【Indexy】Platform for "indexing" and analyzing the crypto asset market / Supports diversification and discovery of new projects / @indexy_xyz

Index investing may be possible in the future.

Good morning.

I am mitsui, a web3 researcher.

Today, we are going to discuss the "Indexy”.

📈What is Indexy?

🚩 Transition and Prospects

💬Replaces all financing

🧵TL;DR

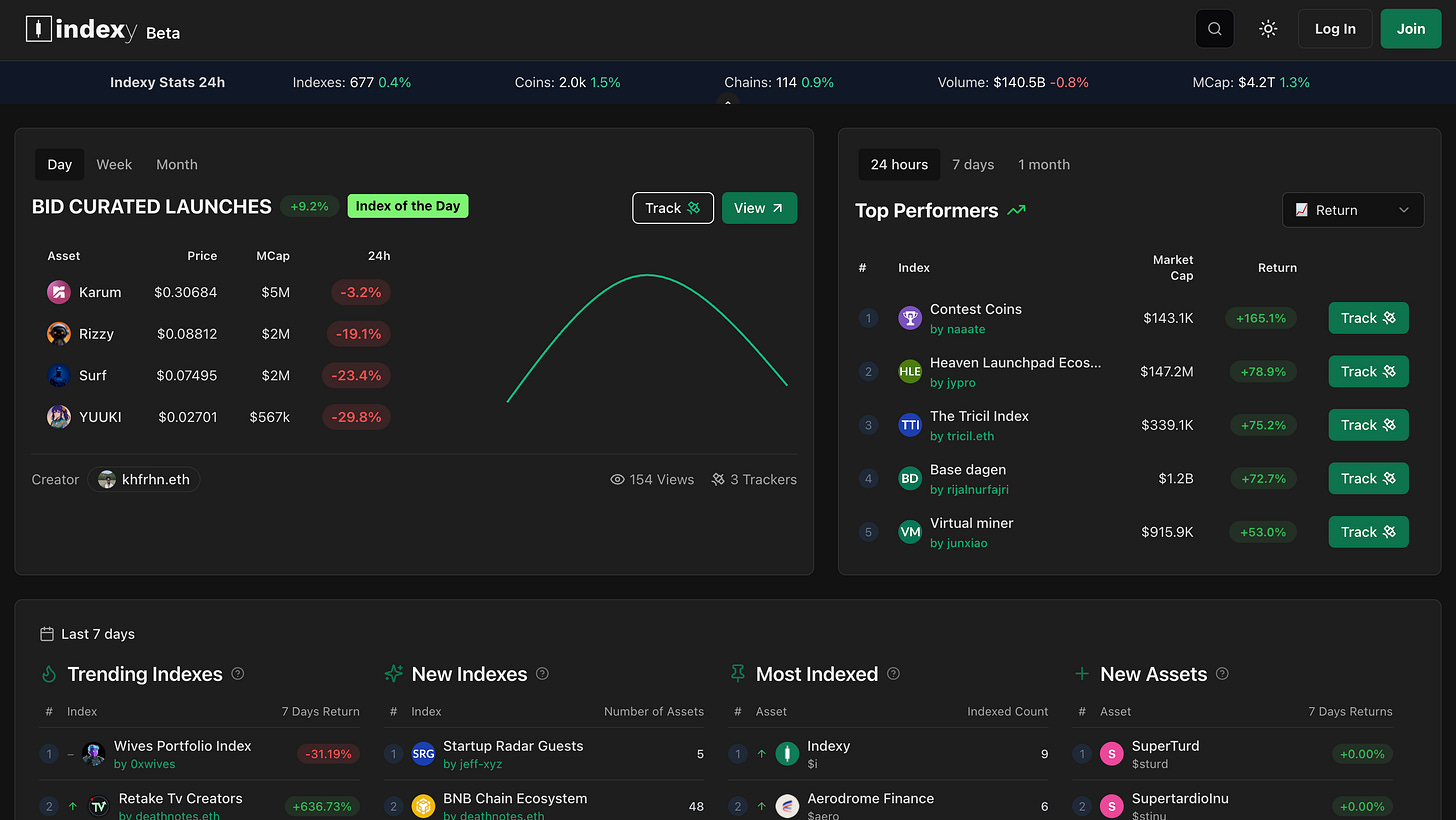

Indexy is a platform for "indexing" and analyzing the crypto asset market, which allows users to understand the market trends of multiple chains of tokens by theme, such as AI, NFT, DeFi, etc.

