【Moonwell】A cryptocurrency lending protocol built on Base/Moonbeam/Moonriver / Proud to have the top TVL on Polkadot, expanding to Base / Developing a governance system for Temporal Governance.

🪅Happy New Year!

Good morning. And, Happy New Year.

I'm mitsui, a web3 researcher.

I was thinking about how to update for the new year, but I had a period of absence last week due to poor health, so I plan to continue updating the morning research during the first three days. I won't be doing any special New Year projects or anything like that, I'll continue researching projects that catch my interest as usual.

Today, I researched "Moonwell".

Table of Contents

1. Overview | What is Moonwell?

-How to use

-Other features

-Supported chains and cryptocurrencies

2. Transition and Outlook | Extending from the Polkadot ecosystem to Base

-Extending to Base

-Governance mechanism

3. Analysis | The lending protocol is quite revolutionary

Overview | What is Moonwell?

Moonwell is an open and decentralized cryptocurrency lending protocol built on Base, Moonbeam, and Moonriver. With an intuitive interface and robust security, you can either provide funds and earn yields or borrow funds.

◼️Usage

The basic usage is the same as a typical lending protocol.

○Lender (Supply)

Check the available cryptocurrencies and APY offered, then provide funds through wallet connection.

The yield obtained can be classified into two types: "Base APY" and "Rewards". "Base APY" refers to the yield calculated based on the borrower's interest payment and is the common yield. This yield is automatically added to the principal, so there is no need to claim it.

On the other hand, "Rewards" are distributed as rewards from the protocol. These can be obtained by claiming them from the deposited page or from one's own portfolio page.

"Base APY" is earned in the same token as the deposited assets, while "Rewards" are often received in tokens issued by Moonwell. The presence of these two reward systems allows for high yields.

○ Borrowers

Borrowers can secure a credit limit by collateralizing their preferred cryptocurrency and proceed with borrowing. Moonwell loans do not have a fixed repayment deadline, and borrowers can continue borrowing as long as their credit balance is above zero.

