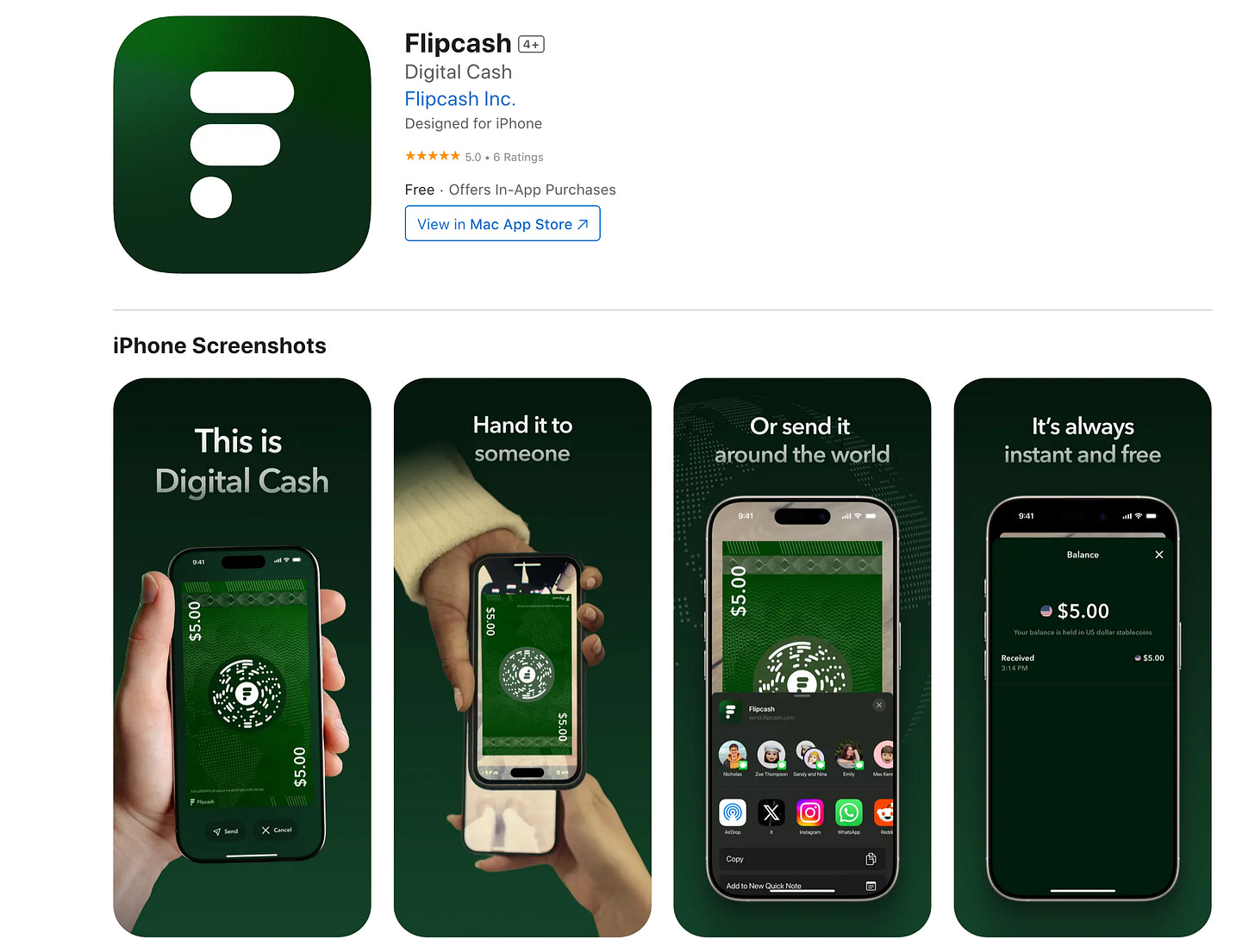

【Flipcash】Digital money transfer app built on Solana / Instant free USDC transfers / Second attempt by founders derailed by SEC / @flipcash_app

It could be downloaded in Japan.

Good morning.

This is mitsui, a web3 researcher.

Today, I researched about "Flipcash".

💰What is Flipcash?

👤Second attempt by project owner aborted by SEC

💬Challenge to create digital cash

🧵TL;DR

Flipcash is a digital money transfer app that runs on Solana and allows instant and free international money transfers using USDC Stable Coins with just a scan of a QR code.

