【ERC-404】Hybrid Standard of ERC-20 and ERC-721 / First Project "Pandora" Surpasses $100 Million in Trading Volume in a Few Days / Solving Liquidity Issues of NFTs / @Pandora_ERC404

Hot Topic! Will the hybrid standard ERC-404 of ERC-20 and ERC-721 revolutionize NFTs?

Good morning.

I'm mitsui, a web3 researcher.

Today, I will explain about "ERC-404", which has been a hot topic for the past few days. I have summarized its overview, origin, and notable projects, so please take a look!

Table of Contents

1. Overview | What is ERC-404?

2. Specific Example | What is the first project of ERC-404, "Pandora"?

3. Origin and Value | Where does the intrinsic value of ERC-404, which creates excitement in just a few days, lie?

4. Other Cases and Prospects | Is the ERC-404 standard boom coming? Will it be proposed as an official standard?

5. Consideration | Is ERC-404 a temporary craze or a new standard that fundamentally changes the way NFTs are?

Overview | What is ERC-404?

"ERC-404" is a hybrid standard that combines ERC-20 and ERC-721.

It should be noted that it is "not yet an official standard". In addition, since it has not been submitted to EIP or discussed, it is easier to think of it as the project name "ERC-404". When I first heard this name, I was wondering, "Even though EIP has already reached four digits, why go back to the three-digit range?" But it seems that ERC-404 is simply a name set for convenience.

According to the founder team,

We named it ERC-404 after the error message of a typical website.

Since the whole thing was very experimental, we thought this name was appropriate. Also, because the functions of ERC-721 and ERC-20 are mixed, we knew that many protocols and DApps would be confused at the time of release.

So that's the story.

Now, let's explain what kind of standard "ERC-404" is, which is the main topic.

ERC-404 is a standard that allows ERC-20 tokens to be associated with NFTs issued under the ERC-721 standard. To explain its greatness, let's first talk about the challenges of NFTs (ERC-721).

Since each token of NFT is unique, low liquidity is mentioned as a challenge. The uniqueness is also the strength of NFTs, but assets with low liquidity hesitate to be purchased, and as a result, the ecosystem does not grow.

Luxury brands like GUCCI are expensive, but they can be resold, so they are easier to buy even at high prices. Luxury watches are also the same; even if the value drops a little, they can be sold in the secondary market. While there is secondary circulation for NFTs as well, because each one has a unique design, it requires a match or a fan (if it's CryptoPunks, any design is wanted) for a transaction to take place.

The "ERC-404" is a new standard (new proposal) that solves the liquidity problem of NFTs.

In simple terms, it issues ERC-20 tokens associated with the issued NFTs. By buying and selling these tokens, the liquidity of NFTs is realized.

??? It's complicated, so the ERC-404 proposal team will introduce an example of the released project "Pandora".

Example | What is the ERC-404 First Project "Pandora"?

Pandora is the project name that sold 10,000 tokens called "$PANDORA" and 10,000 associated "Pandora NFTs (called Replicants)".

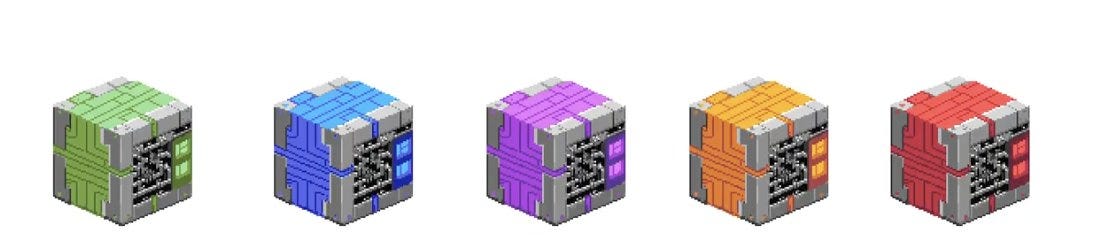

"Pandora NFTs (Replicants)" have five levels of rarity.

Green: approximately 39.45%

Blue: approximately 23.44%

Purple: approximately 19.53%

Orange: approximately 11.72%

Red: approximately 5.86%

So, what does it mean for this NFT to be associated with a token? First, as usual, the NFT can be bought and sold.

In addition, you can trade "$PANDORA" on DEX platforms like Uniswap. This functionality is actually the main focus as it links NFT liquidity with ERC-20 tokens to solve liquidity issues.

