【CreatorFi】A lending platform where creators can receive USDC in advance against future earnings (advertising, royalties, etc.) / @insomnia_labs

Will it become the financial infrastructure for the creator economy era?

Good morning.

I’m Mitsui, a web3 researcher.

Today I researched “CreatorFi.”

What is CreatorFi?

Transition and Outlook

The Financial Infrastructure of the Creator Economy

TL;DR

CreatorFi is a lending platform that allows creators to receive USDC in advance against future earnings (such as advertising revenue and royalties), with the key feature being that it provides access to funds without taking away their copyrights.

Using AI to analyze revenue data and calculate optimal loan amounts, with automatic repayment from YouTube and other revenue streams. Tokenizes debt on Avalanche/Aptos for transparent collateral management.

Developed by Insomnia Labs and highly regarded by major chains and investors, it is positioned as financial infrastructure for the creator economy, with expectations for large-scale expansion through RWA adoption and secondary market formation.

What is CreatorFi?

CreatorFi is a stablecoin lending platform for digital creators.

Creators such as YouTubers, TikTokers, music artists, and developers of games like Roblox and Fortnite will be able to borrow funds secured against their future digital revenue streams (including advertising income and royalties).

Traditionally, banks have not considered such digital rights revenue as creditworthy, and record companies and others have often imposed unfavorable terms—such as demanding 80% of copyrights in exchange for advance payments—leaving creators without sufficient means to secure funding.

CreatorFi solves this challenge by helping creators convert the future revenue of their content into immediate capital.

Creators can enjoy the following benefits:

Rapid funding:Instead of bank financing, you can receive immediate funds (advance payment) based on your future earnings, enabling you to secure the cash flow needed to launch new projects or expand production scale.

Global and equitable financing:Loans and repayments are conducted using stablecoin USDC or fiat currency, minimizing foreign exchange fees. This provides low-cost access to global funding for creators who are often excluded from traditional finance.

Protection of Rights:Even if you receive an advance, you do not lose ownership of your copyrights, channels, or other assets. CreatorFi only temporarily retains your revenue rights until the advance is repaid, ensuring creators never lose control of their work. This model is described as “sharing incentives, not ownership,” making it far more creator-friendly than traditional label contracts.

Expanding creator support and monetization models:CreatorFi aims to be more than just a lending platform; it strives to provide comprehensive support for creators’ business growth. Specifically, it is building a network that offers brand tie-ups and licensing opportunities to creators who receive financing.

These characteristics position CreatorFi as a service that “supports the growth of the creator economy from a financial perspective.” With a large market size—the creator economy is projected to reach approximately $1.49 trillion by 2034—the significance of providing transparent and efficient financial access to creators, who traditionally had limited funding options, is highly valued.

◼️Features and Functions

The features and characteristics supporting the above benefits are as follows:

Stablecoin Lending Platform

This is a future revenue-backed financing service. Creators receive loans denominated in USDC stablecoins using their future advertising and copyright income as collateral, repaying in USDC when the revenue is generated.

AI-Based Risk Assessment and Credit Evaluation

We collect and analyze creators’ revenue data, using machine learning models to analyze patterns in channel viewership data, song play counts, and in-game spending amounts.

Based on this, risk-adjusted loan offers (credit limits and interest rates) are calculated instantly. For example, offers such as “Advance payment of up to $XX calculated from your past monthly YouTube income at an annual rate of XX%” are presented, optimized by genre.

Real-time revenue collection and automatic repayment

CreatorFi’s financing model functions similarly to factoring based on accounts receivable (future claims). After a creator receives an advance payment, the revenue generated from that creator’s content platform (such as YouTube or music streaming services) is redirected directly to CreatorFi at the platform level and applied in real time toward loan repayment.

For example, Yoola, our partner YouTube Multi-Channel Network (MCN), has established a process where it first receives the creator’s YouTube revenue, deducts the repayment amount owed to CreatorFi, and then passes the remaining balance to the creator.

This reduces risk for lenders (fund providers) by ensuring reliable and immediate repayment, while creators benefit from automatic repayments deducted from their earnings without having to manage cumbersome repayment procedures.

