【Olea】A digital trade finance platform connecting corporate trade finance needs with institutional investor capital / @OleaTrade

Contributing to solving challenges in global fund transfers

Good morning.

I’m Mitsui, a web3 researcher.

Today I researched “Olea”.

What is Olea?

Olea Solutions

Transition and Outlook

Contributing to solving challenges in global fund transfers

TL;DR

Olea is a digital trade finance platform that connects corporate trade finance needs with institutional investor capital, revolutionizing the traditional complex, high-cost, and slow mechanisms through online transformation.

Utilizing AI for credit assessment and KYC, blockchain (XDC Network) for debt tokenization, and USDC payments, we are expanding SME access to capital while enhancing transparency, speed, and security.

Building a global liquidity pool while adhering to regulatory compliance (MAS license) and maintaining bank-grade security, we are scaling trade finance as a new investment asset class.

What is Olea?

Olea is a digital trade finance platform that provides a seamless service connecting companies needing funds (suppliers and importers/exporters) with institutional investors seeking investment opportunities.

Our mission is to transform complex and time-consuming trade finance into a swift and straightforward process through an online platform, making it accessible to businesses of all sizes. This enables a wide range of companies, including small and medium-sized enterprises, to secure necessary funding in a timely manner, while allowing investors to deploy capital into trade finance assets as a new alternative asset class.

◼️Overview and Challenges of Trade Finance

Before delving into the platform explanation, let’s first discuss trade finance.

Trade finance is a general term for financial schemes that support settlement and cash flow in import and export transactions.

When companies engage in international trade of goods and services, time lags and credit concerns arise from shipment to payment collection. Banks and financial institutions bridge this gap by providing trade finance to ensure safe and smooth transactions.

The following are representative models.

L/C: Letter of Credit:A letter of credit is a document issued by the importer’s (buyer’s) bank guaranteeing payment to the exporter (seller). It is a traditional and widely used settlement method in international trade transactions. While it is characterized by requiring extensive documentation and time, it enhances settlement security by replacing credit risk with bank credit.

Factoring (Accounts Receivable Financing):Factoring is a mechanism where specialized financial companies purchase accounts receivable (money owed for goods sold but not yet collected) and convert them into cash before the due date. Companies (sellers) typically cannot collect funds until the payment due date after shipping goods, but using factoring offers the advantage of converting those accounts receivable into cash early.

Accounts Payable Financing (Reverse Factoring):In contrast to the above factoring, this is a financing scheme initiated at the request of the buyer (importer). Specifically, it involves the buyer having a partner financial institution advance payment for outstanding amounts owed to the supplier (seller).

In addition to the above, various methods exist in trade finance, such as credit guarantee insurance (risk hedging through export credit insurance) and discounted bills (bank purchase of exchange bills). However, the fundamental objectives remain “reducing settlement risk,” “smoothing cash flow,” and “supplementing trade credit.”

Several structural challenges have been identified with these traditional trade finance arrangements.

First, the complexity of procedures and paper-based operations. For example, in letter of credit transactions, the exchange and review of numerous paper documents such as invoices, bills of lading, and insurance policies were required, and time was consumed by correcting document deficiencies and mailing between banks.

Second is the issue of time and cost. Arranging trade finance requires specialized expertise, and for small and medium-sized enterprises, the lengthy process and high costs (fees and interest rates) from application to receiving funds have been burdensome, leading some to abandon the option.

