【Ethos】Protocol for Measuring Trust and Reputation on the On-Chain / Proof of Credibility Validation for Staking People / Raised $1.75M in Pre-Seed from 59 Angels / @ethos_network

Interesting mechanism for staking people.

Good morning.

Mitsui from web3 researcher.

Today we researched Ethos.

🔵What is Ethos?

💰Incorporating economic security into reputation

💬The importance of incorporating economics

🔵What is Ethos?

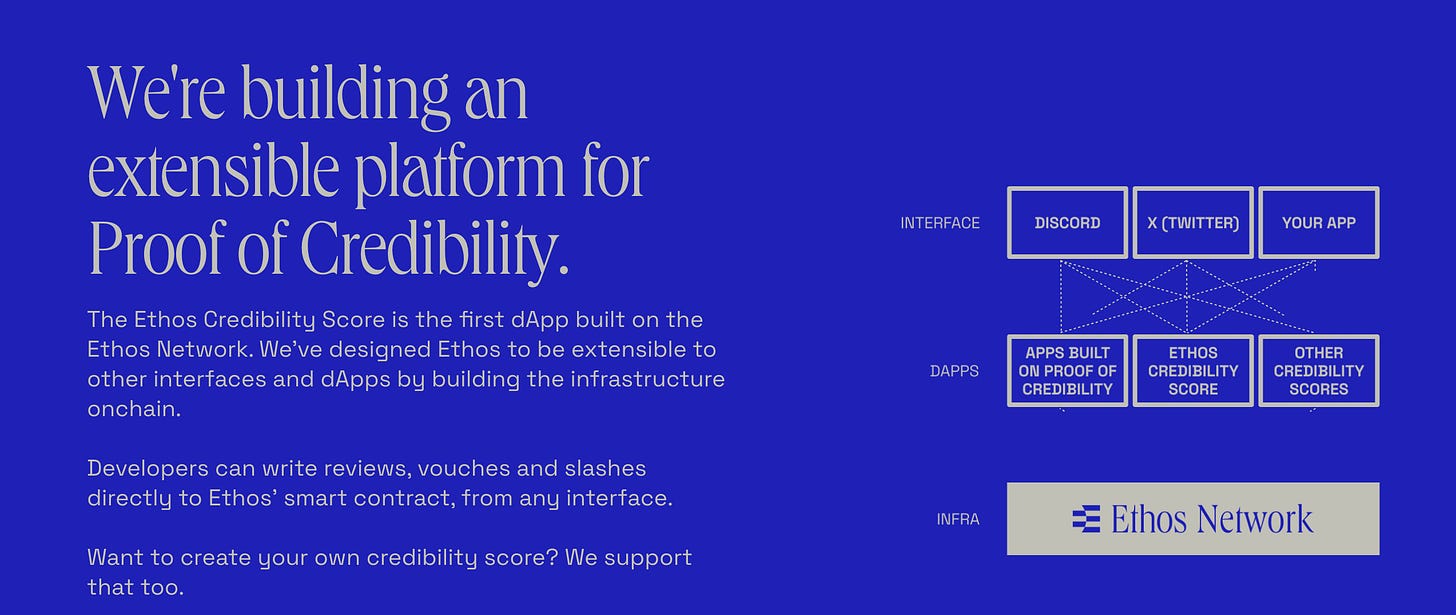

"Ethos" is a protocolfor measuring trust and reputation on-chain.By building a DID, we aim to eliminate fraud from the on-chain and create a world where people can use the system with confidence.

Fraud is currently rampant in the web3 world; TRM estimates that in 2022, $9.04 billionmore is estimated to have been stolen through crypto asset fraud, which is a significant increase over 2016.

So sentiment toward crypto assets is often quite negative.In fact, 75% of U.S. investors say they do not believe the current methods of investing or trading in cryptocurrencies are safe or reliable.

