【Inversion】Emerging PF fund to improve profitability through acquisitions and blockchain implementation / Also built own L1 with Avalanche / @inversion_cap

After acquiring a company, we aim to reform its management by introducing blockchain.

Good morning.

I am mitsui, a web3 researcher.

Today I researched "Inversion".

🏢What is Inversion?

🚩 Transition and Prospects

💬 and very interesting attempt

🧵TL;DR

Inversion is a NY, USA-based investment firm founded in 2024 with a PE-type model of acquiring traditional businesses and transforming them through blockchain implementation.

The areas of focus are inefficient core industries such as telecommunications and financial services, which have already proven to be effective in reducing remittance time and communication costs.

In September 2025, the company raised $26.5 million from Dragonfly and others and is developing its own chain, Inversion Chain, on Avalanche while selecting an acquisition target.

The goal is to become an on-chain version of Berkshire, integrating a group of acquired companies and expanding the ecosystem revenue and chain economies on a flywheel.

🏢What is Inversion?

Inversion is an emerging investment firm that aims to transform traditional businesses using blockchain technology.

In the image of PE fund x blockchain implementation, the most important feature of the investment style is the introduction of blockchain through the acquisition of traditional companies (M&A).

While typical VC firms make small investments in emerging startups, Inversion takes a private equity (PE)-type approach, acquiring an existing business in its entirety, taking control of management, and incorporating blockchain technology in a top-down strategy.

Specifically, we will focus on "traditional but low-margin core industries" such as telecommunications (telecom) and financial services. These industries have inefficiencies caused by legacy infrastructure, and there is significant room for cost reduction and operational efficiency improvement through the introduction of blockchain.

In fact, blockchain payments can reduce settlement times by up to 60% compared to traditional money transfers in financial transactions, and in telecommunications, the Helium network has already proven to be effective in some cases, reducing wireless data costs by up to 75%.

Inversion is a strategy to increase value through blockchain integration, focusing on areas where there is significant room for reform in these traditional businesses.

As for the main portfolio, no specific acquisitions have been announced at this time (2025); Inversion has just completed a seed financing round and is in the process of researching and selecting promising acquisition targets.

As mentioned above, the company has indicated that it is considering telecommunications and financial services companies as its first acquisition targets, and in terms of geography, it is reportedly also looking at emerging markets (especially in Africa and other regions) where there is a high need for efficiency gains through the introduction of blockchain.

In addition, the company plans to build its own blockchain, the "Inversion Chain," as a self-developed project, and the acquired companies are expected to be positioned as a portfolio in the form of interconnected companies on the Inversion Chain.

◼️Inversion Chain

According to information released by the Avalanche Foundation in February 2025, Inversion plans to build its own dedicated blockchain infrastructure using Avalanche's subnet technology, with the aim of integrating and supporting the acquired group of companies into a single economy.

Inversion's founder, Mr. Santos, has stated that "we want to make our chain the 'on-chain version of Berkshire (Hathaway),'" and his vision is to pursue economies of scale and synergies by operating the various businesses acquired through acquisitions on a single blockchain. The vision is to pursue economies of scale and synergies by operating the various businesses acquired on a single blockchain.

He cited Avalanche's "high performance and customizability as the ecosystem that best fits our mission (to promote cryptography).

The Inversion Chain is currently under development, and while a specific date has not yet been set for the start of operations, the company is "aiming for the earliest possible launch.

🚩Transition and Outlook

Inversion was founded in 2024 and is headquartered in New York, USA. The founder is Santiago Roel Santos, a prominent investor in the crypto asset space and former partner of ParaFi Capital (a DeFi-focused fund).

In addition, Suzanne Dannheim has joined the firm as co-founder and COO, who joins from Goldman Sachs in 2025 where she worked on crypto asset strategies.

Under the leadership of these founding members, Inversion's vision is to "Real GDP onchain", and aims to make businesses run faster and more efficiently by using the blockchain as an "operating system" for the company. Inversion's vision is to "Real GDP onchain"

As mentioned above, no specific acquisition deals have been announced at this time (2025) and we are still in the process of researching and selecting promising acquisition targets.

Funding for this has been completed, with a seed round of $26.5 million raised in September 2025.

The lead investor is Dragonfly Capital, a crypto asset fund, and other leading investors in both the crypto industry and traditional finance, including HashKey Capital, VanEck, ParaFi Capital, and Wintermute, are also participating in the investment.

This round reportedly valued Inversion at $100 million, and there was strong support from prominent VCs and financial institutions for the company's vision of "integrating blockchain into traditional businesses.

The $26.5 million raised will be used mainly for building the company's operational infrastructure (hiring and technology development), and the actual acquisition funds will be raised through a separate fund (Inversion Capital).

In addition, the site presents the following three pillars as specific approaches for the future

Strategic Acquisitions:The company will: acquire an existing leading company with a user base and improve its cost structure through the introduction of blockchain. By acquiring a company that already has a customer network, the aim is to improve efficiency by adding technology to an existing business rather than acquiring users from scratch.

Monetize Ecosystems:Create a new revenue stream by deploying fintech services such as stablecoin to the customer base of the acquired company. For example, if a telecommunications company is acquired, the image is to provide digital wallets and remittance services to its customers and convert them into value-added services by utilizing crypto assets behind the scenes.

Own the Economy:The company will: integrate multiple businesses on its own blockchain (Inversion Chain) to simultaneously earn private equity-like returns and growth profits from the on-chain economic sphere. As transactions increase on the company's own chain, the value of the token economic sphere also increases, which creates a virtuous cycle that becomes a source of further investment.