The app consists of two buttons, "Cash" and "Balance," and anyone can easily start using it with an intuitive UI and an initial registration fee of about 150 yen.

Remittances are temporarily processed on a VM to protect privacy, while the design allows for fraud detection, and supports linked remittances and QR code remittances.

Based on the experience of the Kik/Kin project, founder Ted Livingston aims to create a global payment infrastructure that can be used "like cash," drawing on lessons learned in price volatility risk elimination and regulatory compliance.

💰What is Flipcash?

Flipcash is a digital money transfer application built on the Solana blockchain.

It aims to digitize the sensation of handing over physical cash, and money transfers can be completed instantly simply by holding smartphones over each other and scanning a QR code.

There are no remittance fees, and remittance speed is in microseconds (virtually real time), making it "always instantaneous and free of charge".The currency used is USDC, a stable coin, which eliminates the price fluctuation risk of crypto assets, providing a stable value that is familiar to users.

It is also claimed to be compatible with "any currency in any country," and since currency conversion and exchange are automatically performed within the application, there are no additional costs or exchange rate losses when transferring funds internationally.

The main features of the app are as follows

Easy and intuitive money transferEasy and intuitive: There is no need to enter the other party's phone number or email address when sending money. Just have the other party scan the code displayed on your smartphone screen as if you were handing over cash.

Fast and Free:.Due to the high performance of the Solana blockchain, money transfers are instantaneous with no delays (zero delays in your experience).There are no remittance fees (gas fees) on the blockchain and it is always free of charge, whether domestic or international.

Stable currency by USDC:In-app balances are managed in USDC.By adopting USDC instead of proprietary cryptocurrency, users can handle their money as if it were legal tender, without the worry of diminishing value due to price fluctuations inherent in crypto assets.

Global support and automatic currency exchange:Designed to be used without awareness of country or currency barriers.The currency displayed on the app can be switched to any legal tender, and automatic currency exchange is performed in the background when sending money between different currencies.No commissions or rate differences are incurred in this process, and the value of the money sent will be sent to the recipient as it is.

Simple UI: The application screen is extremely simple, centered around two buttons, "Cash" and "Balance.The screen structure of the application is extremely simple, with two main buttons: "Cash" and "Balance.The app is designed to be as easy to use as cash, in that anyone can operate it intuitively and it does not require complicated wallet address entry or knowledge of cryptography.

It was released as an app on both IOS and Andoroid on June 10, 2025.

I was able to download it in Japan.

First is the account registration screen, where you are presented with a seed phrase just like a typical wallet.The unique thing is that there is a $150 fee when you register an account; I was able to pay directly from Apple Pay.(Initially, this seemed to cost about $20 and USDC would be given for that, but I downloaded it now and it only charges a fee of about $1.00.)

The functions are simple and there is nothing to do except send the money or check the wallet balance.The feature is that since the wallet was downloaded in Japan, it is denominated in Japanese yen.This country can be changed.Also, when I wanted to deposit funds, I had to send money to this address.

Also, when you are meeting face-to-face, it is QR code money transfer, but you can send money via link to someone who is far away.

This approach was also used in the marketing of Flipcash, where a link is published on X and someone receives it on a first-come, first-served basis.

Flipcash also pays close attention to the balance between protecting user privacy and ensuring transaction transparency.For example, instead of completely anonymous transfers, all transactions are processed on a "virtual machine (VM)" within Flipcash before being recorded on the blockchain.

This makes it difficult for outsiders to trace the details of individual transactions, while allowing the service to take fraud detection and security measures as needed.The team commented, "While there is a non-zero chance that a highly specialized person could track them down, improving privacy is a goal that we will continue to work toward."

👤Second attempt by project owner aborted by SEC

Flipcash is operated by Flipchat Inc. located in Los Angeles, USA.The project name of this service was originally called "Code" and was changed to "Flipchat" before this release.

The founder is Ted Livingston, a Canadian entrepreneur who founded the youth messaging app "Kik," which grew rapidly to one million users in just 15 days.

Kik was a well-known messaging app that sold anonymity like Telegram, and at one point reached a valuation of $1 billion.

The company then went on to launch Flipchat, and there is some drama in this transition, which we will explain in a bit more detail.

