【Flatcoin explanation①】What is the "AMPL" crypto asset tied to the 2019 CPI-adjusted dollar? / @AmpleforthOrg

I'm chouimuji.

Good morning.

Mitsui from web3 researcher.

Today we will explain "flat coins" through the description of the specific projects "AMPL" and "SPOT".

(Since it has become too long, we will make it into two parts: (1) Part 1 is an explanation of AMPL and (2) Part 2 is an explanation of SPOT.

The AMPL and SPOT are complicated and require financial knowledge, so I will explain them with specific examples so that you can understand the whole picture even from zero, but I will skip the detailed logic because I think you will really lose the point if I try to cover them in detail.If you are interested in the details, please refer to the document at the end of this article.

Let's get started.

⚫️What is AMPL?

👀What are the drawbacks of legal tender-backed stablecoins?

🪙What is a flat coin?

💬Feels like the next generation of money

⚫️What is AMPL?

The "AMPL" is a crypto asset based on the 2019 CPI-adjusted dollar.It is primarily used as a unit of calculation and a collateral asset.

CPI refers to the Consumer Price Index, and a CPI-adjusted dollar is the value of a currency adjusted for the effects of inflation.

In simple terms, CPI-adjusted dollars are a way to express "the amount of stuff you can actually afford.This allows for a fair comparison of amounts at different times.

The "AMPL" is based on the 2019 CPI-adjusted dollar.

For example:

If $100 in 2015 would be $110 CPI-adjusted in 2019, then $100 in 2015 had the same purchasing power as $110 in 2019.

Conversely, if $120 in 2022 would be $100 CPI-adjusted in 2019, then $120 in 2022 would have had the same purchasing power as $100 in 2019.

How this is expressed in crypto assets is by taking a model that adjusts for supply rather than reflecting it in price relative to demand.

The price of tokens is determined by supply and demand, and usually the price per token increases when demand> supply, and decreases when demand< supply.

AMPL, on the other hand, fluctuates in supply while the price remains fixed.

For example, when the price of bitcoin triples, the price per token goes directly up.AMPL, on the other hand, when the price increases due to excess demand, the price of 1 AMPL remains the same but becomes 3 AMPL.

In other words, the number of AMPL tokens in a user's wallet automatically increases or decreases in response to changes in AMPL token prices (changes in supply and demand).It increases when demand increases and decreases when demand decreases.This means that if you buy 1% of the network, you will always own 1%, regardless of supply adjustments, unless you buy or sell more.

It's a little difficult, isn't it?

I think what makes it complicated is the mixture of "controlled by supply" and "based on the CPI-adjusted dollar".

My personal feeling is that the first point, "controlling by the amount of supply," is somewhat understandable, but I think many people do not understand the second point, "using the CPI-adjusted dollar as the base currency.

The vision is to create a true stable token, but the value of the resulting token will depend on "what it is based on".

Most current stable coins are backed by legal tender.However, the AMPL production team (Ampleforth) argues that legal tender has drawbacks in the first place, and so do stable coins that are collateralized by it.

👀What are the drawbacks of legal tender-backed stablecoins?

Let's start with the drawback of legal tender as a collateral source.

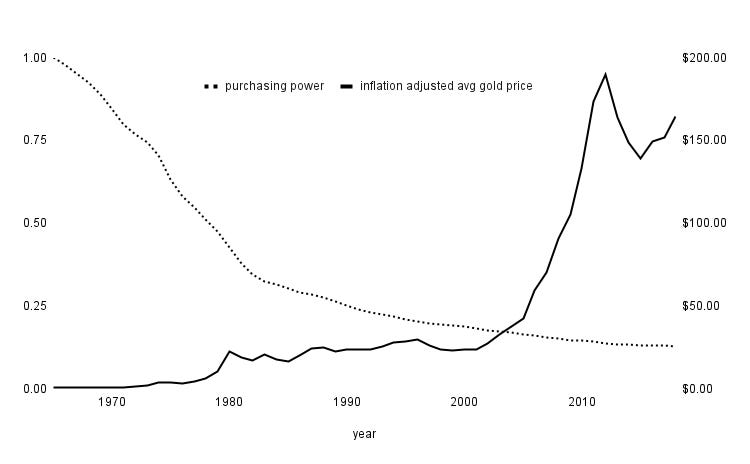

It is "inflationary.Inflation is a decline in the value of a currency, and printing an excess amount of paper money leads to an oversupply, resulting in a decline in the value per bill.The times when demand is catching up here are good, but no currency in the history of mankind has ever escaped inflation.

