【Dew】NFT Aggregator on Polygon / "Dew Name" NFT with revenue distribution feature / Incubated by X2Y2 and raised $10 million from Polygon and Circle / Token airdrop program in progress

This is the Polygon version of Blur and Tensor.

Good morning.

I am mitsui, a web3 researcher.

Today, I researched about "Dew".

Table of Contents

1. Overview | What is Dew?

-Functionality

-Trading volume

2. Features | What is "Dew Name" with profit distribution function?

-Opportunities for profit distribution

-Acquisition method and rarity of Name

-Is the airdrop coming soon? The existence of Chapter 1

-Market data

3. Transition and Outlook | Fundraising from Polygon and Circle, operated by a luxurious team.

4. Consideration | Diversification and complexity of tokenomics and competitive strategy

Overview | What is Dew?

"Dew" is an NFT aggregator that exists on Polygon. It is the Polygon version of NFT aggregators for professionals like Blur in ETH and Tensor in SOL. As an NFT aggregator, it has become the largest ecosystem on Polygon.

◼️ Functionality

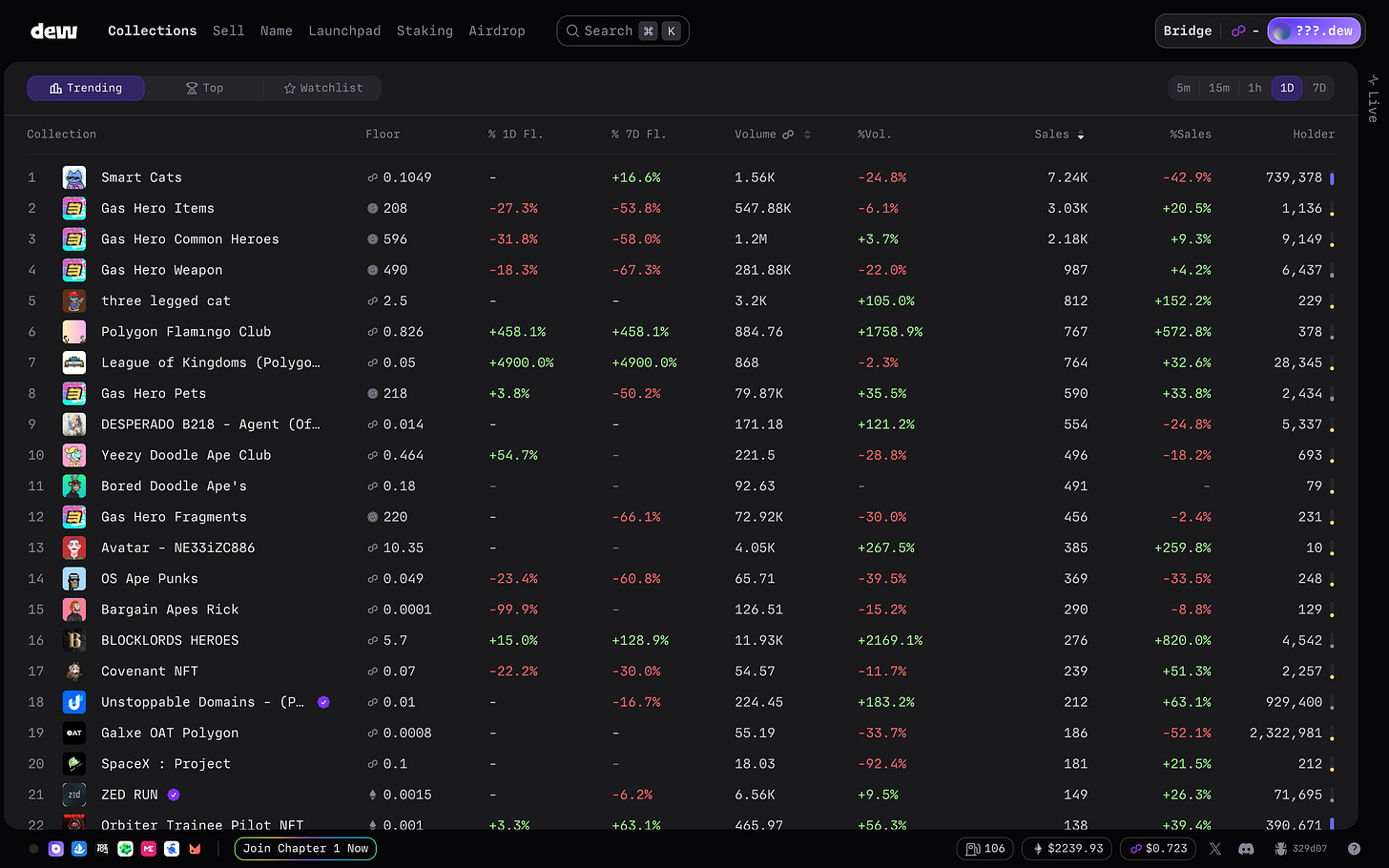

① NFT trading

The basic functionality is the same as Blur and others, allowing for the trading of NFTs. As an aggregator, it collects information from various marketplaces and displays the optimal prices.

②Launchpad

This is the first decentralized Launchpad on Polygon. Launchpad partners are voted by Dew Name holders (※ mentioned below), and 100% of the profits are distributed to Dew Name holders.

