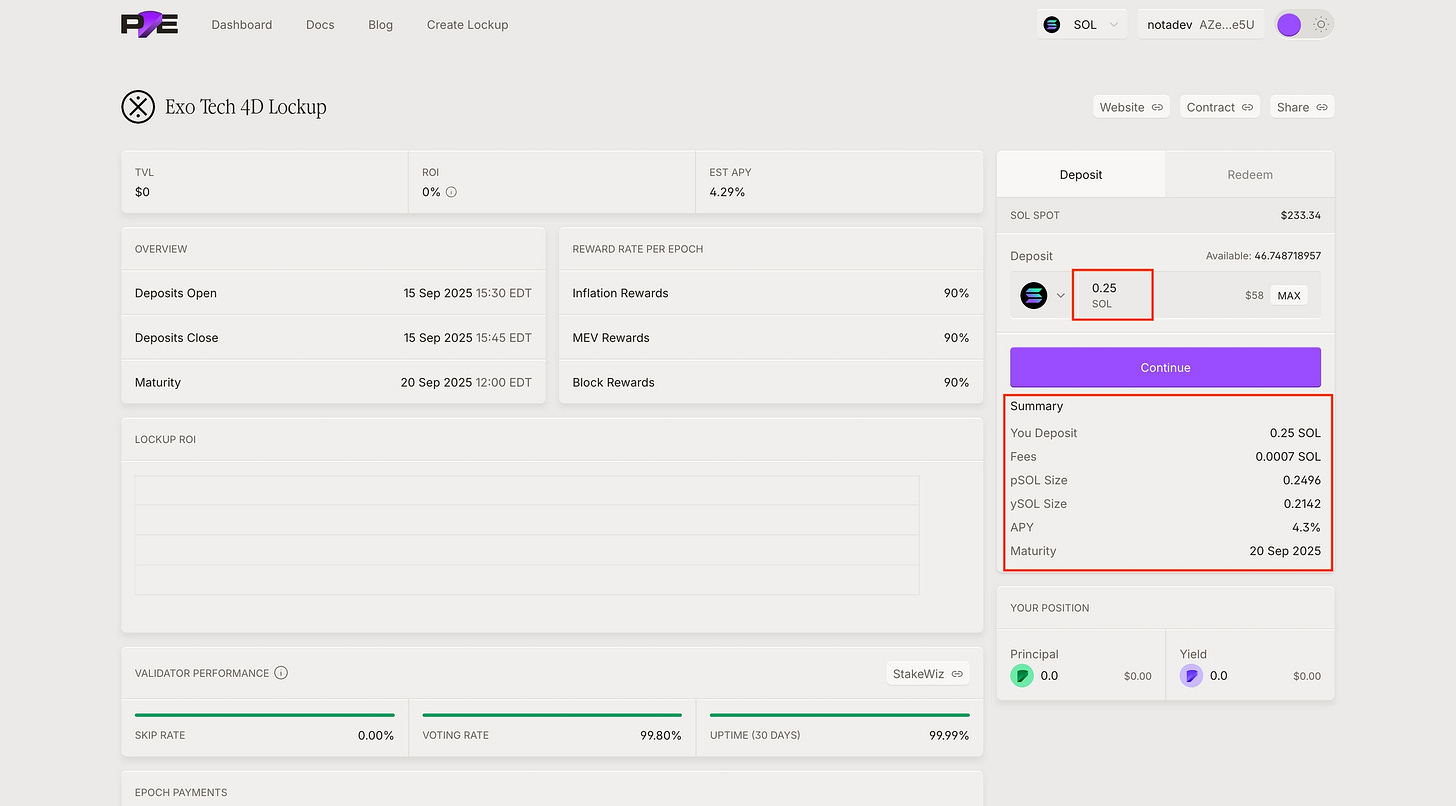

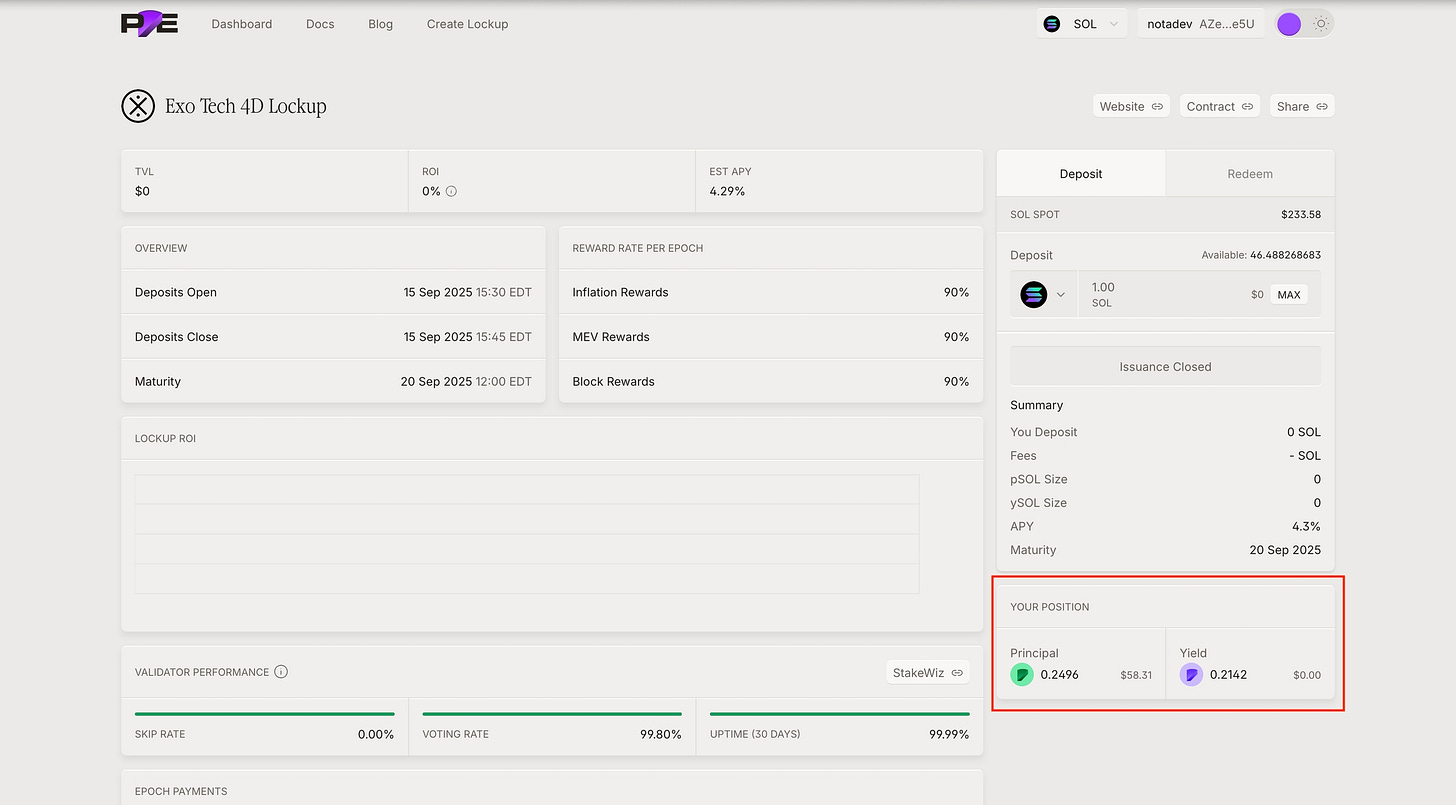

When users deposit SOL, the corresponding amount of PT and YT will be issued.

PT is an SPL token representing locked principal SOL, exchangeable for 1 SOL per PT upon maturity. YT is also an SPL token representing the total rewards generated by that PT until maturity. At maturity, 1 YT is exchangeable for all rewards generated by 1 PT, meaning PT and YT are issued as a pair representing 100% rights.

For example, if Alice deposits 100 SOL into a Pye product to stake from September to November 2025 (for 3 months), she will receive two types of tokens: “100PT-SEP25-NOV25” and “100YT-SEP25-NOV25”.

Alice can redeem 100 PT for 100 SOL at maturity (November 2025), and simultaneously exchange 100 YT for the actual SOL rewards earned over those three months. If Alice sells her YT during the term, someone else inherits the right to receive those rewards, allowing Alice to capture future interest in advance.

Both PT and YT tokens are issued under Solana’s SPL token standard, enabling seamless integration with DeFi protocols on Solana.

For example, it is technically possible to trade on an AMM, use it as collateral in a lending protocol, or incorporate it into other derivative strategies.

In particular, YT tokens represent the future yield itself, so like Pendle, they are expected to be usable for futures-like price discovery of yields. On the other hand, PT tokens have separate liquidity pools for each maturity, potentially forming yield curves in the market similar to long-term and short-term government bonds.

◼️Staker Usage Flow

The above described the protocol architecture. Next, we’ll examine the usage flow from the staker’s perspective and what’s happening behind the scenes.

Users stake their Solana cryptocurrency SOL by depositing it with a specific validator. Behind the scenes, the following processes occur in the Pye account:

Creating a stake account:A new stake account is generated and delegated to the specified validator.

Time Lock Application:A lock preventing withdrawals for a set period is applied to the staking account. Users cannot unstake until the contracted maturity date, but in return receive preferential treatment from validators, such as increased reward rates.

Reward Distribution Logic Configuration:Stake accounts with time locks incorporate data specifying the distribution ratio of staking rewards during that period (the split between validators and stakers). This enables different reward conditions for each Pye account (e.g., what percentage of rewards the validator returns to the staker).

