【Printr】Chain Abstraction Token Marketplace for launching and trading cross-chain / Built Liquid Bonding Curve / Raised $2.5M in pre-seed round / @printrgobrrrr

Will be the Next Pump.fun!Allows users to activate, discover and trade tokens without permission on any blockchain.

Good morning.

Mitsui from web3 researcher.

Today I researched "Printr.

🔵What is Printr?

⚙️ Features

🚩Change and Outlook

💬2025 enters the era of cross-chain

🔵What is Printr?

Printr is the first chain-abstracted token marketplace that allows users to launch, discover, and trade tokens on any blockchain without permission, consolidating fragmented liquidity and communities.

In today's crypto asset market, new tokens are created daily, most of which are meme coins.40,000-50,000 new meme coins are created every day, with Solana accounting for about half of the market.However, token issuance is also active on other chains such as Base and Ethereum, and as more sophisticated blockchains such as Hyperliquid, Berachain, Monad, and MegaETH appear in the future, liquidity and community fragmentation will accelerate.

When tokens are issued on a single chain, opportunities for both token issuers and users are greatly limited.The chain ecosystem is closed, so selecting any one chain will reduce the opportunity for access to another chain user.

Users also do not want to access the different platforms of each blockchain in order to discover and trade tokens.(For example, Base users need to be able to find and trade Solana tokens with a single click.)

Printr is a platform that solves these problems.

Printr" builds a chain-independent binding curve that allows users to buy and sell any token on any chain.

⚙️ features

Now let's look at the detailed mechanism.

Liquid Bonding Curve (LBC)

Unlike the usual bonding curve, we have constructed a mechanism called LBC.

