【Kredete】Fintech app integrates international money transfer and credit building for African diaspora / Transaction history leads to improved US credit score / @kredete

API for B2B is also available.

Good morning.

I am mitsui, a web3 researcher.

Today we researched Kredete.

📱What is Kredete?

🚩 Transition and Prospects

💬Stablecoin payment infrastructure continues to expand

🧵TL;DR

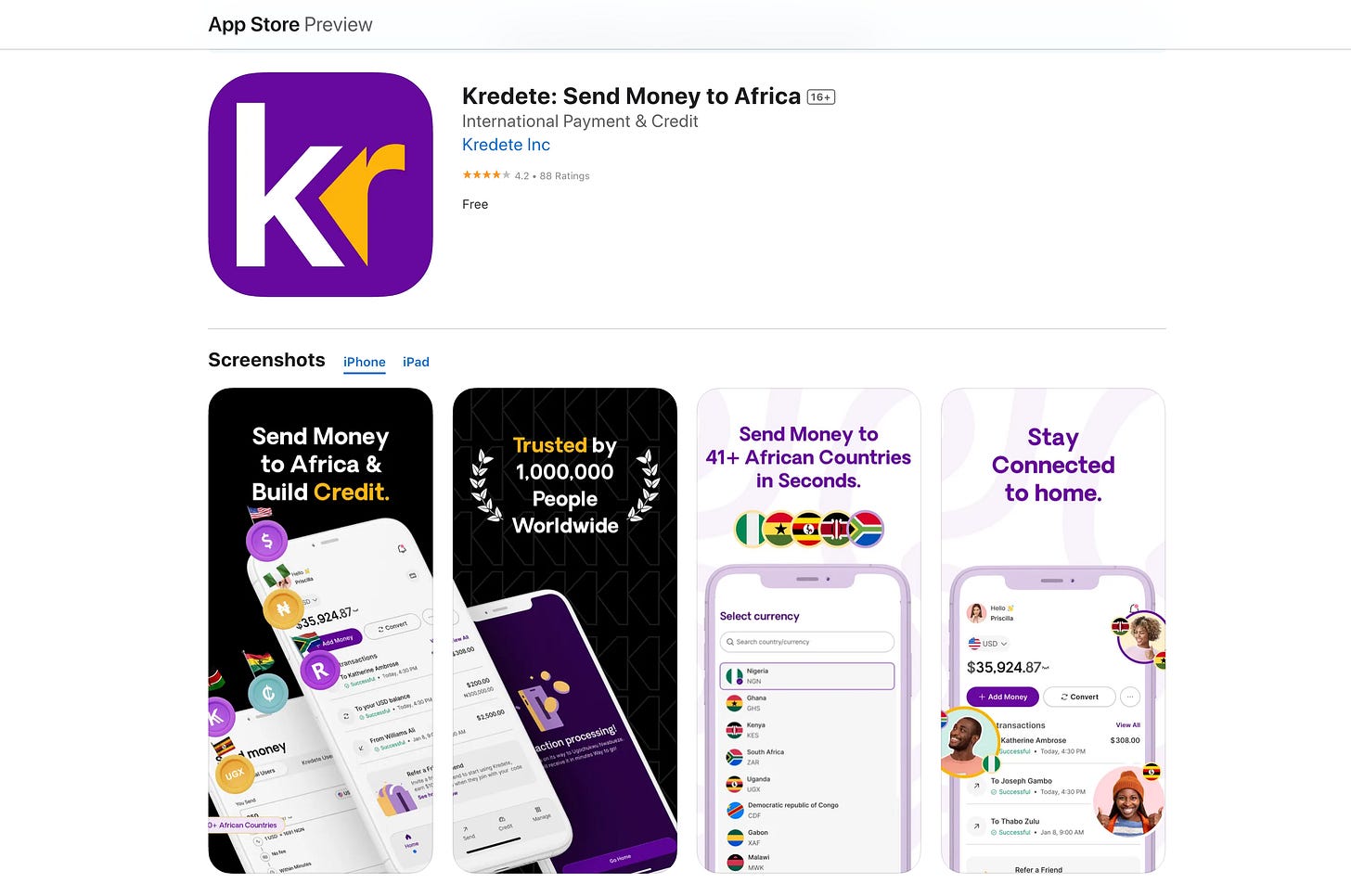

Kredete is a fintech app that integrates international money transfer and credit building for the African diaspora.

You can send money instantly to more than 25 countries, with fees as low as less than $1, plus your transaction history will improve your U.S. credit score.