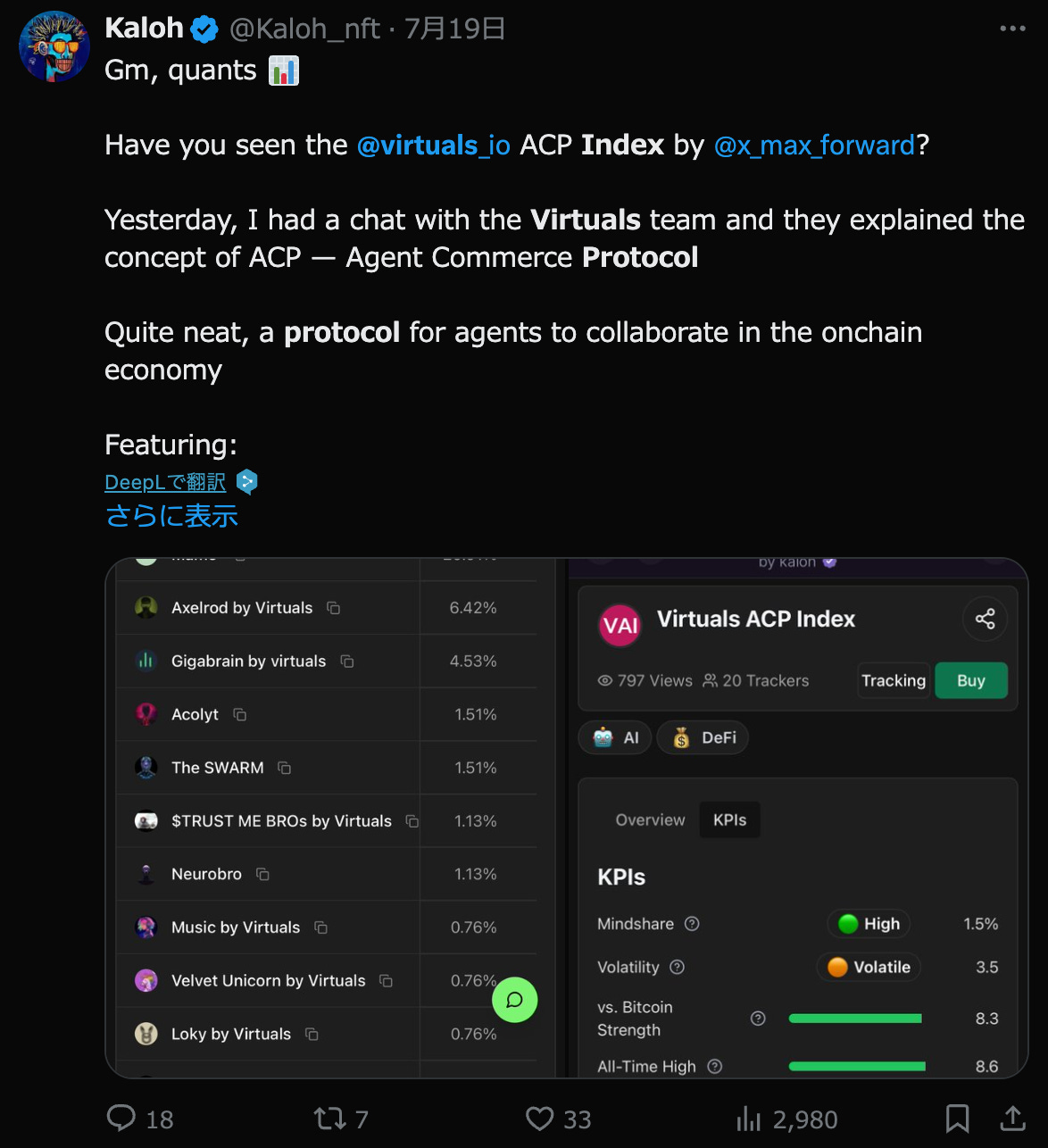

It supports diversification and new project discovery, and users themselves can create and share custom indexes.

