The Future of DeFi Seen in Kamino's RWA Deployment

The RWA market will disappear, and DeFi will integrate with financial markets.

Good morning.

I’m Mitsui, a web3 researcher.

Today I’ll be writing a report titled “The Future of DeFi Seen in Kamino’s RWA Deployment.”

Kamino’s RWA Deployment

Overview of Six New Products

The RWA market will disappear, and DeFi will integrate with financial markets.

TL;DR

Kamino has grown as a leading DeFi lending platform on Solana. However, recognizing limitations in growth and institutional adoption within crypto-collateralized, variable-rate DeFi, it has decided to fully expand into the RWA space.

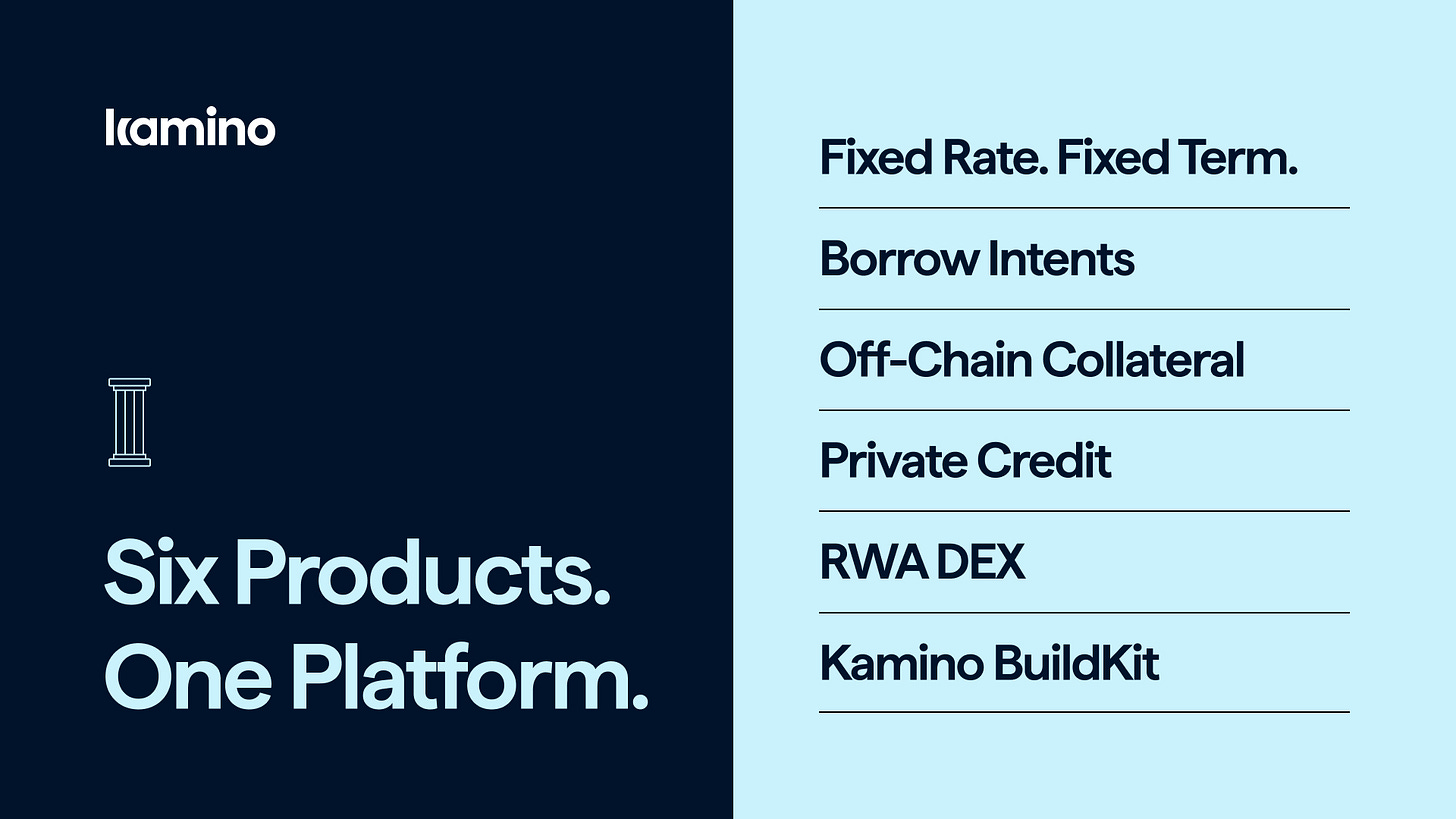

The six products—fixed-rate loans, order-based financing, off-chain collateral, institutional credit, RWA-dedicated DEX, and developer infrastructure—constitute an integrated suite of financial products designed to connect the RWA market with DeFi.

Through these efforts, Kamino is evolving beyond a mere DeFi application into a “credit market infrastructure” that integrates real-world assets, institutional capital, and interest rate markets onto Solana.

Kamino’s RWA Deployment

On December 12, 2025, Kamino, a prominent lending protocol on Solana, announced a new development.

This announcement centers on our expansion into the RWA space, evolving beyond our existing lending capabilities to introduce six new products aimed at becoming a financial infrastructure platform for institutional investors and tokenized assets.

