Predicting the Future in a World of Mixed CEX and DEX

This presentation will introduce examples of collaboration and discuss future predictions that can be read from them.

Good morning.

This is mitsui, a web3 researcher.

Today, under the theme of "Predicting the Future in a World of Mixed CEX and DEX," I will introduce examples of CEX and DEX collaboration that have been gaining momentum recently, and discuss the future predictions that can be read from them.

📗What are CEX and DEX?

👀DEX integration case study by CEX

❓Background of the incorporation of the DEX within the CEX

💬Possible future of the CeDeFi market

📗What is CEX and DEX?

First, let me reiterate the basics of CEX and DEX, which you may be familiar with.

◼️CEX (centralized exchange)

An exchange where the operating company manages all systems, asset management, and matching engines.

Users first deposit legal tender or crypto assets into the exchange and then buy and sell them as balances within the exchange

Order matching is completed on the off-chain (exchange database) at high speed.

○Features and Mechanisms

Order Book MethodOrder Book Method: Limit and market orders are placed on the order book (buy/sell list) and executed by the matching engine.

High-speed matchingHigh-speed matching: Executions in milliseconds due to in-server processing.

Legal Currency SupportDirect deposit and withdrawal of Japanese yen, U.S. dollars, and other currencies via bank transfer or credit card deposit.

Ancillary ServicesIncludes: leveraged trading, futures, staking, lending, launchpad, API/margin trading, and many more.

Custody ManagementUser private keys are stored by the exchange.Deposit/withdrawal processing and security are handled by the exchange.

○ Advantages

High liquiditySmall slippage even for large accounts due to the large number of participants.

Fast trading speedExecution in milliseconds to seconds.

Excellent supportJapanese language support, help desk, deposit/withdrawal troubleshooting, etc.

Legal Currency HandlingDirectly from Yen to Virtual Currency and Virtual Currency to Yen are possible.

Regulation compliantOperated under license, with mechanisms for customer protection (segregated management and insurance).

○Disadvantages

Hacking and theft risk: Easy to become a huge target due to centralized management.

Bankruptcy and freezing risk: Fear that assets may be locked up due to the mismanagement of the operating company or regulatory action.

Decline in privacyKYC/AML: Personal information registration is mandatory due to KYC/AML obligations.

Self-management is not possible.Private keys are managed by the exchange.

Restrictions on listed issues: Only tokens that have been vetted by the Exchange will be handled, so emerging projects may not be able to be purchased.

◼️DEX (Decentralized Exchange)

Programs assembled with smart contracts operate autonomously on the blockchain.

Users connect their wallets and exchange tokens directly on-chain

No third-party asset management required

○Features and Mechanisms

AMM (Automatic Market Maker) methodAMM (Automatic Market Maker) method: Two types of tokens deposited in a liquidity pool are priced using the formula (x-y=k).

Concentrated LiquidityConcentrated Liquidity: LPs may place liquidity at any price point from Uniswap v3 onwards.

On-chain CLOBOn-Chain CLOBs: Have on-chain board orders like Hyperliquid and execute them with price priority and time priority.

Off-chain order board + on-chain settlement:A hybrid method like dYdX v4 and Aevo where orders are processed off-chain at high speed and only the execution result is written to the chain.

LP RewardsLiquidity providers receive transaction fees as compensation.

○ Benefits

Self-CustodySelf-custody: You can manage your own private keys and avoid the risk of exchange failure.

Highly anonymous.No KYC required, only a wallet address is needed.

Wide variety of tokens handled.Anyone can be listed if they provide liquidity.

Global AccessGlobal access: available from anywhere with an Internet connection and a wallet.

TransparencyTransparency: All orders and executions are recorded in the blockchain and can be monitored and verified by anyone.

○Disadvantages

Gas cost burdenNetwork fees are charged per transaction and are relatively high, especially for small transactions.

Limitations on transaction speed: In some cases, waiting for block approval takes several seconds to several minutes.

No user supportNo remedy in principle in case of operational errors or loss of private keys.

Risk of insufficient liquidity: Thin pools and large slippage in minor pairs.

