The Basic Logic Behind the Introduction of U.S. Tariffs Causing Crypto Asset Prices to Fall

Why would the introduction of tariffs cause crypto asset prices to fall?

Good morning.

Mitsui from web3 researcher.

Today's article will be titled "Reasons for the Crypto Asset Market Decline".

Last week, market conditions deteriorated due to the DeepSeek shock, and this week, prices are expected to fall following President Trump's decision to introduce tariffs on Mexico and Canada and China, but why do prices of crypto assets fall when tariffs are introduced?

This article explains the basics.

In detail, the economic situation is so complex that it cannot be explained in a single factor, but it is explained in a simplified manner so that the general idea can be understood.

The decision to introduce tariffs

What is a tariff? Why do they affect the economy

Why tariff increases → lead to inflation

Inflation fears → higher rate hike expectations

Why crypto assets fall as rate hike expectations rise

Summary: From Tariff Decision to Crypto Asset Price Decline

What's Next?

The decision to introduce tariffs

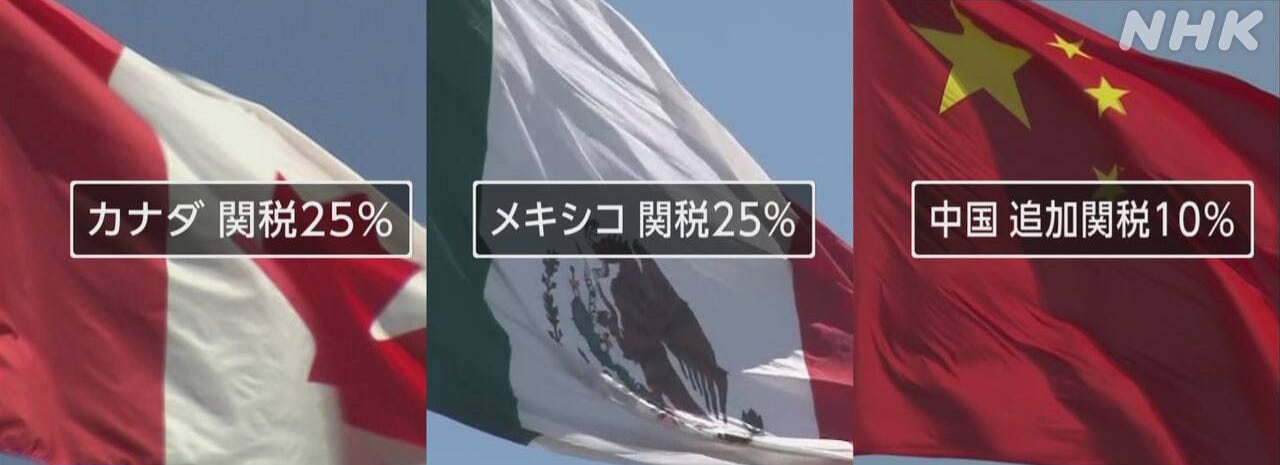

To start with the news, President Trump announced on February 1 that he will impose additional tariffs of 25% on imports from Canada and Mexico and 10% on China.

The decision was made to impose tariffs on imports from neighboring countries as a general rule, with minor differences, such as 10% for energy from Canada.

It is said that the motivation behind this tariff decision is to protect the U.S. economy (to eliminate the trade deficit and increase the influence of U.S. companies) and to use it as a bargaining card with other countries.(For a technical explanation of this area, please see the economic media.)

So, in response to this result, the Nikkei Stock Average has temporarily lost more than 1,100 yen in value, and above all, the market conditions for crypto assets have deteriorated significantly.

The market capitalization has fallen by more than 13% in 24 hours, with ETH in particular falling significantly.

Why do prices of crypto assets fall when tariffs are introduced?We will explain one by one, along with some basic terminology.

What are tariffs? Why do they affect the economy?

A tariff is"a tax applied when importing goods from another country".For example, when the U.S. imports auto parts from Mexico, a certain percentage of tax is added and collected.Goods imported into the U.S. will be distributed at a price with this added duty.

The main purposes for which countries impose tariffs are

Protecting Home Industries

As more and more cheap goods are imported from overseas, it becomes harder for domestic companies to sell the goods they produce in their own country.Therefore, the government tries to adjust price competitiveness and protect domestic industry by adding taxes to imported goods.

Securing the Nation's Financial Resources

Tariffs increase a country's tax revenue.However, in modern times, they are rarely a major source of revenue and are mainly used as a protectionist policy or diplomatic card.

When the U.S. raises tariffs on important trade partners, such as Mexico and Canada, it increases the price of imported goods.For example, if agricultural products from Mexico or metal products from Canada are subject to tariffs, companies in the U.S. that use those products may be forced to raise their purchasing costs and consequently their selling prices.

The possibility of this leading to higher prices (inflation) is the key to this topic.

Why Tariff Increases → Lead to Inflation

Increased import costs push up prices

As mentioned above, higher tariffs increase the taxes added to imports from abroad.Companies are often forced to pass that increased cost onto the selling price of their goods.This means that the final price of goods and services will likely increase.

For example, if many of the parts needed to manufacture a car come from overseas, manufacturing costs will rise if those parts are subject to tariffs.And since automakers cannot bear all of these costs on their own, they will eventually increase the selling price of new vehicles and pass them on to consumers in an increasing number of cases.This is inflationary pressure.

