【The Music Industry's web3 Usability】An in-depth look at the current market size, major business models, transition, web3 solutions and use cases!

Thorough explanation of web3's potential in the music industry.

Good morning.

Mitsui from web3 researcher.

Today we researched "web3 Use Cases for the Music Industry".

We update this newsletter daily with the latest web3 trends and projects of interest, but we decided to start an initiative to report on how web3 can be used for specific industries.We will update this on a regular basis if there is a response!

We do not simply summarize the use cases of the industry, but also investigate the current market size, business model, past changes, and challenges of the industry, consider what web3 can do to address these issues, and introduce actual web3 use cases.

The analysis of the current situation is as flat as possible, but since this is a web3 newsletter, web3 will be used as the solution.Naturally, there may be solutions other than web3, but please understand that the purpose of this newsletter is to explore the possibilities of web3.(=Please see this page with that assumption)

The first part is the "music industry".

🎧Existing Music Industry

💥Existing Music Industry Issues

⛓️Solutions brought by web3

💬The sale of rights seems difficult due to regulations,Looks like a good match.

🧵TL;DR

While the music industry is regrowing through streaming, it faces structural challenges such as opacity in artist compensation and middleman exploitation.

Web3 shows the possibility of solving these issues by automating revenue distribution, transparency of rights management, and direct sales through NFT.

The sale of goods to a small number of fans through NFT is a particularly good match for less popular artists as a means of generating revenue outside of streaming.

While it is difficult to change the revenue structure of streaming itself, Web3 can be an effective means in creating new revenue models.

