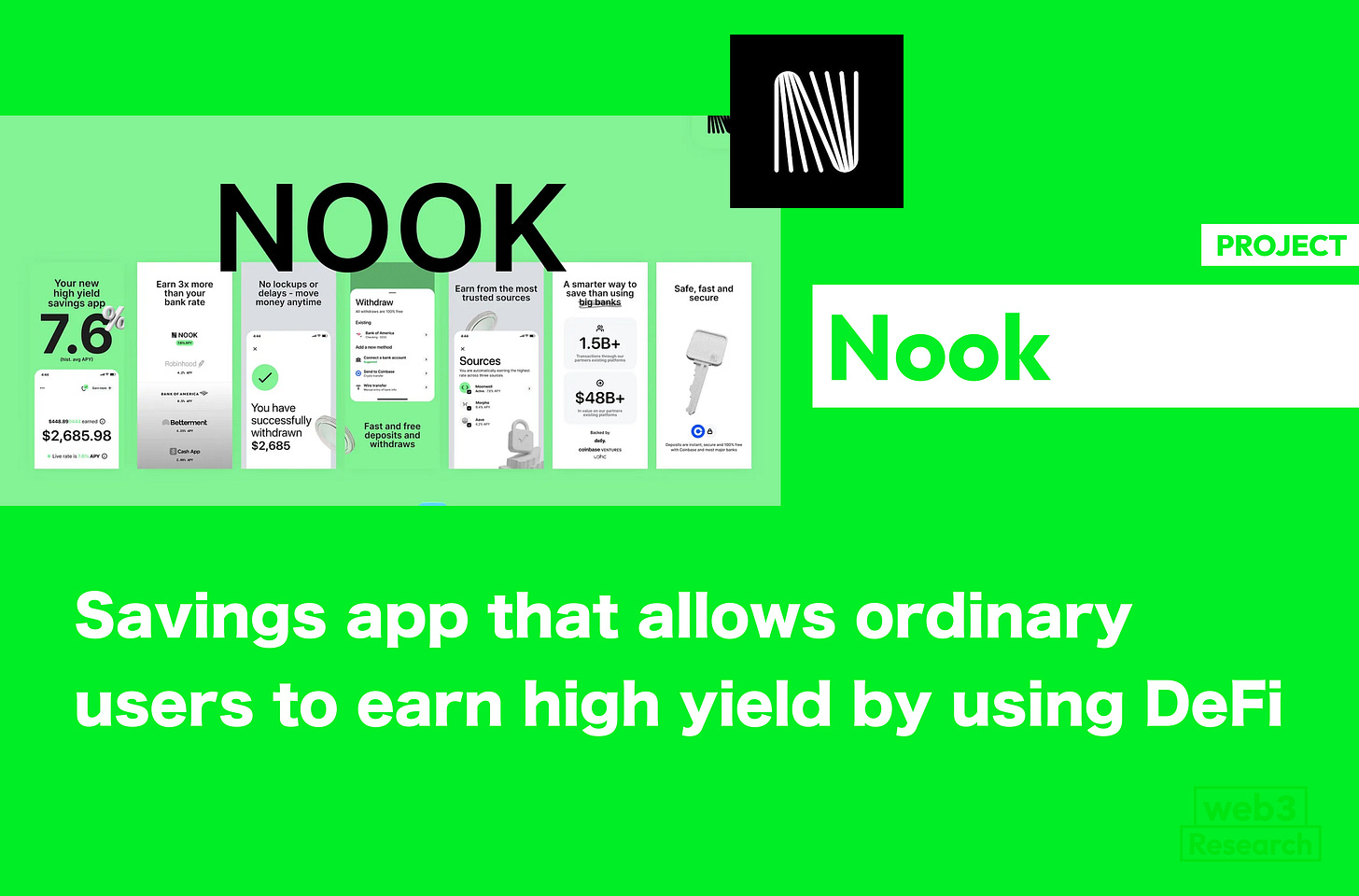

【Nook】Savings app that allows ordinary users to earn high yield by using DeFi / Earn interest of 7-9% per year, which is "about 10 times higher than a regular bank account" / @nook_savings

The era of holding stable coins instead of bank deposits is approaching.