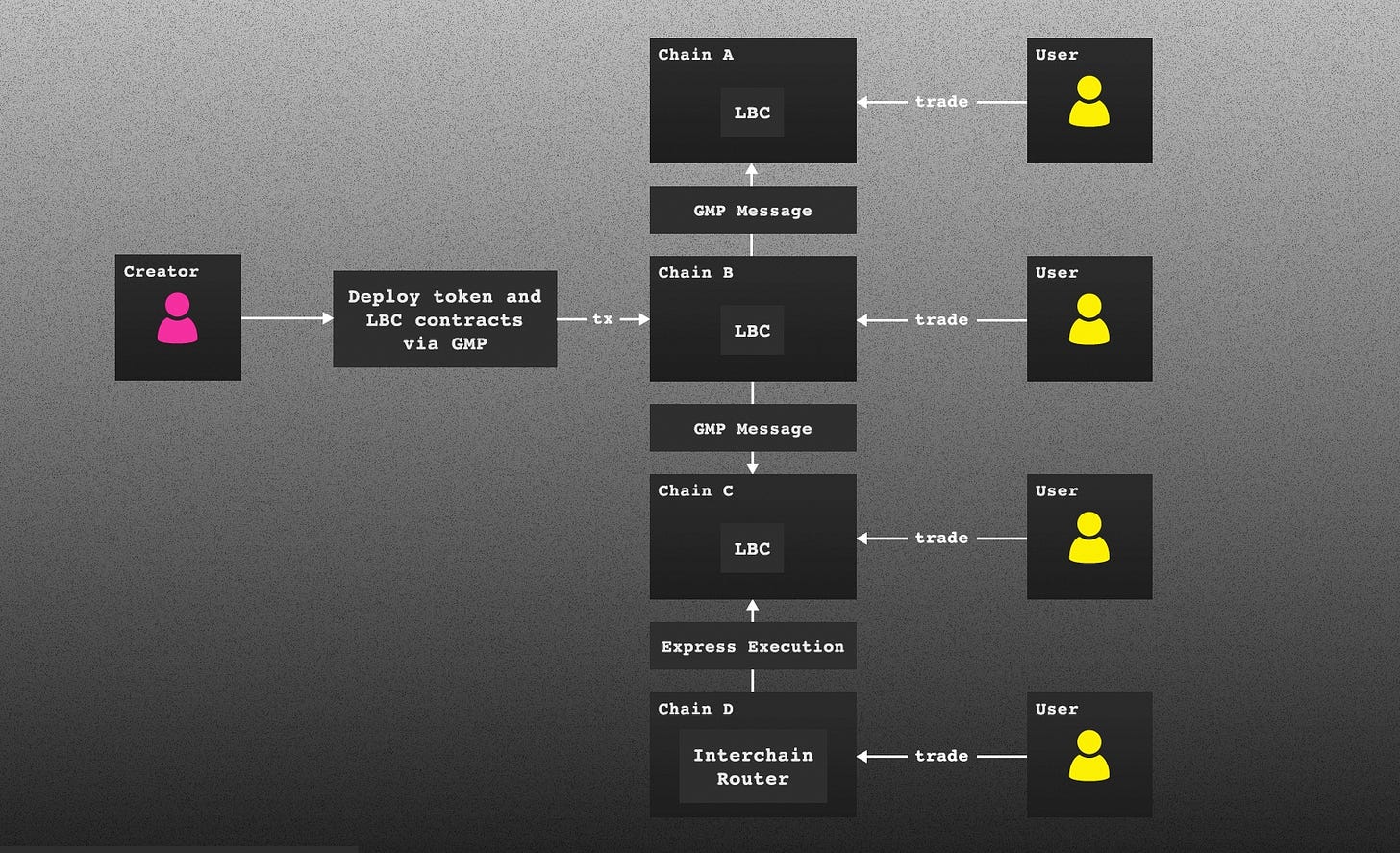

The token issuance flow is as follows

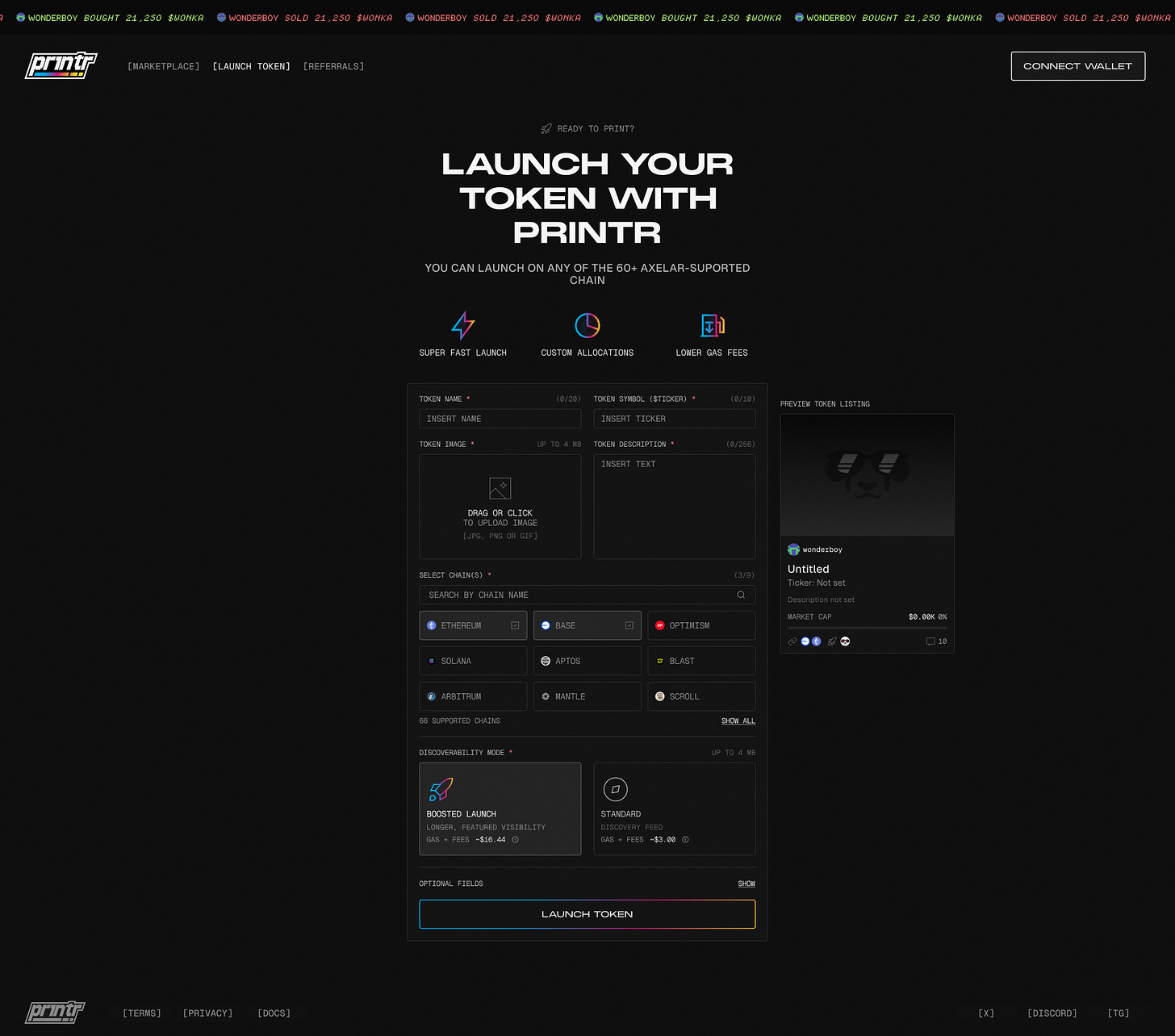

The creator selects the name, other details, and which single or cross-chain the token and liquidity will be deployed to.

When the creator signs the transaction, the token and Liquid Bonding Curve (LBC) are deployed on the selected chain.

Users buy and sell tokens on the bonding curve.

Users on other chains can purchase any token in a single transaction via cross-chain swapping by Squid Router

Swapping and bridging are relayed instantly, so funds are received within 20 seconds

Once the market capitalization reaches the set threshold, the liquidity from the bonding curve is equally distributed to the chains selected by the creator or sent to the creator as raised capital.

Liquidity from the bonding curve is sent to the main DEX of each selected chain.

After listing on the DEX, users on other chains can seamlessly buy and sell in a single transaction via a cross-chain swap.

During the post-launch sale, the following screen shows the progress of the bonding curve for each chain and the overall progress.

