【All About Ethena】An in-depth look at the growth strategy, transition, and surrounding ecosystem of USDe, the fastest growing delta-neutral stablecoin in the market.

You can see Ethena in its entirety.

Good morning.

I am mitsui, a web3 researcher.

Today we have researched "Ethena". We have compiled this information to help you understand the past changes and new initiatives regarding the very present Ethena, so please read it through to the end.

💴What is Ethena?

🗺️ proprietary tokens and surrounding ecosystem

💬 Fastest-growing next-generation stablecoin

🧵TL;DR

Ethena is a stable coin platform that issues USDe, a "delta-neutral" crypto asset + short futures, and has expanded rapidly since its launch in 2024 to become one of the top 3 cryptocurrencies by market capitalization.

The sUSDe is a USDe stake beneficiary token that distributes a yield on the LST staking fee plus the funding rate/basis as a source of funds (supported by a reserve fund in the event of an emergency). The design aims to mitigate the trilemma of "diversification, stability, and capital efficiency."

Ecosystem extended to ENA/sENA (governance and compensation/airdro multiplier), Ethena Network (Ethereal/Derive), L2 Converge, derivative USDtb (government bond backing), tsUSDe (TON version), iUSDe (institutional).

Strategy is to accelerate growth through alliances and multi-chain expansion (Telegram/TON, etc.) + ENA buyback by StablecoinX. Key risks are collapse of delta neutrality and CEX/custody dependence; ENA utility enhancement is key going forward.

💴What is Ethena?

The "Ethena" is a new type of stablecoin protocol built on Ethereum, offering a synthetic dollar "USDe" backed by crypto assets.

Unlike traditional legal tender-backed stablecoins such as USDC and USDT, the USDe is designed to maintain value through short positions in physical crypto assets such as Bitcoin and Ethereum and futures that offset their price fluctuations.

While USDC and USDT are legal tender-backed and USDS (formerly DAI) is called crypto-asset-backed, USDe is a delta-neutral stablecoin.

This mechanism is so revolutionary that USDe has quickly grown to be the fourth largest stablecoin by market capitalization in less than four months since its release in 2024, and is now the third largest by market capitalization.

I would like to begin with an explanation of USDe, and I will start with the genesis of the idea.

◼️USDe Birth Background

The inspiration for the Ethena project stems from the vision proposed in the blog post "Dust on Crust" published by BitMEX founder Arthur Hayes in March 2023.

Hayes noted that "yielded digital dollars" are the biggest opportunity in the crypto asset market, and that demand for this product far outstrips the entire crypto market, including bitcoin.

Ethena Labs was founded to realize this vision and launched in February 2024 with a USDe of "synthetic dollars". The founder and CEO is Guy Young, who has nearly a decade of experience in traditional finance (investment banking, hedge funds, and private equity) and most recently led the principal investment department at Cerberus Capital, a large US investment fund. Mr. Young's knowledge and practical experience in traditional finance has been incorporated into the design of Ethena, including its high yield offerings and risk management.