In addition, it has a virtual card and B2B API infrastructure, providing a mechanism to transform remittances from "spending" to "investing in the future.

📱What is Kredete?

Kredete is a combined international money transfer and credit building platform for Africa. It offers a mobile experience that combines international money transfer and credit building, primarily targeting the African diaspora (immigrants) living in the United States.

It currently supports instant money transfers to more than 25 African countries and handles more than 15 currencies. Funds can be placed in the in-app wallet from the source and transferred directly to a mobile money account (e.g., M-Pesa or other mobile money transfer service in the country), to a local bank account, or to the recipient's Kredete app account. The in-app wallet is multi-currency compatible and can store, send and receive multiple currencies.

The following are the features

◼️Low transfer fees and fast money transfers

Featuring extremely low remittance fees and transparency, Kredete reduces costs by utilizing stable coin technology for its remittance infrastructure, resulting in a fee of less than $1 per international transfer.

In addition, the real-time payment network using stable coins enables faster arrival of funds than conventional bank transfers.

The front user screen has a simple legal tender-based UX, while the back side uses stablecoin for the money transfer system.

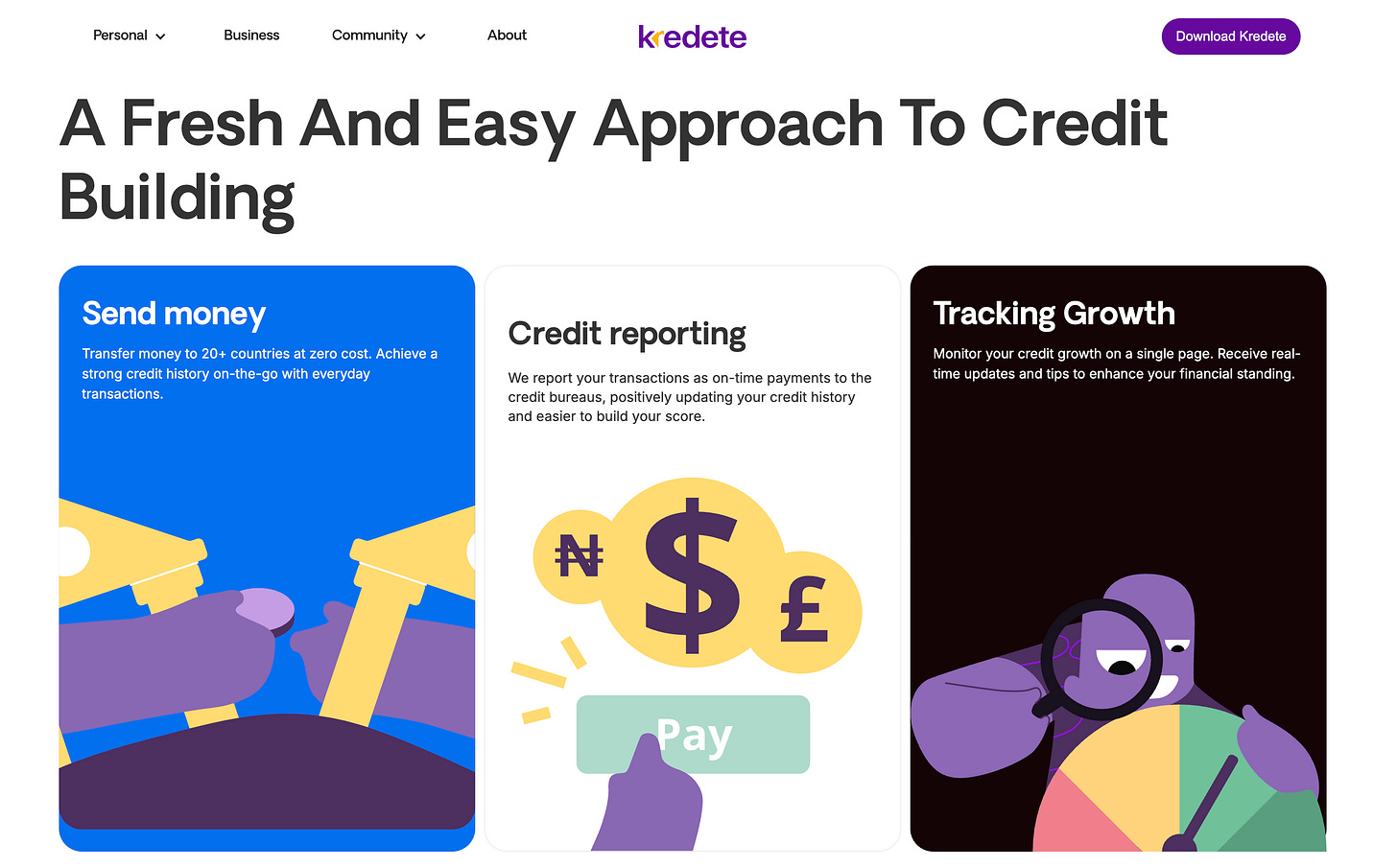

◼️Building Credit Scores

The most important feature is the unique function of "building a credit score with remittances," which goes beyond mere money transfers.