🎧Existing music industry

◼️Market Size

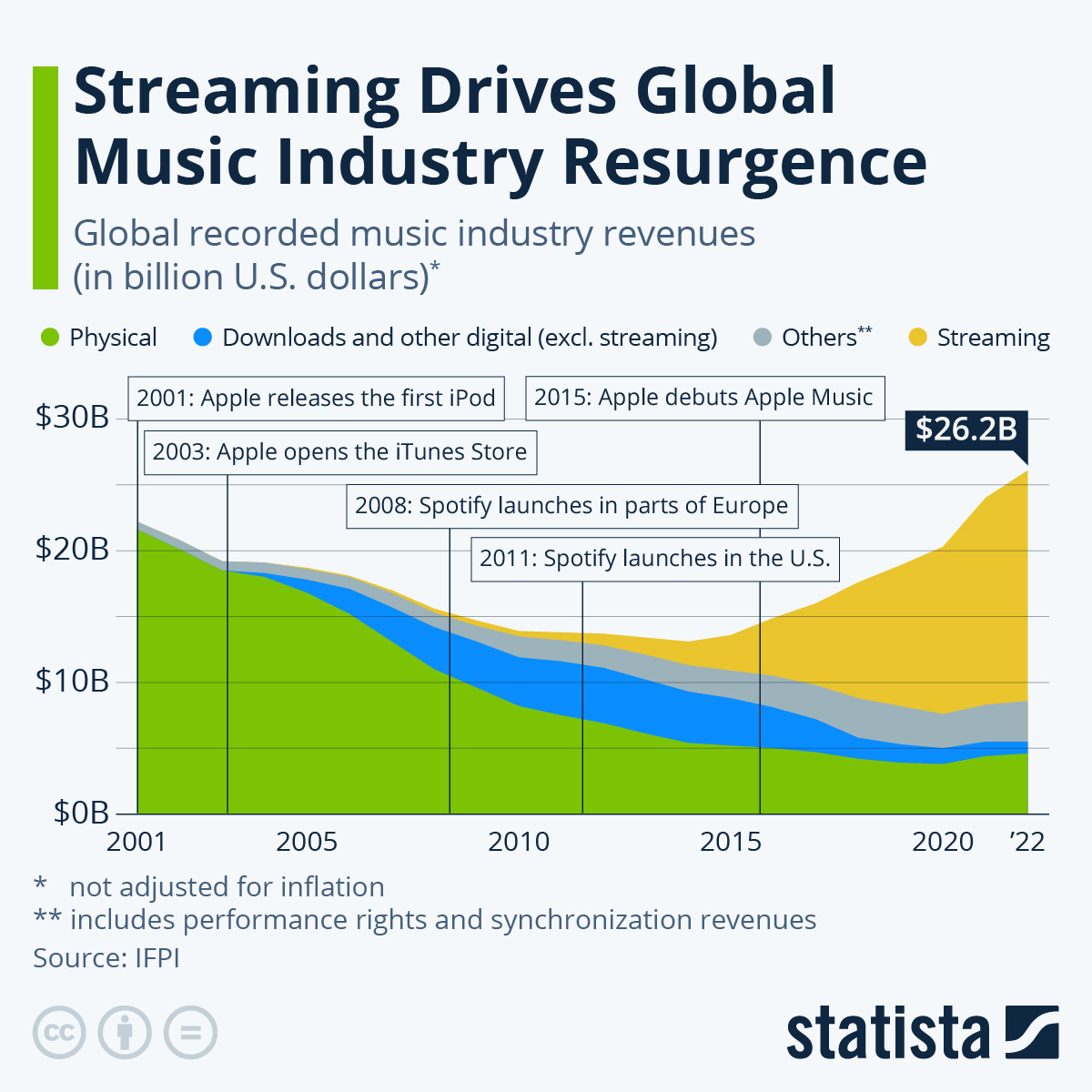

The global music industry has been growing strongly in recent years, recovering from a long period of stagnation due to the proliferation of streaming, with the IFPI (International Federation of the Phonographic Industry) reporting that global recorded music sales in 2022 reached approximately $26.2 billion, up 9% from the previous year, the eighth consecutive year of growth.

This was achieved after nearly two decades of stagnation due to piracy and the shift away from CDs, with sales falling to $13.1 billion in 2014, half the level of the peak (circa 1999) of $22.3 billion.Since the advent of streaming, however, the market has reversed course after bottoming out in 2015, growing to $28.6 billion in 2023 (+10.2% YoY).

As such,the music market size is on a growth trajectory driven by streaming.

◼️Major Business Models

Currently the main revenue source isdigital music distribution (streaming)and by 2022 streaming will be67%of global music sales.