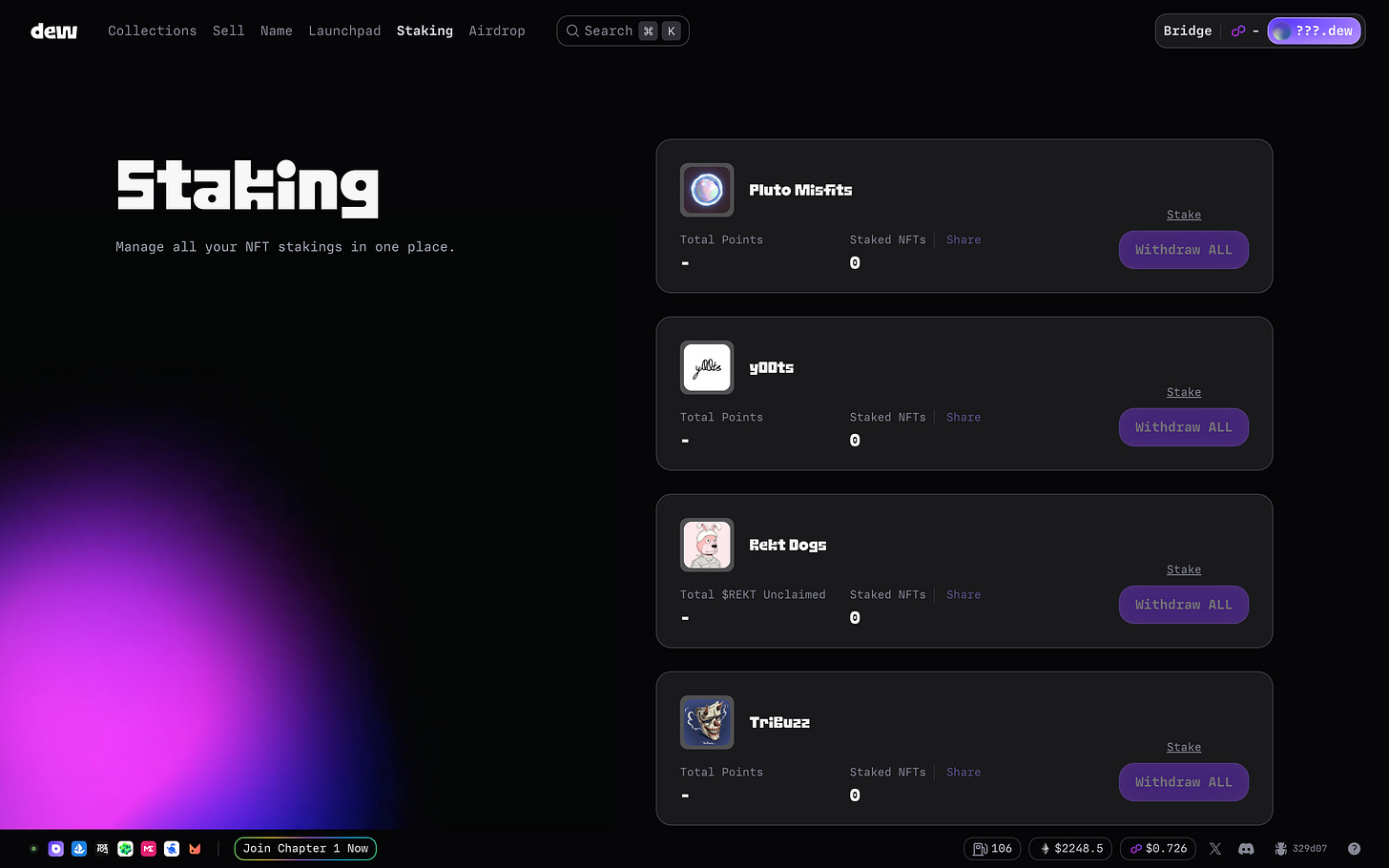

③Staking

You can manage staking of NFTs on Polygon all at once. Not only can you stake and unstake, but you can also manage accumulated points.

④Dew Name

In simple terms, Dew Name is the ENS (Ethereum Name Service) version for Dew. However, this