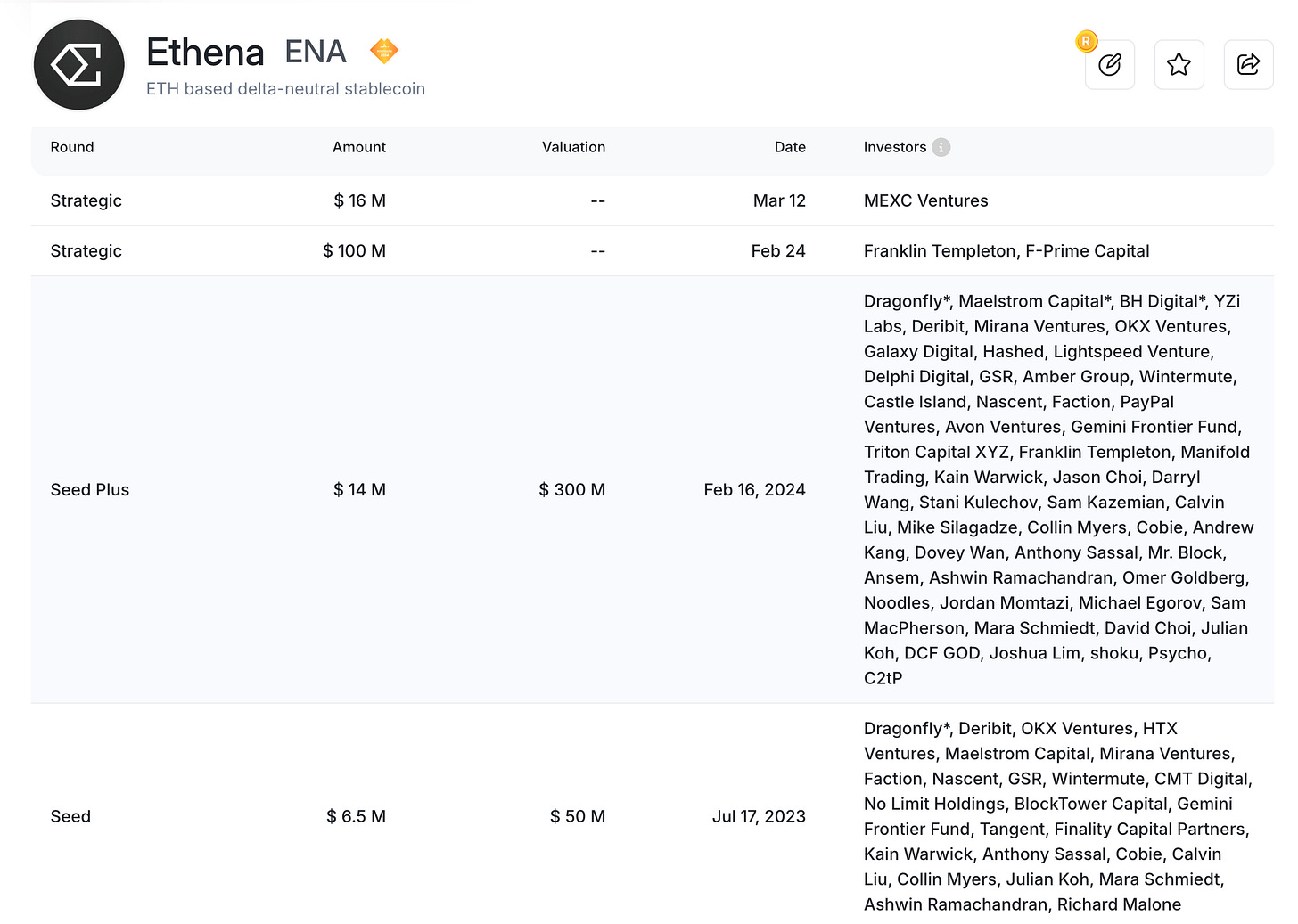

Since its inception, Ethena has received support from prominent investors and companies, including BitMEX founder Arthur Hayes (who published the blog that inspired his vision), US asset management giant Franklin Templeton, crypto asset investment firm Galaxy Digital, and exchange Binance Labs, among others.

With such strong backing, Ethena launched its protocol in the spring of 2024 and rapidly gained users and liquidity in the first few months after launch.

◼️How USDe works

So, let's cut to the chase: how does the USDe work? What is a synthetic dollar?

USDe is a delta-neutral stable coin whose value is stabilized to $1 by crypto asset collateral and futures hedging.

