【Internet Capital Market】Solana envisions a world where anyone can participate in capital markets using only an internet connection, powered by blockchain technology.

Is ICM the goal of blockchain?

Good morning.

I’m Mitsui, a web3 researcher.

Today, we’ll explain the Internet Capital Market (ICM).

Internet Capital Marketとは?

Solana Roadmap

Is ICM the goal of blockchain?

TL;DR

ICM (Internet Capital Market) is a Solana-born vision aiming for “a world where anyone with an internet connection can participate in capital markets.” It redefines capital markets through asset tokenization, 24-hour trading, and the elimination of intermediaries.

Solana RoadmapWe are now working to progressively build a decentralized, high-performance financial infrastructure that delves into market microstructure through technologies such as ACE, BAM, DoubleZero, and MCL.

Ultimately leading to UBO (Universal Basic Ownership)A global internet capital market involving both people and AI will be realized, and blockchain will expand from finance into social infrastructure.

Internet Capital Marketとは?

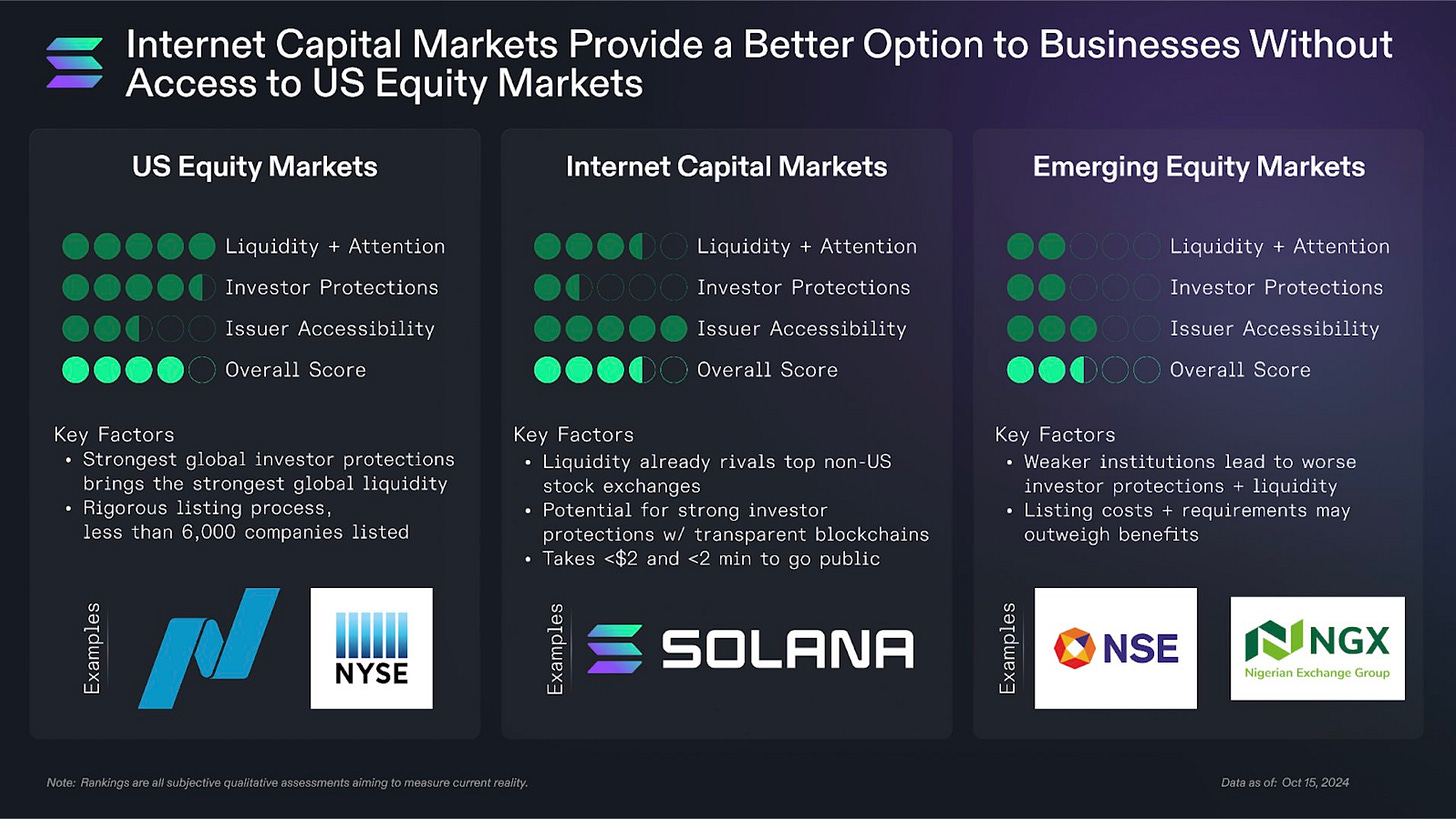

Internet Capital Market (hereinafter referred to as ICM) is a concept proposed in November 2024 by Akshay BD, who serves as the Marketing Director of the Solana Foundation.