Good morning.

This is mitsui, a web3 researcher.

Today, I researched "Nook".

👛What is a Nook?

🚩Transition and Prospects

💬Towards an era of seamless connection to the on-chain

🧵TL;DR

Nook is a DeFi-based high-yield savings app that leverages USDC and operates on crypto asset lending protocols to achieve an annual interest rate of 7-9% (7.6% average over the past 12 months).

Aiming for interest rates approximately 10 times higher than a bank account, the app features a simple UX that allows even crypto-asset novices to convert to USDC with a single tap and easily start high-yield investing.

Interest is calculated and distributed in real-time approximately every 16 seconds, providing liquidity for deposits and withdrawals at any time without penalty.

It uses a self-custody system where users manage their own wallets and private keys, and automatic rebalancing to multiple protocols ensures transparency and security.

👛What is Nook?

The "Nook."a high-yield savings application that utilizes DeFiIt is.User deposits areconverted into USDC and operated through a lending protocolThe interest rate is significantly higher than that of a traditional bank account.

Specifically, we are aiming for an annual interest rate of 7-9% (average of 7.6% for the past 12 months), which is "about 10 times higher than that of a regular bank account,Even ordinary people who are not familiar with crypto assets can earn a high yield with simple operations.This is one of the features of this product.

The main features and functions of the Nook application are as follows

High yield (interest rate)On deposited fundsUp to 7.6% interest per annumcan be earned.As a track record, in 2024, the Moonwell protocol achieved an average yield of 9.34%, which is almost 20 times higher than a bank savings account (about 0.5% per year).

Instantaneous Interest DividendsInterest is calculated in real time on the blockchain,and reflected in your account as a reward approximately every 16 seconds.The interest is calculated frequently and the compounding effect can be seen immediately.Interest calculations are frequent and the compounding effect can be seen immediately.

Easy Funds On-Ramp: You can deposit funds directly from your bank account or Coinbase account, or if you already have USDC, you can deposit it directly.In-appConverting legal tender to USDCThe process of converting legal tender to USDC is safe and smooth, using the payment infrastructure provided by Coinbase.

Flexible deposits and withdrawals (liquidity)Flexible deposits and withdrawals (liquidity)Deposit and withdraw any amount at any timeYou can deposit and withdraw any amount at any time.There is no lock-up period or minimum deposit amount, and there are no penalties or fees for mid-term withdrawals.Withdrawals are processed in less than 60 seconds and can be sent to your bank or Coinbase account.

Automatic Optimization (Rebalancing)Nook compares multiple DeFi protocols and automatically rebalances your portfolio at night,Nook compares multiple DeFi protocols and automatically rebalances the portfolioto pursue the highest interest rate.Originally selected by Moonwell, the June 2025 update adds support for new protocols such as AAVE and Morpho, and implements automatic fund transfers between multiple platforms.

TransparencyTransparency: Users' fund management status and interest earned aretracked in real time on the blockchainYou can track your funds in real time on the blockchain.You can check which lending market your funds are in and how much they are increasing within the application, which provides transparency and peace of mind for your operations.

SecurityNook isDesigned to Secure User Assetsand secure user assets.The protocols to which we lend (e.g., Moonwell, AAVE, etc.) are audited by Halborn, a leading security firm, and have a standing bug bounty program (up to $250,000), and Nook itself has a bug bounty that pays up to $5,000 to anyone who finds a vulnerability, in an effort to find defects early.Nook itself has a bug bounty that pays up to $5,000 to anyone who finds a vulnerability.

Self-Custody.Users create their own crypto asset wallets within the Nook app and hold USDC in those wallets.Funds are lent from the user's own wallet to the DeFi protocol, and the private key is also controlled by the user; Nook does not have access to the wallet, and users can export their keys at any time and transfer them to another wallet.

