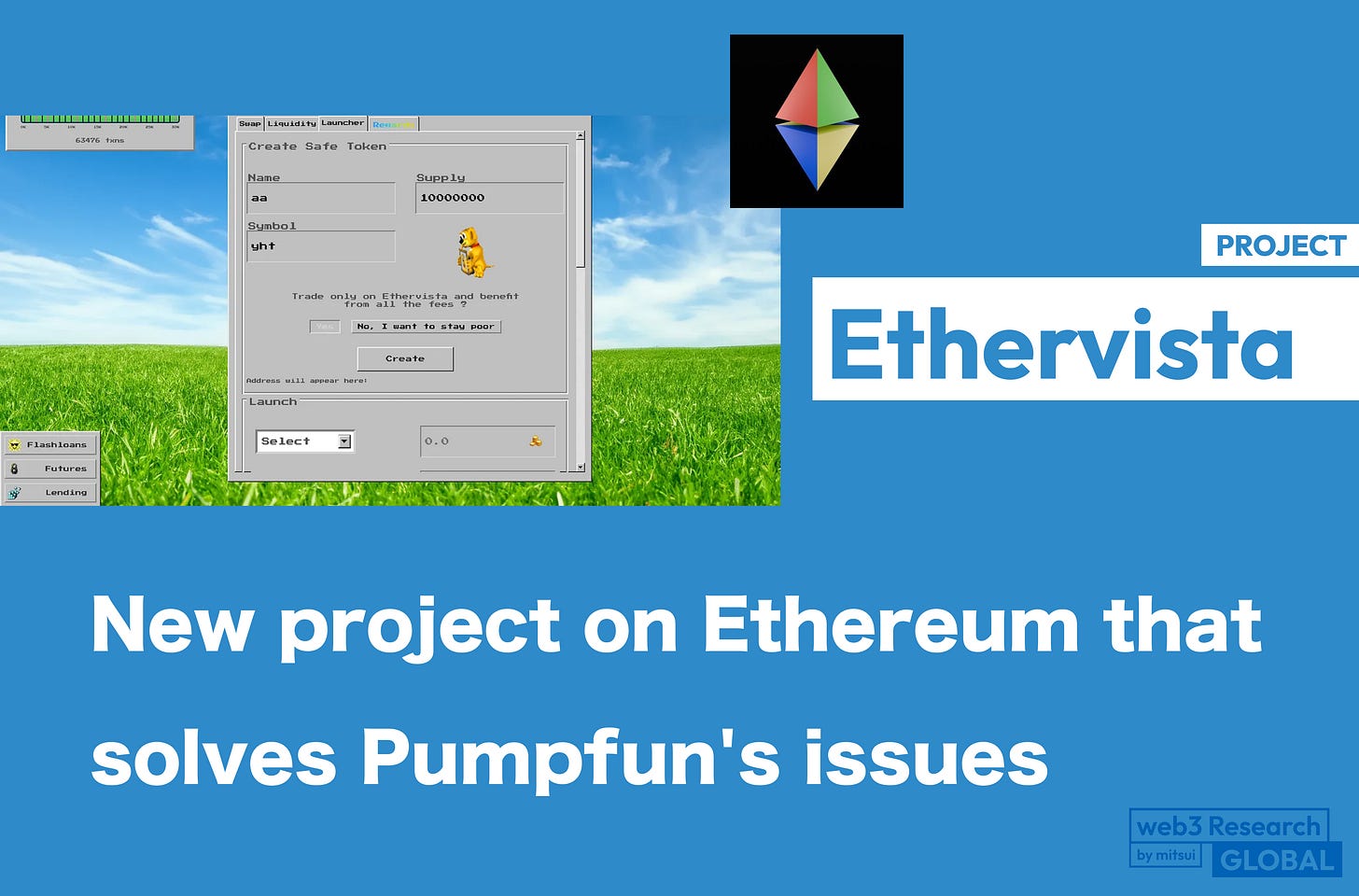

【Ethervista】New project on Ethereum that solves Pumpfun's issues / features liquidity lock period, custom fixed fees, ETH fees, etc. / @ethervista

Updated protocol from Pumpfun may create a meme wave on Ethereum.

Good morning.

Mitsui from web3 researcher.

