【Margarita Finance】Protocol for structured products of existing finance with DeFi / First round offers "Yield Boosters" / Raised $1M in pre-seed, also secured grant from Solana / @margfinance

Offers high yields against stabled coins.

Good morning.

Mitsui from web3 researcher.

Today we researched Margarita Finance.

🟢What is Margarita Finance?

📊Aiming for a $7 trillion market

💬Existing financial productsis realized in DeFi, the potential and risks

🟢What is Margarita Finance?

Margarita Finance is an investment platform that brings Wall Street-style structured products to the cryptocurrency world, offering potentially higher yields through customizable "Yield Boosters".

Structured products are investment products created by combining multiple financial instruments.The goal is to bring such financial instruments as used in the existing financial world on-chain.

The first product, Yield Boosters, is a structured product called a "Barrier Reverse Convertible" (also known as a BRC) in the existing financial world.

It is a product that combines the sale of a bond and a put option.A put option is "the right to sell an underlying asset at a predetermined price on a predetermined date.The investor who subscribes to the option receives a premium (option fee) for the put option in exchange for assuming the risk of a large decline in the underlying asset.

Simply put, "an investment product that earns high monthly interest but may reduce your principal if the stock price falls significantly".

For example, "You can buy a property for 1,000,000 yen that provides you with 10,000 yen of rental income every month, but if the land price in that area drops by more than 30%, the value of the property will also drop in proportion to the land price.

The reason this product can pay high interest is that the investor acts like an "insurance company.

For example, in auto insurance:

Instead of taking the "risk of paying a large insurance payout in the event of an accident," the insurance company

they get a monthly premium.

The same is true for barrier reverse convertibles:

Instead of assuming the "risk of a large drop in the stock price," the investor

they get a high monthly interest rate.

In other words, behind the high interest is hidden the "risk that the principal may decrease".This product is an investment product for those who fully understand that risk.

The on-chain version of this product is called Yield Boosters.It is a customizable financial instrument that allows users to potentially earn higher yields than standard staking.