Privacy ProtectionIn terms of privacy protection, Nook's Privacy Policy sets forth the following provisions regarding the handling of users' personal information and data.

Information collected when using the Nook application, such as "name, email address, phone numberPersonal identification information, device information, usage data, transactions, etc.Financial informationIs.It states that the minimum necessary information is obtained and used for the purpose of providing services, fraud prevention, and legal compliance.

The data collected isNot sold to third partiesand will be shared only with partners who support the provision of services (e.g., banking API providers) or when requested by law.

Data storage and encryptionFor the Nook itself, an external service with advanced cryptographic technology (e.g., for wallet creationPrivy, Inc.for the exchange of legal tender and USDCBridge, Inc.Nook's servers do not store sensitive personal data or private keys.Users' personal information is encrypted in the trusted third-party system and cannot be viewed in plain text even by Nook management.

As I mentioned, even those who are not familiar with crypto assets can simply convert their legal tender to USDC with a single tap and deposit it directly into the lending protocol.And the app can secure a yield of more than 10 times the bank interest rate.

🚩Transition and Outlook

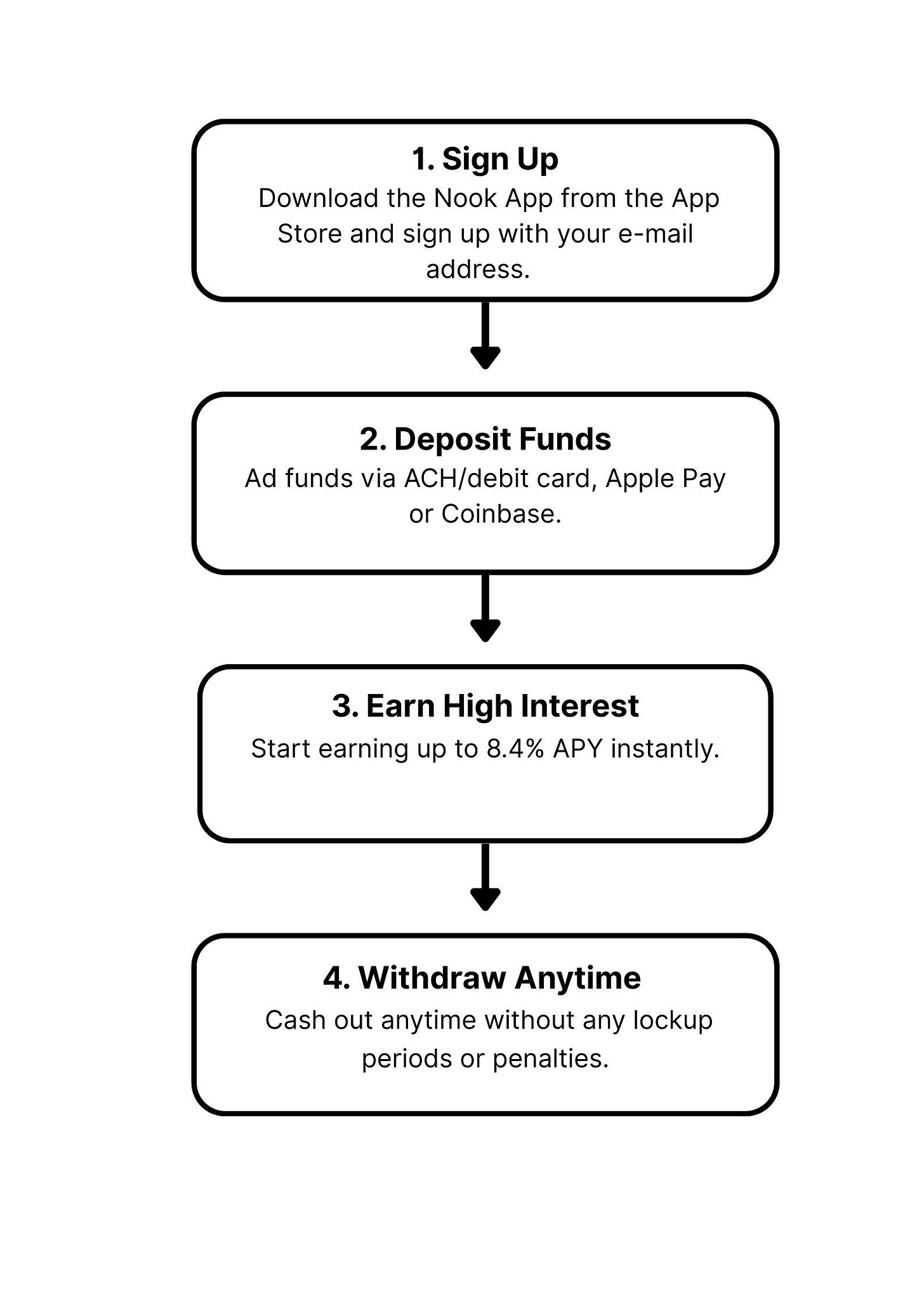

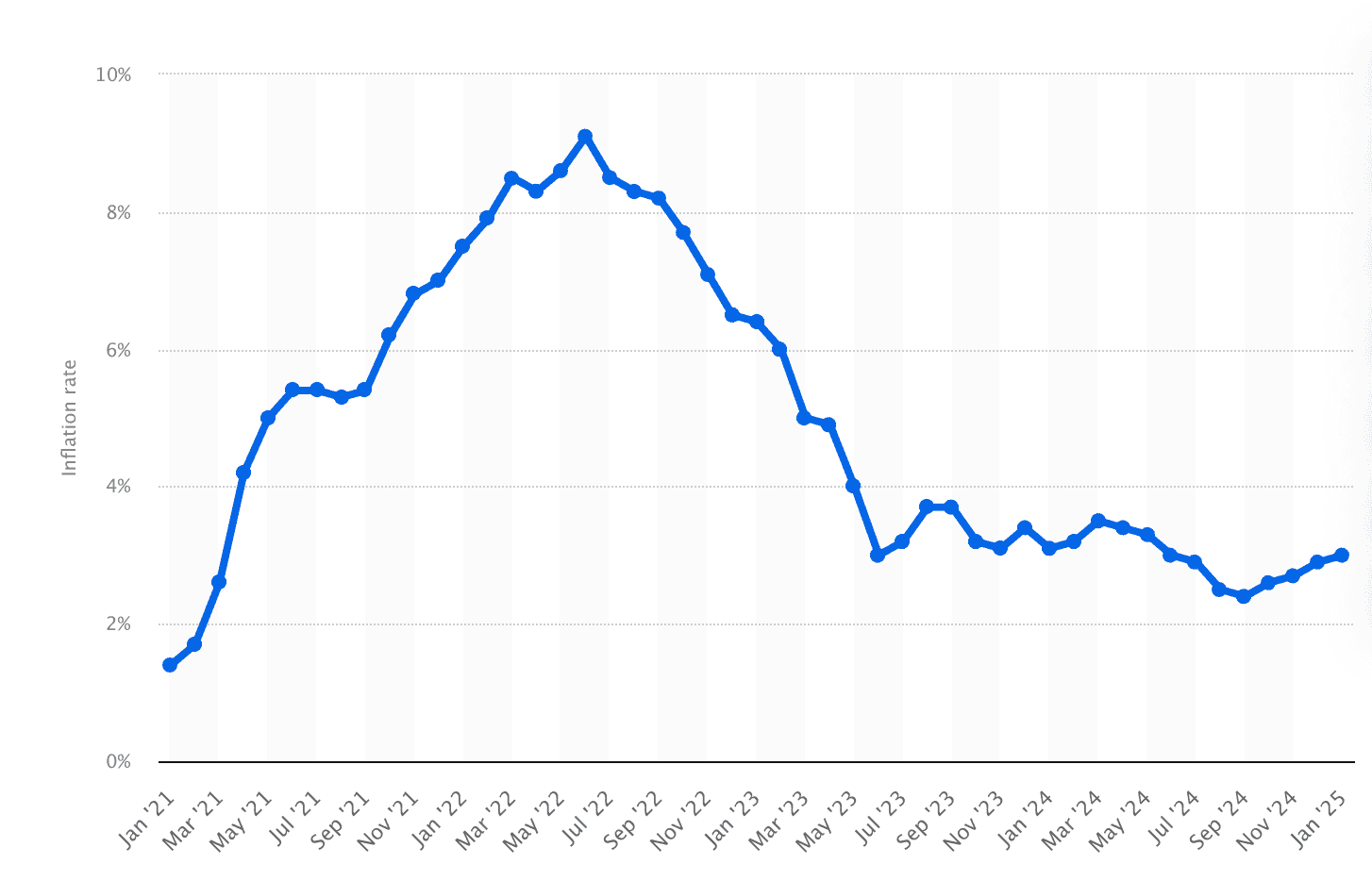

The Nook app is developed and provided by Nook App Inc, a startup company founded in 2025 and co-founded by three engineers (Joey Isaacson, Kenzan, and Sohail Khanifar) from Coinbase, a US crypto asset exchange.The following graph shows the rate of inflation over the past five years.