Smart Contract Risk: possibility of funds being extracted if a vulnerability or bug is exploited.

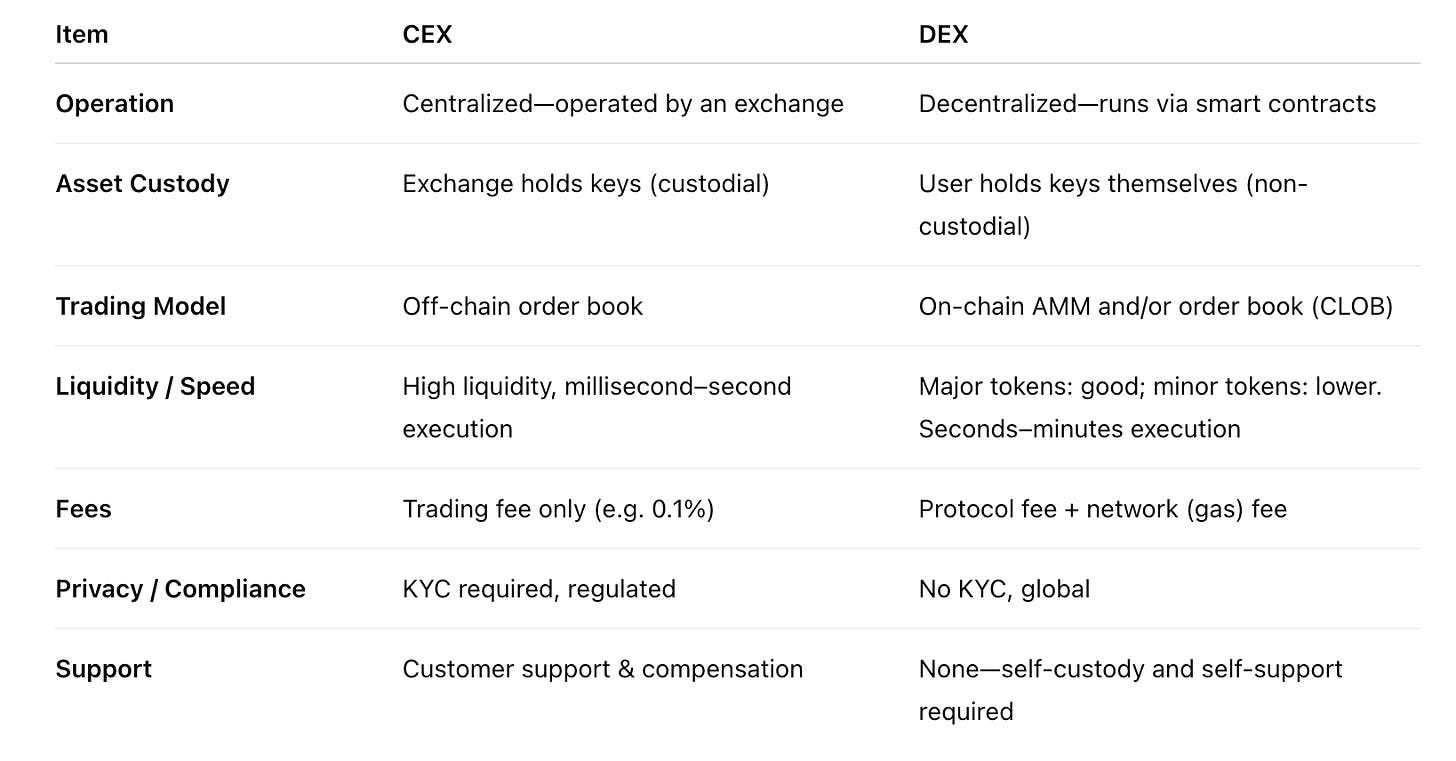

◼️CEX vs. DEX

To summarize, the differences are as follows.But, well, many of you may have some understanding of this area.

