【Pichi Finance】First trustless marketplace to buy and sell points before TGE / Trading Wallet NFT using ERC-6551 / Raised $2.5M in seed round / @PichiFinance

Crypto world getting even more layered with points trading.

Good morning.

Mitsui from web3 researcher.

Today we researched Pichi Finance.

🍑What is Pichi Finance?

🪜Transition and Outlook

💬Combined with forecasting market,prices are formed?

🍑What is Pichi Finance?

Pichi Finance is the first trustless marketplace for buying and selling points before TGE.Currently, it is dedicated to the re-staking context and allows trading of airdrop points from EigenLayer, Renzo, Pendle, and others.

Currently, the mainstream practice is to give points before airdrop, but these points are stored off-chain and linked to a wallet (EOA), making it impossible to buy or sell before TGE.(Strictly speaking, you can buy and sell each wallet, but to do so, you have to give your private key after you get paid, which is not a stressful process).

Pichi Finance" solves this problem.

The solution is simple: create a wallet that accumulates points in NFTs utilizing ERC-6551.

ERC-6551 is a standard launched in ethereum in May 2023 that allows NFTs to be wallets.Walletized NFTs are called Token Bound Accounts (TBAs), and FTs and NFTs can be stored within NFTs.

By utilizing this ERC-6551 to create a wallet with NFTs and accumulate points there, it would be possible to buy and sell points by buying and selling NFTs.

This mechanism makes it possible to buy and sell points (or more precisely, a wallet NFT containing points) in trustless.

🪜Transition and Prospects

The "Pichi Finance" was founded in February 2024 by Wesley Tang, David Zhu, and Eric Zhu, who have over 10 years of experience in GameFi, development, and marketing at web2 and web3.

The company was originally named Michi Finance, but changed its name midway through the year to its current name, Pichi Finance.

The company is also an ETHDenver 2024 finalist in the DeFi, NFT, and gaming categories, and is suddenly in the spotlight. in July 2024, the company announced the completion of a US$2.5 millionannounced the completion of a US$2.5 million seed funding round led by UOB Venture Management, Signum Capital, and Mantle Network.

Currently, the marketplace for buying and selling points is functioning, as well as the launch of a points program for airdrops in "Pichi Finance" itself.

Points are accumulated by depositing into the Pichi Wallet and will be airdropped into PICHI tokens in the future.

