【CoW Swap】Realizing Intent by Badge Auction / Developed by CoW DAO, the developer of CoW Protocol, MEV Blocker, CoW AMM, etc. / @CoWSwap

CoW Swap, an interface powered by CoW Protocol, enables intent trading.

Good morning.

Mitsui from web3 researcher.

Today I researched "CoW Swap".

Although the title is "CoW Swap" for the sake of clarity, "CoW Swap" is only an interface, and behind the interface is a protocol called "CoW Protocol," which is the main explanation of the protocol.

To be more precise, CoW DAO is the operating entity, which develops and operates CoW Swap, CoW Protocol, MEV Blocker, CoW AMM, and other products.However, the main focus is on CoW Swap and CoW Protocol, which will be explained in this article.

🐮What is CoW Protocol?

⚙️How the CoW Protocol works

✨CoW Protocol andIntent Benefits

👤CoW DAO Product Group and Governance

💬CoW Protocol Achievements and Intent Future Considerations

🐮What is the CoW Protocol?

The "CoW Protocol" is a meta-DEX aggregation protocol that leverages trading intent and batch auctions to find better prices for users to trade crypto assets.

This is a protocol that enables a form of trading called "intent," which means that the technology behind the protocol uses technologies such as batch auctions and meta-DEX aggregation, which is a further aggregation of DEX aggregation.This is what it means.

I will explain one at a time.

◼️Intent means

Intent means intention, and refers to a transaction in which the user declares a desired result and the transactions in the process are free to execute, yielding only the desired result.This allows users to use web3 intuitively, without having to search for the best rate in multiple Dapps or ensure gas money in every chain.

For simplicity, here is an example from everyday life.The current web3 deal directs all routes on the left side, but in the world of Intent, the driver will drive the best route at his/her discretion.

However, whether this cab driving is the optimal route depends on the competence and conscience of the cab driver.There is a possibility that the taxi driver will deliberately make a detour to earn a fare, or that the route will not be optimal due to simple lack of knowledge.

In the web3 world, the entity to which this transaction is entrusted is called a "solver.Solvers" fight with each other and propose the best route to the user, so that the best route is always chosen for the user, rather than being decentralized and unfair.

Let's take a closer look at how CoW Protoco works, including how the "solvers" work.

⚙️How the CoW Protocol works

The following is the transaction flow.

User creates an intent: Signs a message specifying the asset and amount he/she wishes to trade, as well as other parameters, to indicate his/her intent to trade.

Aggregation into batch auctions: Multiple users' intentions are collected in an order book and put into batch auctions.

Solver seeks and proposes optimal transaction: Solver seeks and proposes optimal transaction route, either P2P transaction within CoW or AMM of external DEX.

Solver is selected and executes transaction: The winning solver sends a batch transaction on-chain on behalf of the user.

User receives assets

Solvers receive rewards in $COW tokens

Let me explain one by one.

◼️ batch-auction

The CoW Protocol collects and aggregates user intents off-chain and settles them into groups called batches.These batches are then "auctioned" to solvers.

This has several advantages, which we will mention as advantages of the overall CoW Protocol after we also explain the solver.

◼️ solver

Solvers are affiliated third parties that execute transactions on behalf of users through an intent-based delegated execution model.It leverages open solver competition for order matching to achieve optimal price results.

◼️Coincidence of Wants(CoW)

Basically, the above two mechanisms are used, but there is an important concept that exists within them: Coincidence of Wants (CoW)", which, as you can see from the word abbreviated as CoW, is the origin of the name of the Cow Protocol.

Some people think of CoW simply as referring to cows, since the logo is also a cow, but the real meaning is here.

Also translated in Japanese as "match of desire," this means a direct exchange of assets between two parties, each of whom owns assets that the other party needs, in an equivalent barter transaction.In essence, it is a P2P transaction.

For example, if one trader in a batch wants to sell $2,000 DAI for 0.5 ETH and another trader in the same batch wants to sell 0.5 ETH for $2,000 DAI, the CoW Protocol solver matches both traders,allow them to exchange assets without having to rely on on-chain liquidity.This saves liquidity providers fees.