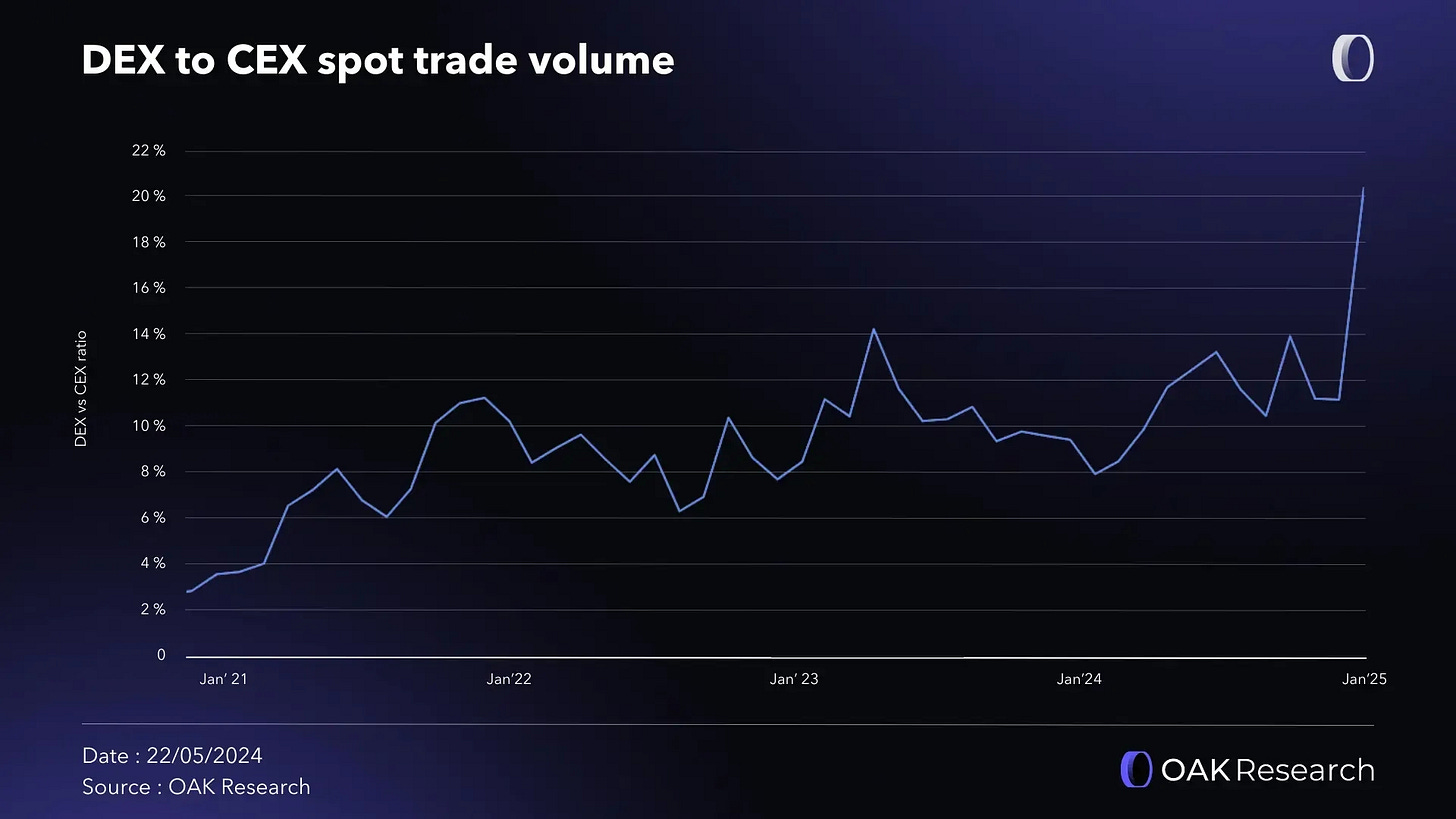

And here is a graph showing the share of the DEX relative to the CEX in physical trading over the past five years.The DEX's share of cash transactions relative to the CEX has grown to nearly 20%.

This excitement on the DEX side has also accelerated the recent trend of mixing CEX and DEX.

👀DEX integration case study by CEX

Now here is a real case study.