This area is connected to the discussion of "commodity money" and "fiat money" and "easy money" and "hard money," and it gets more complicated, so I will not explain it in depth.

To explain only in crazy simple terms, legal tender relies on trust by a centralized state, which depends on the state for its power to issue currency.The state prints too much paper money to maintain its power, so paper money is gradually inflated.Gold and Bitcoin are not over-inflated because they are hard money and their issuance is limited, while soft money, which has unlimited issuance and can easily be issued new, will always be inflated.

And Ampleforth says that even gold, which is relatively stable, is too volatile and good to be pegged to a currency used for living.

And a stablecoin pegged to such a flawed legal tender will naturally be inflated.And since the issuance of USDC and USDT itself is also based on centralized operations, it is not possible to have a fully decentralized stablecoin in the first place.

The arguments are twofold.

Legal tender is over-inflated, and gold is volatile.

Legal tender-backed stablecoins are also naturally inflated, and they're not even issued in decentralized form to begin with.

What I mean by the first argument is that neither legal tender nor goldis too volatile for most of the assets we have now?This means.Volatility means price fluctuation.While an increase in the value of an asset is a good investment, too much volatility is undesirable when viewed as a "currency". Why is high currency volatility undesirable?

Why is high currency volatility (price fluctuation) undesirable?

(I am sure there are many definitions.) To begin with, currency is said to have three functions: "preservation," "exchange," and "measure" of value.With the invention of currency, mankind was able to store value into the future, exchange it with a common measure, and create a measure of wealth.

In other words, high volatility makes it difficult for a currency to fulfill its functions.Specifically, it interferes with the functions of "saving" and "exchange.

This may be easier to imagine now that the yen has depreciated.If you have 1,000,000 yen in your account now, will it be "preserved" at the same value until 5 years from now?The yen may depreciate further, and the real value of the account may be about 600,000 yen.This would make it impossible to "exchange" it for something worth 1,000,000 yen.

It's a fine point, but "save" and "exchange" go together, don't they?Some people may think that "preservation" and "exchange" are the same thing.This may include my interpretation, but the "preservation" of currency implies a sense of security and prediction for the future.Before the invention of currency, humans had difficulty planning for the future.This is because there were only perishable items such as rice and wheat, and they could not continue to preserve their current assets.If we were to live completely self-sufficient without currency now, we would not be able to prepare for the next five years.Living this year will be our top priority.

In other words,The conservation value of currency has given humanity a future.

(This is no longer an explanation of web3, but rather an explanation of "currency" and "finance," but please bear with us as we cannot understand AMPL without understanding this part.(However, I personally think it is very important to discuss this area because I believe that finance and currency are the foundation of the blockchain.)

If this invention of currency, which we have at the time, becomes too volatile, we will not be able to predict the future and what we could exchange this year will not be able to be exchanged three years from now.

The point is that legal tender itself is also flawed as a currency in the first place.So that is why that legal tender-backed stablecoin is flawed.

So what would the ideal currency look like?

One answer is the flat coin.

🪙What is a flat coin?

AMPL" enables flat coins.A flat coin is a currency based on CPI (purchasing power).

I mentioned that "AMPL" is a crypto asset based on the 2019 CPI-adjusted dollar, and since CPI is the consumer price index, it is said to be a number actually tied to purchasing power.

A currency tied to the CPI meansthat the size of the value that a million yen can buy will remain the same in 10 years.

Perhaps to further complicate the expression, flat coins do not value currency in terms of price, but in terms of purchasing power.When we looked back at the value of a currency in the first place, we concluded that the three elements of storage, exchange, and measure needed to be aligned, as mentioned earlier, and that to create a currency that meets these requirements, it is necessary to evaluate it in terms of purchasing power, not in terms of price.

We implemented that mechanism using the blockchain so that supply and demand would be automatically controlled.So, AMPL is volatile in the short term, but in the 5 years of experimentation so far, it has returned to one value (2019 CPI-adjusted dollars) in the medium to long term.

And it does all of that in a decentralized manner: the AMPL has no collateral assets, so there is no need for centralized asset management, and it is issued by the AMPL protocol.It claims to be a true stablecoin that is decentralized and managed, yet trustworthy.