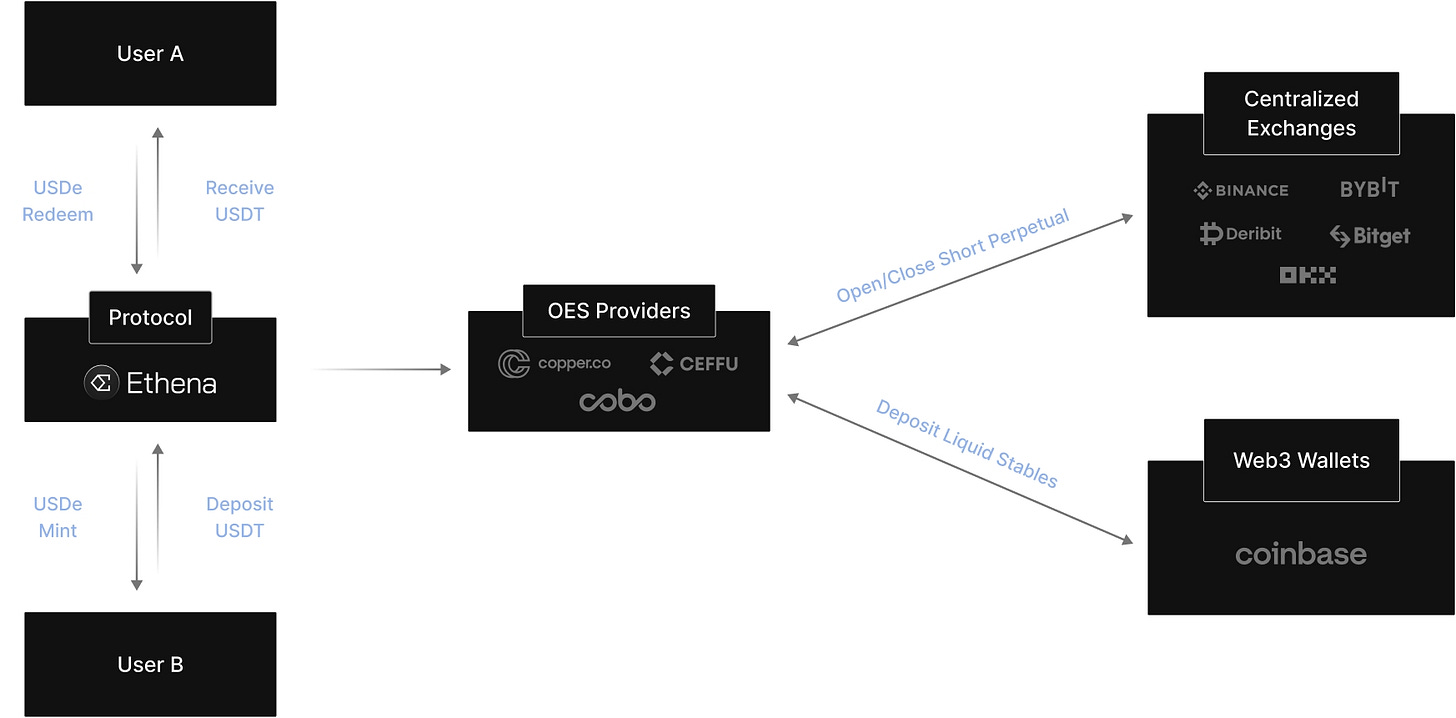

Users can deposit ETH, WBTC, staked ETH (stETH), or even USDC into the protocol to mint USDe. ETH is then sold (shorted) on the futures market to offset the risk of price volatility of the collateral ETH. This allows the shorting of the futures market to offset the loss of the shorted ETH against the increase in the value of the physical ETH collateral when the price of ETH rises, and vice versa when the price of ETH falls.

It is a little difficult to understand here, especially if you have not had much exposure to finance. This delta-neutral type is not a new concept in crypto, but a trading strategy that has been around in the financial world until now. As I mentioned earlier, the founders have 10 years of experience in finance, and they brought that experience to crypto.

Simply put, delta-neutrality is a strategy of taking a neutral stance, whereby two strategies, one that benefits when prices rise and one that benefits when prices fall, are taken so that neutrality is maintained regardless of whether prices go up or down.