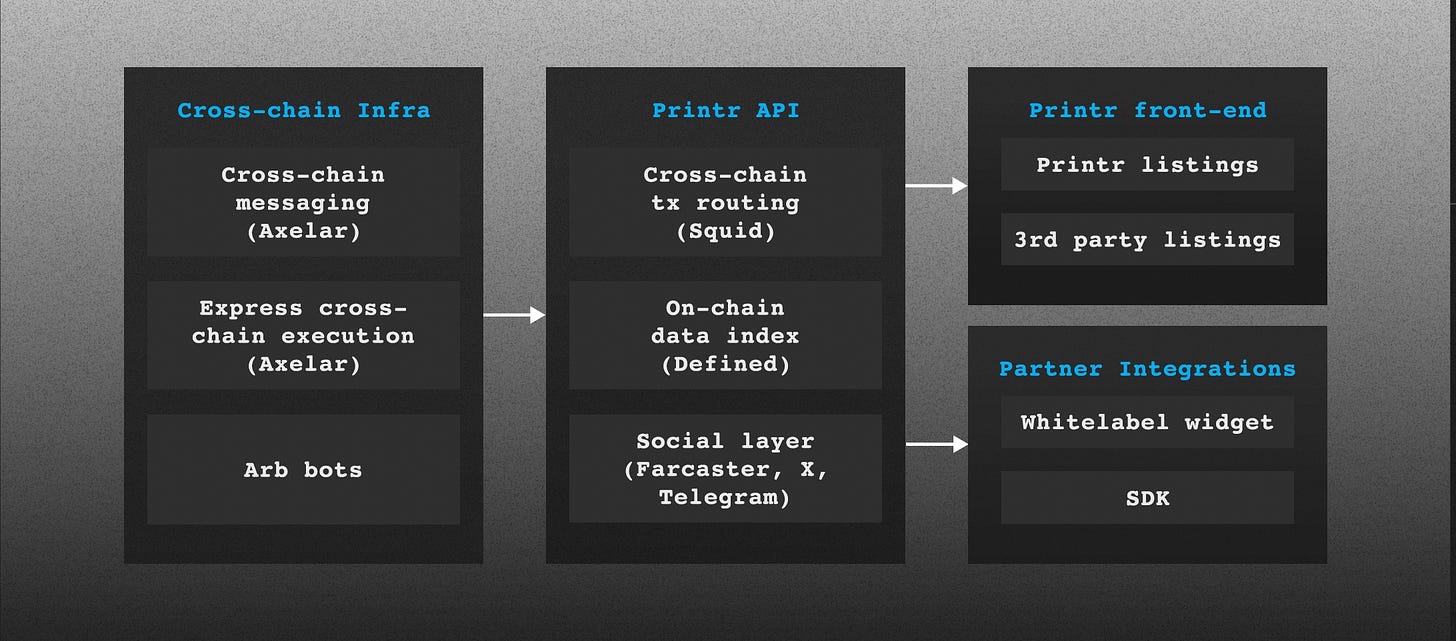

Technology Stack

For cross-chaining, we use a project called Axelar, which provides secure cross-chain communication for web3 and allows us to build Interchain dApps that grow beyond a single chain.

They allow for cross-chain token launches and token purchases from non-launched chains.

Option Launch

One of the main features of this method is that bonding curves can be set in detail.Specifically, the following items can be freely set

Size of the combined curve: [enter threshold for market capitalization per chain ($)].

Start Time: [Determine the time to start trading].

Maximum Purchase Amount: [limit the maximum amount an investor can purchase].

Development Token Staking: [lock development tokens for a specific amount of time in exchange for a percentage of the transaction proceeds].

Early Sale Tax: [can apply a sale penalty to anyone who decides to sell within the join curve].

No Sale Token: [Allows blocking of sales by buyers on the join curve for 24 hours].

Token Detection Features

King of the Hill: When a token reaches a certain market capitalization, it takes its current King of the Hill position and appears in the spotlight.This usually attracts new buyers.

Paid Boost: Creators can pay a fee to display their tokens in a spot of interest for a certain amount of time to increase their visibility.

In addition, to allow different types of projects to raise funds in their own structures, the bonding curve can be structured according to initial market capitalization, market capitalization thresholds, and the percentage of raised capital distributed to teams and DEXs.For example, a team that already has a product may want to raise funds at a larger valuation than a meme coin that bootstraps tokens from scratch.

In such cases, the following settings can be made

Initial Market Capitalization: The token price is set based on the total token supply and the desired initial market capitalization.For example, if the initial market capitalization is $3,000,000 and the number of tokens is 69,000,000, the initial price will be set at $0.0435.

Market capitalization threshold: Once the market capitalization reaches the threshold, liquidity is distributed to the team and sent to the decentralized exchange.

Capital Raised: Percentage of the combined curve sent to the creator as capital raised.

DEX Liquidity: percentage of the bonding curve locked in the AMM for immediate liquidity.

The point is that in a normal bonding curve the market capitalization logic is fixed first, and all funds purchased by the user are deposited in the DEX; Printr can be used to fund the team by allowing this to be configured.

Aggregation Marketplace

Just as Blur aggregated the NFTs of Oppensea, we will aggregate other token creation platforms into Printr's one-stop marketplace.This will make it easy for users to find and trade tokens for any asset on any chain.

Reputation System and Social Integration

To prevent malicious individuals from issuing and selling out tokens, accounts can be linked to X-Farcaster and others.Token issuers will also be given 1-3 stars based on past performance.A star will be awarded if they have previously launched a token that has reached a specific market capitalization and volume threshold.

White Label Widgets and SDKs

We are building a plug-and-play widget/SDK that can be quickly rebranded and integrated into existing application user interfaces.