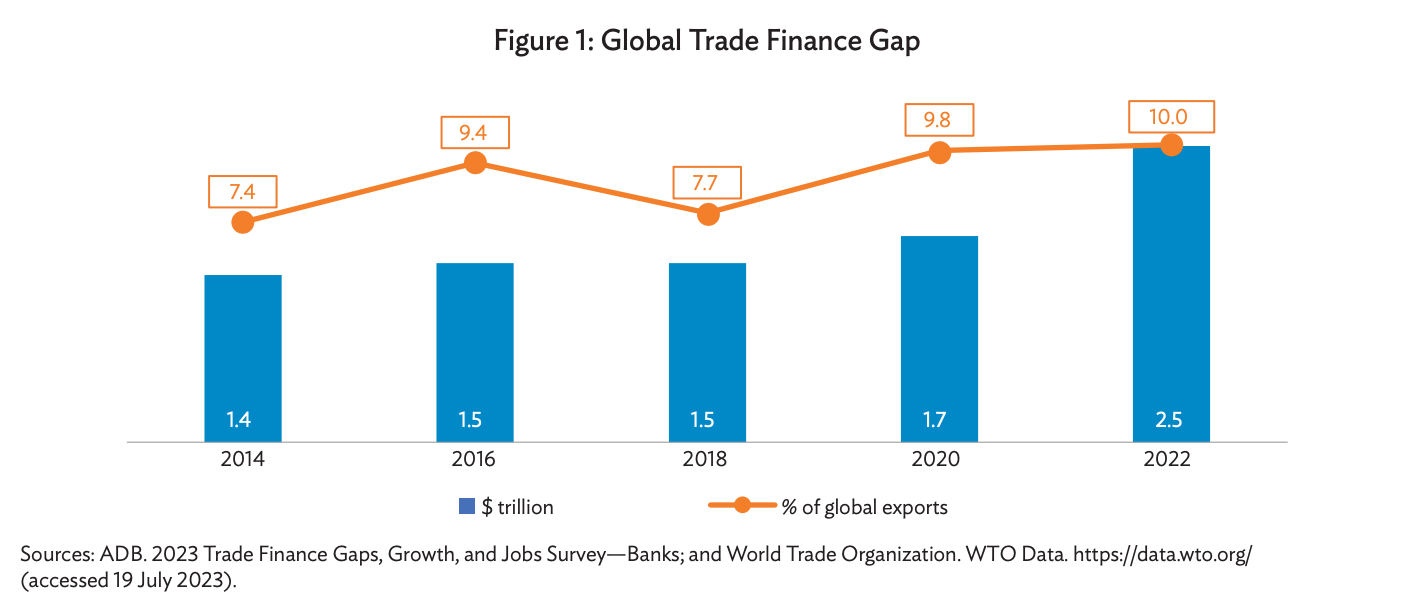

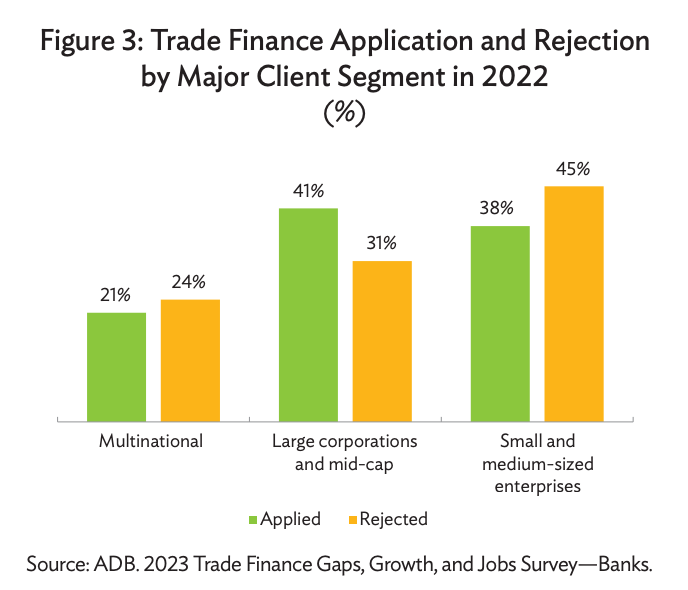

In fact, according to a study by the Asian Development Bank (ADB), the global trade finance gap (the difference between demand and supply) reached a record high of $2.5 trillion in 2022, revealing that the funding needs of small and medium-sized enterprises (SMEs) in particular remain unmet. Banks tend to avoid high-risk small and medium-sized deals due to regulatory constraints and the hassle of credit screening. Consequently, reports indicate that 40% of trade finance applications rejected by banks came from SMEs.

Third are credit risk and fraud risk. In international transactions, limited access to counterparties’ credit information makes credit assessments difficult, and fraud incidents involving fictitious transactions and document forgery have occurred. With paper-based operations, detecting irregularities such as duplicate factoring of the same receivable can also be challenging.

Against this backdrop of challenges, many financial institutions and fintech companies have recently taken on the challenge of digitizing trade finance, with Olea being at the forefront.

Olea Solutions

Olea leverages cutting-edge technology and innovative business models to provide comprehensive solutions to the challenges faced by traditional trade finance.