◼️Kik Launch

Ted Livingston is a Toronto native born in the late 1980's, and has shown an interest in robots and Lego since childhood. 2005 he went to the University of Waterloo to major in mechatronics engineering, but while there he interned at Research in Motion (RIM), a company known for its BlackBerry.(RIM), known for its BlackBerry, he dropped out of college to pursue entrepreneurship.

In 2009, he joined the university's incubation program, Velocity, and founded Kik Interactive, which released its mobile messaging app, Kik Messenger, in 2010.

Kik Messenger is a free chat application for smartphones and a platform for text messaging, photo and video sharing, and bot interaction.It is characterized by the fact that anonymous accounts can be created with only an email address and name, without the need to register a phone number, and was popular among younger users who value their privacy.

Kik gained its first million users within 15 days of its launch, making it the fastest growing service in history at the time.Since then, the number of users has continued to grow rapidly, mainly among teenagers, and as of 2015, the number of registered users exceeded 275 million, with approximately 40% of U.S. teenagers using the service.

This success has made Kik Interactive a "unicorn company" with a valuation of over $1 billion and a $50 million strategic investment from Chinese IT giant Tencent, and Livingston personally has been recognized for his accomplishments, including being named to Forbes "30 Under 30" technology list in 2014.He has also received media attention for his personal achievements, including being named to Forbes' 2014 "30 Under 30" list in the technology category.

◼️Launch of the "Kin" crypto asset project at Kik

In the mid-2010s, Kik had acquired a huge user base but faced the challenge of finding a monetization model.While competing social networking and chat apps relied primarily on advertising revenue, Kik's privacy-conscious philosophy prevented it from easily using user data for advertising.

Kik's policy of not collecting or selling users' personal information, and its design to immediately delete messages without storing them on the server, were the reasons for the company's support of anonymity and privacy protection.

To overcome this situation, Livingston launched a decentralized ecosystem concept with its own crypto assets.

First, in 2014, he introduced Kik Points, an experimental currency that does not use blockchain, within the Kik app to test a system that would allow users to earn and spend points.As a result, more than 300,000 point transactions occurred per day from the start, and by the end of the test, approximately 2 million points were sent and received per day, confirming the demand for small payments by users.Based on this success, Kik embarked on full-scale issuance of its own crypto assets.

In September 2017, Kik Interactive launched its crypto asset "Kin" and raised funds through an ICO, which raised the equivalent of approximately 168,732 ETH (approximately $97.5 million at that time) from over 10,000 investors in 117 countries, making it a major sale of nearly $100 millionThe total volume of the Kin issue was ultimately $3.5 billion.

The total amount of Kin issued was ultimately set at 10 trillion tokens, and Kik itself held a significant amount of Kin as an issuer to cover operating costs.

The goal of the Kin project was to create an economic sphere in which users could pay content creators directly for their content within the Kik app and, in the future, on external partner apps for a small fee of a few yen to a few tens of yen.Specifically, users would be able to pay in Kin for digital content of their choice (articles, illustrations, stamps, etc.), or conversely, earn Kin by viewing advertisements or responding to surveys.

A non-profit organization called the Kin Foundation was also established to manage and promote the Kin, and a token economic zone was developed independent of Kik.

However, the Kin project faced friction with regulators immediately after its launch: in 2018, the U.S. Securities and Exchange Commission (SEC) began investigating the legal nature of the Kin token, and the following June 2019, the SEC formally filed a lawsuit against Kik Interactive for violating securities laws (selling unregistered securities).filed a lawsuit against the company.

In its complaint, the SEC noted that "Kin tokens are de facto investment contract securities that were sold to the investing public without proper registration," and alleged that the approximately $100 million ICO conducted by Kik constituted an issuance of unregistered securities in violation of the federal securities laws.

Livingston consistently countered that "Kin is a currency, not a security," and in the same year he joined with the virtual currency industry to launch a legal defense fund called "Defend Crypto," in an all-out showdown with the SEC.In September 2020, the U.S. District Court granted the SEC's motion and ruled that the Kin token sale constituted an unregistered issuance of securities.

In response to this ruling, Kik agreed to a settlement with the SEC the following month.Kik paid a $5 million fine and agreed to notify the SEC in advance of any sale or issuance of digital assets for the next three years, and to comply with a permanent injunction to prevent similar illegal activity in the future.