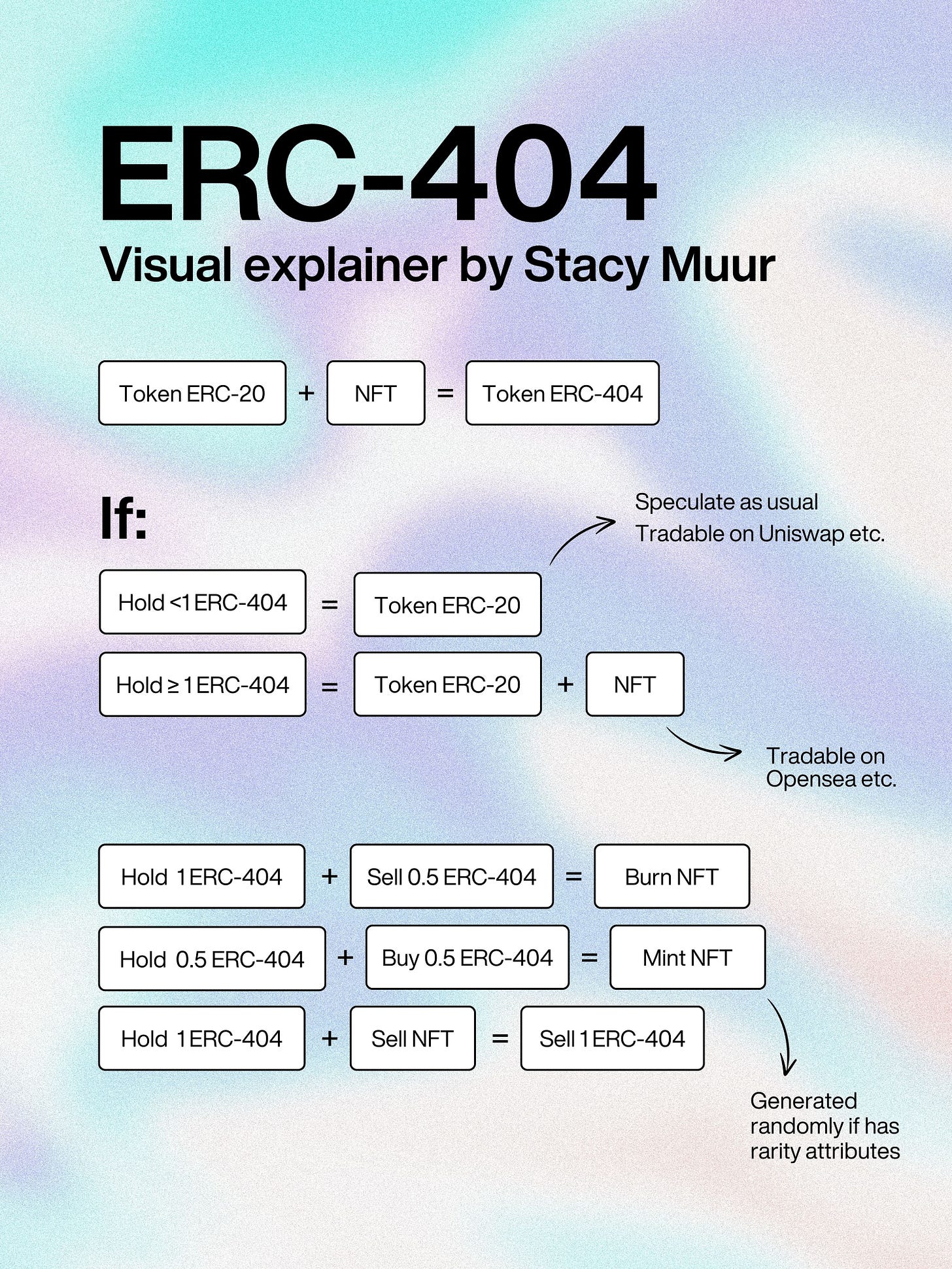

"$PANDORA" and "Pandora NFT" are linked one-to-one, so when you trade "$PANDORA", the following events occur:

Purchasing 1 token of "$PANDORA" mints 1 NFT (you will have 1 $PANDORA and 1 NFT)

Selling 0.1 token of your holdings burns the corresponding NFT (you will have 0.9 $PANDORA)

Buying 0.1 $PANDORA on a DEX with 0.9 $PANDORA holdings automatically mints 1 NFT, resulting in a total of 1 $PANDORA and 1 NFT (you will have 1 $PANDORA and 1 NFT)

Purchasing an additional 0.5 $PANDORA will not trigger any events (you will have 1.5 $PANDORA and 1 NFT)

I hope this is clear. The $PANDORA token freely moves with high liquidity, and for every 1 $PANDORA held, an NFT is minted or burned.

Please find the attached diagram for a comprehensive overview. ERC-404 is explained below.

The very interesting aspects of this mechanism are:

The guarantee of liquidity provided by tokens

The automatic burning and minting of NFTs

In particular, the second aspect of the automatic burning and minting of NFTs is revolutionary.

As mentioned earlier, Pandora NFTs have five levels of rarity, and when you hold 1$PANDORA, a randomly generated NFT can be minted, which means there is a possibility of minting high-rarity NFTs.

