Coinbase Business Structure and Strategy

In-depth explanation of the evolution of the company and its strategy toward Everything Exchange

Good morning.

I am mitsui, a web3 researcher.

Today we will discuss Coinbase's business structure and strategy. Most recently, the company has been aiming to build a super-application for trading everything under the banner of "Everything Exchange," and we will unravel the aims behind this.

🟦Basic information about Coinbase

🚩Coinbase's 6 aims

💬 Can you commit to a medium- to long-term future?

🧵TL;DR

Coinbase, a publicly traded company founded in 2012, promotes "Everything Exchange" with Custody, Staking, USDC collaboration, Derivatives, and its own L2 "Base" in addition to physical trading.

Revenues will be shifted to the two pillars of "Trading (high volume)" and "Subs & Services (stable revenues such as USDC interest, staking, Custody, etc.)" and non-trading revenues will be strengthened after the market downturn and layoffs in 2022.

Expand the on-chain economy starting from the user experience and spin the long-term growth flywheel with high-profit products (derivatives, etc.) and tokenization of new assets while reducing reliance on trading.

🟦Coinbase Basic Information

First, let us briefly review some basic information.

Company Overview

name of company:Coinbase Global, Inc.(NASDAQ: COIN)

establishment (of a business, etc.): 2012 (San Francisco, U.S.A.)

co-founder: Brian Armstrong (former Airbnb engineer), Fred Artham (former Goldman Sachs) .

Background:

In 2011-12, Armstrong saw the potential of bitcoin while at Airbnb, joined YC to refine the prototype, and later joined Artham (then a GS trader) to co-found the company. The initial central proposition was "to make the experience of buying crypto assets easy for everyone."

In the beginning, the company started with a product that "anyone can safely buy bitcoins via bank transfer". The company name is derived from the PoW "coinbase transaction.

→ The pitch materials for the YC Demo Day arethis way (direction close to the speaker or towards the speaker)The information is available to the public at

Major Transitions

2012:Founded Coinbase: In October, launched a service that allows customers to buy and sell BTC via bank transfers.

2013:Funding from USV and others (Series A) - Expanding as a "gateway" for consumers to purchase BTC.

2016:Coinbase Pro rebranded its exchange division to "GDAX" (later Coinbase Pro).

April 14, 2021:Listed on NASDAQ(Ticker: COIN). An iconic example of a publicly traded crypto asset company.

2022: Decided to optimize costs (layoffs) in response to deteriorating market conditions, and clarified that the business was to "break away from dependence on trading".

February 2023 → August 2023L2 "Base" was released (February, Test Net) → Main Net was opened to the public on August 9. Accelerated diffusion with "Onchain Summer".

2023: International derivatives exchange opened outside the U.S., expanding futures and indefinite futures (a milestone along the Everything Exchange path).

May 2025 (announced) → August (closed)Acquisition of Deribit, the world's leading crypto derivatives exchange, for approximately $2.9 billion. The company has expanded its full lineup to include the options sector at once.

presentAs the first US regulated and publicly traded company, it is promoting to become an "Everything Exchange" that integrates physical trading, custody, staking, USDC, derivatives, and its own L2 (base). The company is currently promoting the creation of an "Everything Exchange.

◼️ business-structure

Next is Coinbase's business structure. Understanding this is the key to deciphering Coinbase's prospects. You will see why they are acquiring derivative exchanges, why they are doing Base, why they are aiming to become Everything Exchange, and so on.

Here is the Q2 2025 financial data (Q2-2025-Shareholder-Letter ).

Transaction Revenue

Consumer (for individual investors)

Mainly trading commissions. Still the largest revenue source.

The amount increased sharply (over $1 billion) during strong market periods such as Q4'24 and Q1'25.

Institutional

Large transaction fees through Coinbase Prime.

Although the overall ratio is small, it is stable due to liquidity provision and OTC transactions.

Other transaction revenue

Mainly sequencer fees for their L2 "Base" chain and minor transaction revenue for specific services.

2. subscription & services revenue (Subscription and Services Revenue)

Stablecoin revenue

Interest share of USDC reserves. Depends on the level of U.S. interest rates and the volume of USDC in circulation.

Reached $330 million in Q2'25, a stable revenue pillar.

Blockchain rewards

Staking fees (PoS assets such as Ethereum).

Fluctuates according to market conditions and network compensation rates (Q2'25 was in the $140 million range).

Interest and finance fee income

Interest on funds held by customers and interest on loan services.

The amount is linked to the interest rate environment, hovering around $60 million.

Other subscription and services

Coinbase One (subscriber membership service) revenue, custody fees, and cloud services for developers.

It will grow to $120-140 million scale in 2025.

You can see that they have diverse revenue sources, but (1) transaction revenue is highly volatile, whereas (2) subscription & service revenue is relatively stable.