That is what I was writing about earlier, when Ethena accepts collateral funds (e.g., ETH), it holds a short position in an amount equal to the collateral funds.

To recap,

ETH of collateral funds are held in physical form as is -> gain when ETH price goes up

Hold a short position of the same amount → Gain when ETH price falls

Since a short position is an investment strategy that bets on the price going down, the above equation holds true. This allows for a one-to-one collateral fund that is not subject to volatility, even if the collateral fund is a crypto asset, and thus a stablecoin.

So, I'm wondering, why go through all this trouble? and how is the "establishment of digital dollars with a yield", which was the reason for the establishment of Ethena in the first place, being realized?

The USDe itself does not yield, it is simply one of the stabled coins. However, staking USDe to sUSDe distributes the yield on the collateral funds.

◼️sUSDe

You can get sUSDe by staking USDe as explained earlier.

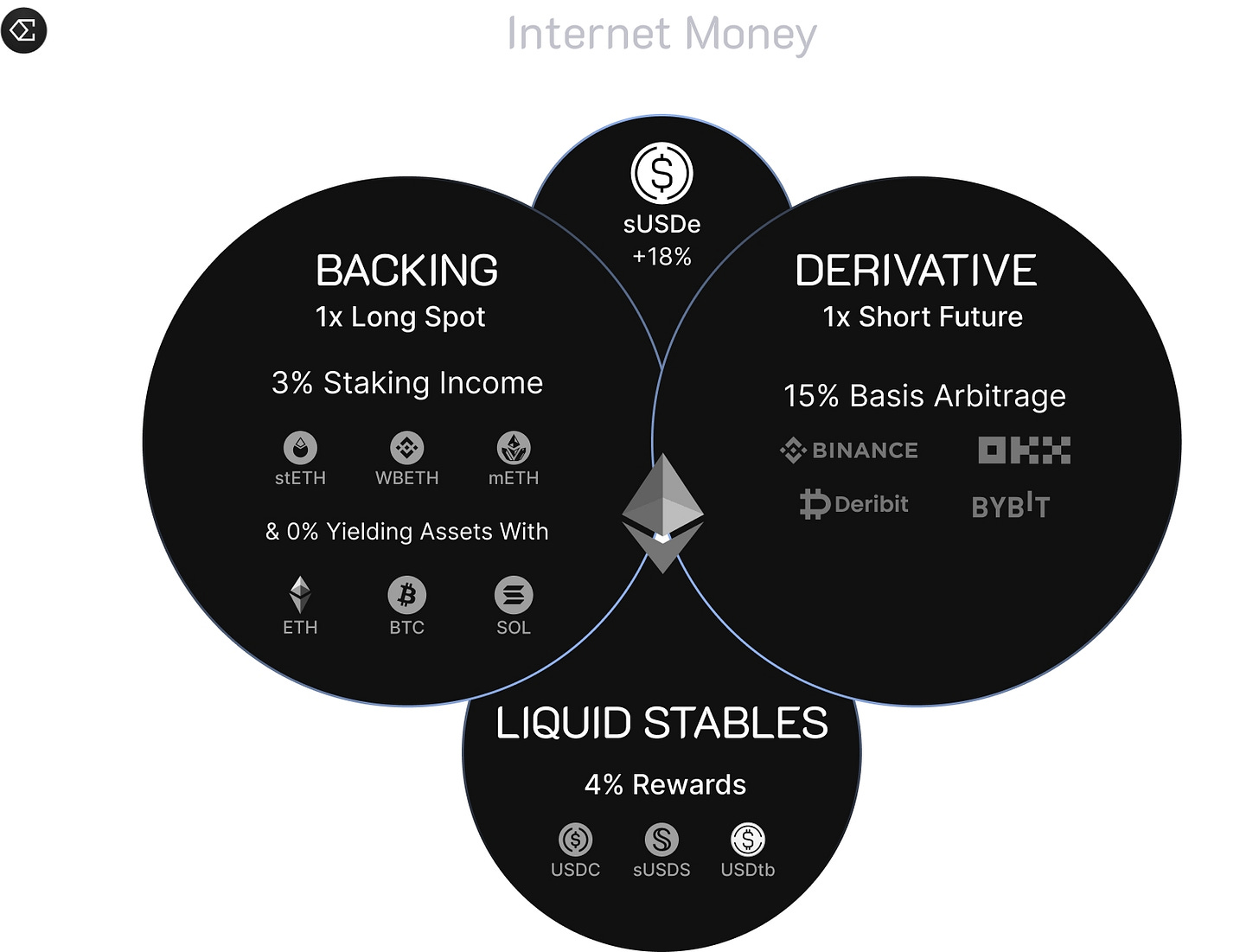

That yield comes from USDe's collateral funds, and there are two main sources of yield

Revenue Source 1: Staking fees from collateral assets

The first component of yield is the revenue generated by the collateral asset itself: when Ethena uses LSTs, such as Lido's stETH, as collateral, the protocol earns revenue from the Ethereum staking fees received by those LSTs. This compensation provides a stable yield, typically around 3-4% per annum, and supports the protocol's revenue base.

Revenue Source 2: Funding rate and basis spread from derivatives

This is the primary and most variable yield on protocol earnings.

Funding Rate: In the perpetual futures market, funds are periodically transferred between long and short positions in order to control the gap between the futures price and the spot price, which is called the funding rate. Historically, bull markets in crypto assets often lead to a "positive funding" situation, where long position holders pay a fee to short position holders because of the increased demand for leveraged long positions, and because Ethena holds short positions, receive this funding rate as revenue.

Basis Spread: This refers to the difference between the futures price and the cash price, which can also be a source of revenue for the protocol.

The fund allocates income from these two investments, providing an APY of approximately 27% at launch, reaching a high of over 67% at one point in the bull market in early 2024. Later, as the market calmed down, it converged to a more sustainable 9% to 15% range. By the way, the average APY for 2024 is reported to be 18%. That's amazing.

In addition, Ethena maintains a Reserve Fund (Reserve Fund) as a safety net to ensure protocol stability. This fund covers the cost of a sustained negative funding rate (short position holders turn to the payout side) should the market turn bearish. It is designed to prevent the underlying assets of the protocol from being damaged and to ensure that sUSDe staking users are not directly exposed to negative yields.

◼️Solving the Stablecoin Trilemma

In addition to pure yield, Ethena also solves the trilemma of stabled coins.