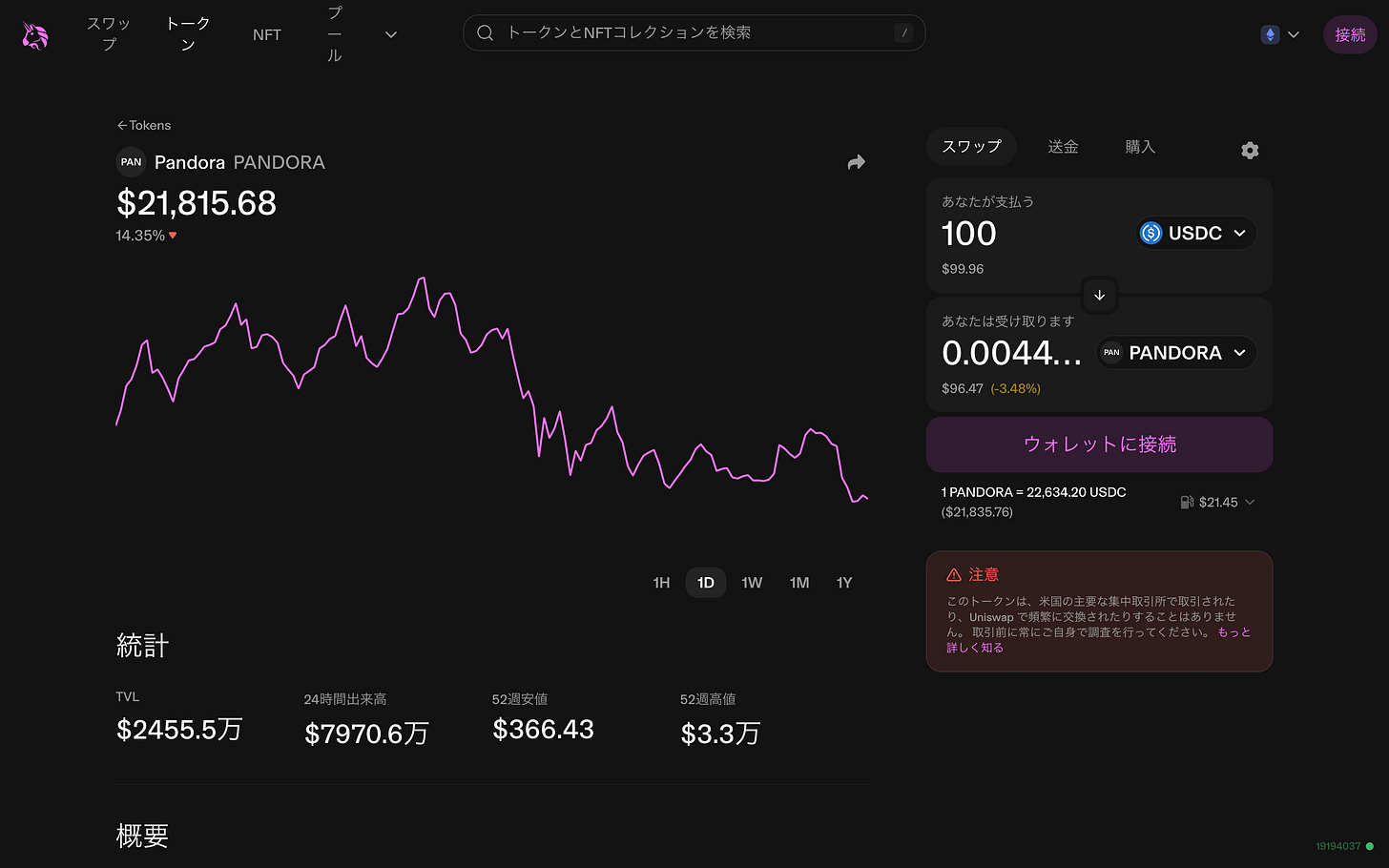

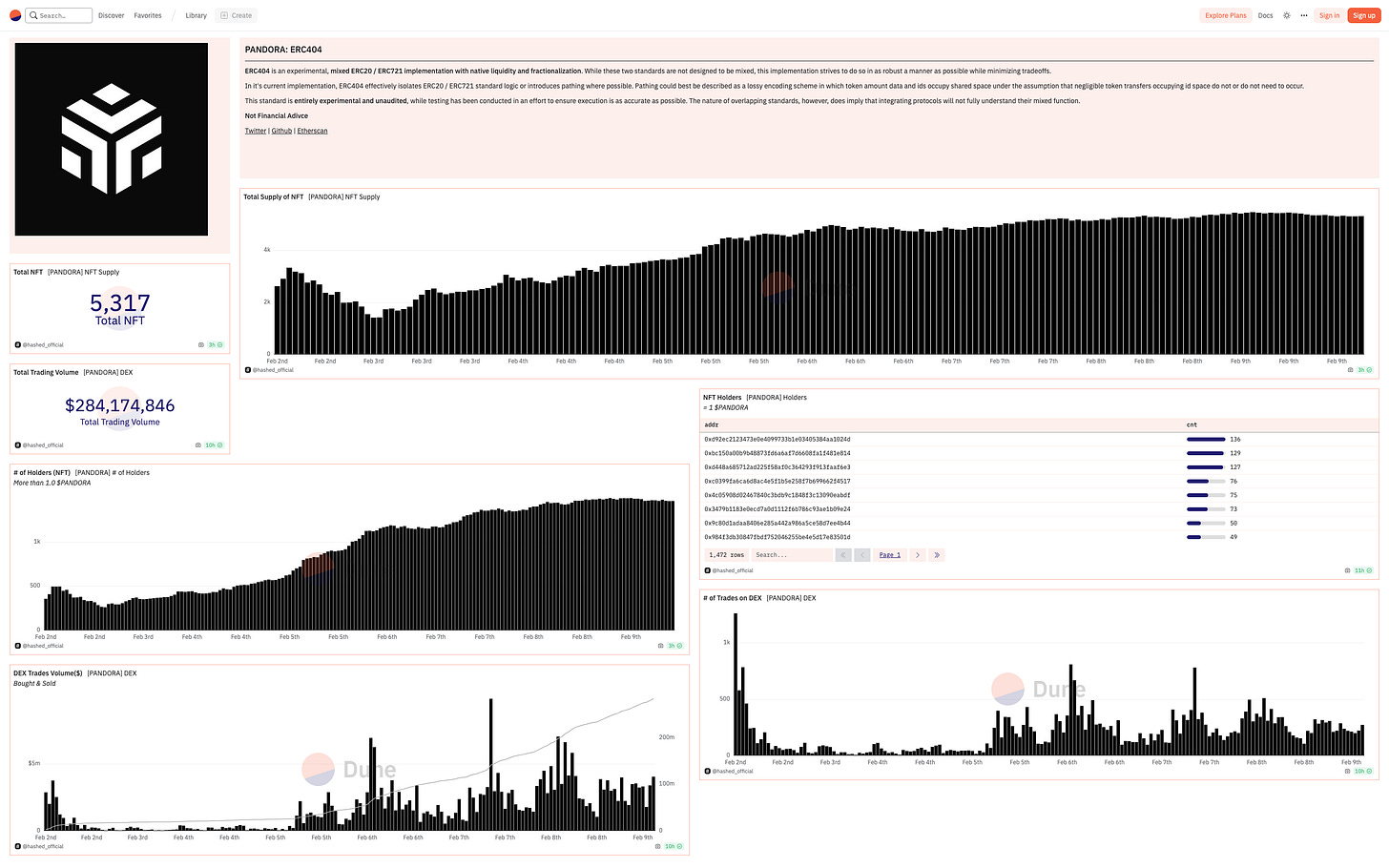

This allows for multiple reveal events, creating an incentive for repeated transactions. Due to this characteristic, $PANDORA saw over $100 million in trading volume on Uniswap in just a few days, generating $1 million in fees for Uniswap (which charges a 1% fee).