Today we researched "Ethervista".

🔵What is Ethervista?

⚙️Concrete Features

💧Declining supply of proprietary token $VISTA

📊Look at on-chain data

💬ETH to explodeWill it be the catalyst to make ETH explode?

🔵What is Ethervista?

Ethervista is a new DEX protocol deployed on Ethereum, a very new project released on August 31, 2024, that has attracted a great deal of attention due to its novel features.

It is often described as a competitor to Pumpfun, but its position is to be a token launch platform like Pumpfun, but with AMM (Automatic Market Maker) functionality.

And it was created to solve the challenges of existing token launch platforms like Pumpfun and AMM.

Let's look at the features one by one.

(1) 5-day liquidity lock period

Ethervista" has a 5-day liquidity lock period after the token is launched.This means that the token creator cannot suddenly withdraw the token's liquidity.

First, the token issuer (represented as the creator) sets up Name, Supply, Symbol, and registers additional metadata, website, etc.Tokens are fair-launched, with no pre-set allocations, and 100% liquidity is released to the market.

The fair launch mechanism is also implemented by Pumpfun and others, but in effect, the token issuer can buy up the tokens from the market the moment they are launched.There have been many cases of people buying up the first tokens without anyone noticing, and then appealing to the public through social networking sites, etc., to pump up the price and sell them all at once.

Ethervista" has established a 5-day liquidity lock period to address this phenomenon and the fact that sellouts by token issuers occur within a few days of token issuance.

(2) Fee setting

Here is another important feature.

Creators (token issuers) can set transaction fees in the initial token setup.Two types of fees are set: LP (Liquidity Provider Fee) and Protocol Fee, for purchase and sale, respectively.

In this case, set the amount in USD basis, not in %.

For example, the following settings are possible

At the time of purchase

LP-Fees: $5.00

Protocol-Fees: $5

At the time of sale

LP-Fees: $10

Protocol-Fees: $10

While some may feel that $5 or $10 for a transaction is high, a fixed amount of transaction fee is very inexpensive for large investor transactions rather than %.Also, while you are free to set a high fee, in the end, if it is not traded in the market, it does not generate income for the creator, so there is an incentive to find a good drop-off point.

