【Fat Wallet Theory】The Time Has Come for Wallets, the Interface to Everything, to Become More Powerful than Protocols

The unique characteristics of web3 are making it difficult for protocols to build a competitive advantage.

Good morning.

Mitsui from web3 researcher.

Today I researched the Fat Wallet Theory.

👛What is the Fat Wallet theory?

🧐Fat Wallet's premise of competitive advantage in the web3 industry

✨Wallet's strengths

💬Summary and outlook, it will be Fat Wallet, but precisely the era of Fat Application Wallet.

👛What is the Fat Wallet Theory?

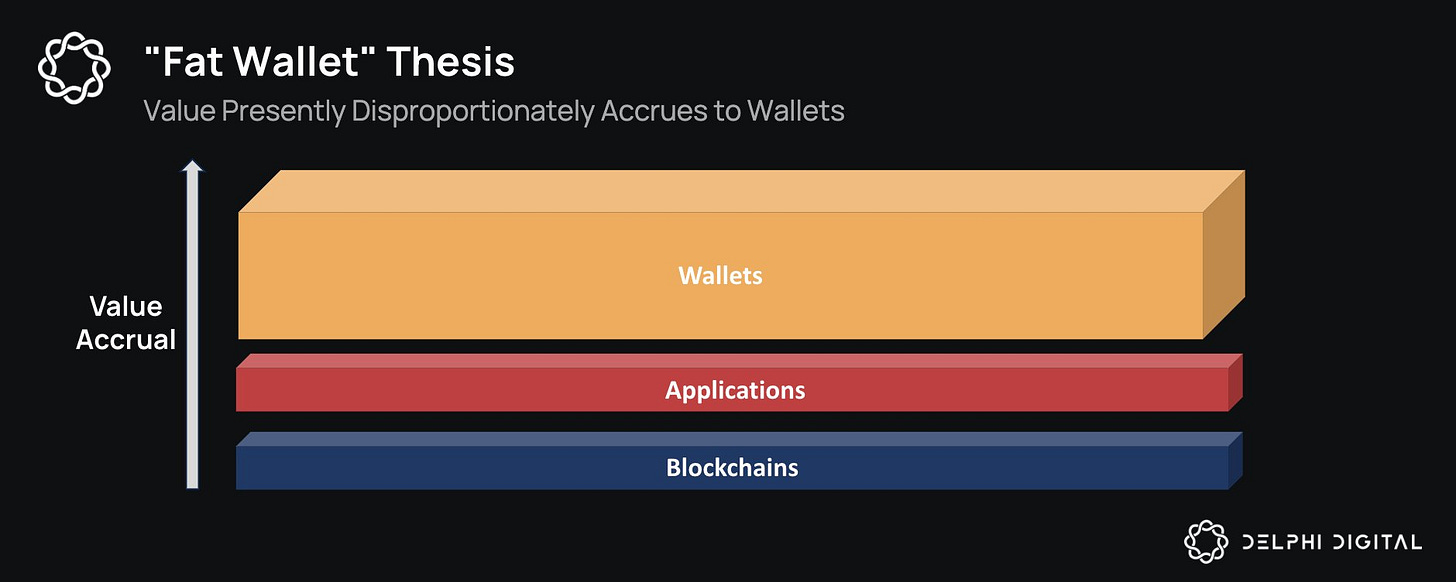

The "Fat Wallet Theory" is a further update of the previously proposed "Fat Protocol Theory," In the future, wallets will be stronger than protocols and applications.It is argued that wallets will become stronger than protocols and applicationsin the future.

This discussion has been around for a long time, but it became a hot topic when it was mentioned on a Blockworks podcast in 2023, and the debate began to gain momentum around this time.In fact, not only pure wallet operators like MetaMask, but also the protocol and application side such as Magic Eden, Uniswap, etc. are releasing wallets one after another.

And in October 2024, Robbie Petersen of Delphi Digital published the article "The Fat Wallet Thesis"", and the topic came up again.

This article will summarize the Fat Wallet theory with reference to these references.

🧐Fat Wallet's premise of competitive advantage in the web3 industry

Before considering the Fat Wallet theory, it is necessary to consider the competitive advantages unique to the web3 industry.Fat is about where value is concentrated, and therefore, it is a strong competitive advantage that cannot be replaced.