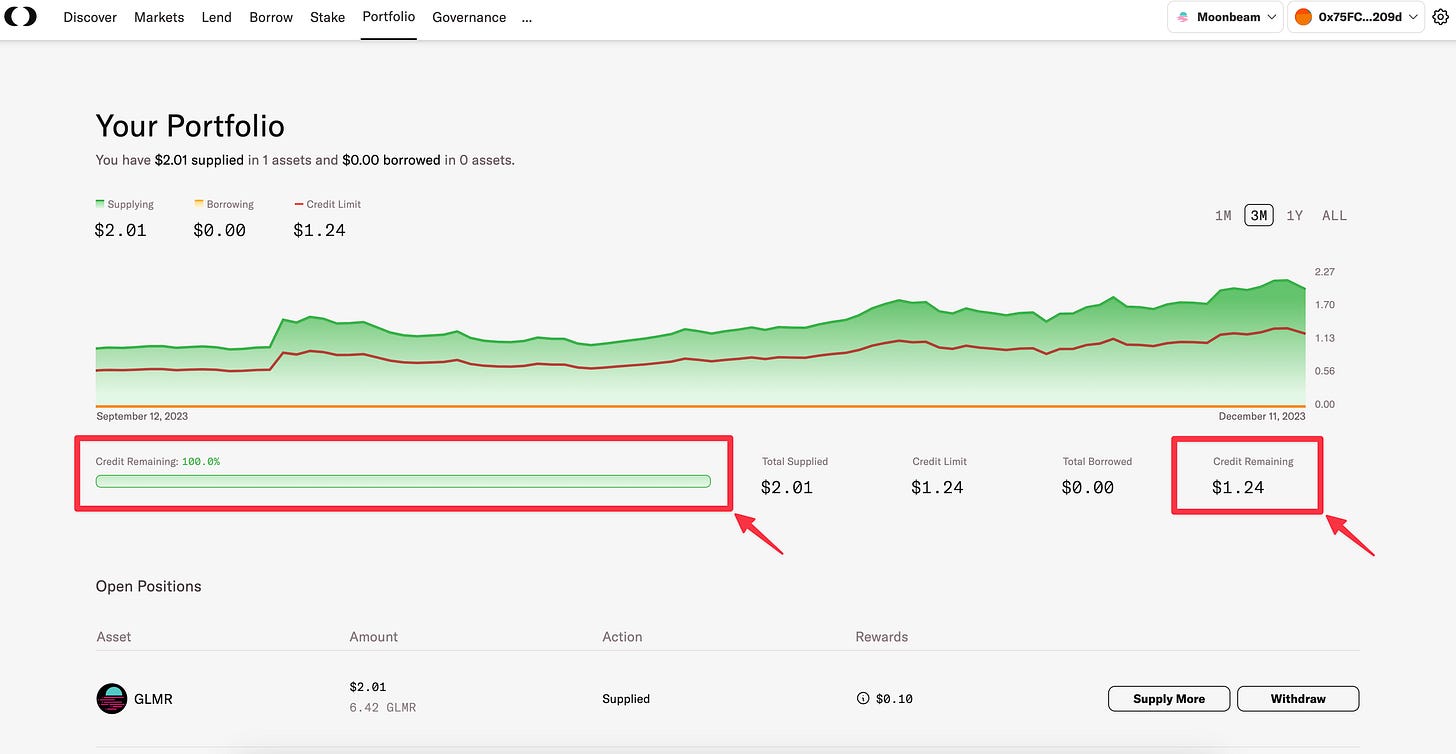

To simplify the terminology, the portfolio page can be displayed as follows. The amount of assets in supply can also be displayed, and the borrowing status can be managed.

The two terms that the borrower should understand are as follows:

Credit Limit: The maximum amount of funds that can be borrowed.

Credit Remaining: The remaining balance of funds that can be borrowed at the current moment (shown in both amount and percentage).

It is easy to understand. The "Credit Limit" is set based on the collateralized cryptocurrency, and if borrowing has already been done, the "Credit Remaining" decreases and is displayed. As long as "Credit Remaining" is not zero, borrowing is possible, but when it reaches zero, the risk of liquidation increases.

The "Credit Limit" is calculated based on "deposited cryptocurrency × collateralization ratio". The collateralization ratio is defined by the protocol, typically around 60% to 80%.

For example, let's say you use $1,000 worth of USDC as collateral, and the collateralization ratio for USDC is 60%. In this case, the Credit Limit would be "$1,000 × 60% = $600", so you can borrow up to $600.

◼️Other Features

While lending is the main feature of Moonwell, you can also participate in staking and governance within the app. In particular, with regards to governance, you can perform on-chain proposals, off-chain snapshot proposals, discussions, and delegate voting rights, all within the app. (Details about the governance mechanism will be explained later).

◼️ Supported Chains and Cryptocurrencies

The currently supported chains are Base, Moonbeam, and Moonriver. Base is an ETH L2 created by Coinbase, Moonbeam is a Polkadot parachain with EVM compatibility, and Moonriver is a parachain of Kusama, which is a Canary network of Polkadot.

The supported tokens are as follows:

Base: USDC, USDbC, DAI, ETH, cbETH, wstETH, rETH

Moonbeam: GLMR, xcDOT, xcUSDT, FRAX, xcUSDC, USDC, WBTC, ETH

Moonriver: MOVR, xcKSM, FRAX

Transition and Outlook | Expanding from Polkadot Ecosystem to Base

◼️ Expanding to Base

Moonwell was founded in January 2022. As the name suggests, it initially operated as a lending protocol on Moonbeam and Moonriver. It started on Moonriver and later expanded to Moonbeam.

Over the next 18 months, Moonwell established itself as a reliable borrowing and lending protocol, growing to become the highest TVL protocol within the Polkadot ecosystem.