mechanism is what makes Dew unique, so I will explain it in detail in the following paragraphs.

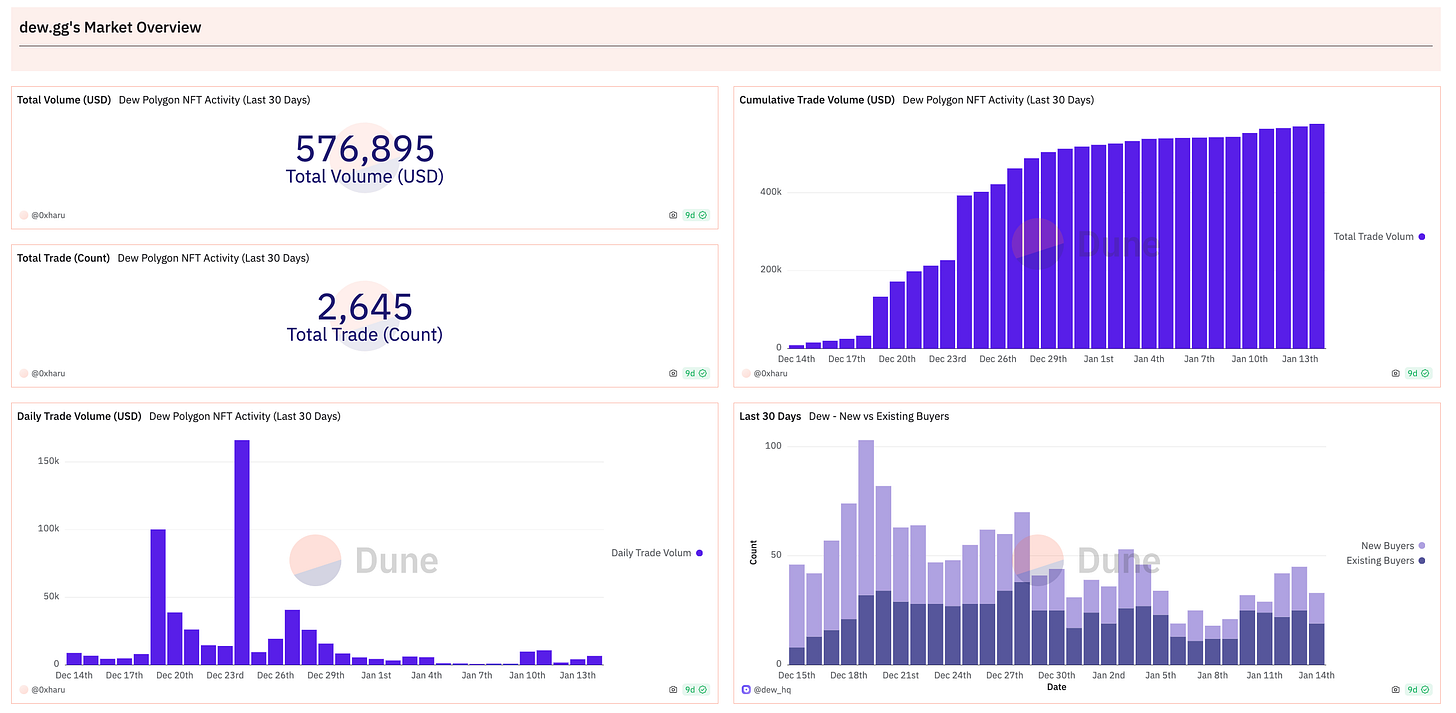

◼️Transaction Volume

As an aggregator, it is significant. However, in the context of the entire Polygon market, it is still very small.