In the existing Web2 industry, Apple and Google's app stores are truly fat.Almost all app businesses deliver their apps to the world through here.Known to be expensive, with fees as high as 30%, app developers have no alternative.

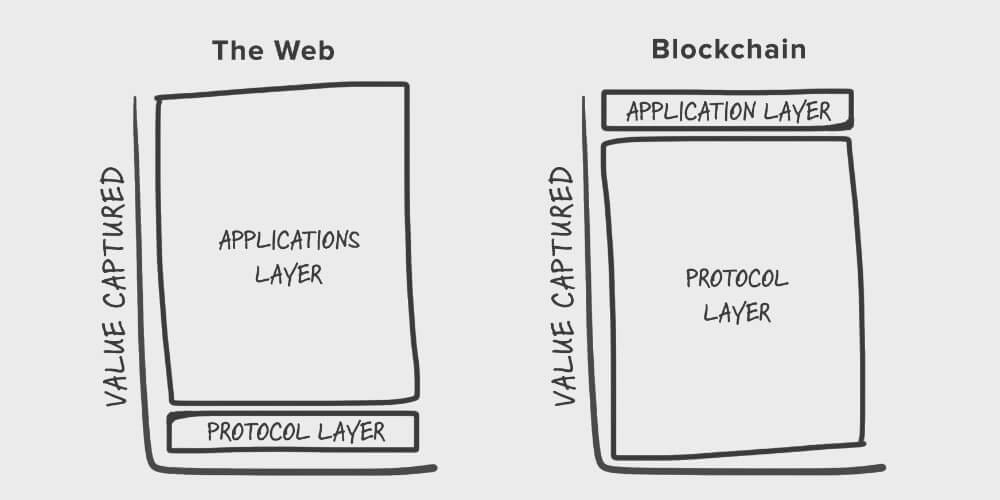

This irreplaceable entity is Fat, which in web3 was once said to be a protocol.

However, some have argued that, in fact, a killer application is essential for the growth of the blockchain layer, and since the blockchain continues to distribute grants and attract applications, it is a Fat Application.

In short, competitive advantage and irreplaceability is the proof of Fat, and the debate is which layer in web3 best fits here.

This was also mentioned in a previous research published by Delphi Digital.

First, he mentions that the web3 industry is an industry in which it is difficult to build a competitive advantage due to its unique characteristics.The three characteristics are as follows

Forkability:The ability to fork an app means that the barriers to entry into the crypto market are implicitly low.

Configurability:The interoperability of apps and protocols makes switching costs inherently low for users.

Token-based acquisition:The ability to use token incentives as an effective user acquisition tool means that the cost of acquisition (CAC) for other crypto projects is also structurallystructurally lower.

In summary, the product itself can be easily copied, switching costs are low because the user owns the data, and users acquired with a token incentive can be taken away with another token incentive.

Let me go into more specifics.

Warren Buffett, the investment god, is said to ask the following question to identify companies with a competitive advantage.

"If I had a billion dollars and started a competitor to this company, could I take significant market share?"

Rewriting this in web3 style, it would look like this

"Can we fork this app and get a $50 million token subsidy to take and keep market share?"

If yes to this question, then the competitive advantage of the service is very low.

In protocols (especially DeFi), the competitive advantage can be the accumulated liquidity or TVL; it is easy to make a copy of Uniswap, but it is extremely difficult to ensure the same liquidity as Uniswap.

However, in the past, marketing with token incentives has often taken its share of the market.For example, Aave, a lending protocol, boasts a high TVL, but is beginning to lose market share to Spark, a company launched by Makar DAO.