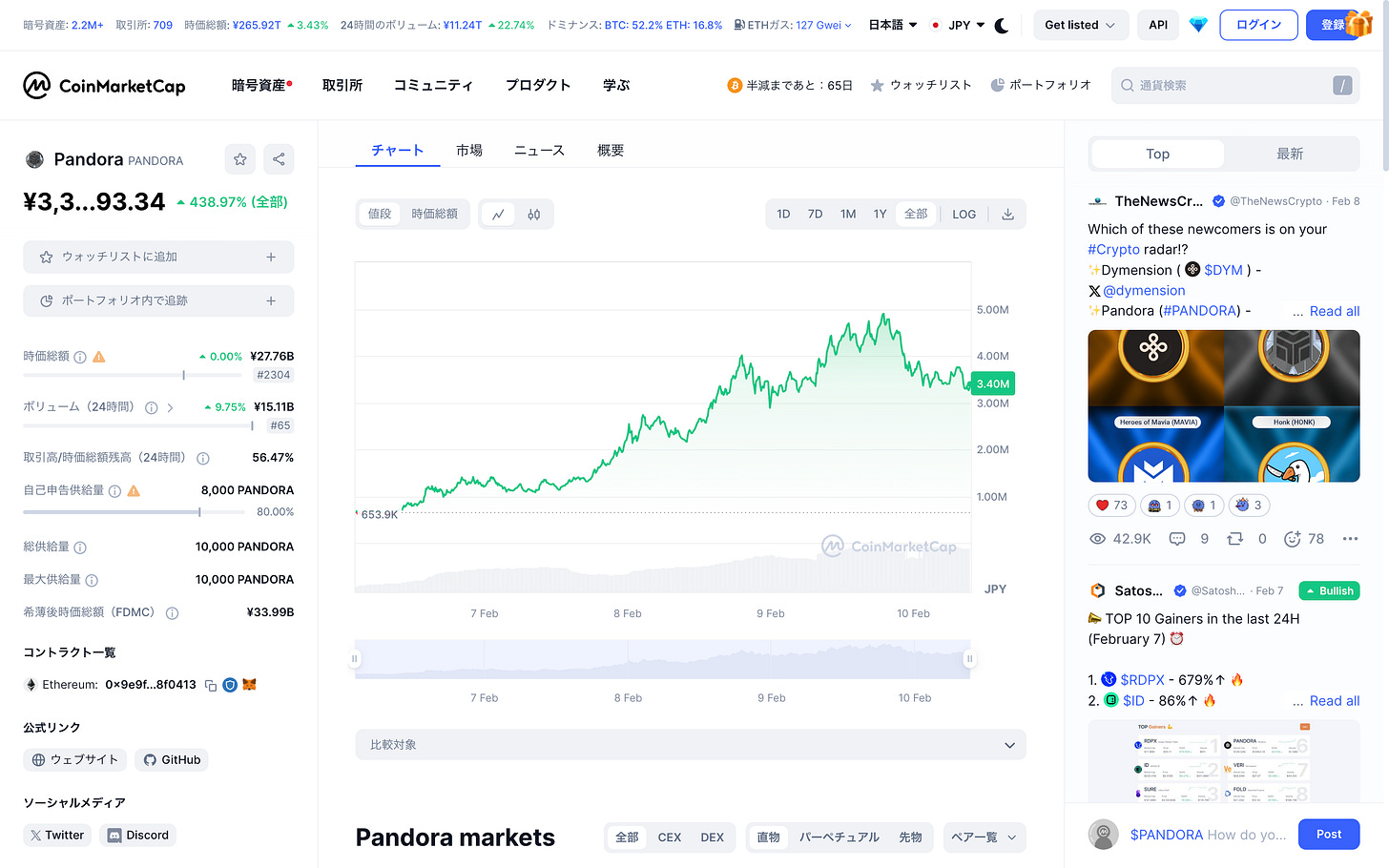

The token's market capitalization has also reached 27 billion yen, and the token price has risen by 438% since launch.