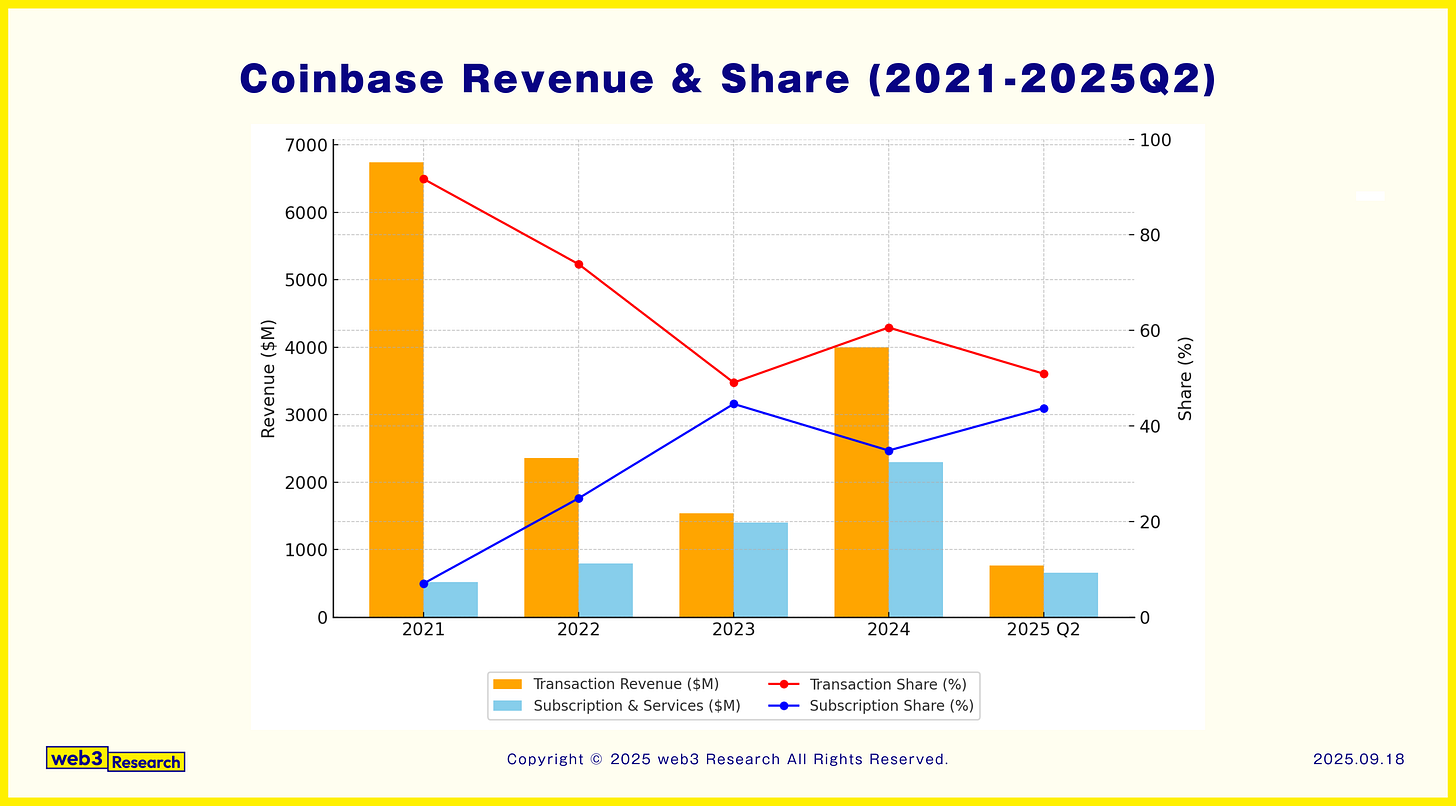

In fact, this transition is a very interesting part of the process.

As you can see, trading revenues are very volatile.

In fact, revenues were high in 2021 at the time of the IPO, but declined sharply in 2022. This is because trading revenues are sensitive to market conditions.

In response to this deterioration in profitability, Coinbase implemented a major layoff on June 14, 2022, reducing the size of its team by approximately 18%.

At this time, Coinbase has indicated that it will focus on "subscription & service revenue" that is not dependent on transaction revenue (= market conditions).

He then stated that in August 2025, the company will become an "everything exchange," and that it is aiming to become a financial super-application that can handle all assets.

In addition, the 2025Q2 letter to shareholders and financial results presentation explain a three-step product strategy to realize this long-term vision.

The evolution of crypto-assets into "Phase I: investment vehicles," "Phase II: updating the financial system," and "Phase III: app platforms," emphasizing the vision of a time when the on-chain will be the new Internet, seeking to update all aspects of the financial system. He emphasized his vision of an era in which the on-chain will become the new Internet, updating all aspects of the financial system.

🚩Coinbase's 6 aims

So, what exactly is your business strategy? Here is my personal discussion based on publicly available information.