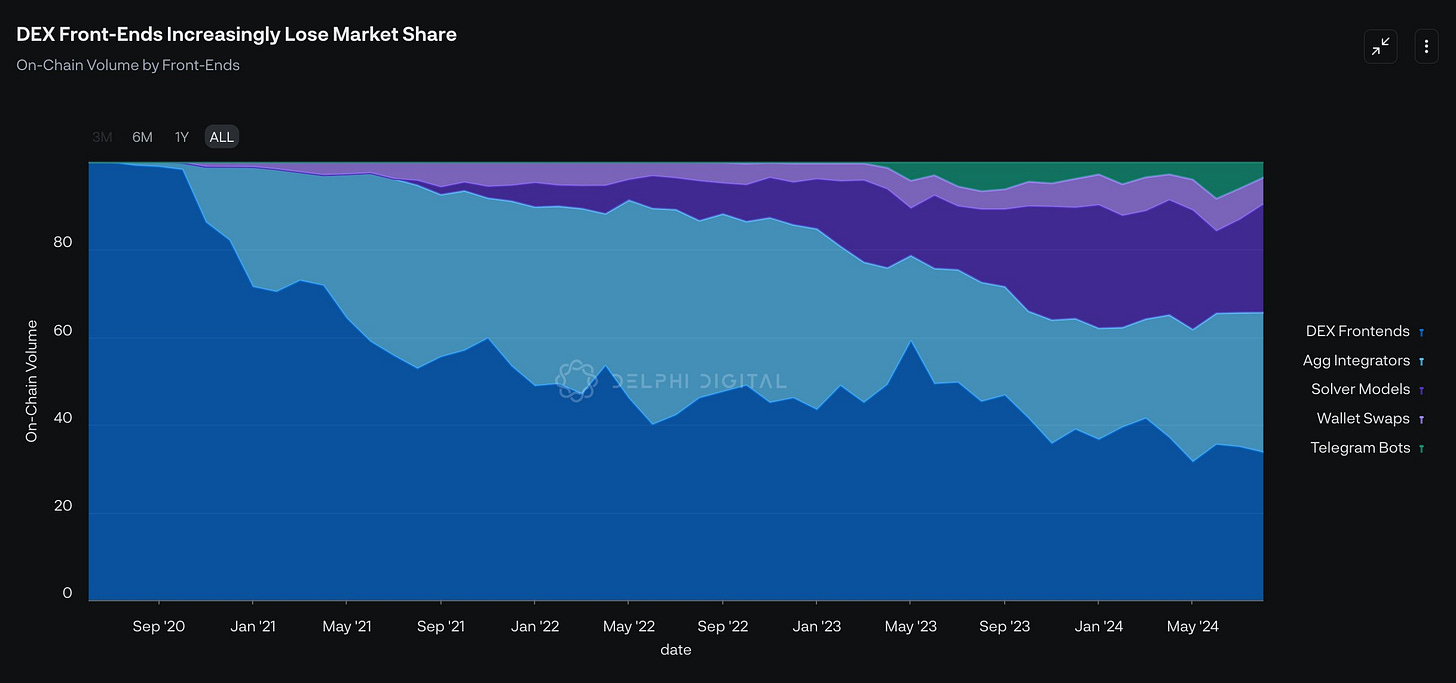

Also, as connected to this discussion, wallets have seen a decline in the percentage of people using the service from the DeFi front end due to the evolution of user interfaces such as Telegram bots.

Furthermore, as trading by Intent and AI agents becomes more mainstream in the future, it will lead to DeFi on the back side being honest about everything.

To recap.

TVL, DeFi's competitive advantage, is not as much of a barrier to entry as one might think.

The time is coming when DeFi will be on the back side, not the front.

In that era, the important thing will be low fees (and technological innovation) and commoditization.

This would make it impossible to raise commissions and would force them to compete at a lower price.

The lack of competitive advantage means that they will be caught in a commoditization and commission competition.For example, what would happen if Uniswap raised its commission rate to 3% now?Most of the users would probably migrate to another DEX.In the past, when users migrated from OpenSea to Blur, it was also a battle based on fee competition and token incentives.

As such, the protocol side will be more behind the scenes in the future, and the battle will be fought with inexpensive fees as a competitive advantage.This is why I believe that the protocol side is starting to release wallets one after another, whether it is Uniswap, Aave, or Magie Eden.

✨The Wallet has the advantage

Based on the discussion up to this point, we can see that Fat Wallet is a result of the fact that wallets are highly irreplaceable and have a high degree of competitive advantage.So what is the competitive advantage?

This area may be quickest to reflect on personal feelings rather than theory.

Once you have funds in the wallet and are using it, aren't the switching costs quite high?Even if you find a wallet that says, "This is better than MetaMask!"Even if you find a wallet that is "better than MetaMask," it is still quite difficult to move all your funds.There is the hassle of withdrawing funds from the protocol you are currently running and transferring all the FTs and NFTs you have.There are wallets that claim to have a feature that allows you to import the whole thing, but it is still a hassle.