◼️Coinbase's Base DEX Integration

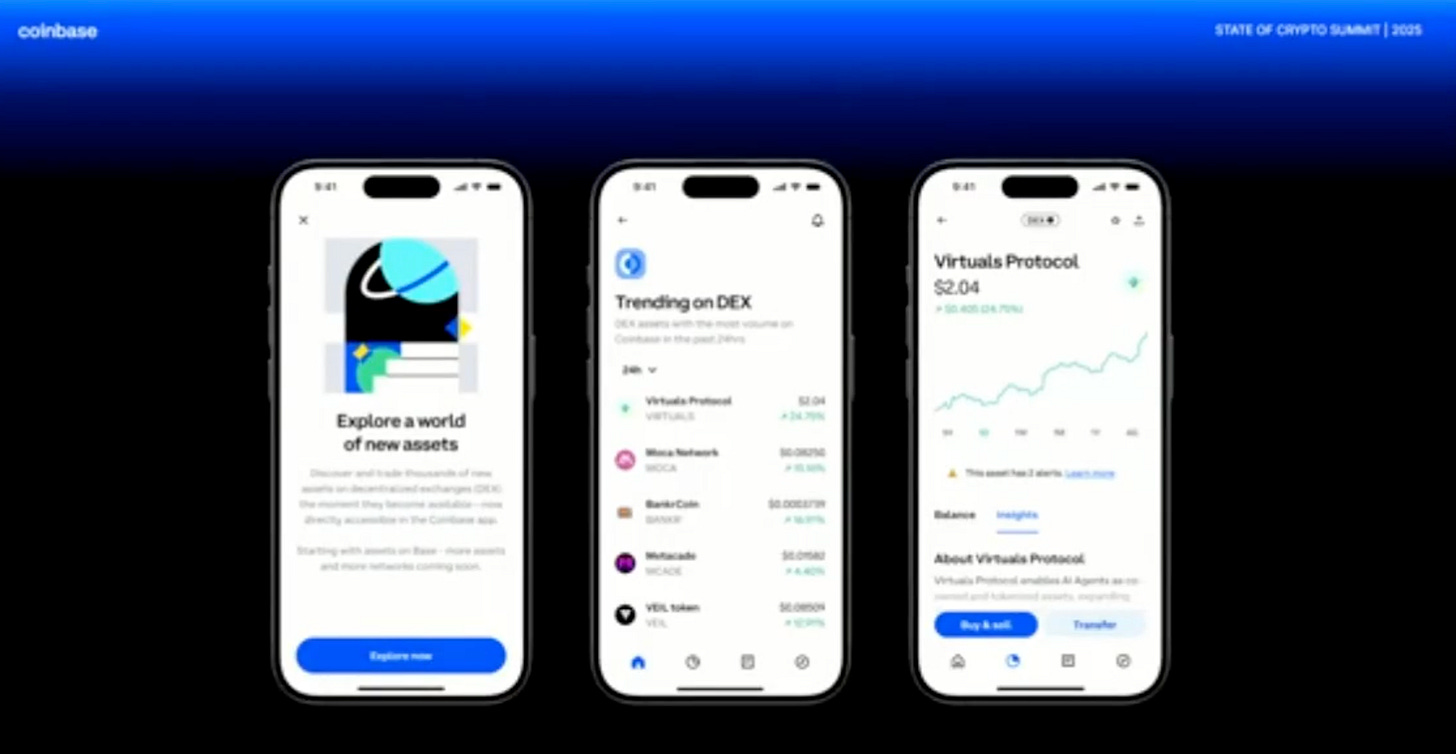

At the State of Crypto Summit on June 13, 2025, Max Bransberg, VP of Product at Coinbase, said, "Millions of assets are created and traded on decentralized exchanges, but very few people can manipulate those decentralized exchanges to access and trade the assets they want.and trade in the assets they want.That is why we are very pleased to announce today that we are integrating Base's decentralized exchange directly into Coinbase's main app," he said.

In addition,.Millions of Coinbase users will soon be able to trade directly on decentralized platforms like Aerodrome.This will not only add millions of new users to Base DeFi, but also give Coinbase customers access to any token traded on Base.This will be an unprecedented ecosystem growth accelerator," commented Alex Cutler, founder of Aerodrome.