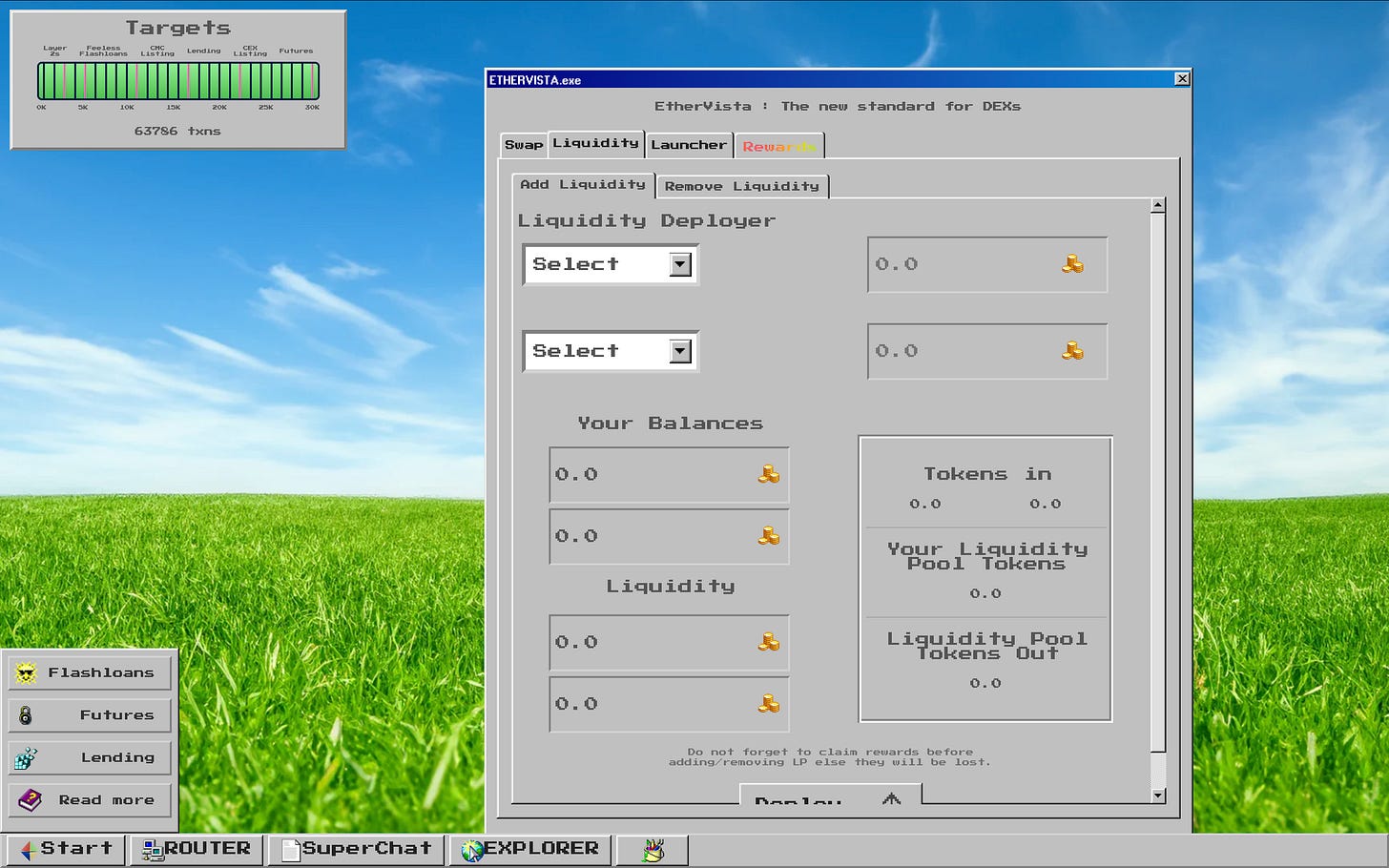

Commission distribution is done automatically via smart contract: LP-Fees are sent to LP providers and distributed according to the amount of funds on deposit; LP providers can access their rewards instantly from the Rewards tab; LP providers can also use the "Rewards" tab to access their rewards.The mathematical model based on "Eulerian quantities" is used to distribute liquidity rewards, but this is a bit difficult to understand because it is entirely mathematical.If you are interested, please see the white paper posted on X.

And Protocol-Fees are distributed to the creators by default, but you can specify the contract to be transferred in the form of Protocol Address, to be precise.This smart contract can be configured for a variety of uses, such as token buybacks, burns, building a community treasury, etc.

In addition, there will be a $1 fee to "Ethervista" itself in addition to this fee at the time of the transaction.This money will be allocated to the ongoing development of Ethervista DEX and $VISTA.

(3) ETH is the transaction fee

Another feature associated with trading.

All transaction fees on "Ethervista" are ETH.On other platforms, the tokens you trade are charged as commission (except for gas).However, "Ethervista" implements a custom commission paid in ETH.This commission is the amount set above and is the reward to be distributed.

This structure provides an incentive for creators to increase the volume of transactions over the long term.

If the proprietary tokens issued are distributed on commission, the more they are traded, the more the creators' token holdings increase and the more incentive they have to sell out, but since they are paid in ETH, the more they are traded, the more stable the reward is, and the more they should keep the tokens going upThe incentive will work.

(4) Settings can be locked

The creator can then permanently lock these transaction fee settings, etc. for transparency and security.

Token transactions can also be restricted to "Ethervista" only by restricting the ERC20 transferFrom function to Ethervista router addresses.

These are the major features.

In general, "Ethervista" is a solution to the current blockchain ecosystem, which lacks the incentives necessary to foster continued growth and resilience, and where token creators are encouraged to prioritize profit by rapidly drawing liquidity and selling tokens at their discretionWe are setting up these features to provide these long-term incentives.

⚙️Concrete Features

Now let's continue with the specific functions.The above is the general framework, but we will explain it again along with the UI.

①Swap

②fluid supply supply

③Token issue

④Earn rewards

⑤EXPRORER

The search will output information about the tokens that exist in Ethervista.Although the number of tokens is still small, it can be used as a search window when the number increases in the future.