We’ll explain the details of each product later, but first, let’s discuss the background behind Kamino’s entry into the RWA space.

◼️What is Kamino?

Kamino is a DeFi protocol built on Solana. Launched in August 2022, it operates as a “one-stop” DeFi hub, providing multiple financial functions—including liquidity provision (LP), lending, and leveraged trading—on a single platform.

Kamino initially launched as an automated LP optimization protocol. At its August 2022 launch, it focused on providing automated management services for centralized liquidity positions to users supplying liquidity to decentralized exchanges on Solana.

Subsequently, the market environment shifted from late 2022 through 2023. While existing lending protocols on Solana stagnated due to the fallout from FTX’s collapse, the Kamino team decided to expand into the credit market. “Kamino Lend (K-Lend)” was introduced, enabling users to deposit SOL or stablecoins on Kamino to earn interest, or conversely, borrow these assets for leveraged trading.

Subsequently, Kamino leveraged its lending infrastructure to offer even more advanced strategies. With the Multiply Vault, users can employ a “loop strategy”—repeatedly borrowing against their deposited collateral for additional investments—to achieve staking yields at 2 to 3 times the scale of their principal.

In 2024, the “Kamino Points” program was launched, and the $KMNO token TGE was conducted on April 30, 2024. This initial airdrop targeted over 250,000 wallets, making it the largest token distribution event in Solana DeFi history.