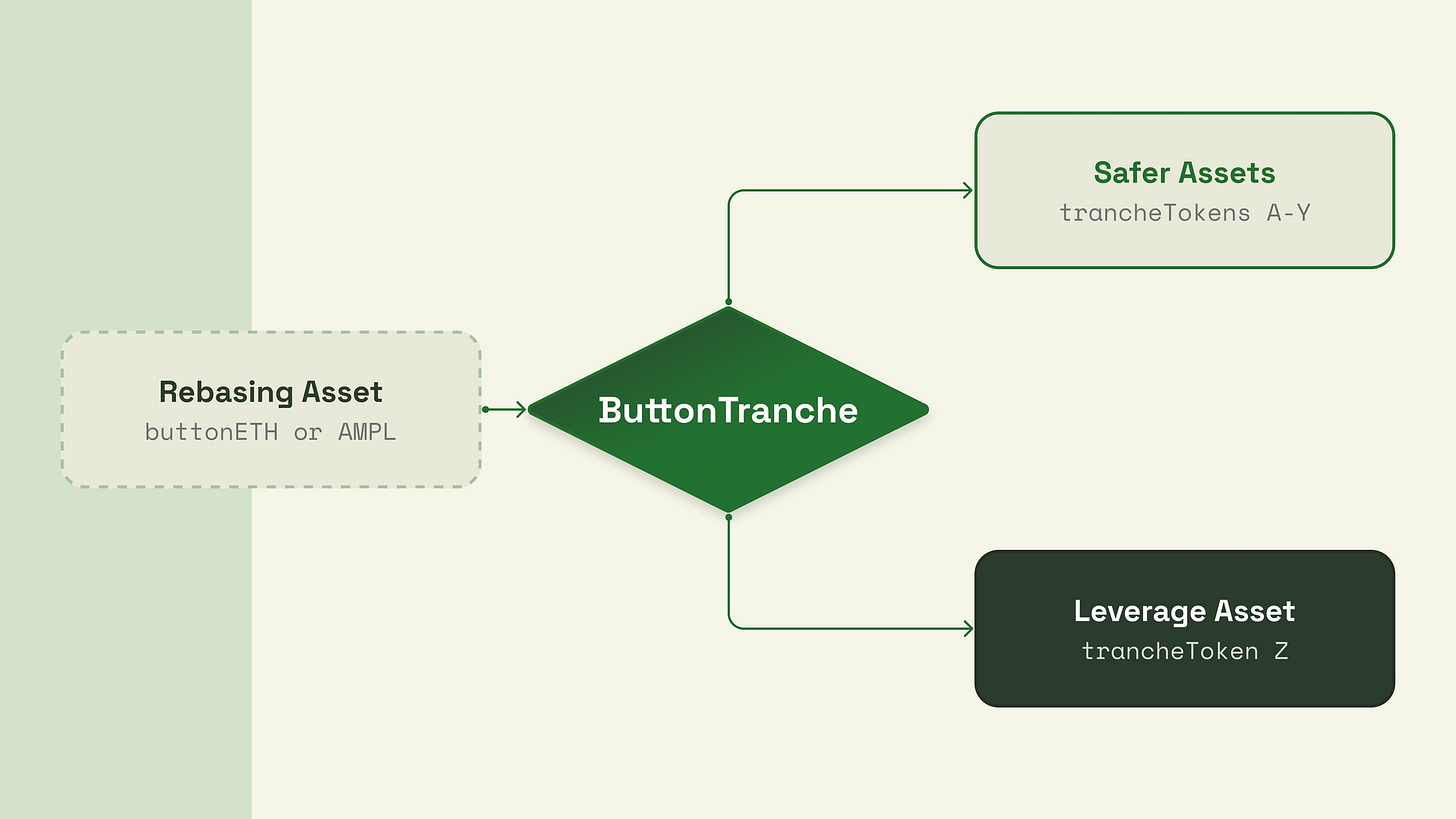

However, AMPL is only used as a unit of calculation or collateral asset, and "SPOT," which will be explained in the latter part of this report, is used as a flat coin (stable coin) using AMPL.

The reason why AMPL is not used as it is as a flat coin is that it is not always stable; AMPL's mechanism is that it fluctuates in the short term but will always return to its base value in the medium to long term due to supply and demand adjustments.Therefore, it is not suitable for currencies used daily.