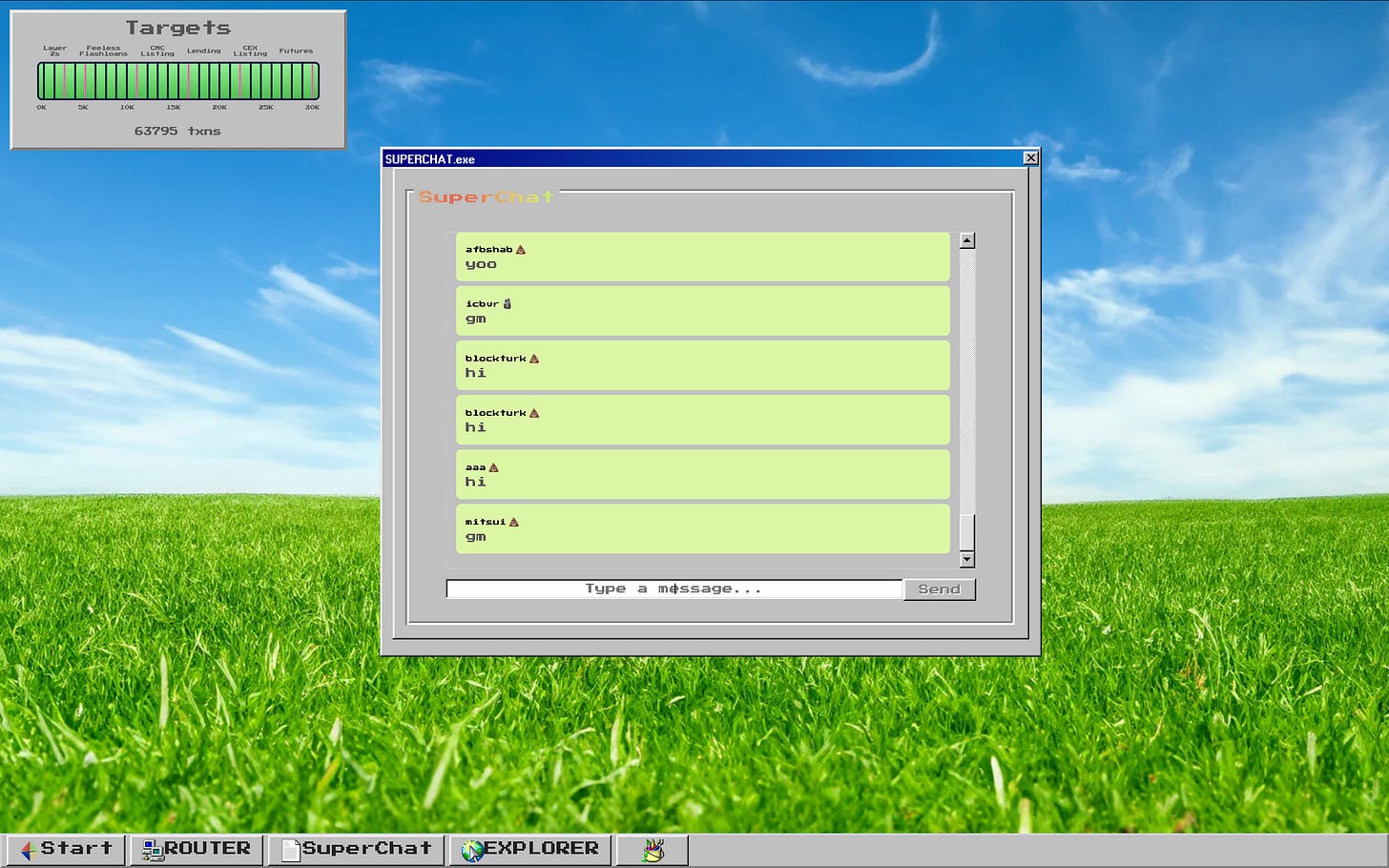

⑥SuperChat

Live chat within the service.This allows users to exchange information quickly; access to SuperChat is tiered according to the number of $VISTA tokens a user holds.