To summarize that approach:

Efficiency gains through digitization

Olea’s platform was designed from the ground up as fully digital, enabling the entire process—from application to review, contract signing, and settlement—to be completed online. This significantly reduces the need for paper documents and manual processes, dramatically accelerating transaction speeds.

For example, in invoice-based financing (equivalent to factoring) cases, once the required information is uploaded, AI performs automatic checks and credit assessments instantly. This reduces the credit decision process, which traditionally took several weeks, to just a few hours to one day.

Additionally, electronic signatures on contracts and digital payment processing enable procedures to be advanced in real time regardless of geographical distance.

Furthermore, because it operates on a cloud infrastructure available 24 hours a day, 365 days a year, transaction parties in different time zones can continue procedures within their own business hours, helping eliminate the time lags often encountered in international transactions. As a result, the reduced lead time to funding and lower administrative costs make it easier to handle smaller deals and short-term funding needs.

AI Applications in Risk Analysis and KYC

Olea builds credit models using advanced data analytics and AI.

Specifically, we integrate each applicant company’s financial data, transaction history, industry benchmarks, and even logistics data and alternative data (such as social media sentiment and satellite data—potential indicators) to perform machine learning-based scoring.

This enables the evaluation of growth potential and transaction realities that conventional financial statement-centric reviews cannot fully capture, making it easier for promising small and medium-sized enterprises to secure funding. Furthermore, AI has been integrated into the KYC process, automating cross-referencing with national databases and suspicious activity detection to achieve rapid identity verification and anti-social forces checks.

Through the utilization of AI and big data, Olea provides investors with robust risk assessments, enabling swift determination of appropriate interest rates and credit decisions for each project. As a result, investors can participate in projects with confidence, while companies avoid being required to provide excessive collateral or guarantees. This benefits both parties.

Additionally, Olea provides each investor with portfolio analysis tools via a dashboard, enabling them to view AI-calculated risk metrics and predictive models to foster transparent risk sharing.

Enhanced Transparency and Security Through Blockchain

Blockchain technology enhances transaction transparency and authenticity. By recording transaction data and debt instruments on a distributed ledger, it creates a tamper-proof shared ledger among all parties involved.

This prevents fraud such as “the same accounts receivable being transferred twice,” and also facilitates transaction tracking. CEO Amelia Ng emphasized, “Leveraging blockchain technology streamlines transactions, reduces costs, and enhances trust among all stakeholders.”

Smart contracts also incorporate automated workflows, enabling programmable contract processing such as triggering payment to the seller company simultaneously when an investor purchases a debt token.

The chain XDC Network It adopts a Layer 1 enterprise blockchain specialized for trade finance and the tokenization of real-world assets (RWA).

It is positioned as an infrastructure that replaces paper-based trade finance processes with digital, on-chain solutions, utilizing an EVM-compatible, open-source, hybrid (public + private) architecture.

Furthermore, the introduction of USDC announced in December 2025 brought the benefit of instant global settlements on the blockchain. Since the flow of funds is recorded in real time on the ledger, the lack of transparency in fund flows is eliminated, and the credit risk associated with fund settlements is also reduced.

Building a Global Liquidity Pool

Traditionally, small and medium-sized export companies, which often lack sufficient creditworthiness or collateral, have frequently been denied bank financing. Olea connects such companies to a global liquidity pool.

Specifically, over 30 institutional investors worldwide (including banks, funds, and non-bank lenders) participate in projects on the Olea platform, providing companies with diverse funding sources that go beyond relying solely on local banks.

For example, when Southeast Asian SMEs monetize their accounts receivable through Olea, investors from Japan, Europe, and the US can purchase those receivables. Investors gain access to alternative investment opportunities in emerging market trade receivables, offering the benefit of stable short-term returns. In this way, Olea builds a mutually beneficial marketplace, ultimately addressing the unmet funding needs of SMEs.

◼️Other

In addition to these, API integration with external systems, security measures, and the acquisition of certification licenses have been implemented.

As a financial platform, we maintain bank-level security standards, with all communications and data encrypted and protected by secure protocols.

The platform itself has obtained ISO/IEC 27001 certification (the international standard for information security management) and implements enterprise-level security measures such as strict access control and audit log management.

Furthermore, Olea holds a Capital Markets Services (CMS) license from the Monetary Authority of Singapore (MAS) and operates as a regulated financial services provider in compliance with applicable regulations.