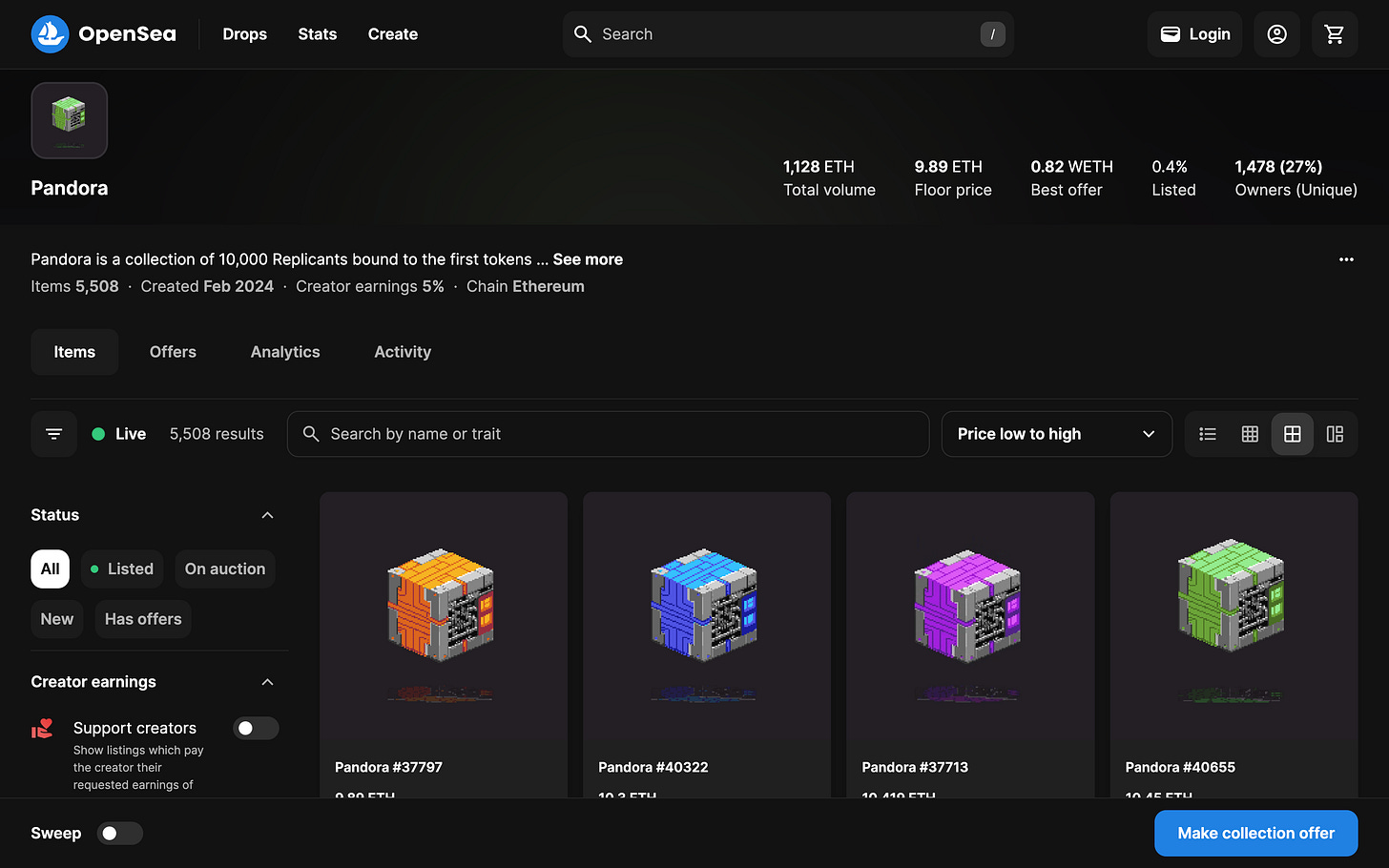

The trading volume of NFT has reached 1,128 ETH in just a few days, and the floor price is 9.89 ETH. It is known that there are currently 5,508 NFTs in existence due to repeated minting and burning. The listing rate is unusually low at 0.4%, but this may be because people do not want to sell in anticipation of price increases in the bubble. It is also believed that the desire to keep high rarity NFTs minted is influencing this decision.

I will also check the other data. The number of holders is about 1,500, and the number of transactions and trades on the DEX remains high as before.

Origin and Value | Where is the Intrinsic Value of ERC-404 That Generates Enthusiasm in Just a Few Days?

I think you might have already grasped the concept of ERC-404, but let's delve deeper into its origin and value.