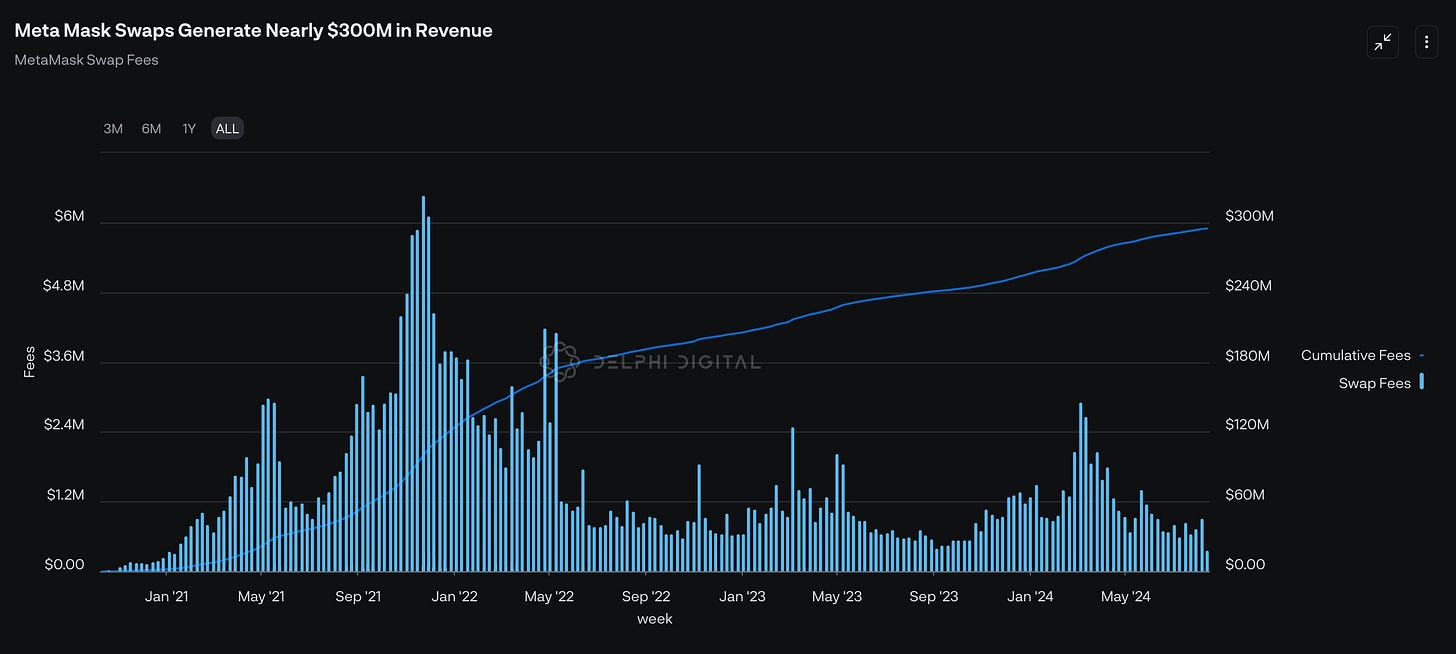

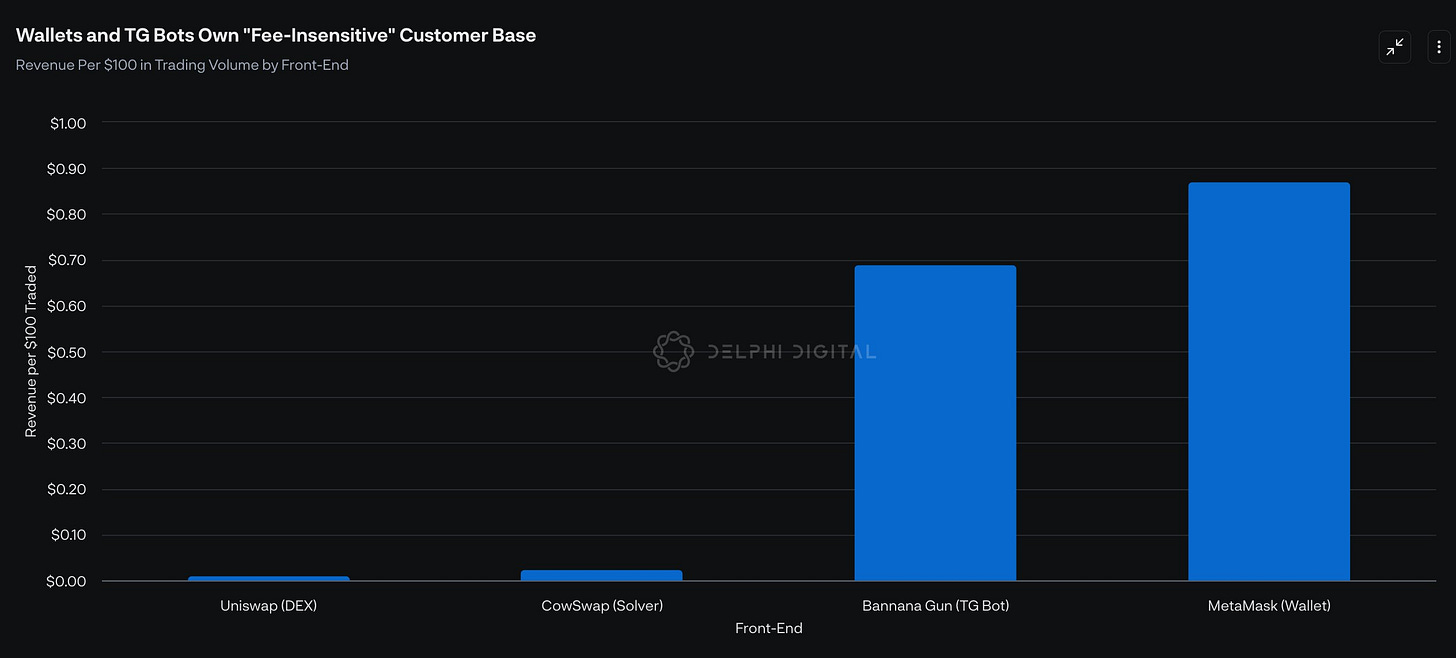

As a result, a great many people continue to use their first wallet.In addition, MetaMask charges a 0.875% in-wallet swap fee, which is by far the highest since Uniswap charges around 0.1%.However, MetaMask boasts a high rate of return on