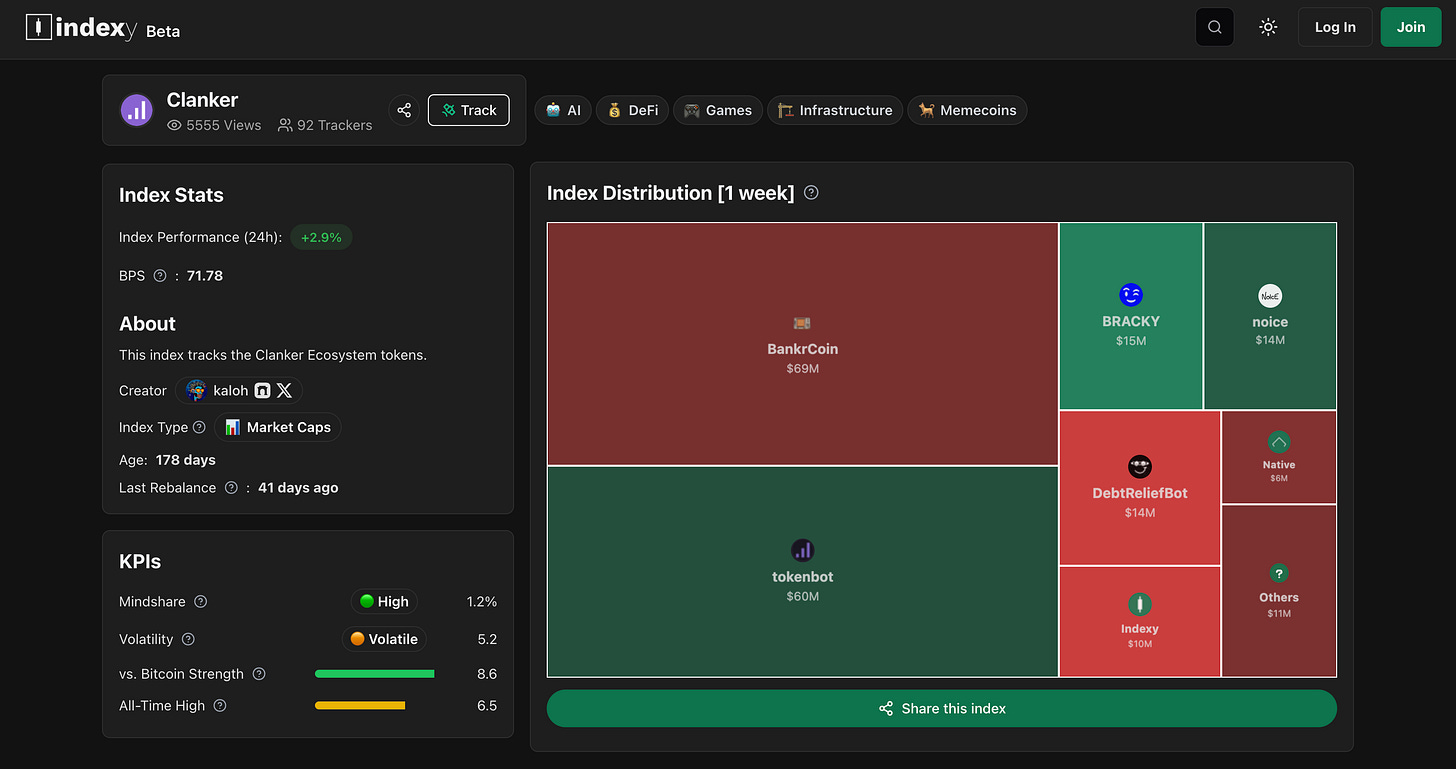

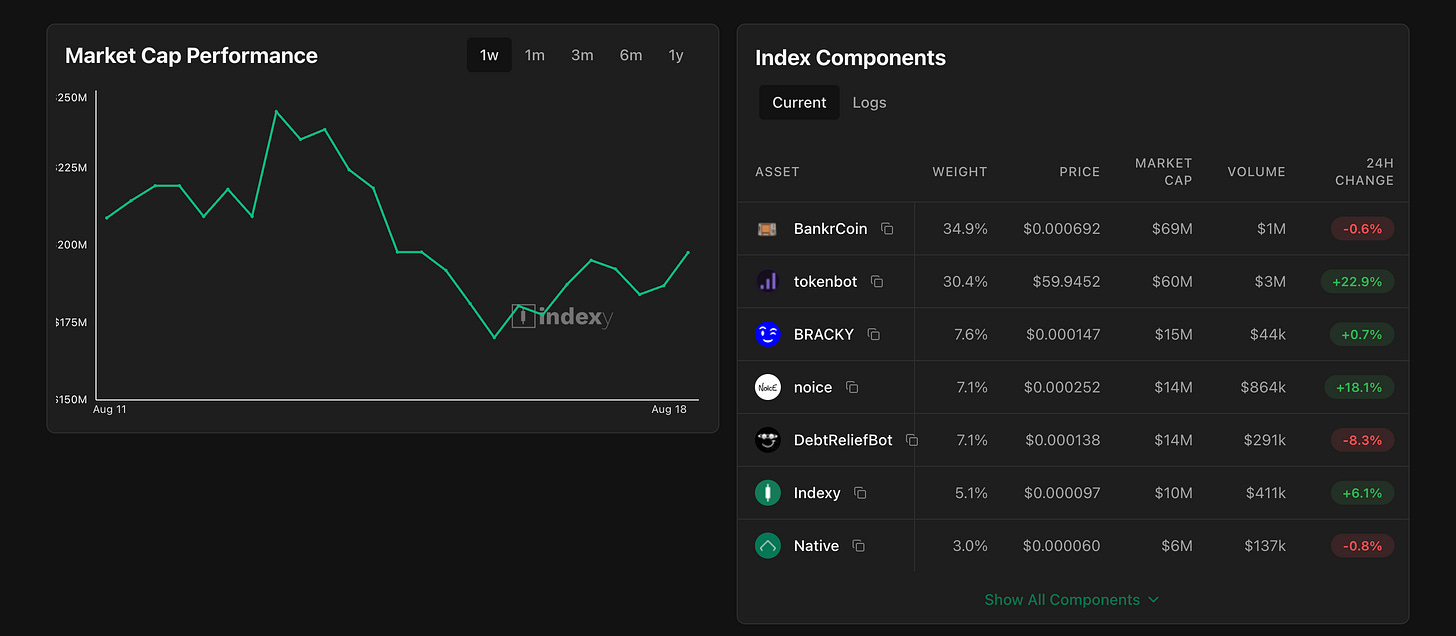

Proprietary KPIs (mindshare, volatility, BTC comparative strength, etc.) allow for multifaceted evaluation beyond mere price trends.