What is inflation and why is it a problem?

Inflationis "a state in which prices of goods and services continue to rise.While a certain amount of inflation can be a sign of a good economy, rapid inflation risks destabilizing economic activity by depriving people of their purchasing power.In particular, if prices continue to rise rapidly while salaries fail to keep pace, the cost of living will increase and many people will find themselves in a difficult situation.

Central banks (in the case of the United States, the Federal Reserve) are tasked with controlling inflation so that it does not go too far.One of the means of control is to "adjust interest rates".

Fears of Inflation → Expectations of Higher Interest Rates

What Happens When Interest Rates Are Raised

Interest rate hikes, in layman's terms"raise the cost of borrowing money"When the Fed raises policy ratesand the commercial bank and lending rates will rise in tandem, making it harder for businesses and individuals to borrow money.

- Company Example

When a company wants to build a new plant, if the cost of borrowing money from the bank goes up, it is more likely to postpone or scale back its investment plans.

- Personal Example

Higher interest rates on mortgages and auto loans increase the hurdles to buying a house or car.

Why Inflation is Controlled

Because "less money is spent to buy or produce goods and services → cooler demand → harder to raise prices"Inflation (price increases)This has the effect of suppressing inflation (price increases).In other words, interest rate hikes are a braketo prevent economic heating (excessive inflation).

At this time, when concerns arise that prices are likely to rise due to tariffs, investors and market participants believe that the Fed may raise rates faster to stabilize prices.This is the so-called "rise in interest rate hike expectations.

Why Crypto Assets Fall as Expectations of Higher Interest Rates Rise

Safe assets become more attractive

As interest rates rise,"safe assets"such instruments as government bonds and time depositsThe "safe assets" are the ones that are "crypto-currencies".For investors, it becomes easier to think, "If there is a product that gives me a stable interest rate, I would rather put my money there instead of going to the trouble of investing in an asset with a large price fluctuation like crypto assets.

Risky assets are sold

Crypto assets, like stocks, are generally classified as "risk assets.Price volatility is high, and while a rise in price can lead to large returns, a fall in price can also lead to large losses.When interest rates are low (when money is easy to borrow), investors are more likely to want to make a large profit even if they have to take risks, so money tends to flow into crypto assets.

However, when an interest rate hike is on the horizon, people tend to judge that there is no need to take risks and that there are now safer investment options, and they are more likely to sell crypto assets and move their funds into government bonds and deposits.As a result, the price of crypto assets is likely to fall.

Increased Costs in Leveraged Trading

In the crypto asset market, investment techniques that use leverage (margin trading) to increase trading volume are popular.However, in an environment where borrowing costs are rising (and interest rates are expected to rise), it is harder to make leveraged investments, making it easier for short-term investment funds to withdraw, which is another factor driving the decline.

Summary: The process from the tariff decision to the decline in crypto asset prices is summarized below

This may have been a bit difficult, but let us again summarize the flow of this topic "The US announced tariffs on imports from Mexico and Canada → crypto assets fell.strong>"Let's put the process in perspective.

Tariff increase announced

Higher import costs from Mexico and Canada

Increased pressure (inflation fears) on prices of products and services in the U.S.

Inflation fears raise expectations of higher interest rates

Market view that "the Fed will raise interest rates to keep prices in check" grows.

Expectations of a rate hike → Safe assets become more attractive → Risk assets are sold.

Yields on bonds and deposits rise, and the relative merits of investing in crypto assets diminish.

Leverage transaction costs also increase, and investors move into risk-off mode.

Crypto asset prices fall.

...funds are more likely to flow out of the crypto asset market, putting downward pressure on prices.

At first glance, the relationship between tariffs and crypto assets may not appear to be directly linked, but the basic idea is that crypto assets are affected as a result through the path of price increases → interest rate increases → risk asset sellingThe basic idea is that crypto assets are affected as a result through the path of

*As I noted at the beginning, it is written in a much simplified manner.

What will happen in the future?

Now, finally, some thoughts and observations.

I was surprised by the large drop in the crypto asset industry as a whole, but I am not too happy or sad about the short-term drop.

I don't discuss price declines in this newsletter, but I wanted to learn more about finance and economics in terms of the logic behind the price declines of crypto assets.

I am not an expert in economics or finance, so I don't know that much about future trends.However, from a macro perspective, I believe that President Trump, who was elected with the support of the crypto asset industry, will not let this situation continue, so I think that he will take some kind of preferential measures.Also, since the crypto asset market no longer has some correlation with the stock market, I think he is considering some measures to boost the U.S. economy by making the stock market higher.

Then, one area that may unexpectedly grow at this time is stable coins.Investments in stable assets will be made via stablecoin, and stablecoin-based projects with yields may grow.Even outside of stablecoin, it is stable investments via on-chain, such as investments in US Treasury bonds.

This would result in crypto assets being recognized not only as risk assets but also as stable assets, and since assets are moving on the on-chain, it would be one evidence that the blockchain has become popular.

I have written a lot about this, but since it is impossible for one business to read or influence the market in the short term, I think that in the end, as a web3 business, we have no choice but to proceed without hesitation, focusing on the growth of the market over the medium to long term.

I will continue to research and update various projects and markets!

This is the basic logic behind the introduction of US tariffs causing crypto asset prices to fall!

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.