The term ICM itself began to be used around this time, succinctly expressing the mission Solana’s founders had championed from the outset: “to build the backbone of a decentralized capital market on the internet.” From 2025 onward, it became the official vision of Solana.

To put ICM’s vision in a single phrase: “Realizing a world where anyone with an internet connection can access capital markets」です。

Specifically, the main components that constitute ICM are as follows:

On-chain issuance (tokenization) of all assets

We issue and represent traditional offline assets such as stocks, bonds, real estate, and currencies as tokens on the blockchain. By backing corporate equities, corporate bonds, and other Real-World Assets (RWA) with corresponding tokens, we enable on-chain trading, holding, and transfer of rights.24/7, 365 days a year · Borderless transactions

On the blockchain, a global market is always open. Through DEXs and other DeFi platforms, anyone can trade anytime without geographical constraints.Automation and Settlement via Smart Contracts

Market rules such as trading, settlement, and dividend/interest payments are encoded as smart contracts and automatically executed.Fundraising and investment participation without intermediaries

Through tokens issued directly on the blockchain, companies and projects can raise funds directly from global investors without going through banks or securities firms. Meanwhile, investors can access this new asset class with just a wallet, without even needing to open an account with a securities firm.Integration with DeFi Protocols and Programmability

The ICM market seamlessly integrates with other DeFi applications. For example, users can deposit tokenized assets into DeFi lending pools to obtain loans, or supply tokens to automated market makers to become liquidity providers and earn yields, enabling interoperability.

As explained above, these concepts are likely nothing new to those who regularly engage with blockchain technology.

It’s similar to Coinbase’s Everything Exchange, and many projects are promoting similar concepts.

Therefore, I believe it is appropriate to understand ICM as a concept that redefines in words the potential and goals of blockchain that have been discussed thus far.

Solana Roadmap

Solana also announced its roadmap for realizing ICM in July 2025.

This announcement clearly outlines the strategy and priority tasks for building ICM not merely as a vision, but as an actual technological infrastructure.

(The following is a summary. For those interested in technical details,Original article please see.)

For Solana to serve as the foundation for ICM, it is recognized that general performance improvements—such as simple bandwidth expansion or latency reduction—are insufficient. Instead, an approach to the highly specialized field of “market microstructure” is essential.

The central concept is Application-Controlled Execution (ACE).

ACE is a mechanism that enables smart contracts to control transaction order at the millisecond level, thereby creating an environment where various applications can implement their own market structures.

Unlike traditional centralized exchanges, the ability to flexibly program transaction handling on-chain is considered key to fostering the most liquid and efficient markets on Solana.

The roadmap presents a concrete technical roadmap divided into short-term, medium-term, and long-term phases.

Short-term initiatives include measures to enhance the performance of existing infrastructure, such as the introduction of the Block Assembly Marketplace (BAM) by Jito Labs and improvements to transaction processing by Anza.

BAM aims to enhance transaction ordering flexibility and enable a trading experience on the mainnet that rivals centralized exchanges, thereby transforming Solana’s block space into an open, verifiable market execution platform.

In the medium term, at the network level DoubleZeroや alpenglow、Asynchronous Program Execution(APE)The implementation of next-generation technologies such as these is being advanced.

DoubleZero is a protocol upgrade aimed at reducing latency and expanding bandwidth through dedicated communication infrastructure, while Alpenglow enables faster finality of the consensus engine (significantly reducing finality time). APE pursues transaction processing efficiency, and these measuresA fundamental enhancement of the network infrastructure supporting ICMIt is positioned as.

And in the long term, full implementation of Multiple Concurrent Leaders (MCL) and ACE is planned.

MCL overcomes the limitations of a single-leader system by enabling multiple leaders to simultaneously incorporate transactions, thereby allowing global information synchronization and avoiding selective censorship.

This enables applications to control their own execution sequence, achieving both real-time performance and market depth.

Solana’s roadmap aims to build a decentralized financial infrastructure that cannot be replicated by centralized competitors through these advanced technical elements.

Is ICM the goal of blockchain?

Finally, we conclude with a summary and analysis.

ICM is the vision Solana has set forth, and I believe these represent one of the goals blockchain aims to achieve.

Everything is tokenized, free from geographical or racial constraints—a world accessible to anyone with a smartphone.

This concept aligns with the idea of Universal Basic Ownership (UBO).

UBO is an approach that expands participation rights in the very sources of wealth creation, rather than redistributing wealth like basic income. Through ICM, people can now directly invest small amounts in startup stocks and unlisted high-growth assets that were previously inaccessible due to lack of capital or qualifications.

As a result, it is expected that the base of people who can participate in wealth creation will broaden, leading to the correction of disparities.

Furthermore, with the advent of AI, not only humans but also AI will conduct all transactions online. This transformation will turn the internet into a capital market, fundamentally altering the very concept of finance as we know it.

The technical infrastructure is already largely in place, so after 2026, we can expect even more assets to go on-chain and user numbers to grow. This will likely lead to a world where people everywhere utilize blockchain technology behind the scenes.

Therefore, I believe blockchain will first establish itself as financial infrastructure, and then evolve into infrastructure for contracts, ID management, and traceability.

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.