When viewed alone, Dew had 2,645 Tx conducted in 30 days with a volume of $576,895.

What is "Dew Name" with the feature of profit distribution?

Among Dew's research, the most unique point I felt was the existence of "Dew Name".

"Dew Name" is like ENS and serves as an ID in the Dew ecosystem. It not only appears as a profile but also provides benefits such as profit distribution, voting for the launchpad, participation in governance, and early access to new features.

Among them, the notable feature is "profit distribution".

Having a Dew Name allows you to have opportunities for four types of profit distribution.

Distribution of NFT transaction fees

Distribution of revenue from Dew Name minting

Distribution of launchpad revenue

Distribution of token airdrops

Let's explain each one by one.

◼️ Opportunities for profit distribution

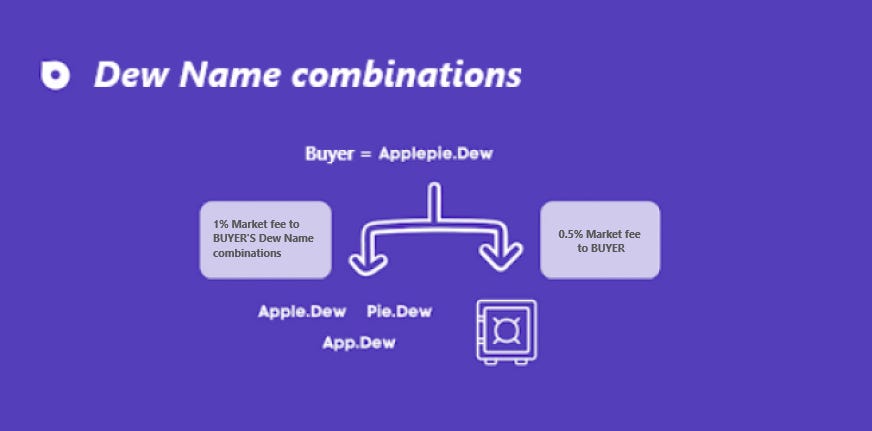

① Distribution of NFT transaction fees

Dew charges a 1.5% fee for all NFT transactions. Out of this fee, 0.5% is distributed to the buyer, and the remaining 1% is automatically distributed to the holders of Dew Names that make up the combination of the buyer's Dew Name.

Please refer to the following example. When the holder of "Applepie.Dew" makes a purchase, if we break down "Applepie" into "Apple," "Pie," and "App," 1% will be automatically distributed to these three Name holders.

②Distribution of Dew Name Mint Sales

Since Dew Name offers various benefits, many people try to mint it. However, 45% of the revenue is stored in the Vault and distributed to all Dew Name holders. The remaining 45% of the 55% is automatically distributed to the Dew Name holders who are the original combination of the minted Dew Names, similar to the example mentioned above.

e.g.) Purchase dew.dew for 160 Matic. 45% (72 Matics) is split between de.dew and ew.dew, and 45% (72 Matics) is stored in the Vault. The 72 Matics stored in the Vault are distributed among all Dew Name holders.