The above three pillars are illustrated as flywheels.

In other words, the cycle is (1) expand on-chain business through acquisitions → (2) increase stable transaction volume without relying on speculation → (3) increase ecosystem value → (4) further increase acquisition capacity → (5) transform business on the blockchain and generate revenue.... It is suggested that this loop aims to achieve both scale expansion and value creation.

💬and very interesting attempt

The final section is a summary and discussion.

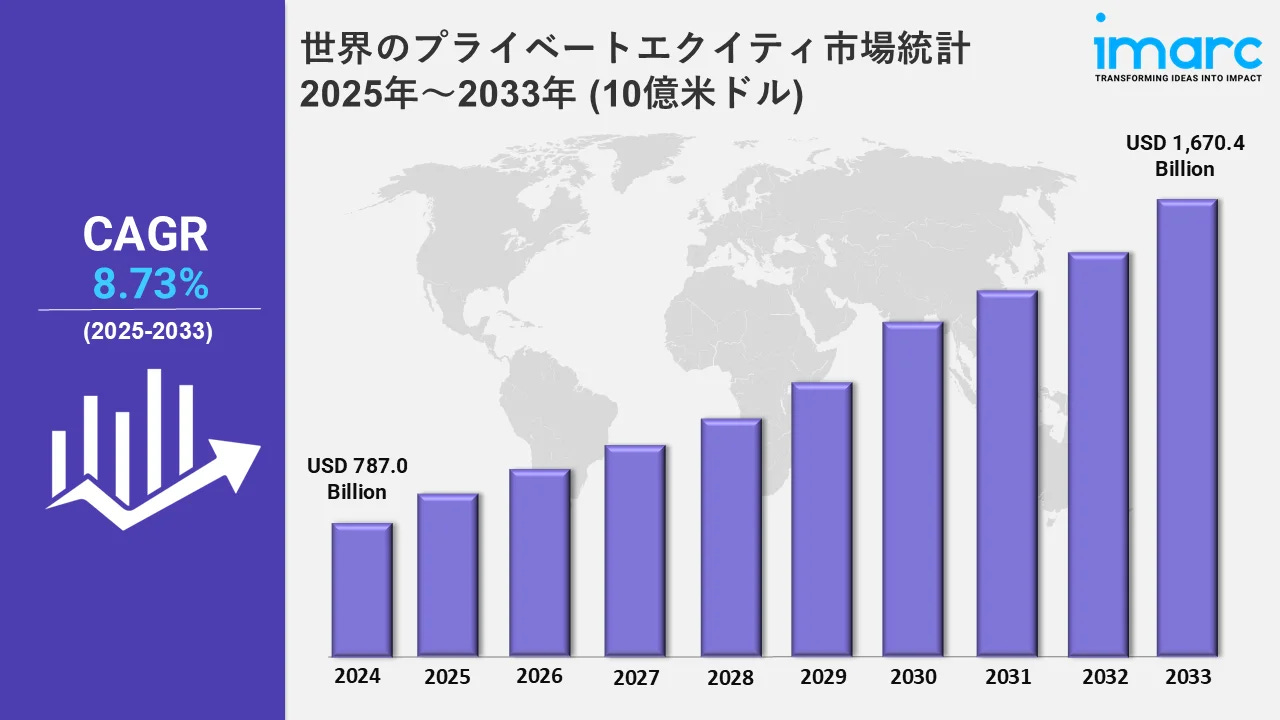

PE funds are a growing area in the business industry as a whole. The business model is not to make a small investment, but to acquire a company with potential (assets) but stagnant management, leverage the company to increase its value, and then sell it again to earn a profit margin.

While there are pros and cons to this business model itself, it is understandable that the commitment is higher than mere consulting, since you acquire everything yourself, leverage the management, and lose a lot of money if you fail to do so. However, there is no doubt that there is a possibility of over-committing to increasing the share price in the process, which could lead to a backlash and a focus on short-term share price only.

Well, leaving aside the business model of PF itself, the idea of doing it in the blockchain area is very interesting. Moreover, if we build our own blockchain and put various companies on it, it will enable a business model that has not been possible with PF so far.

As mentioned in the flywheel above, the business grows in a compounding manner, including the post-acquisition company's earnings, plus the cost of gas for its own chain, as well as the return from the improved price of its own chain's tokens. That's even more above the grunt strategy in the chain. It's not just a form of grant, it's a form of acquisition and leverage.

There may also be a plan to attract funds from global sources by eventually making this place available for investment with security tokens or DeFi, since the fund for acquisition funds was to be built separately again.

Tokenization of funds for acquisitions

Tokenization of shares of the acquired company

By doing this on its own chain, the volume of transactions on the chain will increase, the token itself will receive transaction fees and gas revenues, and the token price will also increase.

In particular, the second, tokenization of the acquired company's shares can be done on a one-to-one backed basis, although unlisted, since they own the shares themselves. Perhaps the transaction fee for that tokenized stock could be distributed to the fund token holders. A new dividend.

To that extent, it is a very new business model in PF.

Or, rather, VC's may create their own chains or marketplaces where they tokenize some of the unlisted shares they have invested and trade them, making their own income from the transaction fees, or startups may sell their own shares in a presale and make sales from the transaction fees. I believe that this type of business will increase in the future.

After working on the token issuance project myself, I have learned that the transaction fee income from tokens is quite significant. And I am very interested in this income because it has the potential to create a business model that has never been seen before. However, I need to be careful in this area because it depends on legal regulations.

First, I would like to look at the "Inversion" trend and see if there is a business model that I can work with.

This is the research for "Inversion"!

🔗Reference Link:HP / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.