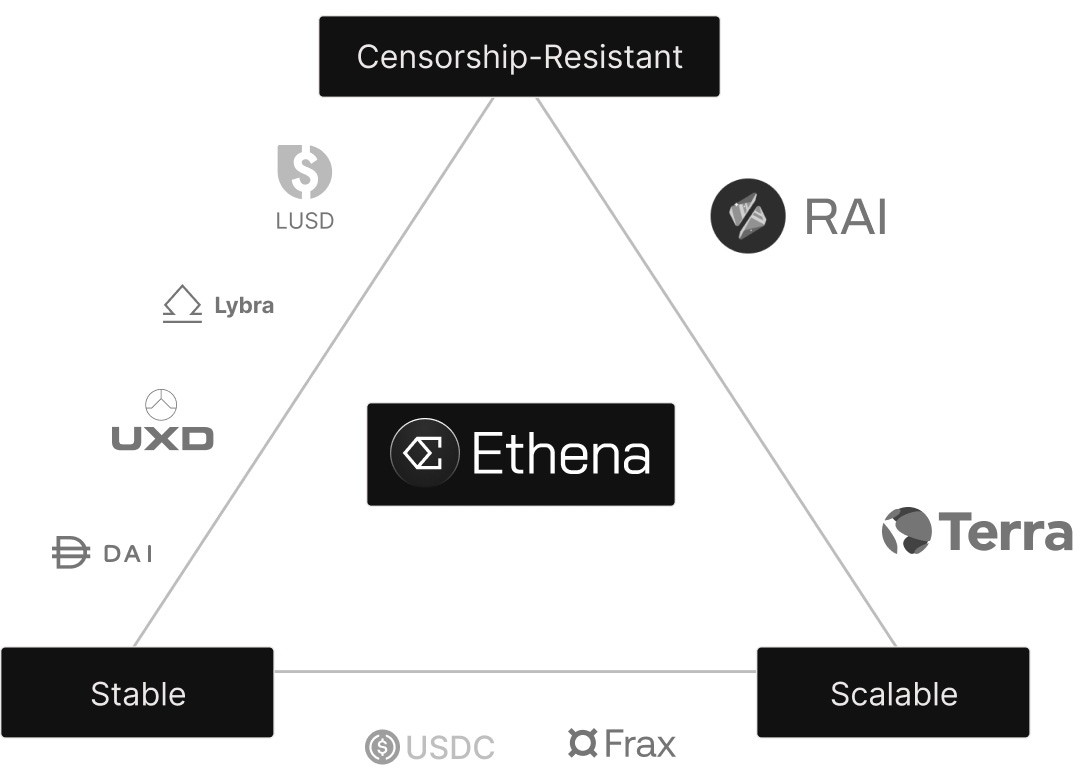

Stablecoin design has long faced a challenge known as the "trilemma." Specifically, the difficulty of simultaneously achieving three desirable characteristics: decentralization, stability, and capital efficiency.

Legal tender-backed stablecoins (e.g., USDT, USDC) ensure a high degree of stability by holding reserves of legal tender such as US dollars in bank accounts. However, the reserves are managed by a centralized bank or trust company, which sacrifices diversification because of the inherent risk of asset freezes due to issuer decisions or government regulations.

Crypto asset-backed stablecoins (e.g. DAI) are issued by depositing crypto assets (e.g. ETH) as collateral in a smart contract. While this increases diversification, it also leads to low capital efficiency, as collateral of significantly higher value than the issue amount (overcollateralization) is required to absorb the risk of price volatility of the collateral asset.

Algorithmic stablecoins (e.g., TerraUSD/UST) are an attempt to stabilize prices by adjusting supply through an algorithm, without specific collateral. This could theoretically be both highly capital efficient and decentralized, but as history has shown, it is vulnerable to market extremes and fails to maintain stability.

Ethena is building USDe as a new approach to this trilemma.

USDe will adopt a "delta-neutral" strategy, using physical crypto assets as collateral while hedging its price volatility risk with derivatives. In this way, USDe aims to achieve 1:1 capital efficiency without the need for excess collateral, while achieving both diversification (censorship resistance) through its crypto-asset native design and stability through its market-neutral position.

However, criticisms and risks also exist. While it is said to be decentralized, it is inevitably exposed to opacity, CEX bankruptcy and hacking risks because the storage of crypto assets and trading strategies are conducted by CEXs such as Binance.

🗺️ proprietary tokens and surrounding ecosystem

Ethena is the fastest stablecoin to reach $10B in the market, and its growth speed is outstanding. Of course, there is the background of the market that USDT and USDC had pioneered at the time of its release, but such rapid growth is tremendous.

Now that we have explained the core mechanisms, USDe and sUSDe, we will now explain Ethena's proprietary token, ENA, and the Ethena ecosystem, which will expand as it grows.

◼️ENA

The Ethena ecosystem is supported by the native token ENA.