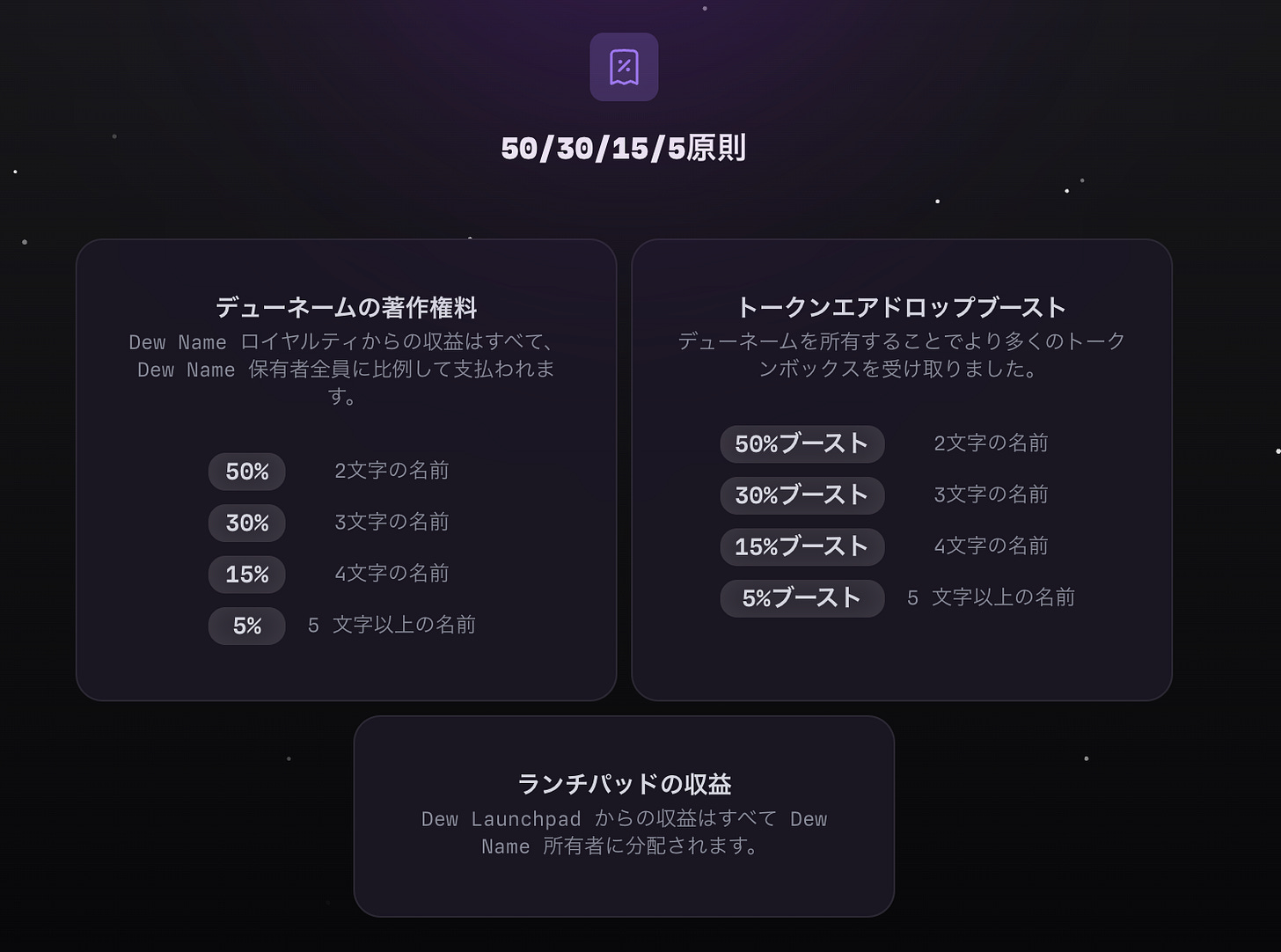

Additionally, all royalties in secondary circulation are stored in the Vault and distributed among all Dew Name holders.

③Distribution of Launchpad Revenue

All revenue obtained from Dew Launchpad is distributed to Dew Name holders.

④Distribution of Token Airdrops

By holding Dew Name, you can receive more token airdrops.

◼️Acquisition Method and Rarity of Names

By now, you should feel that shorter Names are more valuable. This is because they offer greater opportunities for revenue distribution due to the larger number of combinations.

Additionally, Dew Names follow the 50/30/15/5 principle, where the distribution of royalty earnings, token airdrops, and Launchpad revenue explained above becomes larger for shorter character Names.