this fee.The reason why MetaMask internal swap is used is because it is a hassle to go to Uniswap.

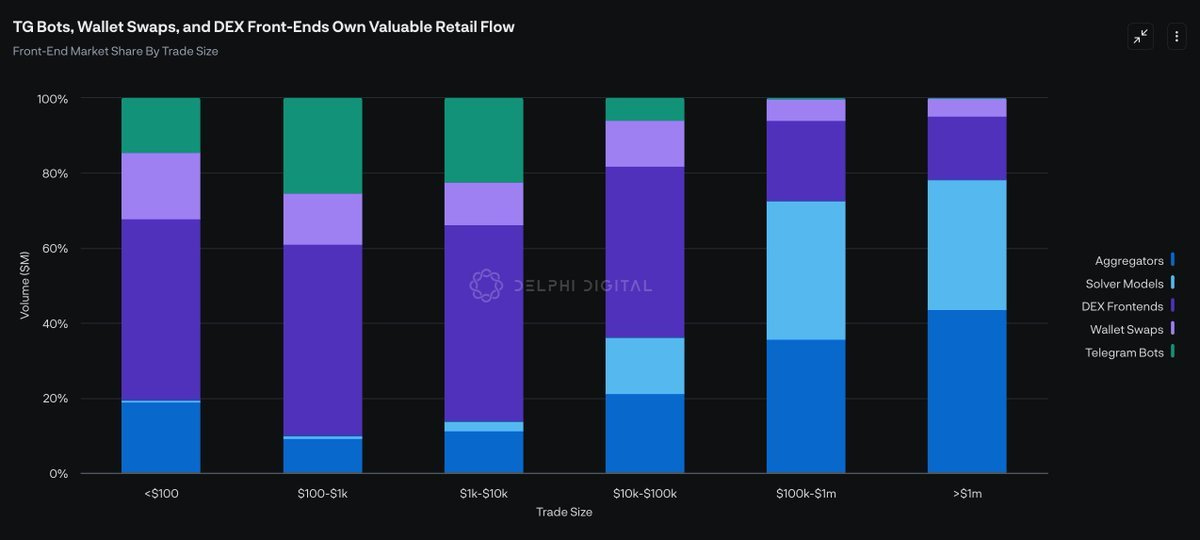

More interesting data is that wallets have as their main customers a segment of the population that is not fee sensitive.The following data shows swap destinations by transaction size.