Kredete reports remittance transactions to U.S. credit bureaus as on-time payment information, building up the user's credit history. This allows African immigrant users to improve their credit score in the U.S. rather than in their home country through daily remittance activity.

In addition, the app has an in-app credit score display and growth tracking feature that allows users to see real-time score trends and receive advice on how to improve their scores.

For the African diaspora living in the U.S. and elsewhere, sending money home to family members is a daily responsibility, but one that traditionally just disappears as an "expense." By sending money through Kredete, their history is reported to U.S. credit bureaus, which can improve their credit scores.

This allows users to take out home and car loans at lower interest rates, reduce rental contracts and utility deposits, and experience reduced living costs and expanded access to finance. In short, Kredete plays a role in transforming remittances from "just another expense" to "an investment that expands future financial options.

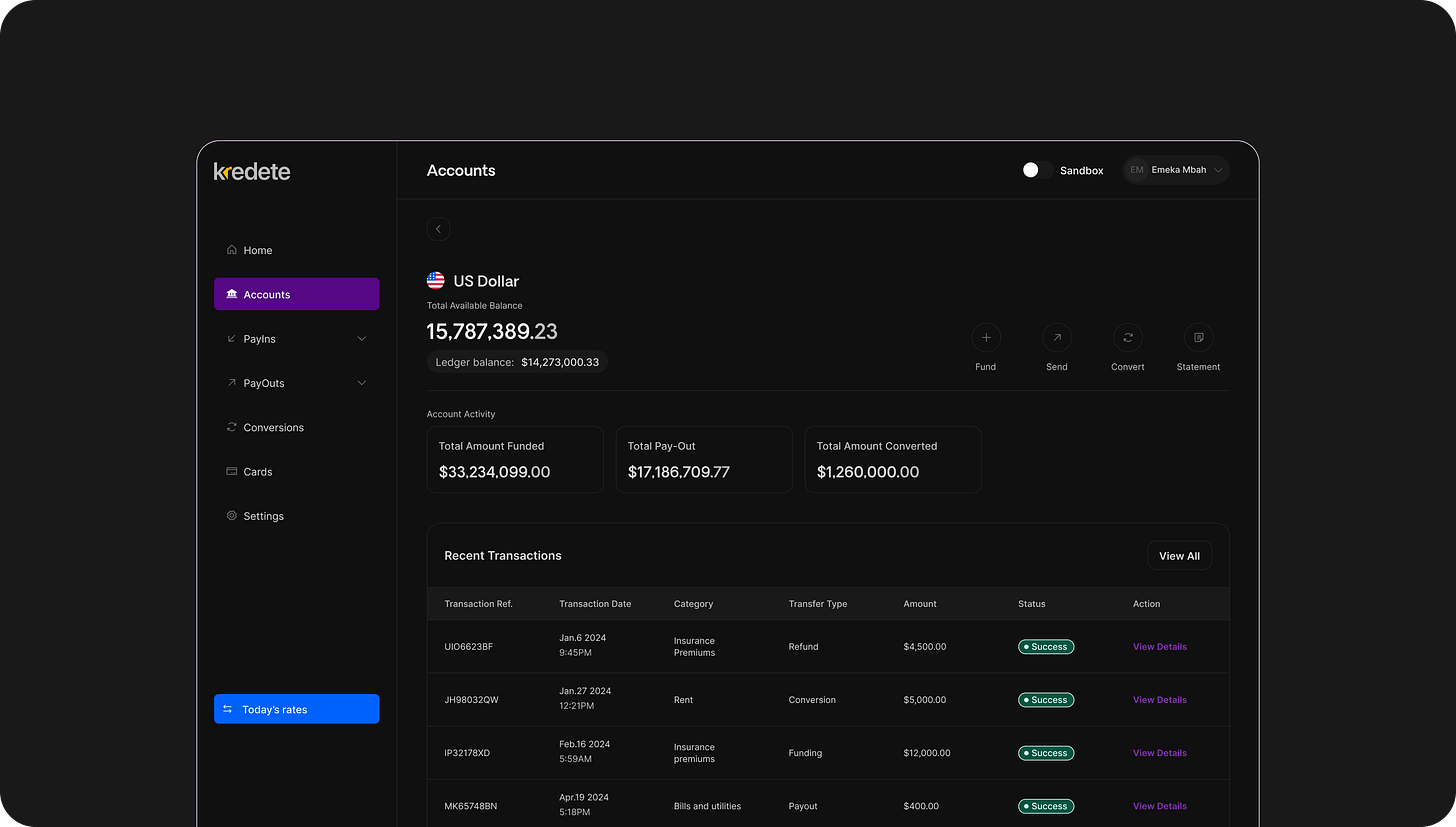

◼️API infrastructure for B2B

Kredete also provides API infrastructure for B2B.

It provides an "aggregation layer" that allows companies to connect to banks and mobile money networks in African countries via a single API for secure and low-cost cross-border remittances.

Recent announcements have also strongly demonstrated this API-first approach, with B2B payments using stable coin technology at the forefront.

In addition to this, it has other basic functions as a fintech application, such as issuing virtual cards and making payments.

🚩Transition and Outlook

Kredete was launched in 2023 by Adeola Adedewe, a serial entrepreneur from Nigeria.

He realized the need for a "financial system that values the act of supporting one's family" after experiencing the barriers faced by immigrants in the U.S., such as a lack of credit history, and the reality of sending money home to his family in his home country.

This is where the idea of "remittances becoming credit" was born, and the core functionality of Kredete, which integrates remittance and credit reporting, was created. In the early days of the company's founding, there was a vision oriented toward expanding access to credit within Africa, but soon after, the focus shifted to the U.S. diaspora. Thus, Kredete shifted its positioning from a mere "remittance app" to "remittance as credit infrastructure" and took its current form.

It currently has approximately 700,000 active users and has reached approximately $500 million in cumulative transfers.

After these achievements, the company also raised $22M in Series A in September 2025. The lead was a prestigious VCAfricInvest from Tunisia, with participation from existing investor Partech, as well as Polymorphic Capital.

The use of the procurement is clear and includes the following three uses

Expansion to Canada, UK and major European countries