⑦Other

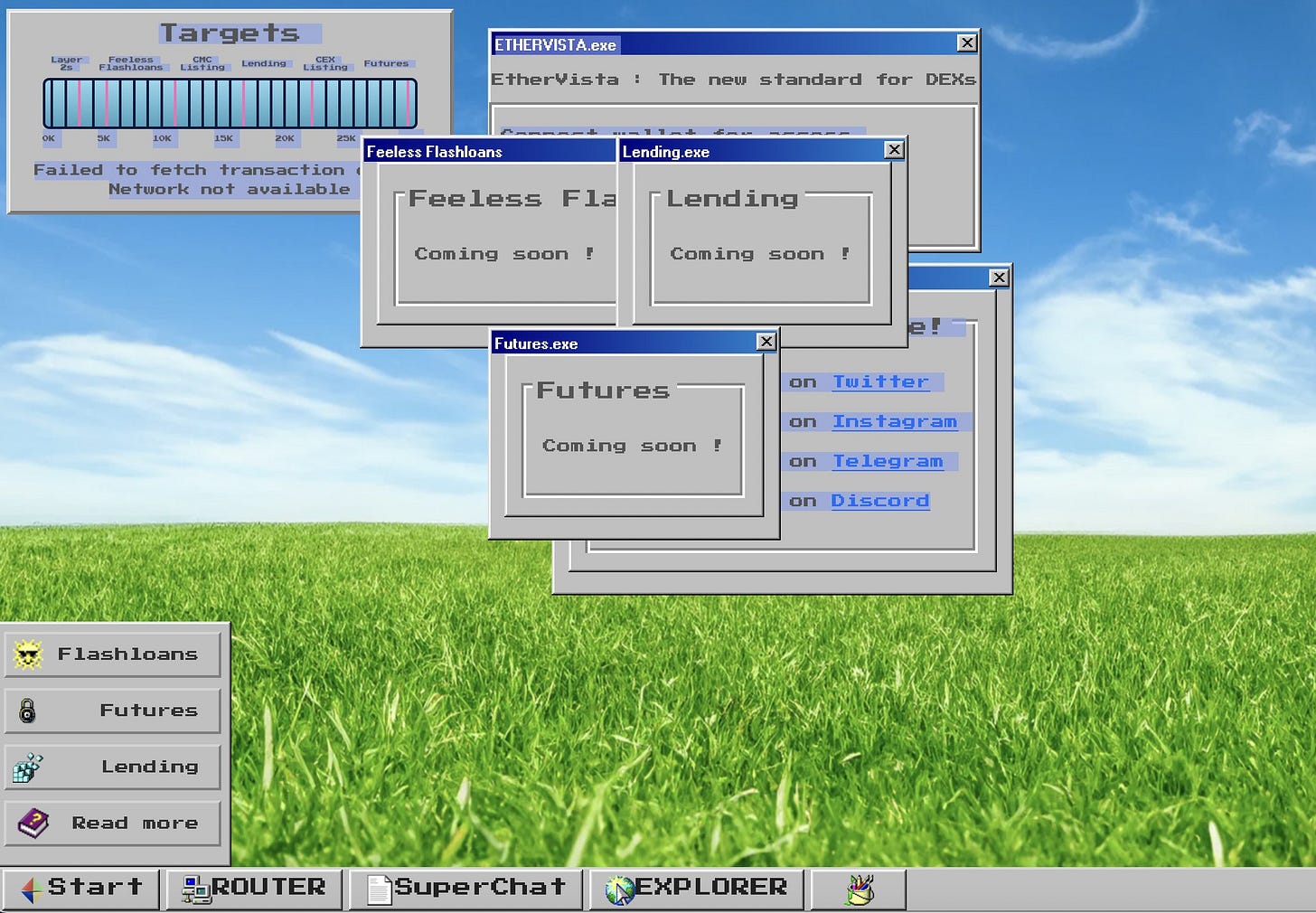

As mentioned in the white paper, there are plans to expand into lending, flash loans, futures, etc., as well as expansion into L2 and CEX listings for proprietary tokens.

💧Decreasing supply of proprietary token $VISTA

Ethervista issues its own token, $VISTA.

The total supply of $VISTA is 1 million tokens, and there is a built-in mechanism to reduce the supply in circulation over time.I mentioned earlier that there is a $1 transaction fee for "Ethervista" and a portion of that fee is used to buyback&burn $VISTA, reducing the supply.