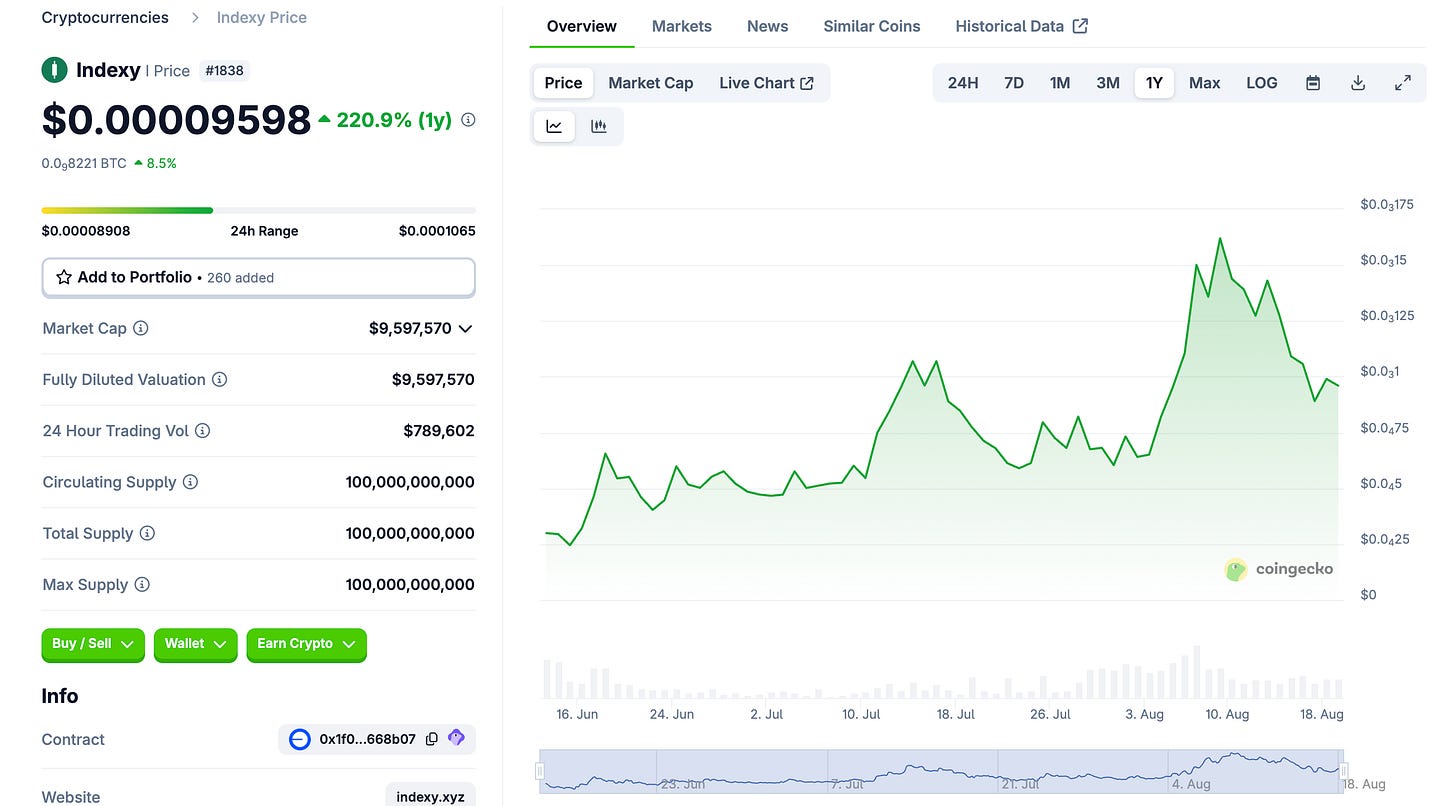

Founder is Kaloh, announced in February 2025. Currently available for free, but has issued its own token "$i" on Base, which could allow on-chain index investing like ETFs in the future.

📈What is Indexy?

「Indexy」is a platform for concise understanding and analysis of trends in the crypto asset market through "smart indexes".

Rather than tracking individual tokens, we will provide a collection (index) of tokens grouped by theme, use case, or blockchain, allowing users to see trends across specific sectors.

This allows for the following

Track the market with a curated crypto asset indexBrowse carefully selected indexes by sector (e.g. AI-related, NFT-related, DeFi, meme coins, social-based, etc.) to clearly track movements by market segment. The indexes are created to include tokens across multiple blockchains (e.g. Ethereum, Solana, Base, Avalanche, etc.) and provide data covering more than 50 blockchains.

diversified investmentIndexes: By using indexes, you can diversify your investments across themes rather than betting on individual stocks. For example, by holding and referencing thematic indexes such as "AI/Autonomous Agents" or "Gaming and Experience," you can take advantage of the growth of the entire sector while diversifying your risk. (*At this time, the index does not = the token, and the Indexy is only a platform that provides indices.)

Discover new projectsThematic Index: By looking at the Thematic Index, you can learn about all the projects that are emerging in each field at once.

Indexing by users themselvesIndexing: Indexy allows you not only to view pre-prepared indexes, but also to create your own custom indexes. After registering an account, you can create your own index by selecting any tokens from the "Create an Index" section, specifying the composition ratio (weight) of each token, and setting a theme or label. By default, the tokens are automatically allocated according to the market capitalization of the tokens you choose, but custom weights are also available.