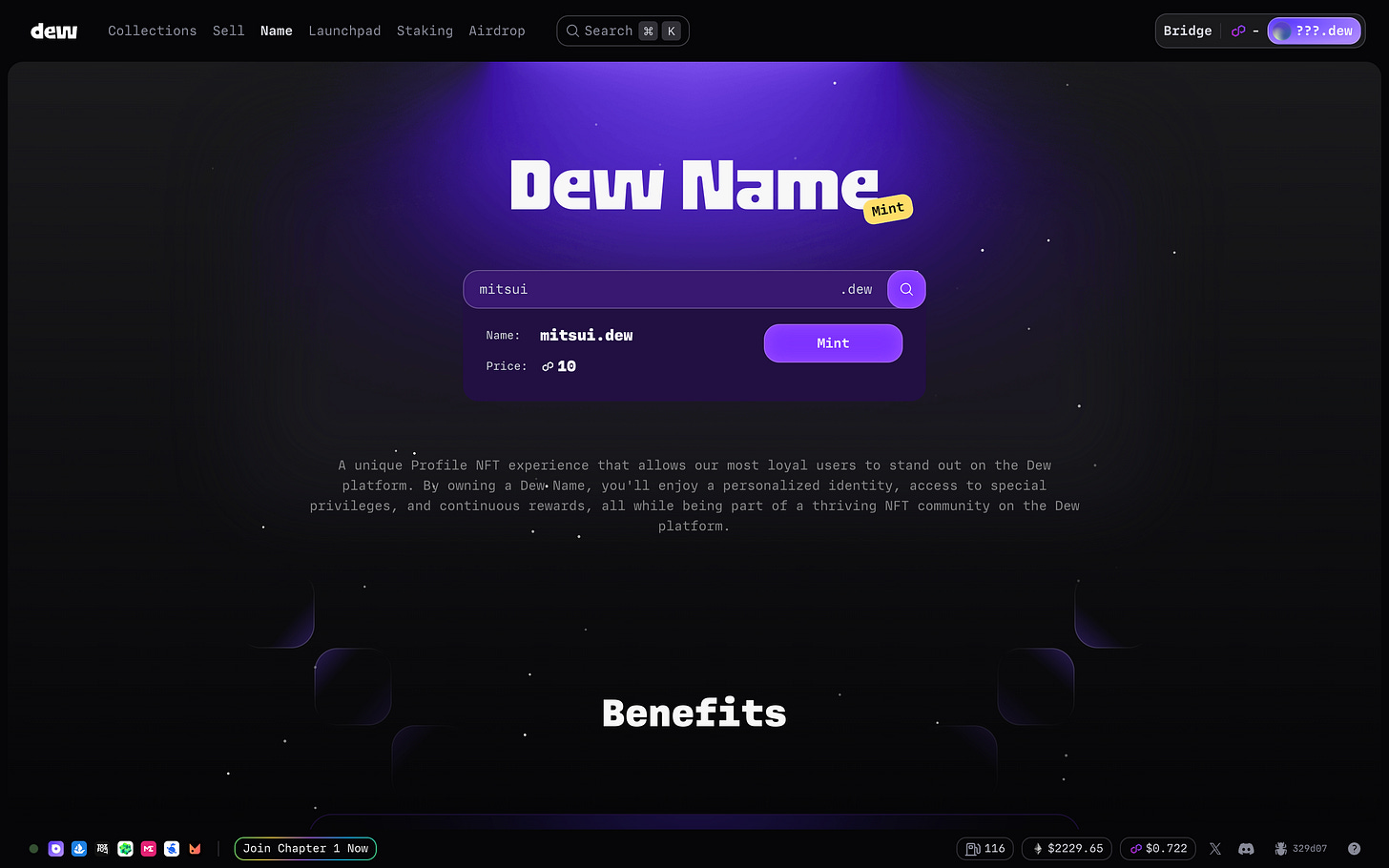

Therefore, it is natural to desire a 2-character name. However, 2-character names are highly competitive, and Mint has already closed registration for them. Currently, it seems that names with 4 characters or more can still be minted (depending on the specific strings, there may still be availability with 2-3 characters).

The acquisition process is simple. Just like ENS, you can acquire the desired string by searching for it and paying the specified amount of MATIC if it has not already been taken.

◼️Is the Airdrop Coming Soon? The Presence of Chapter 1

By owning Dew Name, you can participate in a Dew airdrop program called Chapter 1. This program allows you to accumulate points by using Dew, and you can receive token airdrops based on the points you have accumulated.

Since the points are stored in Dew Name, it is also possible to buy and sell NFTs with accumulated points.