The official X sends out that information on a regular basis, with $200,000 being burned on Day 1, $63,000 on Day 3, and $156,000 on Day 6.

According to CoinGecko, the current total supply is "973,826," which calculates to approximately 270,000 tokens (2.7%) burned in the first week or so after release.

It will continue to be burned with each transaction, and the supply will continue to dwindle.

However, since the tokens are burned from a portion of the USD-based fee, the amount of tokens burned per transaction will decrease as the token price increases.

This mechanism is well thought out.

This is because, conversely, when the token price falls, more tokens are burned, which reduces the total supply and tends to lead to an increase in the token price.Because the tokens are designed that far in advance, it is expected that even when the price drops, buy orders will be placed in anticipation of a price increase, and as a result, demand will continue to be maintained.

However, there are no specific utilities for $VISTA at this time, only a change in tiers in SuperChat.I personally expect this to increase in the future.

Specifically, with decreased transaction fees based on the amount held (based on tier), improved liquidity fees, etc.

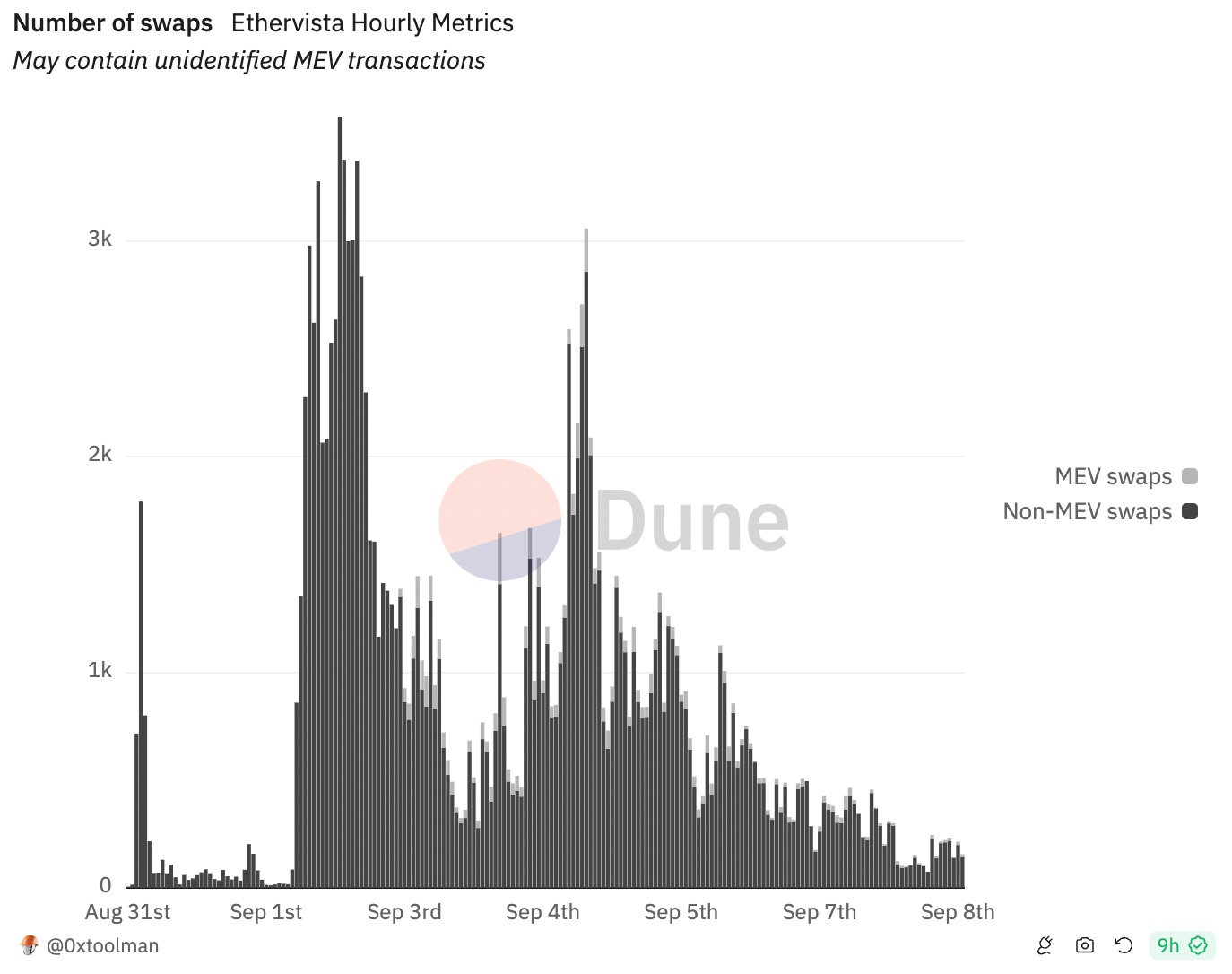

📊Look at the on-chain data

Then we look at the on-chain data.

The protocol has just been created, but TVL is $5.77M and daily transaction fees are in the $40.99k range.

DuneLook at this.

In terms of scale, it is growing gradually, but as expected, it is still an order of magnitude different from Pumpfun.

While it is currently attracting a great deal of attention and is expected to grow, there are some concerns.

While there is a lack of clarity about the creator and concerns about contract audits,speculationthat the project author has sold $VISTA is also rife.uid="206">is also flying around.However, this claim appears to have been inaccurate and has not been confirmed.It is believed that investors who discovered $VISTA early may just be cashing in .

💬Will it be the catalyst to explode ETH

Finally, a consideration.

Ethervista" was one of the most traded exchanges in the Ethereum community over the past week, attracting a great deal of attention from the crypto community.This was, after all, due to a sense of challenge with the existing meme coin platform in the market as a whole.

However, it remains to be seen how far the excitement will go.

Once the non-product unknowns, such as contract audits and founders' credit, are ruled out, the product, if it evolves as it ideally should, could be the catalyst to explode ETH.

Currently, the price of ETH is stagnant.There are many market influences, but since the Dencun update, the gas price has dropped, L2 has made great strides, and these factors have drastically reduced the amount of ETH being burned and inflation has continued to rise.As a result, price performance has been poor for BTC compared to other altcoins.