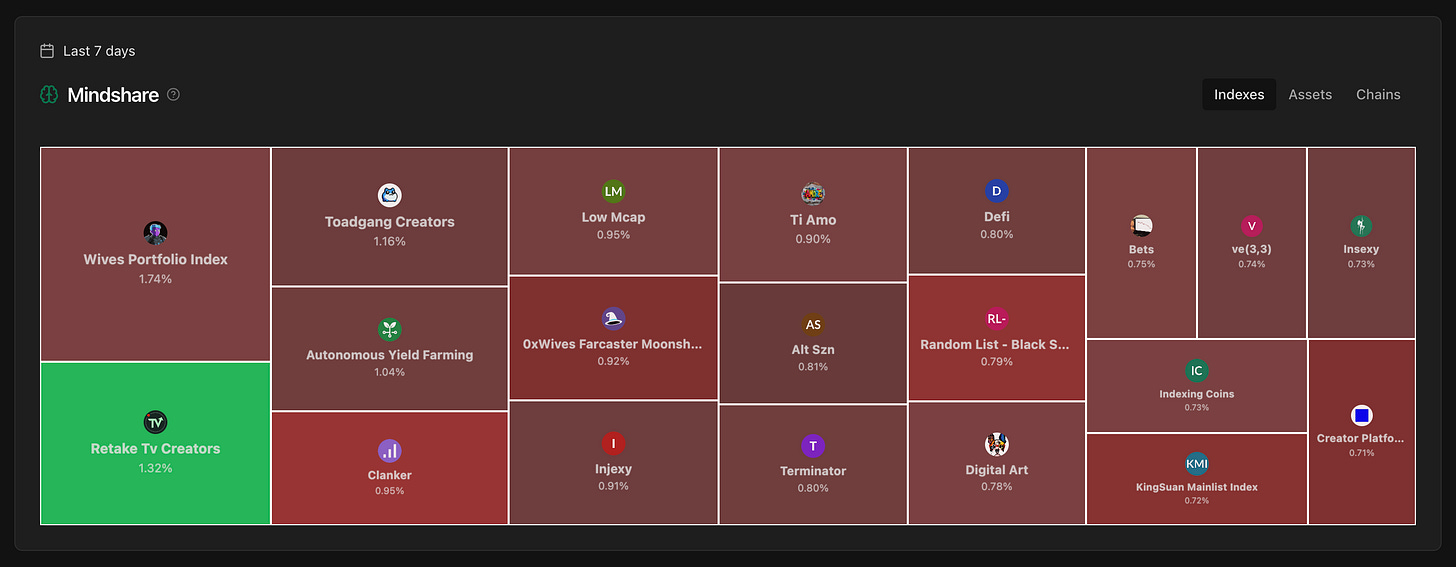

Provide detailed index indicators (KPIs)Indexes are not just about price or market capitalization, but also about a composite index designed to visualize the performance of an index and how much attention it is receiving in the marketplace. For example, "Mindshare" is an index that shows how often each asset or index appears on the Indexy and attracts user interest, providing insight into what is attracting attention within the ecosystem. Other advanced indicators such as "Volatility" (a measure of price stability on a scale of 0-10), "vs. Bitcoin Strength" (an index of how much Bitcoin has outperformed Bitcoin over the same period), and "Distance from All-Time High (ATH)" (what percentage of the peak the current situation is) are also available, allowing each indexes can be evaluated from multiple perspectives.

👇Understanding mindshare

👇Clanker-related tokens index understanding

Thus, the Indexy is a simple tool for diversification, market analysis, and information gathering from the perspective of "indexing" the crypto asset market.

You can view the details for free by registering an account with Google Login or Farcaster Login, and you will also be able to create and follow your own indexes.

🚩Transition and Outlook

Indexy was conceived and developed by someone who calls himself "Kaloh". Kaloh is a data scientist, writer, and builder working in the fields of crypto assets and on-chain culture, and is the author of several prominent newsletters and podcasts at the intersection of virtual currency and arts and culture.

He announced it in his newsletter in February 2025.

At this time, all features are available for free and there are no paid features, but we do issue our own token, "$i". This is a token issued on Base and is used to fund distribution campaigns and the early stages of development.

Official documents indicate that it will soon be integrated into the app and unlock new features.

Although there is no clear roadmap for the future, my personal view is that the creation of various indexes will proceed as follows.

I also believe that it will be possible to invest in these indexes, and that they will become like ETFs. There are still similar projects, but there are not that many projects that stick out and are well-known, so I think Indexy will take this position and become more well-known as a hub for diversified investments.

💬Replaces all financing

The last part is a consideration of the summary.

The product itself is simple, but we believe it will be a very important product in an era when all assets will be on-chain.

As mentioned above, this will be ETFs, when you can not only view indexes, but also invest in them. This will be the era when each individual, company or AI agent can create ETFs and invest in them.

Until now, there have been few assets on-chain, but in a world where RWAs, including equities, are being on-chained, the ability to do the same thing as an ETF in full on-chain is in the near future.

Crypto and existing assets will be mixed, for example, investing in the BTC Treasury Company's equity index, in a mixed index of AI stocks and AI tokens, or in a mixed index of existing financials, crypto asset exchanges and DeFi.

I feel that this would make it easier for beginners to invest. With so many tokens being created, it is quite difficult to invest in specific stocks, but being able to invest in an index of them makes it easier to choose. It will be exactly like investing in the S&P500 for now.

Also, ETF fees for existing financials are already low, but I think they will be even lower when they are on the blockchain. If anything, there is a good chance it will be free. Because all index information is publicly available and if fees are high, others will quickly create index tokens with cheaper fees.

The business model in finance is likely to change as well, since the management fee will disappear and the only fees that can be earned will be swap fees such as DEX, or brokerage fees for wallets that serve as the gateway, or storage fees for custodial wallets, and so on.

In any case, the speed at which blockchain is mixing with and replacing existing finance is accelerating. The Indexy could become one of the core functions of this system, and we will be following it closely for future updates!

This is the research for "Indexy"!

🔗Reference Link:HP / DOC / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.