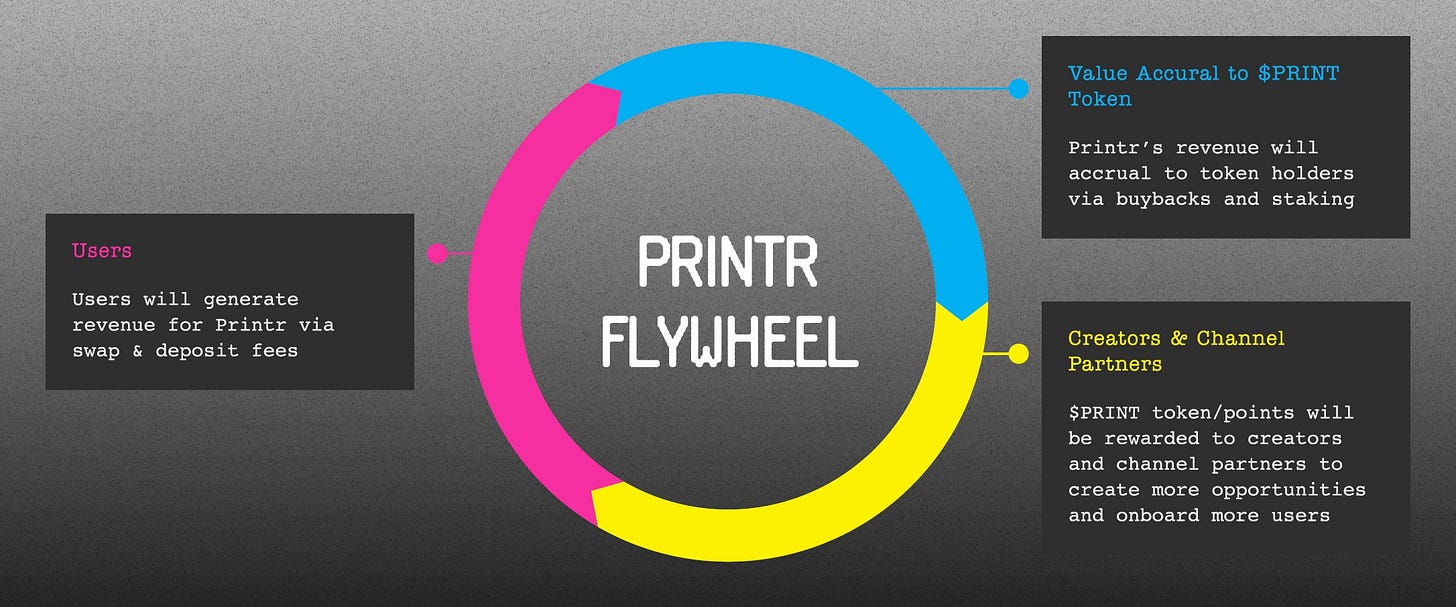

Commission

The following fees will be charged

Swap Fee: 0.5% swap fee charged to users who buy or sell tokens.

Deposit Fee: 2.5% of the value of the bonding curve is charged to cover pool setup, LP burn, and service fees.This fee is charged when the bonding curve is completed and deposited into the decentralized exchange.

Advertising: Printr earns commissions from targeted advertising and from highlighting and boosting meme coins on the platform.

🚩Transition and Outlook

Printr" is currently open to a waiting list, with 210,000 people already registered.

In addition, a pre-seed round of $2.5M was raised in January 2025.

The upcoming V1 launch (cross-chain deployment and points program) is scheduled for 1Q2025.

A points program is a program that awards additional points for trading or creating tokens on the platform.It has been suggested that it will be changed to tokens in the future, but the token economics are still unknown.

However, it was noted that in the future, locking in $PRINT tokens will allow you to receive a partial share of the transaction fee.