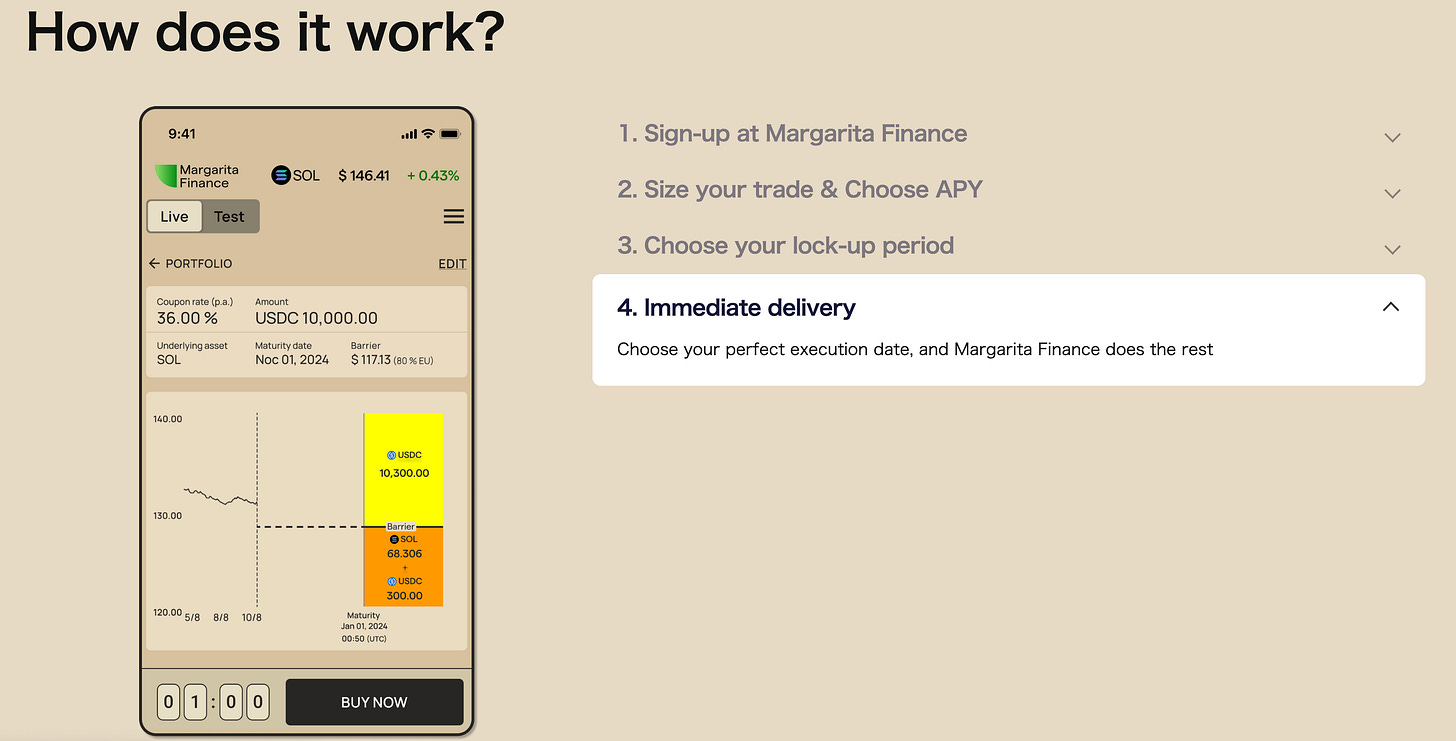

Usage is simple: users choose the crypto asset, lockup period, target yield, and barrier price to generate income, as shown below.

The protocol is built on Solana and supports USDC as the investment currency and initially SOL as the underlying asset.The underlying asset is the currency against which a pre-defined barrier line is set and which will be paid out when it falls below the barrier line.

If you remain above the barrier line, the yield and the underlying asset will return as is, and if you fall below, the yield will return, but based on the initial price when you started investing, the initial investment will be converted back into a linked cryptocurrency asset (currently SOL).

For example, calculate the yield for the following case

You put in 10,000 USDC

Boldly choose 48% APY in one month

You will be offered a 50% barrier to the initial price of the SOL

Two things can happen here

If SOL rises above the barrier, 10,400 USDC will be refunded (10,000 USDC of invested assets + 4% yield for the month).

If the SOL falls 50%, 10,000 USDC of invested assets will be converted and returned to the SOL, which is 50% of the 10,000 USDC, plus an additional 4% yield (= 400 USDC).

Did we convey the message?It is a bit complicated because it is a structured product, but it is a product that allows you to earn a large yield in exchange for assuming the risk of a decline in crypto assets.

📊Aiming for a 7 trillion dollar market

Margarita Finance" aims to create a $7 trillion structured products market in traditional finance on-chain.This will provide an investment destination within DeFi that can aim for high yields despite being a stablecoin.

Solana is currently used as the underlying asset, but in the future, BTC and ETH will also be added as underlying assets, and a sellback feature will be added to allow users to unwind their positions at any time.

In the future, they aim to create many new structured products that combine crypto assets and existing finance.

The company also completed a $1M pre-seed round of funding in November 2024, with several early stage investors and institutions including Tomahawk VC, Outrun Ventures, and Swiss foundation family office N&V Capital.In addition to this investment, the company has also secured a grant from the Solana Foundation (Solana Foundation).

Note that "Margarita Finance" itself is based in Switzerland.

💬Possibilities and risks of existing finance products being realized in DeFi

The last one is a consideration.

The "Yield Boosters" realized by Margarita Finance are very interesting.It is likely that some DeFi people will use this investment strategy, which aims for high yields despite the fact that it is a stable coin.Naturally, there are risks associated with this, but the expanded range of options is likely to be an attraction for more people.

As more and more financial products in the existing financial world appear on-chain in this way, more and more people will enter the DeFi market, and the scale of money handled could be orders of magnitude larger than in the past.

If you think about it, this has the potential to be dozens of times larger than before, and we have a very exciting future ahead of us.Moreover, the impact that only DeFi can have is to give everyone access to investment products that previously were accessible only to a limited number of people.Still, there will be a difference in returns depending on the principal amount, but it should also make sense to democratize access first.

As for risks on the other hand, first of all, basic risks such as hacking risks of protocols and regulatory risks are assumed, and as financial products become more complex in the on-chain world, things like chain bankruptcies could happen.

The bankruptcy of Silicon Valley Bank caused USDC to depeg temporarily, but USDC was at the root of all DeFi, so there was a chain effect.It was good that it returned quickly, but if it had, it would have had a much bigger impact if it had been fully depegged.

I think that being able to create complex products on-chain and smackonly would allow for low fees and interesting products, but the more complex and intertwined they are, the greater the hacking risk and the wider the scope of impact in the event of an incident.

That said, this is true for other protocols as well, so it is not just structured products; as with EigenLayer, operational strategies across multiple protocols have become the norm for DeFi these days.I think that the transition of time has made DeFi a little safer and more complex operational strategies are emerging on top of it, but there is no doubt that complexity is an increase in risk.

However, as I mentioned above, it is good to have more investment options, and the fact that existing financial professionals are joining DeFi is a good sign of market expansion, so I am very much looking forward to future product development.

This is my research on Margarita Finance!

🔗Reference/image credit: HP / DOC / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.