The larger the transaction size, the less people use Telegram bots and wallet swaps.Large traders will use the cheapest one because of the losses they incur due to fees.As a result, protocols such as Uniswap cannot raise fees.This is because if they raise fees, they are switched to another protocol.

Because of this difference, wallets are highly profitable.Users who swap at wallets take convenience over fees, so it does not matter if the fees are a little higher.Herein lies the revenue opportunity that wallets have.

Yet another revenue opportunity exists in the "Distribution as a Service" (DaaS) potential.Since the wallet is the gateway to all applications and protocols, the wallet takes the initiative of where it is accessed.

For example, Coibase Wallet provides access to the protocol from within its app, but from the app's point of view, it depends on whether it can secure users by showing up here. just as Apple monetized IOS, the wallet provides accessin exchange for an exclusive agreement with the app, which puts them in a better position to make an exclusive deal with the app.

In addition, MetaMask offers MetaMask Snap, a platform that allows users to build mini-applications within MetaMask.

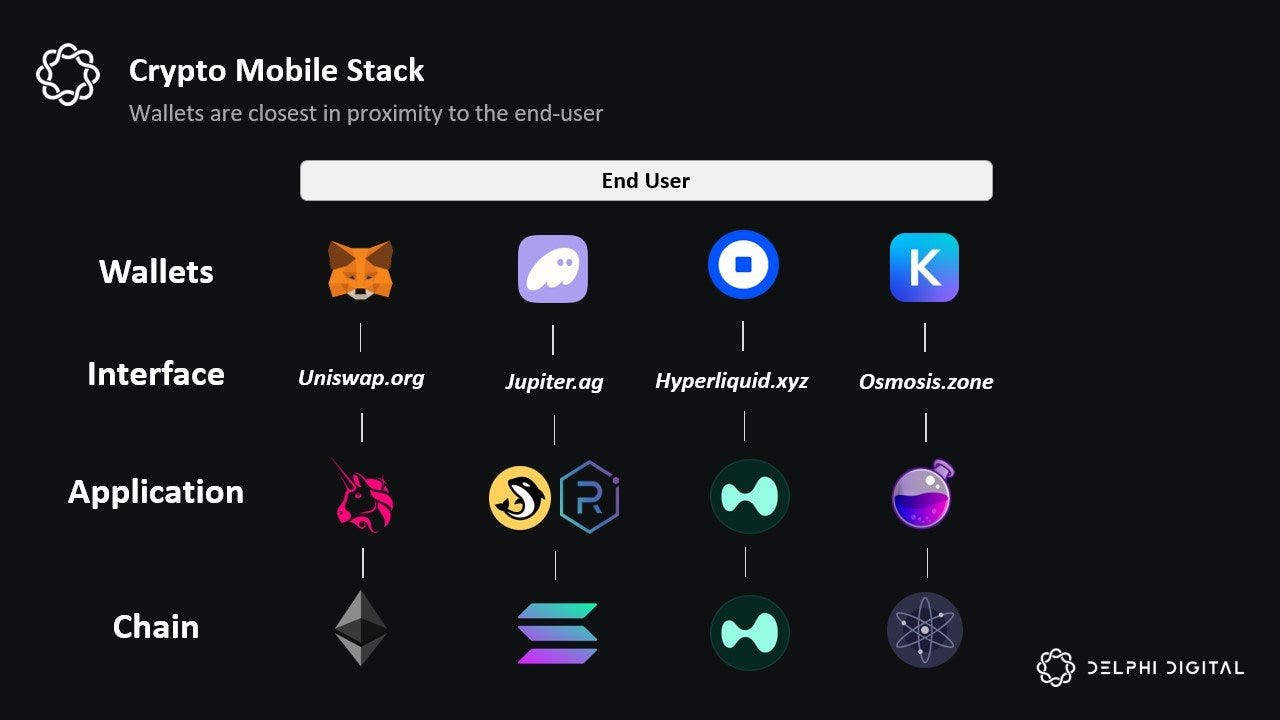

And finally, as I mentioned at the time of the thin competitive advantage of protocols, "intent" and "AI agent" transactions will increase in the future world of blockchain, and "chain abstraction" will become the norm as the supporting technology.