Transition and Outlook

Olea’s business, while relatively new, is expanding rapidly. Key milestones are as follows:

2019:Standard Chartered Bank signed a memorandum of understanding (MoU) with China’s Linklogis. In January 2020, Standard Chartered made a strategic investment in Linklogis and explored collaboration in the supply chain finance sector.

2021:In October, Olea Global Pte. Ltd. was established in Singapore through a joint investment by SC Ventures (Standard Chartered’s venture division) and Linklogis. Positioned as a “fully digital trade finance origination and securitization platform,” Olea adopted a model directly connecting institutional investors (fund providers) with companies along the supply chain (fund seekers).

2022:The platform commenced full-scale operations. In January, a memorandum of understanding regarding collaboration in the trade finance sector was signed among three companies: Refinitiv (a subsidiary of the London Stock Exchange Group), SeaBridge TFX, and the platform.

2023:Expansion of business infrastructure. Olea advanced the establishment of licensing frameworks in various countries, initiated collaboration with Singaporean authorities, and began market development in the Middle East and South Asia regions. Furthermore, this year saw cumulative financing disbursements reach approximately $500 million to $800 million, while the number of participating institutional investors also increased.

September 2024:Olea has officially obtained a Capital Markets Services (CMS) license from the Monetary Authority of Singapore (MAS). This enables Olea to provide a wide range of capital market services, including securities trading and fund management, strengthening the legal foundation for handling trade finance assets on its platform. Concurrently, Olea announced it has achieved cumulative transaction volume of US$1 billion (over 1,000 cases). Furthermore, at this time, it has successfully completed fully on-chain transactions through debt tokenization.

June 2025:Olea has formed a strategic alliance with BBVA, a major Spanish bank, to provide global supply chain finance solutions. BBVA is a bank with an extensive customer base across Europe, the Americas, and Asia. Through this partnership, Olea will offer SCF (supply chain finance) services to BBVA’s corporate clients via its own platform, while BBVA will be able to expand its service reach globally.

July 2025:We have entered into a strategic partnership with Malaysian fintech CapBay to provide funding support for small and medium-sized export companies. CapBay is a Malaysian peer-to-peer lending and supply chain finance platform with a robust local SME network and AI-based credit models. Through this partnership, both companies will jointly offer cross-border financial solutions to support Malaysian companies in securing funding for their international expansion.

December 2025:Official announcement of USDC stablecoin payment integration. Support for USDC on the Olea platform has dramatically improved settlement speed and transparency for cross-border transactions. Concurrently, Series A funding was completed. BBVA served as the lead investor, with participation from Standard Chartered’s SC Ventures (an existing shareholder), the investment arm of XDC Network, and theDOCK (a shipping and logistics-focused VC), raising a total of $30 million USD.

At the time of its Series A funding round, Olea announced that it had facilitated over $3 billion in cumulative funding to more than 1,000 supplier and buyer companies across over 70 trade corridors, growing to a scale involving participation from over 30 institutional investors.

Future plans include allocating resources to enhance AI-driven analysis, develop Web3-compatible solutions, and advance embedded finance solutions. We will also invest in expanding origination (project discovery) in growth markets and further develop our global partner ecosystem to capture new market opportunities.

Solving challenges in global fund transfers

Finally, we conclude with a summary and analysis.

Olea may not be a project you hear much about in the crypto space, but it’s a rapidly growing startup in the trade finance world. As a joint venture involving major established financial institutions, it’s growing steadily while complying with regulations.

I believe one ideal scenario is for blockchain to be naturally integrated into solutions addressing such challenges. While Olea incorporates it now, our policy is to transition all transactions to on-chain processing going forward.

This would enable the migration of all processes—from AI-based credit assessments to the trading of receivables, contract execution, and fund transfers—onto the blockchain, thereby enhancing efficiency and transparency.

Japanese startups don’t have many opportunities for international money transfers or trade, so this isn’t really an issue for them. However, solving the challenges of global fund transfers is a significant market with substantial demand.

This is precisely the domain we call PayFi, and solutions leveraging liquidity pools for fund transfers will likely continue to be built natively on blockchain. While these aren’t solutions reaching the general public, they may become mainstream as offerings for corporate entities, institutional investors, and financial institutions. I look forward to seeing how this evolves.

That concludes our research on “Olea”!

Reference Links:HP / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.