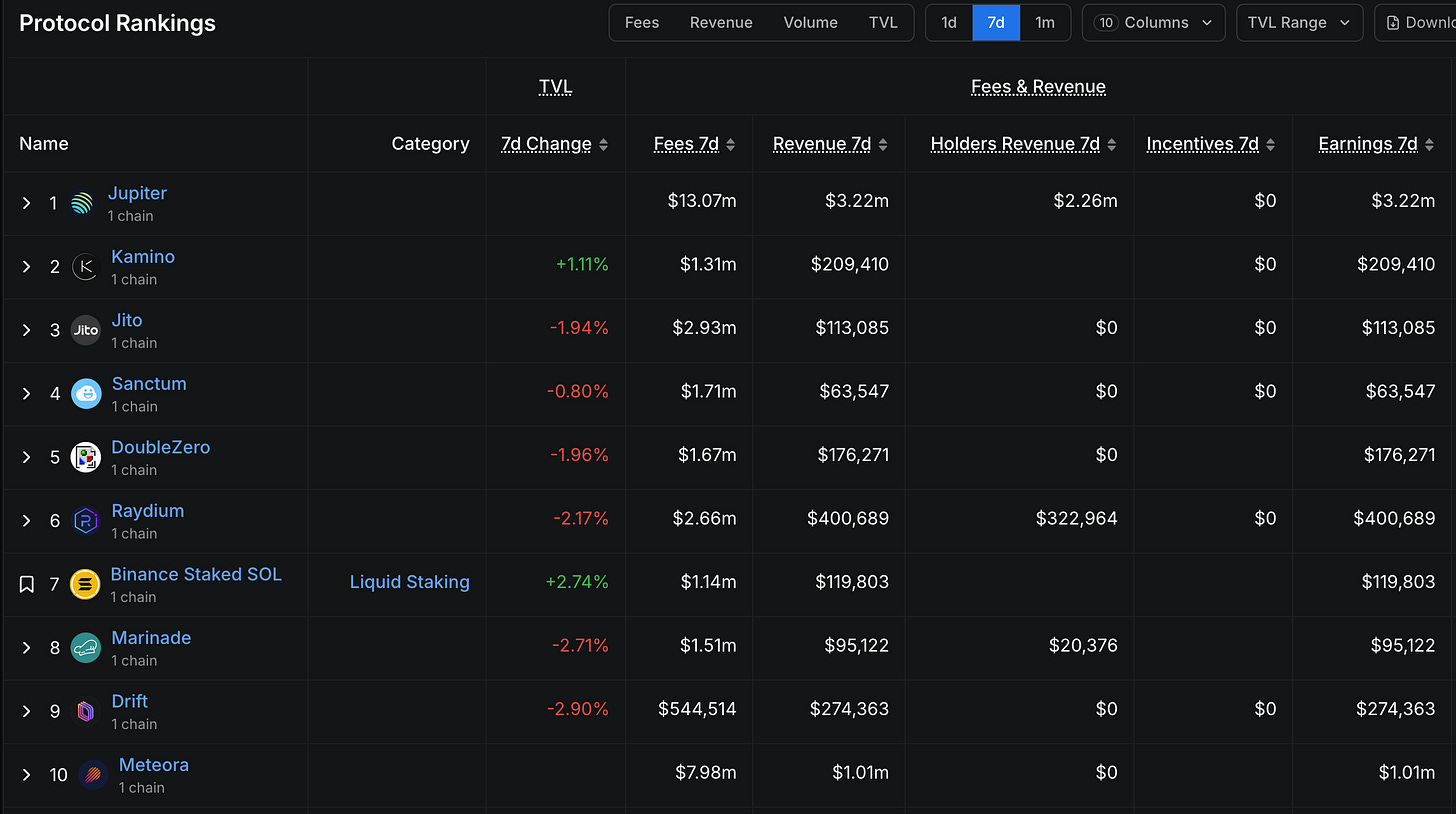

As a result of this evolution, it now boasts a TVL of approximately $4 billion, cumulative lending volume exceeding $16 billion, and loan liquidation processing reaching $183 million (while maintaining zero losses for lenders).

◼️Background of Kamino’s RWA Deployment

Kamino’s next area of focus is the RWA sector.

By 2025, the issuance of RWA will increase by approximately 350%, with over $1.8 billion currently in circulation. However, integration with DeFi remains insufficient, and Kamino will address this gap.

Much of the current DeFi lending market dynamically sets interest rates through algorithms. While this is a highly innovative mechanism, it cannot achieve stable operations amid the intense volatility of collateral funds, making it unsuitable as an investment destination for large-scale markets such as institutional investors.

Kamino is therefore aiming to expand the market by targeting not only the crypto-native market but also existing massive markets such as the bond market, credit market, and equity-backed lending. While the DeFi market is worth tens of billions of dollars, each of the aforementioned markets is worth hundreds of trillions of dollars—literally orders of magnitude larger.

Therefore, we aim for significant growth by creating DeFi features tailored to the growing RWA market.

Overview of Six New Products

Below are the six new products announced by Kamino. All six products form a suite designed to bridge the RWA market and the DeFi market.

Now, I’ll explain each one step by step.

◼️Fixed Rates

This refers to a new loan product that allows borrowing at a fixed interest rate for a set period. Borrowers select a predetermined term and interest rate in advance, enabling them to continue borrowing at the same rate throughout that period regardless of market conditions.