◼️ Origin

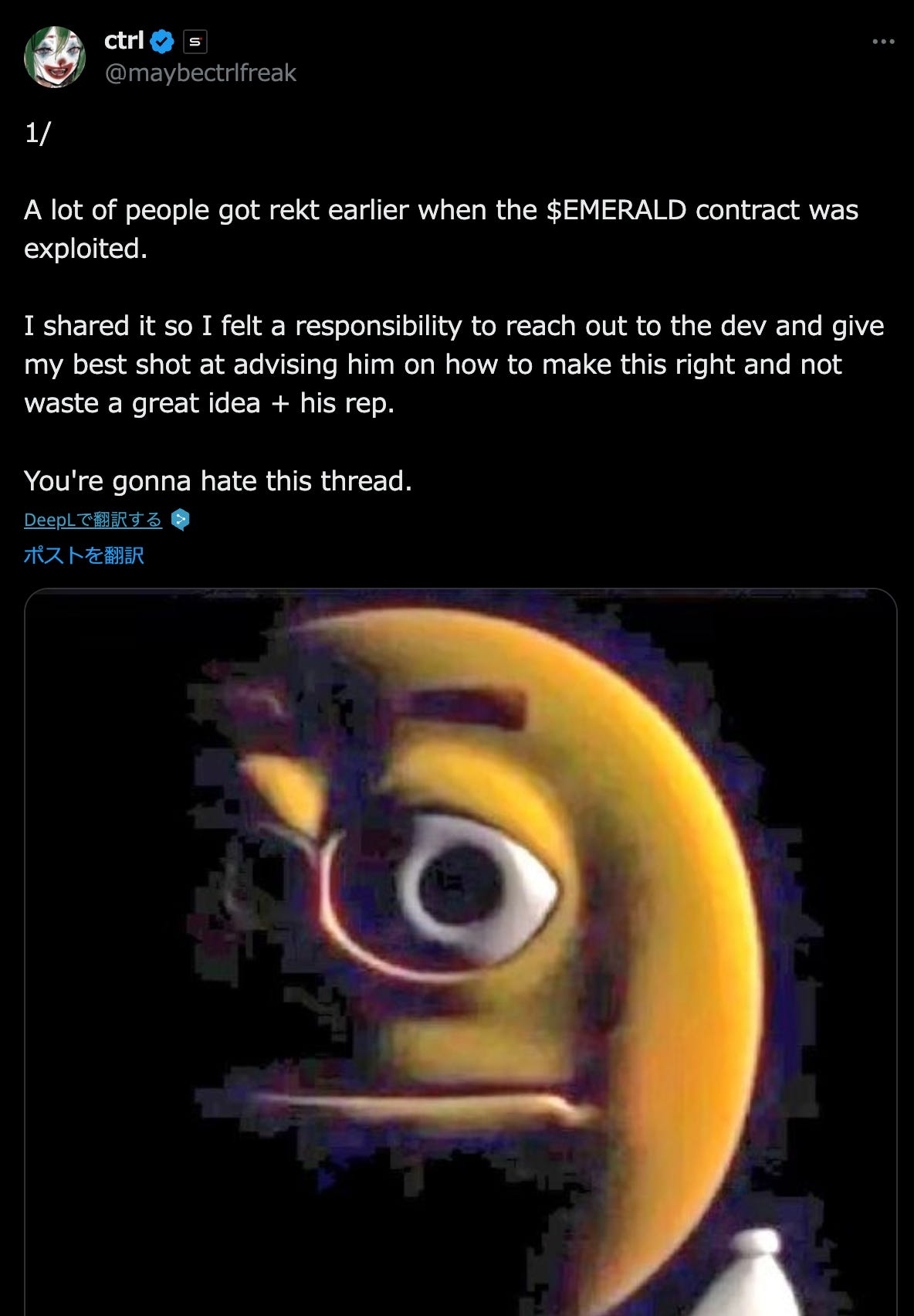

The team behind ERC-404 and Pandora consists of four individuals known as ctrl, Searn, Acme, and Hohenheim. The initiator, ctrl, became interested in a new token called Uniswap Emerald ($EMERALD) in early February 2024. $EMERALD was a project that embodied the ideology of ERC-404, attracting attention as a project that combines NFTs with ERC-20 elements.

Ctrl, who became the initiator of ERC-404, also seemed to have invested in $EMERALD. However, the contract was quickly exploited, resulting in the loss of funds and a significant drop in token price (it became electronic waste). Many people were outraged by this, but ctrl was intrigued by the concept itself and immediately contacted the $EMERALD developers to propose collaboration for recovery.

It was later revealed that the $EMERALD developers were not actual engineers but had used ChatGPT to write the contract, leading to flaws in the code that went unnoticed. Furthermore, the $EMERALD developers showed no interest in assisting with the recovery. As a result, ctrl and the team took it upon themselves to develop proper technology based on that ideology and released Pandora as ERC-404. The release took only a few days.

It quickly became a hot topic worldwide. Not only did Blur and OpenSea already support ERC-404, but wallet services such as Binance Wallet have also started to support it.

◼️Differences from existing solutions and inherent value

Why has ERC-404 become such a hot topic? As a fundamental premise, it is undeniable that the excitement surrounding this new standard has created speculative meaning and a bubble-like frenzy. It is also a fact that trading volume has surged due to the ability to mint and burn tokens repeatedly. Furthermore, since there are still many unverified technical aspects, it is necessary to consider these differences.

With that premise, ERC-404 has the potential to be an innovative technology that solves the liquidity issues of previous NFTs.

The liquidity problem of NFTs has been pointed out in the past. The mainstream solution so far has been to fractionalize NFTs into smaller portions called fractional NFTs to increase liquidity. It is true that it is more accessible to buy 1/1000th of a CryptoPunks for 10,000 yen than to buy a CryptoPunks worth 10 million yen.

However, there were problems with this approach.

To convert all the divided portions back into a single NFT, one would need to collect all of them, which is extremely difficult.

Are there really people interested in owning a 1/1000th portion of an NFT?

The original NFT needs to be locked, so there is always a risk of hacking with the protocol (similar to bridge protocols).

Therefore, although it was technically possible to divide NFTs, in reality, they were not being utilized to that extent due to practical demand and technical considerations.

On the other hand, ERC-404 solves these challenges.

Since it does not issue tokens specific to NFTs, owning one token randomly mints an NFT.

Since minting and burning are repeated, there is no need to continuously lock NFTs, eliminating the risk of hacking.

The price of divided tokens is likely to be equivalent to the floor price of low-rarity NFTs, providing a certain value guarantee.

There is an element of excitement and fun through repeated transactions.

For example, applying NOT A HOTEL NFT to the ERC-404 standard would result in the issuance of NOT A HOTEL TOKEN (tentatively called $NHT) as follows:

Owning 1 $NHT automatically mints an NFT equivalent to 1/365th of a day ✖️○ years.

When no longer meeting the requirements for 1 $NHT (token sale), the NFT is burned (= that date becomes available).

With this mechanism, even people who were left with unpopular dates can easily sell their NFTs. In addition, the increase in transaction volume of $NHT to mint popular dates could potentially lead to an overall increase in floor price.

Later, I will provide a more detailed analysis of the inherent value, including my own thoughts. Generally speaking, I believe that the value of ERC-404 lies in the following two points:

The ability to provide liquidity to NFTs.

Increasing transaction volume through gamification.

Other cases and prospects | Is ERC-404 set to become an official standard?

What happens when a bubble occurs in the world of web3? Numerous similar projects emerge, the movement spreads to other chains, and fraudulent projects also appear. ERC-404 experienced all of this in just a few days.