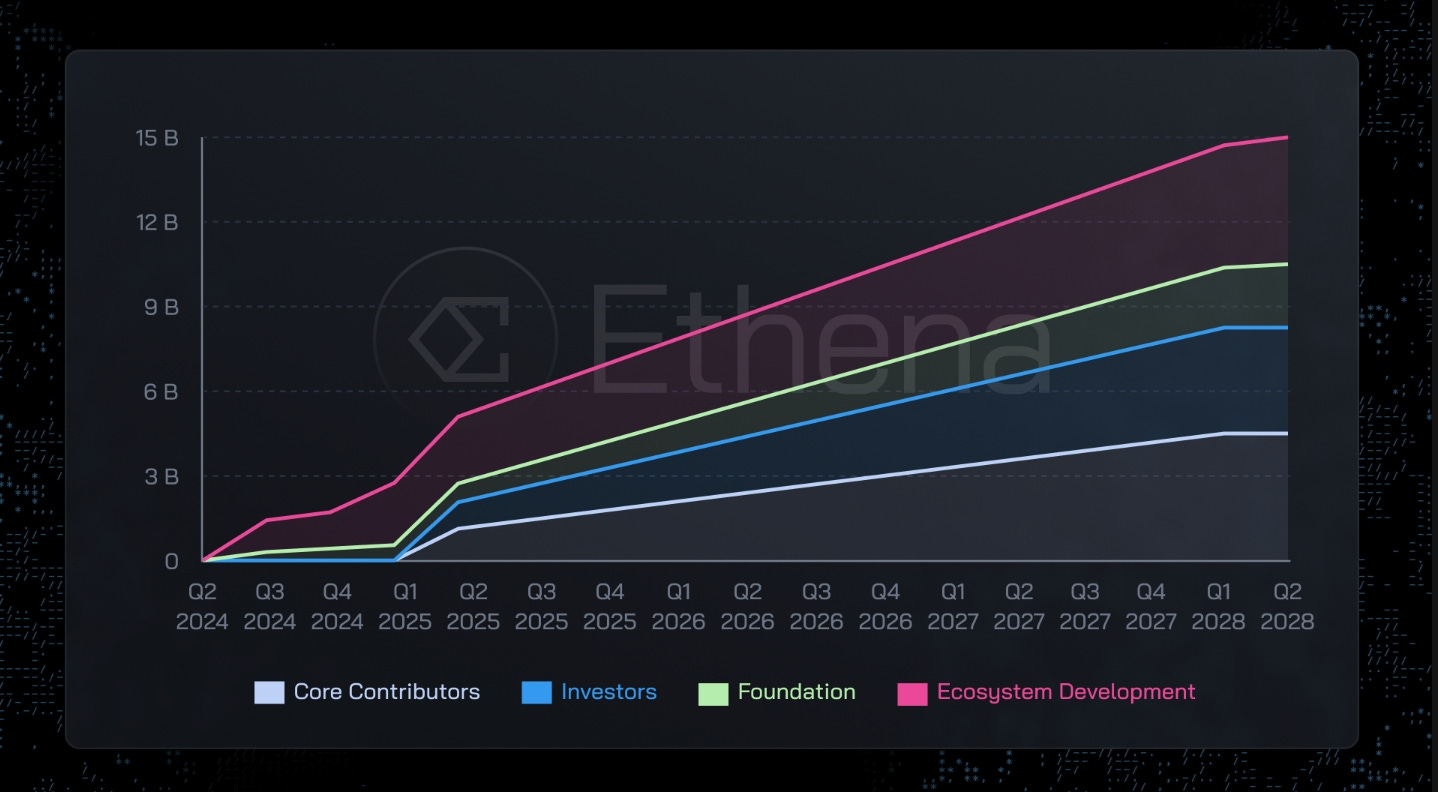

The total supply is 15 billion ENA, with the following vesting schedule: 30% allocation to core contributors, 25% to investors, 30% to ecosystem development (including airdrops), and 15% to the Ethena Foundation.

The utility is primarily used for governance, where ENA holders have the right to participate through voting in key decision-making processes of the protocol, such as decisions on the risk management framework, introduction of new collateral assets, and reserve fund allocation policies.