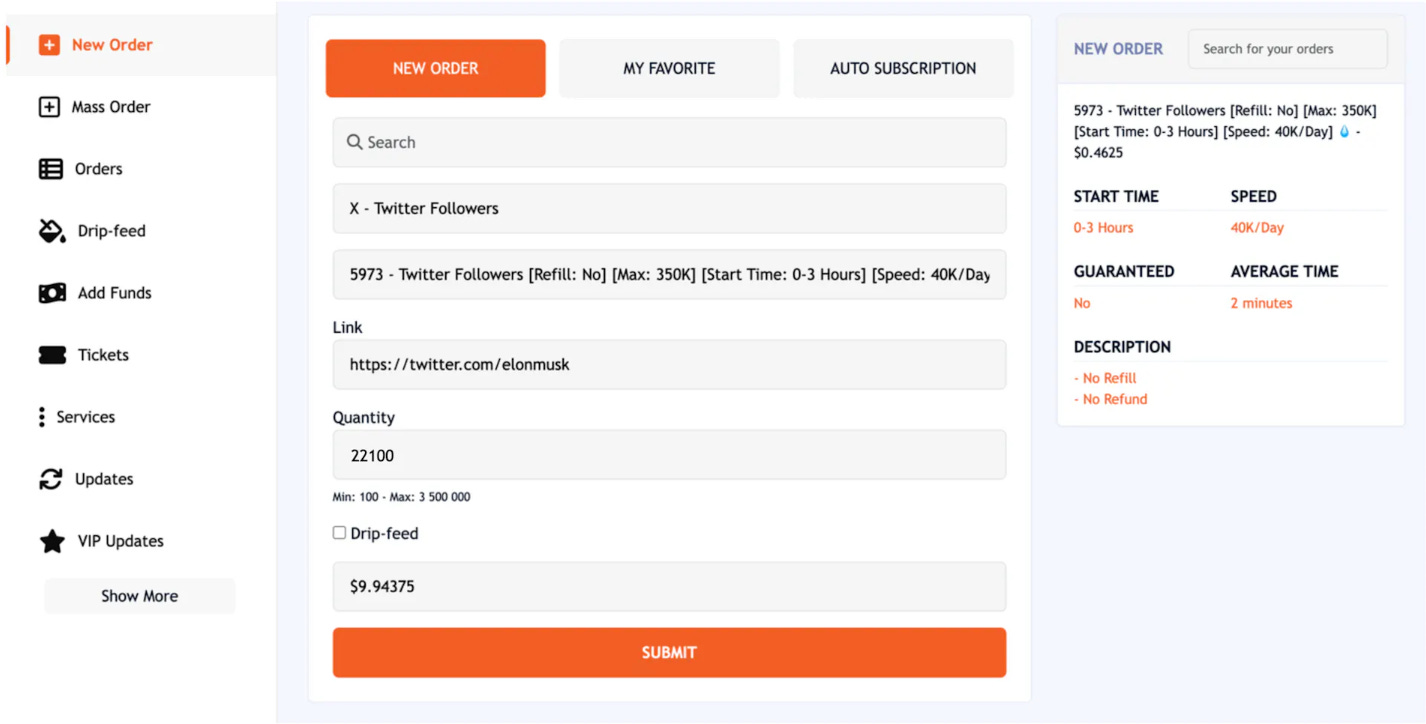

In response to this current situation, we often measure trust by looking at X accounts, etc., but the current situation is that sham figures can be disguised for a small amount of money.

For example, the following sites allow you to create a profile like a top influencer for just a few dollars: 224 retweets for $0.05, 234 likes for $0.05, and 159,000 views for $0.015.

Ethos" solves these problems.

💰Build economic security into your reputation

Ethos" is currently in the process of registering for the waiting list, so this is only the main content published in the white paper, but here are some of its features.

Eventually, the system will be able to calculate a "reliability score" based on several items, as shown below.

Incidentally, the Ethos score is divided into five levels.

0-800 -Unreliable

800-1200 -Suspicious.

1200-1600 -Neutral.

1600-2000 -Reliable.

2000 and above -Exemplary

Now, let us explain the items under which these scores are calculated.

① Reviews.

As the term implies, it is a review.It is a rating from another person.However, the person writing to eliminate malicious posts must also have an Ethos profile and will leave a trace of their writing.