◼️Other cases

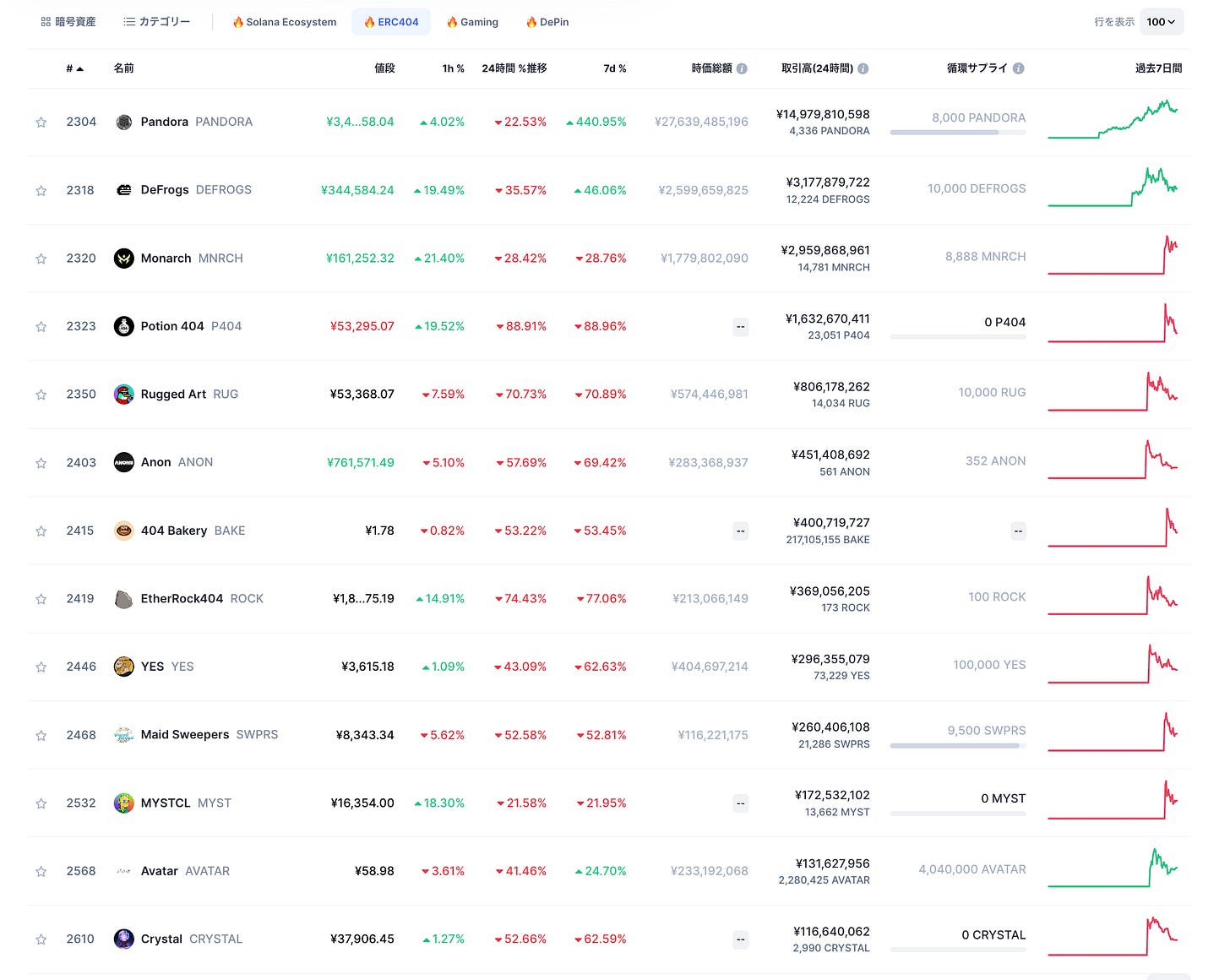

CoinMarketCap listed 13 projects. The top three, Pandora, MNRCH, and DeFrogs, have recorded significant trading volumes.

MNRCH (Monarch) is a game that incorporates ERC-404, allowing owners to evolve NFTs through on-chain competition. It's impressive that on-chain games are already possible.

Most of them are on the ETH chain, but "MYSTCL is on the Base chain" and "Crystal is on the Arbitrum chain," aiming to become pioneers on each chain.

◼️ Concerns

There are also fraudulent projects, and a project called Punks experienced a rug pull after skyrocketing from $350 to over $20,000 in just 2 hours, with the operators making a profit of about $100,000 and disappearing. Similar incidents have occurred with four other ERC404 collections using variations of Punks in the past two days.

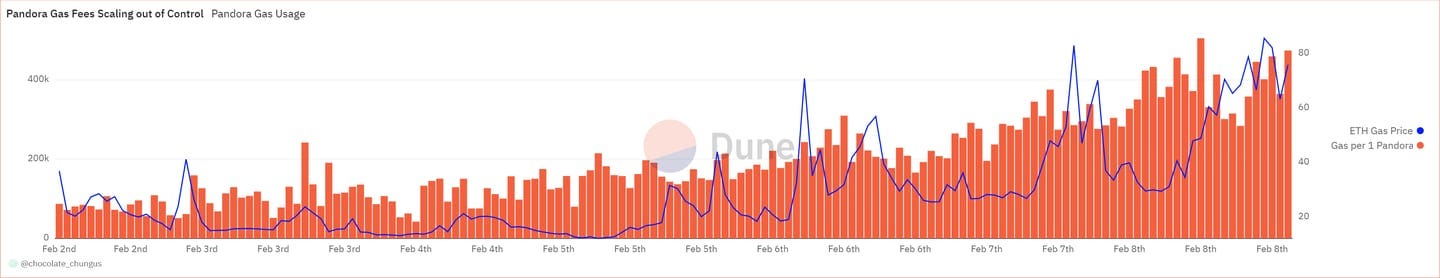

In addition, ERC-404 transactions are more complex than regular transactions, which raises concerns about the surge in gas fees. In fact, this boom is contributing to the surge in gas fees for ETH (although gas fees can also rise for reasons other than ERC-404 when a bubble occurs).

However, in response to this criticism, the team commented in the project's Telegram chat that gas costs are expected to be reduced by 300-400% through improvements in ERC404.

◼️ Outlook

There are four main directions that can be considered for future prospects.

Many projects issue NFTs and FTs using the ERC-404 standard.

Apply as an official EIP standard.

Expand the scope of token utilization in DeFi protocols.

Build tools and infrastructure for products that include ERC-404 tokens.