However, this situation was known before the update, for example, if the gas cost was reduced by a factor of 100, just increase the Tx amount by a factor of 100 or more.

Pumpfun exploded on Solana and now SunPump is exploding on Tron.Meme platforms are exploding on both chains, creating a big Tx increase in excitement.

Recently, platforms like Pumpfun have been created on the Base chain, and there is a lot of promise there, but "Ethervista" may be one of the things that will get ETH going.

Personally, I think the fixed amount of fees and the unique token burn mechanism are interesting.

I think the crux of the web3 project is the incentive design, and from a deeper perspective, it is to allow people to envision possible human movements through the incentive design that has been designed.

The aforementioned token-burn mechanism is exactly like that: when the price falls, the price is likely to rise because the amount of tokens to be burned will increase and the supply will decrease.And since there are likely to be people who think, let's put in a larger buy order when the price goes down, more people will think and execute it, and the price is likely to really rise.

The point is to "make people assume and think," and this is true in the stock investment world as well, where prices are often controlled by the patterned human psychology of "I will place a buy order when XX happens because the price will fall" rather than by reality and logic.This is no longer the case in the stock investment world, but rather, it is often the case that prices are controlled by patterned human psychology.

When you think about it, it is human beings who trade, so it is natural that it is important to design incentives that stick to human psychology and traders' psychology.Paradoxically, no matter how much people actually behave in such a way, if the price movements cannot be assumed at the time of designing token economics, the actual situation will not catch up.

To put it in pinpoint terms, it's important to make a good trader think, "The average investor or user trades thinking they can make money here, when in fact, they could make money if they make this move at this point."It is important to make them believe that this is the case.

Token economics is, of course, as published, but it is an image of an incentive design that reads the surface of one layer and a second layer of incentive design that reads deeper, stacked on top of each other.The incentive design of token economics that makes you assume that much is important, and I believe that good traders and investors will see through to that point, so they will evaluate the team and invest their money.

I wrote this a bit abstractly, but I thought it would be interesting to look at the incentive design of projects from this perspective.And I will continue to follow "Ethervista" with personal attention!(Of course, please use at your own risk!We are not responsible for lagging or being hacked.)

This is my research on "Ethervista".

🔗Reference/image credit: HP / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.