This is a simple example, but all kinds of exchanges are made within the badge, such as exchanges between three people or at the ring, with only the missing parts being exchanged at an outside dex.

In other words, the solver proposes the best route from a wide variety of P2P (CoW), external AMMs, and private markets that only that solver has.

✨CoW Protocol and Intent Benefits

The above is an explanation of how the protocol works, but let me reiterate the advantages of the "CoW Protocol" and the Intent.

Three major advantages were mentioned.

CoW: Direct P2P matching of two or more users who have expressed opposite trading intentions for the same token pair.This optimization, achieved through batch auctions, allows users to avoid Liquidity Provider (LP) fees and reduces trading gas charges since orders do not need to interact with other non-CoW protocol smart contracts.

Private Market Makers:Many solvers can access off-chain liquidity through CEX inventory, integration with private market makers, or their own privateaccess to off-chain liquidity through the CEX inventory, integration with private market makers, or their own private liquidity.This allows certain transactions to be executed at any time at more favorable prices than those available in the on-chain AMM.

MEV Protection: The CoW protocol does not expose the user to MEV bots.Instead, the solver settles trades on behalf of the user and assumes all MEV risk.In addition, the solver sends all orders in batches at a uniform settlement price, so there is no advantage to reordering trades.

Now that the CoW has been explained, we will discuss MEV protection, which is just as beneficial and distinctive.However, we should originally start with an explanation of MEV in the first place, but since it would be quite lengthy, we will only explain it in a simplified manner in this article.

MEV (Maximum Extractable Value) is a form of price exploitation that affects token swaps and other types of transactions on ethereum. an MEV attack occurs when a malicious trader (usually an MEV bot) strategically places transactions before or after a user's order, at the expense of the userand manipulate the price of the asset at the expense of the user.This is commonly known as a "sandwich attack.To date, MEVs have caused more than $1 billion in losses to the average trader.

MEV attacks occur on most major exchanges.However, CoW Protocol's unique trading model protects users from MEVs in three main ways

Uniform clearing price: When the same token pair (e.g. ETH-USDC) is traded multiple times in the same batch, the asset is cleared at the same market price in each transaction.This mechanism is called "uniform clearing price" and makes the order of transactions irrelevant, so MEV bots cannot change the order of transactions for profit.

Delegated Transaction Execution:A third party, called a solver, executes transactions on behalf of the user.This means that the user is not directly exposed to MEVs on the chain (although the solver may be).Since the solver is a professional party, it calculates the optimal slippage for each trade and, if possible, matches liquidity off-chain through CoW or private market makers to mitigate MEV risk.

CoW: MEV attacks rely on automated market maker (AMM) dynamics for price exploitation.However, when orders are matched peer-to-peer via CoW, they are protected from MEVs because they do not exploit on-chain liquidity.

These are the benefits of the Cow Protocol, which creates an intent-based architecture, but there are other benefits from the user's perspective as well, such as

Allows users to pay for gas with sold tokens without holding chain-native tokens (such as ETH) in their wallets

Eliminate fees for failed transactions

Save gas money by allowing users to place multiple orders at once

Of course, there is also the inherent benefit of intent, where you can get the result you want by declaring only your intent.

👤CoW DAO's product suite and governance

We will then briefly discuss the other products and governance of the CoW DAO and its proprietary tokens.

The CoW DAO is a DAO with $COW as its governance token and has four core products

CoW Protocol

CoW Swap

MEV Blocker

CoW AMM

◼️CoW Protocol & CoW Swap

The CoW Protocol has been described so far, and CoW Swap is an interface to the CoW Protocol; since the CoW Protocol is the foundation, it receives orders from other swap protocols and performs the same operation behind the scenes.

It is a generic UI like Uniswap, from which the user essentially executes the intent transaction.

◼️MEV Blocker

Next is the MEV Blocker, an RPC endpoint designed to protect user transactions from front-running, sandwich, and other MEV attacks. in addition to protecting user transactions from MEV compromise, the searcher and builder order flowauctions, it provides users with rebates from backrunning transactions.