① Many projects issue NFTs and FTs using the ERC-404 standard

This is already happening. Other projects are following suit, and expansion to other chains has begun. New use cases are emerging, such as in gaming and RWA, and it feels like the bubble will grow even bigger.

② Apply as an official EIP standard

The team also commented that they plan to apply as an official standard at this stage. If approved, they could receive support from the ETH community and undergo enhanced technical audits, which may lead to widespread adoption, similar to ERC-721 and ERC-20.

③ Expand the scope of token utilization in DeFi protocols

The on-chain index project, Peopods Finance, has already added the Pandora token, which can be wrapped and used to generate yield. The Terra lending platform allows it to be used as collateral, and the Wasabi Protocol trading platform enables permanent trading of tokens.

By tokenizing in this way, all the features existing in DeFi protocols can be utilized. This would further enhance the value of NFTs.

④ Build tools and infrastructure for products that include ERC-404 tokens

The team has also stated that they are developing infrastructure tools to enable creators to easily issue NFTs and tokens using the ERC-404 standard.

Analysis | ERC-404 is a new standard that will fundamentally change the way NFTs are perceived!?

Lastly, let's discuss the analysis. Please keep in mind that this analysis includes my personal biases.

My initial impression was "This standard has tremendous potential." Even after conducting research, my impression remains unchanged, and I believe that ERC-404 will become a widely adopted common standard, similar to ERC-20 and ERC-721.

Since the use cases are different, I don't think that all NFTs will be issued using ERC-404. However, just like how ERC-721 and ERC-1155 are used interchangeably, I believe that ERC-404 will become one of the options in the future.

I believe that the future of NFTs can be categorized into two types:

NFTs that serve as assets

NFTs that serve as proof

NFTs that serve as assets include existing PFPs and NFTs associated with RWAs. They have certain value and provide utility through ownership. They have brand value and speculative value. These serve as assets.

The latter type, which serves as proof, is exemplified by POAP. In the future, NFTs will be issued as self-identifying tokens (sometimes SBT) to provide royalties using NFTs. These do not directly serve as assets but have the function of proving one's identity.

To maintain the value of NFTs that serve as assets, it is essential to consider liquidity. While those with overwhelming recognition and value, like the Mona Lisa, are an exception, most assets hesitate to be purchased without liquidity, and their value gradually decreases.

Digital items such as existing PFPs, which are not associated with RWAs, are particularly vulnerable. However, with the ERC-404 standard, if NFTs can be tokenized, this problem may be solved.

If a CryptoPunks Token ($CPT) is created, each transaction of $CPT would involve minting and burning NFTs, creating a gaming element. Furthermore, $CPT is a token backed by the value of CryptoPunks, which will attract those who engage in speculative trading. People may start using $CPT in DeFi or use $CPT as collateral to borrow and invest in other tokens.

If the trading volume of $CPT increases, the price of CryptoPunks, which serves as the foundation, is likely to rise. And as the price of CryptoPunks rises, the price of $CPT also rises, creating a positive cycle.

Moreover, ERC-404 has the advantage of attracting stakeholders beyond the issuance limit of NFTs. Many NFTs are issued with a limit of 10,000. In that case, the number of stakeholders does not exceed 10,000. If more are issued, the value of the 10,000 NFTs would be diluted, and the uniqueness, which is the greatest strength of NFTs, would diminish.

ERC-404's mechanism solves this problem as well. While CryptoPunks remains at 10,000, it becomes possible for $CPT holders to reach one million, removing the upper limit of the community with vested interests. Though subtle, I believe that this problem-solving aspect holds significant value.

One concern is that if all the rare NFTs are minted and everyone holds onto them, the motivation to trade tokens and participate in gacha may decrease, leading to a potential decrease in trading volume. However, if that happens, the price of NFTs may also decrease, leading to people selling NFTs at a loss and a revival of the probability of minting new rare NFTs. In that sense, it may have a self-cleansing mechanism.

Other possible use cases include compatibility with generating game items like gacha and compatibility with RWA NFTs, as mentioned earlier with NOT A HOTEL NFTs. It would also be interesting to combine them with ticket NFTs to automatically mint seats or ticket ranks with each trade.

In fact, there is even the possibility that all utility tokens in future GameFi will become ERC-404 tokens. By incorporating elements of gacha into token trading, it can activate trading. The ability to make trading itself the purpose is one of the groundbreaking aspects of ERC-404.

Furthermore, it has a high affinity with AI-generated art. By combining it with a mechanism like Nouns, where artworks are generated using certain algorithms, art is automatically generated and minted with each trade. Since the artwork is unique and will be burned when the token is sold, it cannot be owned again. It has a sense of "once in a lifetime" encounter.

However, the difficulty of operation is likely to increase. If all NFTs and FTs are circulated at once, liquidity cannot be guaranteed, and control becomes impossible afterward. Just like designing tokenomics, it will be necessary to gradually circulate them while determining vesting and unlock schedules.

I have written down various thoughts, but personally, among the new standards (technologies) I recently studied, this is the one that excited me the most. If there were tools that allowed anyone to issue ERC-404, I would like to try issuing them myself (although I need to research Japanese laws and taxation again).

There are many things to consider, such as designing the rarity of NFTs, the utility of NFTs, the balance between NFTs and FTs, the speed of providing liquidity, and tokenomics. That's why I am excited because I believe it allows for the design of interesting experiences!

I expect an enormous number of projects to emerge in the next month, so I plan to write a report specifically on ERC-404 projects (use cases) in a few weeks. Please look forward to it (although there is a possibility that I may not write it if there is not much excitement).

That concludes the research on "ERC-404"!

Reference Links:

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

A web3 newsletter delivered in five languages around the world. We deliver various articles about web3, including project explanations, news and trend analysis, and industry reports, every day. You can subscribe for $8 per month ($80 per year) and receive research articles that took 100 hours to complete every day.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.