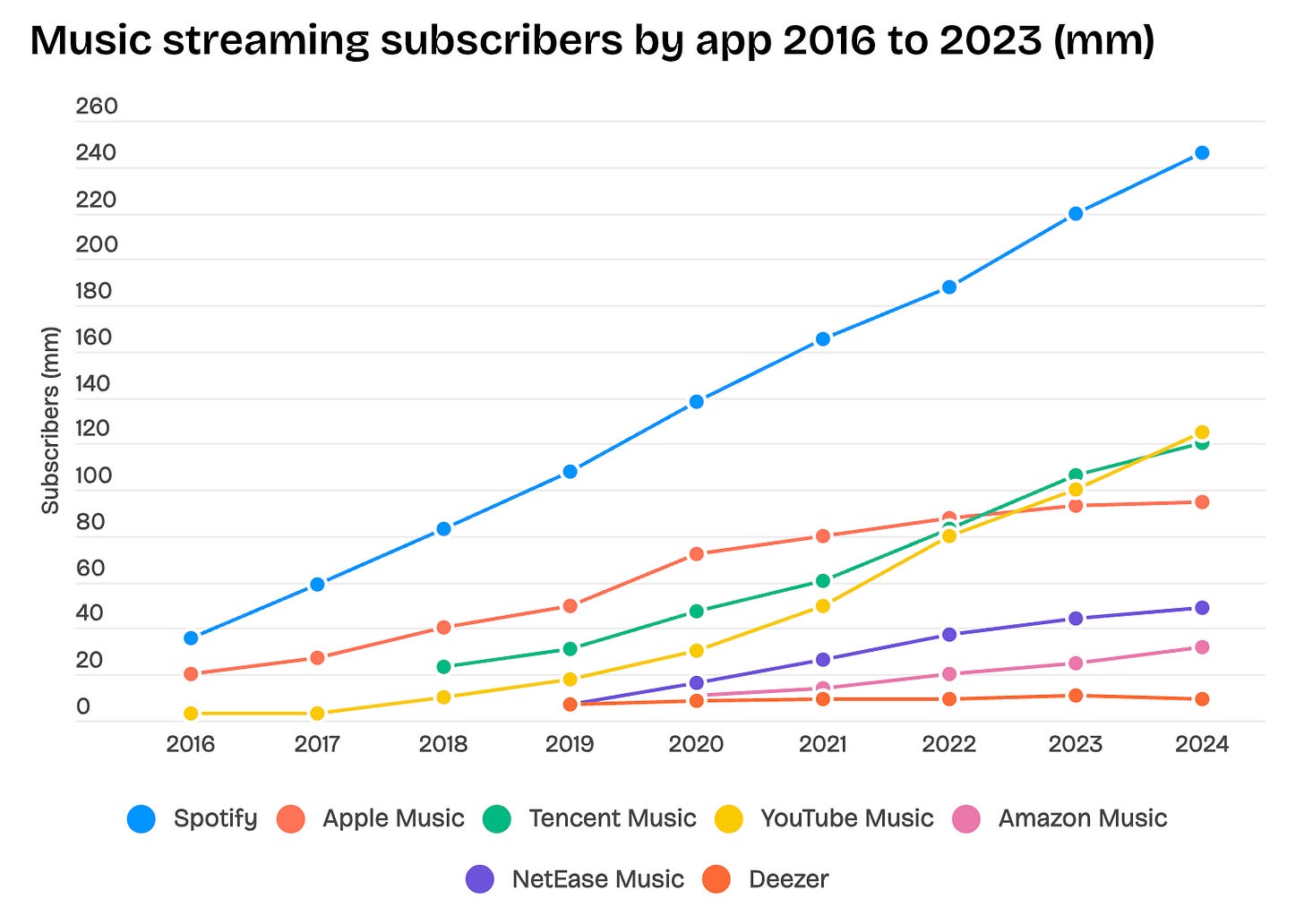

In particular, the number of subscription-based paid streaming subscribers is increasing every year, with approximately 589 million worldwide at the end of 2022 and the number of paid subscriptions reported to exceed 500 million for the first time in 2023.

Meanwhile, download sales have declined sharply, and physical (CDs and vinyl records) is a small percentage of streaming overall, although there has been a record recovery in some areas in recent years.Still, in 2023, physical sales are expected to grow by 13.4% YoY due in part to the popularity of analog records.

The live music marketis another important pillar of artist revenue.Live entertainment reached its largest ever in the late 2010s, but by 2020, the new Corona caused a 75% year-on-year decline in sales, with an estimated loss of over $30 billion in 2020 alone.

Concerts have resumed since 2021, and by 2024, tours by top artists such as Taylor Swift and BTS will be the highest grossing in history (e.g., Swift'sEras Tour is the highest grossing tour in history with an estimated $2 billion-plus), the live music market is rapidly recovering.

On the other hand, rising ticket prices and oligopoly of major companies have also become an issue, with Live Nation (which owns Ticketmaster), the world's largest, being sued by the U.S. Department of Justice for its monopoly status.

The main business models can be summarized as follows

Subscription revenue through streaming distribution services (Spotify, Apple Music, etc.)

Streaming with ad revenue through YouTube, etc.

Physical sales and download sales

Music publishing (royalties for songwriting)

Tie-up revenue

Licensing income such as performance rights fees

Revenue from live performances (concert tours) and festivals

Merchandise sales

For artists, live performances often account for a large portion of their income, and around 2010, when recorded music revenues were declining, it was said that "live performances were the main source of income.However, the live market was also hit hard by the pandemic, as noted above, and fair distribution of streaming revenues has become increasingly important.

◼️Major Players

To understand the major players in the music industry, in addition to the artists, it is necessary to keep in mind both the huge platforms that hold the digital distribution and the record companies that supply the sound sources.

Spotify, the largest streaming service, was founded in 2008 and originated in Sweden, and currently has an estimated 675 million monthly active users, including 206.3 million paying members.

Following Spotify, Apple Music (launched in 2015, approximately 92-93 million subscribers by 2023), Amazon Music, YouTube Music, and China's Tencent Music family (QQ Music, etc.) are global distribution platforms withpresence.

On the record company side, the "Big Three" major record company groups (Universal Music, Sony Music, and Warner Music), which supply the rights to the master recordings, hold the majority of the market share.

Among them, Universal Music has annual sales of $12 billion in 2023, followed by Sony and Warner.

In addition, a collection of independent labels in various countries also have a certain share of the market and have licensing agreements with streaming through organizations such as Merlin.

Other copyright management organizations (such as JASRAC and ASCAP) are also major players in the collection and distribution of music royalties.

