【Figure】The leading company in tokenizing residential collateral loans (HELOCs) / Completing lending, securitization, trading, and servicing entirely on-chain / @Figure

It was listed on NASDAQ in September 2025.

Good morning.

I’m Mitsui, a web3 researcher.

Today I researched “Figure.”

What is Figure?

Business Activities

Transition and Outlook

Everything you can do with on-chain RWA is available

TL;DR

Figure is a financial infrastructure company founded in 2018 by SoFi founder Mike Cagney, initially focused on using AI and blockchain to make home equity lines of credit (HELOCs) faster and less expensive.

Using its proprietary blockchain, “Provenance Blockchain,” the company has built a financial operating system that enables end-to-end on-chain processing from lending to securitization, trading, and servicing, and operates businesses such as Connect, DP, and Markets.

Having rapidly grown through HELOC and achieved an IPO (FIGR), it now stands as a central player in the RWA tokenization and on-chain credit markets, aiming to liquidate all assets and build on-chain financial infrastructure.

What is Figure?

Figure (Figure Technology Solutions, Inc.) is a U.S. fintech company founded in 2018 by Mike Cagney and his wife June Ou.

Mr. Cagney is known as the co-founder and former CEO of online lending company SoFi. After leaving the company, he launched Figure with the goal of “revolutionizing financial markets with blockchain.”

The core business is the home equity line of credit (HELOC). By leveraging AI and blockchain technology, Figure has successfully reduced the loan origination process—which traditionally took over a month—to just a few days while also cutting costs. This efficiency is achieved by completing the entire loan process on Figure’s proprietary blockchain platform, “Provenance.”

Later, we will explain the detailed business activities and evolution, but through these core businesses, Figure achieved its initial public offering (IPO) on the Nasdaq market in September 2025, listing under the ticker symbol “FIGR.” This listing garnered attention for Figure as “the first publicly traded company with RWA as its primary business.”

Now, let’s take a closer look at the details of our business operations.

Business Activities

The core technological foundation of Figure is its proprietary “Provenance Blockchain.” Provenance is a public Layer 1 blockchain built using the Cosmos SDK, designed and optimized for financial services.

On this blockchain, the entire process—from loan origination and contracting to service provision, securitization, and trading—can be executed, significantly reducing the cumbersome administrative procedures and coordination costs that traditionally occurred off-chain.

In fact, Figure achieved end-to-end automation from lending to securitization on Provenance, delivering an average cost reduction of 117 basis points (1.17%) across the entire loan lifecycle. This reduction stems from multiple factors, including lower fees and administrative costs per loan, improved capital efficiency through shorter settlement periods, and reduced risk by eliminating third-party intermediaries.

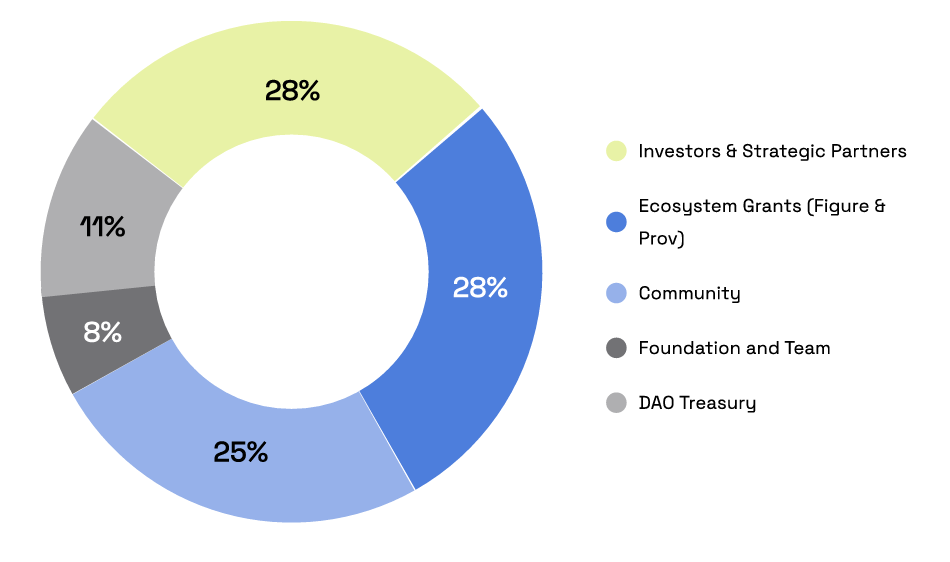

The native token is called “HASH” and is used for paying fees on the Provenance blockchain, governance (participating in block validation through staking and voting), and other purposes. The total issuance cap is 100 billion tokens, with the following allocation set:

The Figure system enables real-time processing on the blockchain from loan origination to debt sale, facilitating a “marketplace-style” lending model that directly connects borrowers and investors.

Figure leverages this technology to offer the following services:

◼️Secured Loans (Especially for Housing)

We offer HELOCs (home equity lines of credit), real estate investment loans, and crypto-backed loans that complete the entire process online—from borrower credit screening to loan disbursement. Utilizing AI and data analytics in our screening process, we can approve applications in as little as minutes and provide funds within days.

The core business that has been operated since the founding period is the home equity line of credit (HELOC).

The primary target users are individuals (homeowners) who wish to leverage the equity value of their homes to raise funds. For example, it is used as a multi-purpose loan for purposes such as renovation funding, debt consolidation, and education expenses.

Figure’s online HELOC eliminates the need for an in-person appraisal by a real estate appraiser, making it easy to apply and borrow. This appeals to busy millennials and tech-savvy individuals. While traditional bank HELOCs take 2 to 6 weeks for approval, Figure provides funds in about 5 days, appealing to users who value “buying time.”

Keep reading with a 7-day free trial

Subscribe to DEBUNK(web3 Research) to keep reading this post and get 7 days of free access to the full post archives.