In August 2023, Moonwell underwent a rebranding of its logo, a UI refresh, and expanded to Base, entering the ETH ecosystem. It was developed with support from the Base Ecosystem Fund.

The current TVL stands at $50.69 million.

Based on the Base protocol alone, it has a TVL of $15.2 million and ranks 7th overall.

◼️ Governance Mechanism

Due to the expansion to Base, Moonwell has become a protocol that spans two chains. There are two types of governance tokens that can be used for voting: WELL (on Moonbeam and Base) and MFAM (on Moonriver). Both types have the same exact authority.

Token holders can activate their voting rights through the governance tab within the app. They can choose to vote themselves or delegate to a representative.

And we have developed a new open-source governance framework called Temporal Governance to conduct governance on different chains. In simple terms, this mechanism allows for decentralized updates of multi-chain protocols by leveraging WORMHOLE to migrate on-chain approved protocol updates on Moonbeam to Base in a trustless manner.

In the future, it is expected that decentralization will continue to be implemented, while further chain compatibility and TVL increase are anticipated.

Analysis | Lending Protocols are Quite Revolutionary

This is the final analysis.

The first research of the new year turned out to be about lending protocols, and it was a very interesting project. The lending mechanism itself is not that unique, but I felt that the UI was clean and the governance mechanisms, among other things, were integrated within the app, making the user experience refined.

Lately, I've become interested in DeFi, so I've been conducting research, and the more I learn, the more I realize the greatness and potential of DeFi. While derivative and farming protocols are also impressive, I think lending protocols are quite revolutionary.

This is because lending and borrowing money is a field that many people can relate to, unlike derivative trading. Regardless of the amount, almost everyone has engaged in lending, including within families.

Moreover, both personal consumer lending and corporate banking thrive in the lending sector. The fact that it is profitable means that there are people willing to borrow even with high interest rates.

Considering this, I have a strong feeling that creating a lending protocol utilizing a stablecoin pegged to the Japanese yen could gain traction after the widespread adoption of stablecoins. Particularly, there seems to be significant demand for P2P lending protocols that allow lending to individuals.

The discussion then shifts to how to assess creditworthiness, and it seems like it would be better to perform KYC. However, instead of retaining KYC data or holding assets, creating a P2P matching platform that only charges a small protocol fee while not keeping any data or owning any assets could attract lenders, enabling borrowers to find a place where they can borrow instantly. As this heats up, following market principles, interest rates would also settle at the optimal level.

Currently, it is possible to achieve the same thing using USDC, but it could be quite interesting to do it with a Japanese yen stablecoin, in Japanese language, and market it specifically for Japanese users (although there is also a scent of potential crackdown).

To sum it up, decentralized lending protocols in the DeFi space, which can operate in a dispersed manner for something as relatable and in-demand as lending, are truly remarkable.

I believe that those reading this already understand that, but the demand for lending is still quite limited if we only consider the crypto asset industry. However, when looking at the entire financial market, it is undoubtedly a large market, so when DeFi spreads to the masses, it may turn out to be a very understandable and in-demand area.

Even in the world of ReFi, where I am involved, there are many projects that provide small loans to individuals and business owners in developing countries, similar to the Gramin Bank. Small amounts of money can often change lives, and with the use of blockchain, managing these loans can be automated, allowing people from all over the world to participate in providing liquidity.

Even individuals or companies that may be denied credit assessments by traditional financial institutions may have the possibility to borrow through lending protocols, thus equalizing opportunities. I will continue to delve deeper into DeFi and lending protocols through further research.

That concludes the research on "Moonwell"!

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

A web3 newsletter delivered in five languages around the world. We deliver various articles about web3, including project explanations, news and trend analysis, and industry reports, every day. You can subscribe for $8 per month ($80 per year) and receive research articles that took 100 hours to complete every day.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.