This was a major blow to Kik, which lost most of the funds raised to legal fees and fines, and also put the crypto asset business under the scrutiny of US regulators.

Livingston himself expressed his dissatisfaction with the SEC's response, claiming, "Our case was not a fraud, but a technicality in the registration of securities, and yet we were forced to make such a sacrifice.

◼️Kik Sale

As the legal battle with the SEC intensified, Kik implemented a painful restructuring plan to continue operations: in September 2019, Ted Livingston announced on the company's official blog his plan to "shut down the Kik messaging app and lay off approximately 80% of its employees.

These changes will reduce our cost consumption by 85% and put us in a better position to fight through to the end of the trial with the funds we have on hand," he said.

With this announcement, Kik Messenger, which had millions of monthly users, was effectively in danger of being shut down, and its nearly 100 employees were reduced to a minimal team of only about 19.

Among other things, Livingston stated that "no matter what happens to Kik, Kin will survive," and expressed his determination to continue the mission of expanding the Kin ecosystem even if it means giving up the messaging business.In fact, as of 2019, there are still about 60 external apps that incorporate Kin tokens, reporting that a certain decentralized ecosystem has been established.

Fortunately, Kik Messenger itself has escaped complete extinction.In October 2019, a few weeks after the closure announcement, Los Angeles-based holding company MediaLab acquired the Kik business and announced its intention to continue the service.MediaLab also announced plans to introduce advertising to generate revenue for the platform in the near future.

Although the acquisition allowed Kik Messenger to survive, Livingston was leaving the messaging business altogether.Livingston later commented that the sale to MediaLab was "a two-for-one deal in terms of enterprise valuation," suggesting the extent of the damage to enterprise value that the dispute with the SEC had caused.

◼️Kin Survives

Meanwhile, the Kin project lost some of its initial momentum due to legal issues and the weakening of Kik itself, but a community-driven path was explored for its continued existence.

In 2022, Kik Interactive underwent a major transformation, transferring Kin-related intellectual property and technology assets to a newly formed non-profit organization and transferring the remaining employees (including Livingston himself) to that organization.With this transition, Kik Interactive itself became a holding company with zero employees and only a 30% stake in the Kin token issuer.

The organization thus established is a project called Code, which will develop a new payment platform while continuing the principles of Kin.

Code, the predecessor of Flipcash, is a project that seeks to realize the vision of decentralized micropayments that Kin sought to realize.

In 2023, Flipcash (formerly known as Code) will be officially founded with fellow members, and in February 2024, the company will raise $6.5 million in seed funding from prominent VCs to proceed with full-scale product development and market launch.

Flipcash's vision is not just a money transfer application, but to revolutionize the very nature of value exchange on the Internet.

Mr. Livingston stated, "With Flipcash, I hope to finally realize Satoshi Nakamoto's dream of peer-to-peer electronic money," and is approaching this project as the culmination of his own longstanding challenge.

This sequence of events shows that this is not just a money transfer application, but a challenging project that has been arrived at after about 10 years of trial and error.

💬The challenge of creating digital cash

The final section is a summary and discussion.

I started researching this project because I thought it looked interesting at first, but there was more drama behind it than I had imagined.

During the ICO bubble at the time, many projects were shut down by the SEC, and the very survival of the service itself was in jeopardy.Telegram, which is now gaining momentum, also launched an ICO with the concept of an anonymous messaging service x token economy, but it was shut down by the SEC, and TON's survival was temporarily in jeopardy.

TON has been operated by volunteers since then, and after several years, the relationship with Telegram has been strengthened once again.

This is a very personal prediction, but I thought that Telegram's survival of a similar concept was largely due to geography: Kik had a Canadian founder whose main market was the US, while Telegram had a Russian founder who was later in Dubai, and their markets included Russia and the Middle East.So, the proximity to the SEC was a big factor.So there may be a difference in terms of proximity to the SEC.Also, Telegram has recently started to monetize its operations, but before that, it was (supposedly) operating using the founders' personal funds, so there may have been a difference in terms of financial leeway.

However, I find it amazing that they have not broken from that and continue to challenge in the direction of blockchain instead of messenger, since the challenge of creating P2P digital cash and being able to send it to anyone in any country faster and cheaper than existing remittance solutions is the beauty of blockchain.I am very much looking forward to its future development.

This is my research on "Flipcash"!

🔗Reference Link:HP / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.