Tokenization of Assets and On-Chain Collateral

CreatorFi was initially built on the Avalanche chain, representing and managing creators’ future revenue rights as “credit assets” on-chain.

For example, Yoola established a $5 million bond program for YouTube creators, with institutional investors like Kamui Finance underwriting it to provide funding. These bonds and loan receivables are tokenized on the blockchain, serving as highly transparent collateral that can be traded and verified.

Starting November 2025, it will also support the high-speed L1 Aptos chain, expanding multi-chain DeFi-style credit provision by enabling creators to maintain Proof of Credit records on Aptos.

This on-chain implementation facilitates easier auditing of fund flows and anticipates future secondary market trading of debt tokens by liquidity providers (currently limited to private transactions for regulated investors).

As described above, CreatorFi leverages blockchain technology to provide multifaceted functions as a “financial infrastructure for the creative sector.”

This project can be broadly positioned as an RWA tokenization initiative that monetizes creators’ content by converting it into digital assets for financing purposes.

Transition and Outlook

CreatorFi is developed and operated by Insomnia Labs, a blockchain company based in New York, USA.

Insomnia Labs is a startup that has been active since the early 2020s, initially providing NFT and tokenization solutions for large corporations.

Notable examples include NFT campaigns for global brands like Coca-Cola and L’Oréal, the launch of digital merchandise for Under Armour, and the International Cricket Council’s (ICC) adoption of blockchain technology.

CreatorFi applies the tokenization technology and data analysis expertise gained from these experiences to the creator economy.

The founding members include Billy Huang, CEO of Insomnia Labs, and Jack Cameron, Chief Business Officer (CBO). Huang, a co-founder of Insomnia Labs, emphasizes the potential of the creator economy, stating, “Creators are building the next generation of global brands. We want to provide them with financial solutions they deserve.”

CreatorFi first launched on Avalanche in July 2025, followed by its launch on Aptos in November of the same year.

When launching CreatorFi in July, it secured a $12 million credit line from Kamui Finance and others. This enabled the start of a partnership program with YouTube network Yoola (a $5 million creator loan facility), with multiple YouTubers utilizing this facility within the same year. In the music sector, US-based Record, which supports royalty processing for prominent artists, adopted CreatorFi to provide fair financing to its own clients.

During the November Aptos integration, we also announced a $2 million strategic funding round from the Aptos Foundation and Aptos Labs.

Executives from the Aptos Foundation and Ava Labs (Avalanche) have both issued comments highly praising the service.

Aptos stated, “This is precisely the real-world use case we seek—delivering solutions to genuine demand in the massive creator economy market left behind by traditional lending.” Avalanche’s Morgan Krupecki praised, “CreatorFi has ushered in an era where creativity itself becomes capital value.”

Additionally, Hadi Kabaran of Kamui Finance, an early-stage investor, commented, “We are realizing a blockchain-based value chain where all participants within the network—creators, platforms, and financiers—emerge as winners,” expressing his expectations for it as an RWA investment target.