They are influenced by the volume and staleness of the reviews, the credibility score of the person who wrote them (the higher the score, the higher his/her own credibility score), and other factors.

②Guarantee

This is the most distinctive mechanism at Ethos, which has come to the conclusion that financial security is essential to the reliability score.This means incorporating financial gain or loss into the reputation system.

Ethos stakes Ethereum against a person.For example, if person A stakes 2 ETH to person B, person B has the assurance that 2 ETH has been staked.The point is that it is proof that he is that trustworthy that he can entrust 2 ETH from someone.Naturally, 100 ETH staking is more reliable.If 100 ETH is staked by one person or 1 ETH is staked by 100 people, both are treated as 100 ETH and the number of people is not considered in the evaluation.

And if you staked someone who staked you and you staked them back (mutual staking), Ethos will record the mutual interest and your trust score will be increased.

Of course, the steeked party cannot be involved in the staked asset.The staking party can withdraw at will.However, as with existing staking, there is a risk of thrashing.

Any Ethos participant can accuse another participant of inaccurate claims or unethical behavior as a "whistleblower".This accusation will result in a 24-hour lock on the accused participant's staking (and withdrawals).

Currently at Ethos, if you have a minimum stake of 2 ETH (if you have had your staking done), you are eligible to participate in thrashing events as a validator.

Validators will be human proofed and vote either for or against.Rewards are earned regardless of the outcome of the vote.If the whistleblower's accusation is agreed upon, the slush not only imposes a financial penalty, but also has a major negative impact on the user's credibility score.

Thus, we are trying to build a reputation system by implementing Proof of Credibility Validation.

③ Proof of Credibility.

This is proof of identity.You can prove this by connecting your wallet or various social networking accounts.

A reliability score is calculated based on these items.

However, since the initial trustworthiness score is difficult to calculate, particular emphasis will be placed on the "trustworthiness score of the person who invited the person.Ethos" will be launched on an invite-only basis, and it is envisioned that by gradually inviting people who can be trusted, the circle of trust will expand in a chain reaction.

As for the future, it is assumed that it will be launched soon, but no specific date or roadmap has been disclosed.