The program started in August of last year and is still ongoing. I have searched on the official website and Discord, but it seems that the issuance of $DEW tokens has not yet been announced, and the detailed conditions for the airdrop have not been disclosed.

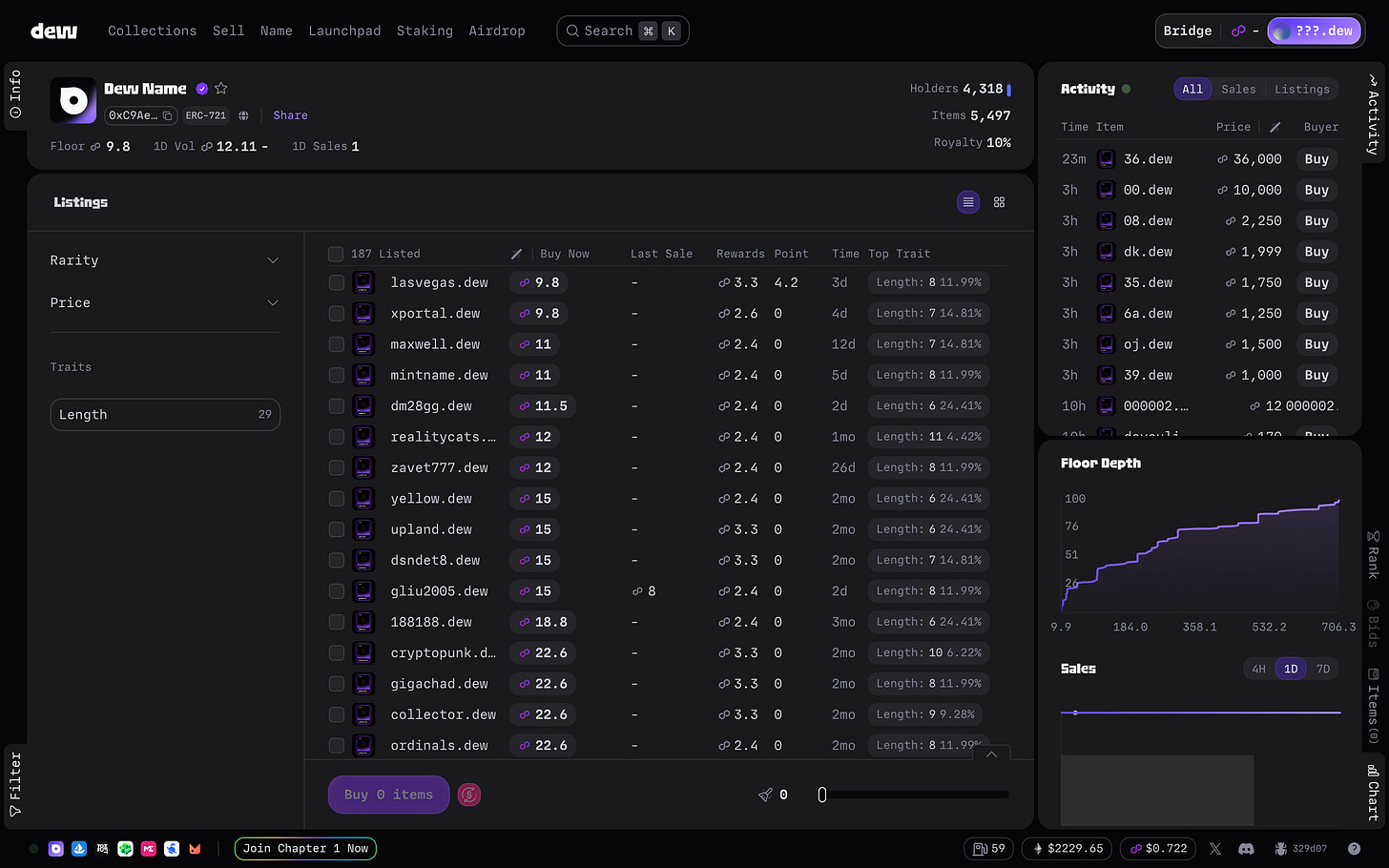

◼️Market Data

When I looked into the Dew Name collection, the current number of issuances is "5,497" and the number of holders is "4,318." The floor price is 9.8 MATIC, but this can vary depending on the item, so it cannot be taken as a definitive reference.