Launch of per-credit products such as rent reporting, savings products, goal-based loans, and credit cards backed by storable coin

Enhanced API-based B2B payment infrastructure

In other words, while expanding the "entry point" of diaspora from North America to the Commonwealth and the EU, we are taking an expansion strategy to vertically extend the front use case from "remittance" to "credit, savings, and cards" and then horizontally through B2B.

Of particular note is the refinement of the payment infrastructure using stable coins on the reverse side.

While ostensibly protecting legal tender UX, Kredete has built a stable coin-based settlement rail on the back end to optimize the speed of money transfer and cost structure.

The phrases "Stablecoin transfers to Africa" and "API-based infrastructure" were repeated in the Series A announcement, suggesting that enhanced B2B deployment of this payment rail is central to the future growth story.

💬Stable Coin Payment Infrastructure Continues to Expand

Now, the final part is a consideration of the summary.

The basic functionality of the product is simple. In addition to stable coin-based transfers and payments, the value offered is a dual structure in which the history of the transaction becomes a credit score.

In the future, in addition to expanding the user base that will be attracted by this system and developing products using credit scores, we plan to provide this system itself via API to companies that wish to use it.

I personally believe that the stable coin system, which allows access to the dollar economy in Africa and immediate remittances from migrant family and friends, will certainly expand.

Naturally, there are many other similar fintech apps, but there will be a difference in fees no matter how hard you try between those that put their infrastructure on the blockchain and others, so I think the future will come when every app has a blockchain behind it and exchanges in stable coins I think that the future will come when every app will have a blockchain behind it and exchange stable coins.

Right now, many people still receive stable coins on the back side that are converted to local currency, but I think it will soon become common to receive them as stable coins, invest them in DeFi when not in use, and pay with a credit card when they are used.

However, if this happens, people will live in dollar terms, so the establishment of home-denominated stable coins is essential for the defense of currency rights. I believe that people will flow in the direction of convenience, so I think it is not unlikely that the number of people around the world who use their own currencies only for paying taxes and live in dollar-denominated stable coins for the rest of their lives will increase.

With this in mind, it may not be long before blockchain becomes the financial infrastructure around the world in a not-too-long time frame, and stable coins are used in everyday currency.

I'm looking forward to it.

This is the research for Kredete!

🔗Reference Link:HP / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.