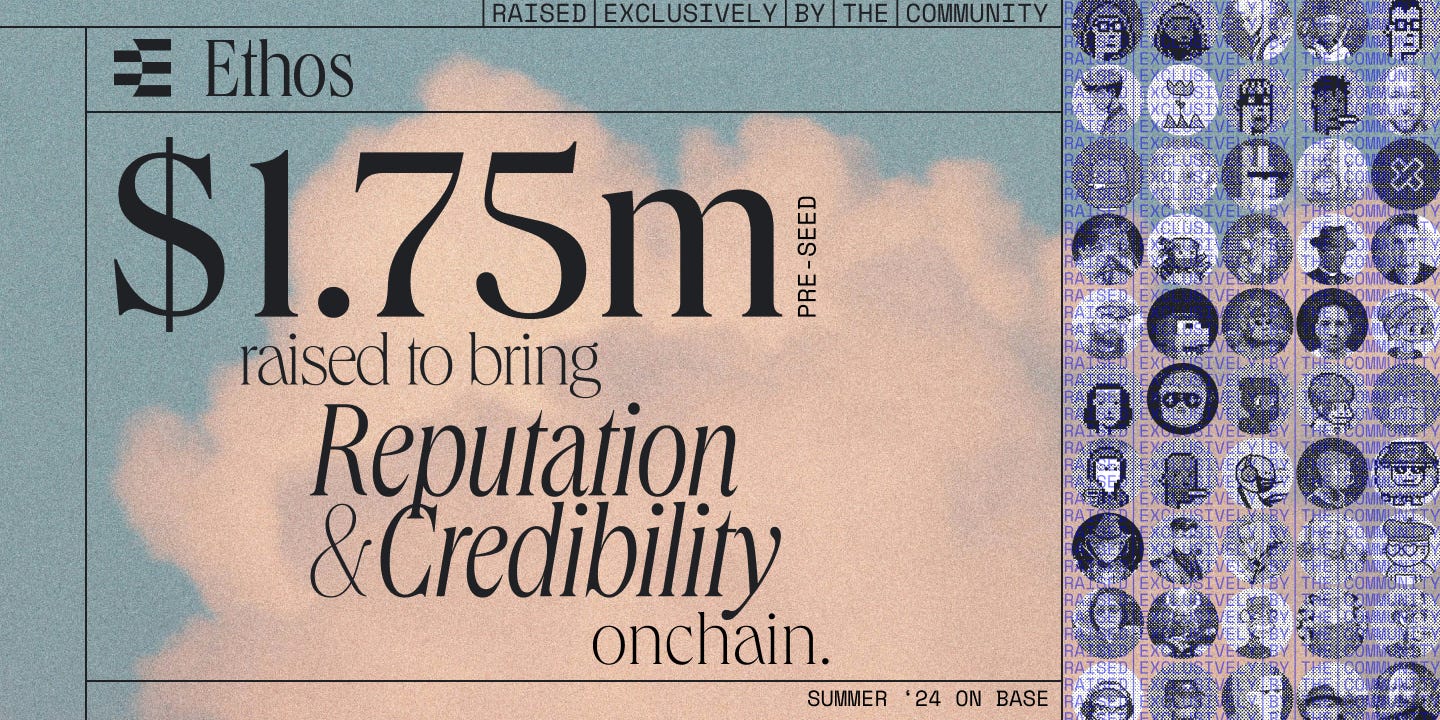

However, the company has completed a pre-seed round of funding of $1.75 million in July 2024.The funds were raised not from VCs or other investors, but from 59 angel investors who shared the ideology.

💬Importance of incorporating economies

The last part is a consideration.

I found this to be a very interesting initiative: the importance of DID and the issue of trust in the on-chain world is often talked about, but no solution has yet been created.

IDs for identity authentication and proof of being human, like WorldID, are slowly emerging, but reputation systems for accumulating trust are still in their infancy.Well, some of it is inevitable because of the changing times and because not every action can be done on-chain yet.

In addition, although it is a chicken-and-egg theory, there is no incentive to build reputation because there is no use for building DID.If that is the case, DIDs will not grow, and it will be difficult to acquire a use for them.

In this context, Ethos' approach was a distinctly different approach.

However, honestly speaking, I feel that it is very hard to stake ETH with no return, so I feel that there is no incentive to deposit unless there is some kind of yield design, such as earning Ethos token airdrop points, making it like liquid staking so that the asset is not locked up, or making it self-managed when deposited like Blast.I feel that there is no incentive to deposit unless there is some kind of yield design.

I think we will probably incentivize yield here.So, if you are going to go through the trouble of staking, it is likely that you will be staking through someone else's reputation system.

However, just like the chicken-and-egg theory mentioned earlier, there is no reason to go to the trouble of staking through a reputation system with the risk of thrashing if there is no use for the DID.Unless the yield is quite high, but then it seems to be a complete reversal of the original idea, and in the first place, ETH staking cannot produce a completely different yield from others.

Then we need to bring about an economic incentive for people to staking each other, albeit without destroying the idea of a reputation system.

So, a Friend[...] based on Ethos' trustworthiness score.It would be good to have a service like tech.Unlike SocialFi, which allows for a certain amount of speculation, SocialFi with a certain amount of credibility score set could work with a moderate amount of speculation.

The difference with the previous Friend[.].The difference with tech is that Friend[.].tech is that there are assets that are staked separately from tech, where there is a thrashing risk and a separate reliability score based on that.I feel that having the funds separated separately will lead to a certain level of trust.

But then, we don't have to do it ourselves, and we could connect the Ethos trust score to another SocialFi, but wouldn't the economy work better if the SocialFi revenue was used for additional yield on staking revenue, etc.?This is what we thought.

The idea is only to DID and to be a foundation to connect with other Dapps.

We won't know the details until it is actually released, but we thought the initiative to incorporate economics was very interesting and will follow up with more information.

This is my research on "Ethos"!

🔗Reference/image credit: HP / DOC / X / Mirror

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.