◼️CoW AMM

The last CoW AMM is a new type of AMM built to protect LPs from a form of price exploitation called LVR; LVR is called loss-versus-rebalancing, a type of arbitrage that occurs when an AMM has an old price relative to other trading venues.

CoW AMMs fully correct LVRs, and liquidity pools have proven to be superior to Balancer and Uniswap pools.

This LVR story is also difficult, so please see herefor more information.

◼️$COW tokens

And they are built on a CoW DAO whose governance is governed by $COW tokens.

The $COW has an initial issuance of 1 billion and no maximum supply cap.It is currently set to remain at 1 billion tokens, but will be set at an inflation rate of approximately 3% per year.

The allocations are as follows

CoW DAO Treasury(44.4%): this large share highlights the central role of the community in the ongoing development and maintenance of the protocol.

Team(15%): Rewards individuals who build and continually enhance the CoW protocol.

GnosisDAO(10%): valued partnership and collaboration in CoW protocol ventures.

Airdrop(10%): ensures that initial users and contributors are recognized and retained.

CoW Community Investment(10%): as an option to increase the initial user stake in the protocol in exchange for a financial contribution to the protocol, broader CoWFacilitates engagement and long-term commitment from the protocol community.

CoW Advisory(0.6%): rewards strategic guidance and expertise provided in the protocol.

Investment Round(10%) Provides the funding and financial support necessary to grow the protocol.