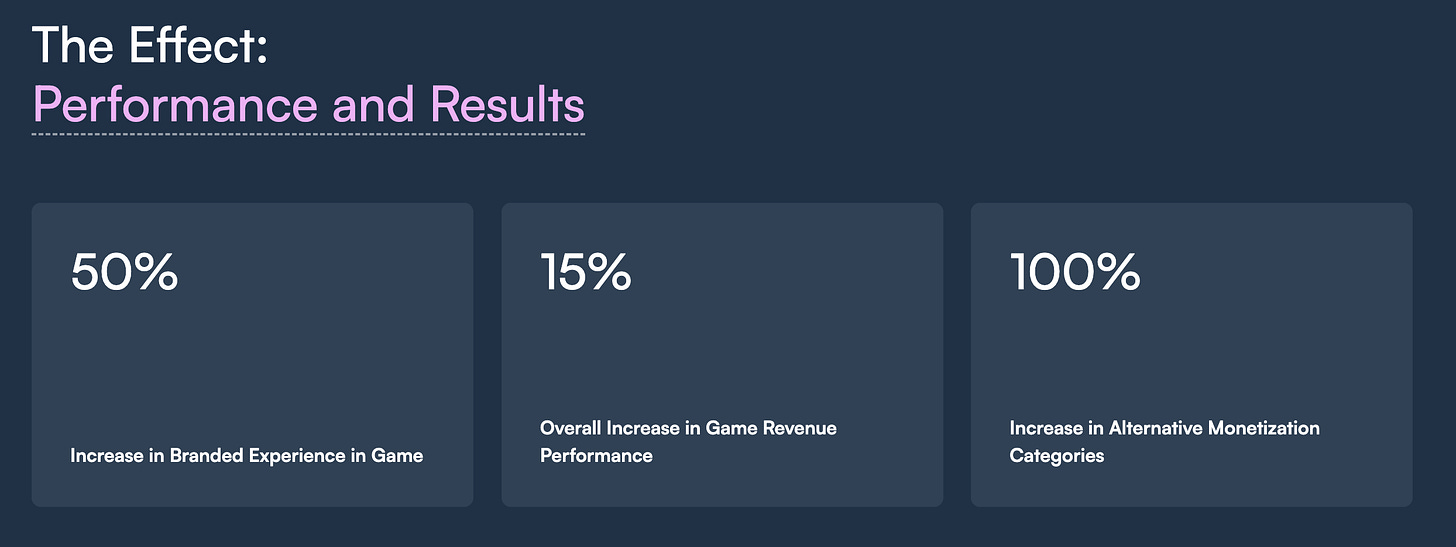

Although it has only recently launched, it has already demonstrated results such as an increase in the growth rate of creators using the platform, and it is expected to expand even further going forward.

The Financial Infrastructure of the Creator Economy

Finally, we conclude with a summary and analysis.

I find this service operates in a very interesting field. While blockchain promotes financial democratization, the primary beneficiaries are people in developing countries without bank accounts. These individuals can use blockchain to hold a wallet on just one smartphone, enabling them to hold, manage, and transfer assets. Additionally, gaining access to the dollar economy rather than relying solely on their local currency is another significant benefit.

However, this segment often has a large potential market size, but its immediate market size is not particularly large. The reason is that the overall economic scale is still small. Therefore, while the number of users increases, it becomes difficult to achieve significant scale when transaction fees are the primary revenue source.

On the other hand, CreatorFi targets areas that are large in economic scale yet overlooked by traditional financial institutions. While emerging digital creators generate significant revenue, they cannot access finance due to their instability and the novelty of the market.

Introducing blockchain and using AI for credit assessments to provide loans seems like a solution with significant market potential. Personally, I believe CreatorFi’s competitive advantage lies in its collaboration with agencies.

The greatest risk remains loan defaults. Given the inherent instability of creator income, we have successfully implemented a system where repayment is received before funds are disbursed to creators through collaboration with their agencies. This model ensures that repayment delays no longer occur when income is available, and eliminates discrepancies in the submitted data itself.

Looking ahead, the key prospects remain the tokenization of lent claims and the marketplace for trading them. This design should be in place by now, and once it starts working, improved capital efficiency will enable expansion at a pace that outpaces competitors.

As I realized during my previous research on Figure, the first target should be areas that are excluded from existing financial services yet have large market sizes, and where AI and blockchain can deliver overwhelming efficiency gains. By targeting these areas to build a track record, we can tokenize the underlying debt and sell it to institutional investors. This improves capital efficiency, enabling the continuous tokenization of debt and accelerating the growth curve.

Furthermore, establishing a system that enables borrowing secured by tokenized debt instruments will allow both our company and institutional investors to expand their investment activities, thereby increasing the overall economic scale.

Implementation may be difficult, but a certain degree of the standard approach has already been demonstrated by leading companies. CreatorFi is still in its infancy, but I anticipate it will likely follow this path. I look forward to seeing how it develops.

That concludes our research on “CreatorFi”!

Reference Links:HP / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.