【Ostium】Perpetual DEX built on Arbitrum, specialized for RWA / Up to 200x leverage on stocks, indices, commodities, FX, crypto assets, and more / @OstiumLabs

RWA Perpetuals Become Prediction Markets

Good morning.

I’m Mitsui, a web3 researcher.

Today I researched “Ostium.”

What is Ostium?

Assets Handled

Technical Features

Transition and Outlook

RWA Perpetuals Become Prediction Markets

TL;DR

A protocol on Arbitrum that enables seamless trading of equities, indices, commodities, FX, and crypto assets with up to 200x leverage, all USDC-denominated and accessible from a single account, on a perpetual DEX specialized for RWA.

Through proprietary oracles, automated execution systems, dynamic spreads/funding rates/rollover fees, and a two-tier Vault structure (Liquidity Buffer + OLP), we achieve both market-realistic pricing and LP protection.

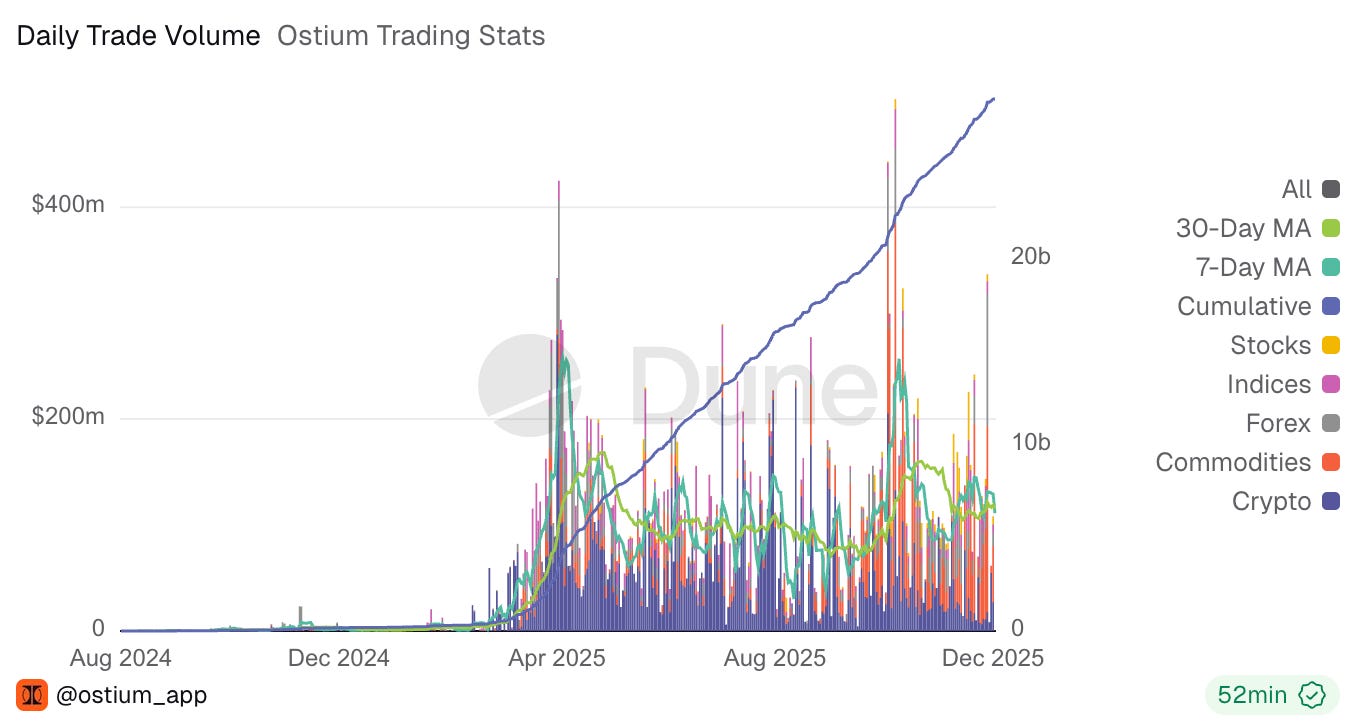

Launched in 2022 as a perpetual RWA specialist, it rapidly expanded with its Points Program and V2 in 2025, achieving over $25 billion in cumulative trading volume and completing its Series A funding. It is now gaining attention as the next-generation RWA derivatives platform.

What is Ostium?

Ostium is a perpetual exchange built on Arbitrum, specializing in real-world assets (RWA).

Users can take long or short positions with up to 200x leverage on stocks, stock indices, commodities, foreign exchange (FX), and major cryptocurrency prices.

Ostium’s mission is to directly realize “access to traditional global markets” on DeFi—something that has only been achieved in a fragmented manner through tokenization and similar approaches—and to provide users with a highly transparent trading environment.

Founder and CEO Kaledora Kiernan-Linn stated, “The global CFD brokerage market will be transformed by DeFi.” She explained that Ostium provides a fully on-chain, transparent alternative to opaque practices employed by traditional CFD brokers—such as hidden fee collection and account freezing when profits become excessive—with no fund freezes or spread manipulation.

The official website’s slogan proclaims “One app. Your wallet. Every Asset.,” emphasizing the ability to trade all asset classes without going through traditional brokers.

The project launched in 2022 and secured seed funding in 2023 to kick off operations in earnest. It has maintained its focus on RWA Perpetuals from the outset, accelerating rapidly in 2025 as the trend began to take hold. Currently, its cumulative trading volume exceeds $25 billion, with approximately 95% of trades concentrated in RWA-related assets such as gold, stock indices, and FX. It is drawing significant attention as a potential next-generation Hyperliquid.

Assets Handled

The range of underlying assets available for trading in perpetual products on Ostium is extremely broad and diverse.