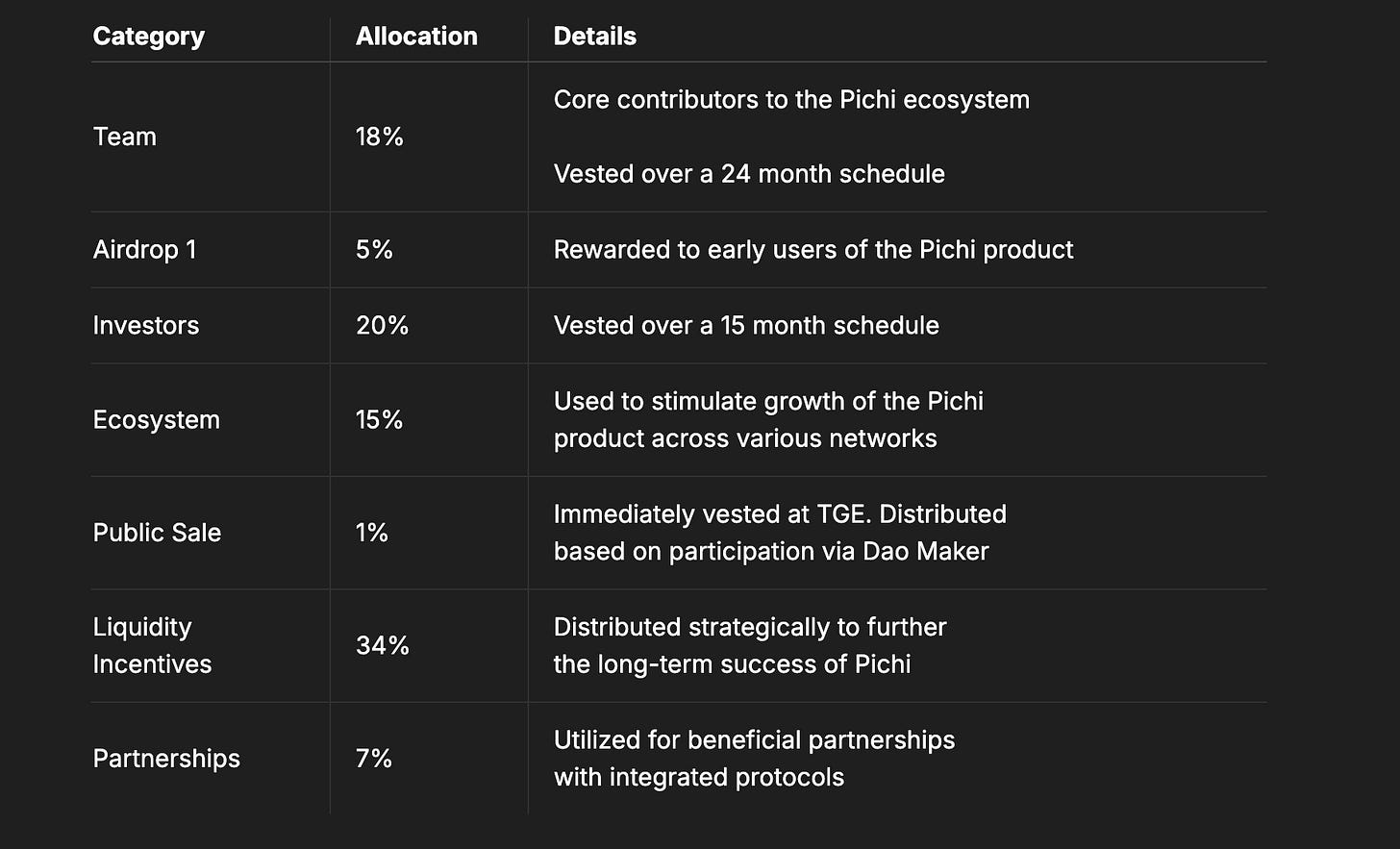

Allocations are as follows.

Season 1 is already over and Season 2 is about to begin.You may use it if you are interested.

💬Combined with the forecast market, prices are formed?

The last one is a consideration.

This is a very interesting protocol, and the idea of utilizing ERC-6551 to trade each wallet has been around since the birth of ERC-6551, but I think the idea has gained renewed attention because of the popularity of loyalty programs.

This is a phenomenon that gets excited because the token price is not known before the TGE, but there is the problem that the selling price is difficult to determine: the price cannot be determined because it will not be evaluated by the market until the TGE, and it may be a little difficult for the general public to trade with the price calculated, since they have to buy and sell with that in mind.It may be a little difficult for the general public to calculate the price and trade.

Personally, I wonder if this is where a prediction market like Polymarket comes into play and leads to a certain price formation?I think so.

For example, we look at the page below where EigenLayer's market cap is forecasted to predict the market cap.On top of that, we can forecast a certain price by looking at the total supply and the amount produced by this airdrop.

So we can expect that prices will be formed with reference to such a forecasted market.

However, this raises the question of where in the world prices will start to form.If a certain amount of price formation occurs in the forecast market and the prior point trading based on it, there is a possibility that the market will be pulled to this point, as the dynamics of the market will continue to go up to the prior forecast even after the TGE actually takes place.

This is a kind of inversion where market valuation is determined based on prior forecast valuations rather than pure market valuations.For example, in a stock market listing, there is a public offering price, and there is also an advance forecast, but it is only a forecast, not a stock that can be bought or sold at the time of the forecast.If a market is already established at the pre-assessment stage, isn't that actually the same as a listing?The question arises, "Is this actually the same as a listing?

I am not averse to a hierarchical financial system in crypto, but I do believe that a hierarchical financial system has the potential to transform the way the market has been evaluated and the way finance has been conducted.

However, I believe that listing and TGE are acts that release a certain amount of liquidity, and that the market is a minimal market in terms of pre-evaluation.

Even though points can now be bought and sold through "Pichi Finance," there is not that much liquidity since it is on a wallet-by-wallet basis.Eventually, it will be possible to buy and sell points on a point-by-point basis, but I think that there will be certain restrictions set in stone, and the project side will be a place to do PoC such as price forecasting.

This is my research on Pichi Finance!

🔗Reference/image credit: HP / X / DOC / BLOG

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.