In the live music industry, major players such as the aforementioned Live Nation Entertainment (the world's largest concert promoter and ticketing company) and AEG lead the international market, but their oligopoly has been criticized for causing ticket prices to skyrocket and opacity.

◼️History of changes in business models and industry structure

The music industry has undergonemajor changes in business models over the past several decades as media technology has advanced.The major milestones are organized in chronological order.

① 1990s: The Golden Age and Peak of the CD

The global proliferation of CDs in the late 1980s and 1990s led to unprecedented sales in the music industry, with CD sales reaching an all-time high of $22.3 billion in a single year around 1999, generating huge revenues for music labels.

This was before the advent of the Internet, when consumers had to purchase physical media by the album.

②1999: Napster and the MP3 Revolution

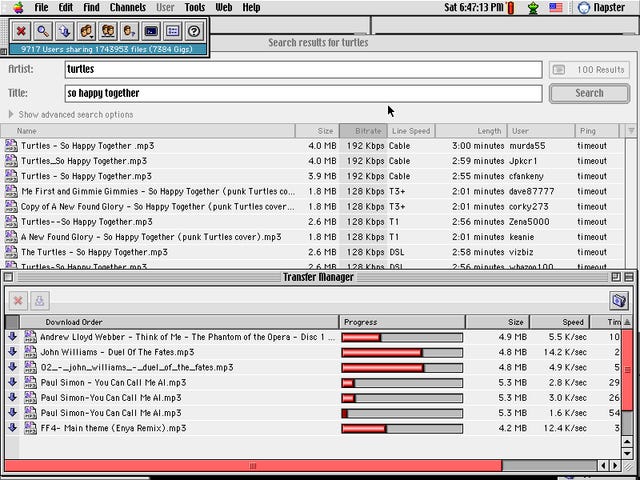

Napster, which appeared in 1999, was the first P2P service that allowed users to share MP3 sound files with each other over the Internet for free.

In just a few years, Napster expanded to tens of millions of users and radically changed music consumption, but was forced to shut down in 2001 after being sued by artists such as Metallica and Dr. Dre and the RIAA (Recording Industry Association of America) for copyright infringement.

But the impact has been enormous, and the wave of MP3 file sharing has caused major changes in existing businesses.It is estimated that between 2000 and 2010, CD and other physical sales declined by over 60%, wiping out $14 billion in annual revenue.During this period, free sharing services such as iMesh and LimeWire, successors to Napster, emerged one after another, adding to the steep decline in music sales.

③ Early 2000s: The Rise of iTunes and Digital Sales

Although the music industry initially rejected the Internet, it was gradually forced to shift its strategy to digital distribution.The symbol of this shift is Apple's iTunes Music Store (launched in 2003).

The model of being able to purchase only the songs you want for $0.99 per song has gained consumer support and changed the sales format from album-by-album to song-by-song.

Apple also worked with iPods and other portable music players to become the driving force behind market-legal digital music.However, the increase in digital download sales (approximately $4 billion per year as of 2010) was not enough to compensate for the collapse in CD sales, and the industry's overall revenue decline did not stop until the early 2010s.

④2010s: Dawn of the Streaming Era.

The music streaming services that emerged in the late 2000s were key to the industry's rebirth.Pandora launched in the U.S. in 2005, and Spotify, a Swedish company, launched in Europe in 2008 and landed in the U.S. in 2011.

Although the subscription-all-you-can-listen model was initially viewed cautiously by labels, user support was strong, and by the mid-2010s, major labels began to embrace streaming in earnest.

As a result, the recording market returned to a growth trajectory after bottoming out in 2014, with sales growing annually in the late 2010s.

Spotify, for example, had a catalog of more than 100 million songs as of 2023 and rapidly expanded its user base due to the convenience of free plans; in 2015, Apple also entered the streaming market with Apple Music, making it a market where technology giants competed.

By this time, the habit of listening to songs on YouTube had taken hold, and the music experience shifted dramatically from "ownership to access.

By the late 2010s, streaming revenue had overtaken downloads and physical music as the primary revenue source, and a new structure was established in which streaming would account for the majority of industry revenue from 2020 onward.

💥Existing Music Industry Issues

So far, we have described the current music industry and the changes that have led to it.

Next, we will discuss the challenges facing the music industry, which is currently being revitalized by streaming.