The graph below shows the difference between the inflation rate and the average bank savings rate over the past five years.

The average bank savings interest rate is at most 0.4%, which has not nearly kept pace with inflation over the last five years.

This huge gap means that funds deposited in traditional savings accounts are quietly losing value and purchasing power every year.

DeFi Lending can provide an investment that can keep up with the rate of inflation, but the threshold can seem very high for those who are not familiar with crypto assets.

The Nook team once worked within Coinbase to provide DeFi Lending functionality in 2022 (service was suspended for regulatory reasons), and they say that they launched Nook with the vision of "leveraging that knowledge to create a savings app that anyone can use.

The product was developed with this in mind, and the official version of the iOS app was released in June 2025, at the same time that Nook announced a $2.5M funding round from Coinbase Ventures and others.

Our future plans include expanding the number of supported protocols, releasing an Adoroid version, and increasing the number of users and market penetration.

Specifically, the company has set a goal of "1% of all DeFi lenders will be through general users.At first glance, 1% may seem like a small number, but with tens of billions of dollars currently deposited in DeFi, even 1% is a very large impact.

💬Towards an era of seamless connection to the on-chain

Finally, a summary and discussion.

The conception of Nook was very convincing, and the UX of the product itself was nicely crafted.Also, the founding team has a good track record.

The difference between interest rates and inflation rates on bank accounts is a universal challenge, and a stable investment destination for such funds is always required.That can be stocks, etc., but it is not realistic to invest all of it in stocks and other assets, and it is inevitable that it will be held in legal tender.

So, those who are familiar with web3 will invest stably in stablecoin, but those who are not that familiar with it will use wallets?DeFi?Therefore, I feel that the value of a product that can be operated as if it were deposited in a bank account, with a clean UX, is very high.

Also, as we have previously discussed during our research on Axiom, we feel that there is a growing presence of products that incorporate all products and provide overall experience value as a customer interface.

Nook also uses Privy for wallet creation, Coinbase and Bridge for on/off ramps, and Moonwell, Aave, Morpho, etc. for DeFi protocols, and incorporates them into one product, just taking the customer interface.

However, I believe that in the future there will be many products that integrate products cleanly like this to maximize the user experience, and they will boast high profitability.Since there are already all kinds of components, these products combine them like Legos.

Currently, Nook is only for US users, but as more and more services like this appear in other currencies, on-chain asset management will become the norm, and it is conceivable that general users in the financial domain will also use this service.I am looking forward to it.

This is my research for the "Nook"!

🔗Reference:HP / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.