The reason why a flat coin using the AMPL as collateral is possible is that the AMPL is divided into a low-volatility SPOT and a high-volatility stAMPL in a scheme called tranching, which will be explained in more detail in the next article on SPOT.I will explain in detail in the next SPOT explanation.

This flat coin concept has been discussed by Coinbase CEO Brian Armstrong, who is looking at flat coins as a direction for venture investment in 2023.

Flatcoins are the next cycle of development after stabled coins, related to the Consumer Price Index (CPI) or purchasing power

In fact, in July 2024, Coinbase Ventures invested $1 million in a strategic funding round for the Ampleforth Foundation's (AMPL development company) flatcoin "SPOT".

The AMPL protocol issues a governance token called $FORTH and is governed by the Forth DAO.

💬I feel like it's the next generation's money.

I hope I have made myself clear.It is a very complicated system, and I may not fully understand it 100% yet.(To be precise, it is a system that requires a great deal of prior knowledge rather than being complicated.)

Even though there is a 5-year experimental period, it remains to be seen here whether it will launch in earnest and work properly.But personally, I am very excited about the protocol.

One of the books that most influenced my life goals was "The Empire of Rion Hazuki"The book is called "The Empire of Rion Hazuki.To be honest, it is my top recommendation, but I have rarely recommended it to others because it is rather long (10 volumes).I have rarely recommended it to others, but if you are interested in reading it, please do so.The story is interesting, but I found the book's ultimate goal of "correcting capitalism" and "establishing a new currency (financial) system" very interesting and thought that such a system could be created with blockchain.It is also one of my objectives.If you read this and are interested, please contact me.I would love to talk with you.

*Some spoilers will be included in this article so that those who have not read the book can get the idea within this article.

To put the vertical storyline in a nutshell, it is a story about a group of high school students who start a business, become very successful, create an independent nation, and revolutionize the world.Of course, it is a fiction, but there are no fantasy elements at all, and the process of starting a business is written in a very solid manner (the author is a pseudonym, but he seems to be the president of the company).

The purpose of starting a business in the first place is to revolutionize the world, and to revolutionize the world, an independent nation is needed, and to create a nation, military power is needed, and for military power, money is needed, so the process of starting a business goes like this.

The main character is a girl who has traveled the world while in high school and has witnessed the gap between the rich and the poor.That is why she decides to revolutionize the world to correct capitalism and create a new financial system.

Well, there are many ways to go about that process, but the final idea we are proposing is a financial system that automatically adjusts to a certain amount".For example, if the money in a bank account is always adjusted to 1,000,000 yen, the poor will increase toward 1,000,000 yen and the wealthy will decrease toward 1,000,000 yen.The argument is that if this were realized, the gap between the rich and the poor would disappear.

Even if this could be realized in reality, I am not sure if it would work ideally.Of course, since this is in a novel, I have left out various tidbits, and I have given a fairly abridged version of the story, so it is explained in a little more detail in the novel.

However, I found it interesting as an idea and remember being shocked at the time.The novel was released in 2010, so I read it when I was in middle school or high school, and even though I knew nothing about blockchain, I thought I would like to create such a social system.

In fact, one of the reasons I got hooked on blockchain from there was that I really thought that blockchain might be able to create a new financial system like the one in this book.

What I mean is that this "automatically decreasing or increasing money" is a book IIt was an existence that I encountered, and I am telling you that I was very impressed with the idea of flat coins, which is a close idea, and AMPL and SPOT, which embody this idea.

Maybe I don't understand it 100% yet, but I personally feel that flat coins are the next generation of money.I think it will be an opportunity for humanity to have a future again.

But to be honest, I do not know if it will penetrate the market, because reality does not work according to logic.It is quite possible that aggressive promotion of legal tender will not be welcomed, since denial of legal tender would be treason against the state.It's still a niche area, so it's okay, but if it becomes well-known, and it looks like it will not really be de-pegged, it is not very desirable, because a decentralized, unsecured, non-inflationary currency will be born, and it will function without inflation.

Nevertheless, it is a new concept and we will continue to follow it!

In the next article, "Flatcoin Explained (2) (Part 2)," we will explain the flatcoin "SPOT" based on AMPL.The mechanism of "SPOT" was also very innovative, as it realized stabling by isolating volatility.We hope you enjoy it!

🔗Reference/image credit: HP / X / DOC / BLOG

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.