Tokenization:Furthermore, locked stake positions are split and issued as two distinct tokens. One is the Principal Token (PT), representing the deposited SOL principal and redeemable 1:1 for SOL at maturity. The other is the Yield Token (YT), representing the right to receive the rewards generated by the principal during the staking period. When staking SOL on Pye, both PT and YT are issued, and users can hold and trade each separately.

User returns are derived from the standard network rewards earned through staking (inflation rewards + validator block generation rewards + MEV profits, etc.), distributed according to the promised allocation ratio by the validator.

In Pye’s mechanism, validators can choose to reduce their own rewards and add that portion to stakers’ rewards, thereby increasing the stakers’ yield.

Transition and Outlook

The Pye development team is comprised of experienced professionals from the blockchain industry.

Erik Ashdown, co-founder and CEO, has a background in web3 business development, including serving as Director of Ecosystem at blockchain infrastructure company Covalent in 2020.

Alberto Cevallos, the other co-founder and CTO, is an engineer who has worked as an Ethereum developer and researcher from 2017 to the present. He also contributed to the co-founding of BadgerDAO in the DeFi space. Alberto is well-versed in token economy design, having designed the token economic model for the travel platform Travala.com in 2018. He has also authored numerous blockchain-related technical articles for platforms like Medium and HackerNoon, making him a developer who combines technical expertise with strong communication skills.

In this way, two experts—one in business and one in technology—are at the core, driving the project forward.

Additionally, Pye is a project that emerged from the Solana Incubator, an incubation program under Solana Labs. It received support from the Solana Foundation during its early development and has a track record of winning an award in the DeFi category at the Colosseum hackathon held within the Solana ecosystem.

In terms of funding, we completed a $5 million seed funding round in December 2025.

This round is led by Variant Fund and Coinbase Ventures, with participation from several prominent companies and funds including Solana Labs, Nascent, and Gemini. Among individual investors, notable industry figures such as Solana co-founder Anatoly Yakovenko and LayerZero Labs co-founder Bryan Pellegrino are also listed as backers.

Additionally, major staking platforms like Everstake and Klin are participating in the round, and partnerships on the validator side are also progressing.

Variant’s investment announcement expressed high expectations, stating, “Pye has the potential to become an essential yield infrastructure for Solana.”

Regarding the roadmap, prototype development and a closed alpha test are scheduled for 2025. Following subsequent funding rounds, a private beta version is planned for launch in the first quarter of 2026.

According to co-founder Erik, the protocol was validated through a closed alpha operation with limited participants in the first half of 2025, and adjustments to its core functionality were completed.

Following the funding round, we plan to expand our development team and refine our product. We will launch an invitation-only private beta in Q1 2026 and gradually increase the number of supported validators and staking products.

As of the end of 2025, no information has been disclosed regarding proprietary tokens.

Will staking operations become the equivalent of government bonds on-chain?

Finally, we conclude with a summary and analysis.

This is a very interesting project. I believe Pendle is the most successful project in separating principal and yield, and this is essentially its staking version.

Until now, the financial productization of staking—such as yield separation, time locks, and condition setting—faced technical challenges and regulatory uncertainties. Consequently, DeFi solutions around staking were limited to options like LT.

Therefore, I feel that the solution proposed by Pye will be highly groundbreaking and significant. This isn’t merely about tokenizing staking rewards to please traders; personally, I believe it holds greater significance.

First, staking rewards will decrease going forward. Strictly speaking, the amount of tokens issued will decrease, so if the token price rises sufficiently to offset this, the absolute amount of rewards will not decrease. However, as the chain stabilizes, the inflation rate of staking rewards will certainly decrease. This happens not only on Solana but on every chain.

However, even in that case, staking must still be performed, and the number of validators cannot be reduced. This is because this mechanism is precisely what guarantees the decentralization of the blockchain.

Therefore, I believe mechanisms like Pye that tokenize staking rewards into financial products will be crucial for validators and stakers in the era of deflationary staking rewards. This is because there is room for optimization in how these rewards are managed, allowing for improved efficiency through effort.

Also, while I briefly mentioned it in the PT explanation, I believe the following possibility is quite significant.

On the other hand, since PTs distribute liquidity across separate tokens for each maturity, a yield curve may form in the market, similar to long-term and short-term government bonds.

It’s unclear how the protocol will perform until it’s put to work, but for example, instruments like 10-year SOL-PT, 3-year SOL-PT, or 1-month SOL-PT could exist. These might function as stable investment assets, similar to government bonds on the on-chain board. They wouldn’t offer explosive yields, but they would provide liquidity and ensure safe, reliable investment.

If staking rewards are allocated to that position, the absolute amount of staking will not decrease; rather, it will continue to be managed as a stable asset, thereby ensuring the blockchain’s security remains intact.

Therefore, I personally believe that Pye’s mechanism has the potential to occupy a highly significant position within the mid-to-long-term blockchain ecosystem. That’s precisely why Solana Labs and its founders are investing in it.

However, I’d like to see how it actually works after the official release first!

That concludes our research on “Pye”!

Reference Links:HP / DOC / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.