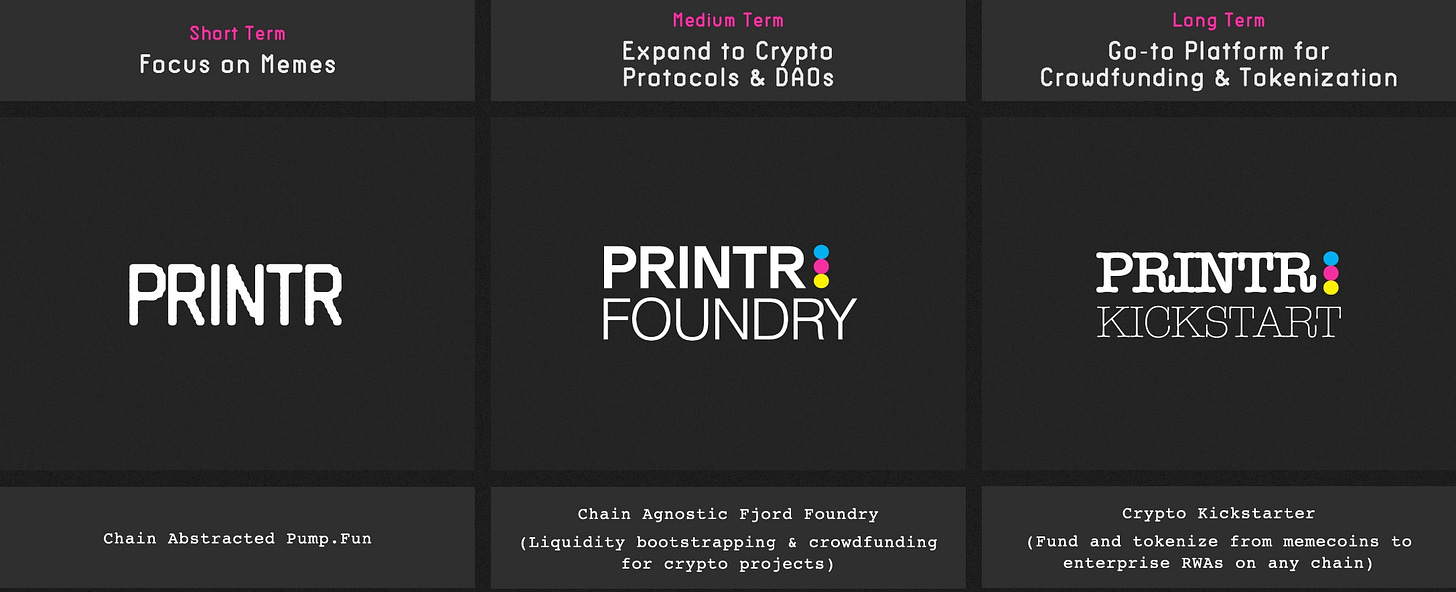

And while the initial focus is on meme coins, the mid- to long-term goal is to get to a point where they can be used for other protocols, DAOs, and eventually for token issuance by Web2 companies.For example, they envision a crypto version of a crowdfunding platform like Kickstarter.

💬2025 will enter the era of cross-chain

The final section is a discussion.

This is a very interesting project, and I felt that it could solve a problem that has existed in the past despite the demand.

The NFT industry is also not cross-chain, but there is a history of Blur gaining market share as an NFT aggregator while utilizing tokens after OpenSea was the dominant player, so the token launchpad may also be a pump[...].fun to gain market share all at once may be possible.

From a macro perspective, there is no doubt that the user experience will continue to improve, and the liquidity problem between blockchains will be solved.In the near future, we should be able to buy and sell tokens freely on all the chains, without being so concerned about "which chain issues the tokens".

We do not know the time frame, but it is certain that this future will come, and the winner in that future will either be the existing champion, Pump[...] Fun, or the upstart, Printr.fun or an emerging platform like Printr?

I think Printr is quite aware of taking market share from the competition, since the document says that they aim to be the No. 1 token launchpad and their strategy is to start with meme coins and also do the vampire attack.

However, Pump[.].fun already has a huge user and funding base and has not yet launched its tokens, so we do not know what will happen.

At any rate, I feel that in 2025 we will finally begin to enter the era of cross-chain abstraction, token abstraction, etc.Things that have been discussed for a long time are finally starting to appear as touchable products.

I am looking forward to the release of Printr.

This is my research on Printr!

🔗Reference/image credit: HP / DOC / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.