In the item description, there are sections for Rewards and Points, which correspond to the "rewards (yield) obtained by owning this Name" and the "points earned so far" that were explained above. This seems to also have an impact on the price.

Transition and Outlook | Funding from Polygon and Circle, Operated by a Luxurious Team

Dew is operated by an experienced team who have worked at X2Y2, Tencent, FTX Finance, and other companies. It was launched in March 2023 and became publicly available after an invitation-only Chapter 0.

As a product incubated by the NFT marketplace X2Y2, Dew has successfully raised $10 million in seed funding from prominent investors, including Polygon and Circle.

In January 2024, a creator community called the Creators Council was established to attract notable creators to the Polygon ecosystem and the Dew ecosystem.

Furthermore, we are also focusing on collaborating with well-known NFT projects on Polygon such as GasHero, as well as building communities.

Furthermore, it has been announced that dew will also collaborate with the Astar zkEVM, which is planned to be built using the Polygon CDK.

It has been less than a year since its release, but recently it feels like there has been a lot of excitement building up towards the token airdrop. If you're interested, give it a try!

Analysis | Diversifying and Complex Tokenomics and Competitive Strategies

Lastly, let's discuss.

I'm not sure if it's my sensitivity or if there is actually a lot of excitement, but I've been seeing the name "Dew" more frequently lately, so I decided to do some research again. The result was a very interesting project.

No matter how excellent a project is, its outcome is influenced by market trends.

The market trends that influence Dew are as follows:

"web3 market > NFT market > Polygon NFT market > Dew"

When the entire web3 market is declining, the power that one project can exert is limited. For Dew to exert its influence and grow, the web3 market as a whole needs to grow, and within that, the NFT market needs to grow, and within the NFT market, the Polygon market needs to expand.

It may feel like there are many constraints, but this is the truth in all businesses, and it is very important to capitalize on the timing of the market.

In that sense, March 2023, when Dew was released, was the worst for the market, with the web3 market also being sluggish and the NFT bubble bursting. From there until now, the web3 market has gradually been recovering, the NFT market has regained its momentum, and the Polygon NFT market has also been growing rapidly.

Perhaps, as a result of the market trends, Dew's momentum is also increasing.

Even when looking at Dew alone, its ecosystem was unique. Since the token has not been issued yet, we don't know the entire tokenomics, but the mechanism of revenue distribution utilizing Dew Names is very unique.

Honestly, I'm not sure if this falls under securities law. It's just an NFT with a revenue distribution function. (Wasn't it okay for the distribution of cryptocurrencies? I'm not well-versed in legal knowledge in this area, so I will study it again. Please make sure to do thorough research before making a purchase.)

Setting aside the legal aspect, I found the concept to be interesting. It not only highlights the benefits of early entry but also designs to increase the number of people who would be happy to see the Dew ecosystem grow. If $DEW tokens are issued, there will be a dual governance system of Dew Name holders and $DEW holders, which could create a very interesting tokenomics.

On the other hand, it seems that the brilliant airdrop strategy by Blur was a trigger, but recently, the tokenomics of Dapps and protocols have been diversifying and becoming more complex. While studying from the outside, I can discover many use cases and it's very enjoyable, but if I don't choose the ecosystem I participate in, my assets become dispersed and I don't get the expected returns.

Furthermore, one of the major advantages of web3 was the ability to migrate without being dependent on specific Dapps or protocols because they are operated in a decentralized manner and can be accessed through wallet connections. However, recent complex tokenomics seem to negate this advantage.

Both Dew Names and Blur tokens are examples of this, where companies continue to issue their own unique NFTs or FTs, reducing the incentives to migrate functionally but enclosing users within their own strategies.

However, from the perspective of Dapp and protocol developers, securing competitive advantage is essential for business strategy, so it can be considered a natural progression. Nevertheless, this trend effectively brings the market closer to a state where huge Dapps and protocols dominate.

While predicting where this trend will settle, I would like to continue researching constantly.

That concludes the research on "Dew."

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

A web3 newsletter delivered in five languages around the world. We deliver various articles about web3, including project explanations, news and trend analysis, and industry reports, every day. You can subscribe for $8 per month ($80 per year) and receive research articles that took 100 hours to complete every day.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.