It will be a world where the majority of users do not think about the blockchain or transactions, but are automatically executed at the optimal rate and route from any protocol.

However, even in that world, users will still need an entity to manage and direct their assets.That is where the wallet should come in.

💬Total Summary and Outlook, Fat Wallet, but precisely in the era of Fat Application Wallet

The last one is a consideration, but it may have been a little difficult to talk about, so let me get it straight.

Formerly called Fat Protocol, the unique characteristics of the web3 industry that the product itself can be easily copied, switching costs are low because the user owns the data, and users acquired with a token incentive can be stolen with another token incentivemay cause the protocol to become commoditized and subject to fee competition.

Furthermore, it is expected that users will have less and less exposure to the protocol in the future due to the rise of chain abstraction, intent, and AI agent-based transactions.

Since light users take convenience over fees and core users take fees, fees cannot be raised for core users, who are the current users of the protocols.

Wallets, on the other hand, are the gateway to all protocols, so they can take the initiative on which protocols they let people access.

For users who value convenience, a few fees are not a problem, so profitability is high.

Even in the age of chain abstraction, intent, and AI agents, the entities and interfaces that manage assets and convey intent will remain, and that is where wallets come in.

In fact, MetaMask is highly profitable, and on the protocol side, Uniswap, Magic Eden, Aave, and others are releasing wallets in rapid succession.

Naturally, I am abstracting the discussion to make it easier to understand, but there are many different protocols and many different wallets, so I am not saying that all of them are like this.

However, the strength of the Base chain may lie in the fact that it is a chain (protocol), but it is easy to build a competitive advantage and does not have to be monetized by itself.Exchanges and wallets exist, so it can flow seamlessly from there to Base, and if sales from synergies are expected, there is no problem.We have a structural advantage over other chains that have to monetize the chain by itself.

And personally, I think the Fat Wallet theory is definitely true.

As I mentioned earlier, there are a thousand different wallets and protocols, so not all of the power relations will be wallets up, but there is no doubt that the wallets that have a grip on users will become more influential.

However, being Fat means having a high competitive advantage, so naturally the hurdle for late entrants to gain market share is high.After all, no wallet has yet emerged to break MetaMask's stronghold.So, it seems that late entrants have two choices: either go for existing web3 users or become the first wallet for those who have not yet been exposed to web3.

Many wallets are probably aiming for the latter, but I personally don't think this is a wallet originating point here.The most obvious example is the World App: you download the app because you want Worldcoin, and it also comes with a wallet function for receiving tokens.

The point is that people who have not yet been exposed to web3 are unlikely to use the wallet alone as a new user, since there has never been a need for it.It is more likely that a need will arise separately, and the order in which the wallet will be needed to receive it makes more sense.

Conclusion.

I would be Fat Wallet, but I think Fat Application Wallet is correct.

There is no doubt that the wallet will be in a strong position, but the application will exist as the front end of the wallet, and actually attract users by providing a wallet on the back side of the application.By providing wallet functions to the users thus attracted, the revenue base is topped up with swap fees and DaaS as described above.

Therefore, we believe that the trend of businesses that have content and applications that can attract users will accelerate to provide wallets on that basis, rather than businesses that provide wallets alone, and that the latter will have a higher probability of success as wallets.

And finally, to make a more outlandish prediction, we also think that the demand for something like the "DID Wallet" will unexpectedly increase.Meaning that some kind of proof is issued by SBT (NFT), which is ERC-6551, and the proof itself is a wallet.

However, in this case, I am wondering if it is not possible to go beyond that, since a wallet is needed to receive that proof SBT (NFT) in the first place, and I am thinking that a wallet or token gate starting from the DID may be quite possible.

I will write an article on this area when I have more language together.

This is my research on the Fat Wallet Theory!

🔗Reference.

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.