💬CoW Protocol results and the future of intent considered

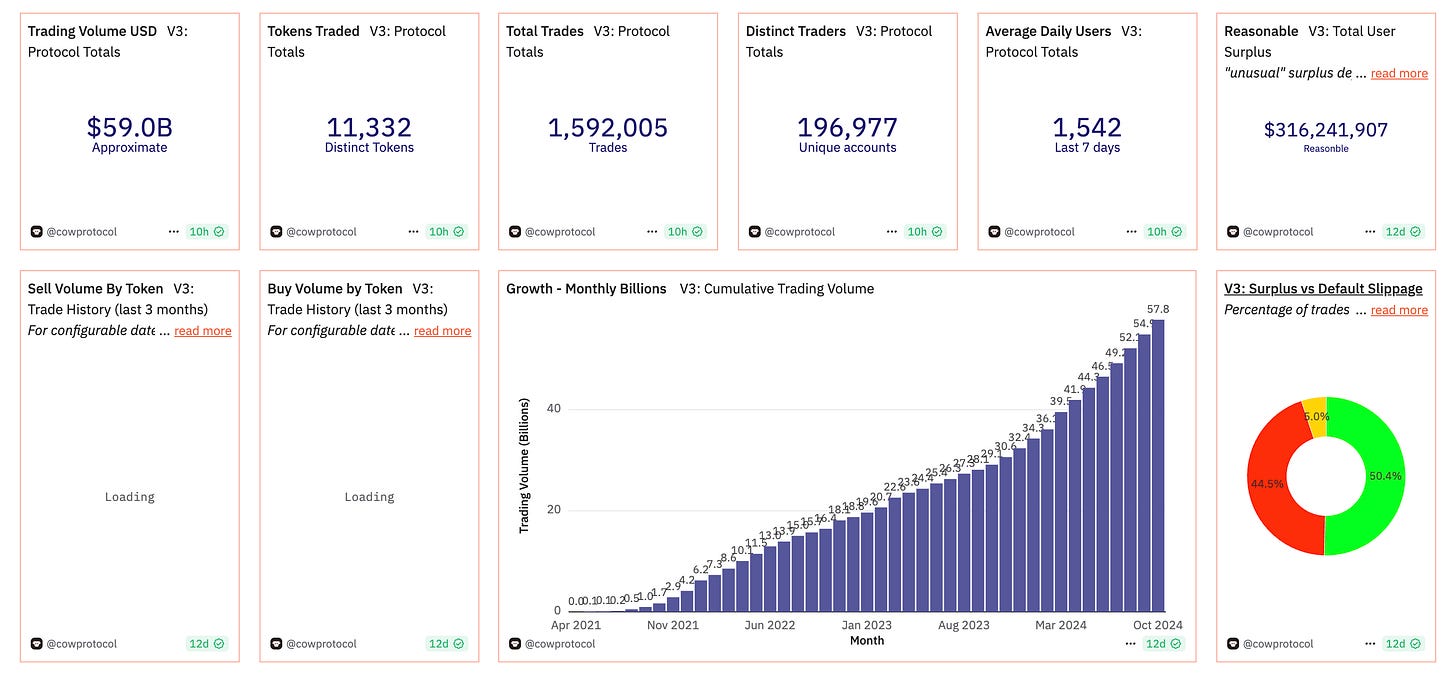

Finally, we will look at the current CoW Protocol performance and predict the future with reference to the Dunehere.

First of all, that's the monthly revenue for CoW DAO as a whole.We collect a portion of transaction fees, so the protocol fees make up the bulk of it.The units are not written, but assuming $10,000, the revenue for October was $3.29 million.

Other trading volumes and number of traders are as follows

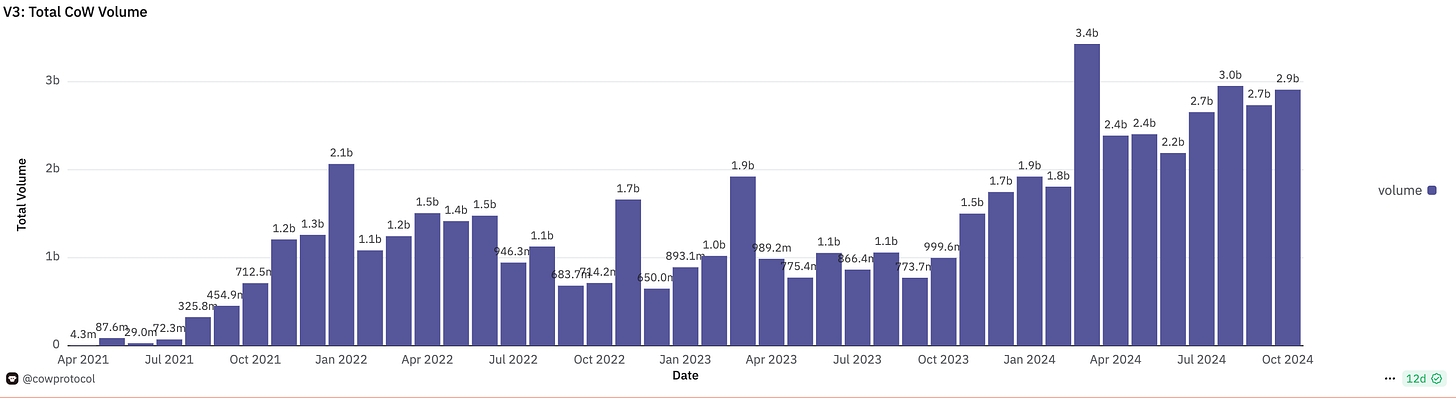

CoW volume has also been increasing a bit, with some ups and downs.

Uniswap's weekly transaction volume is around $12b, so it is still not as large as it should be compared to that.Also, there was data on market share in DEX aggregation, and while it seems to be growing a bit, I have the impression that the market as a whole has not grown that much yet.

From this, we can see that CoW Protocol and CoW Swap are often heard in the context of intents, but are still far from widespread.We believe that there are two factors here: a technical factor that the intent has not yet demonstrated true evolution, and a marketing factor that it simply has not been able to interface.

As more technological innovation continues and multi-chain intent is truly realized and more users trade on DEXs, it is likely that the intent market will become more widespread and the CoW Protocol will attract more attention.

However, UniSwap has also launched an intent-based protocol under the name Uniswap X, and each DEX is expected to follow suit, so the CoW Protocol-specific technical differences and marketing strategies will also be of interest.

This is our research on CoW Protocol / CoW Swap!

🔗Reference / image credit: HP / DOC / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.